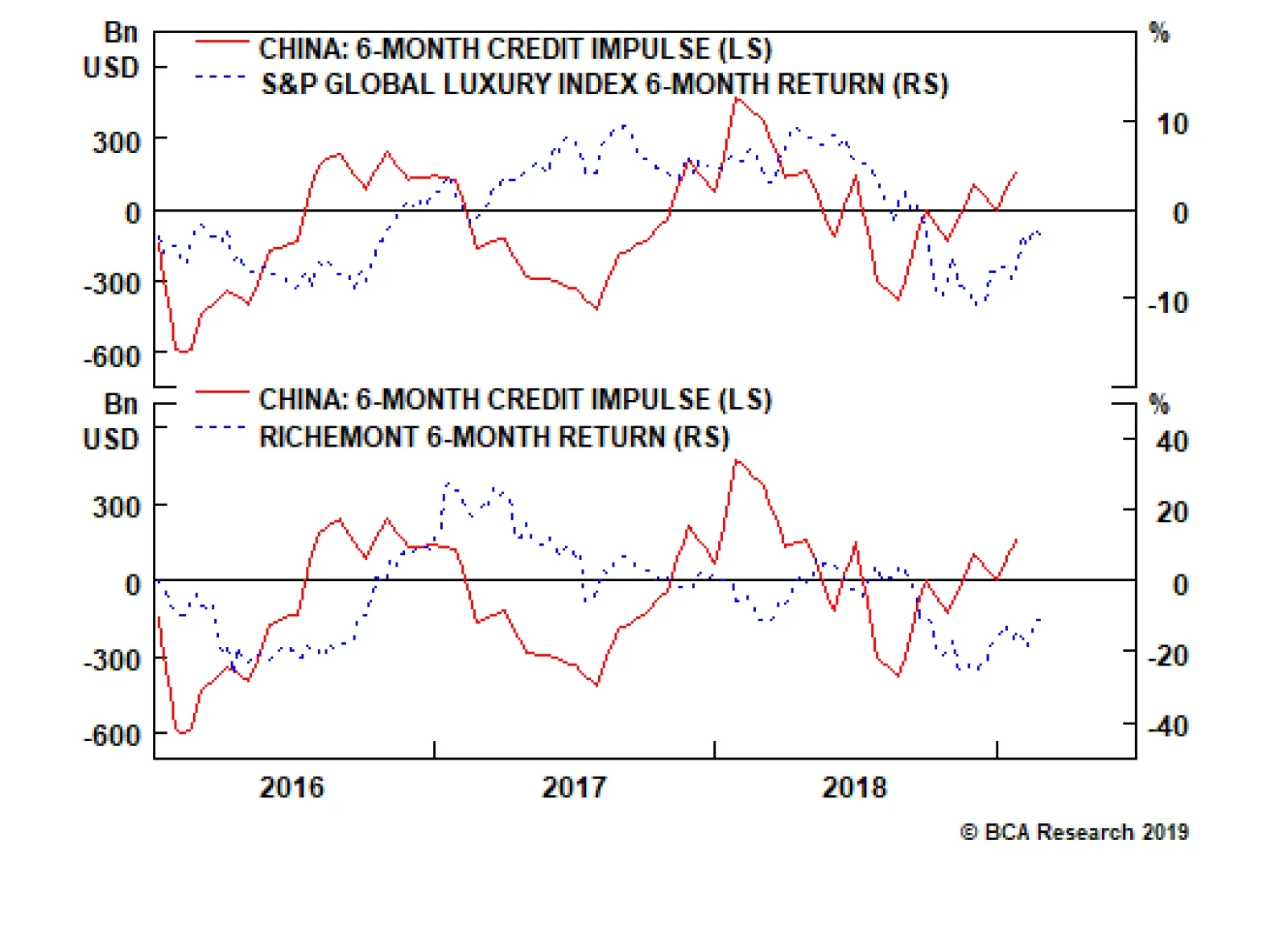

Regarding the European luxury goods sector, we often get following question: is it, just like the basic resources sector, a direct play on China’s growth cycle? The answer is no. Recently, the connection between the…

