Highlights Set your overall investment strategy with two 'rules of 4' based on 10-year bond yields: If either the Italian BTP or the sum of the U.S. T-bond, German bund and JGB stays above 4 percent, then sell equities and buy…

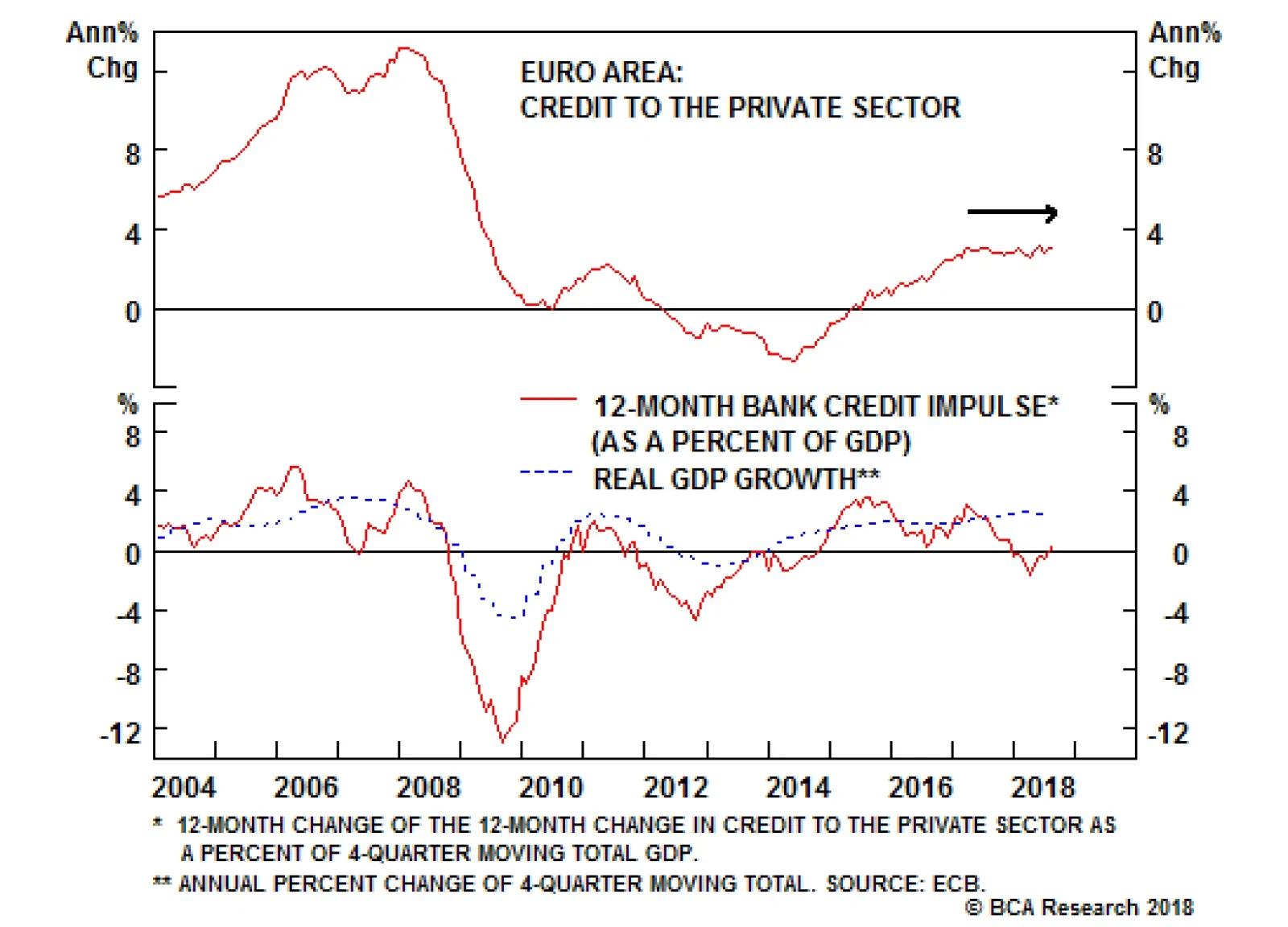

Weaker growth in China and other emerging markets certainly has not helped. However, much of the problem lies closer to home. Bank credit remains the lifeblood of the euro area economy. The 12-month credit impulse - defined as…

