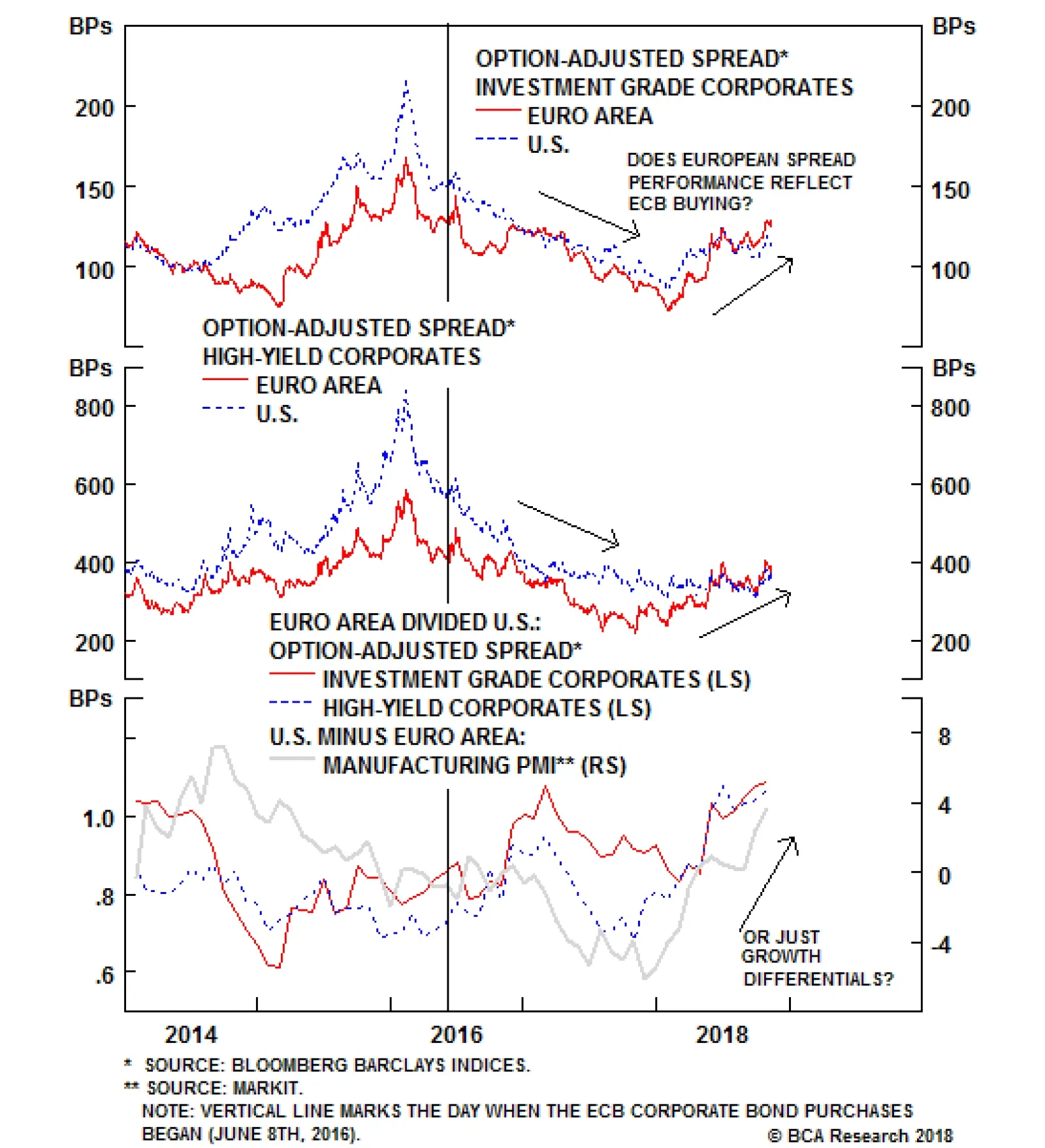

The ECB has been buying corporate bonds since 2016. The Corporate Sector Purchase Program (CSPP), as it is formally known, has been a targeted tool used by the ECB to ease financial conditions for euro area companies. This effect…

