This week, we cover the main questions we fielded during our latest client trip in Europe. Among the many topics broached are Europe’s recession odds, the impact of China’s stimulus, and the outlook for European markets.

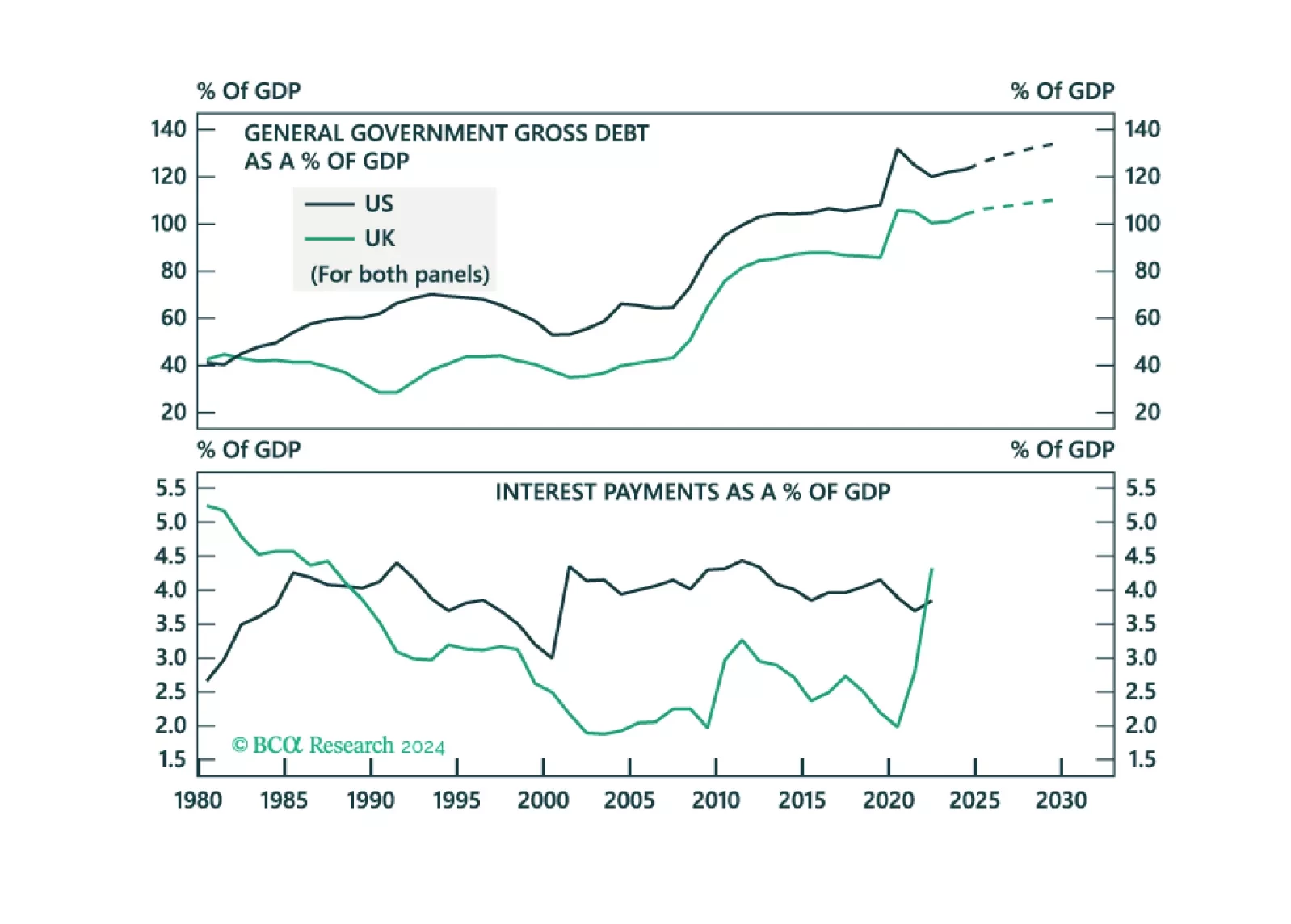

In this Insight, we assess whether investors should expect fiscal turbulence in the UK, that will drive UK yields higher and the pound lower.

