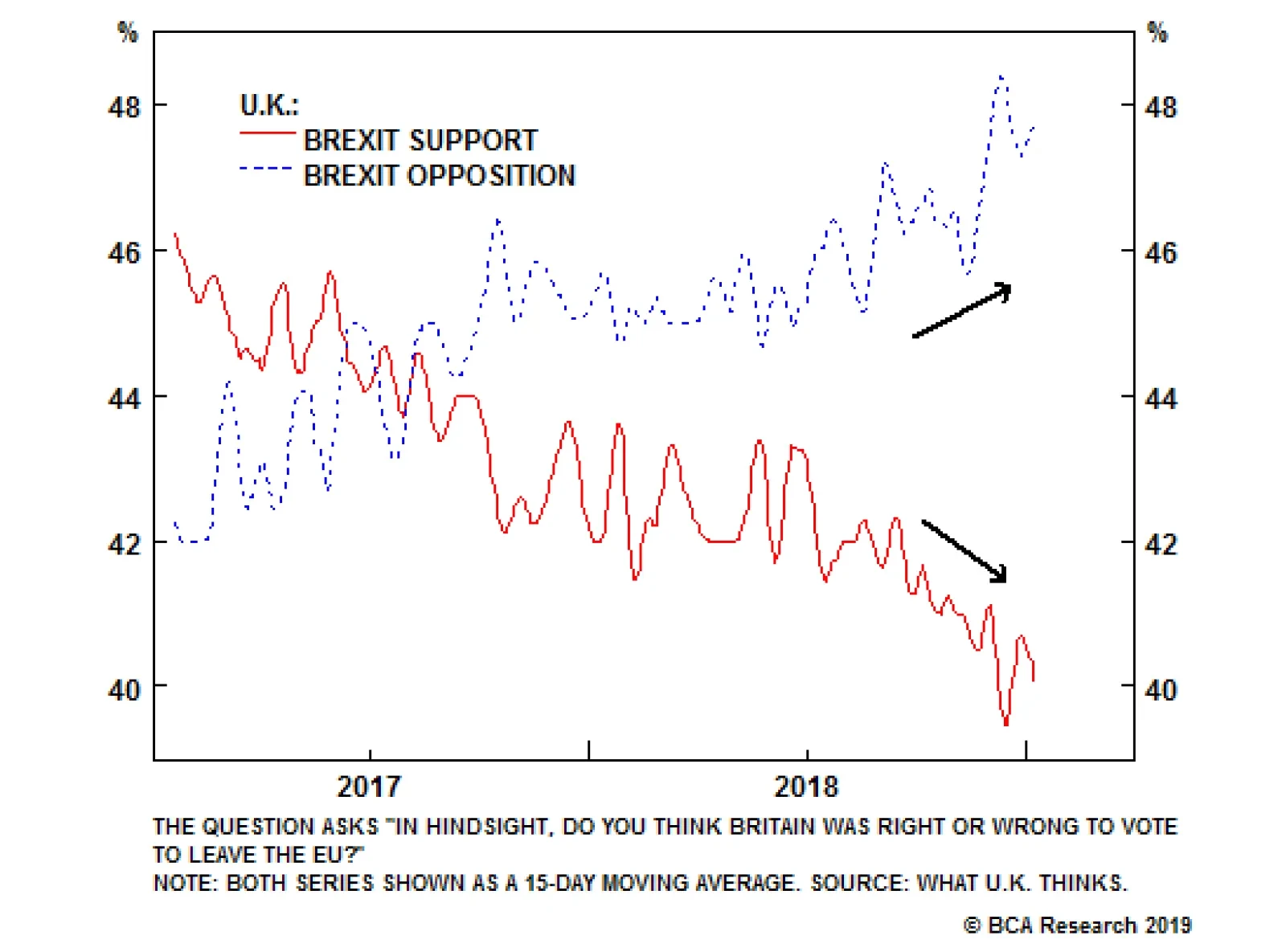

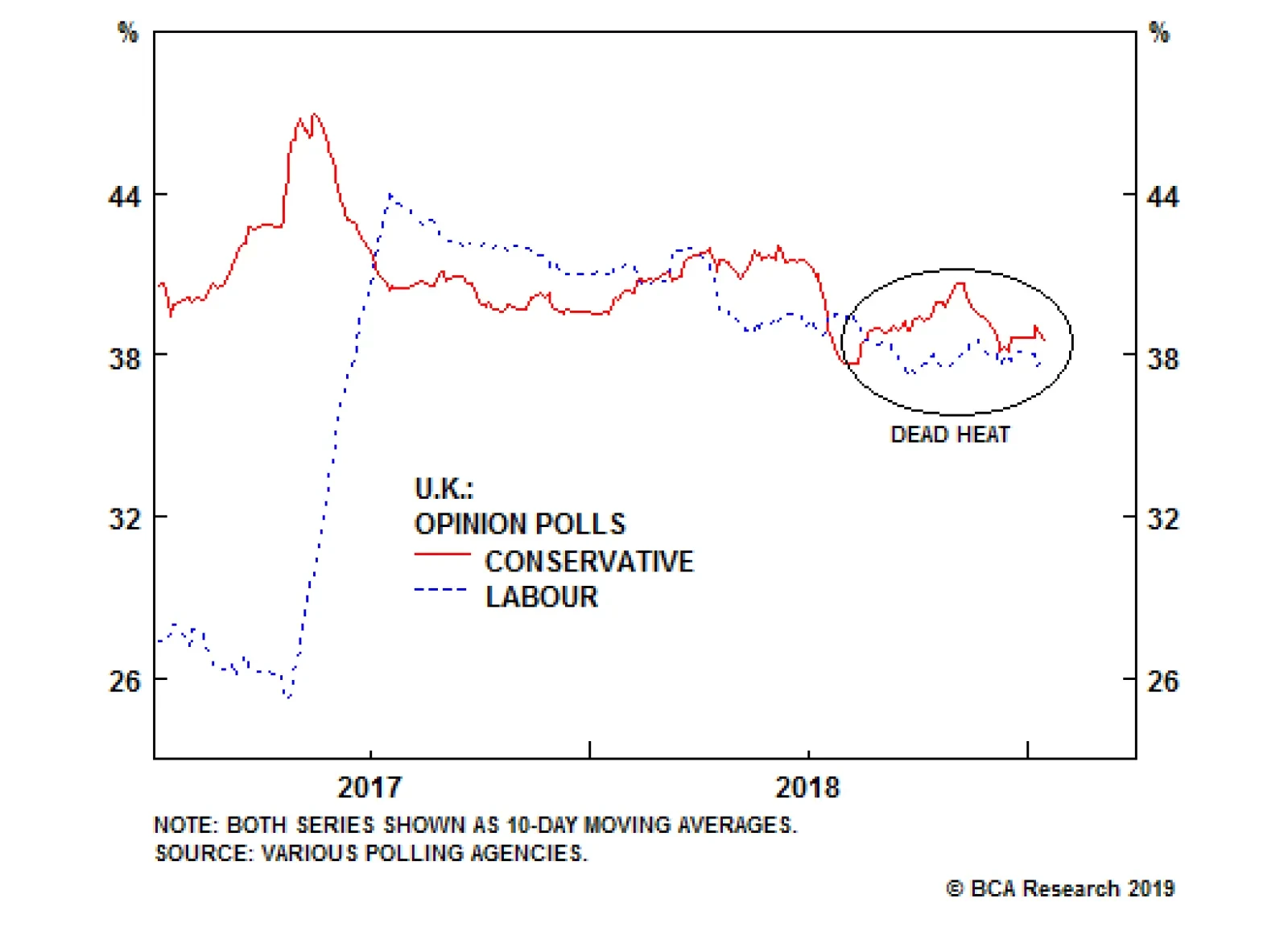

Highlights After this week’s drama, the Brexit political process remains extremely complex, but the probability of a hard Brexit is still below 10%. No easy compromise will come through as Brexit suffers a fundamental…

Any relationship entailing continued access to EU institutions and markets will require two elements that reduce sovereignty: Paying an access fee and accepting the acquis communautaire of the EU without having a say in how it is…

The EU is on record stating that it would agree to extend the Article 50 deadline, currently set for March 29. The EU can do so with a unanimous vote of the EU Council. London can extend Article 50 with a simple legislative act,…

