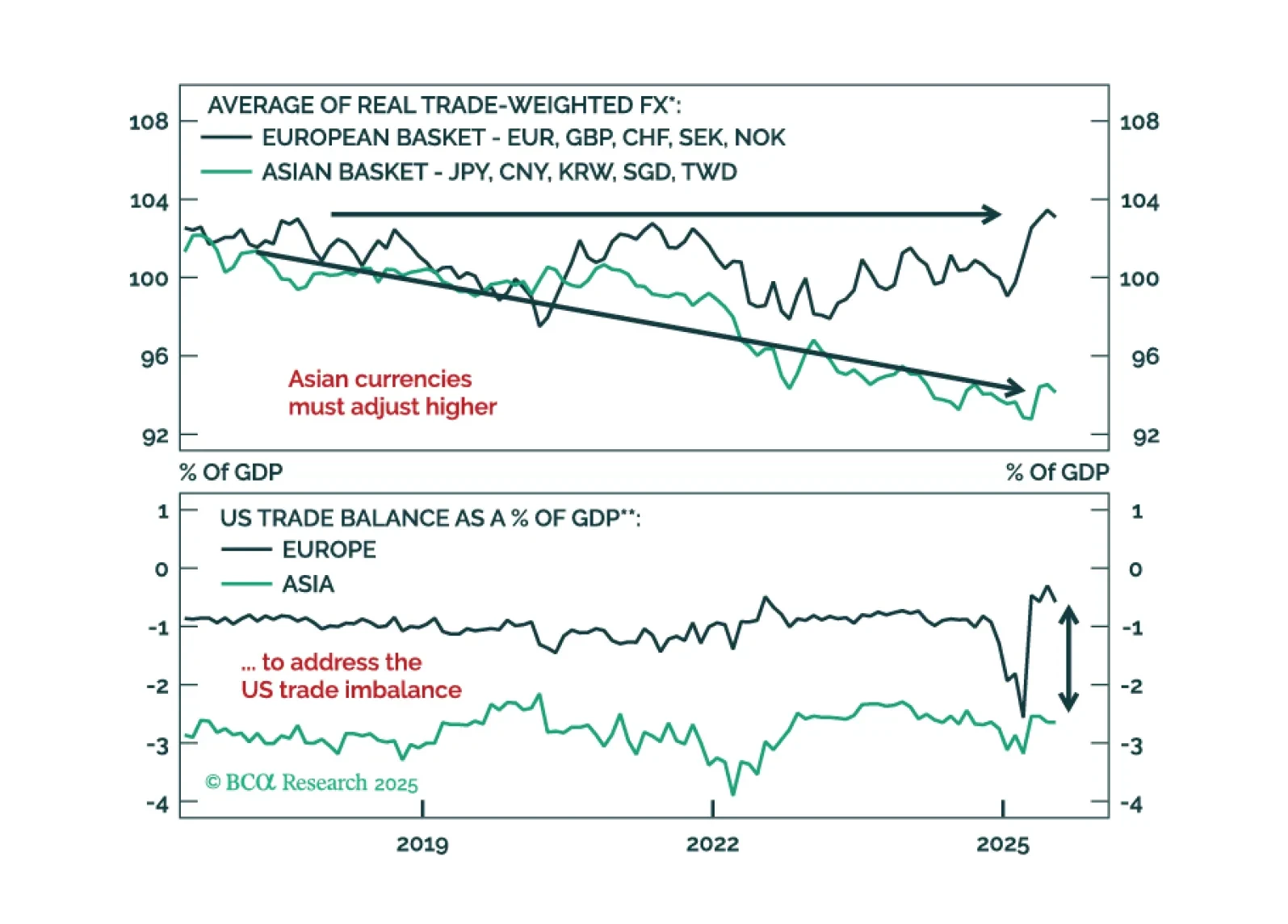

A fleeting greenback rally post Fed rate cut will offer a final chance to reset short dollar exposures. See why undervalued Asian FX are poised to lead the next leg lower in USD and how to position now.

