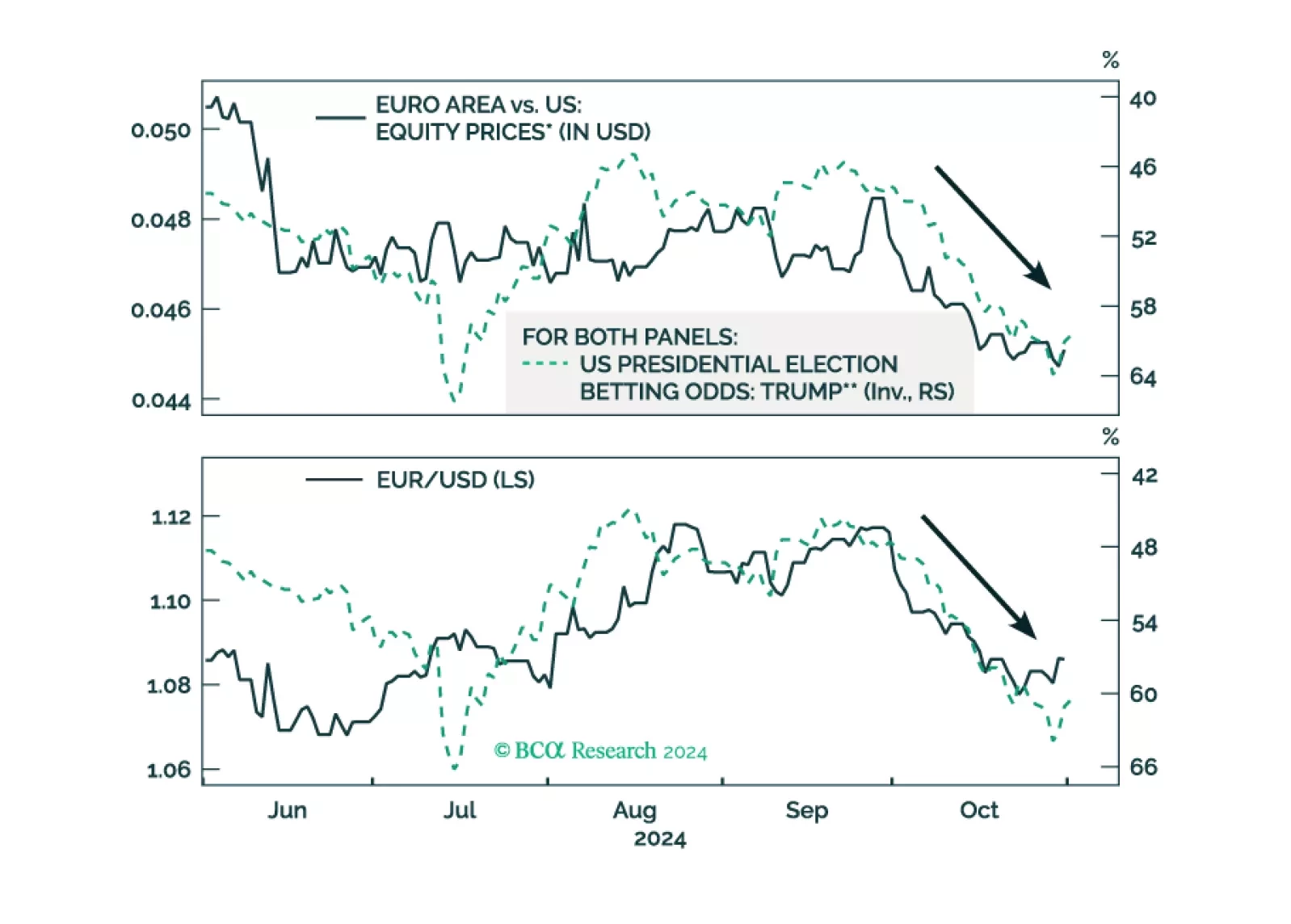

As the odds of a Trump victory rise, European assets underperform US ones. What would be the immediate impact of a Trump victory on European stocks?

