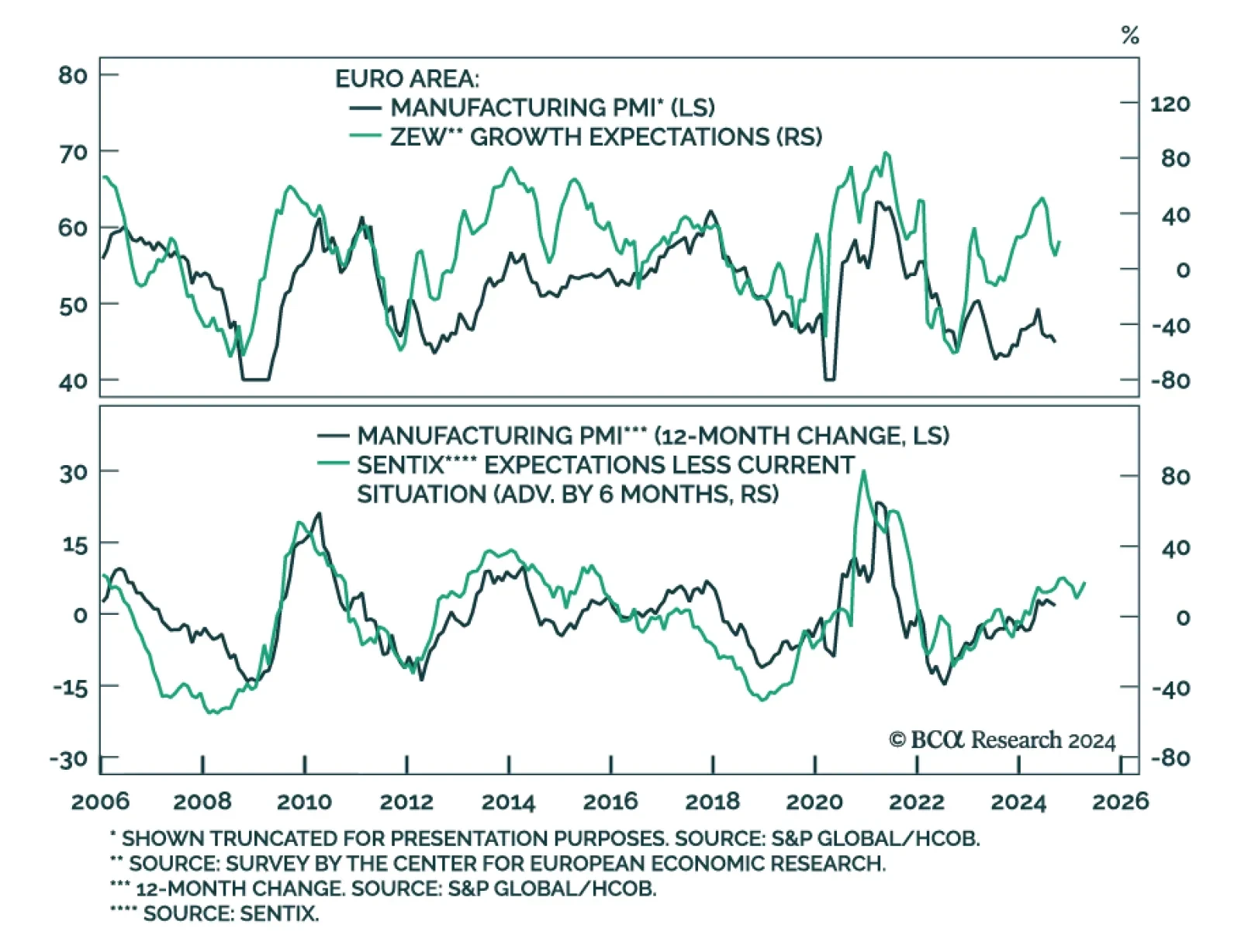

Developed markets Flash PMIs estimates for October were mixed, with resilient US numbers and weakness elsewhere. The eurozone composite met expectations but remains below the 50-level expansion threshold. Germany…

