After surprising to the upside in July on higher energy costs, Eurozone CPI resumed its deceleration in August. Headline and core CPI declined from 2.6% y/y to 2.2% and from 2.9% to 2.8%, respectively. Energy prices contracted…

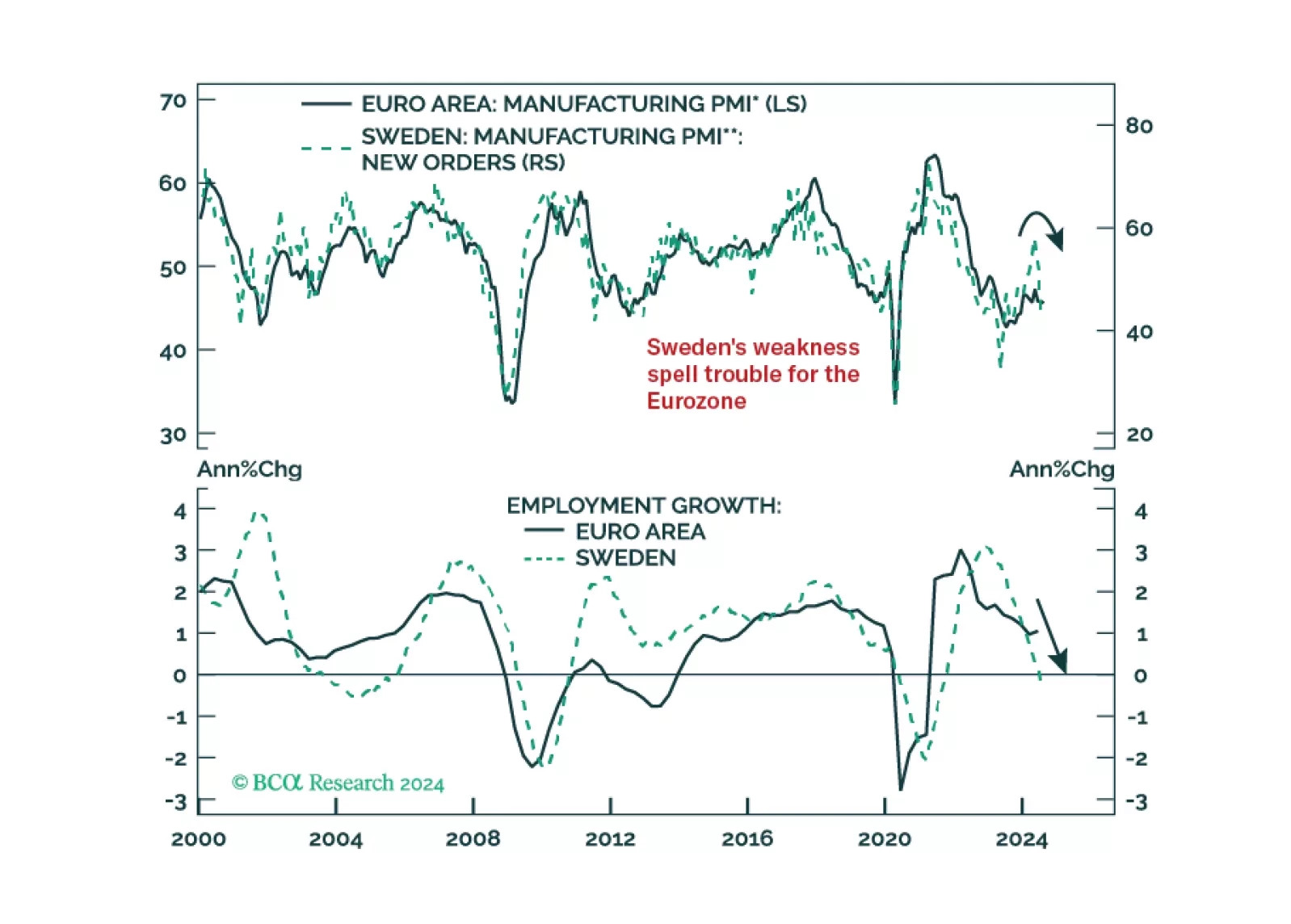