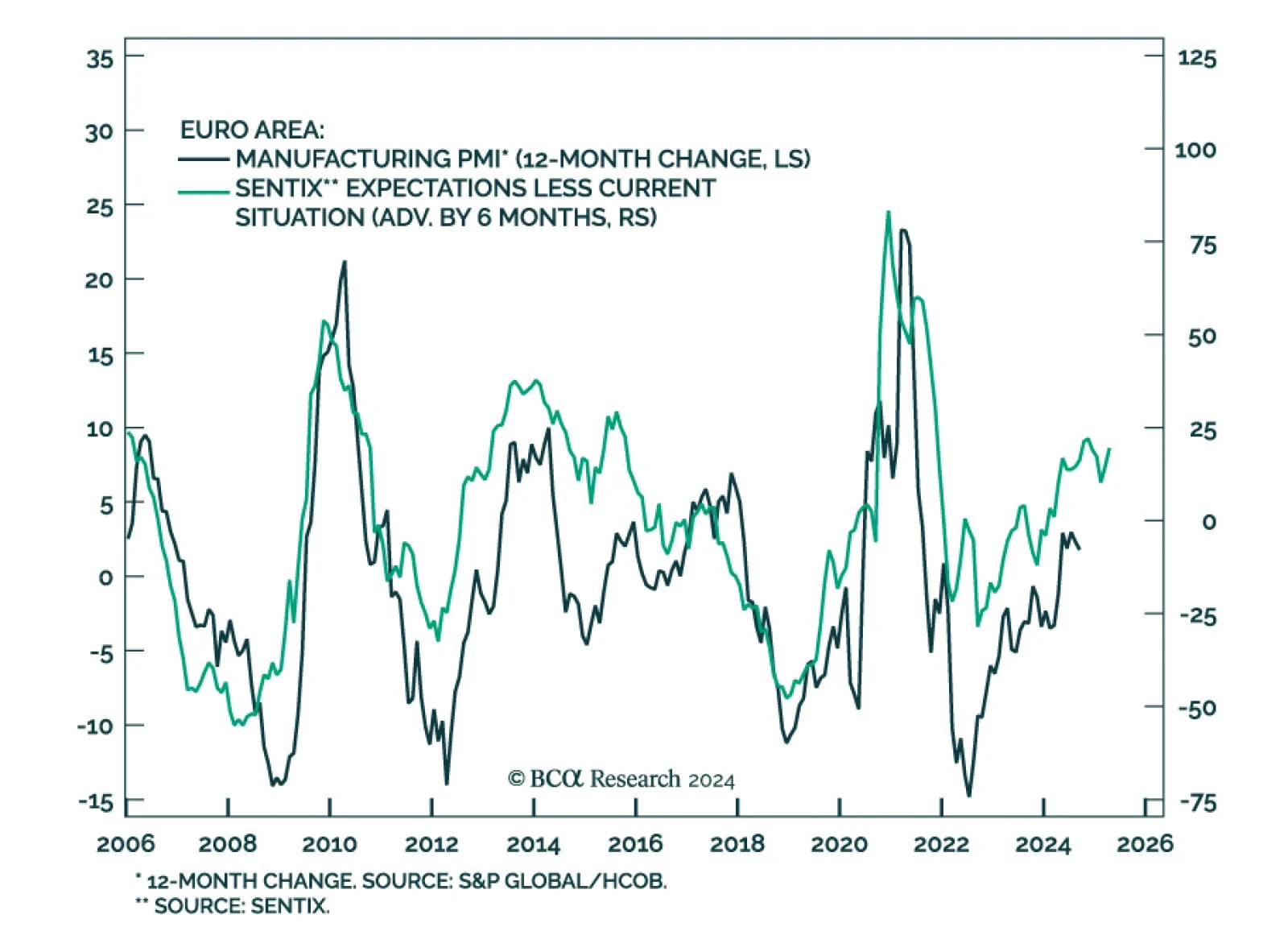

The Sentix Investor Confidence index unexpectedly improved in October from -15.4 to -13.8. A notable improvement in Expectations (from -8.0 to -3.8) drove the overall index higher, while the Current Situation subcomponent…

