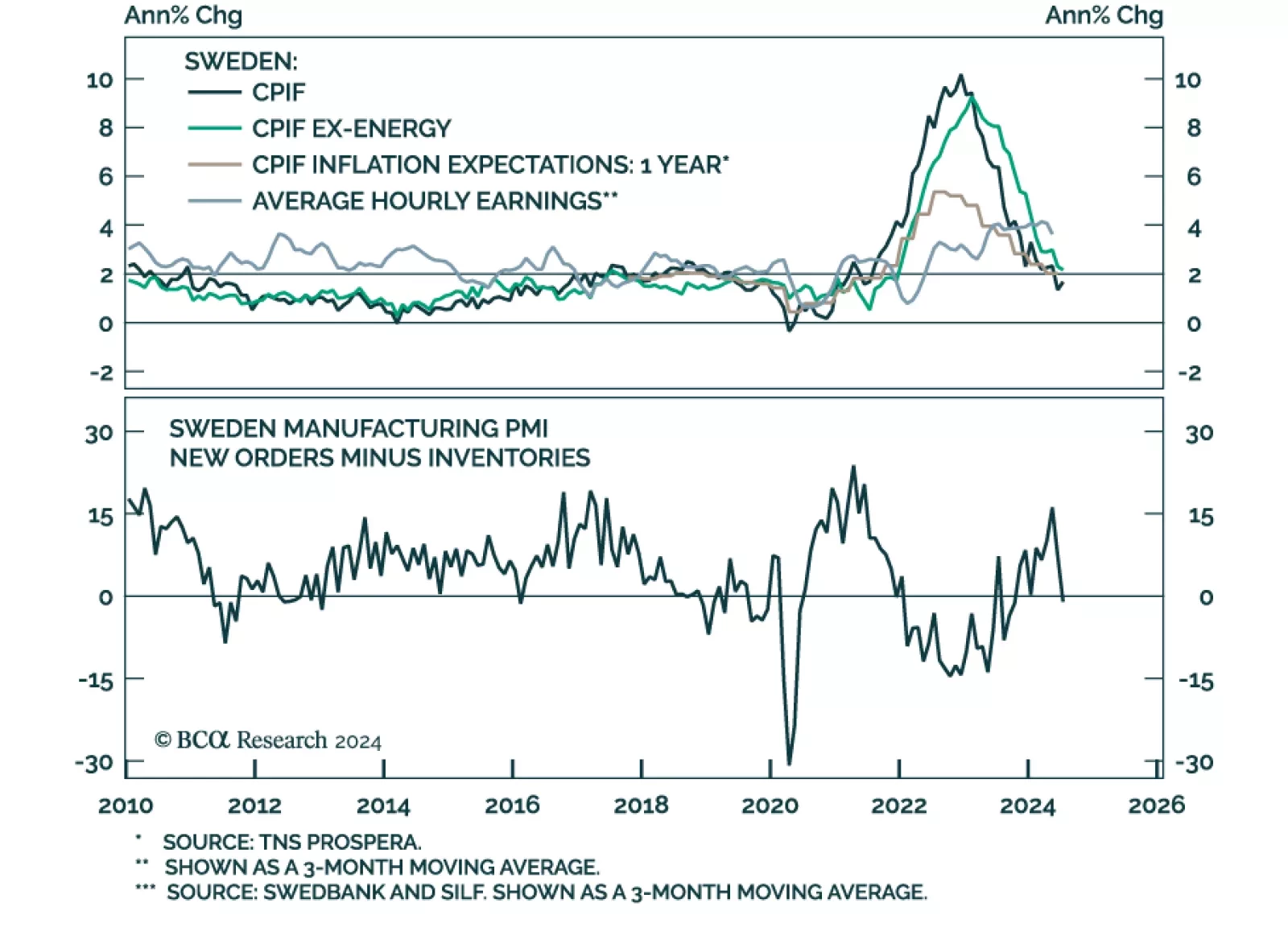

In a widely expected move, the Riksbank lowered its policy rate from 3.75% to 3.5% in August. It had kept rates on hold in June, after having led many other major DM central banks in easing policy in May. The Riksbank also…

