As Trump’s victory odds rise, the underperformance of European equities deepens. How negative would a global trade war be for European assets?

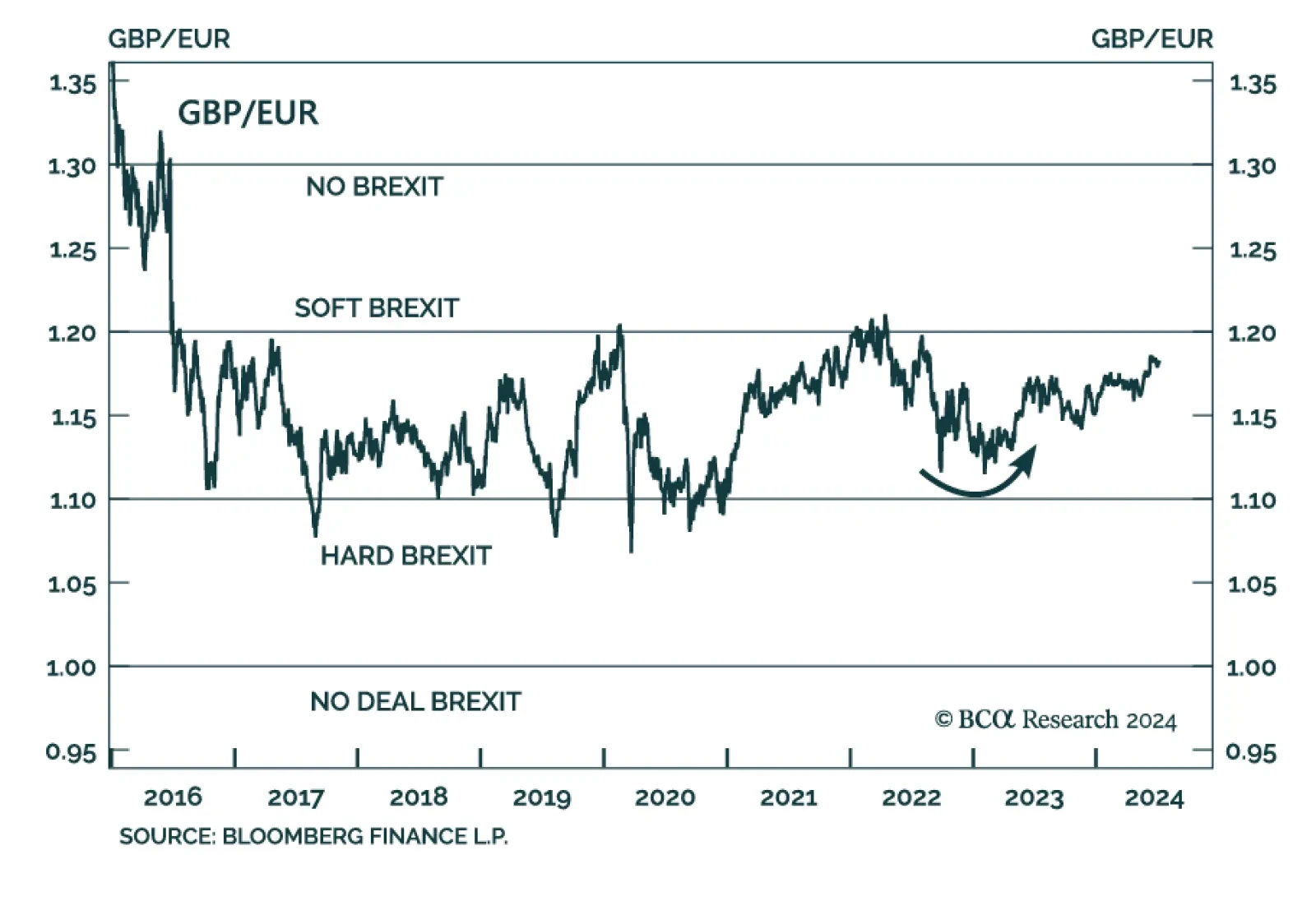

We review some of the key data releases this week that we find have an impact on our currency strategy. Long yen positions make sense today. Long sterling and the euro bets are more of a judgment call, and we will fade any strength…

Investors should overweight US assets and de-risk their portfolios in anticipation of a major increase in policy uncertainty and geopolitical risk surrounding the US election and its global ramifications.