Highlights Recommended Allocation We don't see any change over the next six to 12 months to the current trends of strong U.S. growth, continuing Fed hikes, rising long-term interest rates, and an appreciating dollar. We…

Highlights Macro outlook: Global growth will continue to decelerate into early next year on the back of brewing EM stresses and an underwhelming policy response from China. Equities: Stay neutral for now, while underweighting EM…

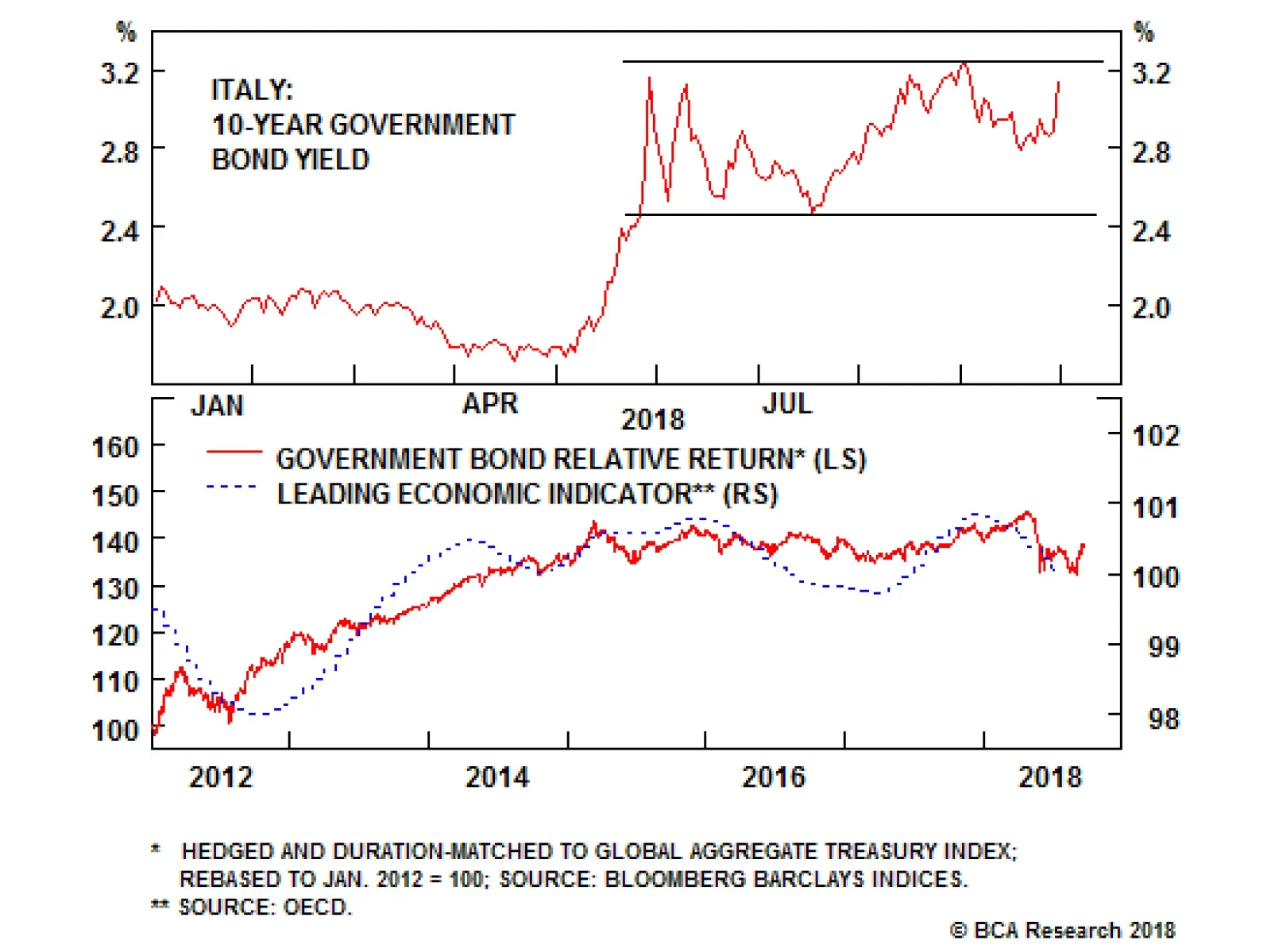

The Italian 10-year government bond yield jumped 25bps, returning to the upper end of the range that has prevailed since late May, while the Italian MIB equity index plunged -3.7% with some Italian banks suffering losses of as…

