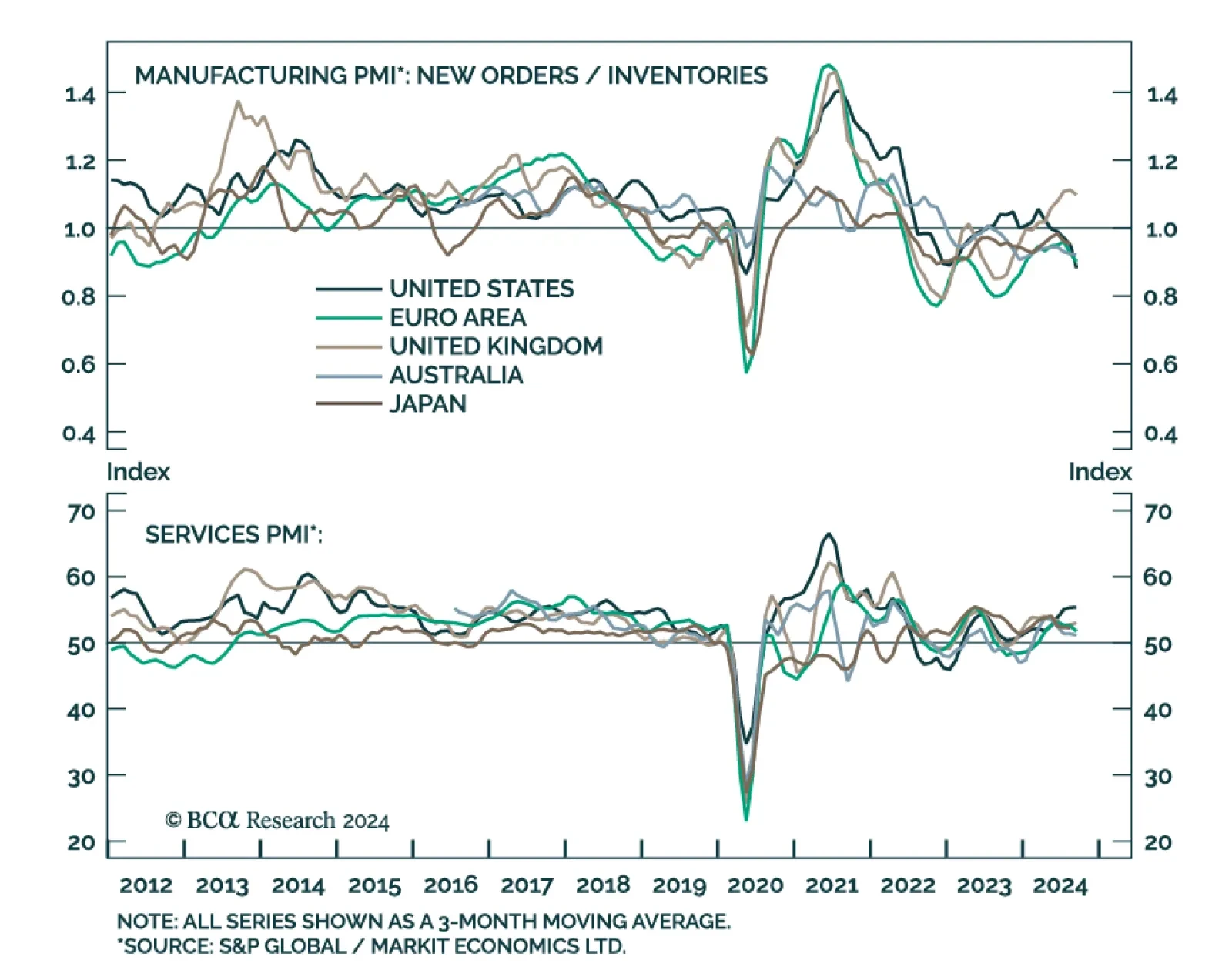

Preliminary estimates suggest that activity continued to slow across DM economies in September. Manufacturing PMIs contracted at a faster pace in the US, Eurozone, Germany, France and Australia, and grew at a slower pace in…