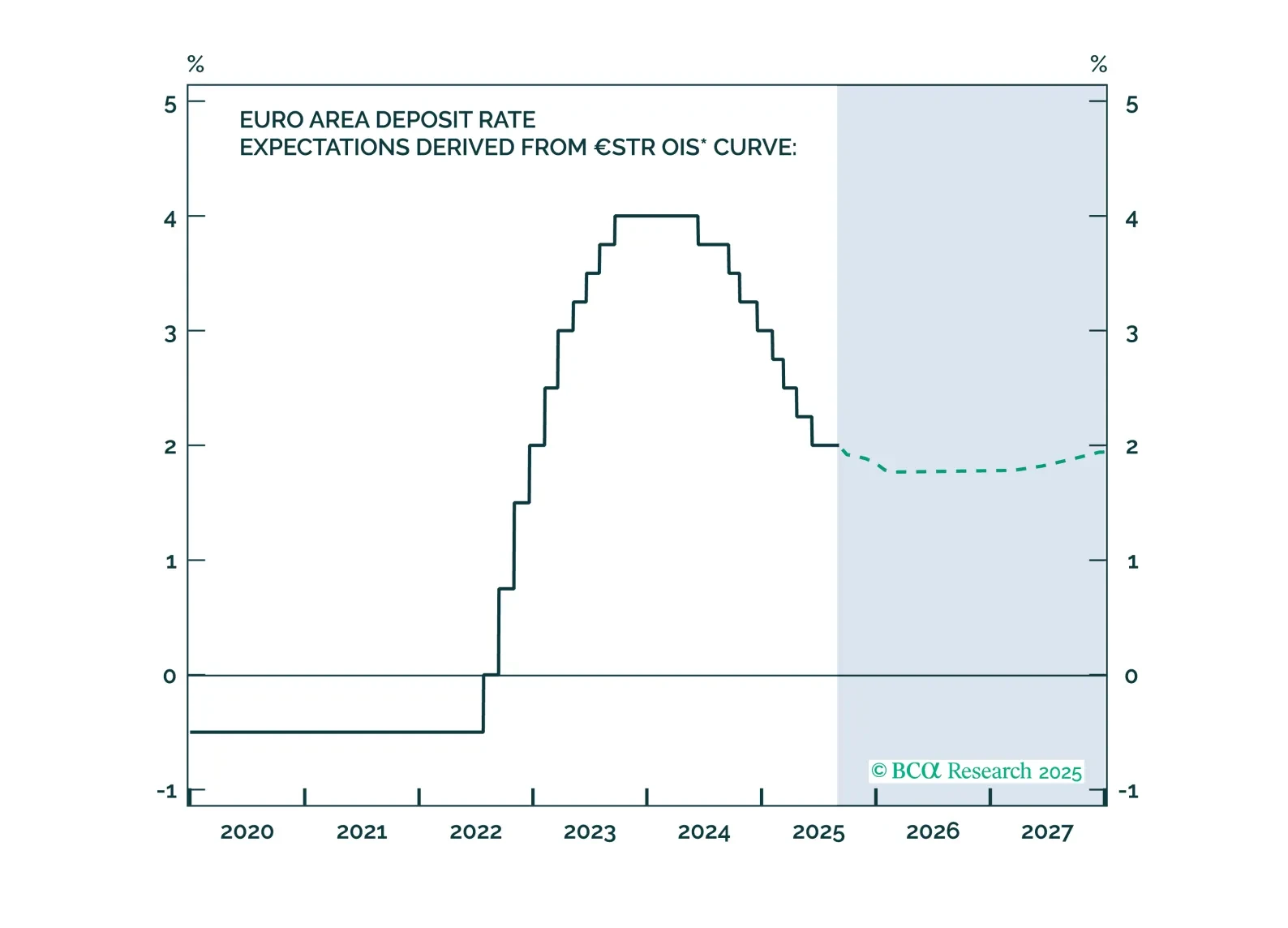

The European Central Bank has achieved a soft landing. Inflation is back to target, with well-anchored inflation expectations. The unemployment rate is historically low, and real economic growth is stable, albeit weak. Given that…