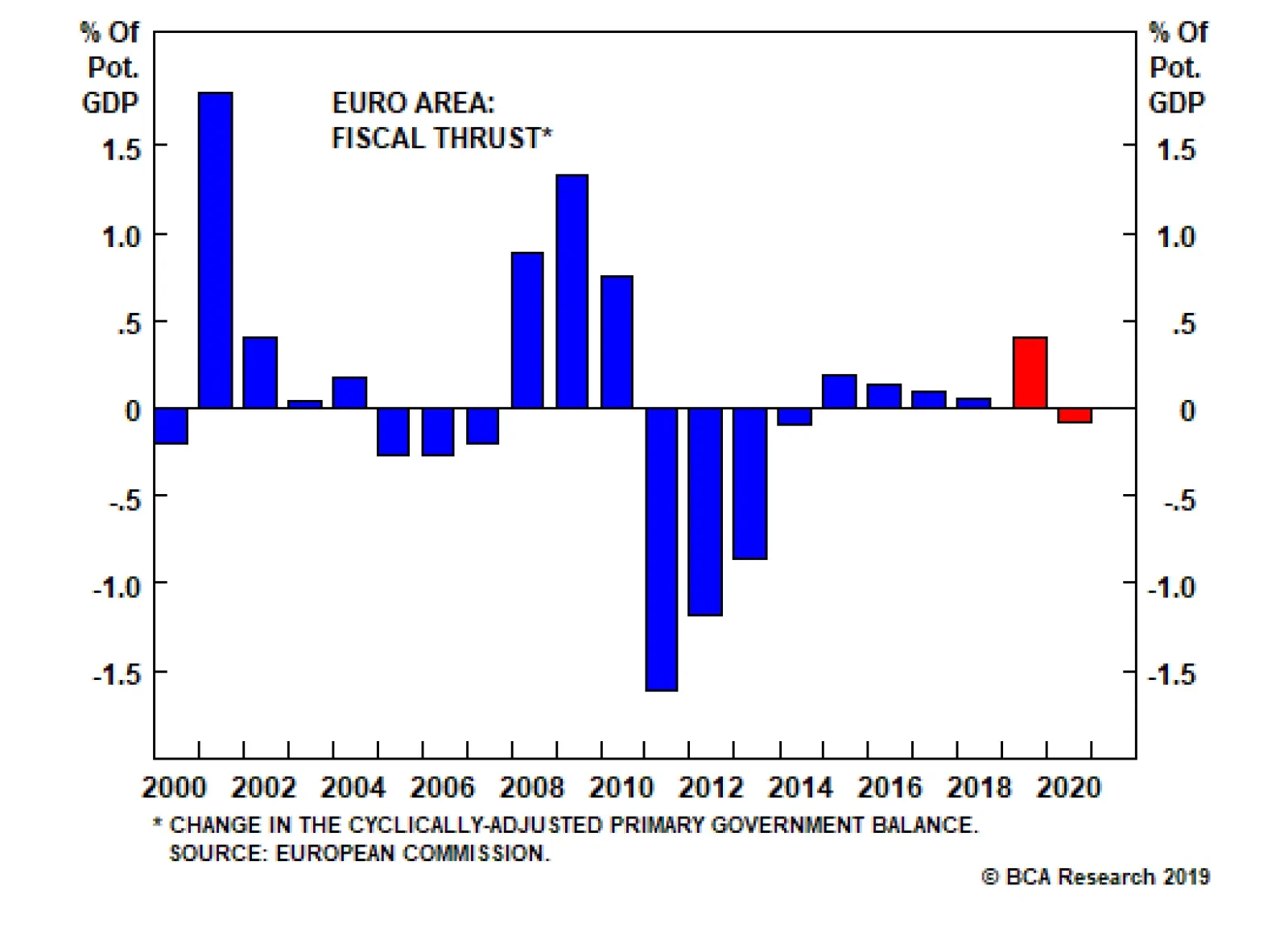

Austerity fatigue has set in. Trump’s big budget deficits and his “I love debt” mantra are the waves of the future. For their part, the Democrats are shifting to the left, with the “Green New Deal”…