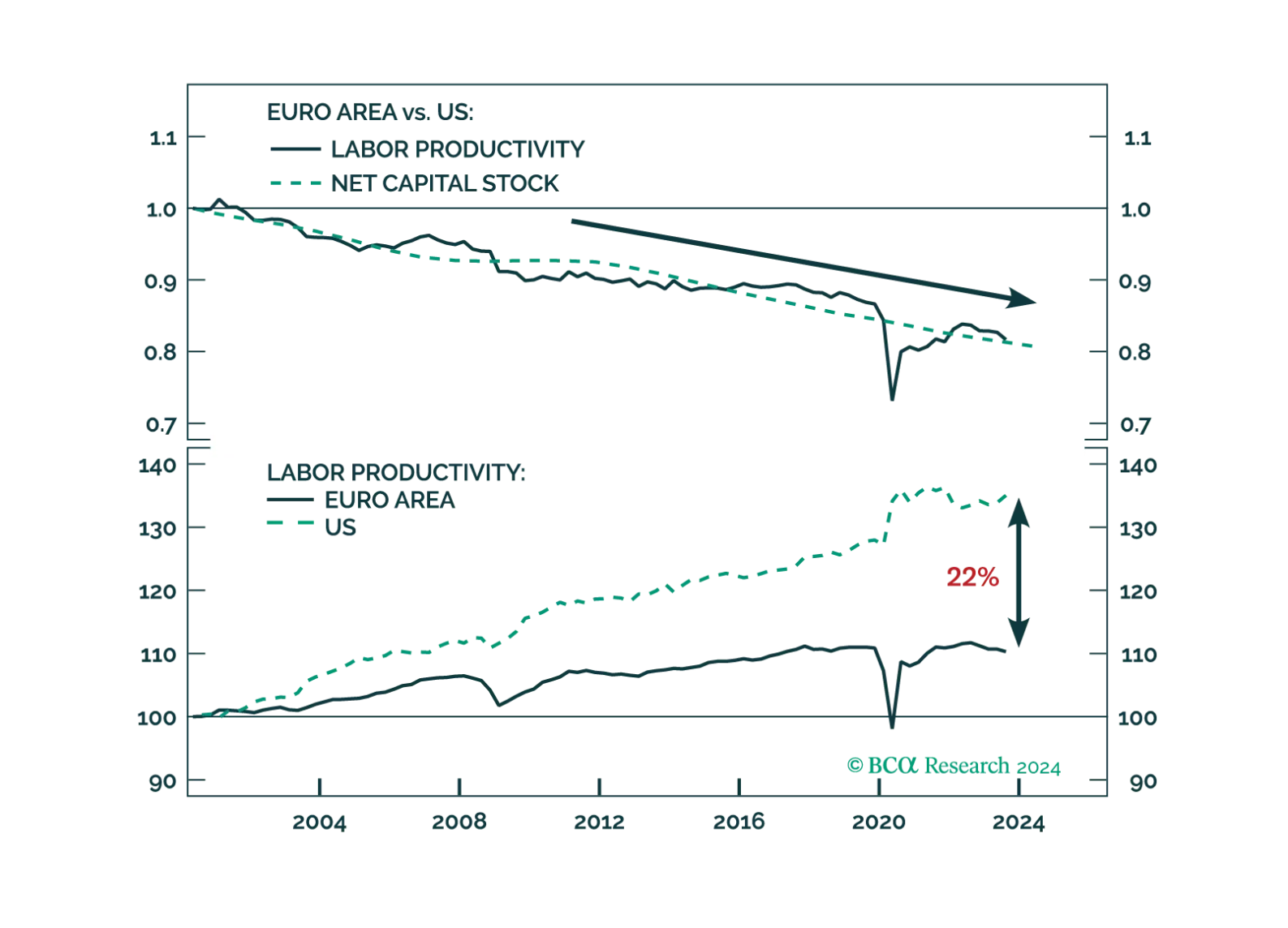

The Draghi report highlights sensible reforms that would address many of Europe’s productivity shortcomings. Whether European capitals heed Mario Draghi’s advices remains to be seen.

