Following a 12-year-long bear market, Greek equities have returned a whopping 186% in EUR terms from their 2016 lows. The Greek macroeconomic backdrop has indeed improved. Since 2021, Greece’s nominal GDP growth has…

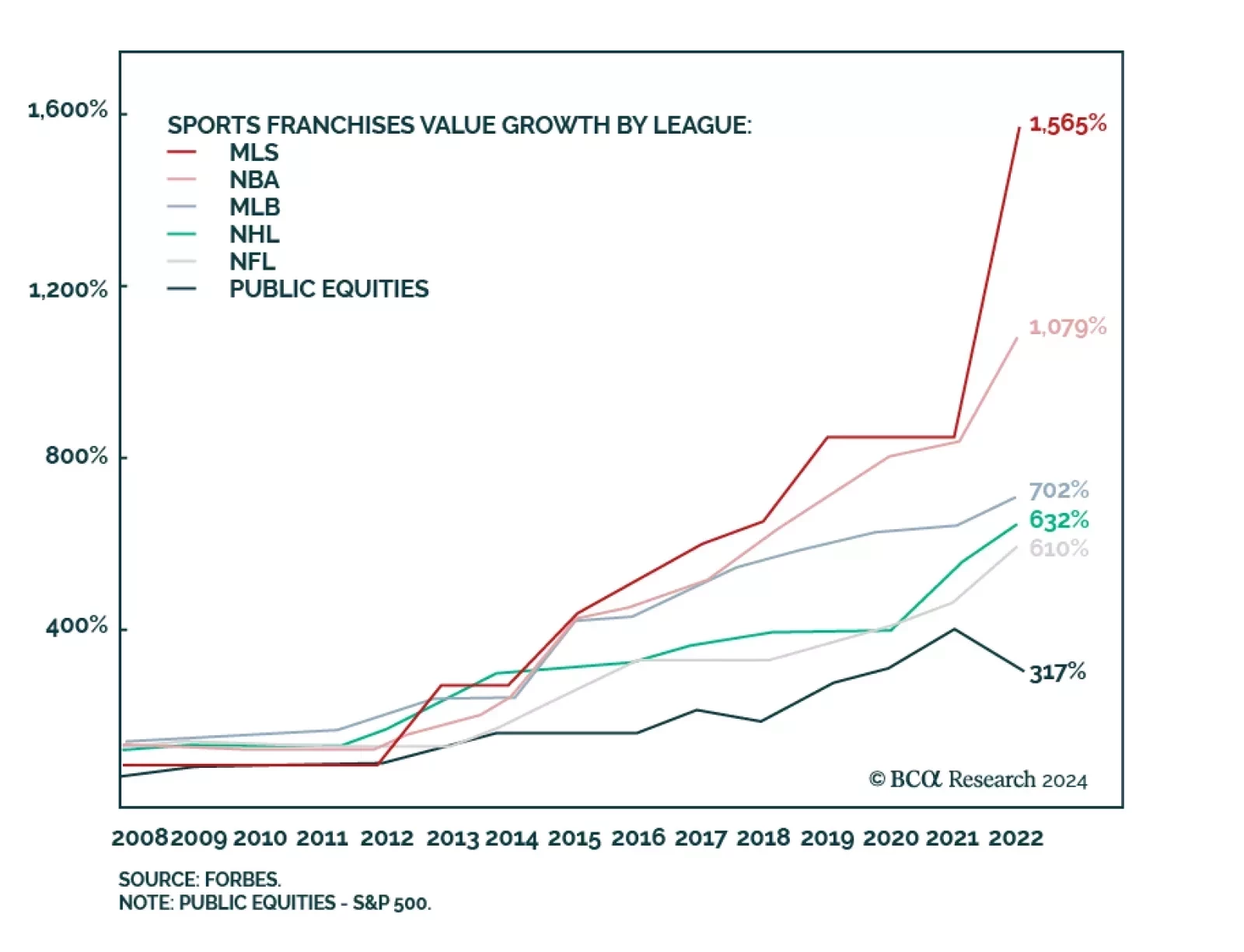

According to BCA Research’s Private Markets & Alternatives service, the Sports Franchise market presents a compelling opportunity for Private Equity due to its strong growth potential, evolving business models, and…