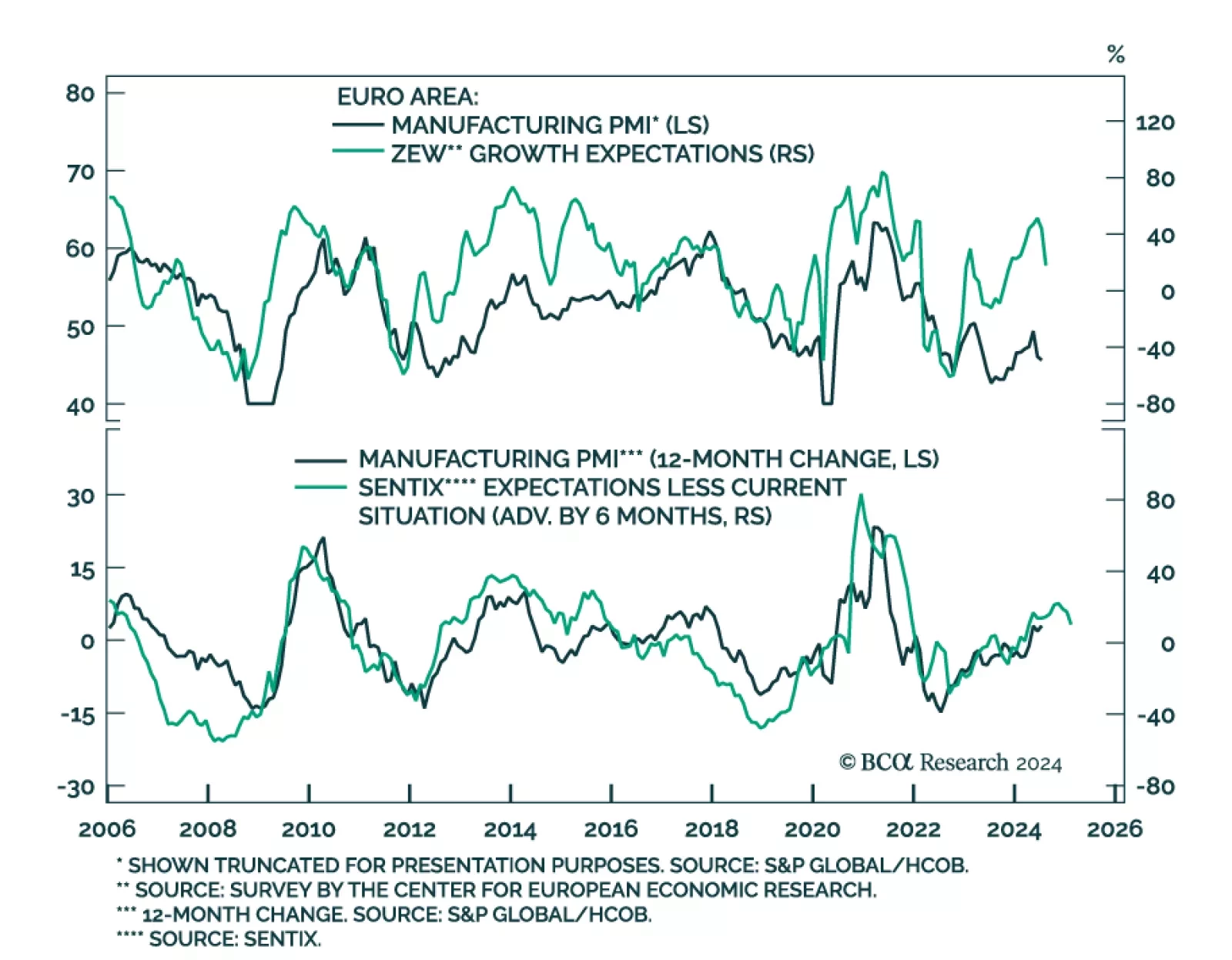

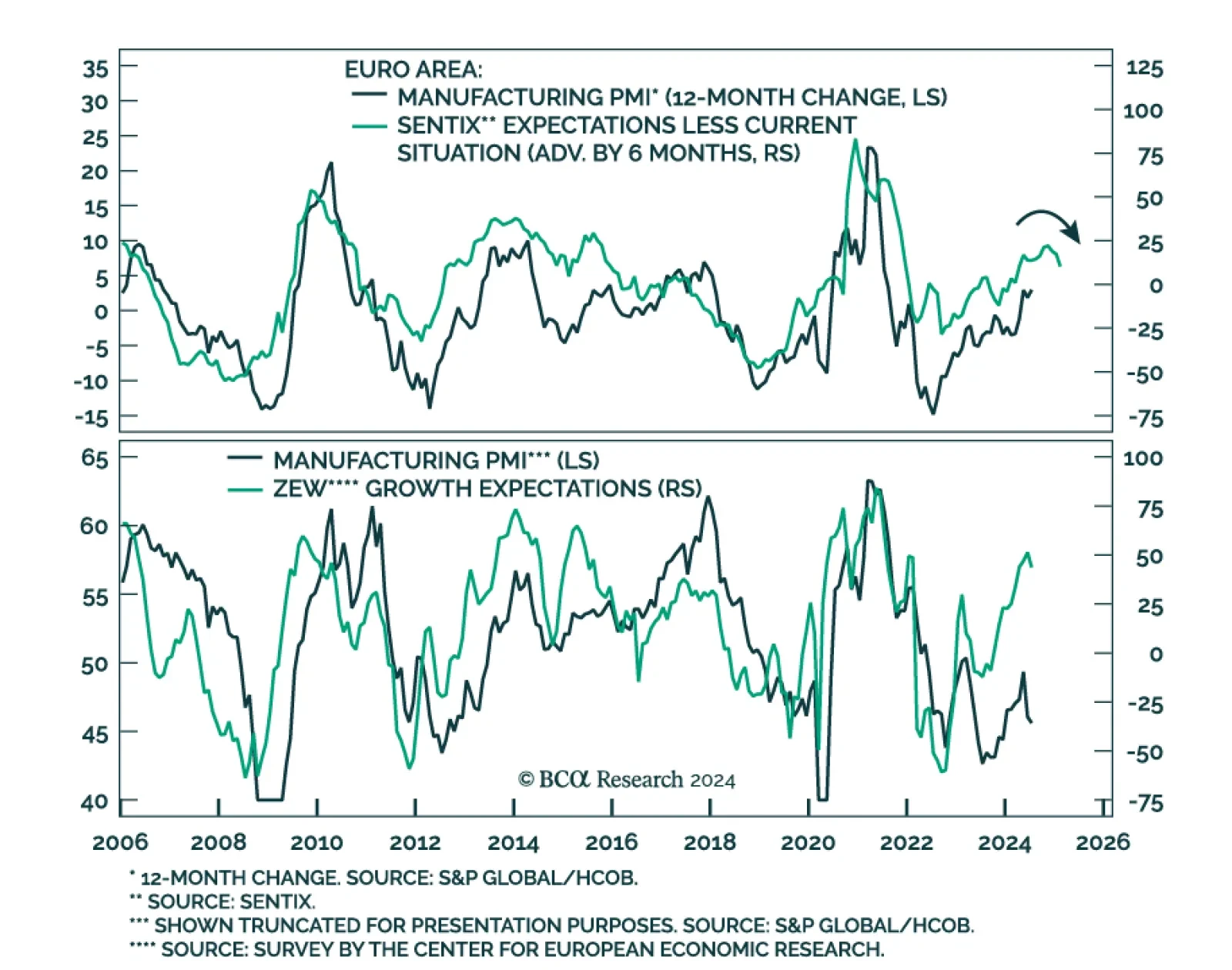

The ZEW survey of Eurozone business expectations decreased by a whopping 25.8 points to 17.9 in August. Notably, expectations for Germany’s current situation disappointed, worsening from an already depressed -68.9 level to…