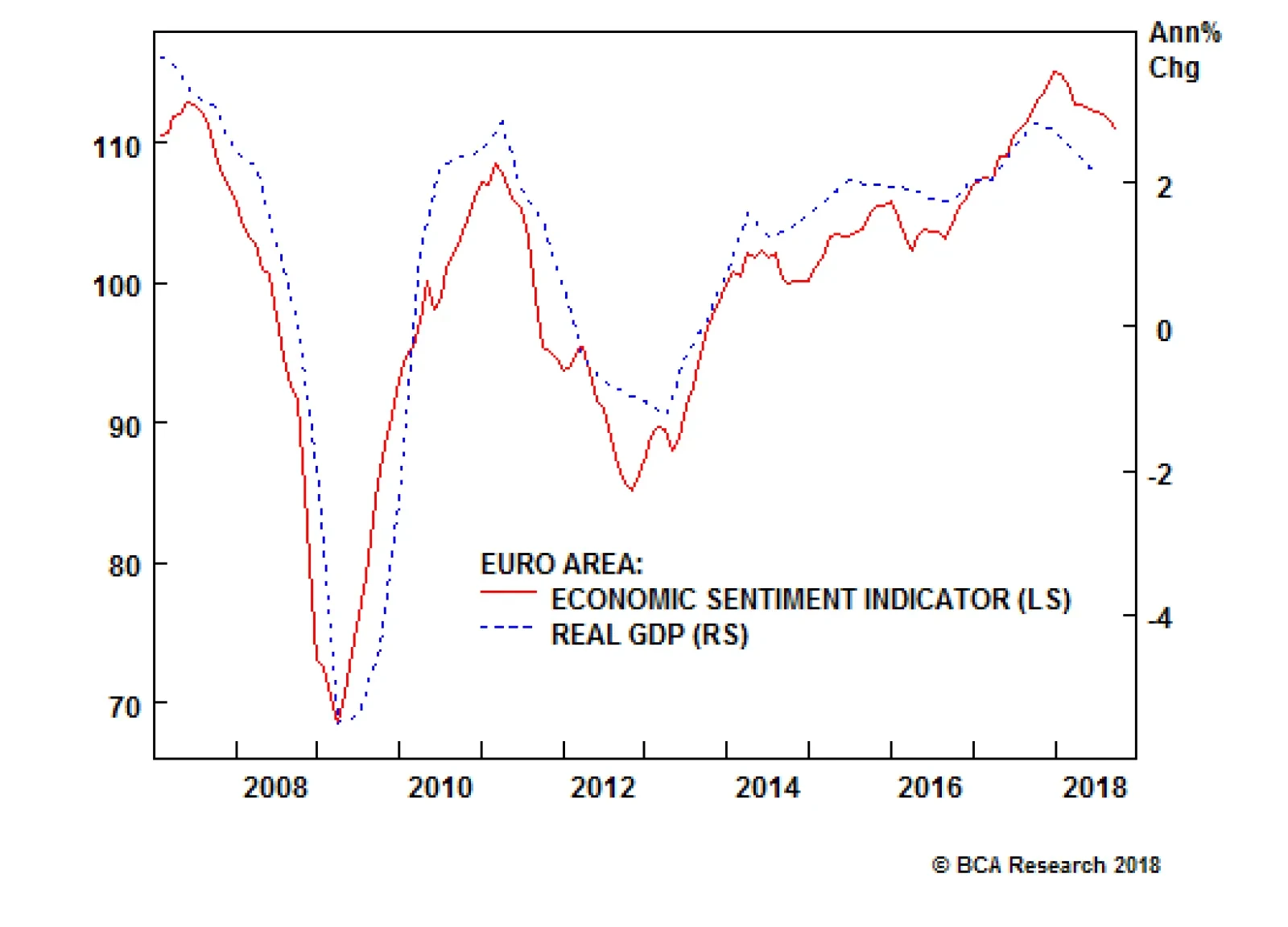

Although ECB President Mario Draghi sounded a more hawkish tone on the outlook for the euro area, the economic data have been under pressure for most of 2018, and the recently released European economic sentiment data show that…

