Highlights So What? Global divergence will persist beyond the near term. Why? China’s stimulus will be disappointing unless things get much worse. U.S.-China trade war will reignite and strategic tensions will continue.…

Highlights The delay to the U.K. parliamentary vote on the current Brexit deal has edged up our assessed probability of no-deal to 20 percent. Our probability-weighted value of the GBP is still around 5 percent higher than today.…

Highlights Late-cycle pressures will keep pushing bond yields higher. Global growth will remain above trend in 2019, keeping unemployment rates low and preventing central banks from turning dovish. The unwind of crisis-era global…

The SPX had a significant reversal earlier this week and washed out technical conditions likely signal that the recent triple bottom formation will pave the way for a rebound. The CBOE VIX index of volatility also stayed below…

Highlights The dollar will continue to rally despite the trade truce agreed upon last weekend between U.S. President Donald Trump and China President Xi Jinping. Not only is this truce far from a permanent deal, but global growth…

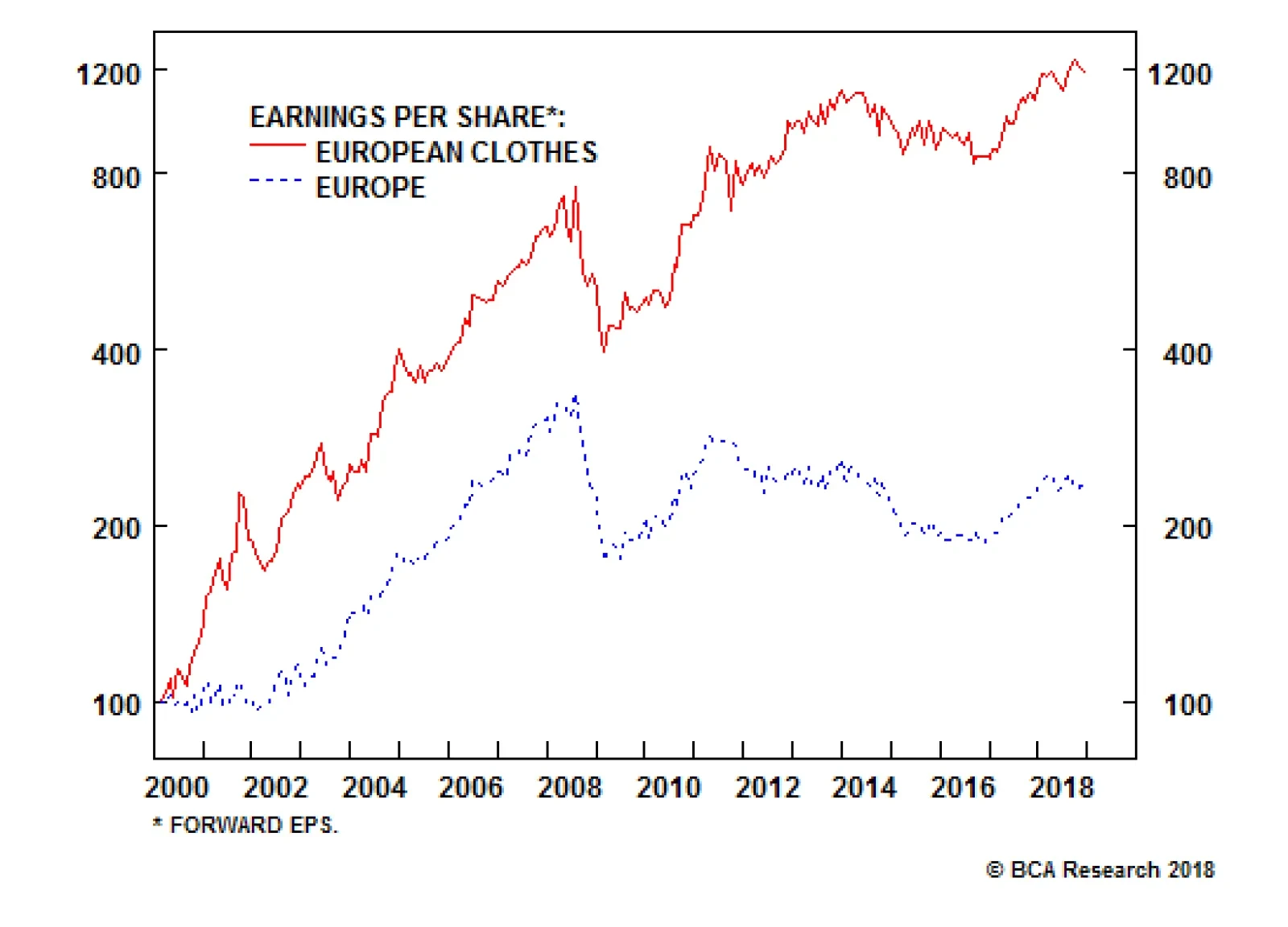

Since the turn of the millennium, the clothing and accessories sector’s profits are up by a thousand percent. Our European investment strategists argue that this megatrend has further to run, as its principle driver is…