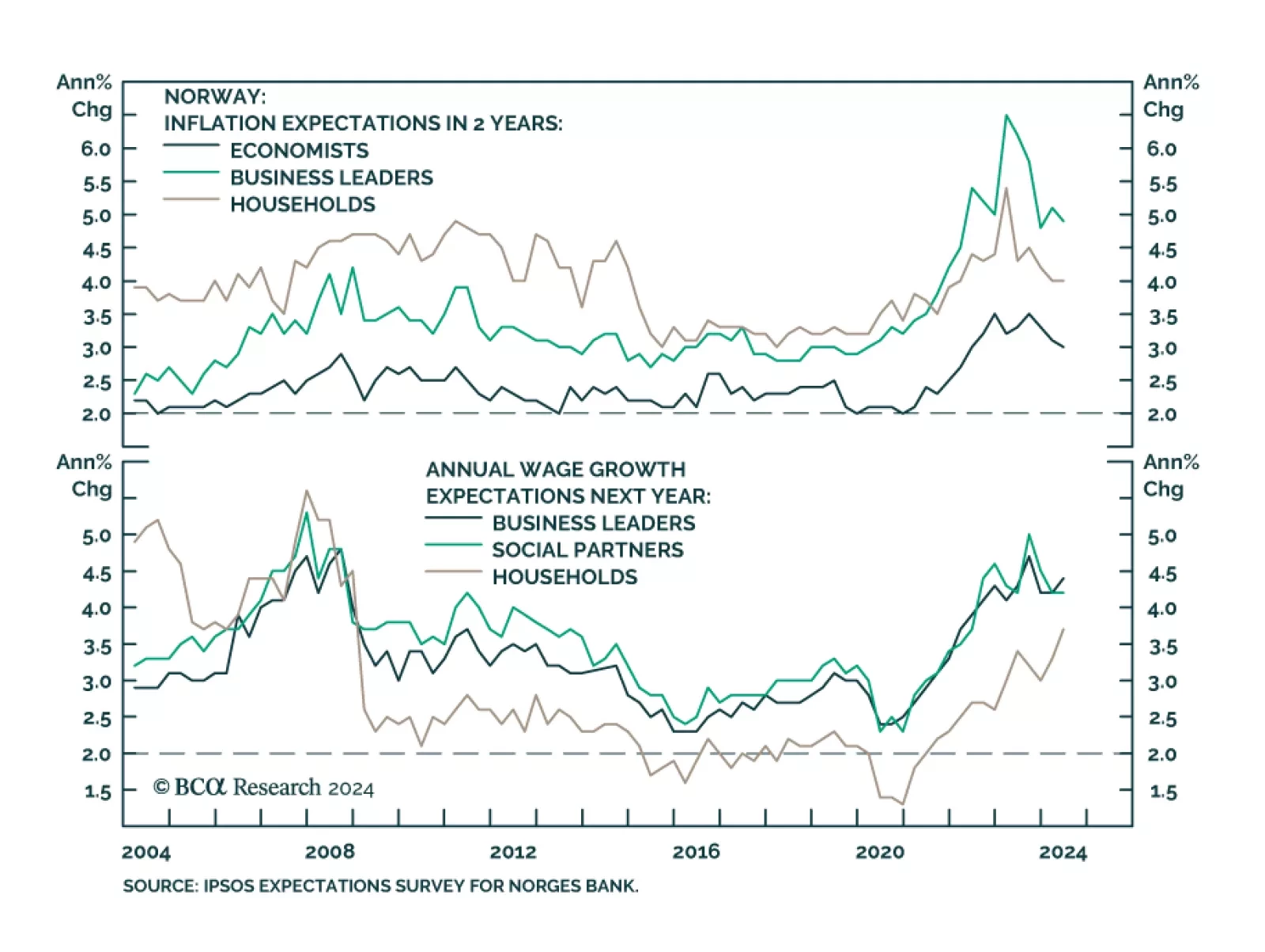

The Norges Bank kept its policy rate unchanged at 4.5% at its September meeting and signaled low odds of policy easing before the first quarter of 2025. The inflation backdrop does not warrant easing policy. Although core CPI…

