Highlights In this Weekly Report, we present our semi-annual chartbook of the BCA Central Bank Monitors. The message now conveyed by the Monitors is that divergences between the cyclical pressures faced by the individual central banks…

The euro has recently benefited from easing Italian political risk. The populist Five Star Movement / Lega Nord coalition is backing away from a budget confrontation with Brussels, as Italy's minister of finance wants a 2%…

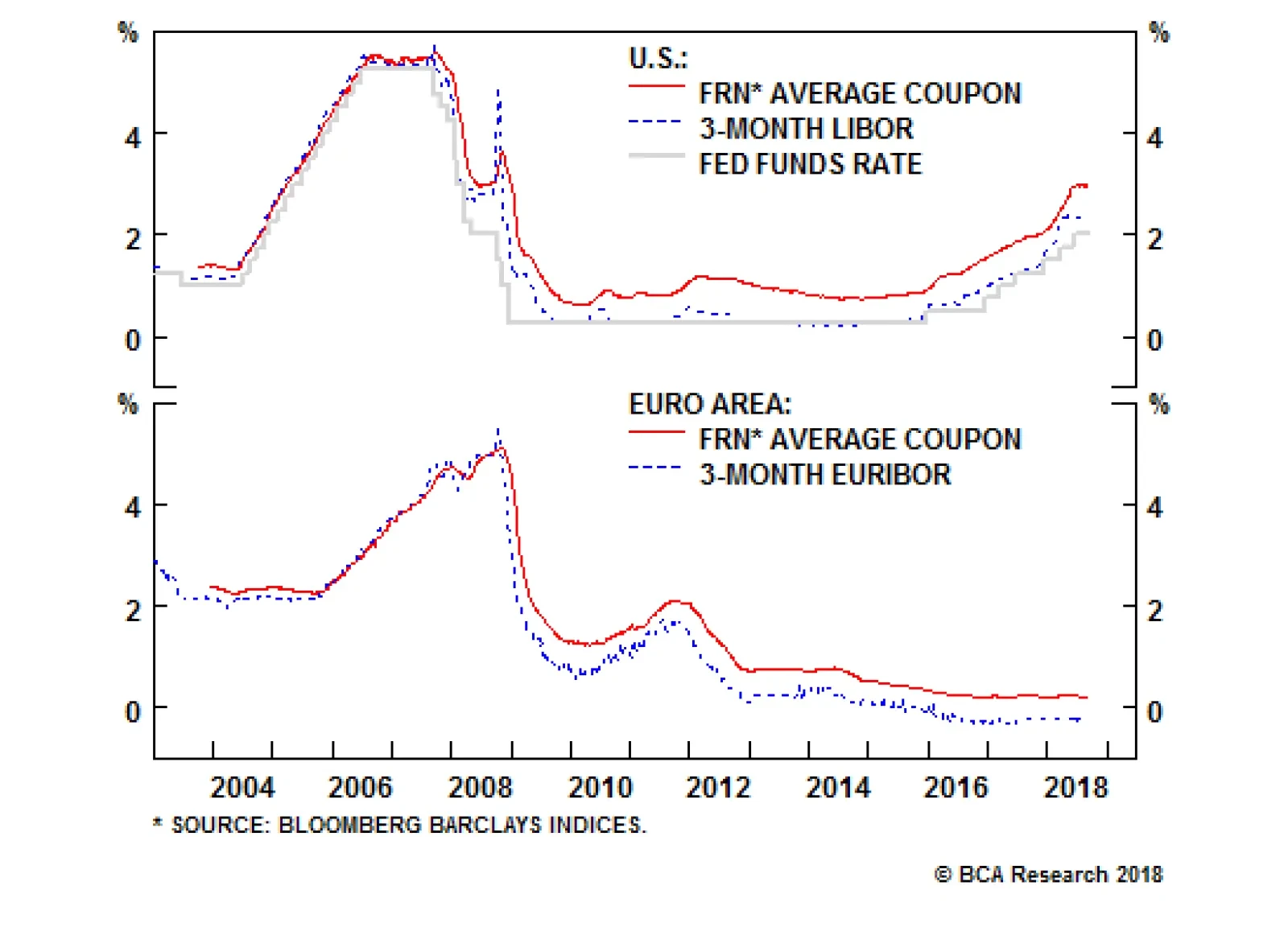

One potential solution for investors in a rising inflation and rate environment is to get exposure to Floating-Rate Notes (FRN). An FRN offers coupon payments that float or adjust periodically based on a predetermined…

