Highlights The Fed remains on a tightening course as the U.S. economy has no spare capacity, yet growth in the rest of the world is suffering as EM financial conditions are tightening. It will take more pain for the Fed to capitulate…

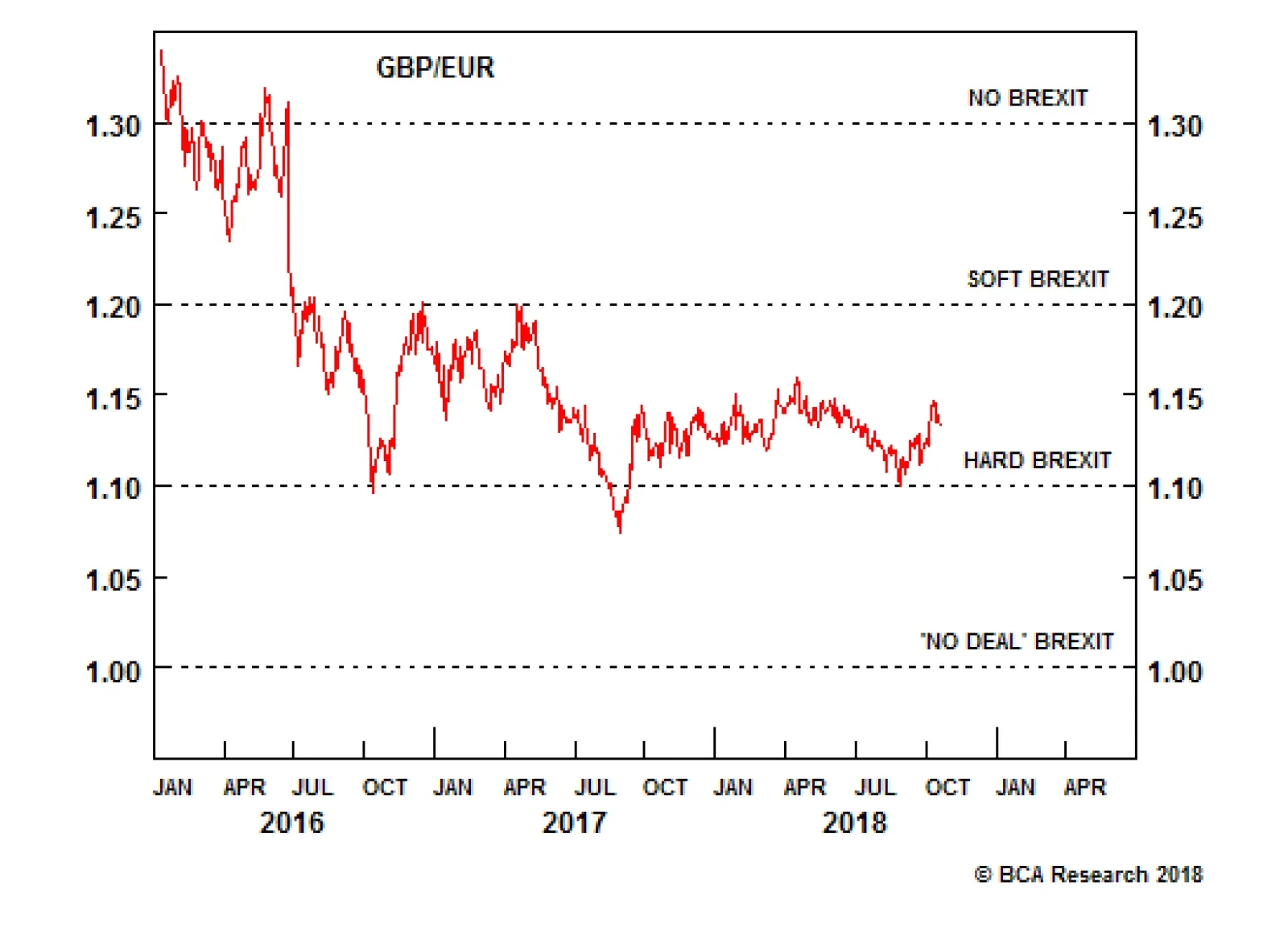

The first option, to stay in the EU, is politically impossible unless a new referendum in the U.K. overturns the original referendum's vote to leave. The second option, to join the European Economic Area, the European Free…