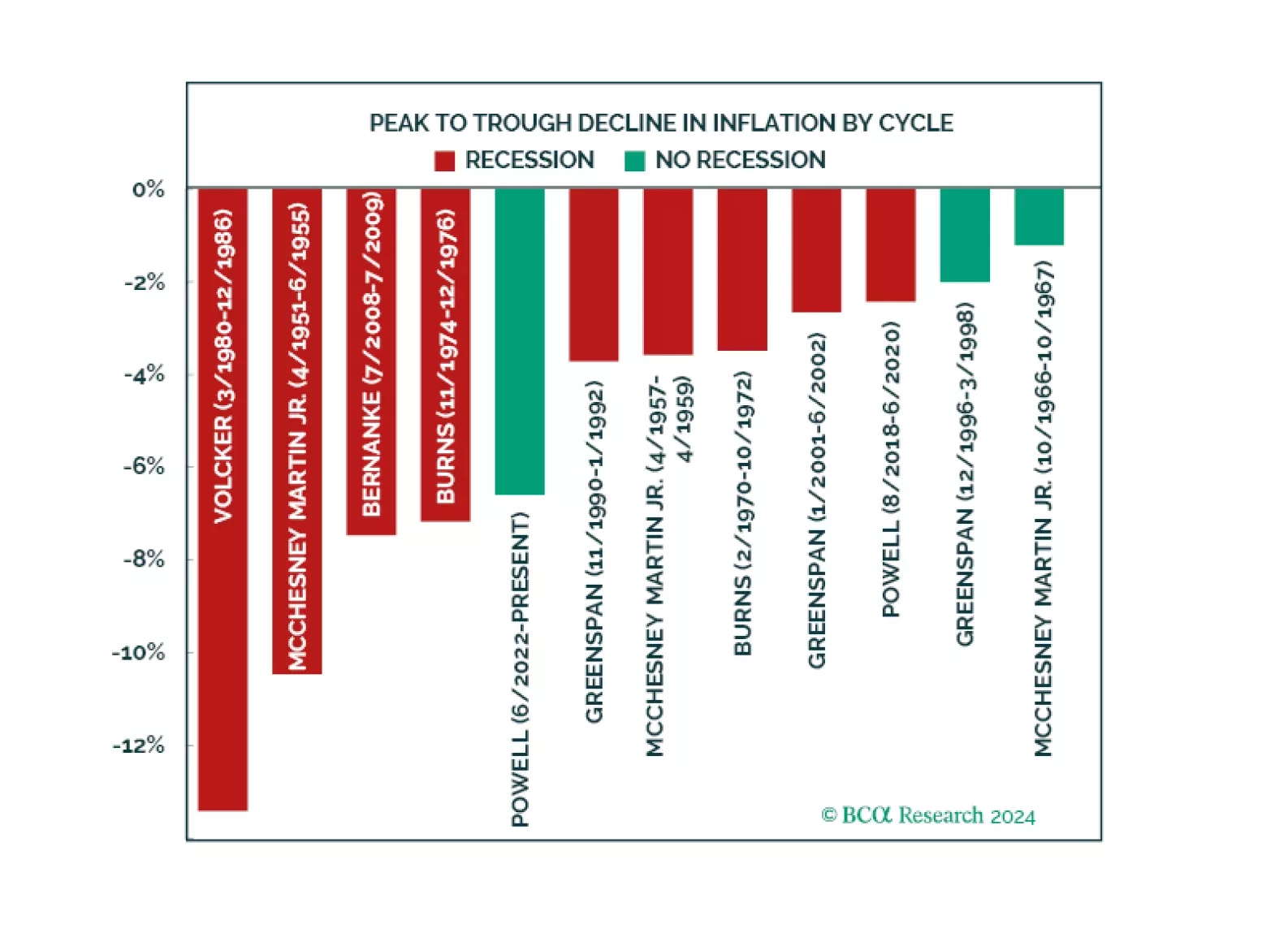

Can Powell achieve a soft landing? There are some indications he is doing it. We examine why our negative stance was wrong and analyze the four growth engines that kept recession at bay. Half of these forces remain while the other…