Highlights Falling Oil Prices & Bond Yields: Murky trends in global growth data, at a time of tight labor markets and gently rising inflation, are preventing a full recovery of risk assets after the October correction. A new…

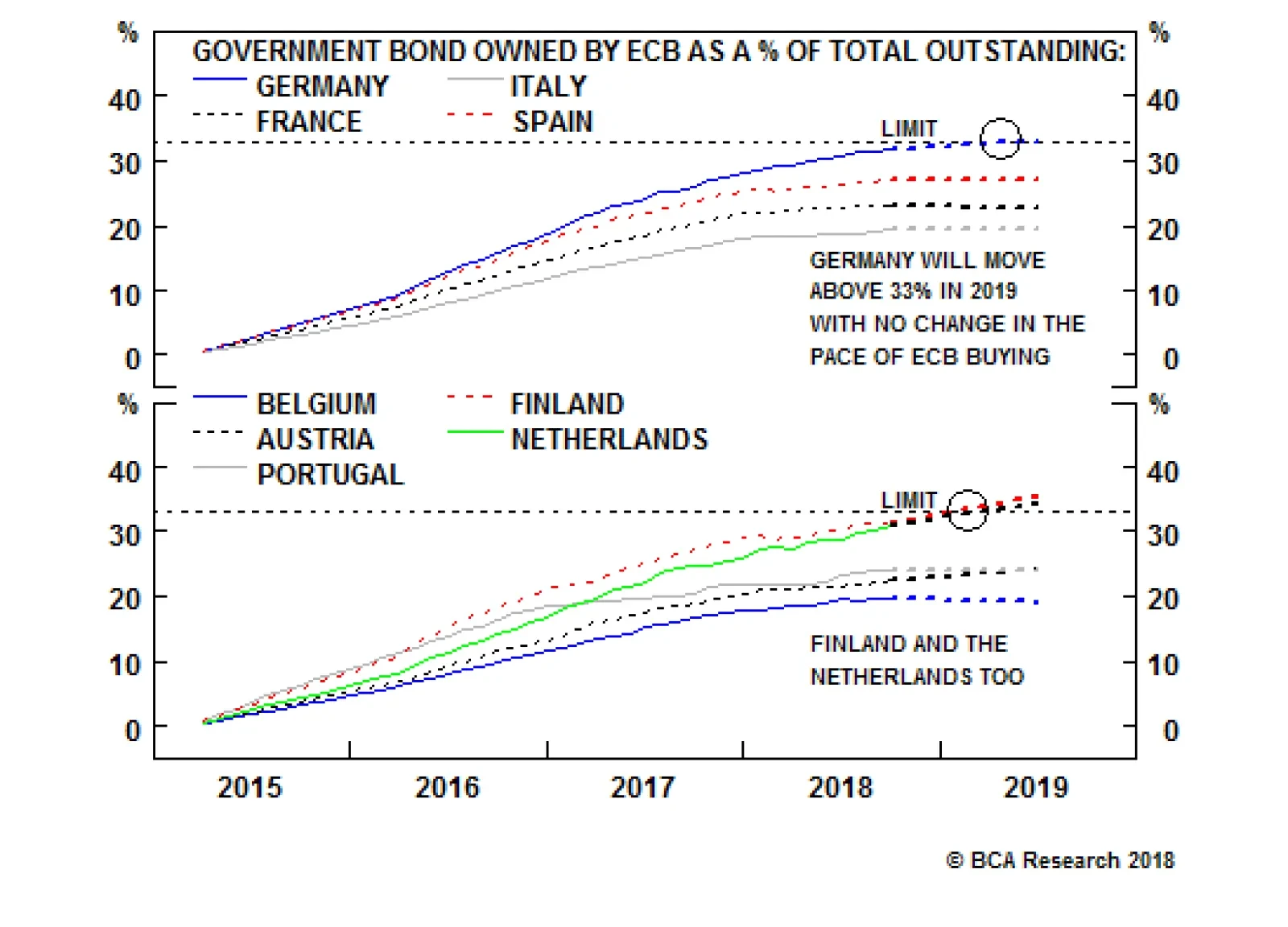

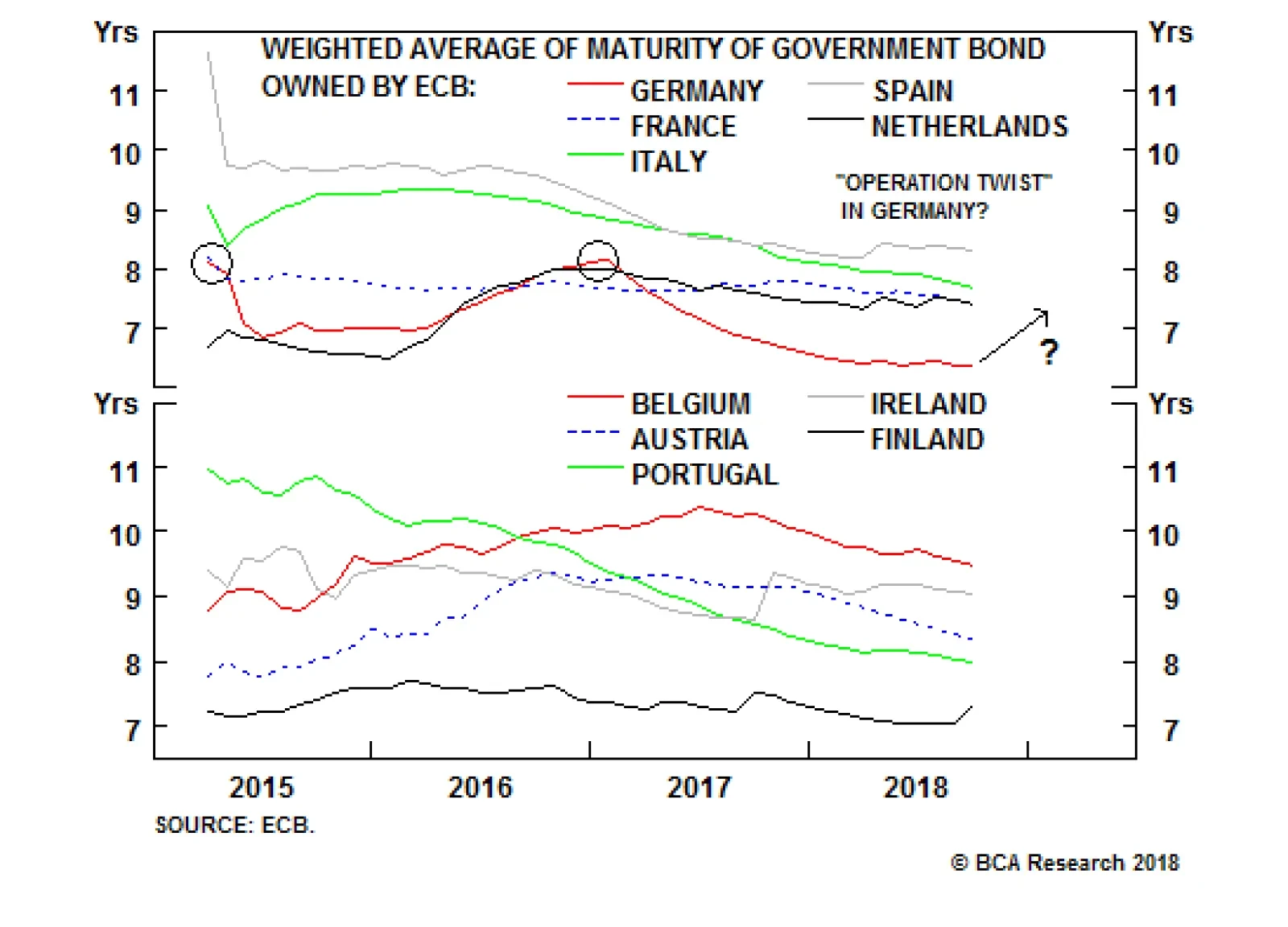

Extending the Asset Purchase Program (APP) into 2019 is the least likely choice because the ECB is already close to some of the self-imposed constraints on its government bond holdings. The ECB has set a limit of owning no more…

The ECB could choose to buy more corporate bonds or covered bonds, but those are less liquid markets where there is arguably more evidence that ECB buying has impacted market functionality. The ECB may be reluctant to take on…