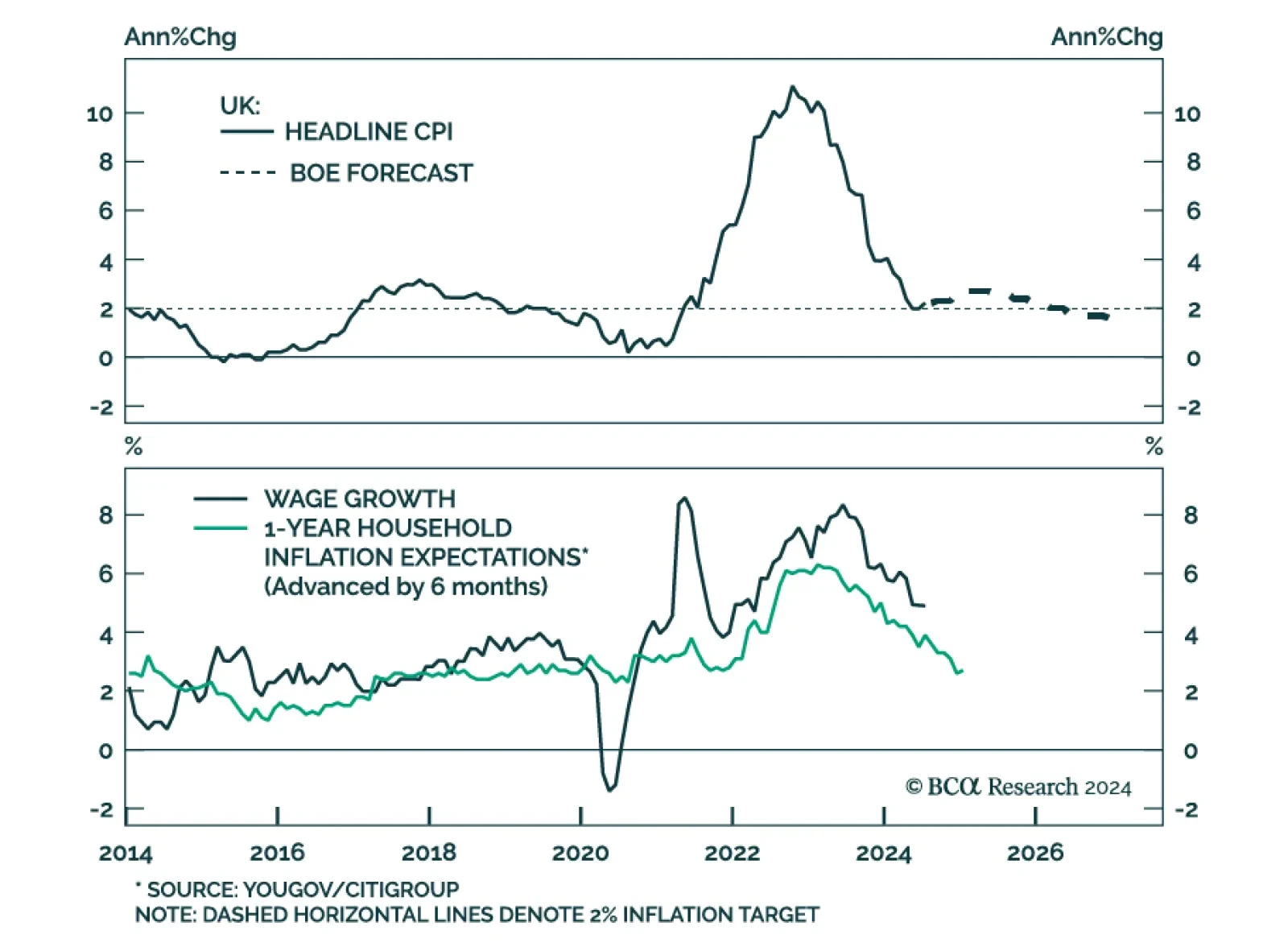

The BoE embarked on its easing cycle in August, delivering its first 25 bps rate cut. The decision was nowhere near unanimous, with 5 MPCs out of 9 voting in favor of lowering policy rates. Indeed, while headline inflation is…