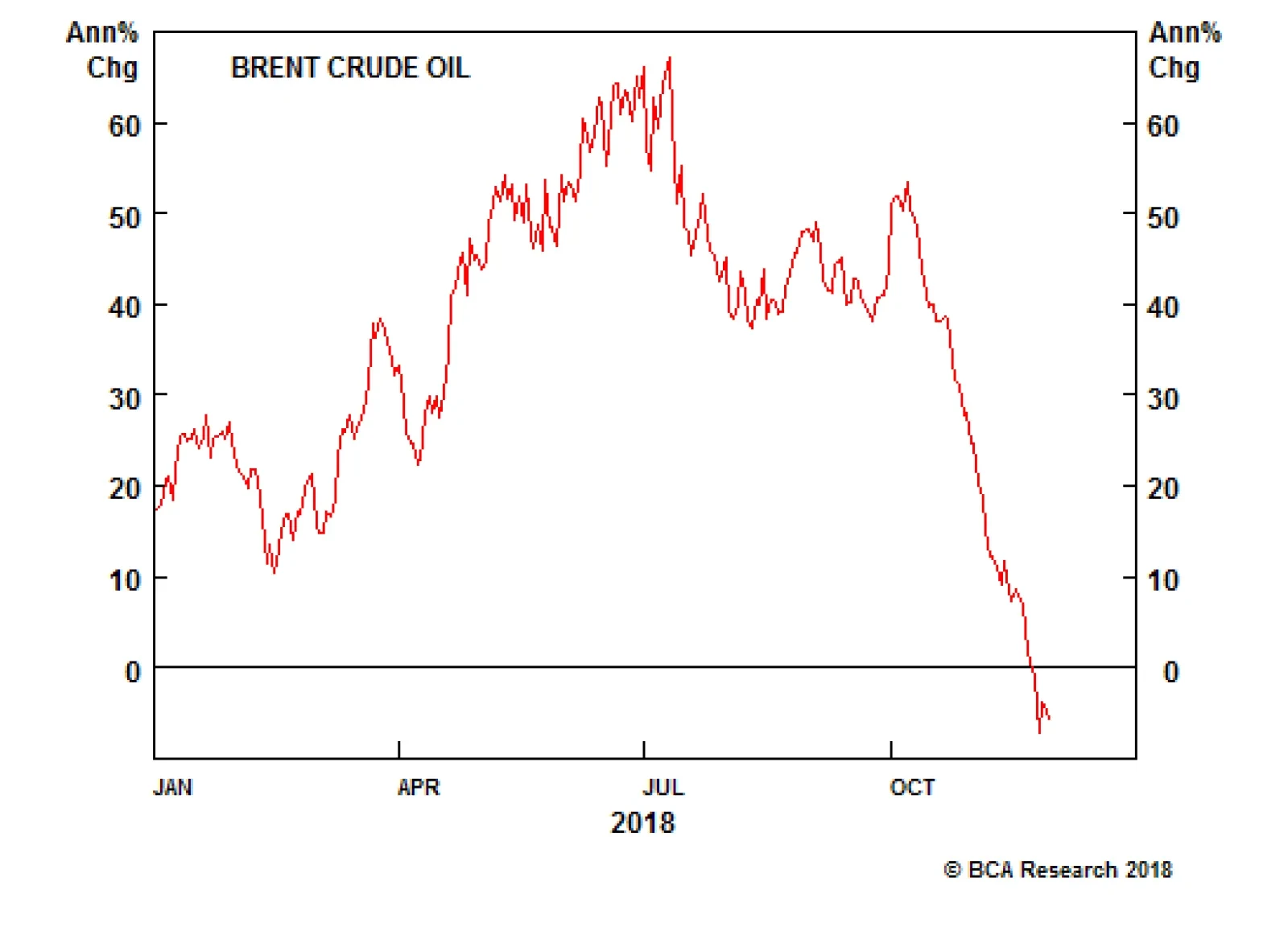

Oil prices are sharply lower as they are now contracting at a 10% annual rate. Furthermore, the sharp deceleration in global credit growth that prevailed from February to September is starting to reverse. Bank stock prices and…

Highlights On a 6-month horizon, go long a combination of banks and high quality 10-year bonds. The recommended combination is 25 cents in the banks and 75 cents in the bonds. The preferred banks are European or euro area and the…