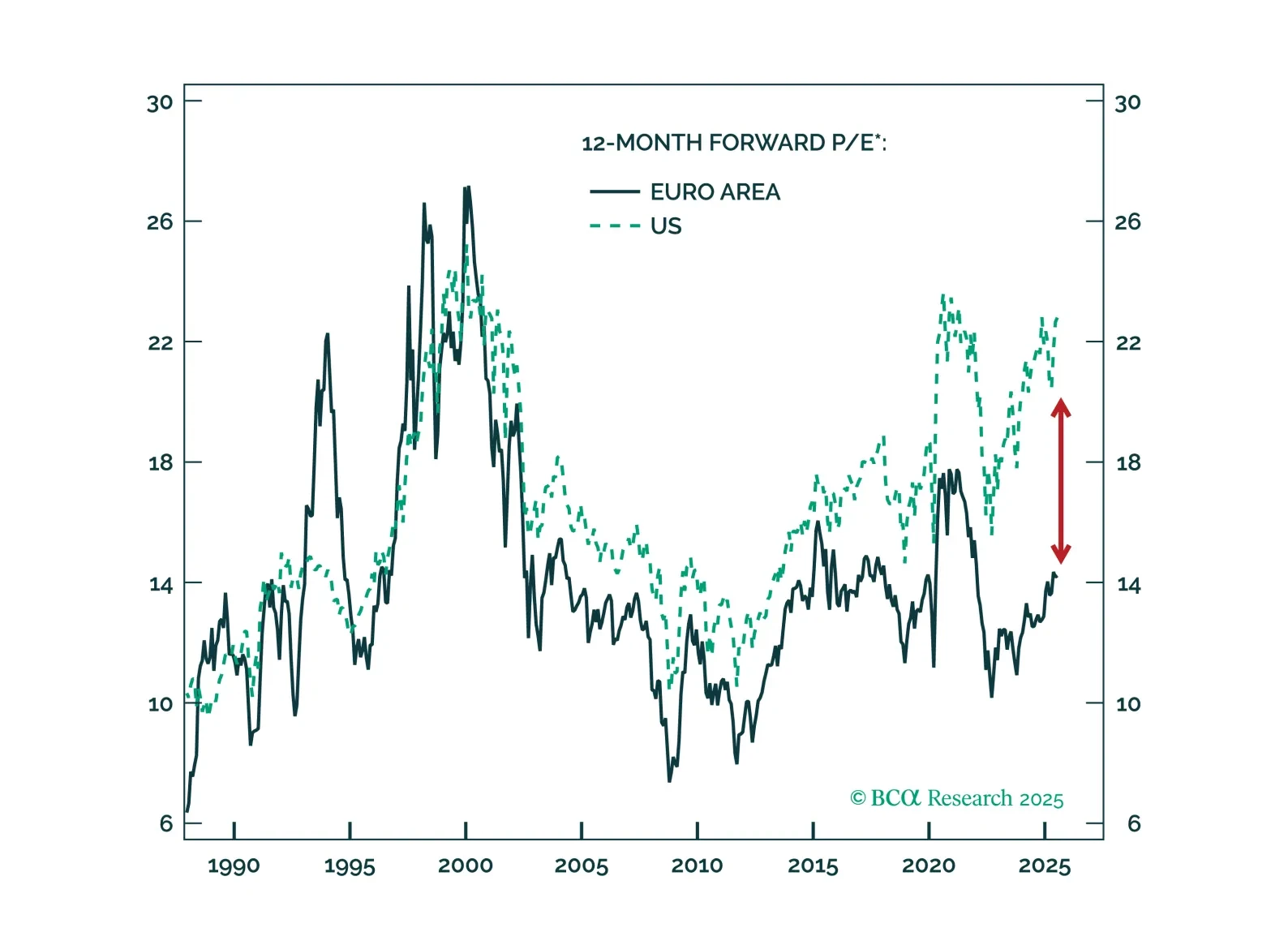

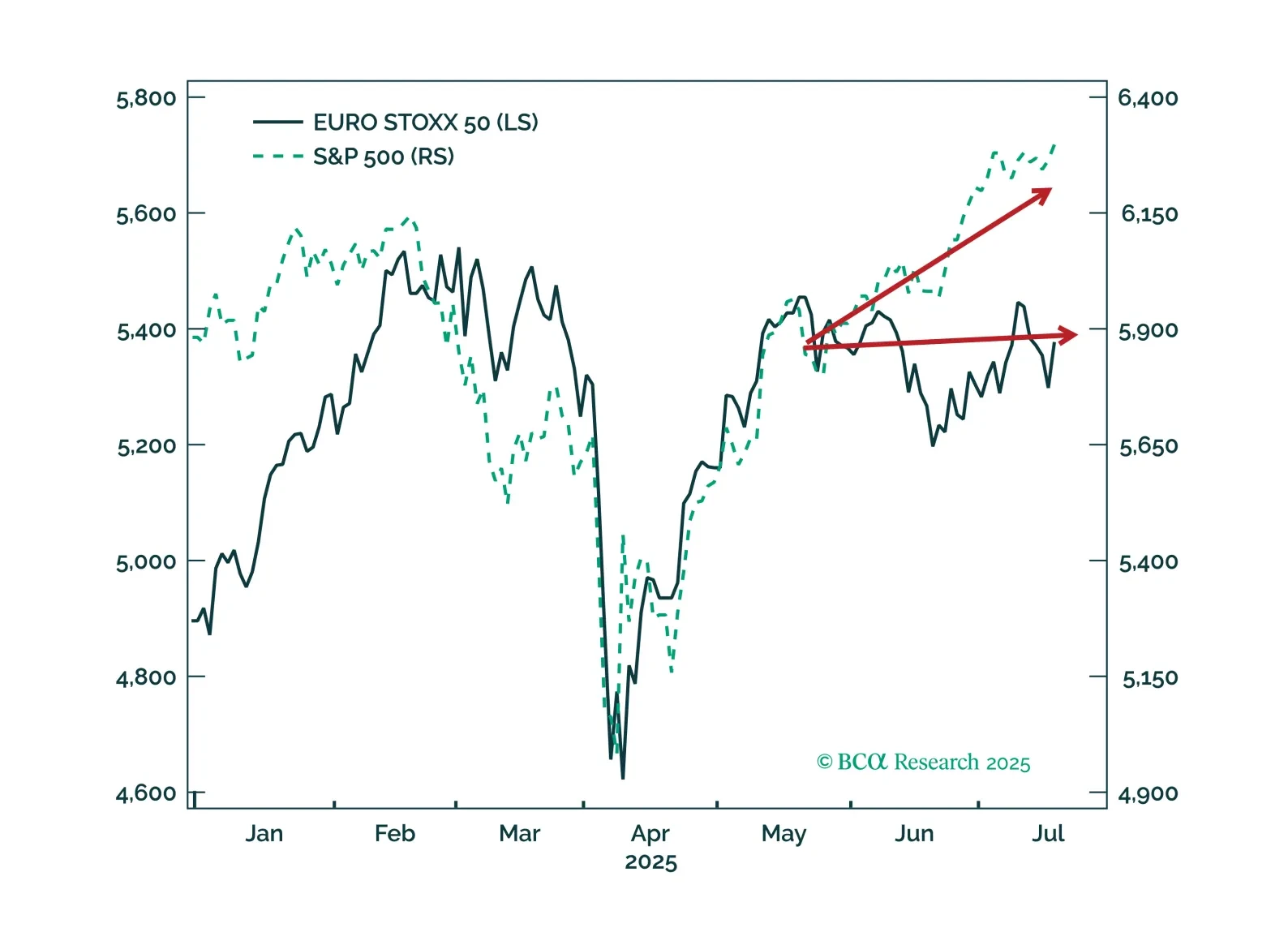

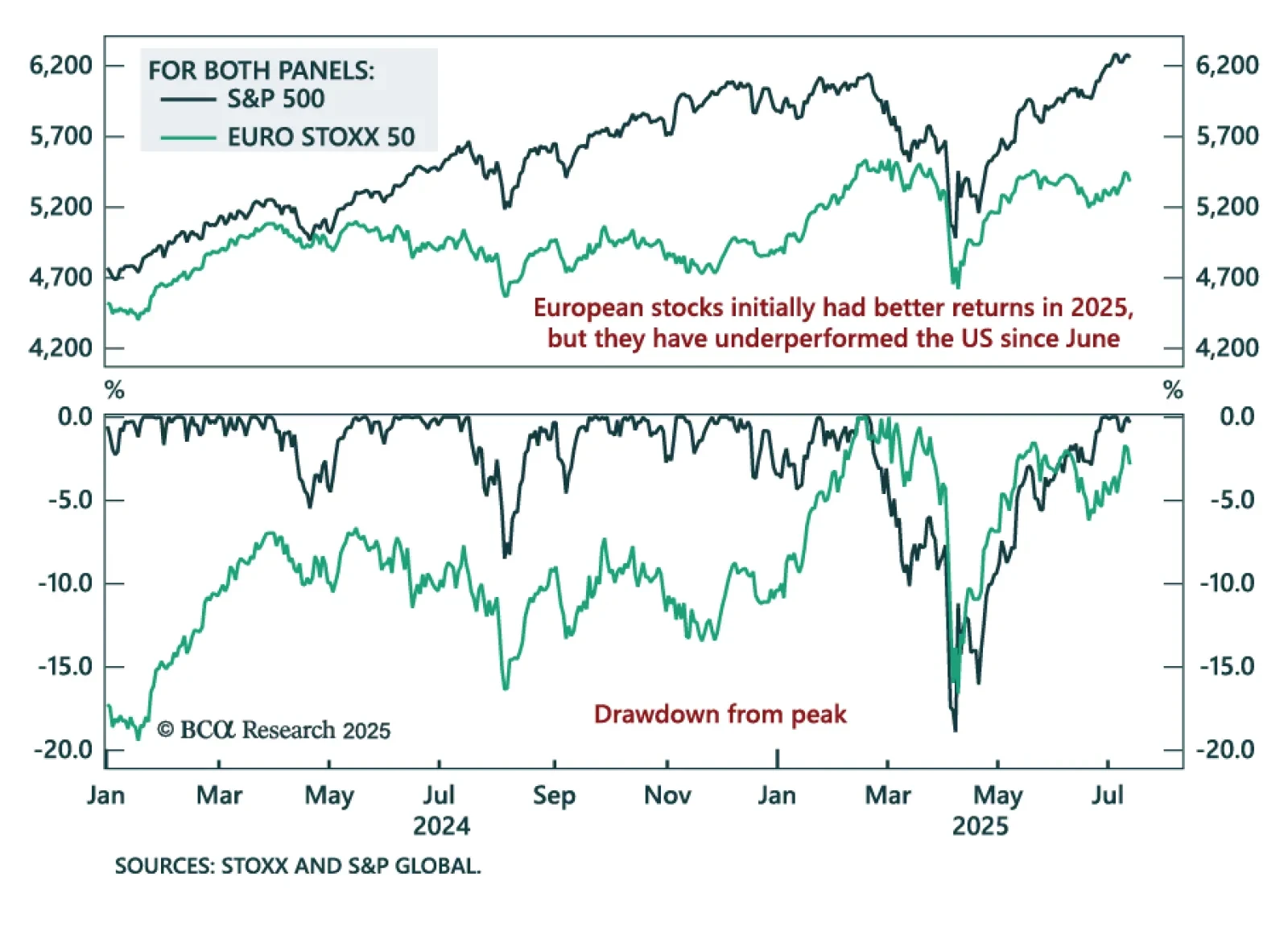

The post-Liberation Day rally has broadened, reducing skepticism and strengthening the case for US outperformance versus Europe. The S&P 500’s climb to all-time highs has been unusually smooth, compressing realized…