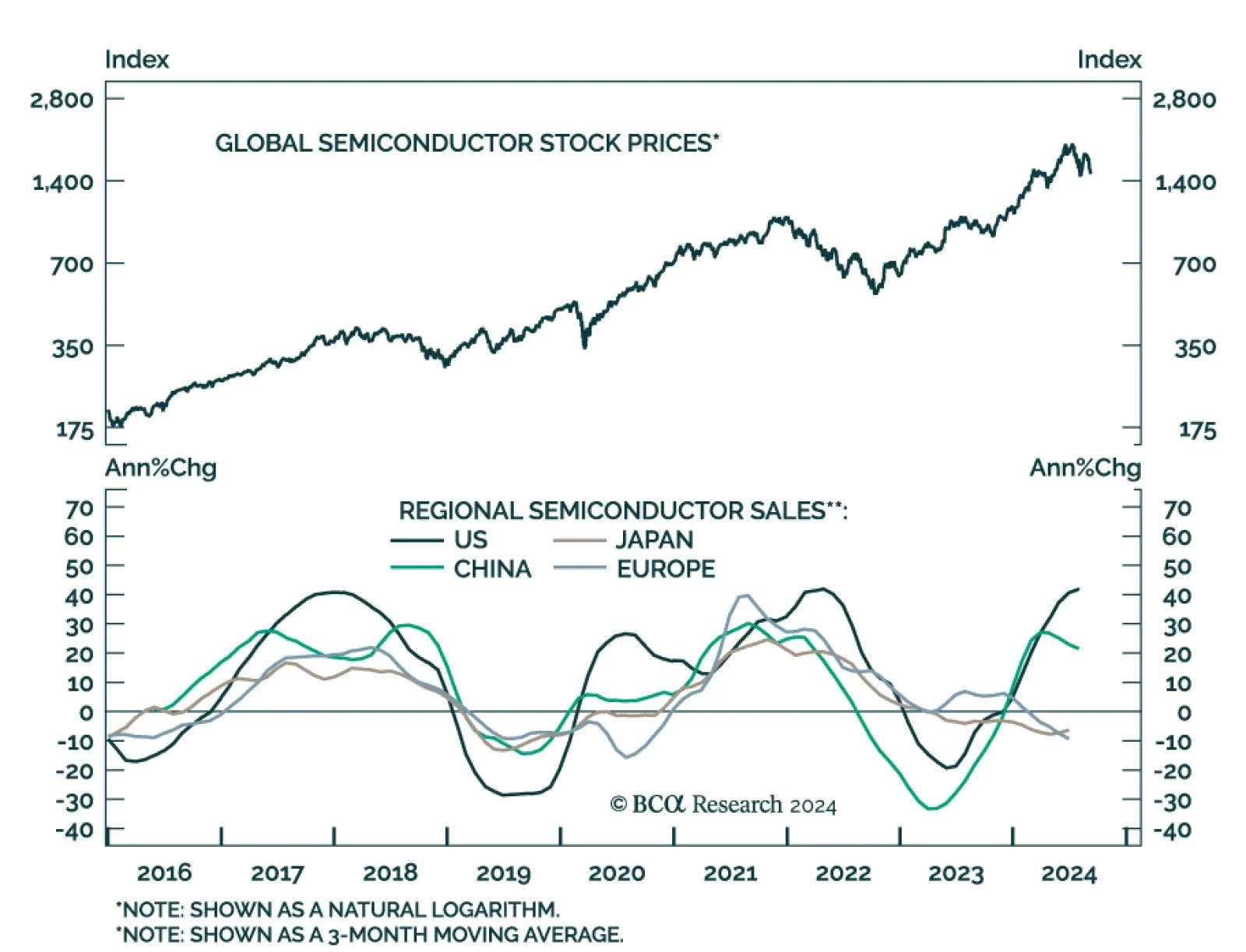

Global semiconductor stocks have returned 50% YTD in USD terms, and a whopping 200% since their September 2022 lows. However, they may have peaked back in July. Our Emerging Market strategists highlight a significant…