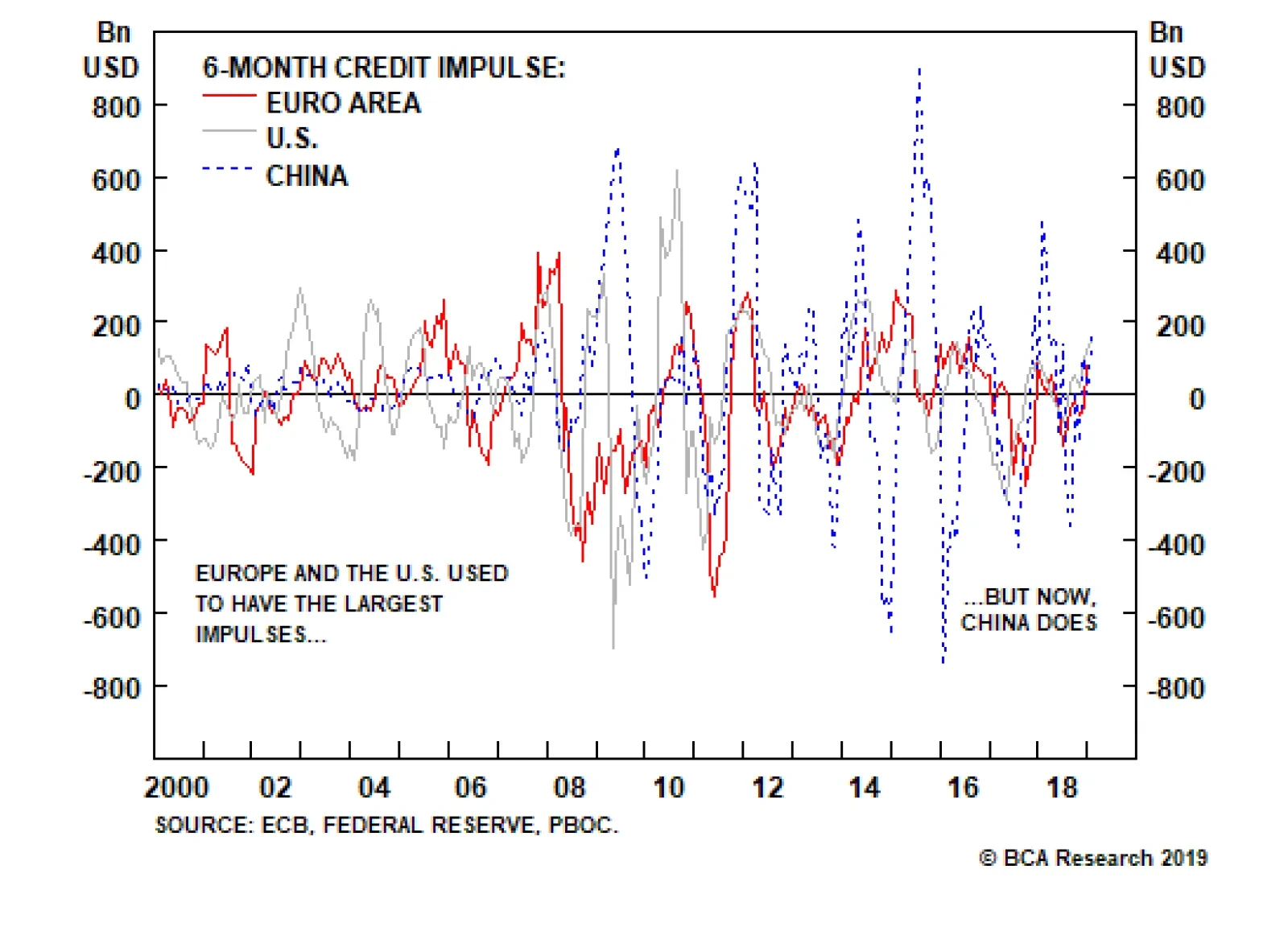

The chart above shows the short-term credit impulses, expressed in USD terms, for the euro area, U.S., and China through the past twenty years. The comparison reveals that the dominant short-term impulse – the one with the…