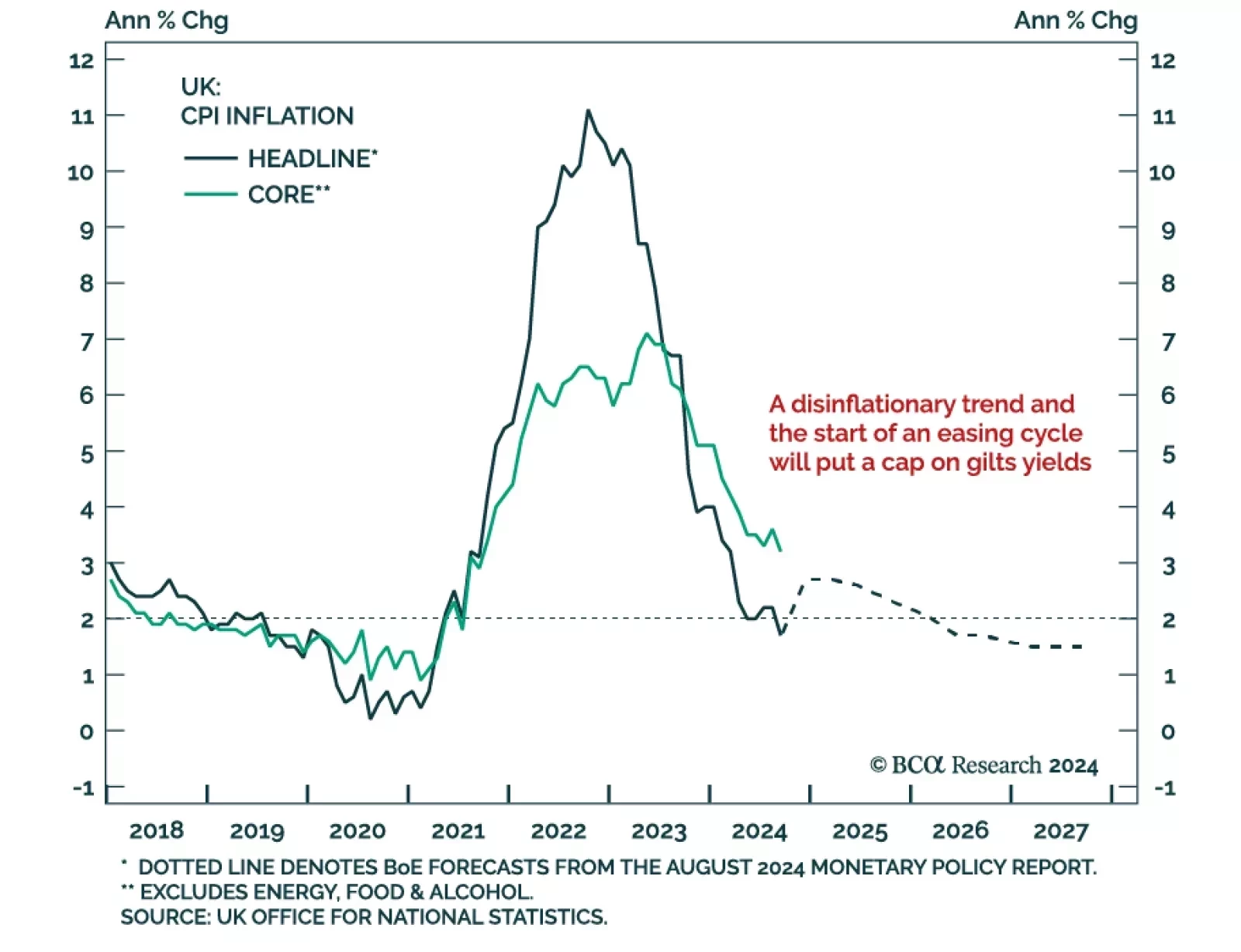

We recently pointed to the UK Budget announcement as a pivotal event for UK assets. Following an initially positive reception, the market has turned and priced in further fiscal premia in UK assets, with both gilts and the pound…