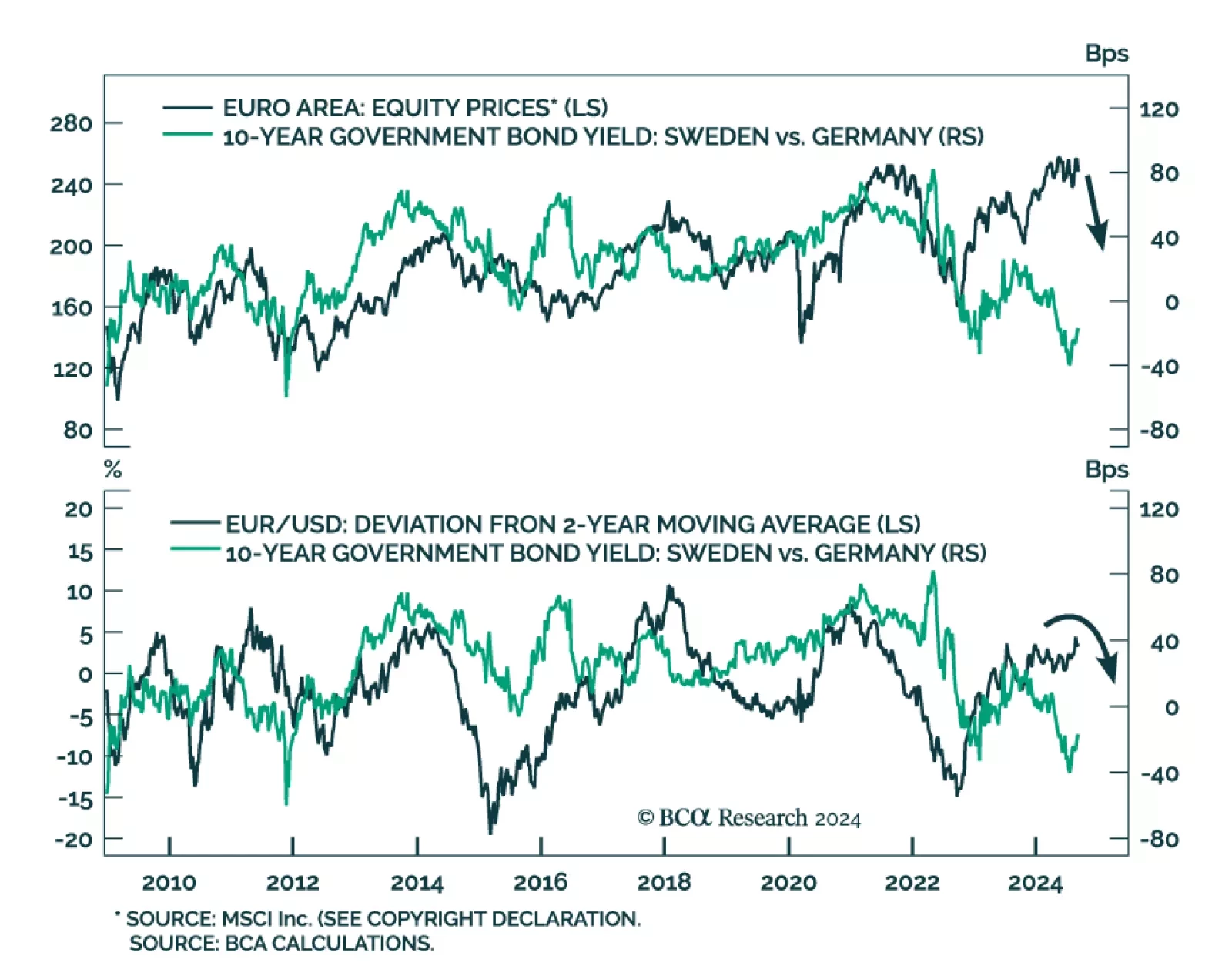

The Swedish economy’s cyclicality and sensitivity to global trade make it a reliable bellwether for global growth. Sweden is facing significant domestic weakness. Employment growth declined by 0.14% y/y in July and…