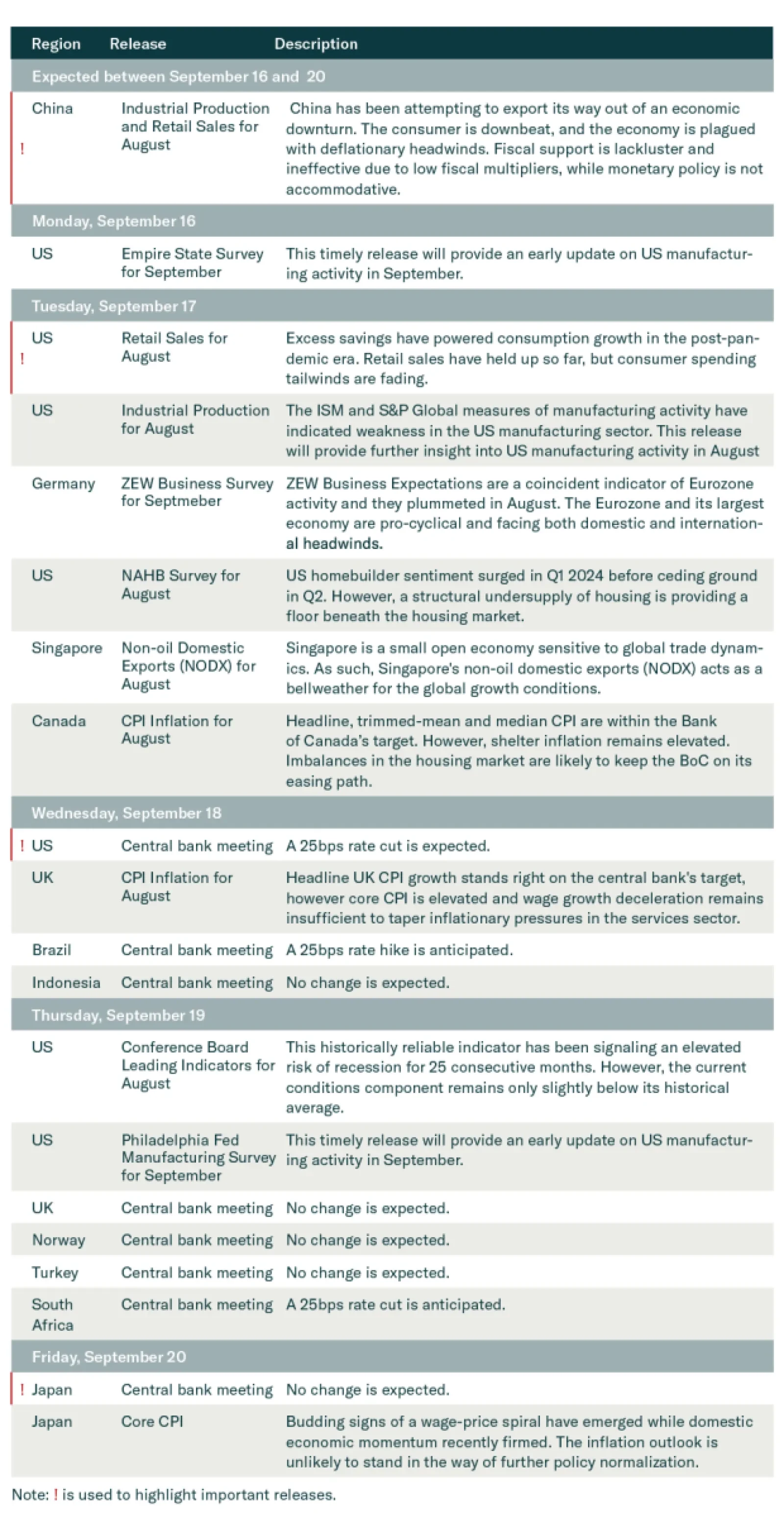

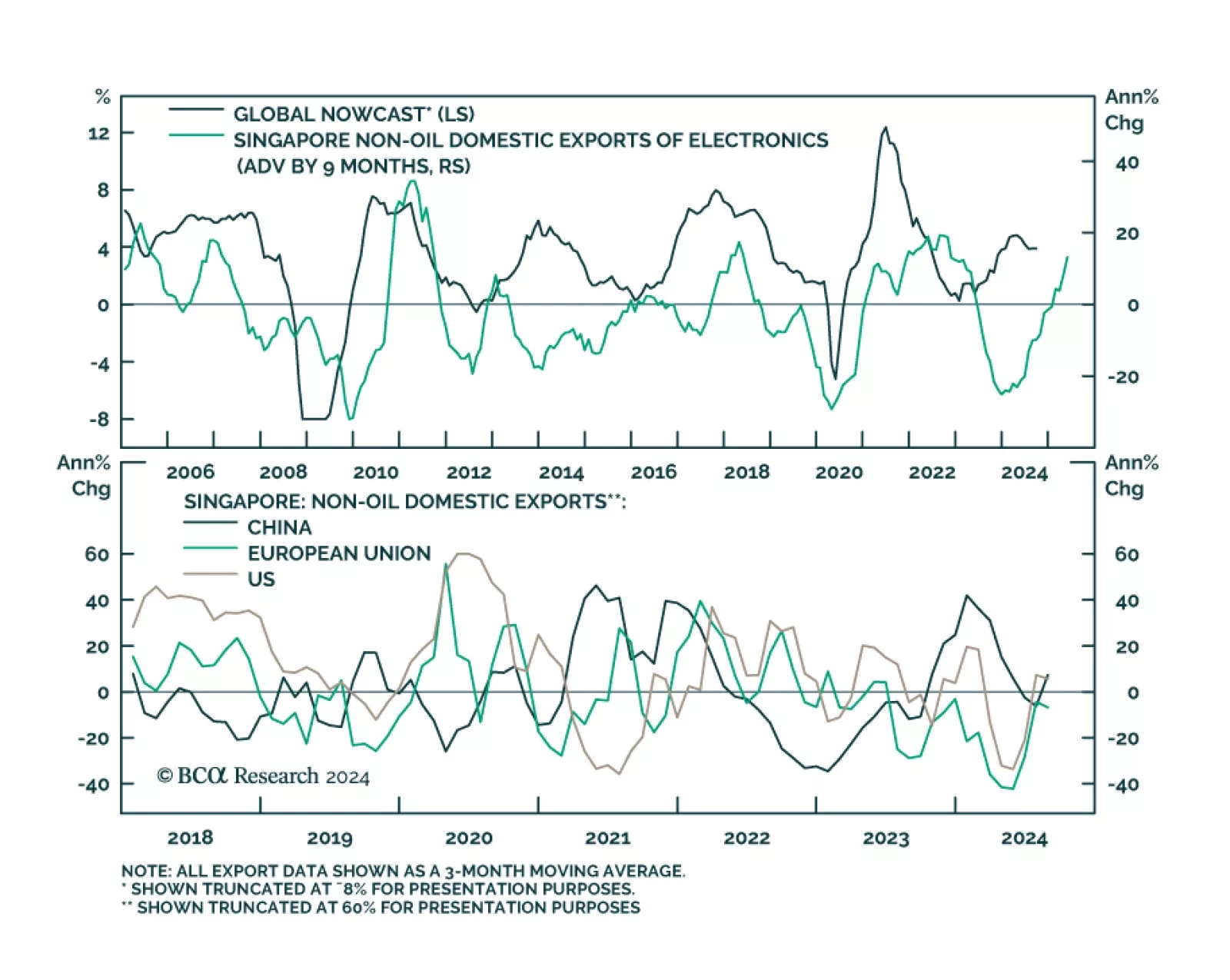

Singapore is a small open economy sensitive to global trade dynamics. Its non-oil exports (NODX) are thus a good bellwether for global growth conditions. Overall exports, which are highly volatile on a month-on-month basis,…