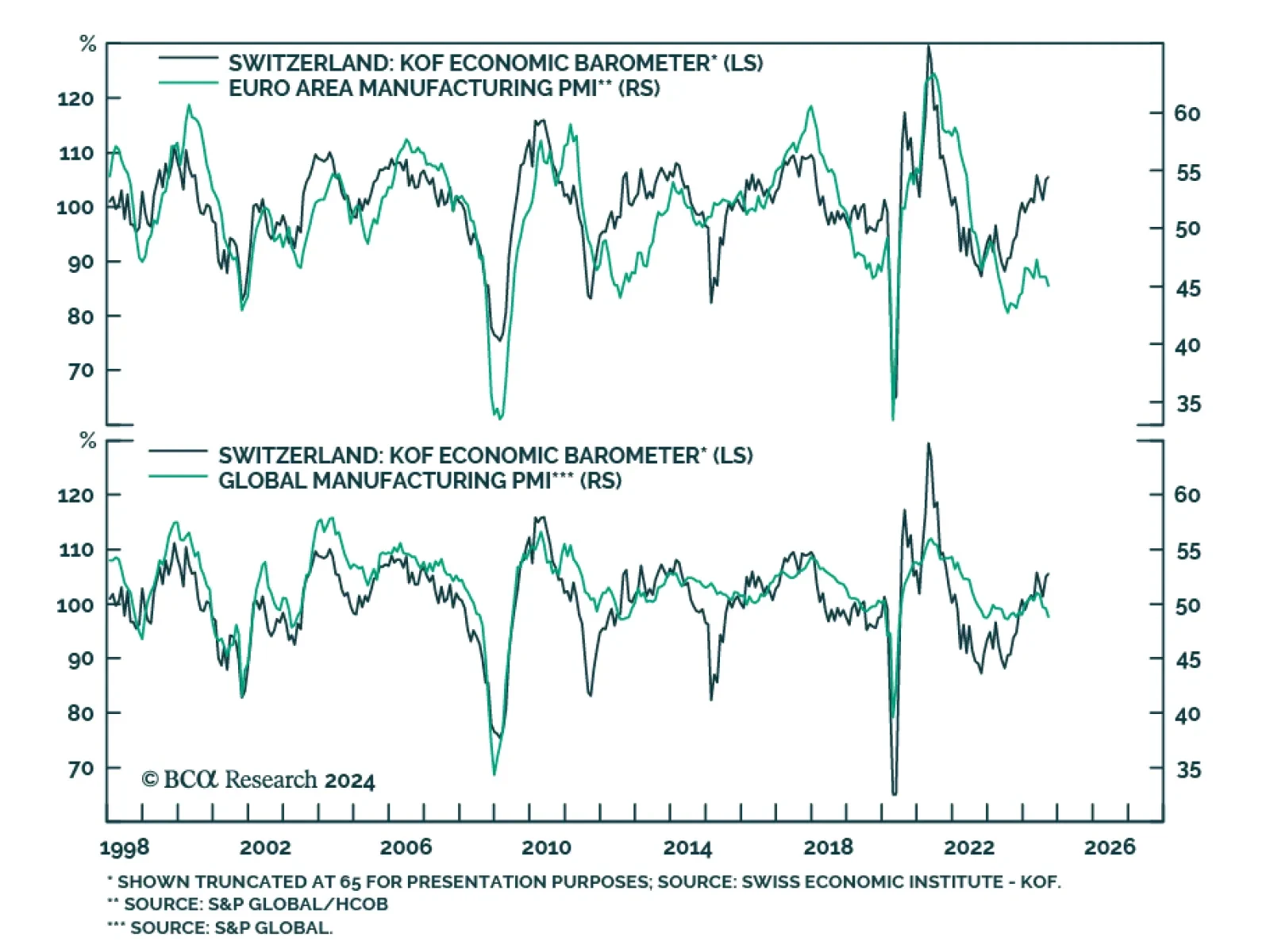

The Swiss KOF Barometer is a composite leading indicator of the Swiss economy. It surprised to the upside in September coming in at 105.5 against expectations of 101.0. The August reading was also significantly revised higher,…