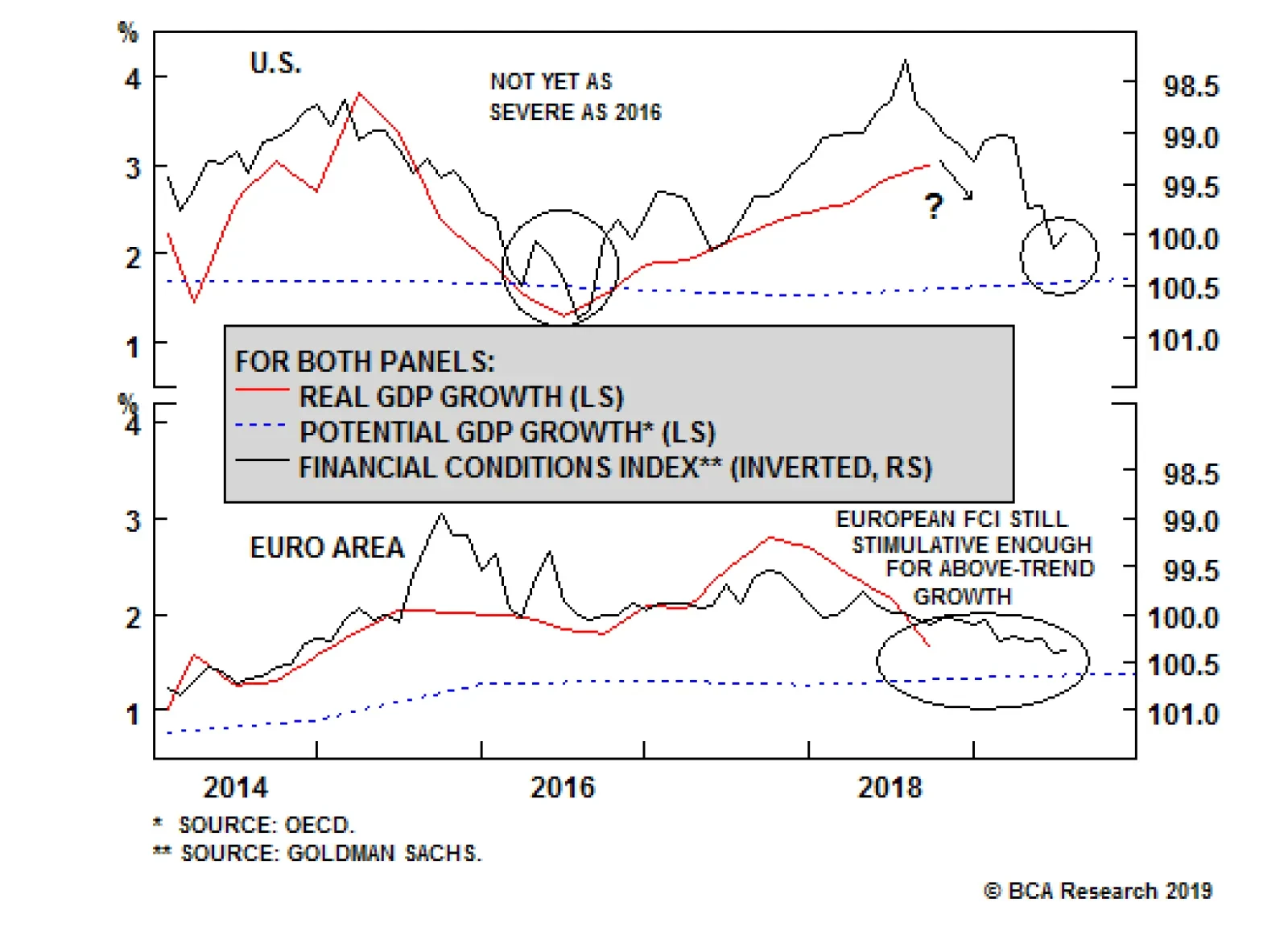

Highlights The U.S. economy is slowing in a completely predictable manner. With inflationary pressures largely dormant, the Fed can afford to stay on hold for the next few FOMC meetings. Growth in the U.S. and the rest of the world…

Highlights Buy the pound as soon as the U.K. parliament coalesces a majority around an action plan to counter a no-deal Brexit. For equity investors the best play is a FTSE Small Company Index ETF and/or U.K. REITS. Beaten-down banks…

Highlights Global Corporates: The Fed is now clearly signaling a near-term capitulation to tightening financial conditions alongside slowing global growth and inflation. A pause in the U.S. rate hiking cycle, after credit spread…