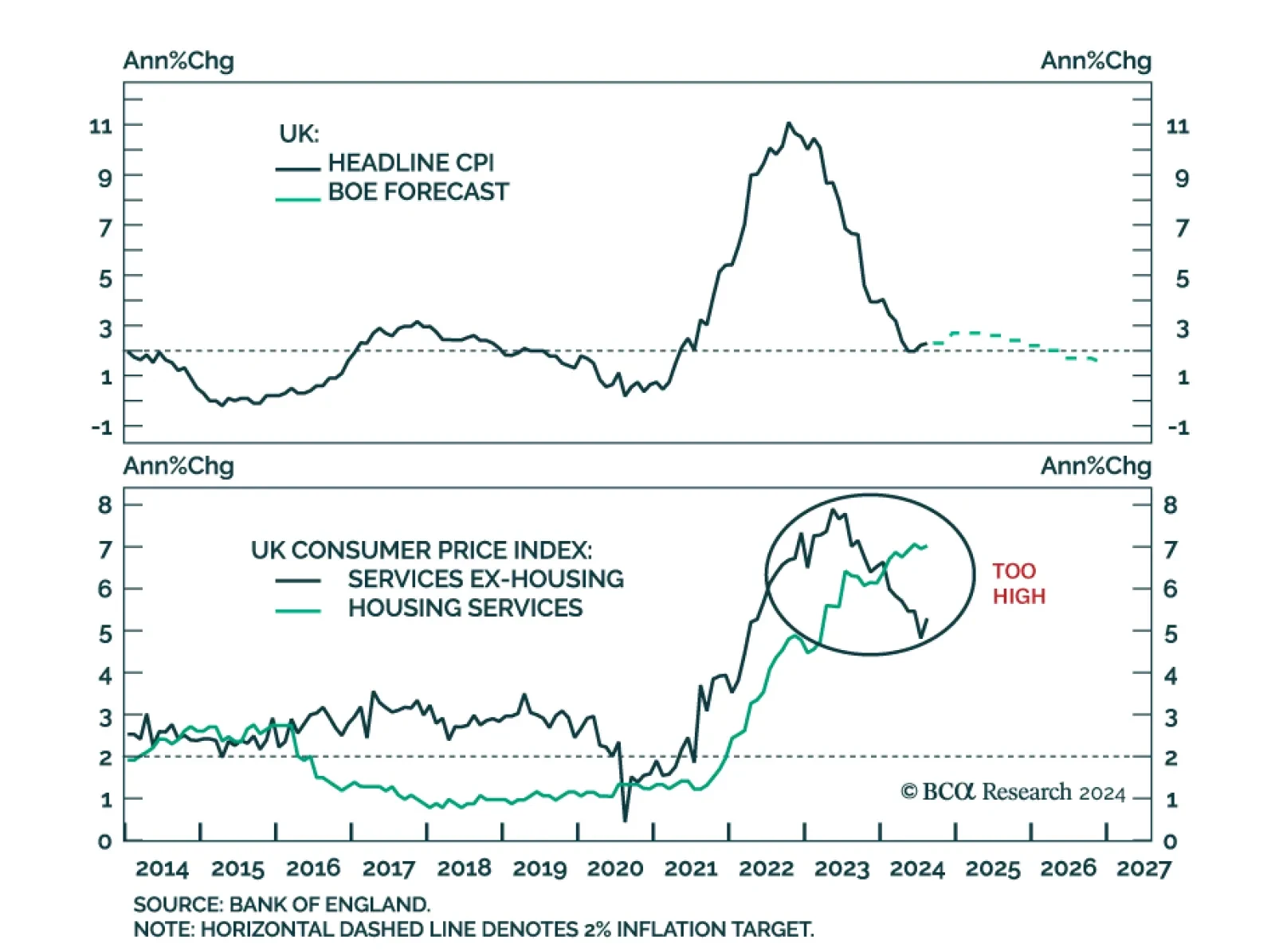

UK headline CPI grew at a stable 2.2% y/y in August, though the core measure accelerated from 3.3% to 3.6%, in line with expectations. An 11.6% annual increase in airfare largely drove core CPI higher, while offsetting…