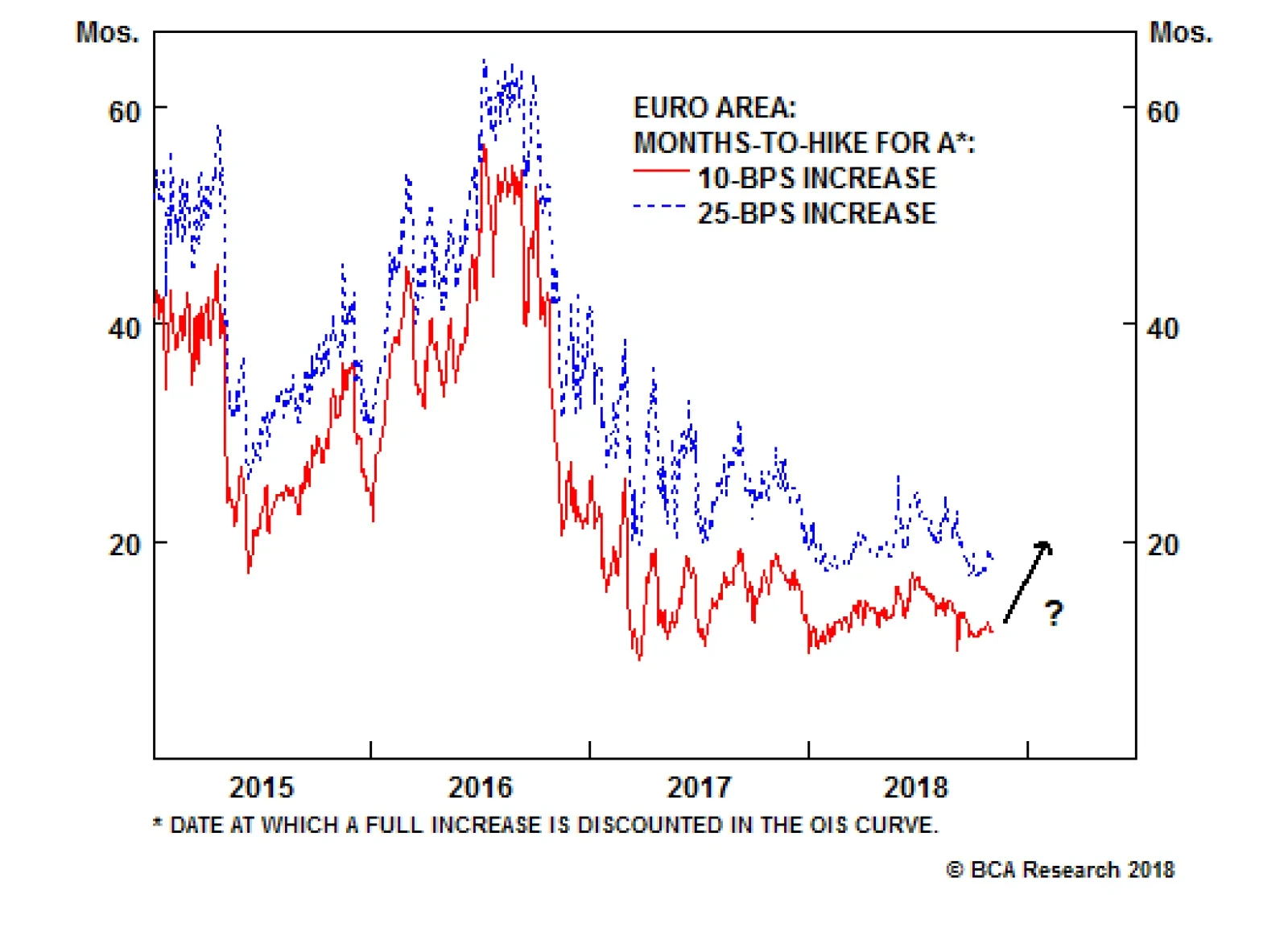

Right now, our Months-to-Hike indicators, which measure the time until a full rate hike is discounted in the European Overnight Index Swap (OIS) curve, are discounting a hike of 10bps by November 2019 and a hike of 25bps by May…