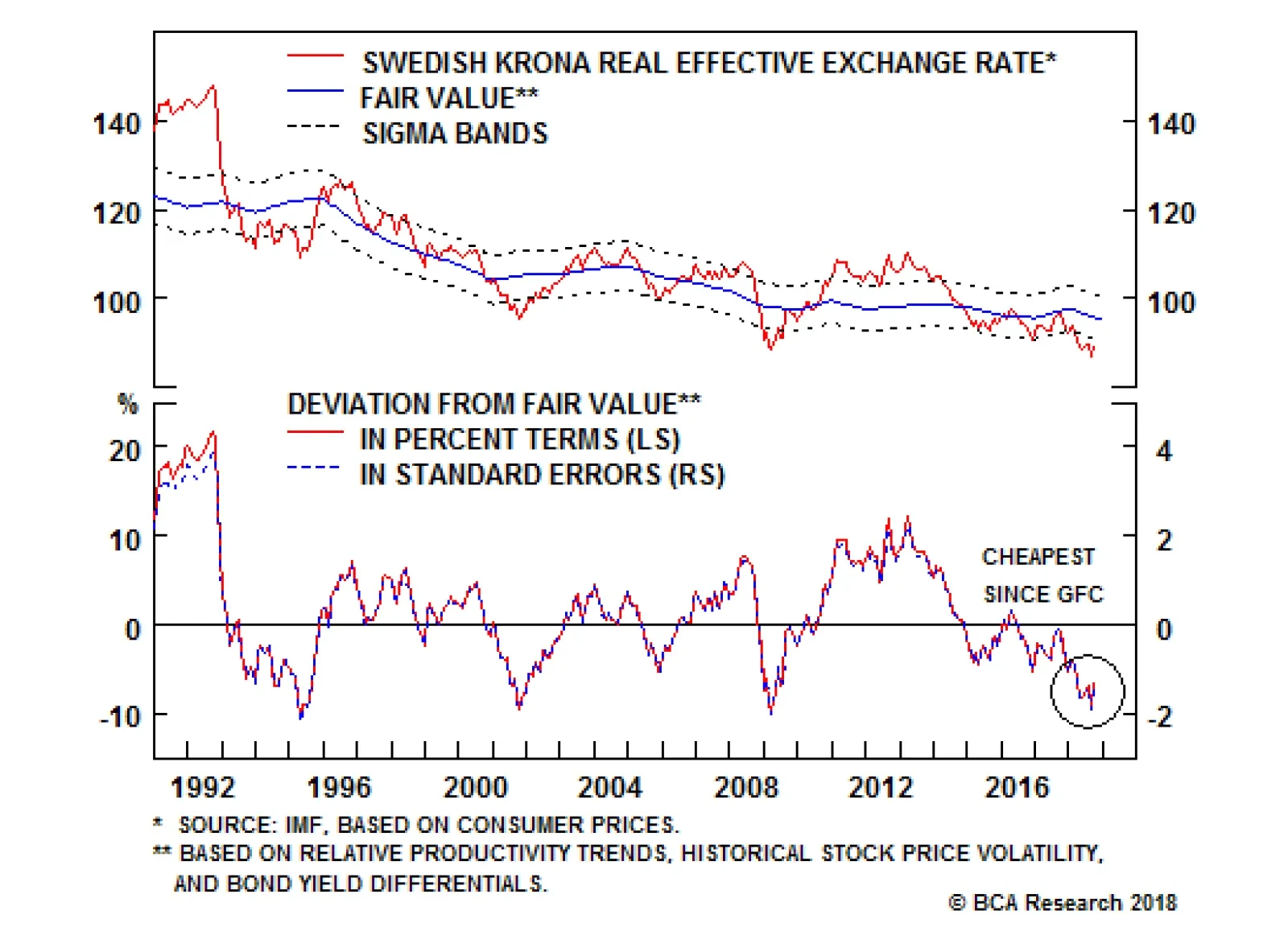

Our Foreign Exchange Strategy group believes the SEK is clearly cheap. The trade-weighted krona is trading at its cheapest levels relative to BCA’s long-term fair value since the Great Financial Crisis (see chart). The SEK…

Highlights The U.S. dollar is likely to correct further over the coming weeks. The CAD should benefit as it is cheap and oversold, and the inflationary back-drop warrants tighter monetary conditions. This will be a bear market rally,…

Highlights Prediction 1: A major financial downturn will trigger the next major economic downturn, and not the other way round. Prediction 2: The straw that will break the back of a fragile financial system will be the global long…