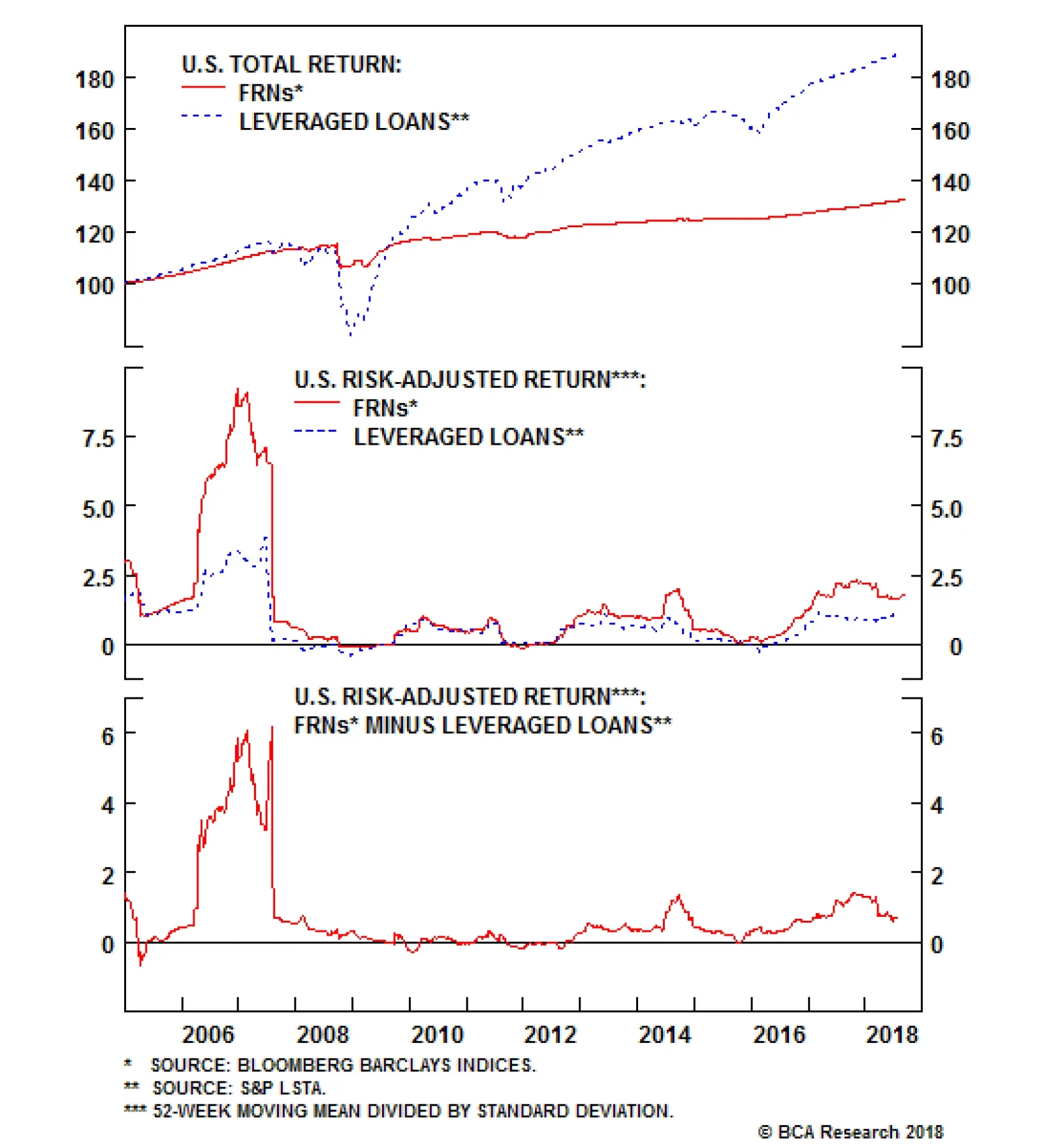

Leveraged loans tend to be senior to an issuer's traditional corporate bonds, and are collateralized by a pledge of the issuer's assets. However, secured does not mean safe. Even though like FRNs bank loans share the same…