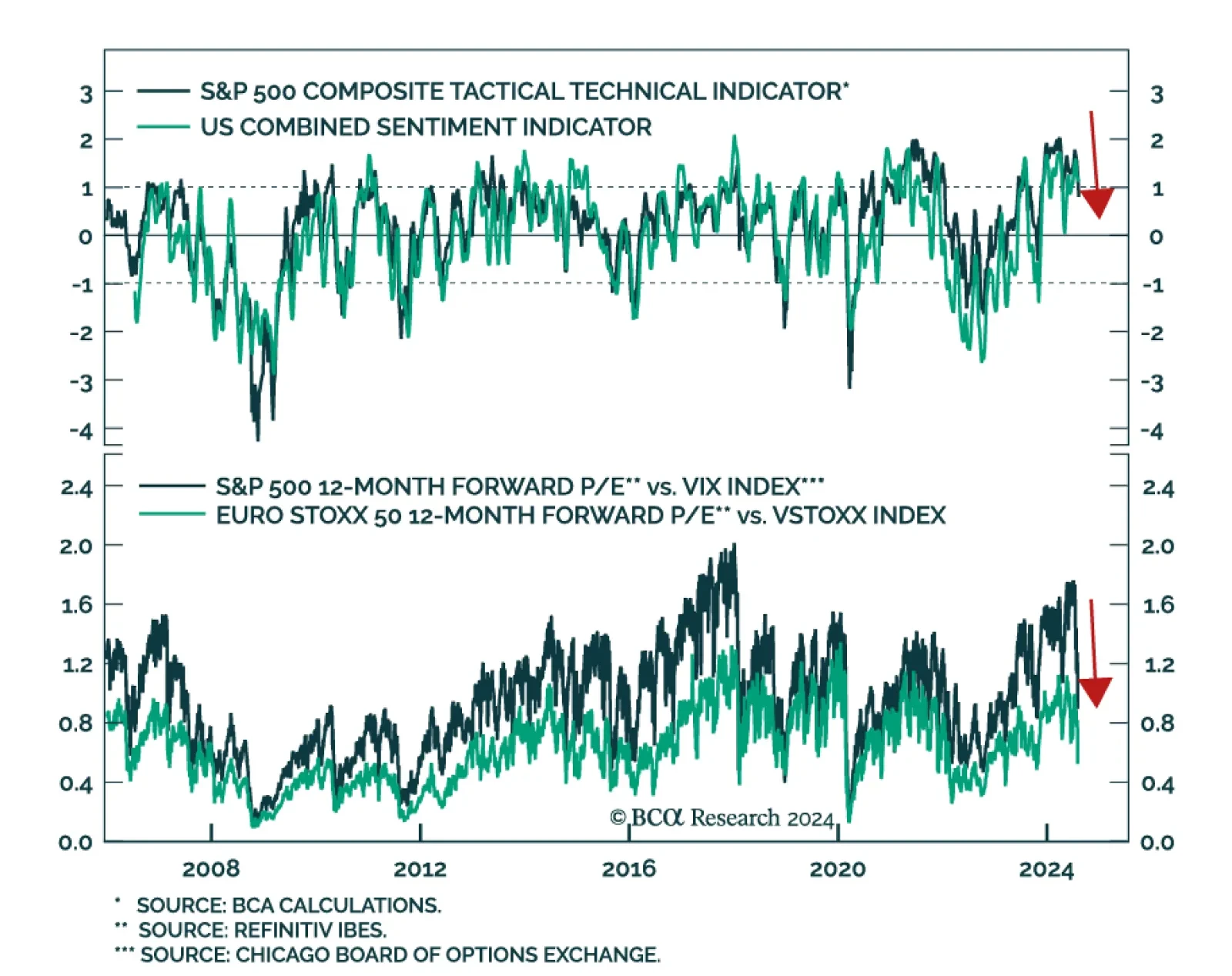

According to BCA Research’s European Investment Strategy service, investors should fade the rebound in European equities and bond yields as the euro is also at risk. Last week’s bounce in global equities is…