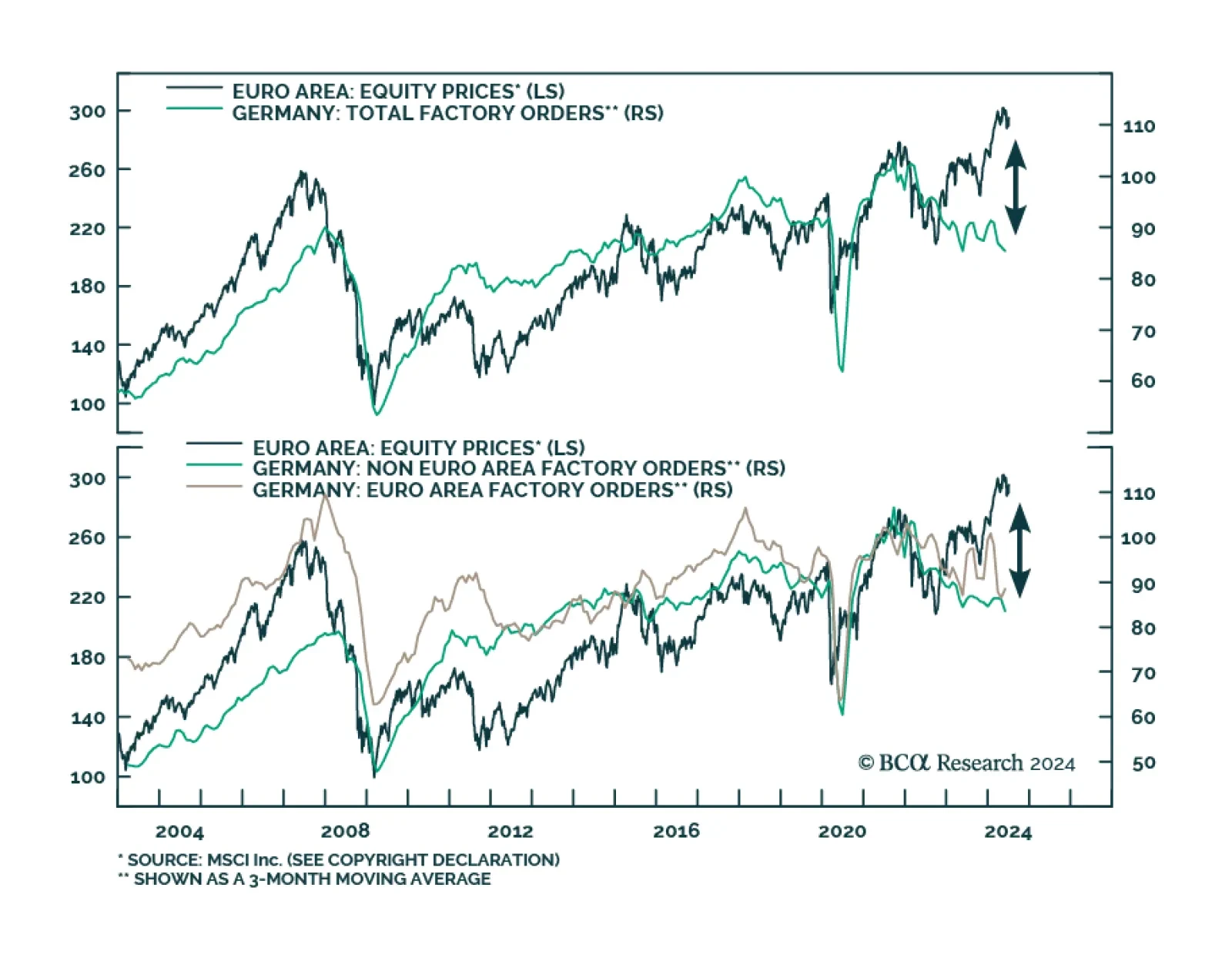

According to BCA Research’s European Investment Strategy service, the threat to European equities stems from growth, not French politics. After the dissolution of the French parliament on June 9th, investors sold…