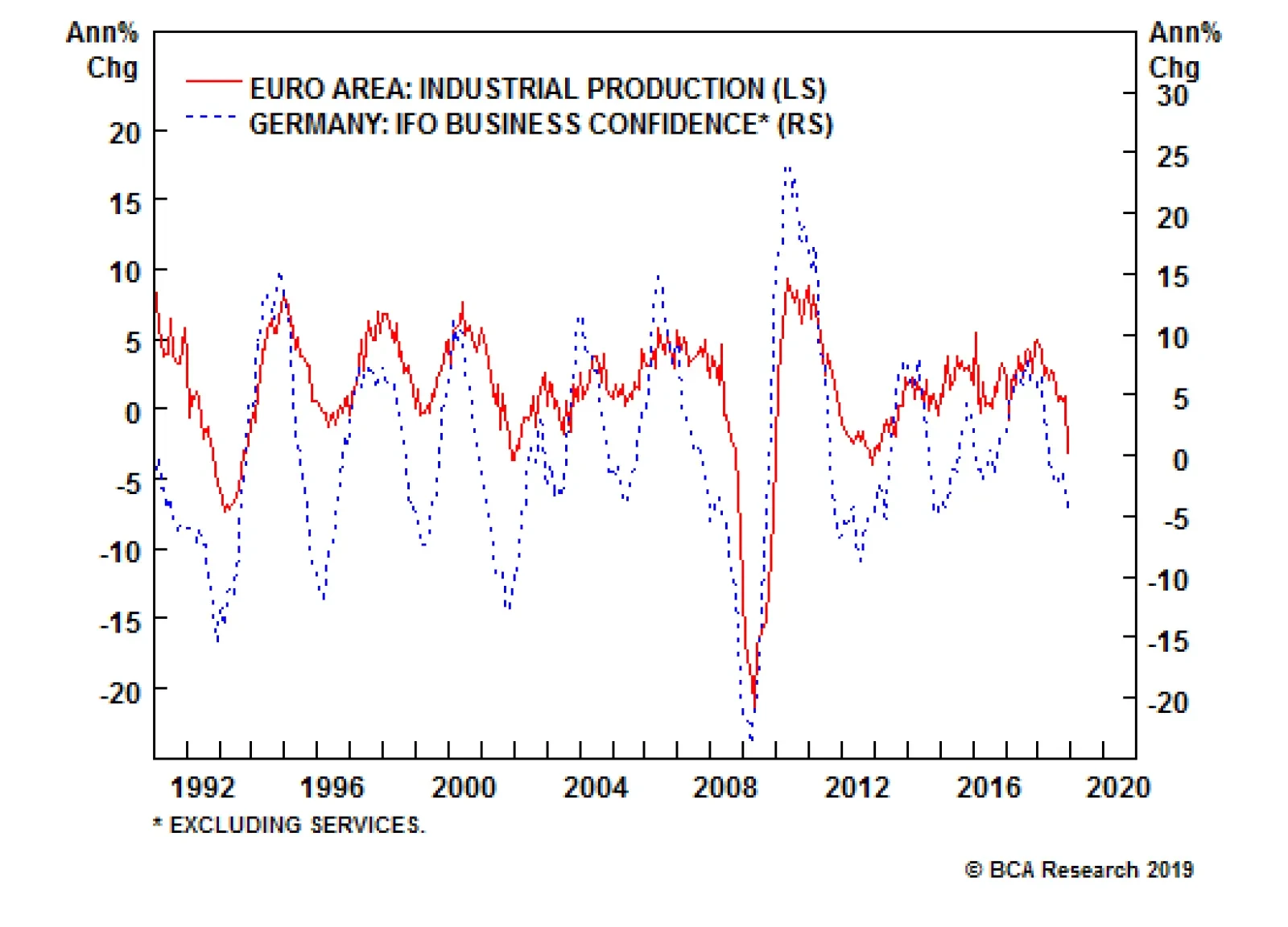

Today’s Industrial production in the euro area dropped to -3.3% on a year-on-year basis, much worse than expectations. The month-over-month number is -1.7%. This grim result raises concerns on the growth conditions in…

Highlights All of our recent investment recommendations have performed very strongly but have further to go: 1. Own a combination of European banks plus U.S. T-bonds. 2. Overweight EM versus DM. 3. …

Question Three: Have central banks become less concerned about financial market selloffs? The idea that central banks have fallen “out of tune” with financial markets has spooked investors who fear that…

Dear Client, In lieu of next week’s report, I will be hosting a webcast on Wednesday, January 9th at 10 AM EST, when I will be discussing the economic and financial market outlook for 2019 and answering your questions. Best…