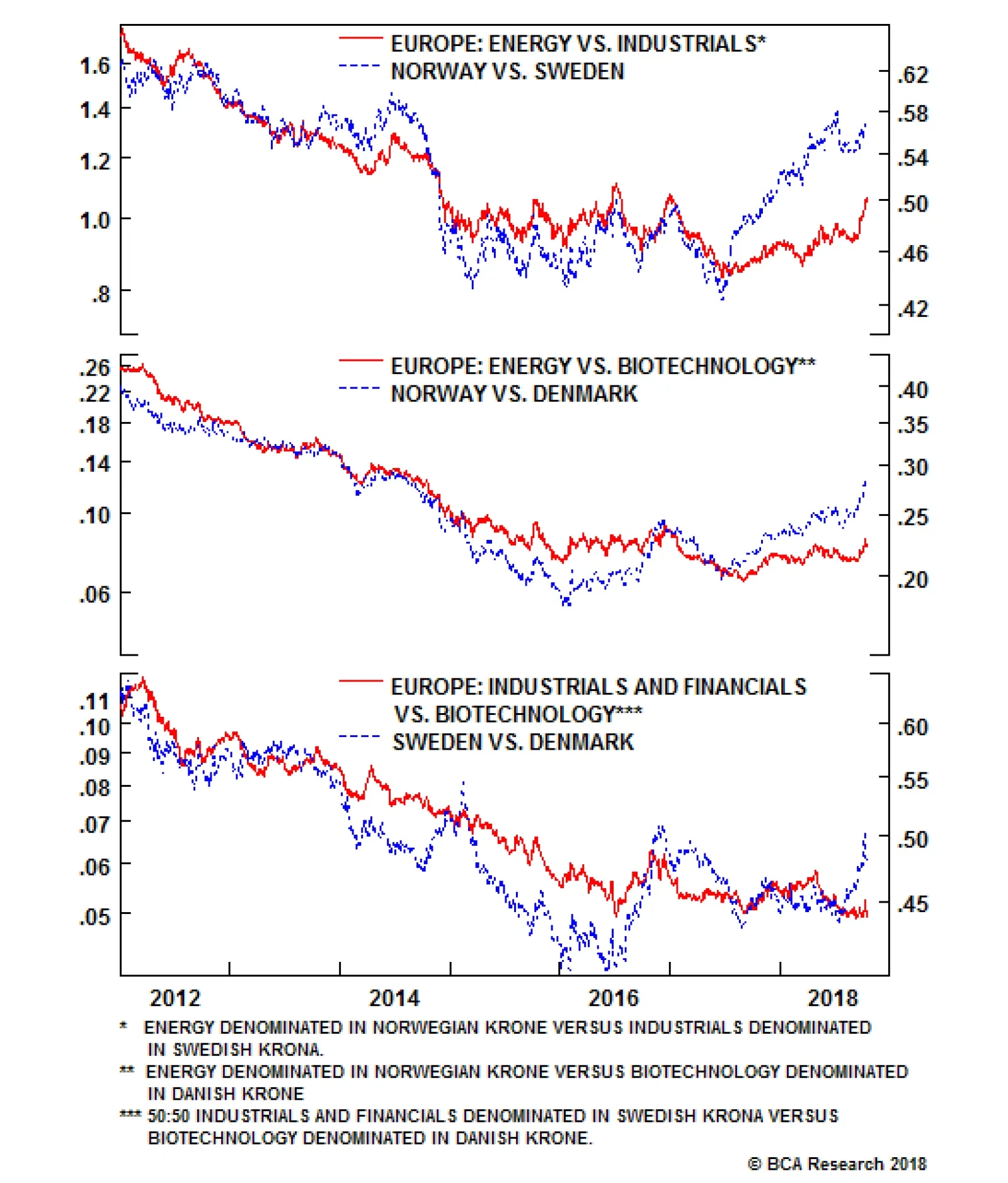

Looking at these three bourses, each has a defining dominant sector (or sectors) whose market weighting swamps all others. In Norway, oil and gas accounts for over 40 percent of the market; in Sweden, industrials accounts for 30…

Highlights The long term direction for the pound is higher... ...but as the EU withdrawal bill passes through the U.K. parliament, expect a very hairy ride. The stock markets in Norway, Sweden and Denmark are driven by energy,…

Highlights Rising U.S. bond yields will continue to put downward pressure on global stocks in the near term, but will not trigger an equity bear market until rates reach restrictive territory. We are still at least 12 months away from…