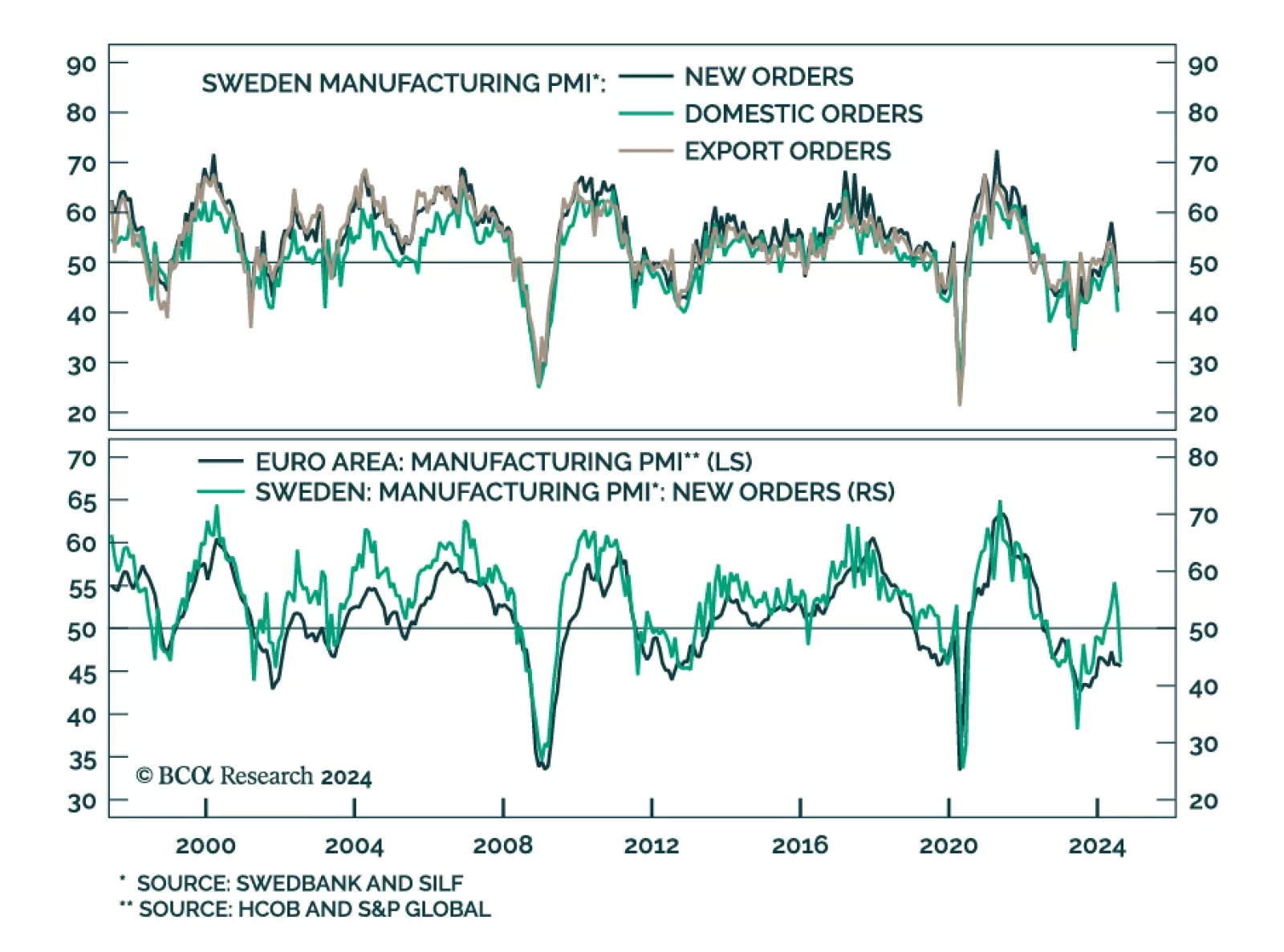

According to BCA Research’s European Investment Strategy service, Sweden, which acts as a bellwether for the global economy, will offer early insight into whether our base-case late 2024/early 2025 recession scenario will…