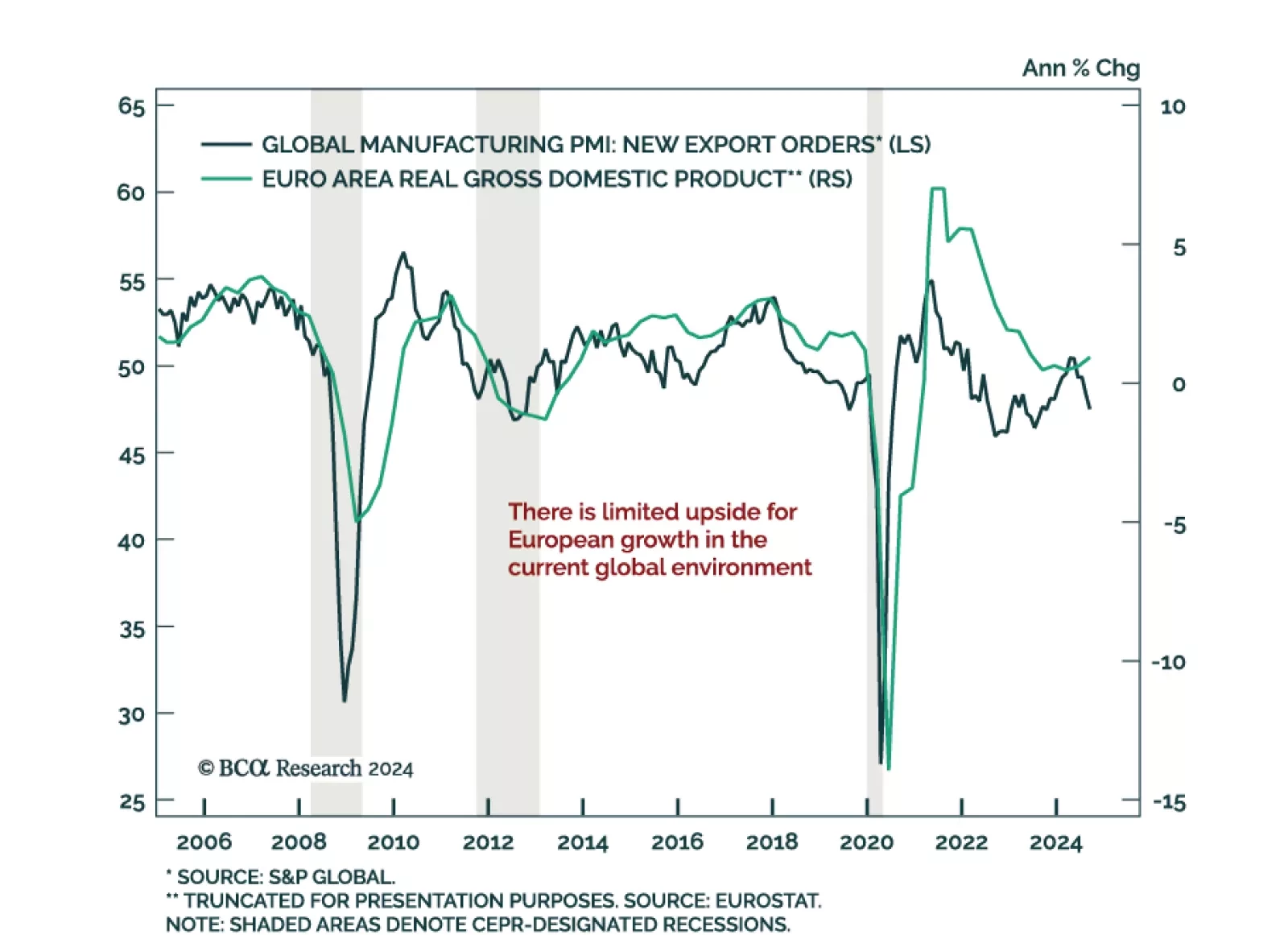

Flash Q3 GDP estimates for the Euro Area beat expectations, accelerating to 0.4% quarterly growth from 0.2% last quarter. The momentum was spread across major countries, except for Italy. Meanwhile, the European Commission’…

The global political system is destabilizing and the US will turn more hawkish in foreign policy, trade policy, or both, regardless of the election outcome. Tactically go long the dollar.

