Highlights German real estate and real estate equities remain a worthwhile multi-year position, especially in relative terms. The dominant stocks are Vonovia, Deutsche Wohnen, LEG, and GSW. Swedish real estate and real estate equities…

Highlights 2018 YTD Summary: Investment grade corporate debt in the developed economies has performed poorly so far in 2018, led by lagging returns in Financials and some steepening of credit curves. U.S. credit has outperformed…

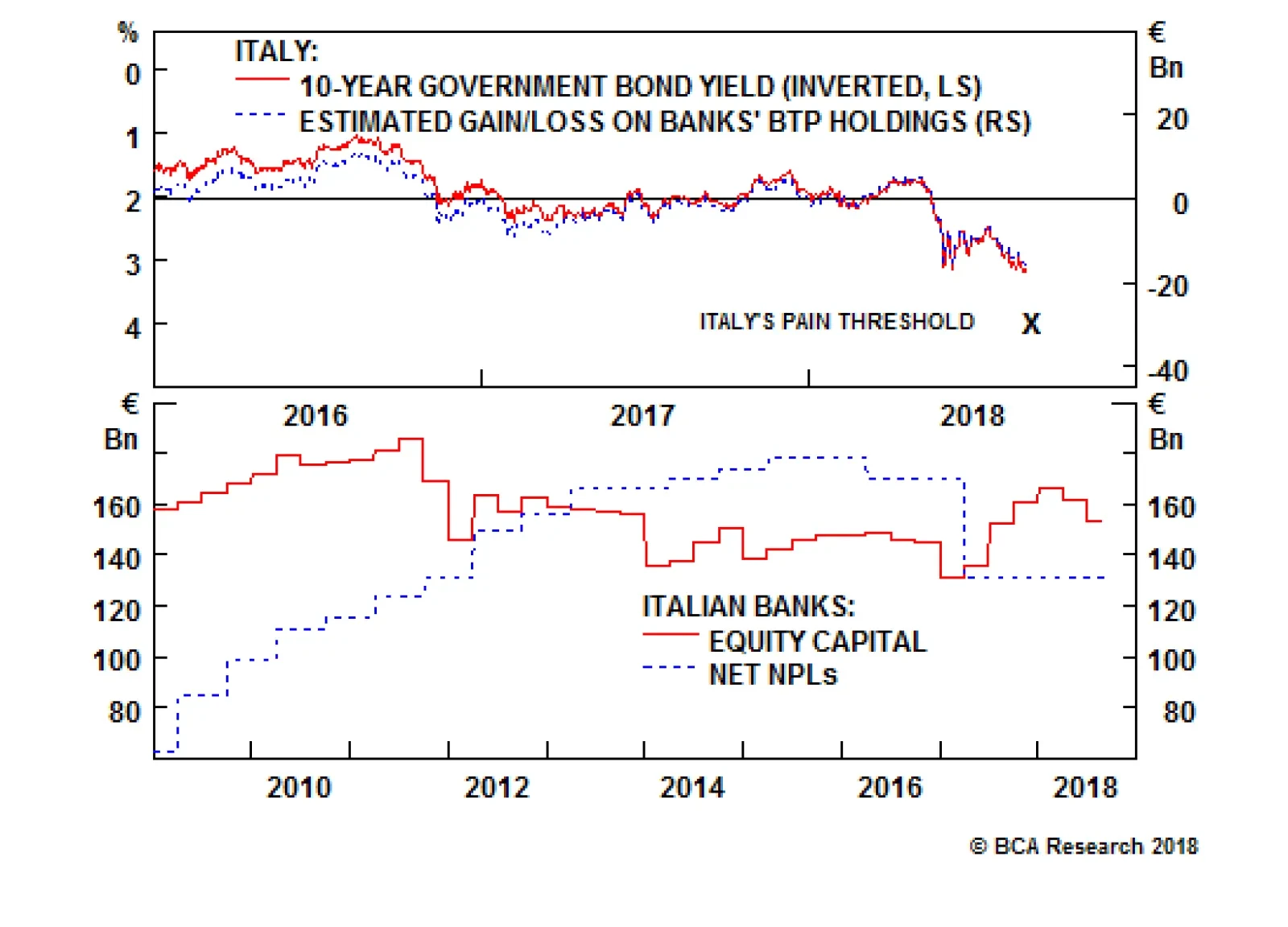

When Italian bond prices decline, it erodes the value of the €350 billion of BTPs held by Italian banks and also weakness their balance sheets. Investors start to get nervous about a bank's solvency when…

Highlights We remain bullish on the dollar, but no longer think that being long the greenback is the "slam-dunk" trade that it was earlier this year. A reacceleration in growth outside the U.S. and an overly dovish Fed…

Highlights The global 6-month credit impulse is likely to turn up in the fourth quarter. This warrants profit-taking in some pro-defensive equity sector, regional, and country allocation... ...for example, in the 35 percent…

Highlights Two key issues will remain important drivers of global financial markets in the coming quarters: the direction of the dollar and Chinese policy stimulus. Policy and growth divergences will remain tailwinds for the dollar…

Highlights Lesson 1: Inflation is a non-linear phenomenon. Lesson 2: Beware government interference in monetary policy. Lesson 3: An emerging markets shock is deflationary for developed markets. Lesson 4: The 'Rule of 4' for…

Dear Client, We had intended to send you the second part of our two-part special report on long-term inflation risks this week, but given the sharp moves in the dollar and emerging market assets, we decided to write this bulletin instead…

Highlights It has not been a lot of fun being a corporate bond investor in 2018. Global credit markets have struggled to deliver positive returns, amid a news flow that has been overwhelming at times. Geopolitical uncertainty, shifting…