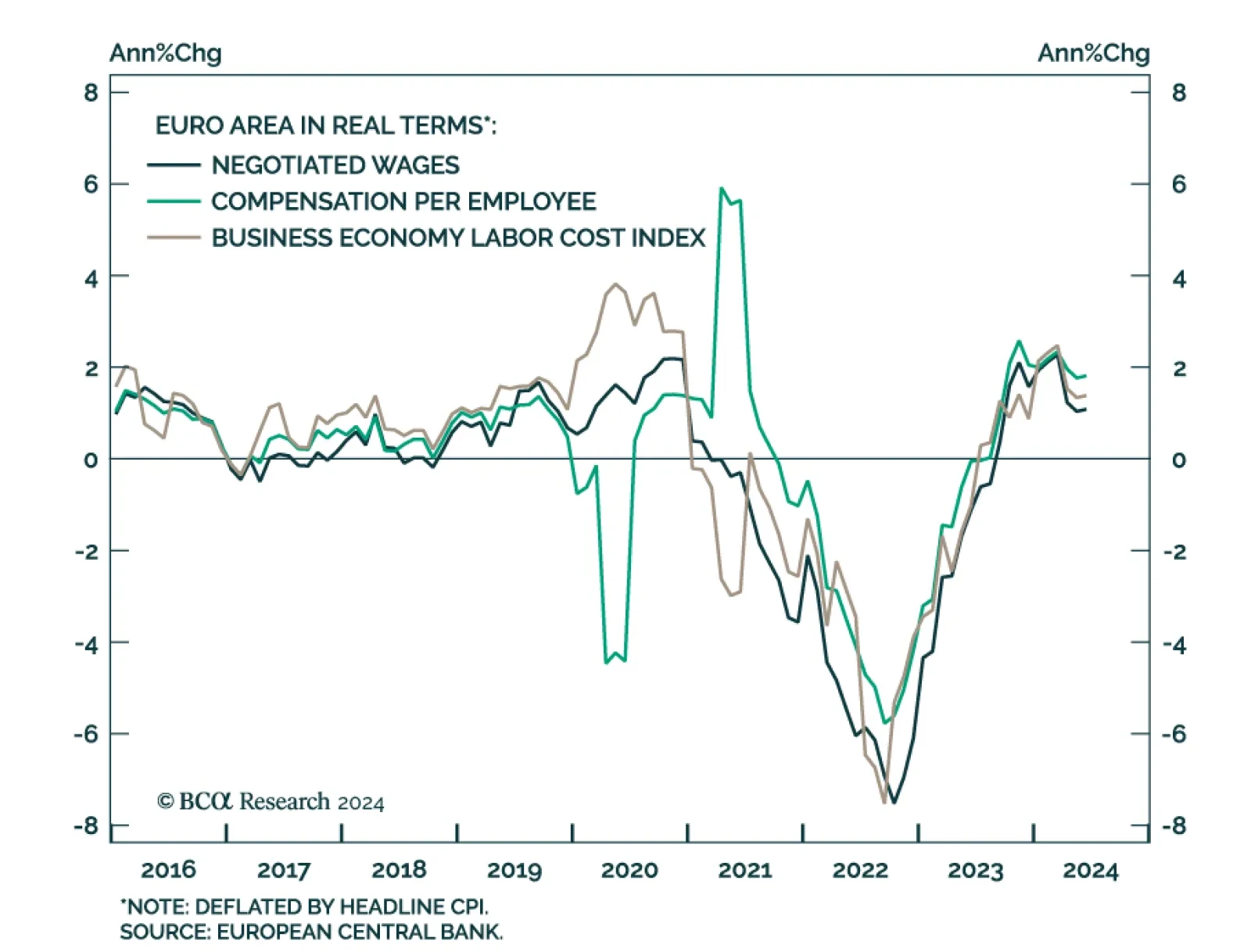

Eurozone GDP’s final estimate indicates that growth was slower than expected in Q2. Output grew 0.2% q/q in Q2, compared to 0.3% previously reported. A significant downward revision to capex (2.2% contraction against 1.8%…