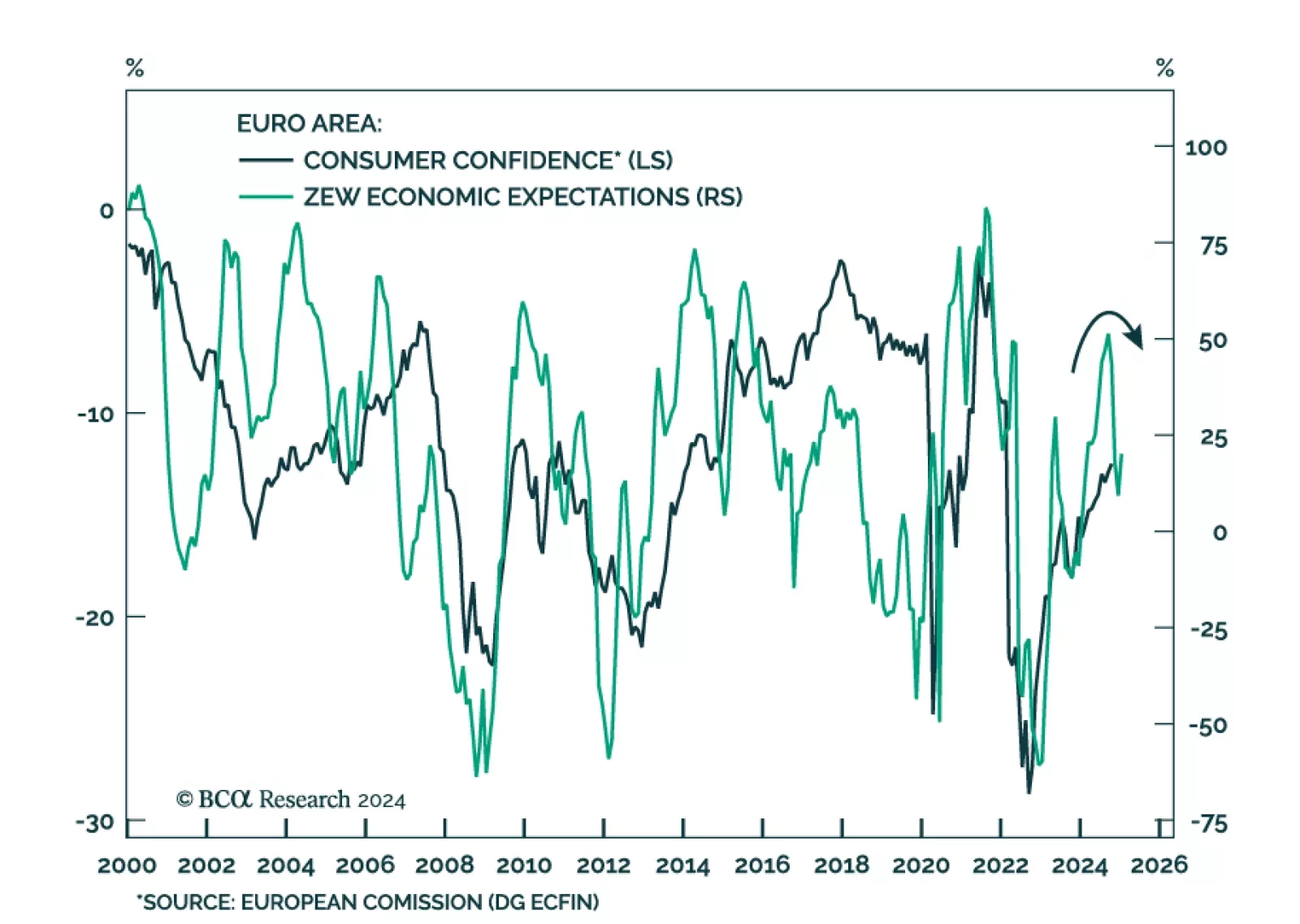

Flash estimates for European consumer confidence met expectations at -12.5 in October, rising from -12.9 in September. Despite this positive development, Euro Area sentiment remains poor. Consumer confidence remains below its…