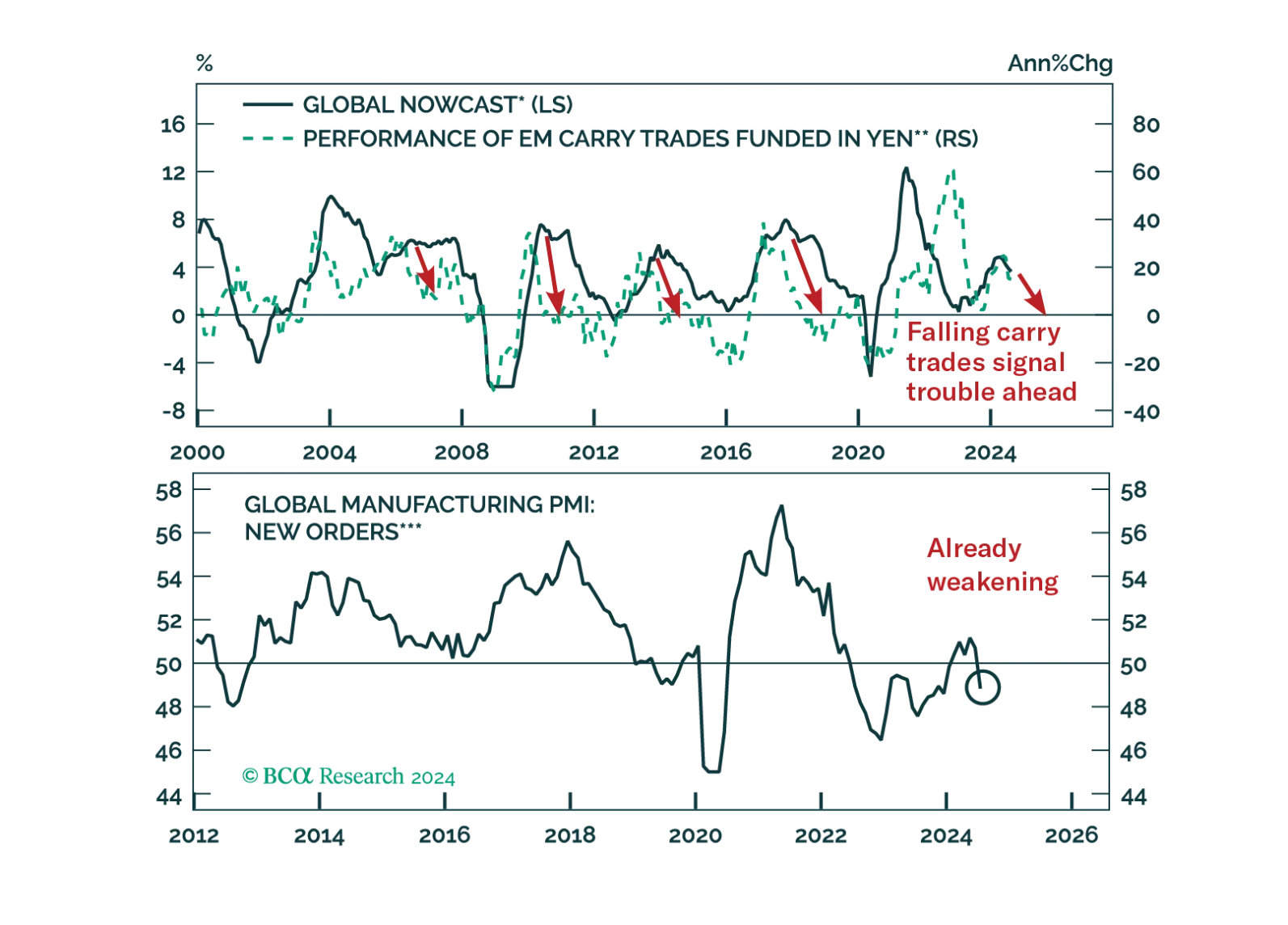

Regular readers are familiar with our expectation that the stabilization in global growth this year will be fleeting. The US has been the main source of demand in this cycle. We view the latest string of US employment data as…

The unwind of yen carry trades caused violent tremors across the globe. Was this shock a one-off event or the prelude to more troubles?