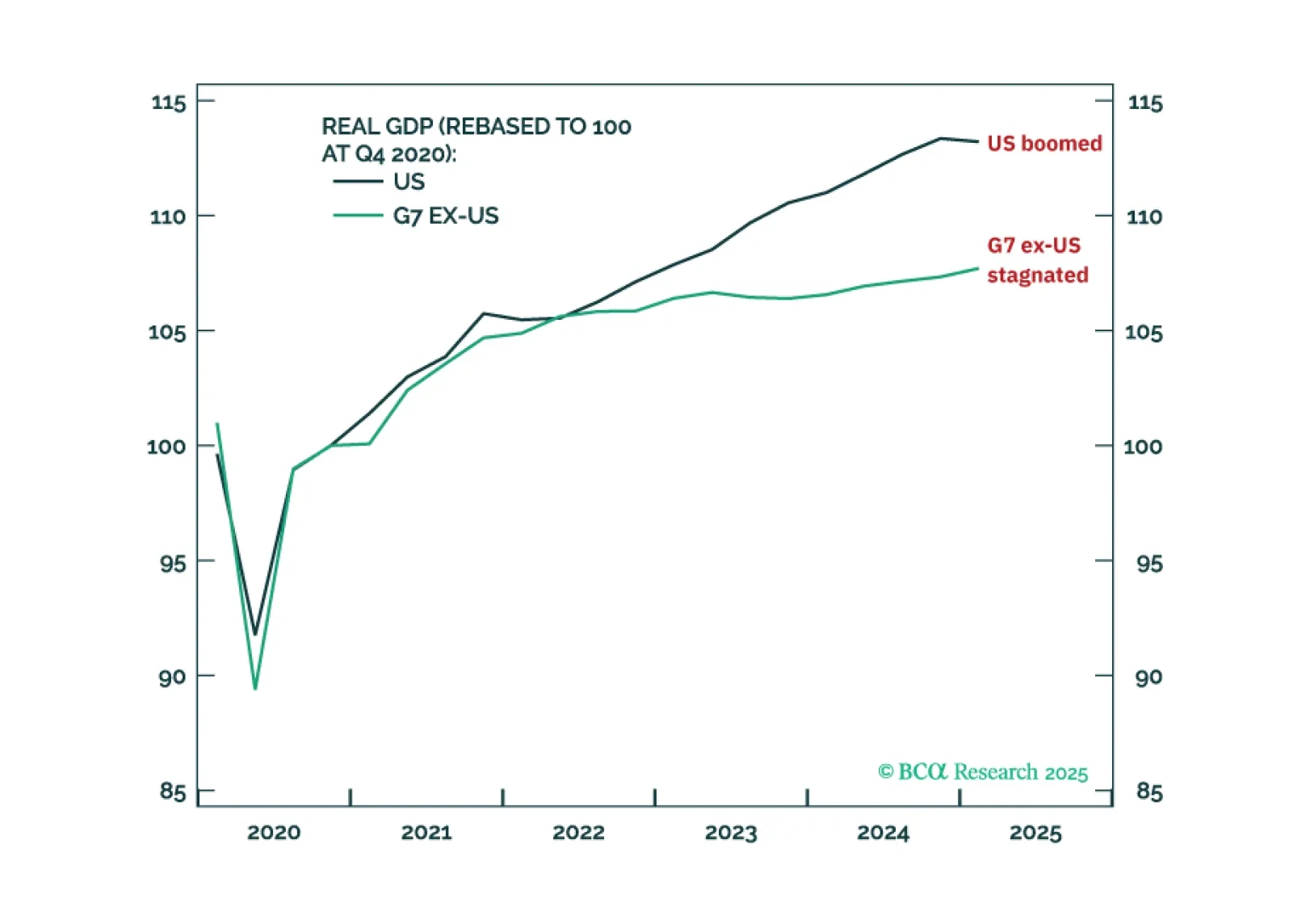

Dollar softness has had little growth impact, and European equities should keep lagging. A key 2025 trend has been USD depreciation, but the associated easing in financial conditions has offered minimal support to US growth,…