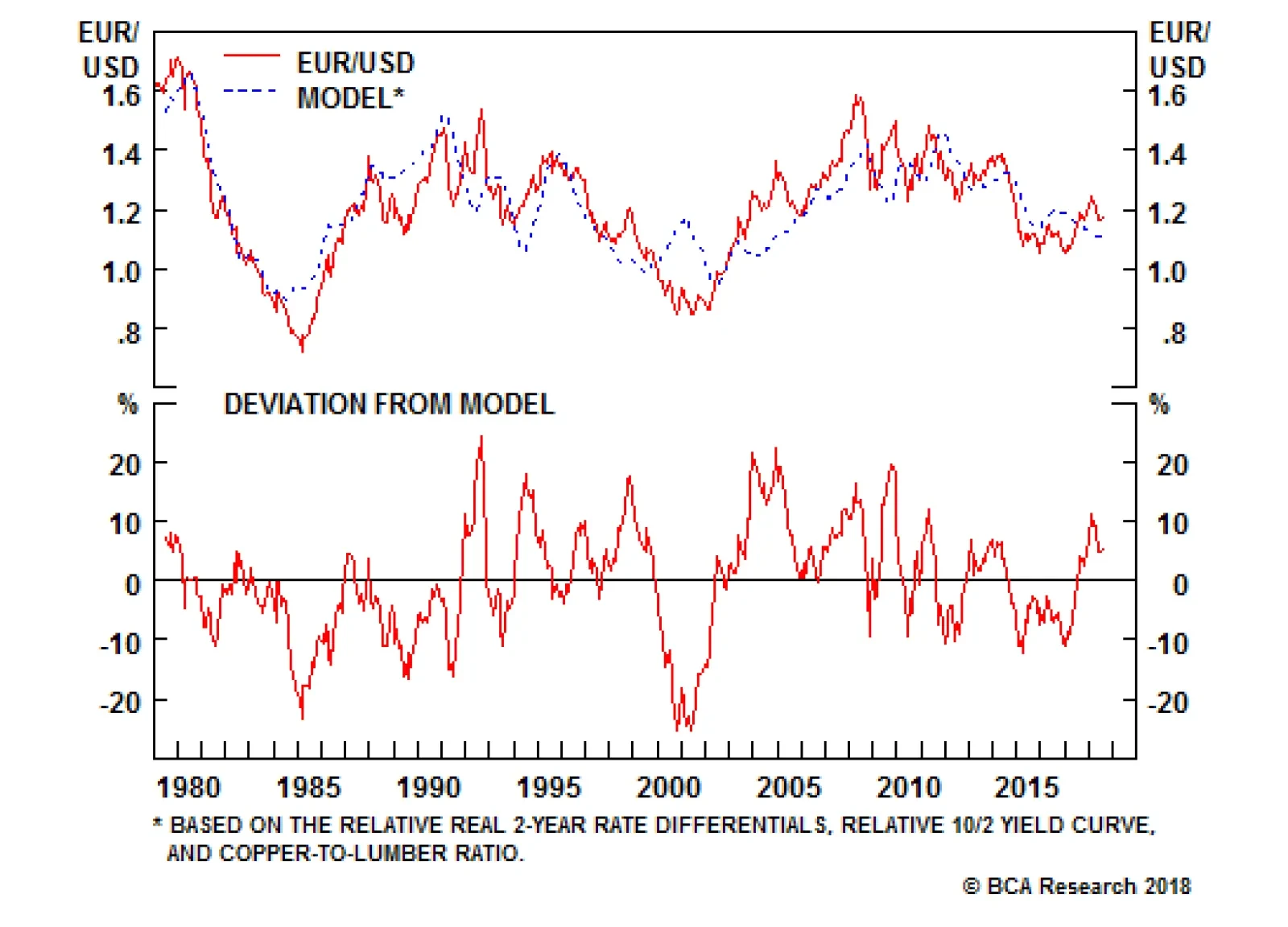

Highlights The USD remains supported by fundamentals, especially now that its late-2016 excesses have been purged. Solid U.S. growth contrasts with weaker growth in the rest of the world, which will incentivize further inflows into…

Highlights An inflation scare would initially take bond yields higher. But the higher bond yields would undermine the valuation support of global risk-assets worth several times the size of the global economy. Thereby, an inflation…

Highlights The U.S. midterm elections are far less investment-relevant than consensus holds; Trump will increase the pressure on China and Iran regardless of the likely negative election results for the GOP; The Iranian sanctions,…