Highlights Historically, the dollar exhibits positive seasonality in October and November. Technical and valuation indicators suggest that this year will be no exception. Continuing divergence between U.S. and global growth, rising…

Highlights Asset allocation: Go long industrial commodities versus equities on a 6-month horizon. If an inflationary impulse is dominating, beaten-down industrial commodities have more upside than richly valued equities; and if a…

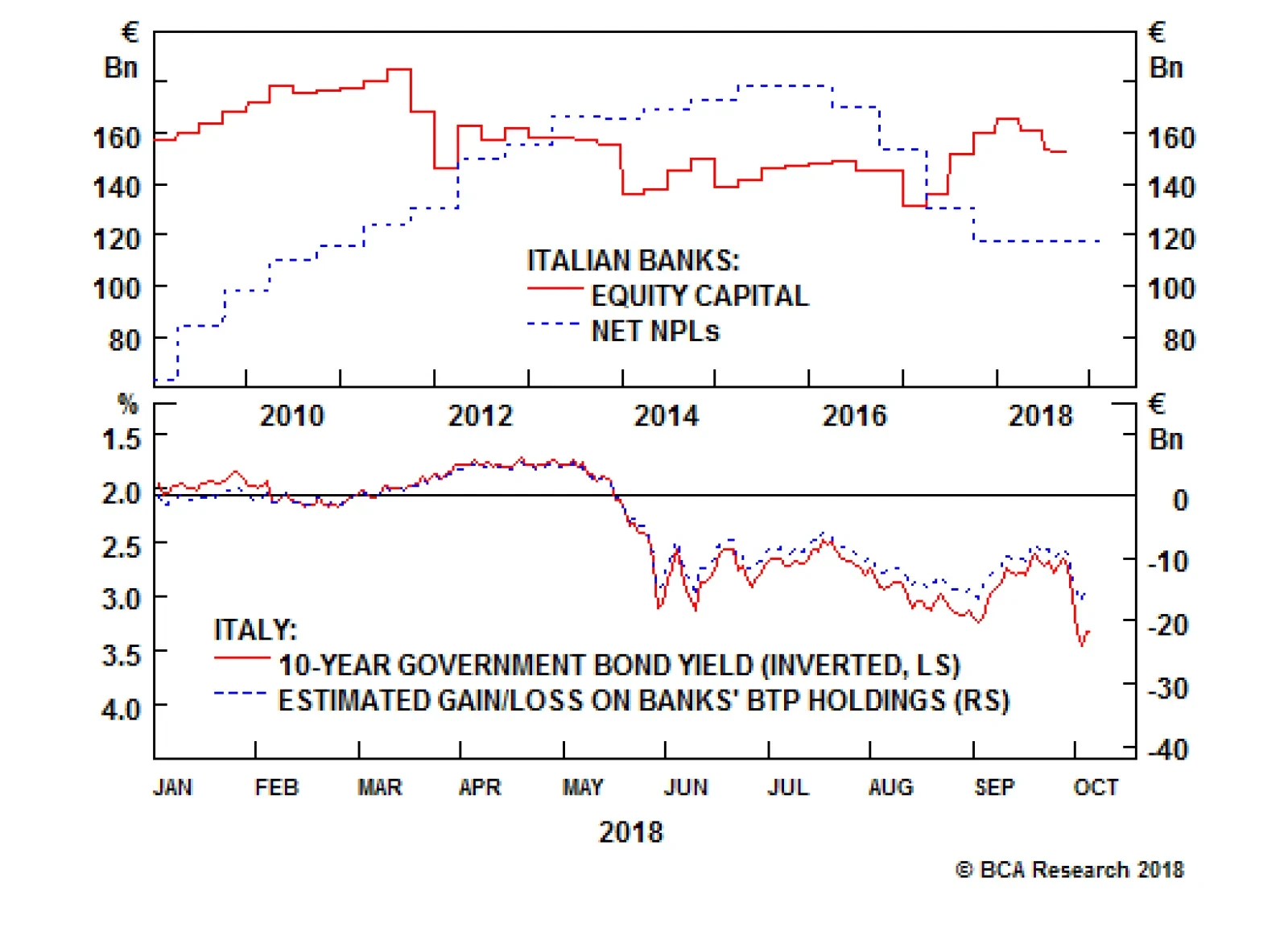

The euro debt crisis was essentially a liquidity crisis which resulted from bond vigilantes running amok. When markets refuse to lend to sovereigns at a fair interest rate, maturing debt has to be refinanced at penalizing rates,…