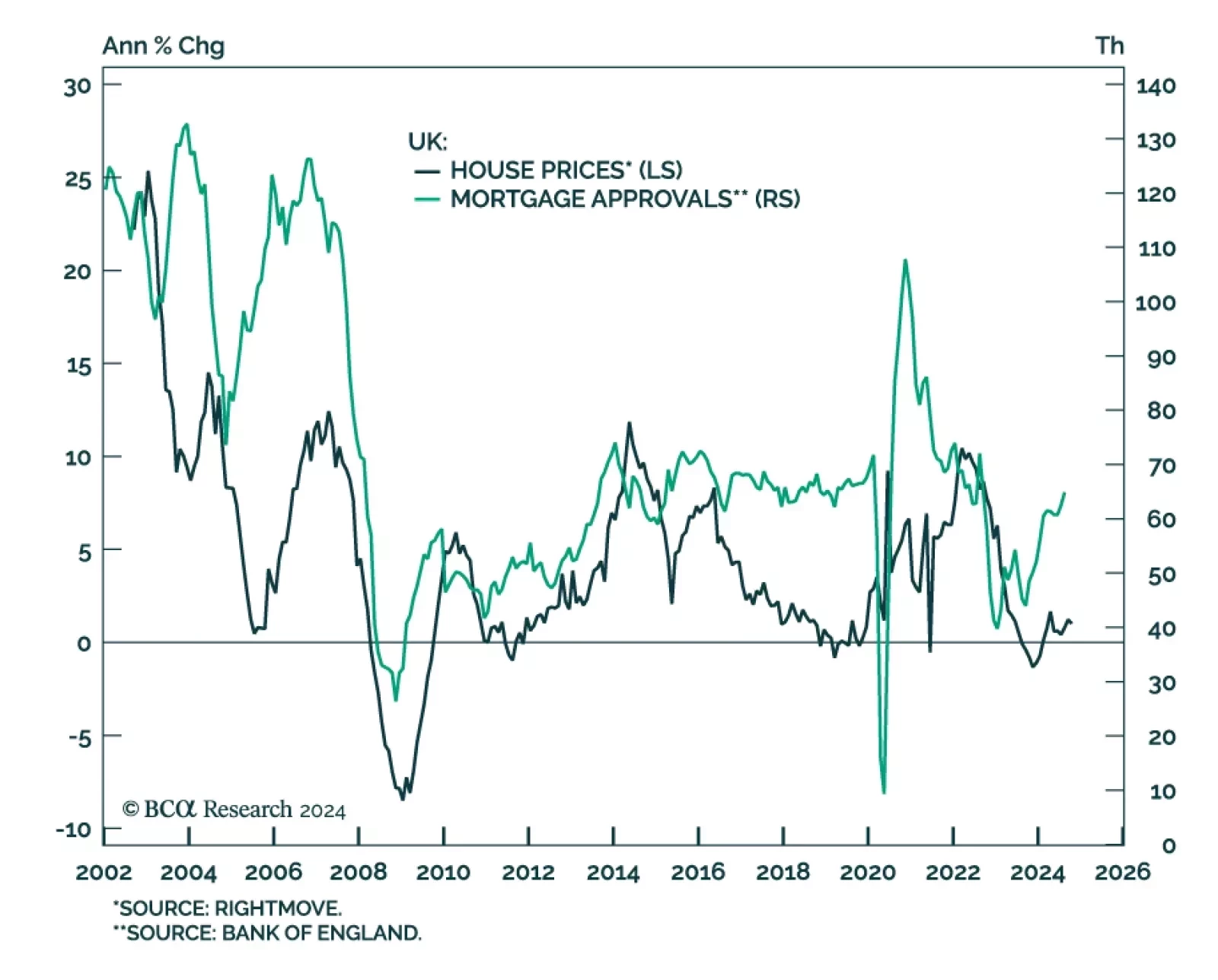

Despite elevated mortgage rates, UK home prices remain resilient. Average new seller asking prices were roughly flat in October, even as evidence of selling pressures are emerging. According to Rightmove, total home…