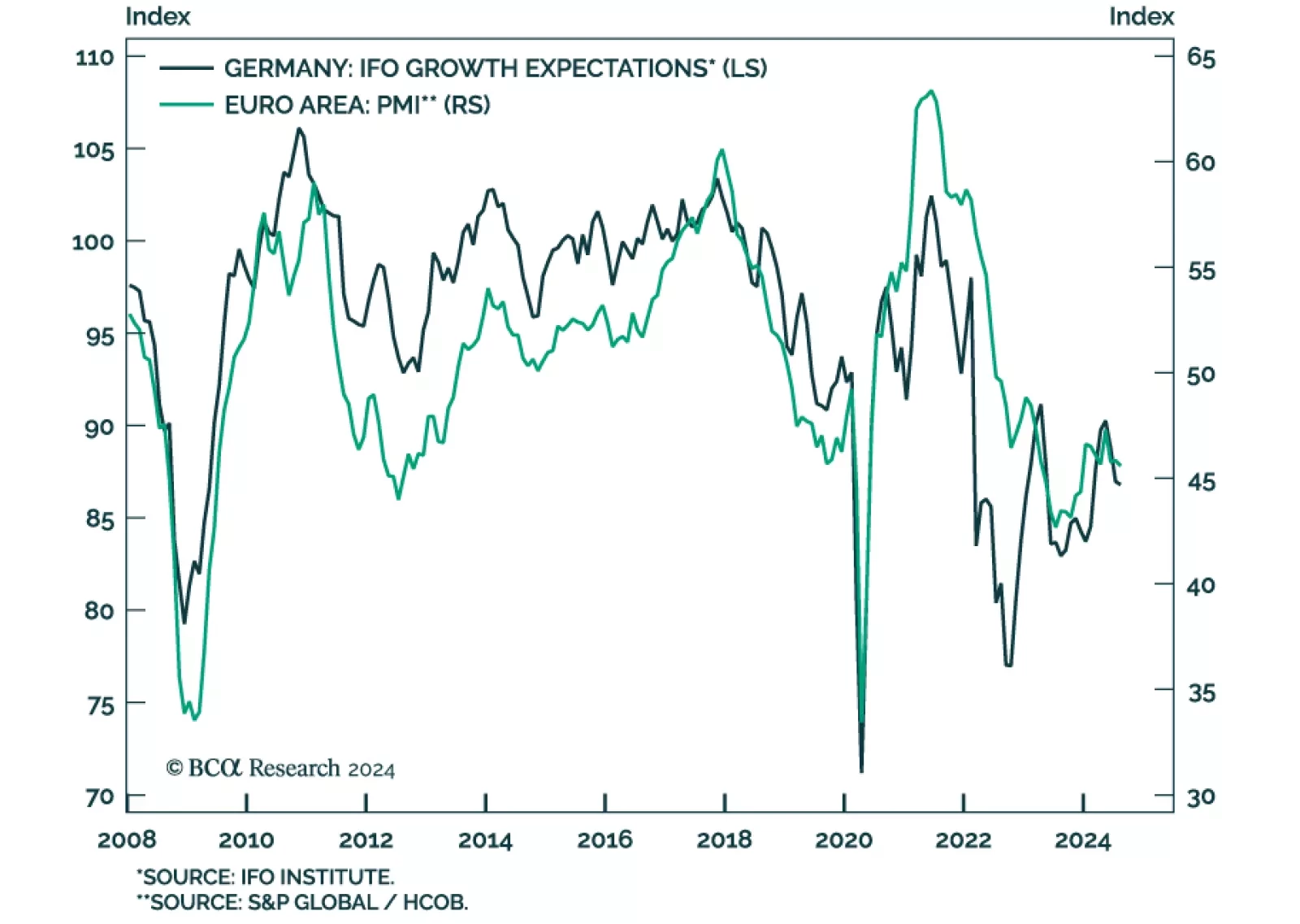

Sentiment among German companies declined in August from 87.0 to 86.6. Current conditions shed 0.6 points to 86.5 while the expectations component ticked 0.2 points lower. It nevertheless exceeded consensus expectations for a…