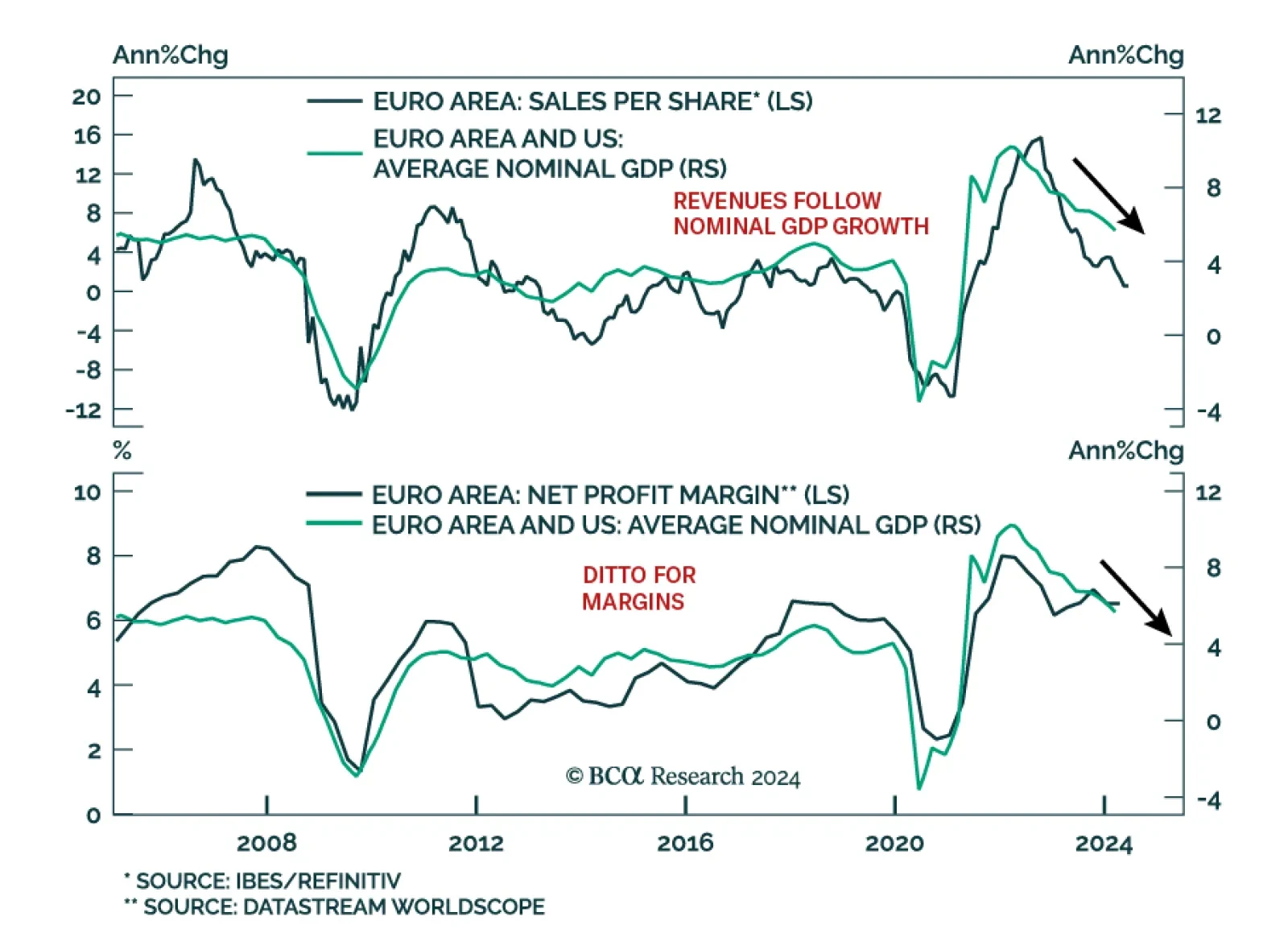

The real threat to European equities is growth, not political risk. How low will Eurozone earnings fall during the coming recession and how much will equities decline in response?