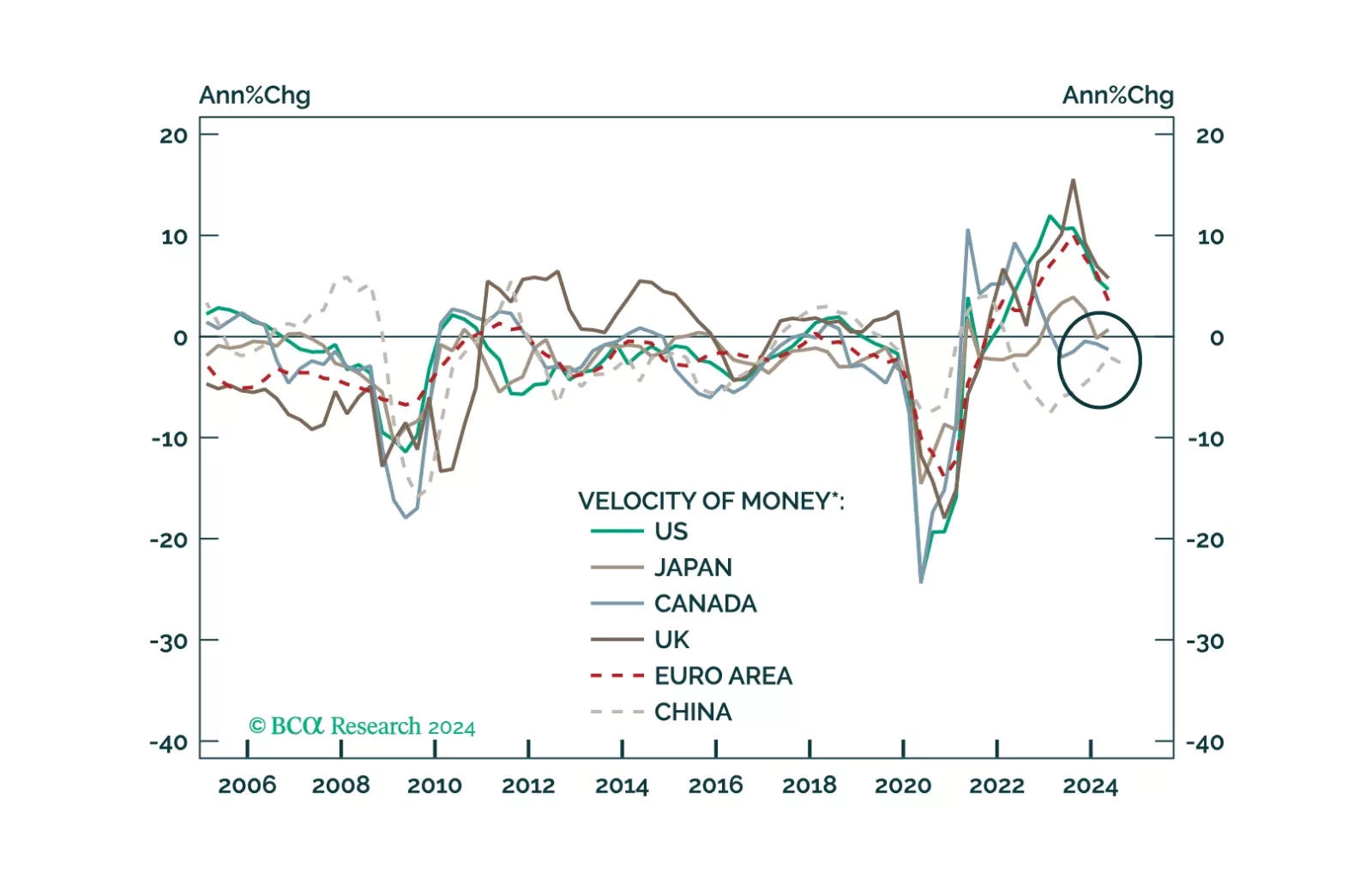

This Insight looks at the likely direction of bond yields and the dollar, from the lens of money velocity.