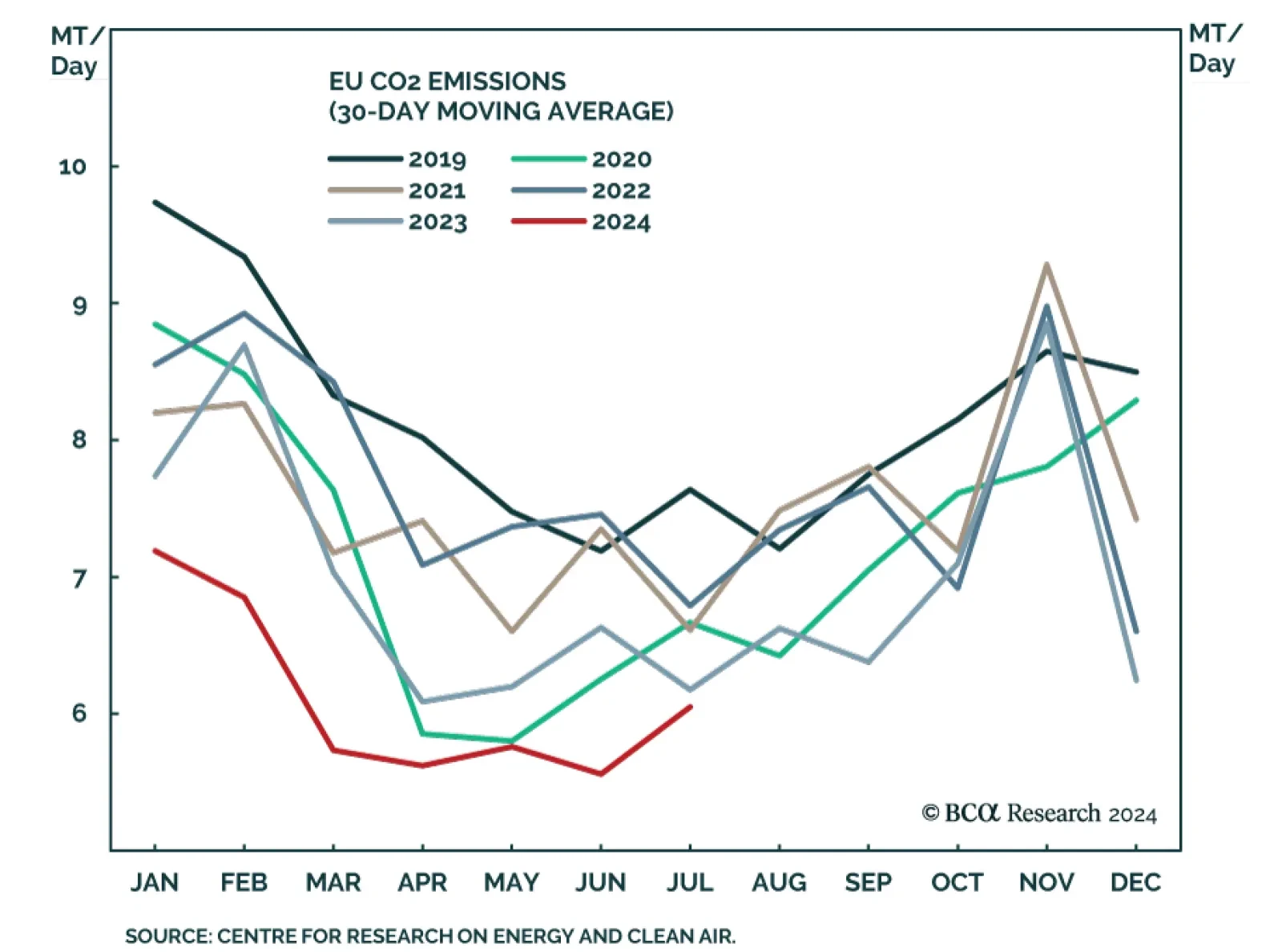

European regulatory carbon credits (EUAs) are becoming increasingly investable as an asset class. In a Special Report published last September, our Global Investment strategists agreed to the strategic bull case for EUAs, but…

Our negative stance on European growth and assets is not devoid of risks. To gauge whether these risks warrant upgrading our growth outlook, we monitor Sweden closely. So, what is the current message from this Nordic economy?

