The most important question for global investors is whether Merkel's fall from grace is related to a growing trend of populism in Europe. The answer is ‘yes’ in part, but Merkel's problem runs deeper.…

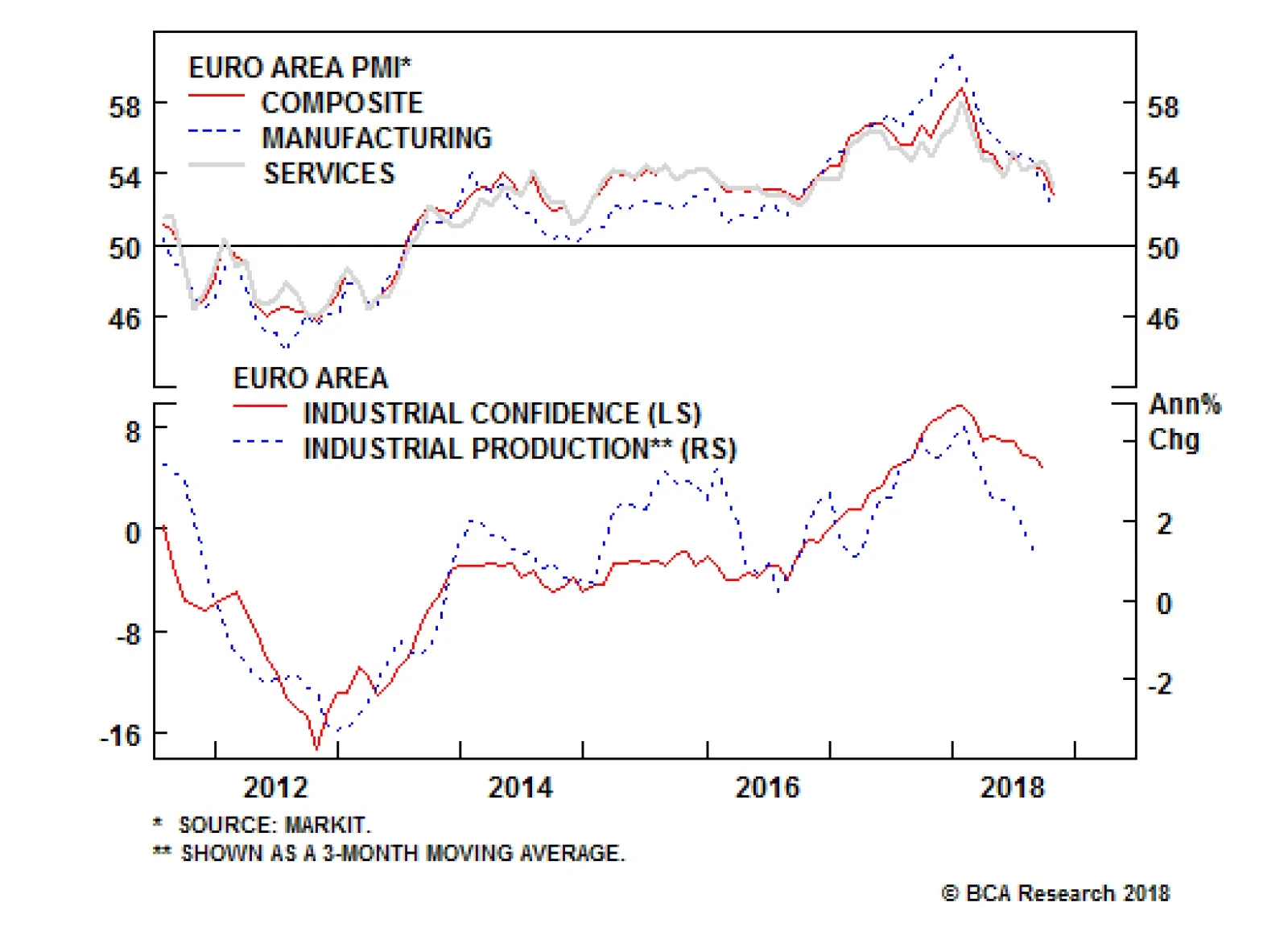

The latest data releases for the Eurozone have been mixed. Real GDP growth disappointed with a 0.2% Q/Q rise in the third quarter. This is in line with the pullback in other indicators, such as the PMIs, highlighting that the…