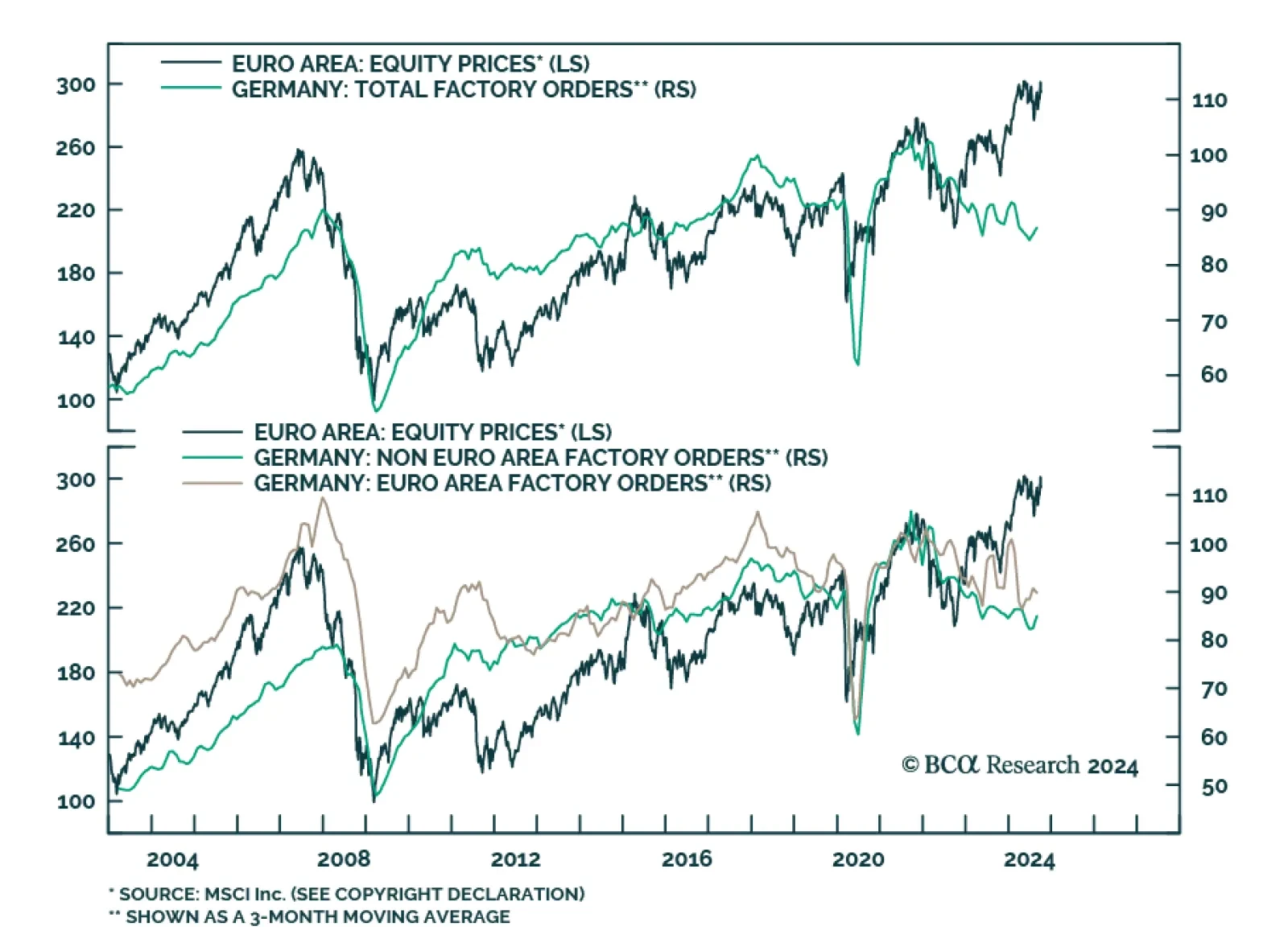

German factory orders contracted by a larger-than-anticipated 5.8% m/m (3.9% y/y) in August, from a 3.9% expansion (4.6% y/y). Domestically, Germany is constitutionally bound to maintain a balanced budget. The emergency…

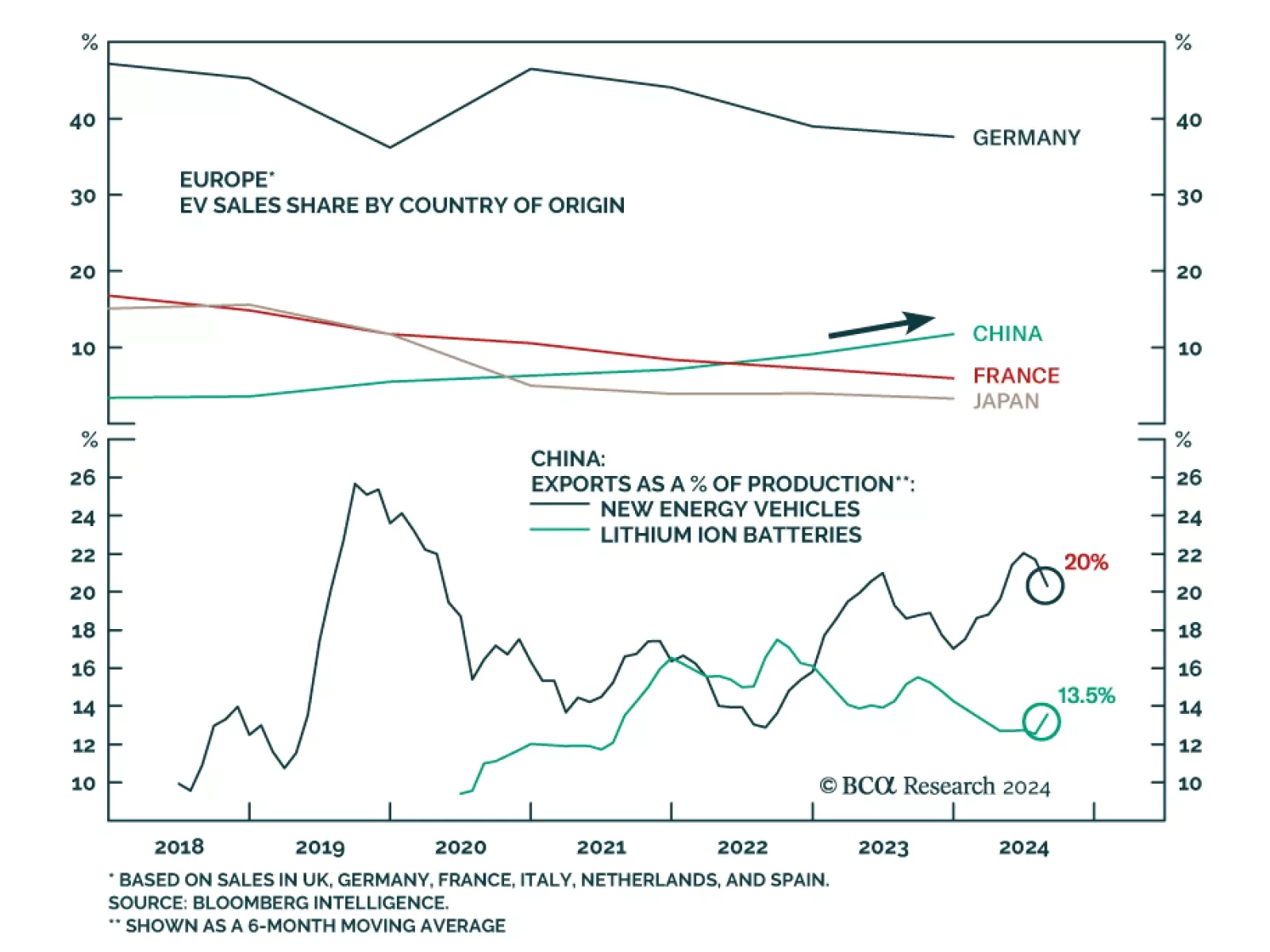

The European Commission voted to impose tariffs of up to 45% on imports of Chinese electric vehicles (EVs). The announcement follows previous tariffs imposed on Chinese EV imports back in June. This new round of economic…