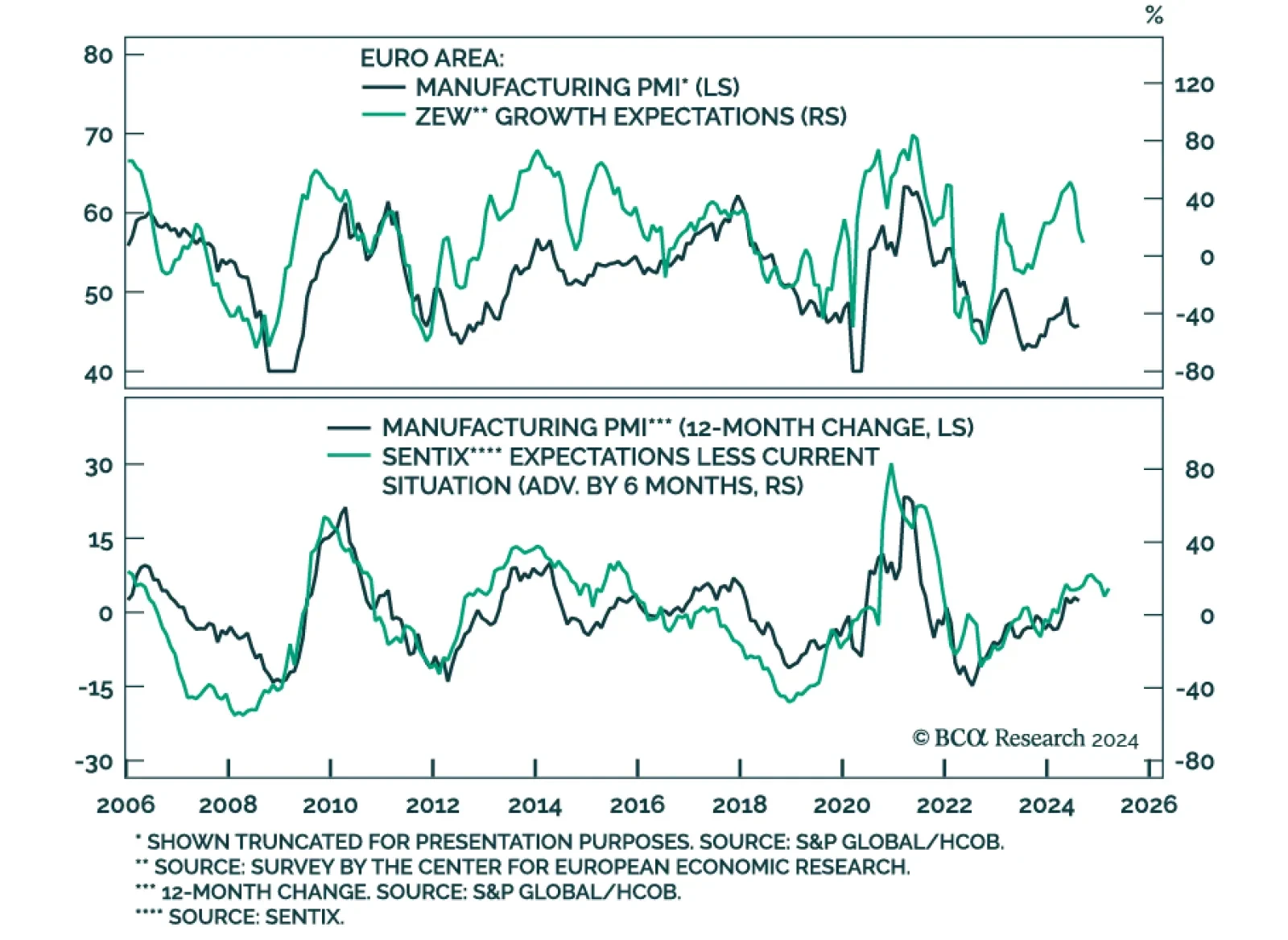

The ZEW survey of both German business expectations and current situation largely disappointed in September, decreasing by 15.6 points to 3.6 and by 7.2 points to -84.5, respectively. The ZEW survey of expectations for…