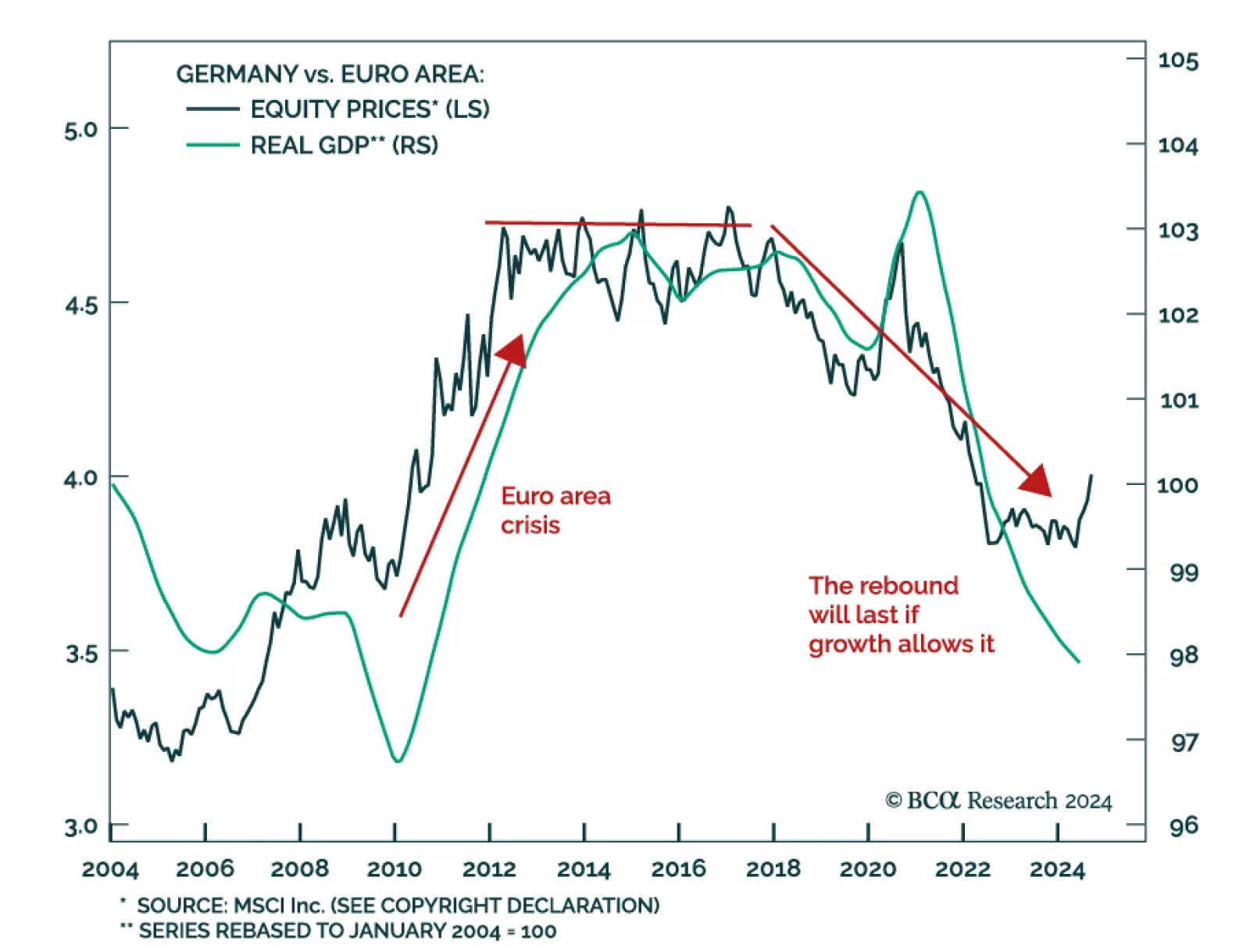

Germany’s problems are well known: Demographics, Chinese competition, underinvestment, energy dependence, and constrained fiscal policy. Our European Investment Strategy colleagues believe this bad news is priced in…