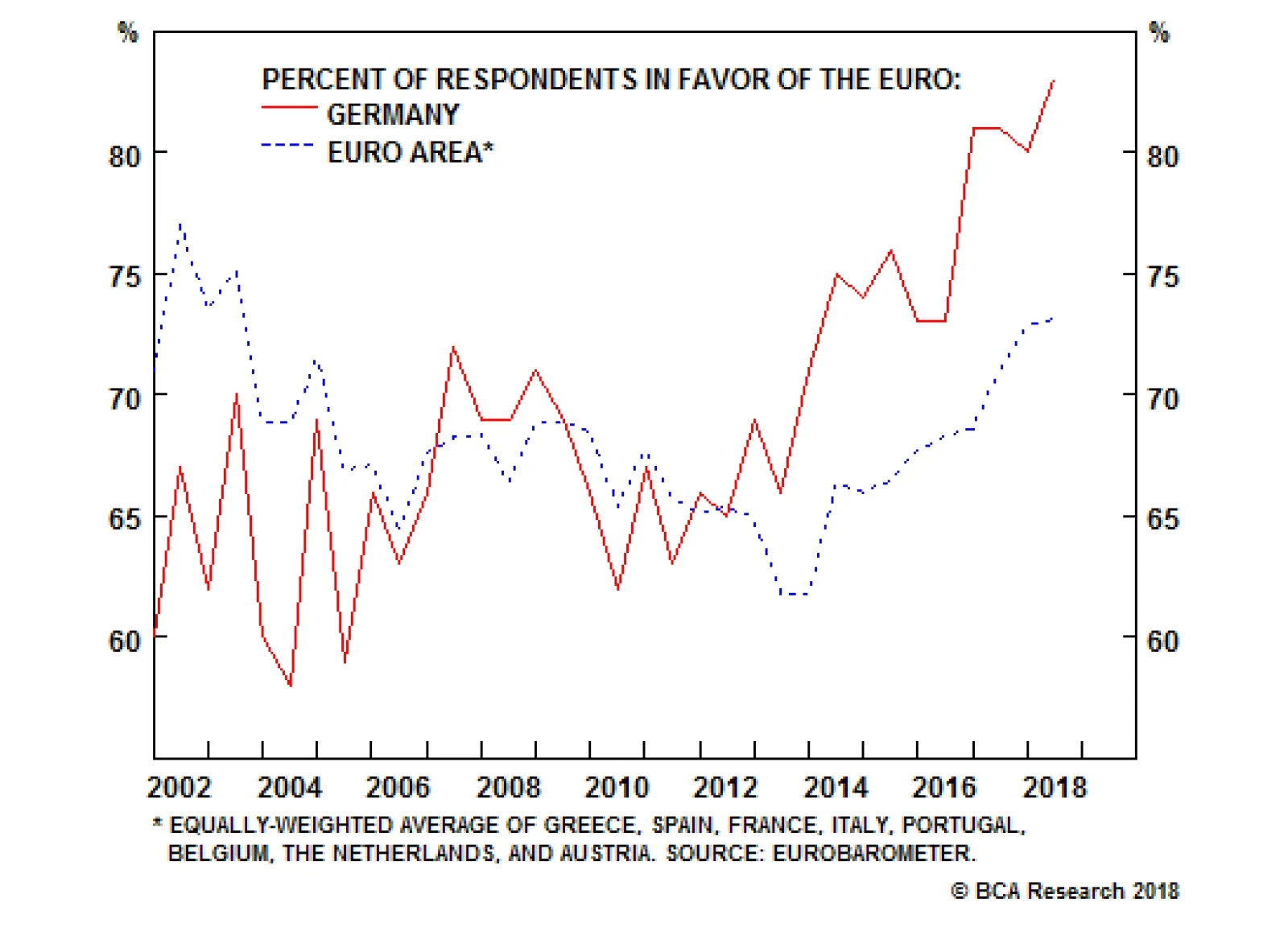

The main risk confronting Europe’s major institutions such as the ECB, the EU Council, and the EU Commission is an existential risk. This is because the very existence of the pan-European project relies on the ongoing (…

Highlights Five risks to our bullish dollar stance need to be monitored: further weakness in the S&P 500; rebounding gold prices; stabilizing EM exchange rates and bond prices; Spanish bank stocks at multi-decade lows; and large,…