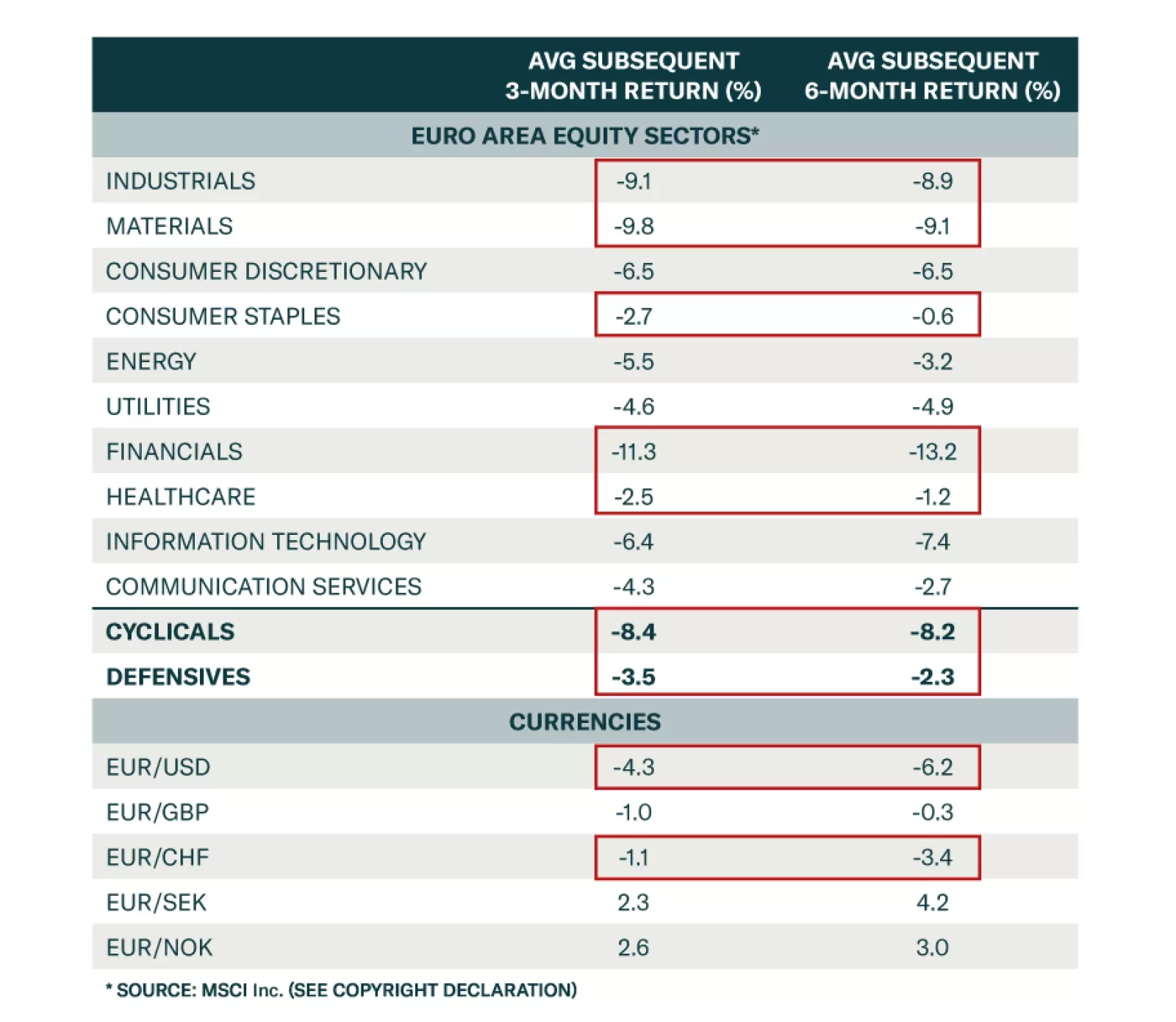

BCA Research’s European Investment strategists looked at previous episodes of carry-trade blowups and assessed the performance of the Eurozone’s key sectors, national markets, and currencies three and six months…

The pro-cyclical Eurozone economy is highly exposed to a global downturn, which we expect will materialize by early 2025. The ECB is behind the curve and we thus expect it to ease more aggressively than markets expect next year…