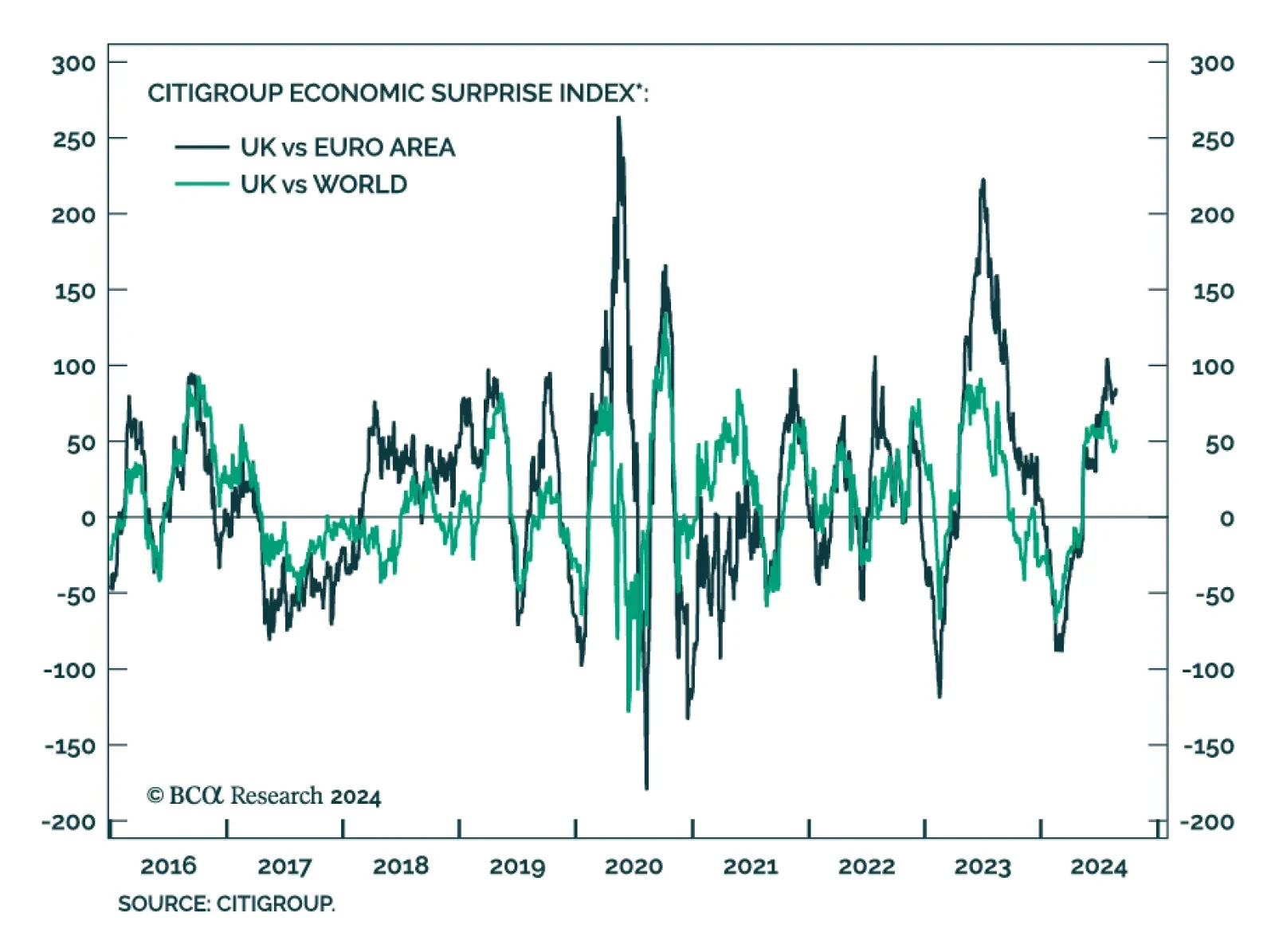

UK GDP growth accelerated to 0.6% in the second quarter, and the latest PMI data underscores contrasts with its DM counterparts (see The Numbers). Several tailwinds are supporting the UK economy. Two-year Gilt yields have…