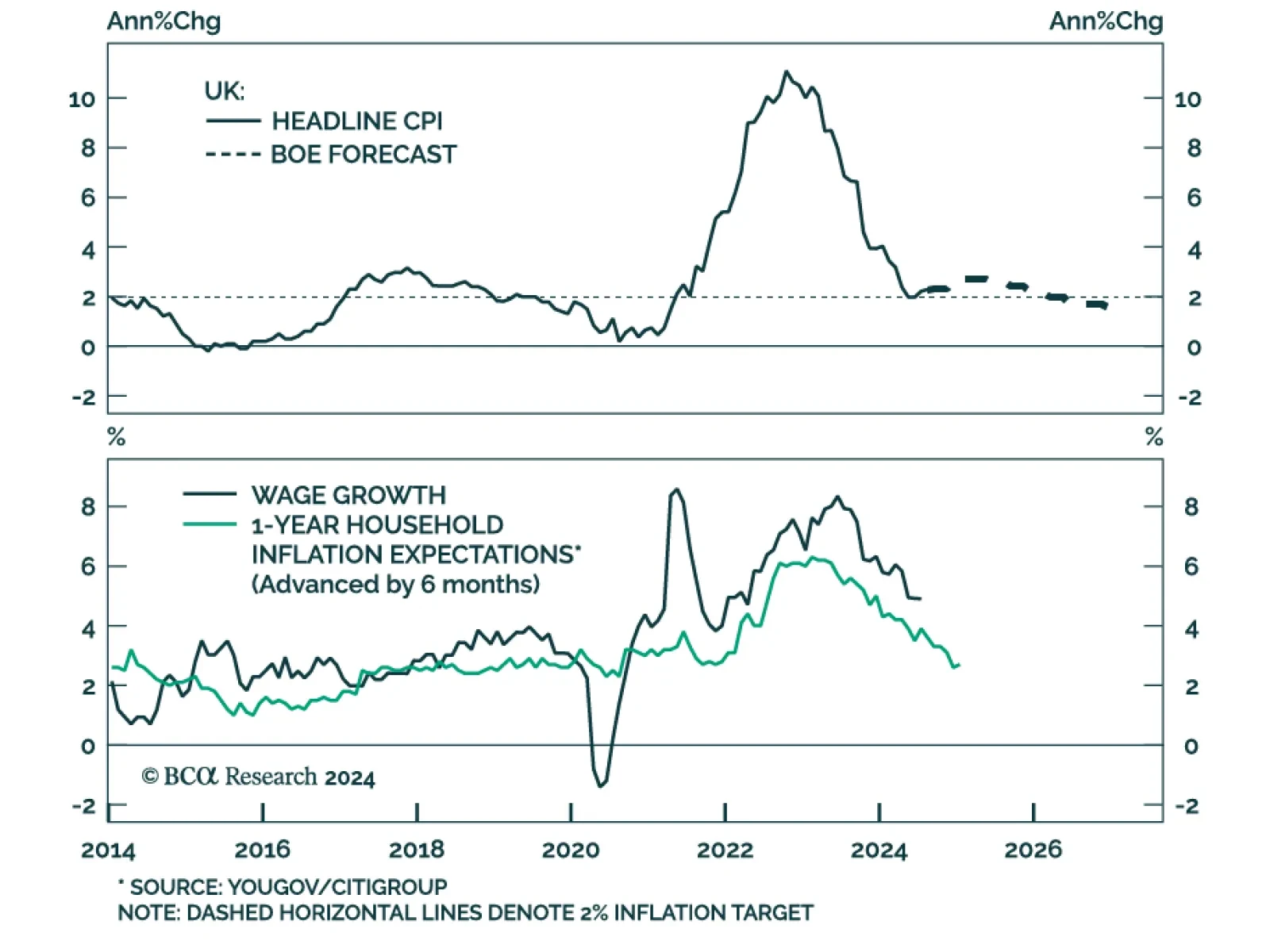

Comments from Bank of England Governor Andrew Bailey on Thursday, hinting at “a more aggressive” pace of rate cuts, marked a shift in rhetoric from previous meetings which signaled a “gradual” pace. The…