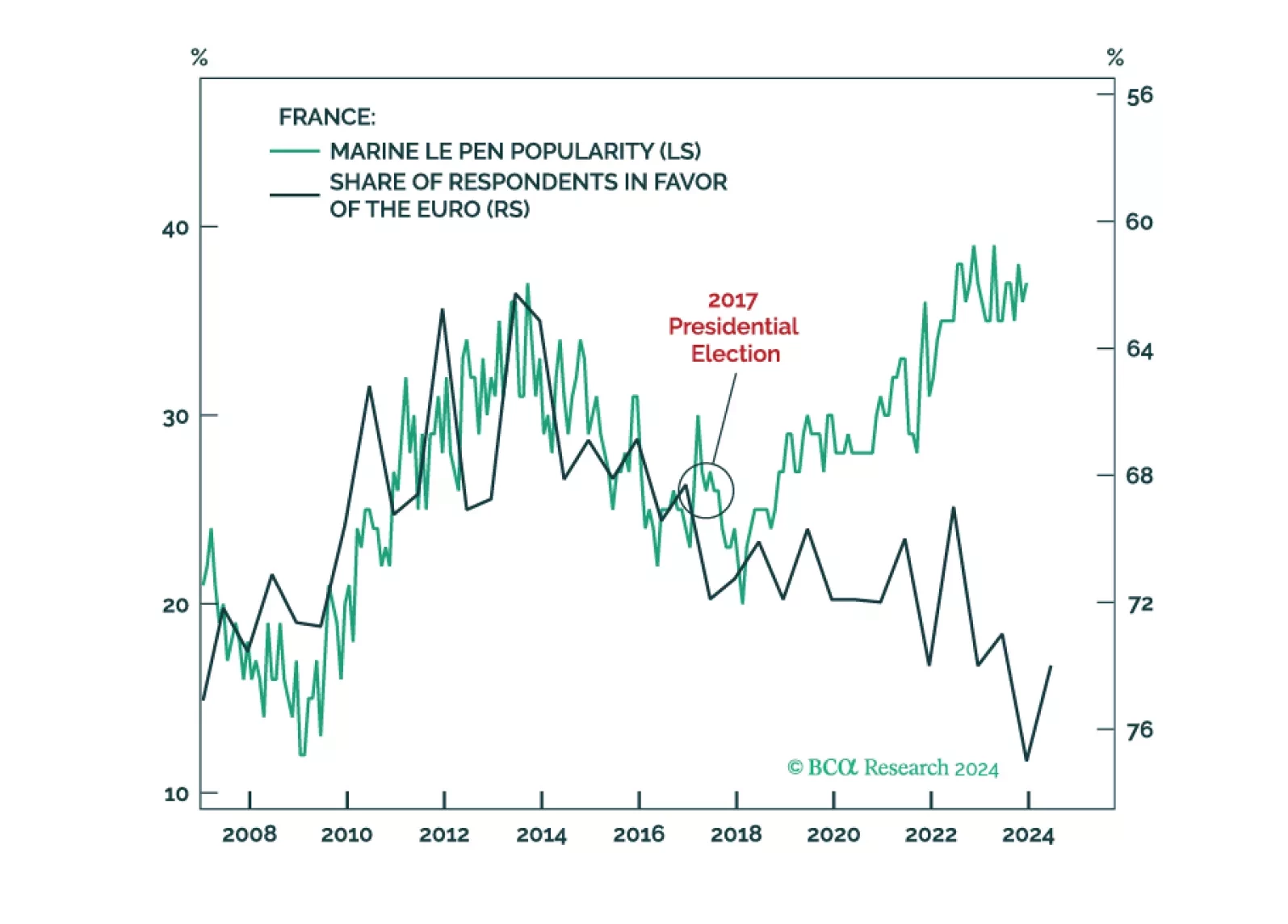

Investors in European sovereign bonds should find solace that continental voters are not turning away from support for EU integration. As such, populist parties are not really that “far” left or right. And as long as they want to…