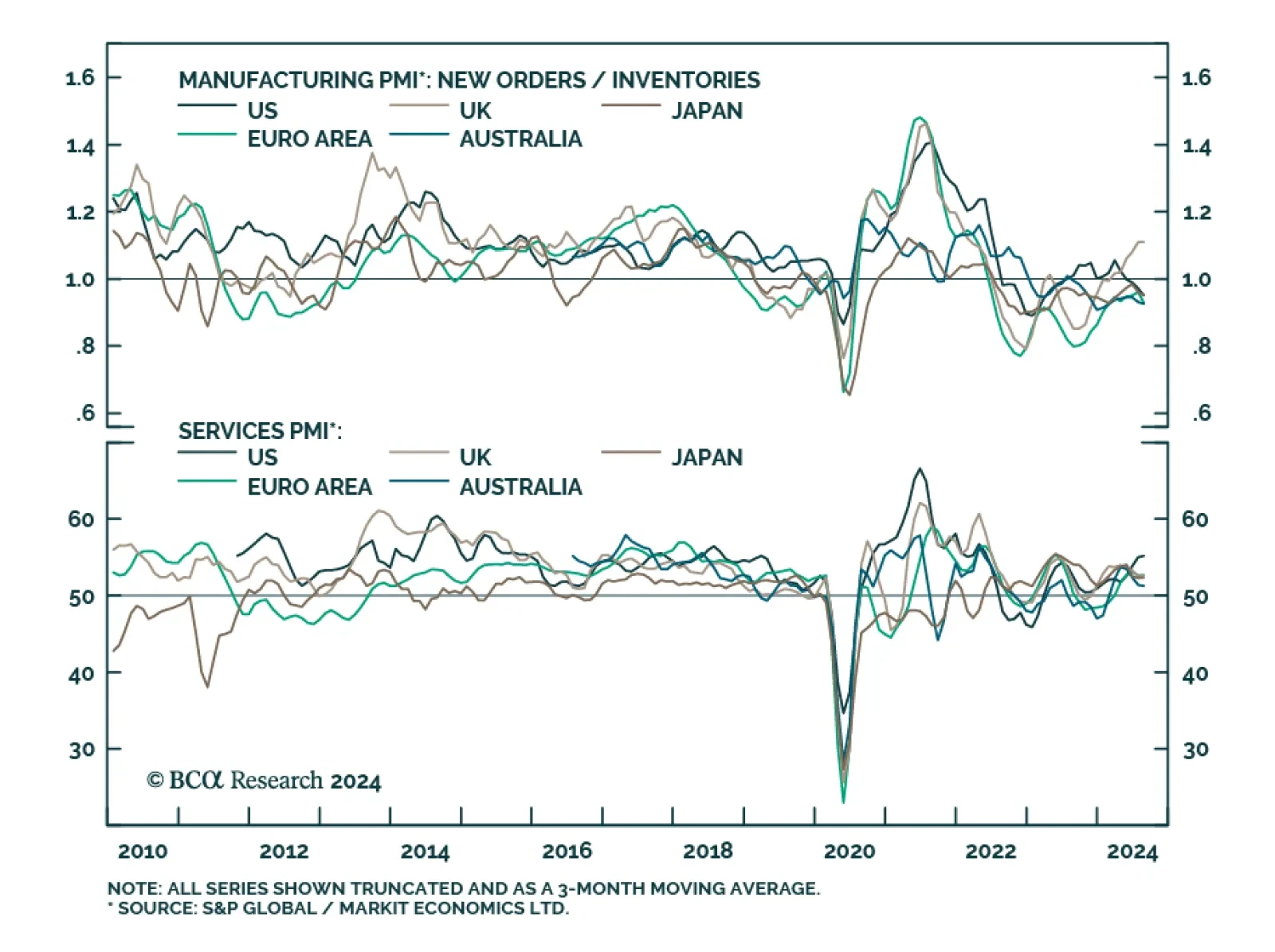

Preliminary estimates suggest that with the exception of the UK (see Country Focus), manufacturing activity remains lackluster in DM economies. Manufacturing declined at a slower pace in Japan and Australia but the contractions…