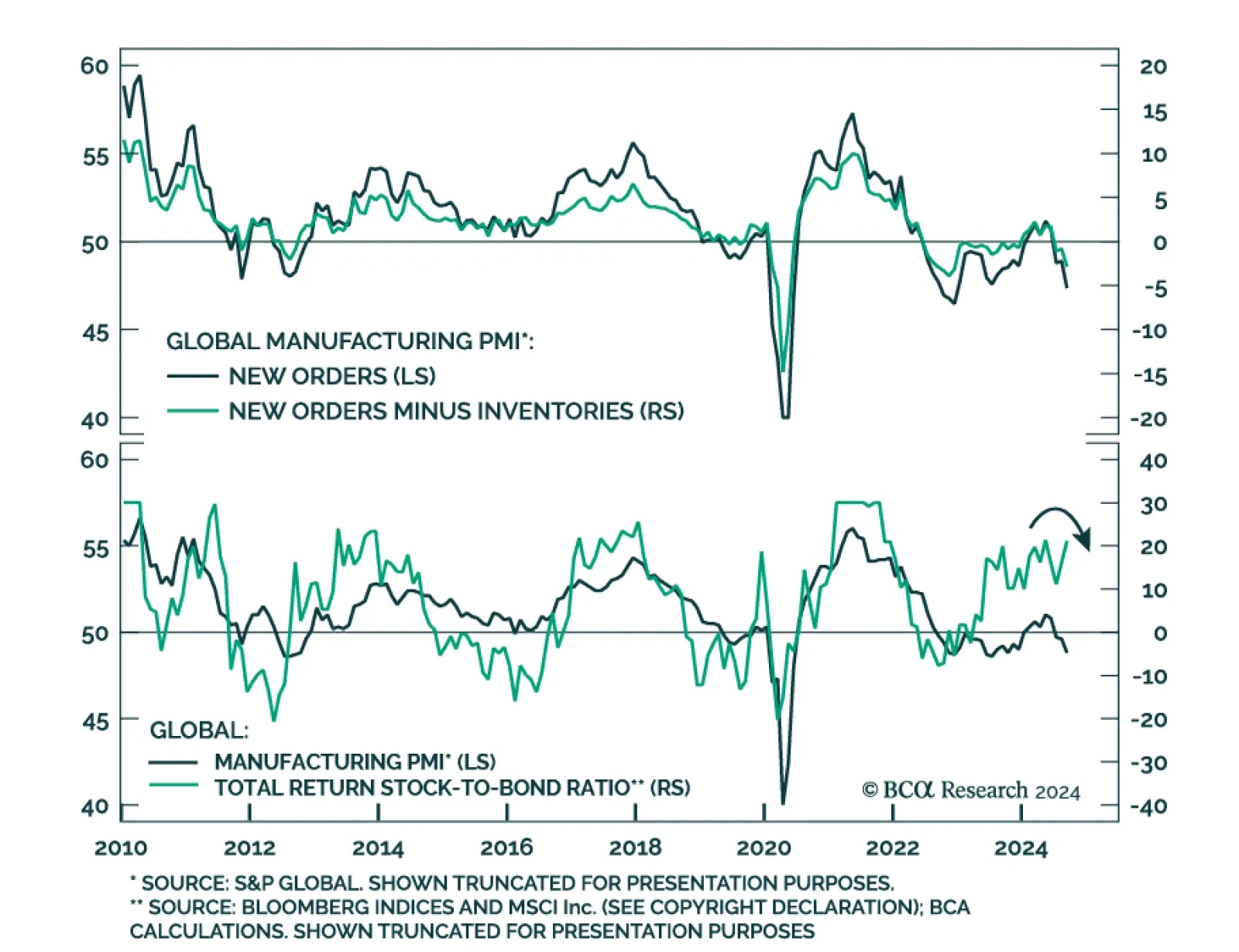

The JPM Global manufacturing PMI declined at an accelerating pace in September (49.6 to 48.8). Moreover, international trade flows deteriorated notably with the new export orders component falling from 48.4 to 47.5. A sector…