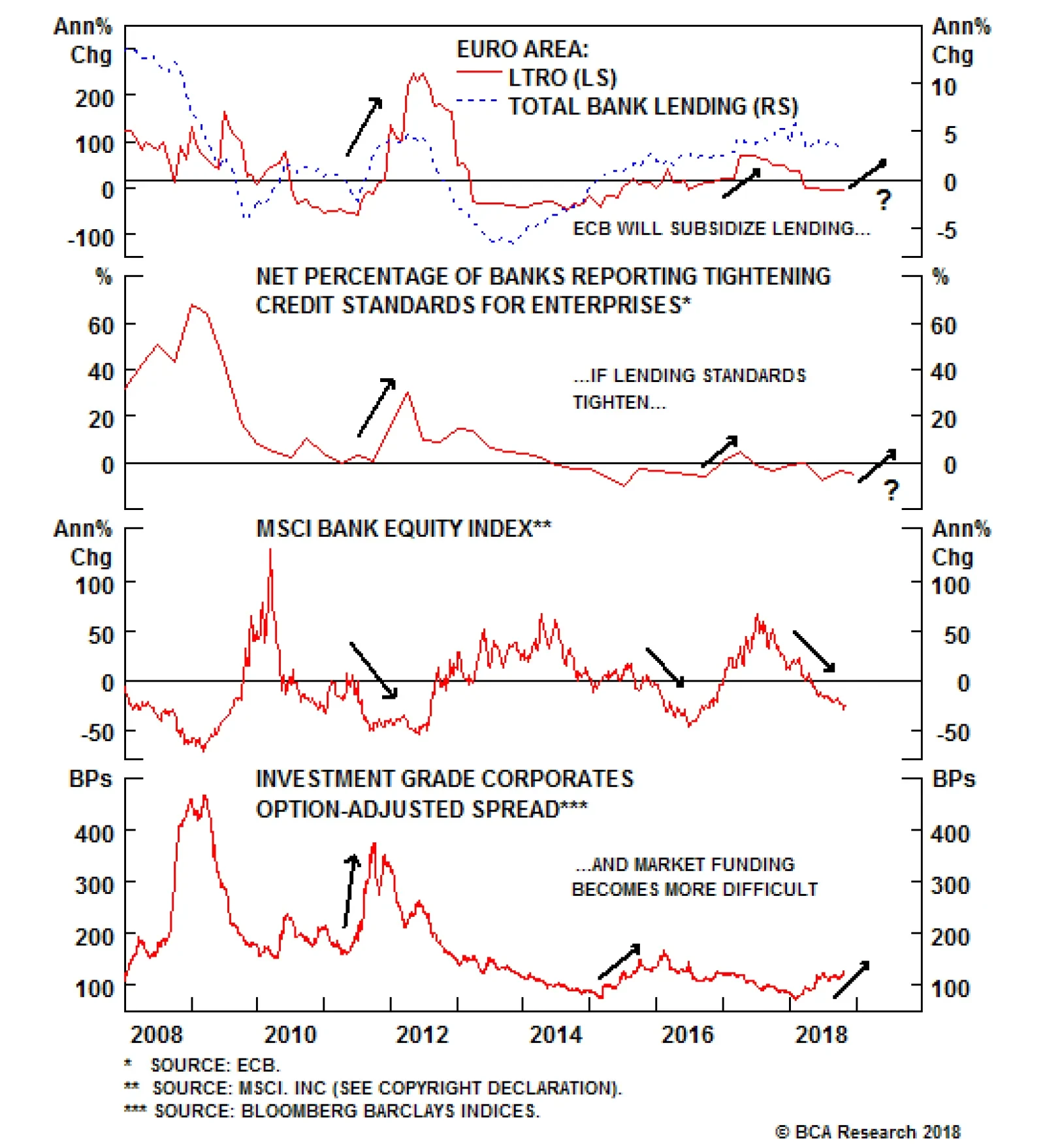

This is the most effective way to get European banks to extend credit to borrowers at lower interest rates, since the banks would be able to fund that borrowing via the TLTRO at a rate lower than market rates. In our view, a…

Highlights Four high conviction long-term investment views: The Italy versus Spain sovereign yield spread will compress. The yen will go up. The yield shortfall on German bunds versus U.S. T-bonds will compress. Swedish real estate…