Highlights We do not view October's equity downdraft as a signal to further trim risk assets to underweight. Nonetheless, stocks have not yet fallen enough to justify buying either. The economic divergence between the U.S. and the…

Highlights Asset allocation: overweight industrial commodities versus equities... ...and neutral equities versus bonds. The euro: neutral for a broad basket but stay long JPY/EUR. The pound: long-term upside, but a better entry…

The growth and policy divergence between the U.S. and China remains a key investment theme at BCA. A weaker Chinese economy should produce a greater headwind for non-U.S. economies, including the euro area. This is why looking at…

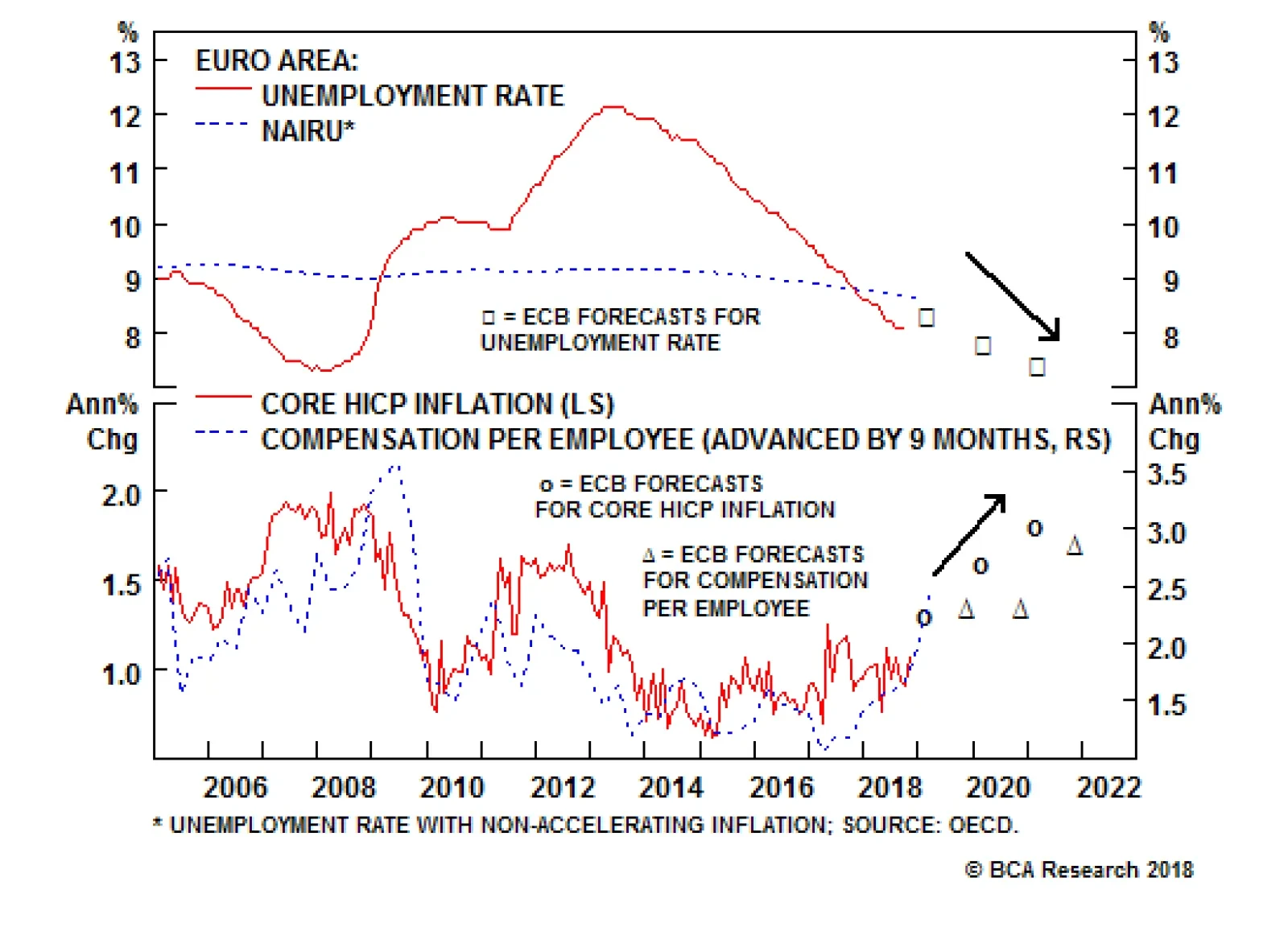

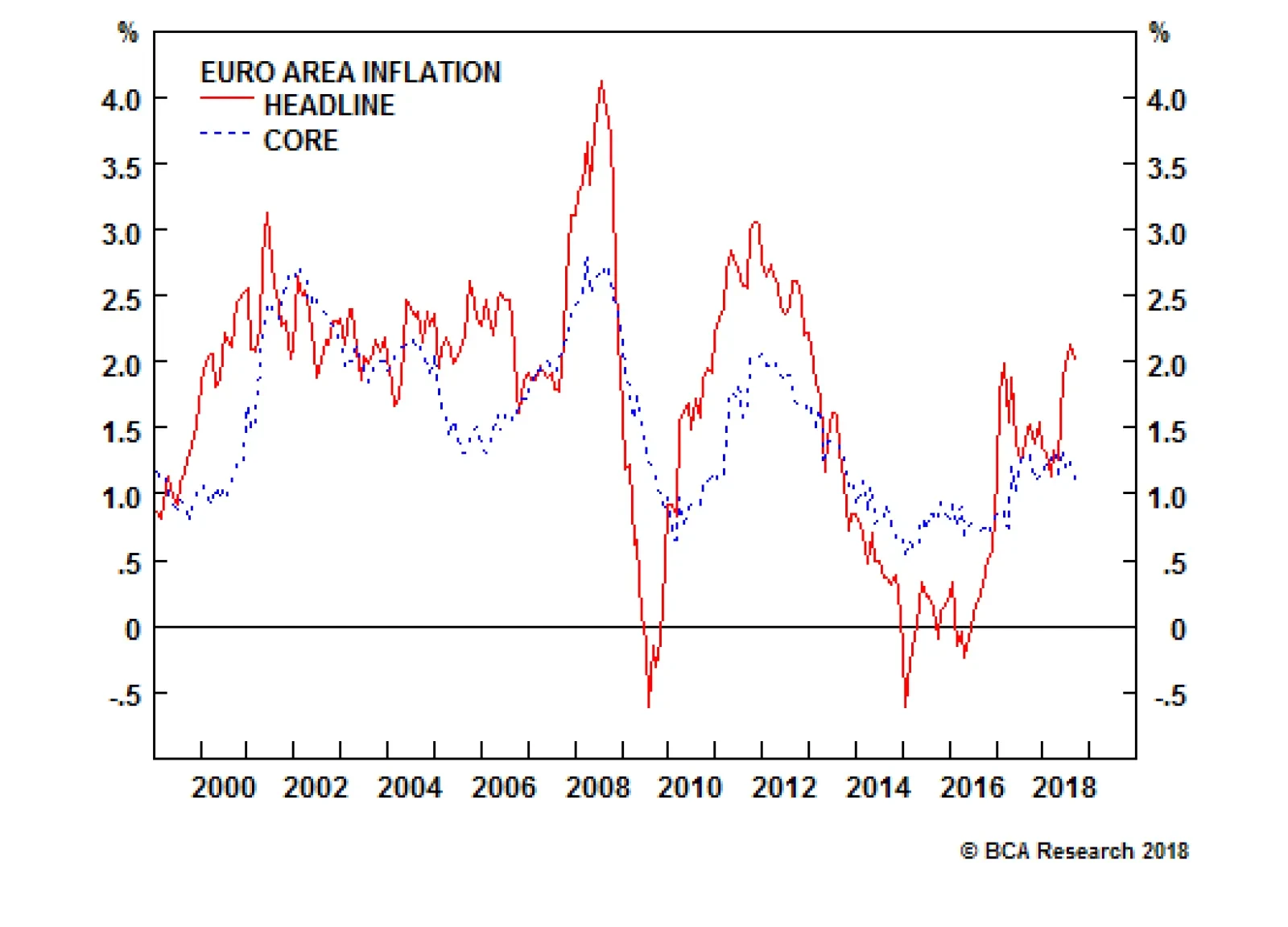

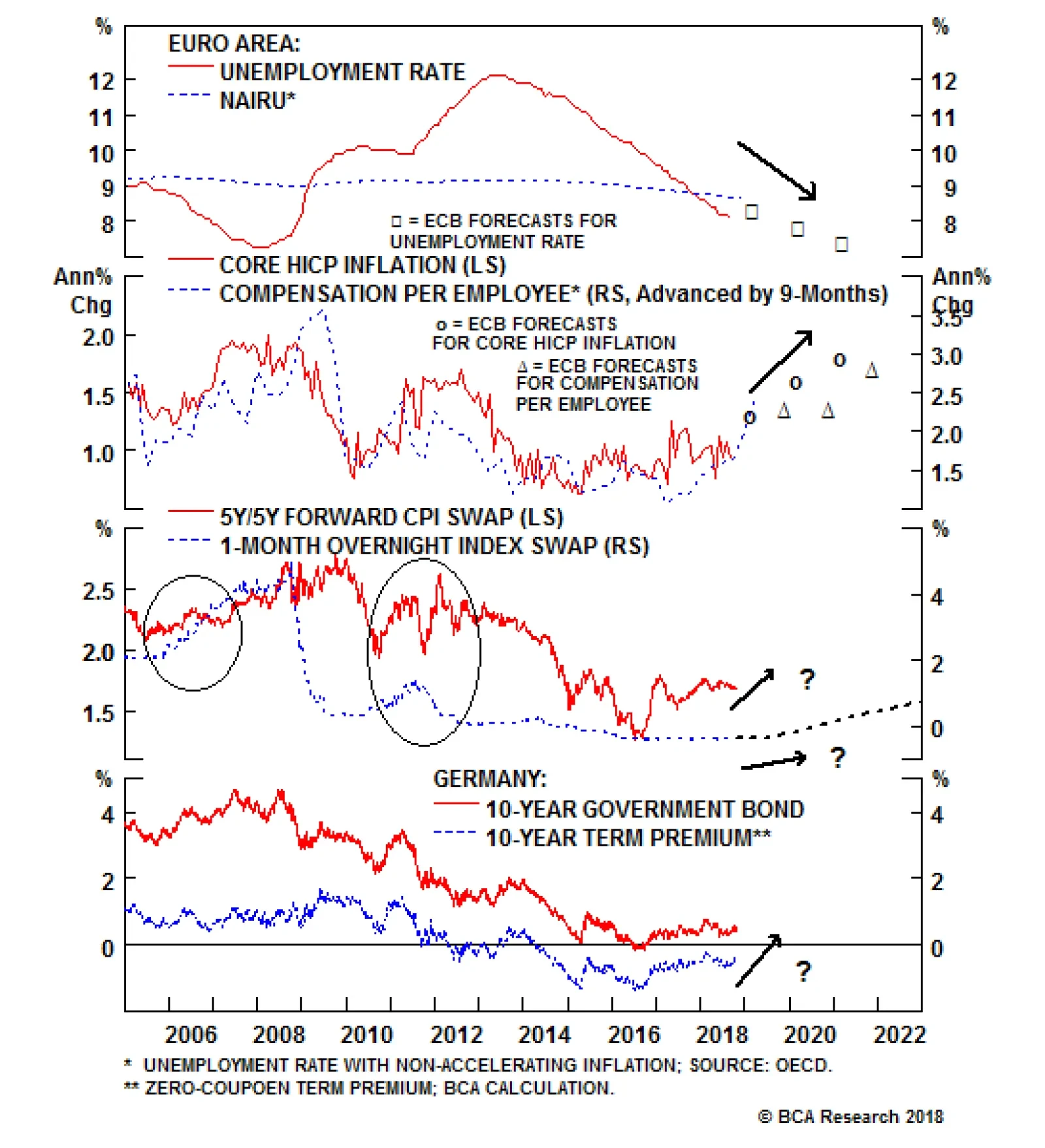

Our Global Fixed Income Strategy team is currently underweight euro area government bonds. They recommend tracking the following indicators to determine if the view remains appropriate. In its latest set of economic…

Highlights Duration Strategy: The recent market turmoil was a long overdue risk asset correction that does not change any fundamental underpinnings for rising global bond yields. Stay below-benchmark on overall global duration exposure…