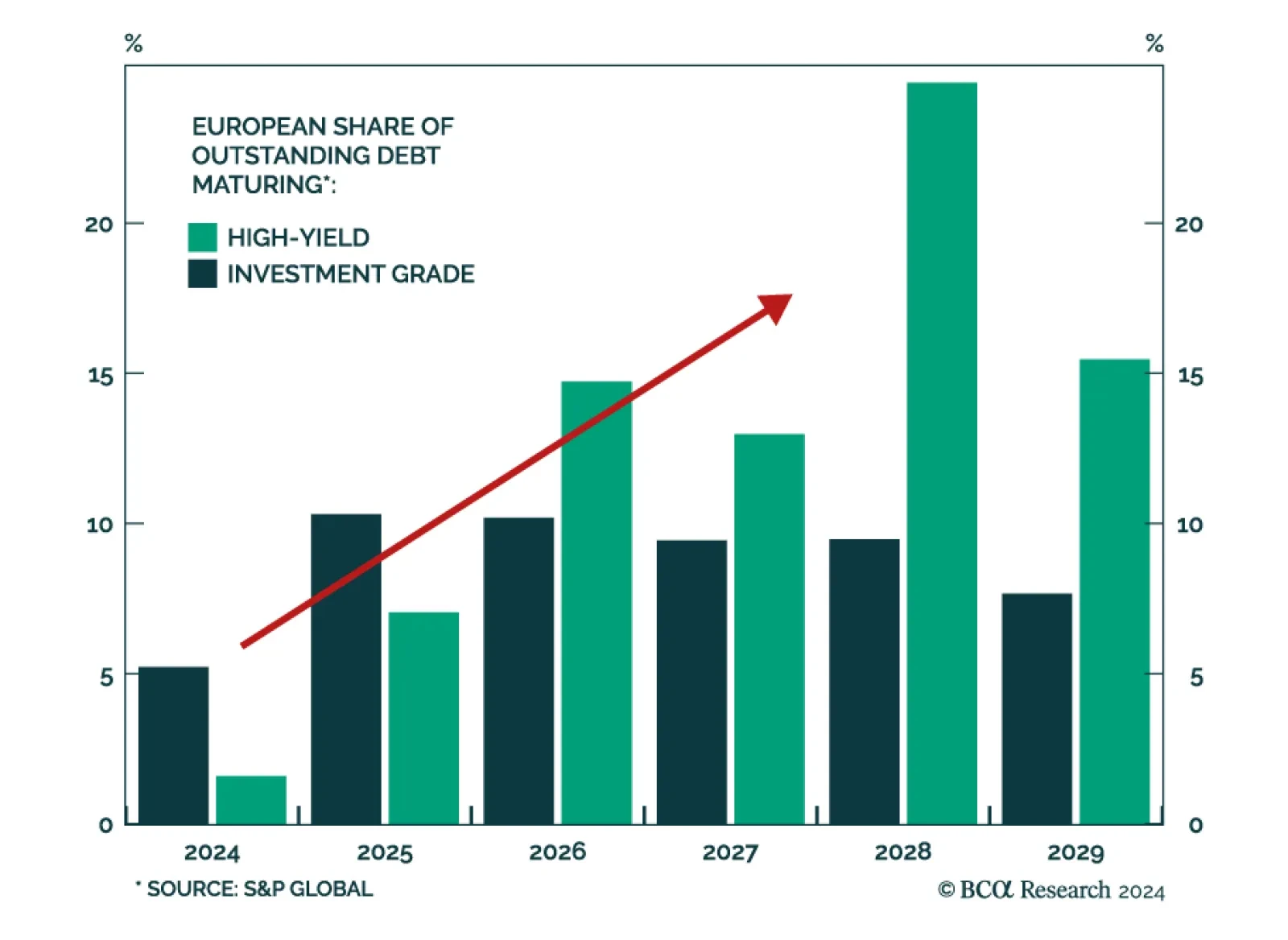

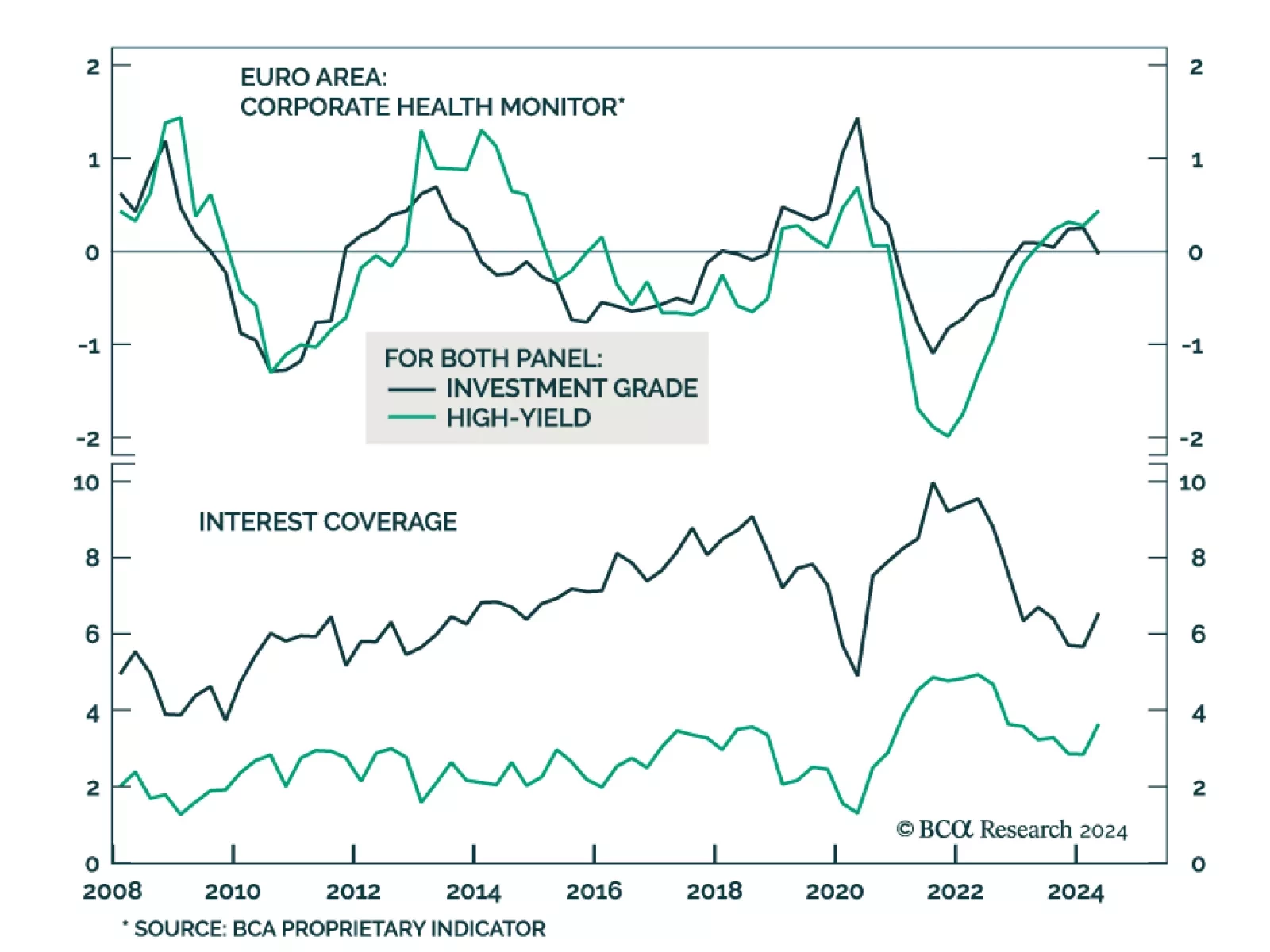

According to BCA Research’s European Investment Strategy service, an increase in borrowing costs will further weaken vulnerable corporate balance sheets. As suggested by their Corporate Health Monitors (CHMs), the health of…

Even after the Fed cuts rates, policy will remain restrictive for some time. Moreover, in history, stocks have tended to fall around the first rate cut. We remain cautious on the outlook for the economy and risk assets.