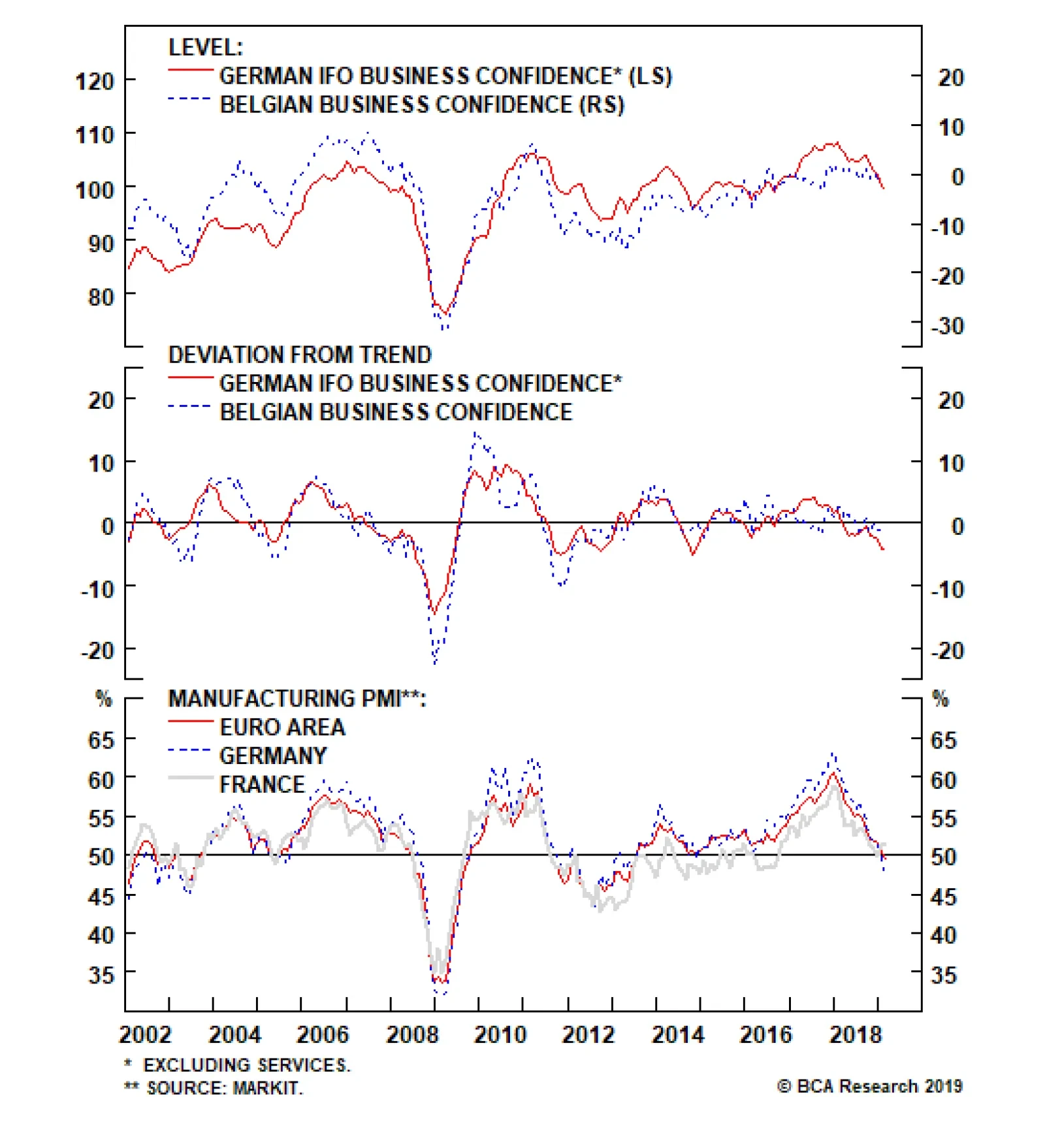

The European economic slowdown shows no sign of ending. This morning, both the German Ifo and the Belgian business confidence decelerated further, with the former falling to 98.5 from 99.3, and the latter weakening from -1.5 to -…