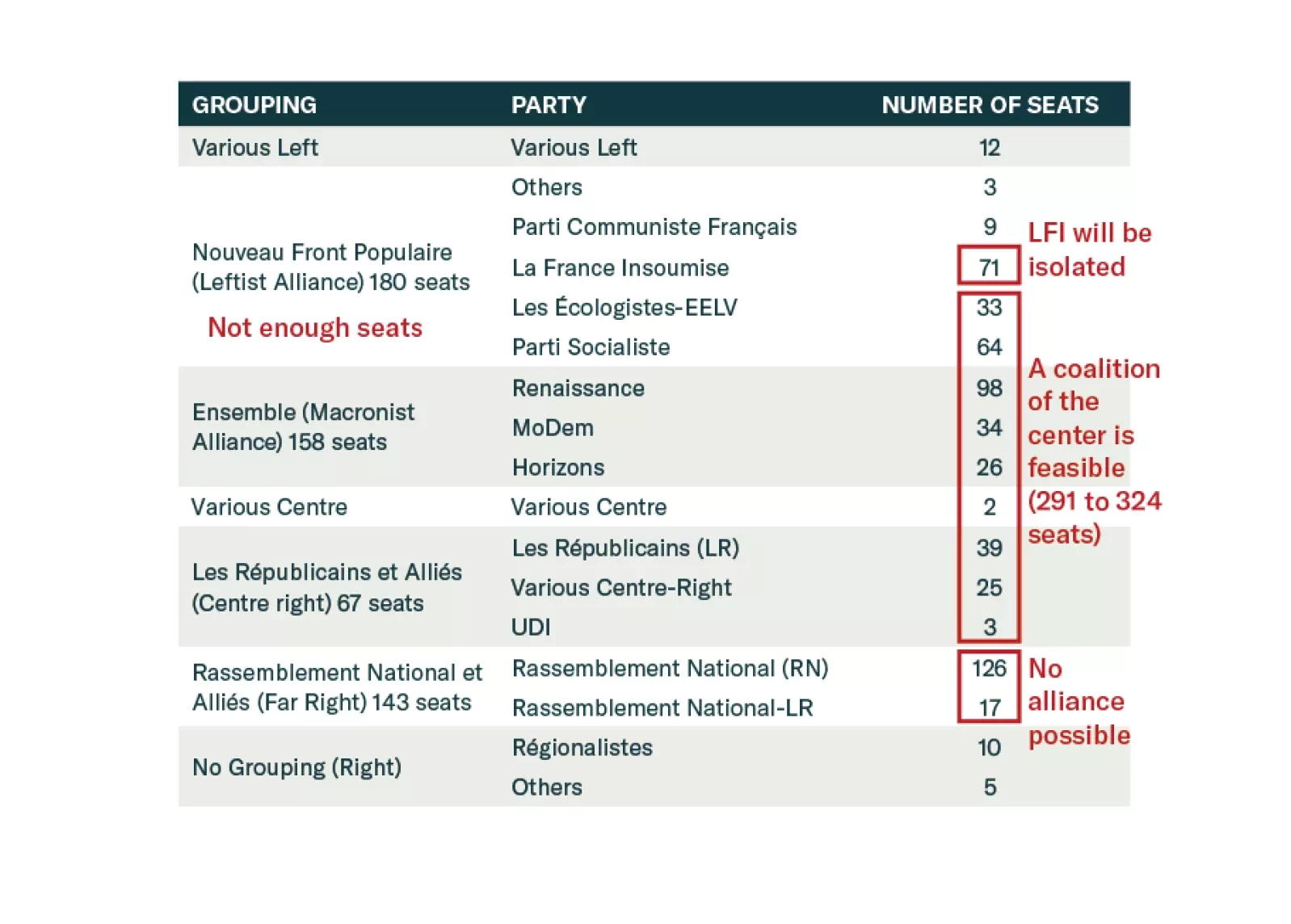

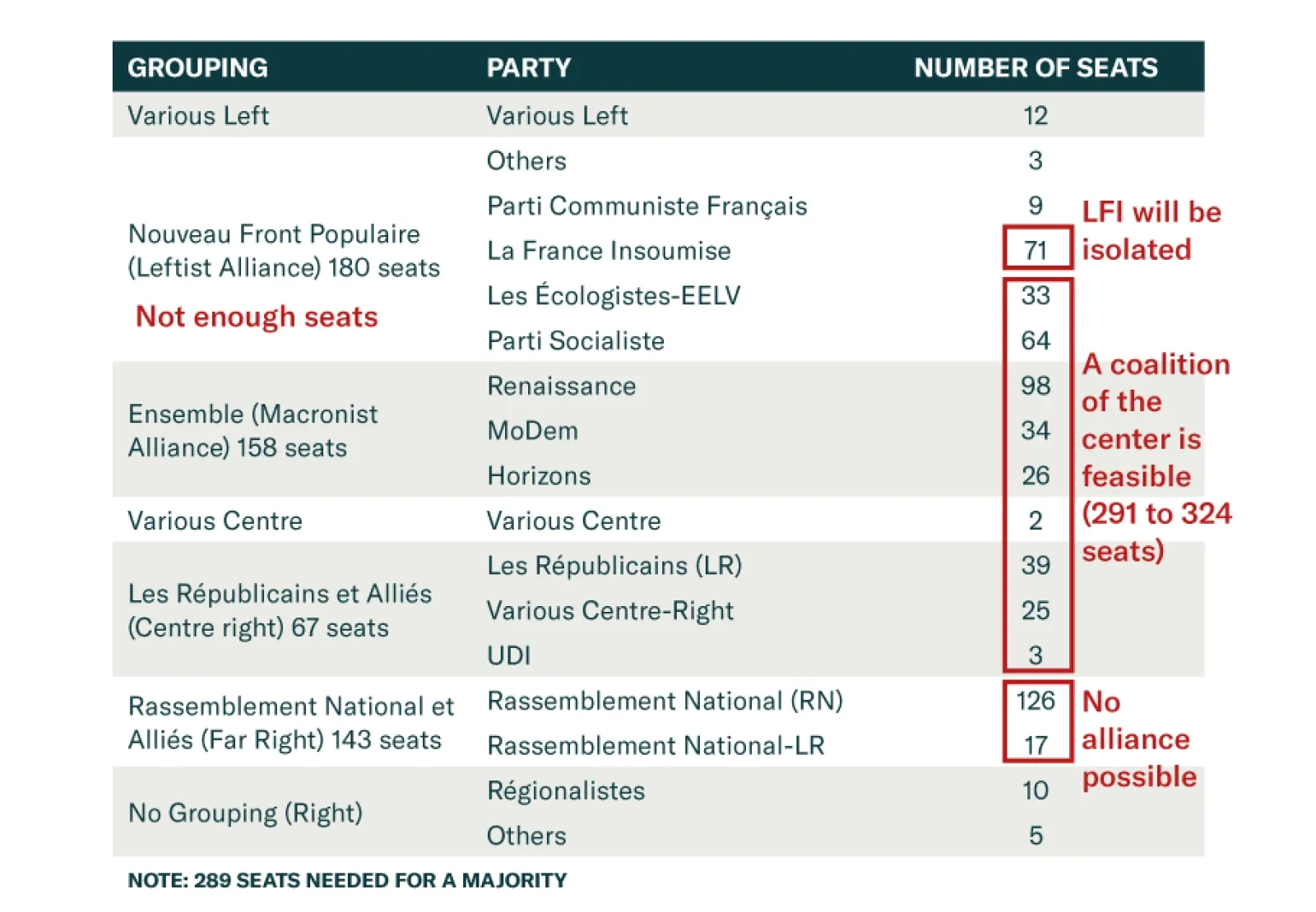

France’s snap election is over and, according to BCA Research’s European Investment Strategy service, President Emmanuel Macron’s gamble paid off in some ways: neither the far right nor the far left can form a…

At first glance, France has moved to the far left. However, this coalition is fragile, and Macron’s allies still hold the balance of power. What are the assets that will benefit from this new political setup, and those that will not…

The Labour Party won the UK election, just as BCA Research’s Geopolitical Strategy service predicted back in 2022. However, this win is unlikely to rock the proverbial geopolitical boat. Popular enthusiasm for Sir Keir…

German Factory orders disappointed on Thursday. The month-on-month contraction deepened to 1.6% in June from a contraction of 0.6% in May, revised down from the previously reported 0.2%, well below expectations of a modest 0.5%…