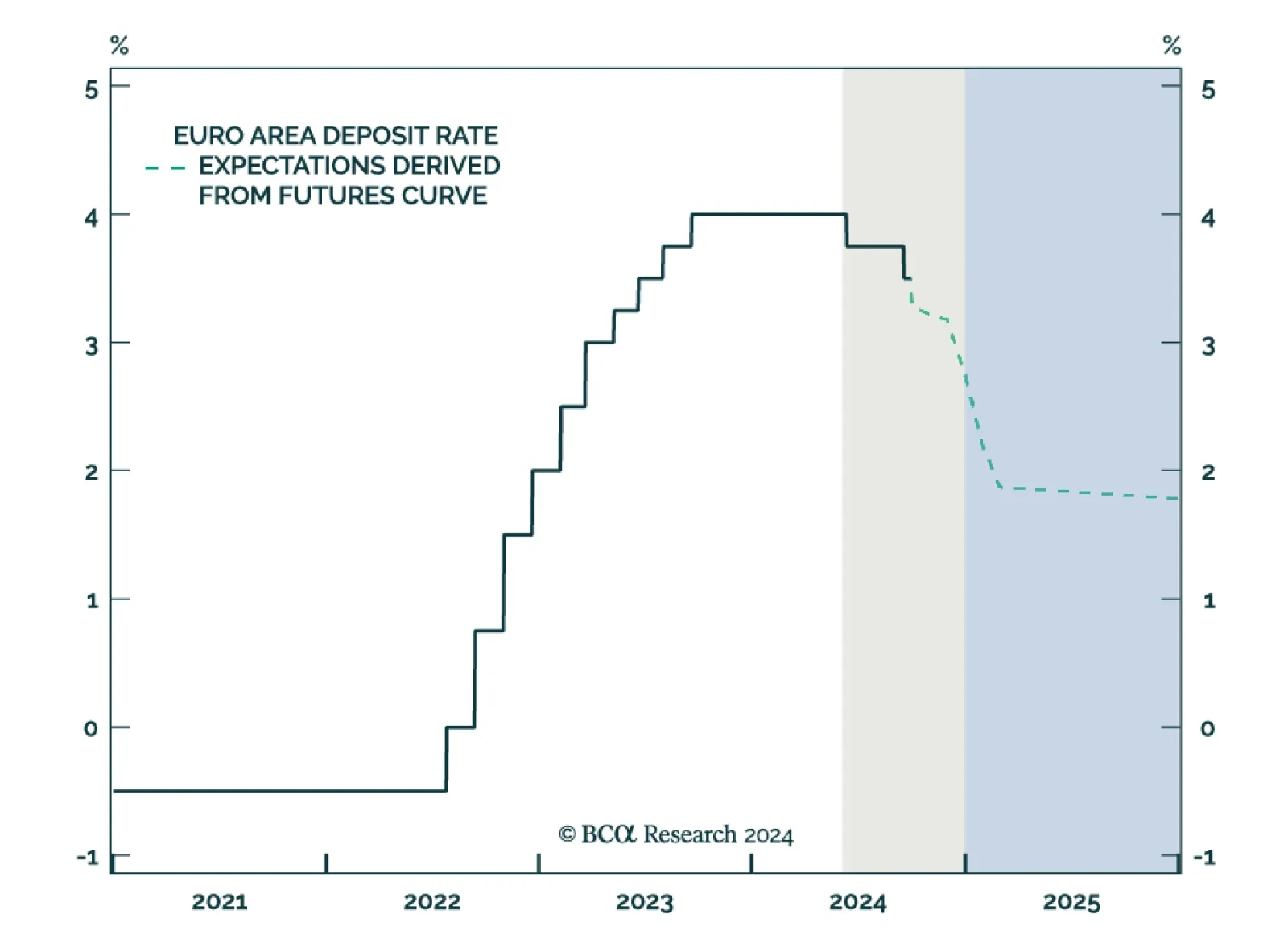

Preliminary estimates suggest that Eurozone headline and core CPI inflation decelerated from 2.2% to 1.8% y/y and from 2.8% to 2.7%, respectively, in September. The inflation data from individual Euro Area countries earlier last…