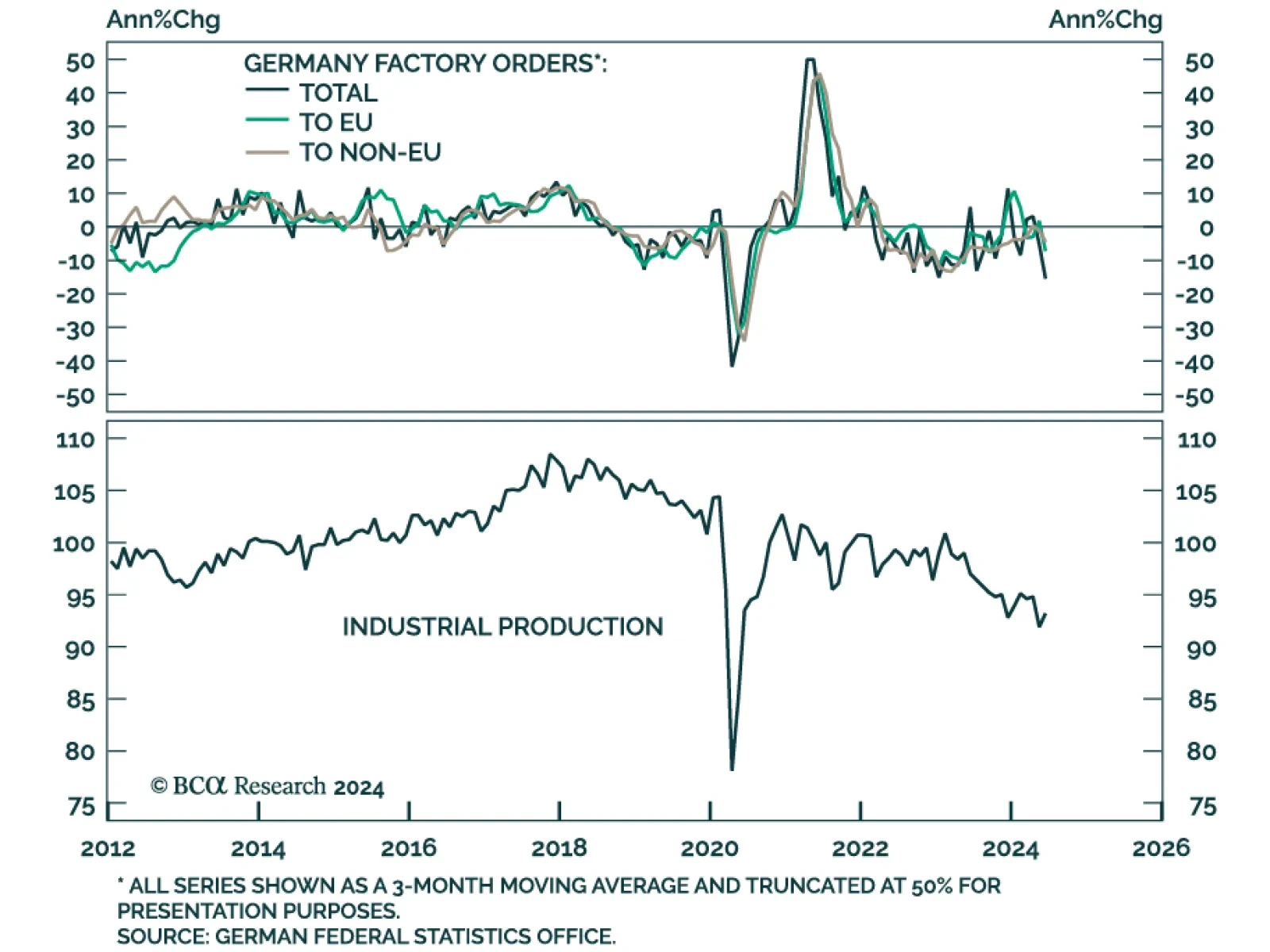

German Industrial production and factory orders continued their slump in June. The usual powerhouse of the Euro Area economy has been trailing its peers throughout 2024. While both industrial production and factory orders…