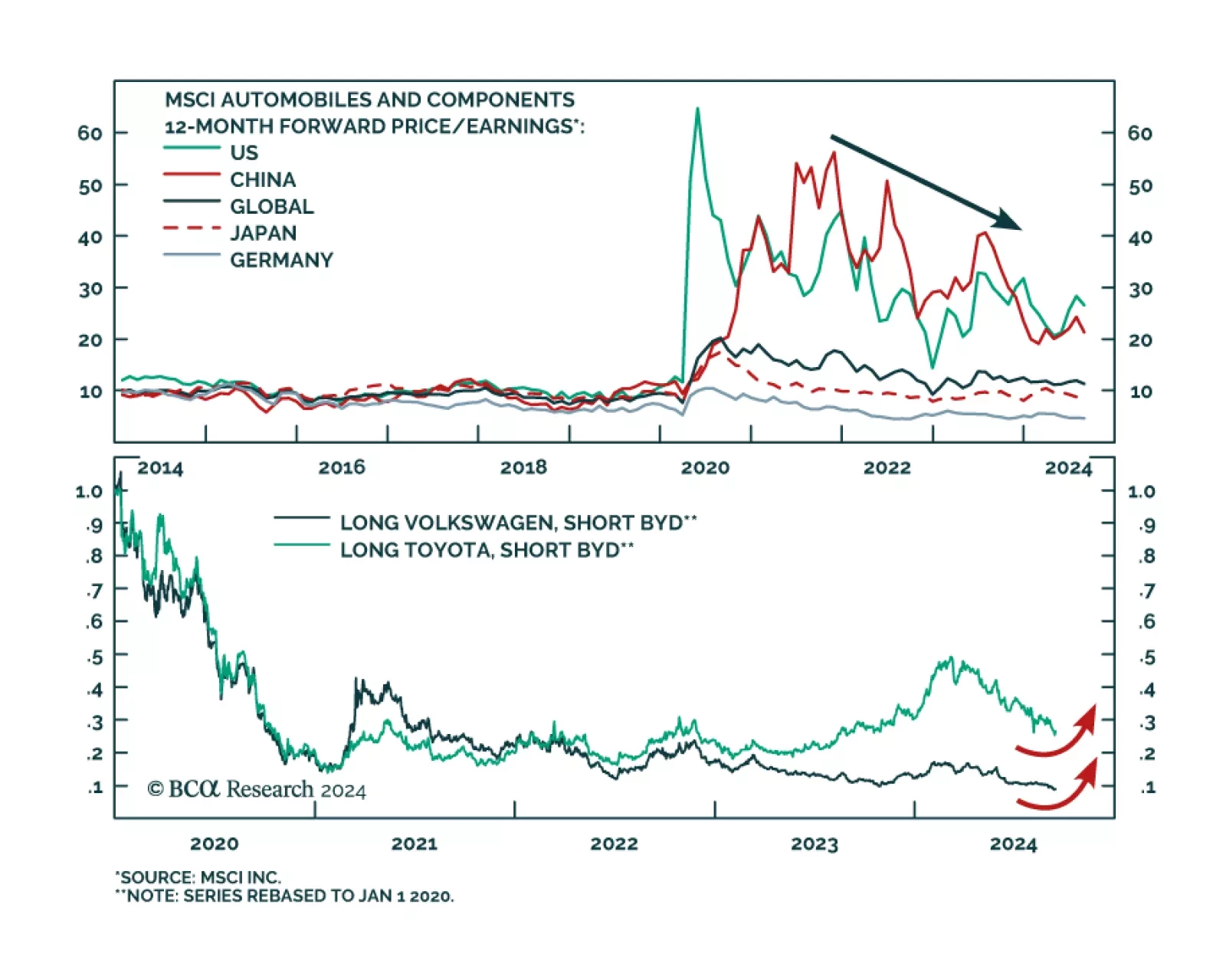

Volkswagen’s CEO has been making the point that the market for European carmakers has been deteriorating. Earlier last week, he went on to make a rather pointed reference at Chinese EV manufacturers. He was quoted…