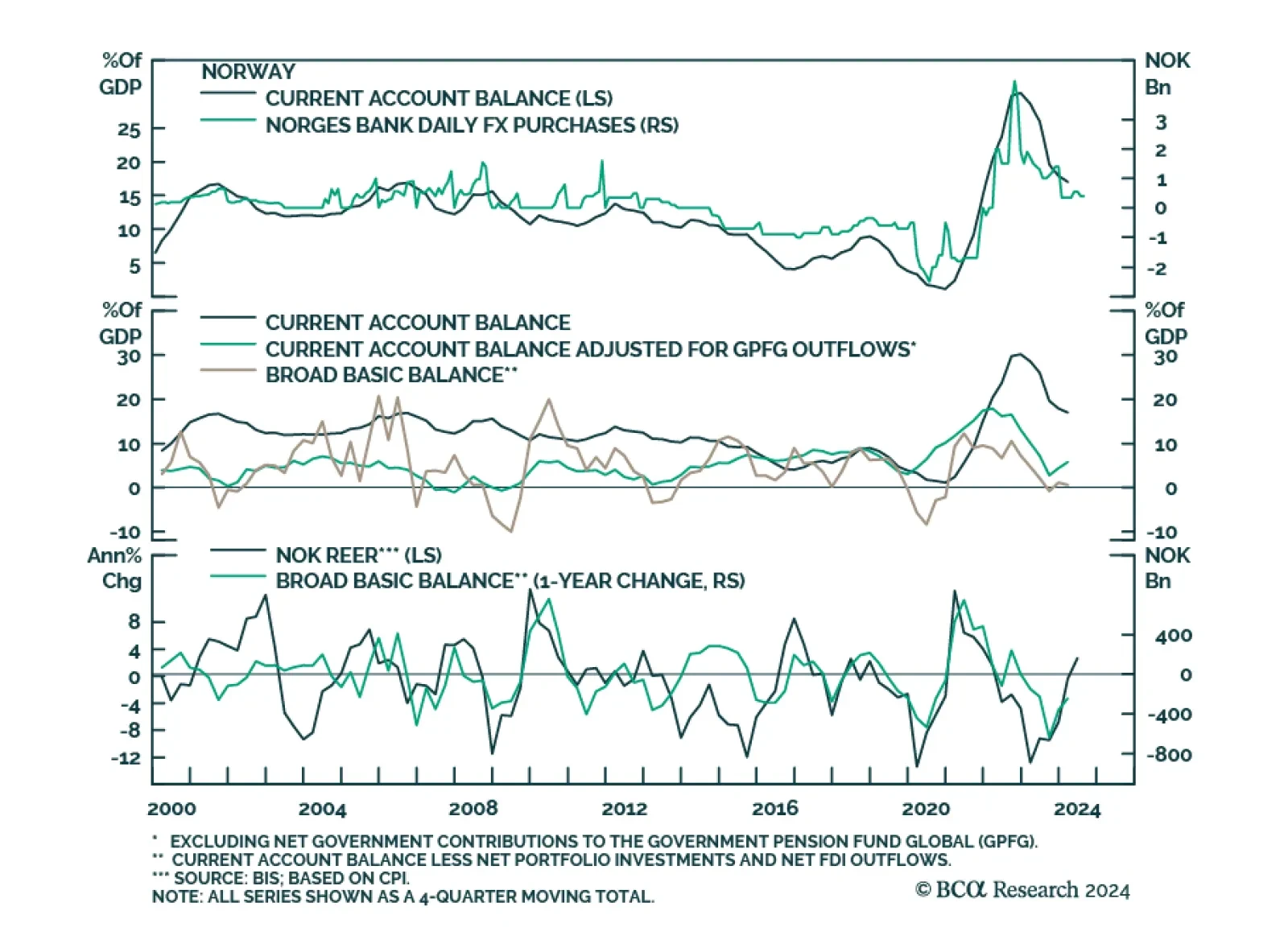

According to BCA Research’s Foreign Exchange Strategy service, the domestic economy does not really explain the recent weakness in the Norwegian krone. Some of this weakness can be attributed to structural and…