After briefly breaking a 27-month streak of negative sentiment back in June, the Eurozone Sentix Economic index disappointed in August. The overall index worsened from July’s negative reading to -13.9, below expectations…

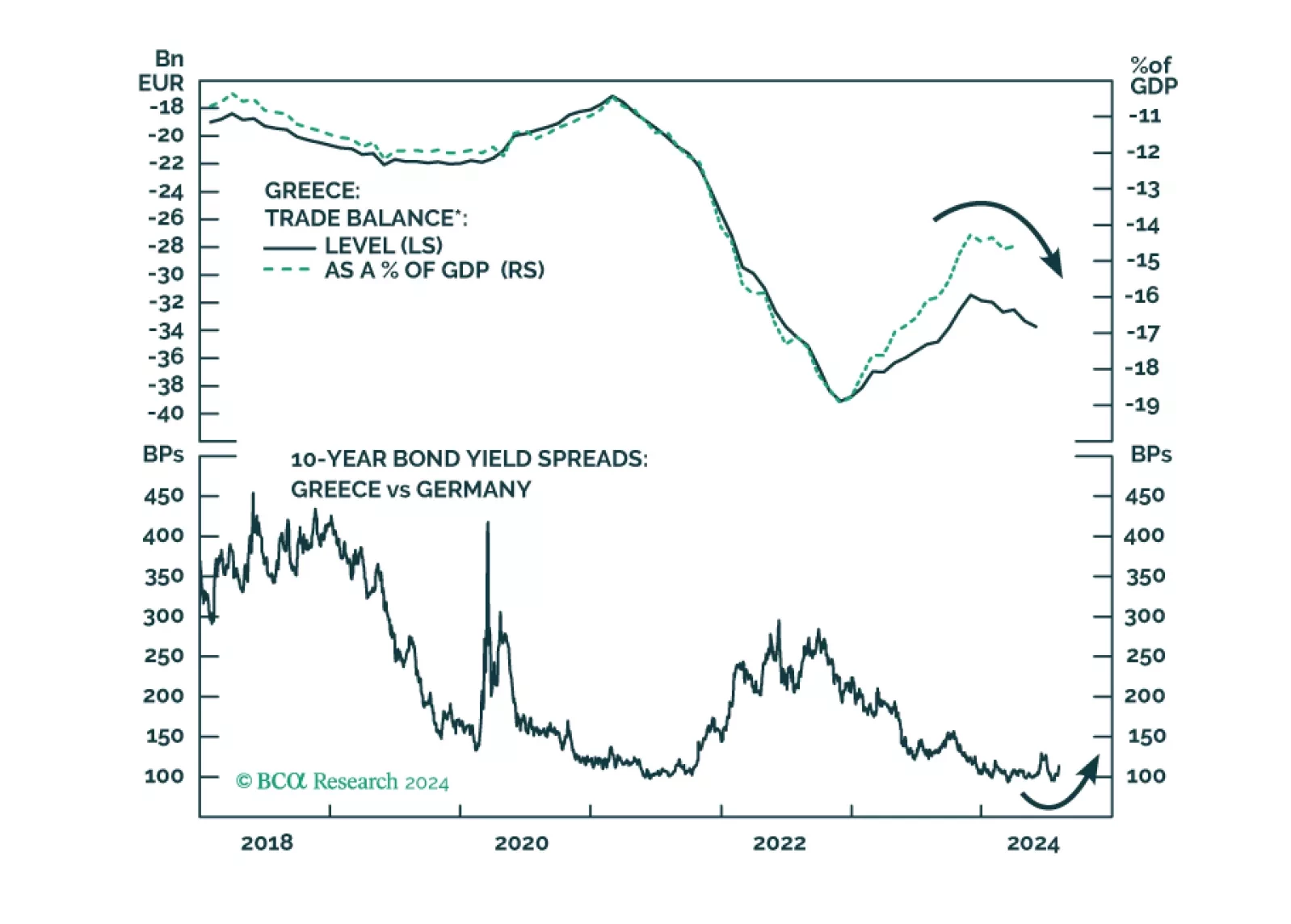

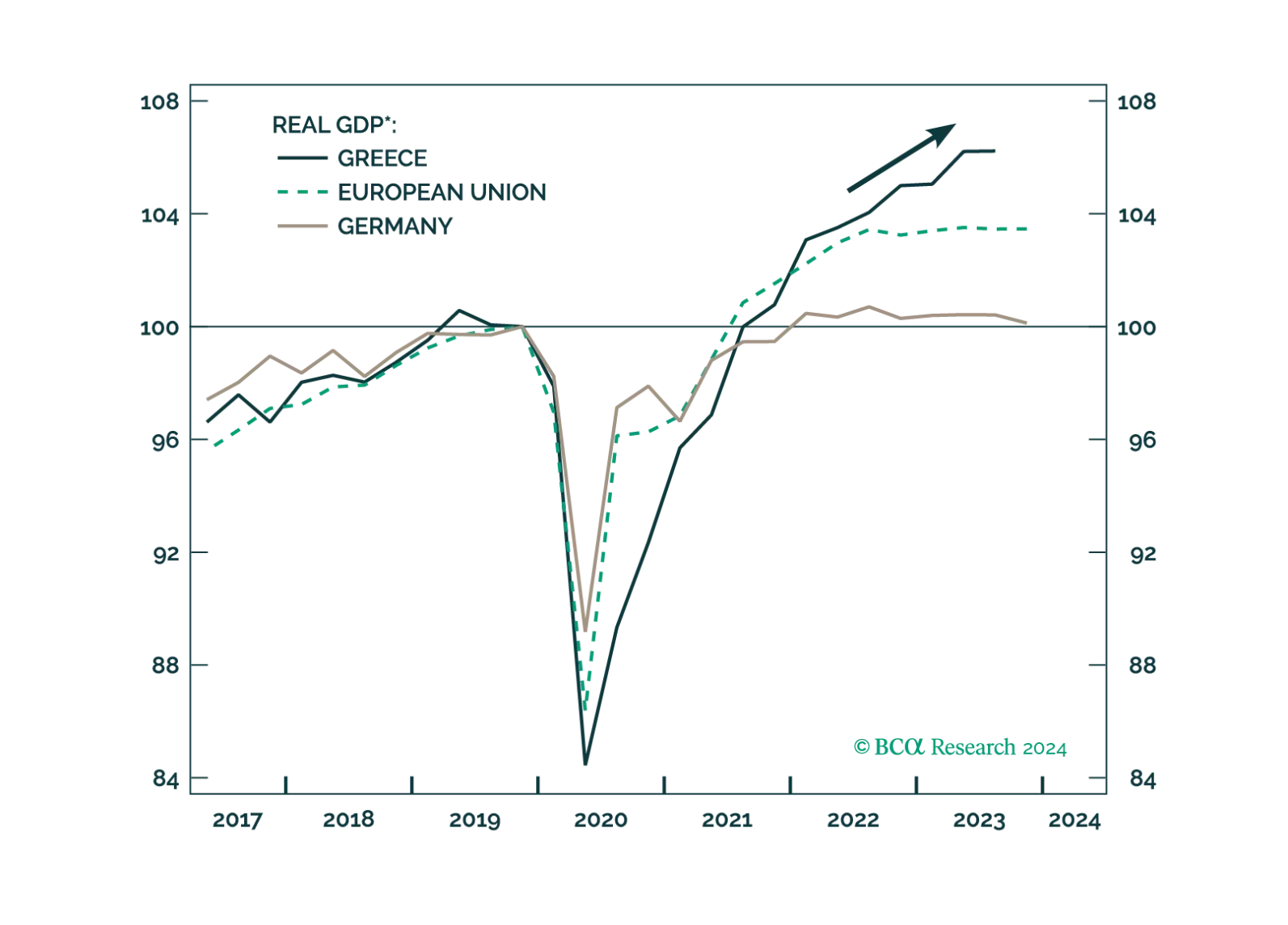

Absolute return investors should be tactically cautious on Greek assets. Dedicated EM equity portfolios, however, should overweight Greek stocks.