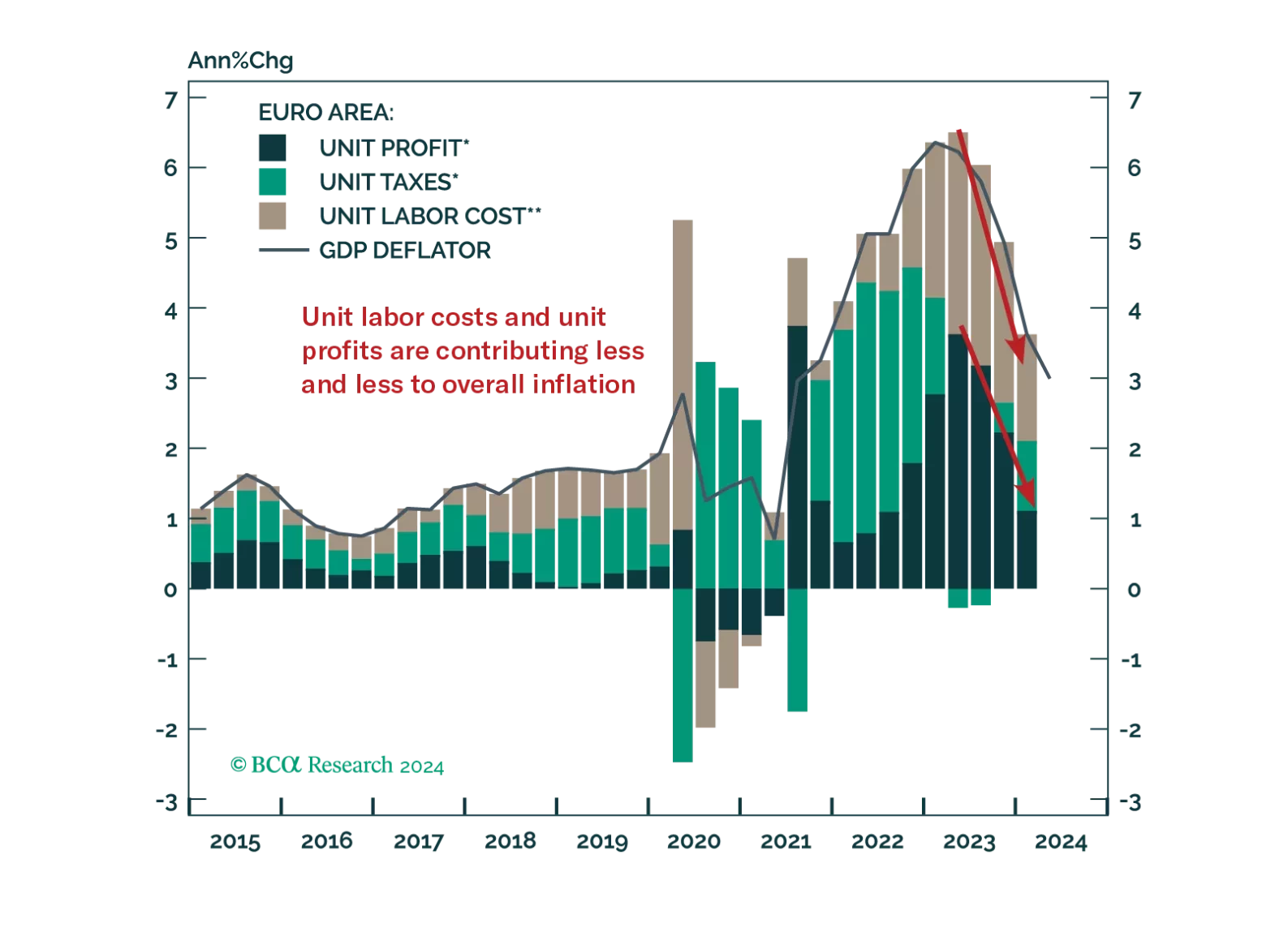

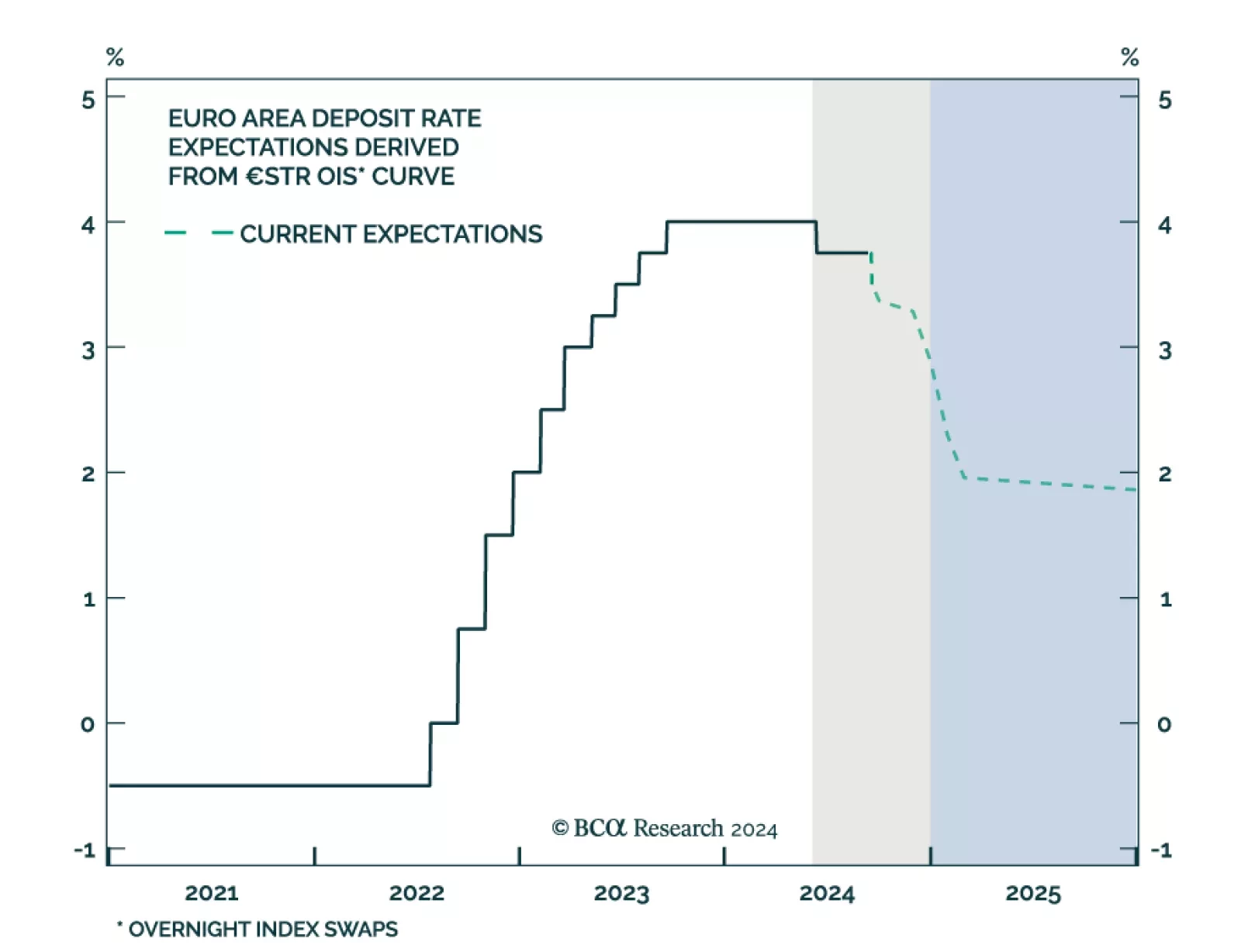

The ECB will cut rates once more this year; however, markets underprice how far it will ease next year.

ECB Governing Council members unanimously voted in favor of lowering the deposit facility rate by 25 bps to 3.50% in September, marking the second cut this year. Moreover, expectations for weaker domestic demand led the ECB to…