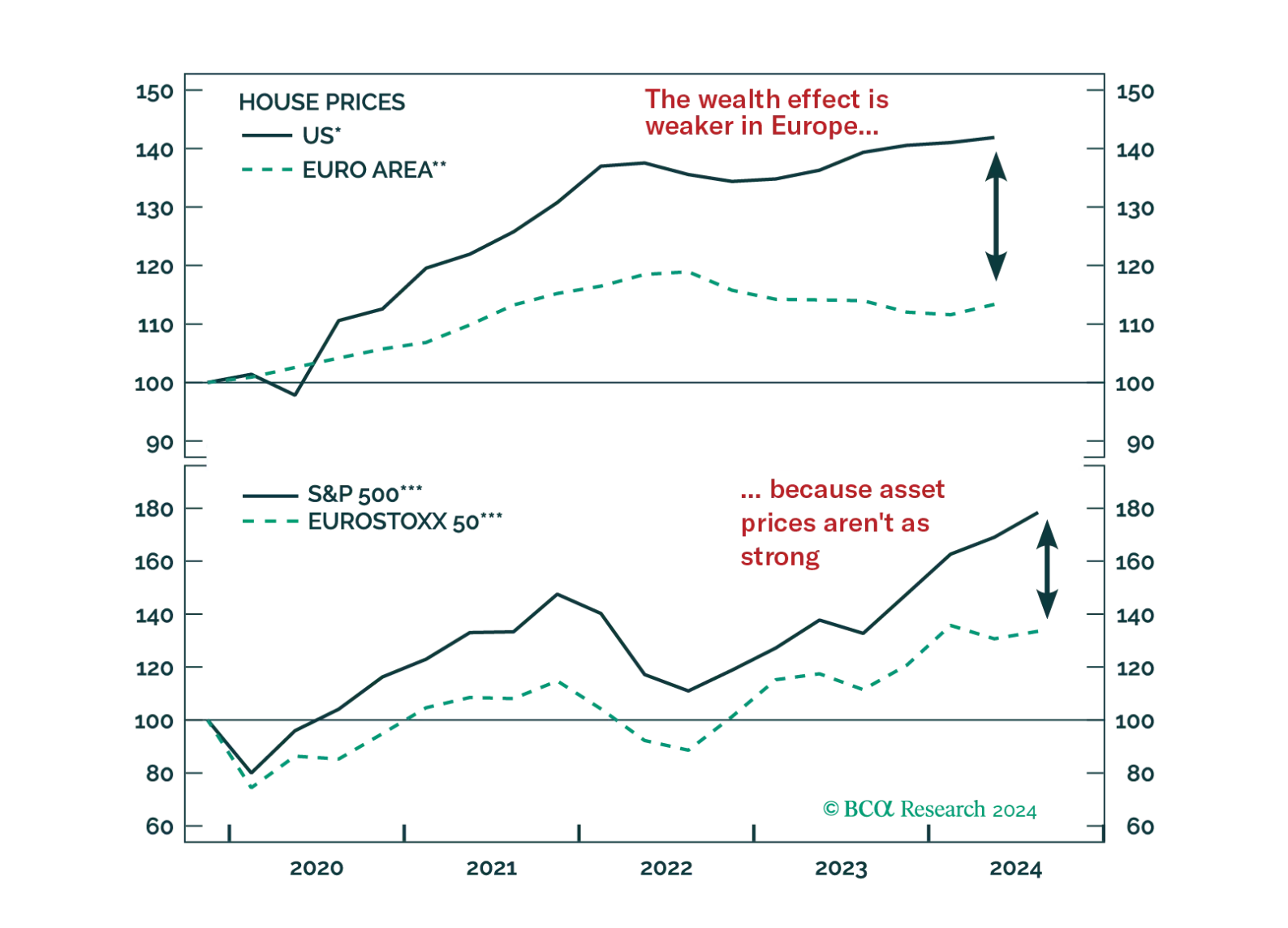

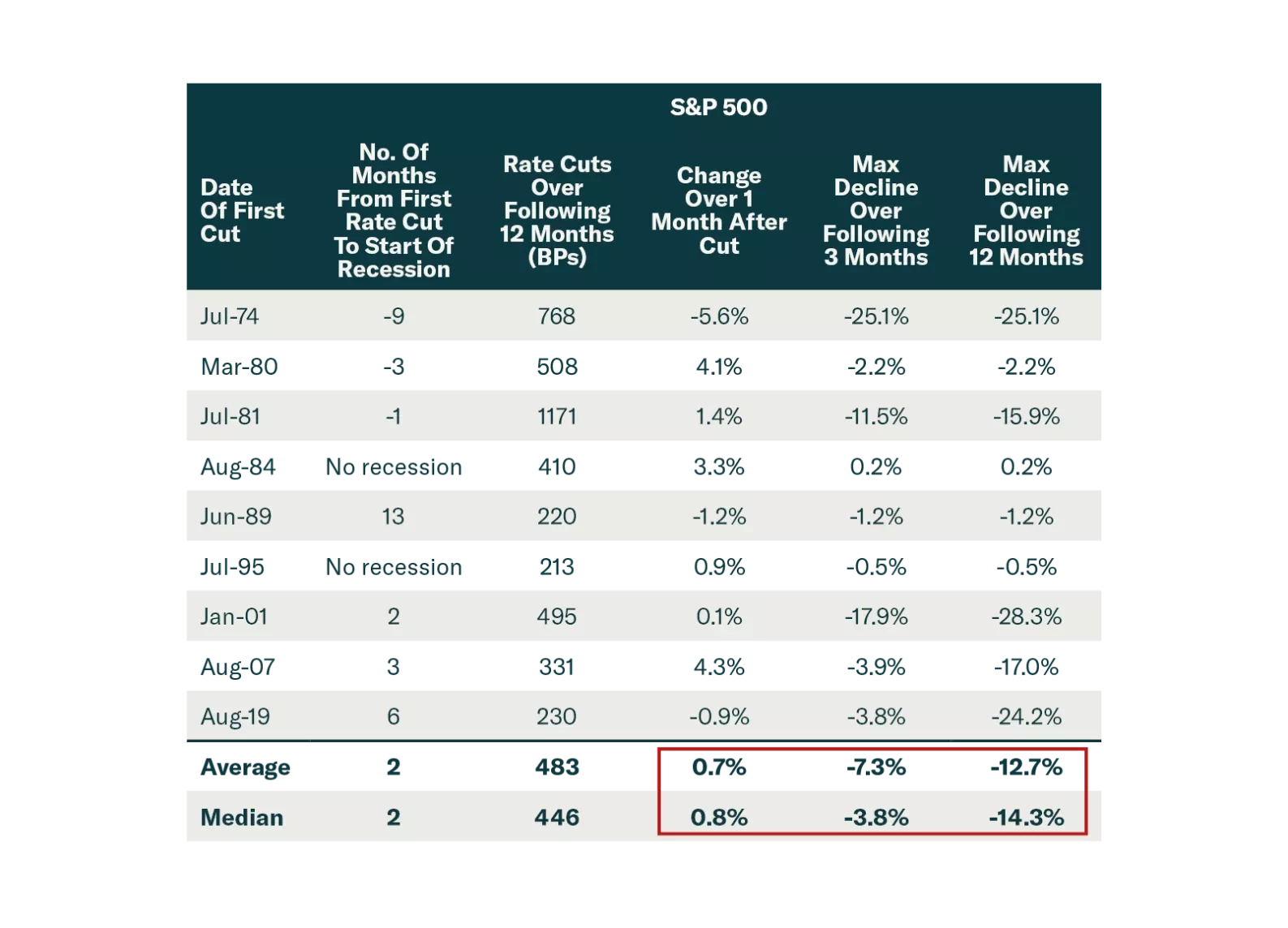

The market got excited by the 50 bps Fed cut and China stimulus. But these are a recognition that economies are slowing significantly. Stocks often rally after the first Fed cut, before falling sharply. Investors should stay…