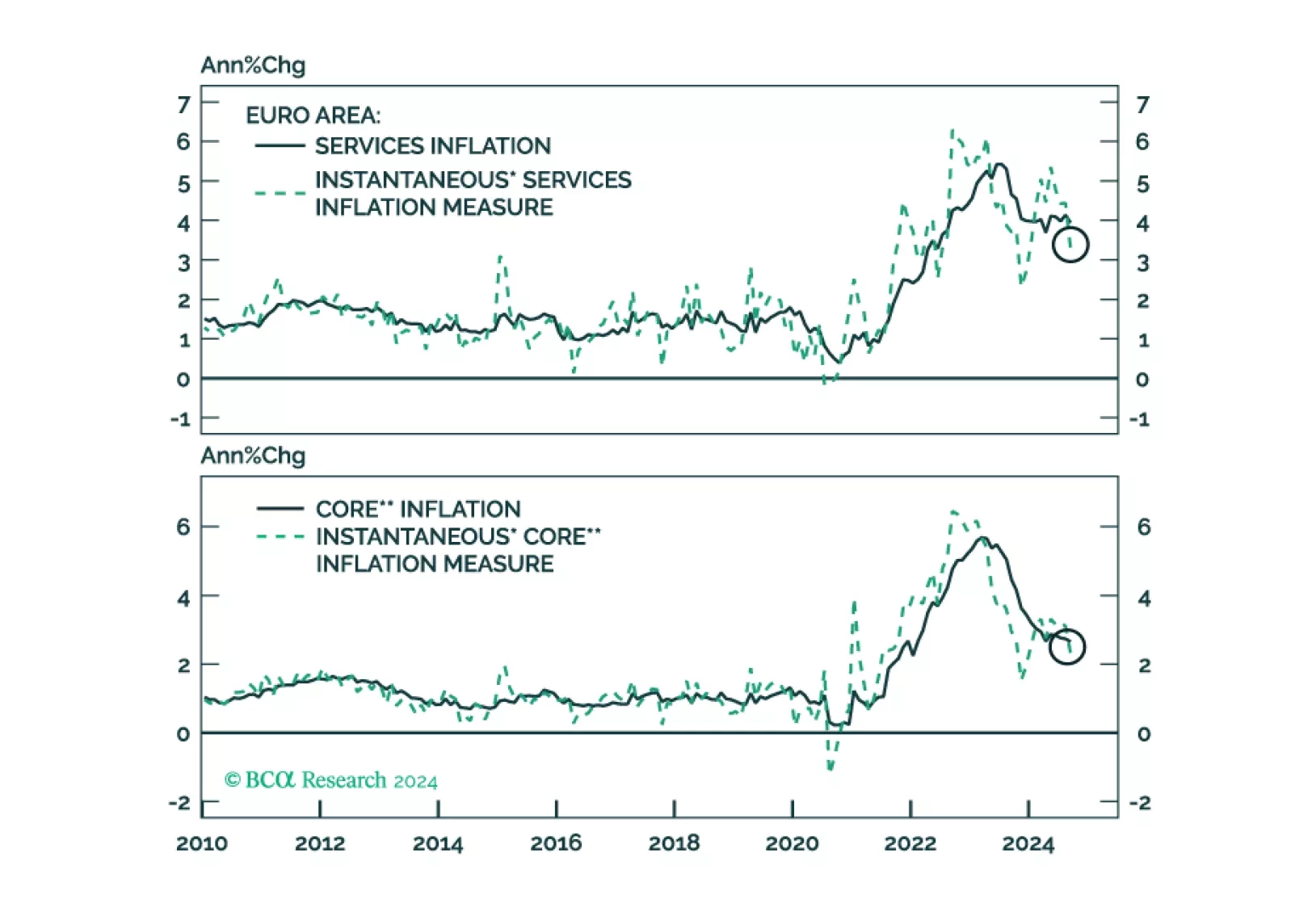

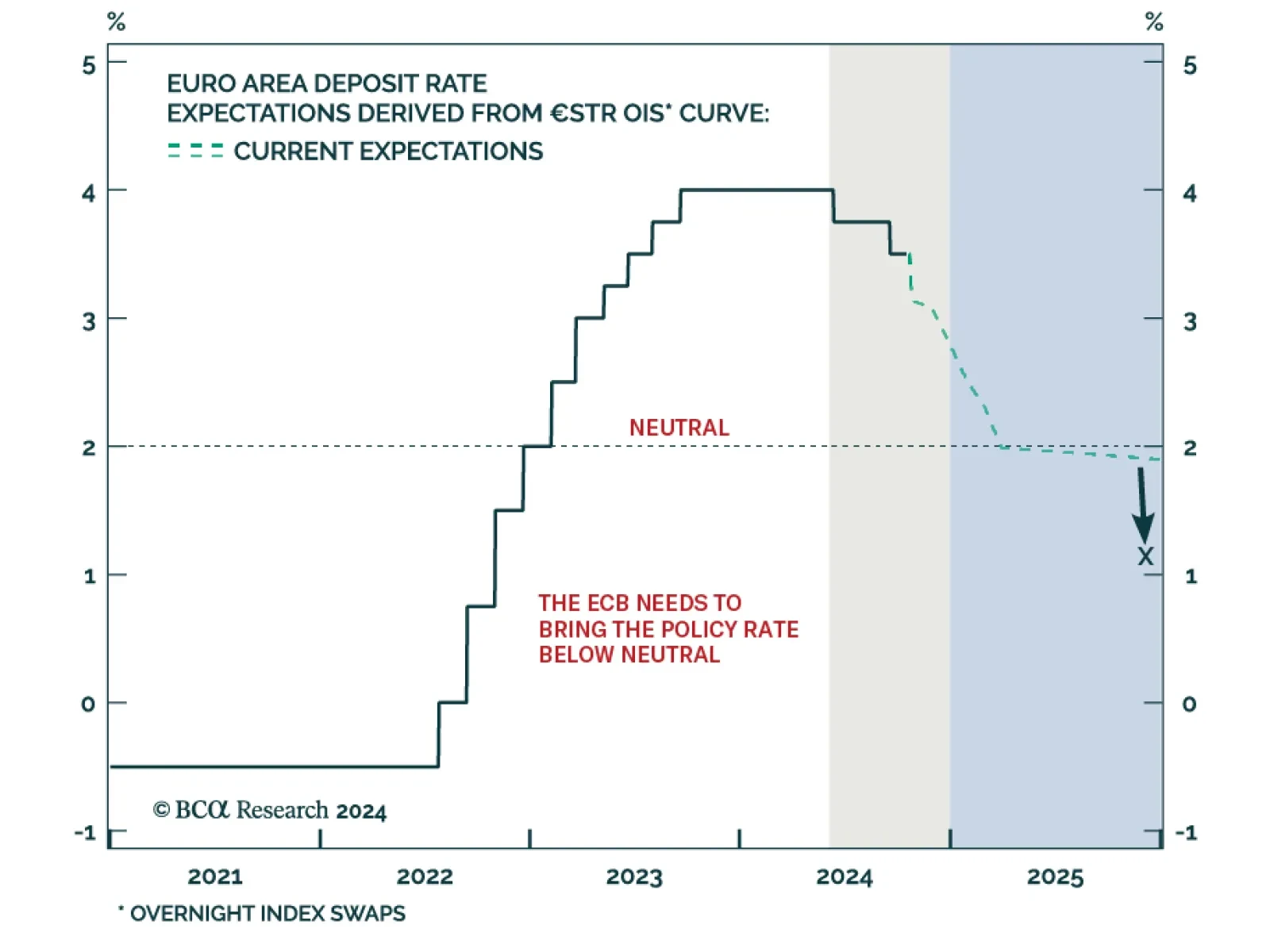

Yesterday, the ECB solidified its recent dovish tilt in response to weaker growth and decreasing inflationary pressures. It is now set to cut rates 25bps each meeting. How low will the ECB deposit rate ultimately go and what does…

The ECB cut interest rates by 25 bps for the third time this year, lowering the deposit facility rate from 3.5% to 3.25%. While the ECB is avoiding explicitly committing to a path for policy, President Lagarde’s repeated…