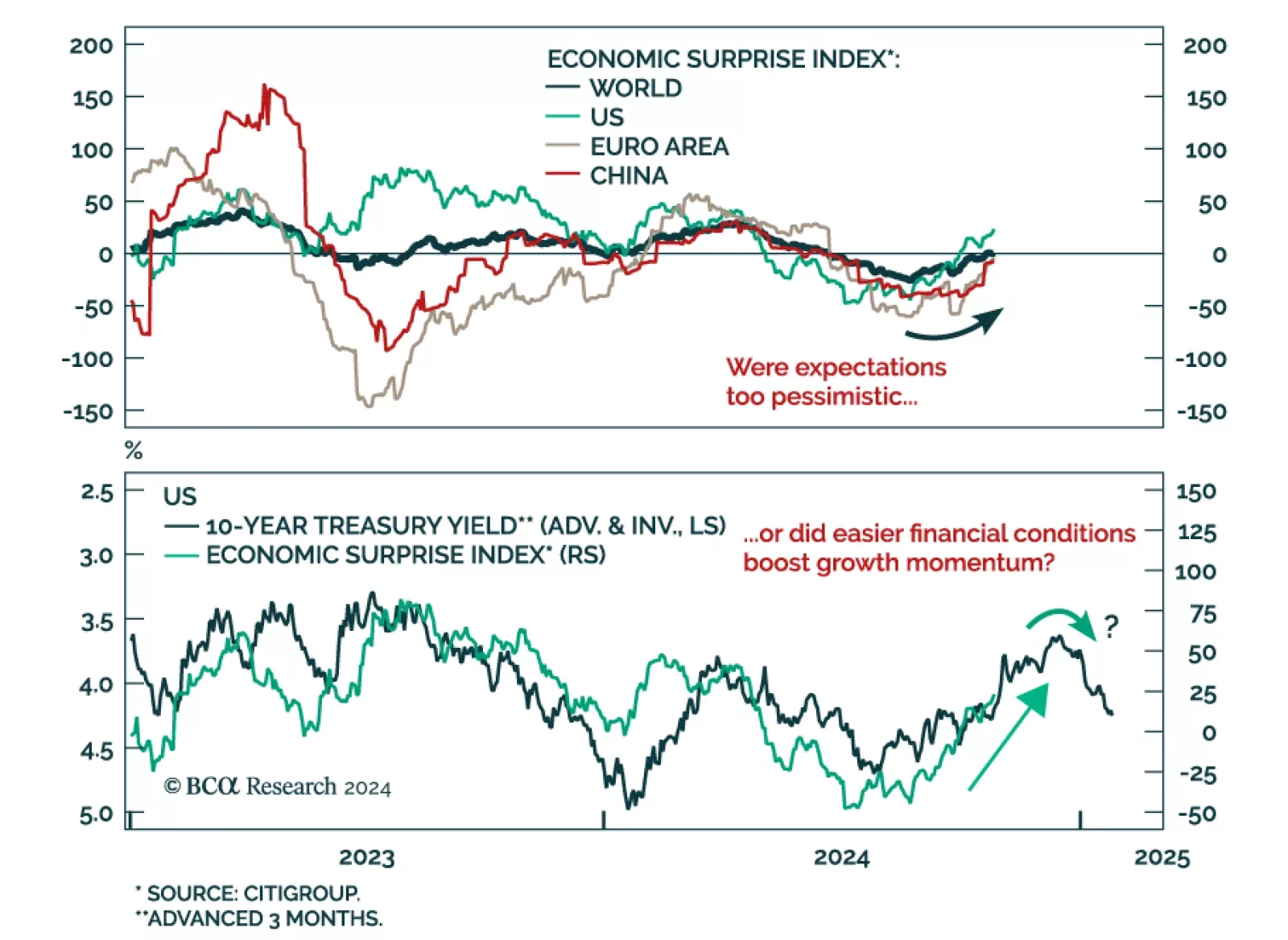

Global economic surprises have improved. Currently positive and improving in the US, they are rising from a low level in the Eurozone and China. Two explanations could explain this momentum. First, the recent easing in…