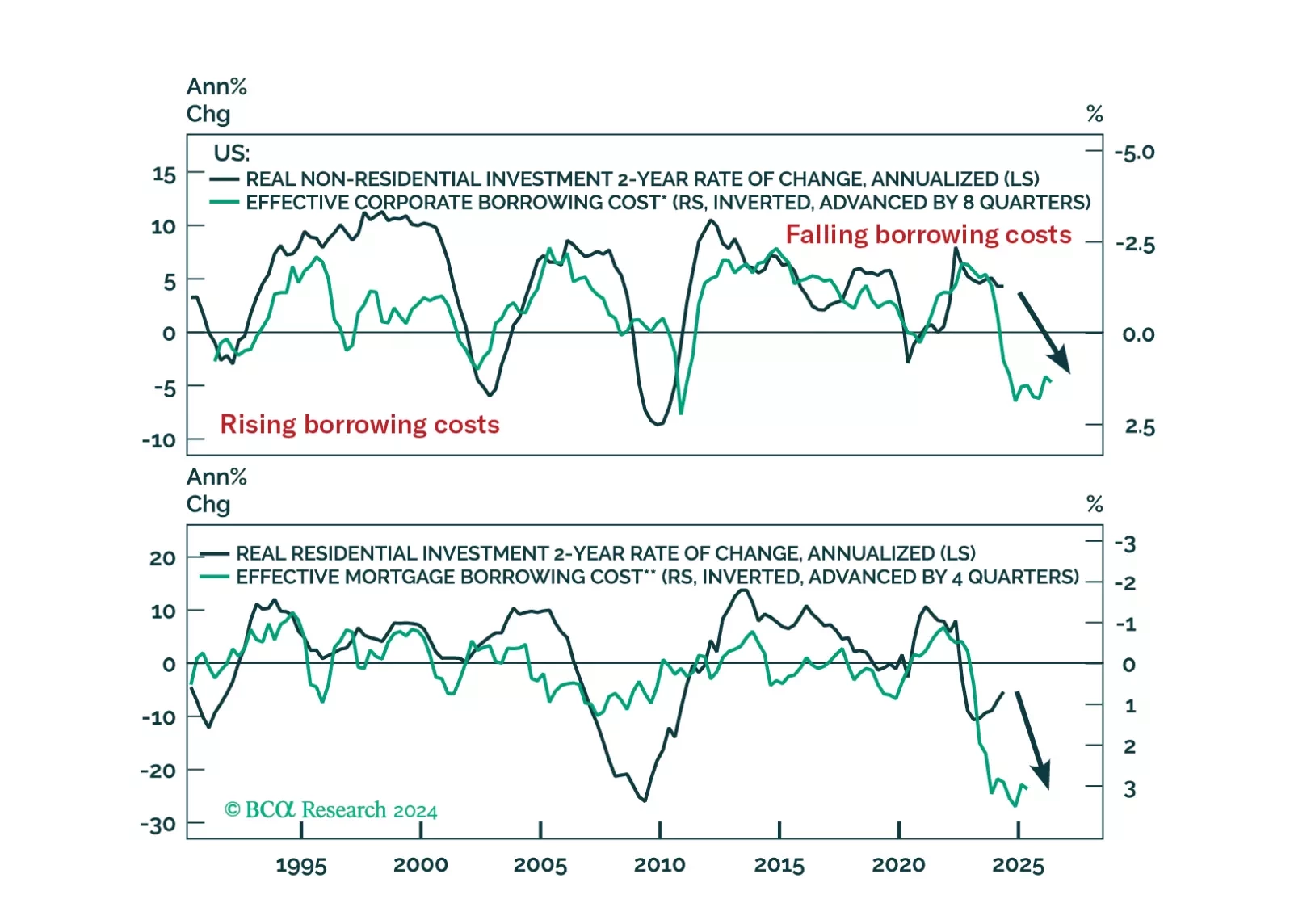

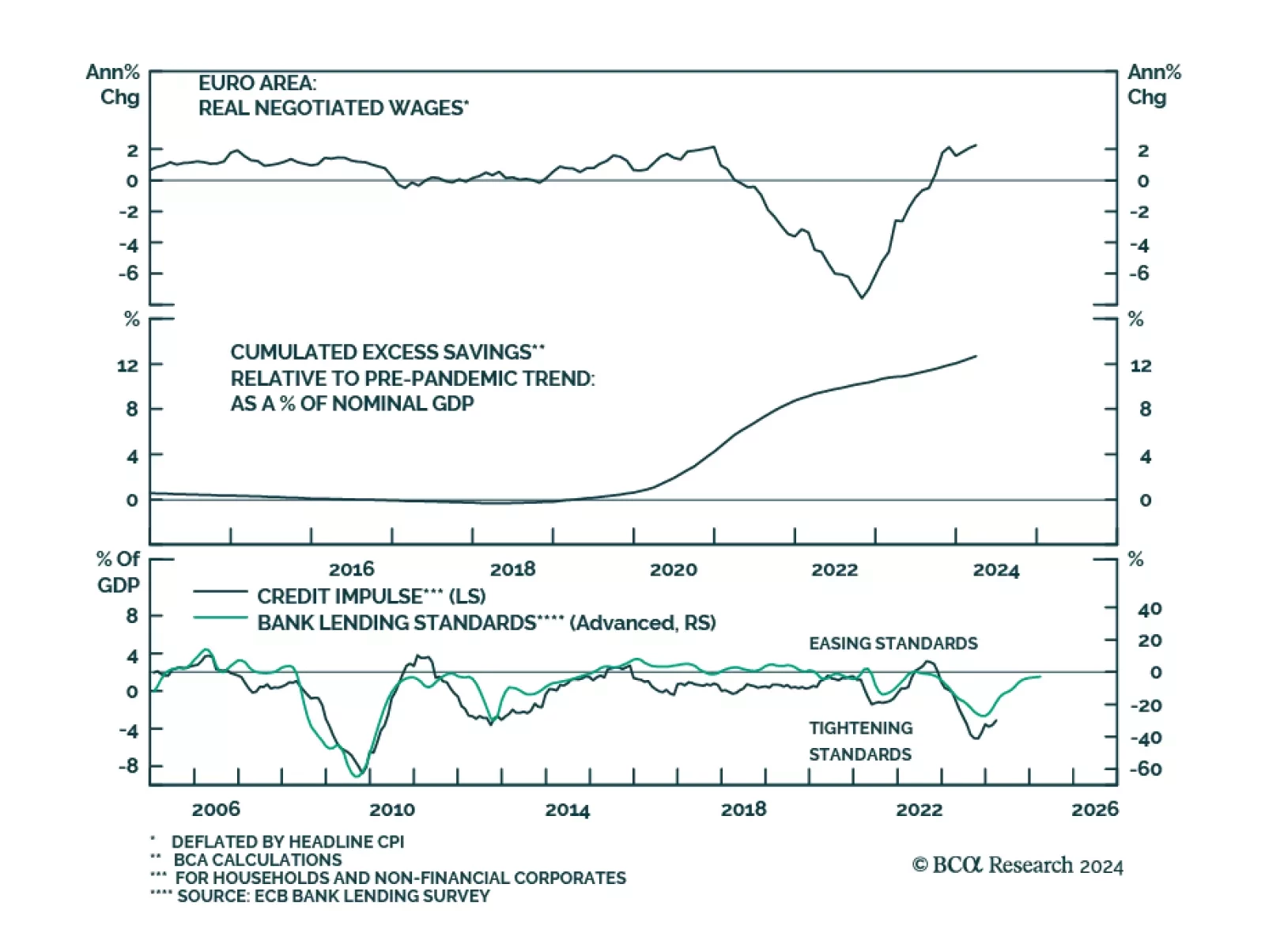

We’ve highlighted that continued deterioration in consumer fundamentals will tip the US economy into a recession. Slower compensation growth, tighter lending standards for consumer loans and dwindling excess savings will…