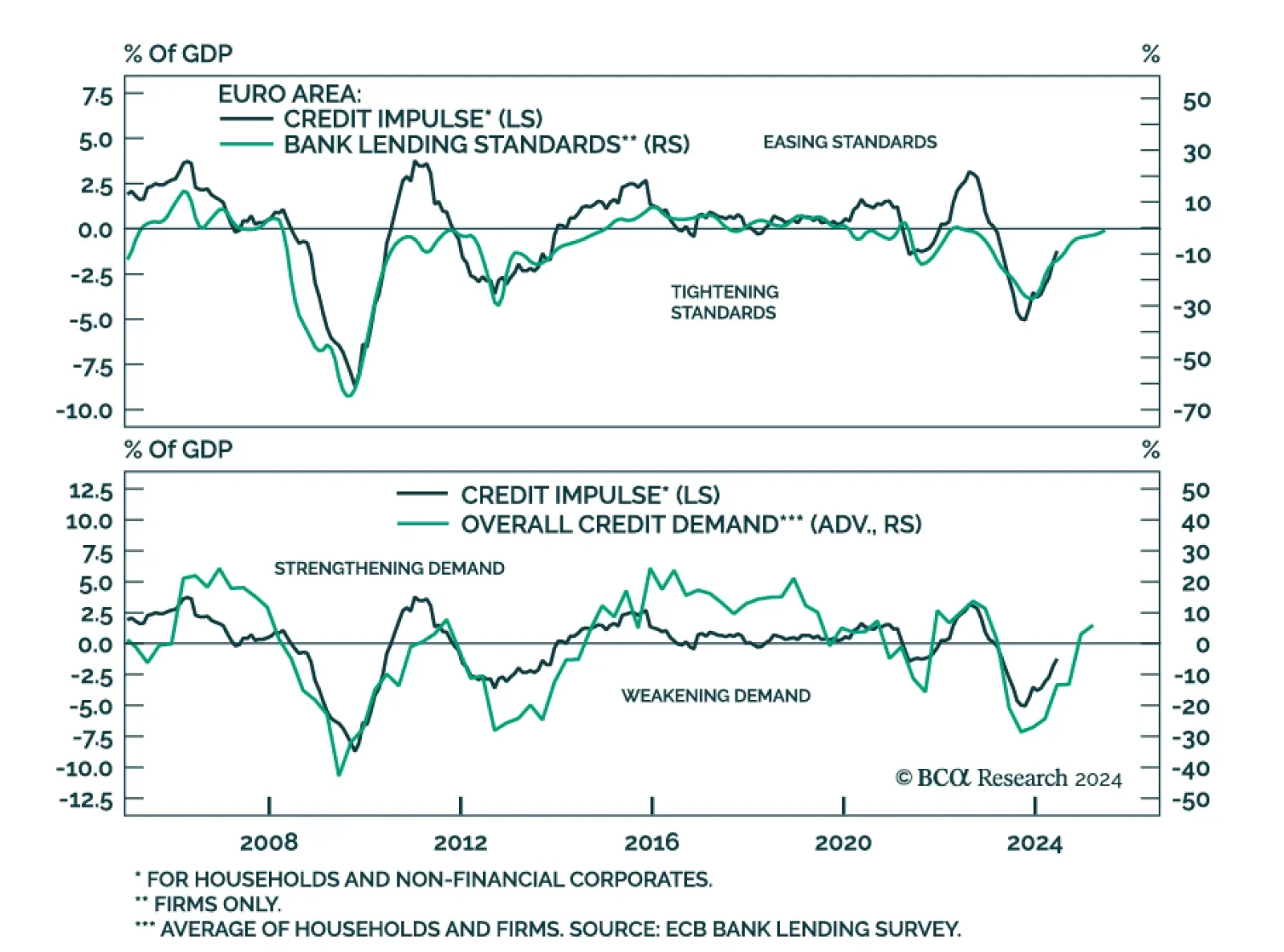

Banks reported an increase in loan demand from both firms and households in the European Central Bank’s Bank Lending Survey, marking the first rise since 2022. This demand increase occurred as lending standards for firms…

Japanese core machinery orders decreased by 1.9% in August and dropped 3.4% year-over-year, missing expectations for modest growth. This decline reversed July’s improvement, when machinery orders grew at an 8.7% annual pace…

The UK August employment report was in line with recent data showing an economy humming at a decent pace. The unemployment rate decreased 0.1pp to 4% after peaking at 4.4% before the summer. The BoE will look kindly to the…

Economic expectations for the both Germany and the Eurozone ticked up in October and surprised positively for the first time since they collapsed this summer. The assessment of current conditions however worsened, going from -84.…