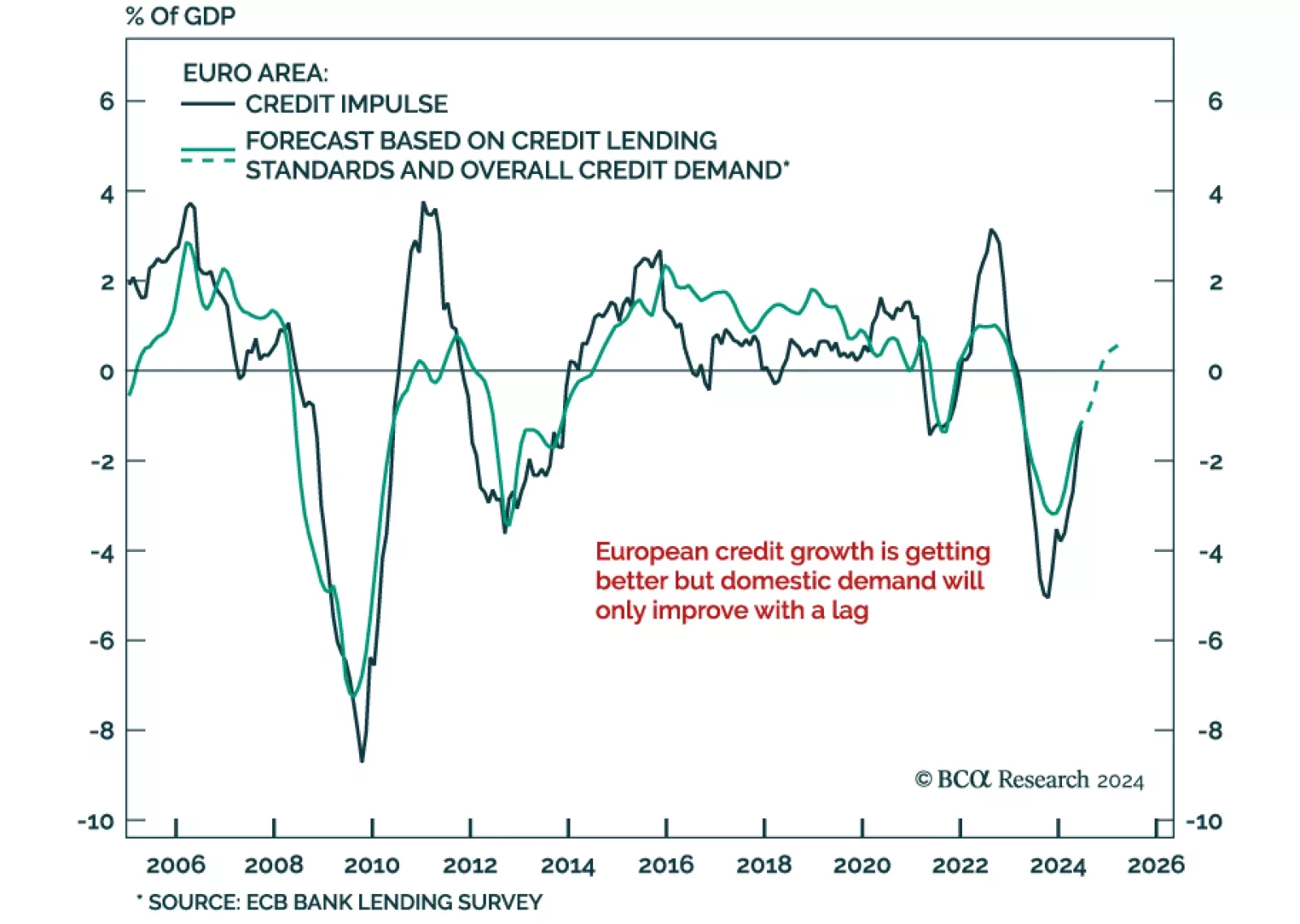

Eurozone money and credit data beat expectations, with M3 accelerating to 3.2% year-over-year in September from 2.9% a month prior. Household and corporate lending both drove the improvement. This development echoes the latest…