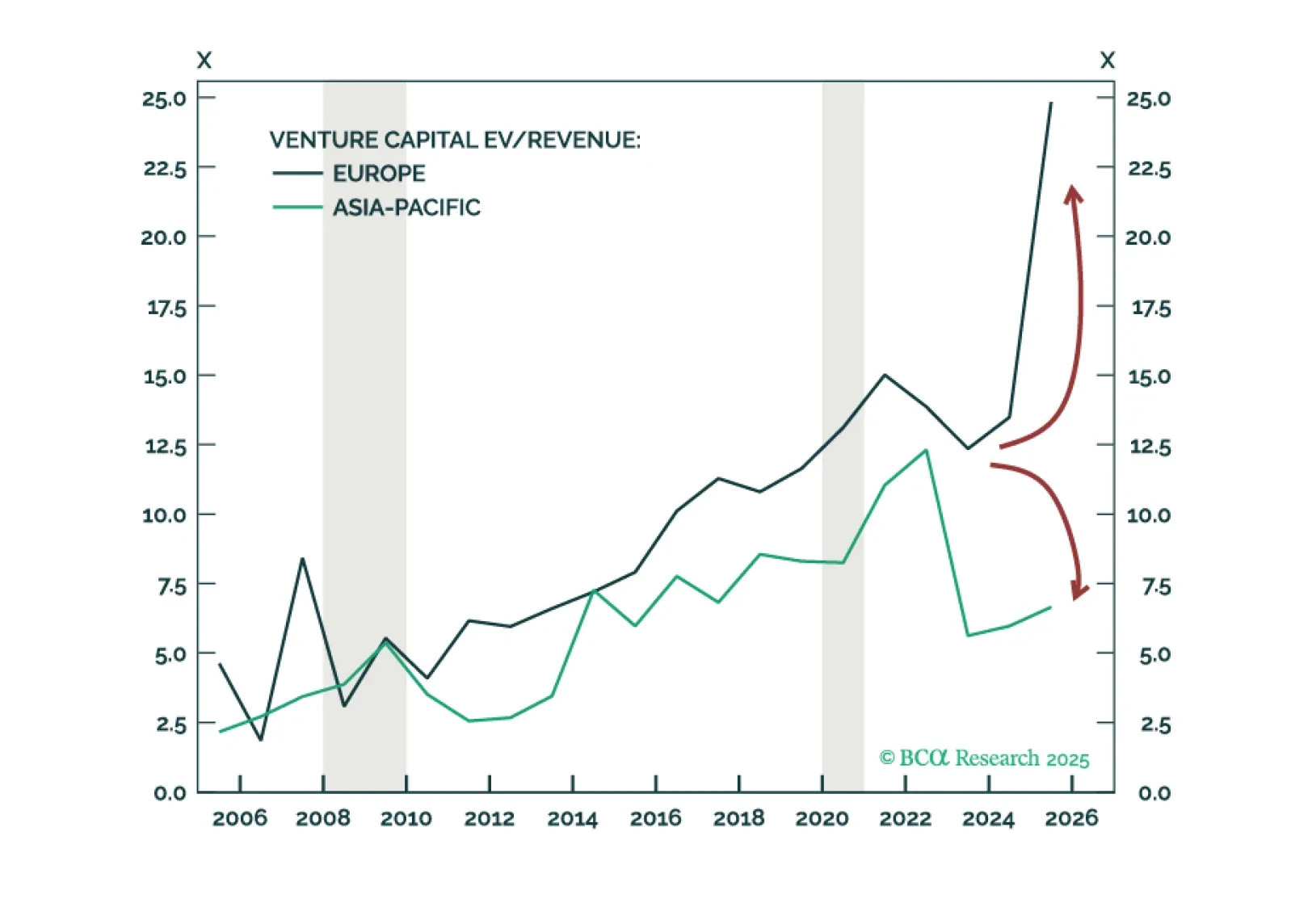

European euphoria is overdone. The most exceptional asset class in Europe is Infrastructure, but granular opportunities span other asset classes by sector and country. Venture Capital is a North America and Asia-Pacific play. We…

This insight gives life to four high-conviction views on European small caps, aero¬space & defense, banks, and telecoms by harnessing the power of BCA’s Equity Analyzer (EA).

Euro area and Chinese interest rates must fall much further to prevent monetary policy from becoming ultra-restrictive. But Trump’s attempts to force unwarranted rate cuts from the Fed risks a vicious backlash from the bond…

Our DM ex-US strategists see EUR/USD in a multi-year bull market and recommend selling EUR/JPY at 172.5. The euro’s 2025 rally has been driven first by improving Eurozone growth expectations, then by mounting concerns over the US…

European equities have recently lagged the S&P 500, with short-term risks building despite a constructive long-term outlook. After reaching all-time highs in February, the EURO STOXX 50 began to stall as US markets sold off on…