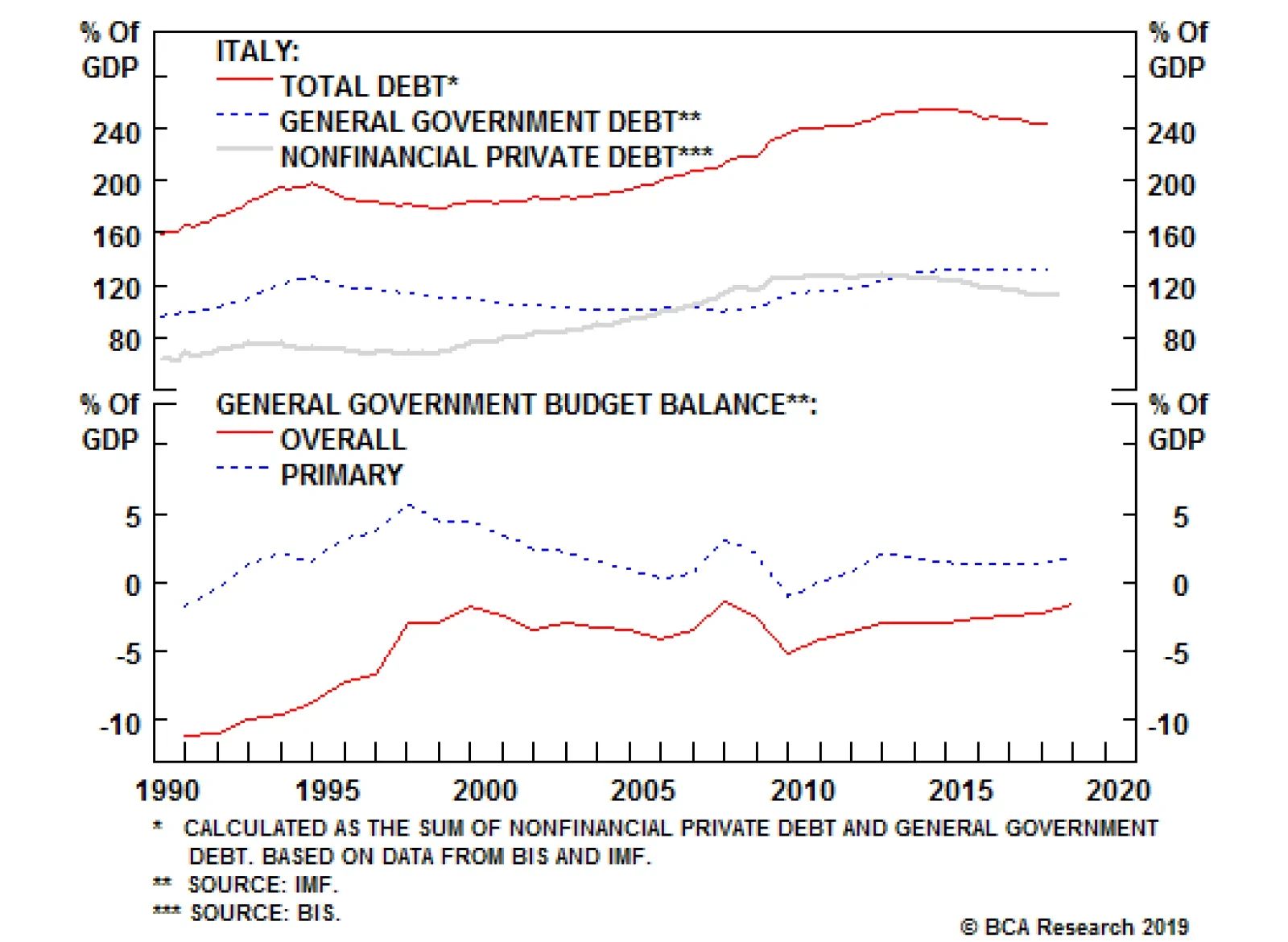

Highlights It may seem self-evident that most governments are overly indebted, but both theory and evidence suggest otherwise. Higher debt today does not require higher taxes tomorrow if the growth rate of the economy exceeds the…

Highlights Equities can continue to outperform bonds for a few months longer. The pro-cyclical equity sector stance that has worked well since last October can also continue for a few months longer. Overweight pro-cyclical Sweden…

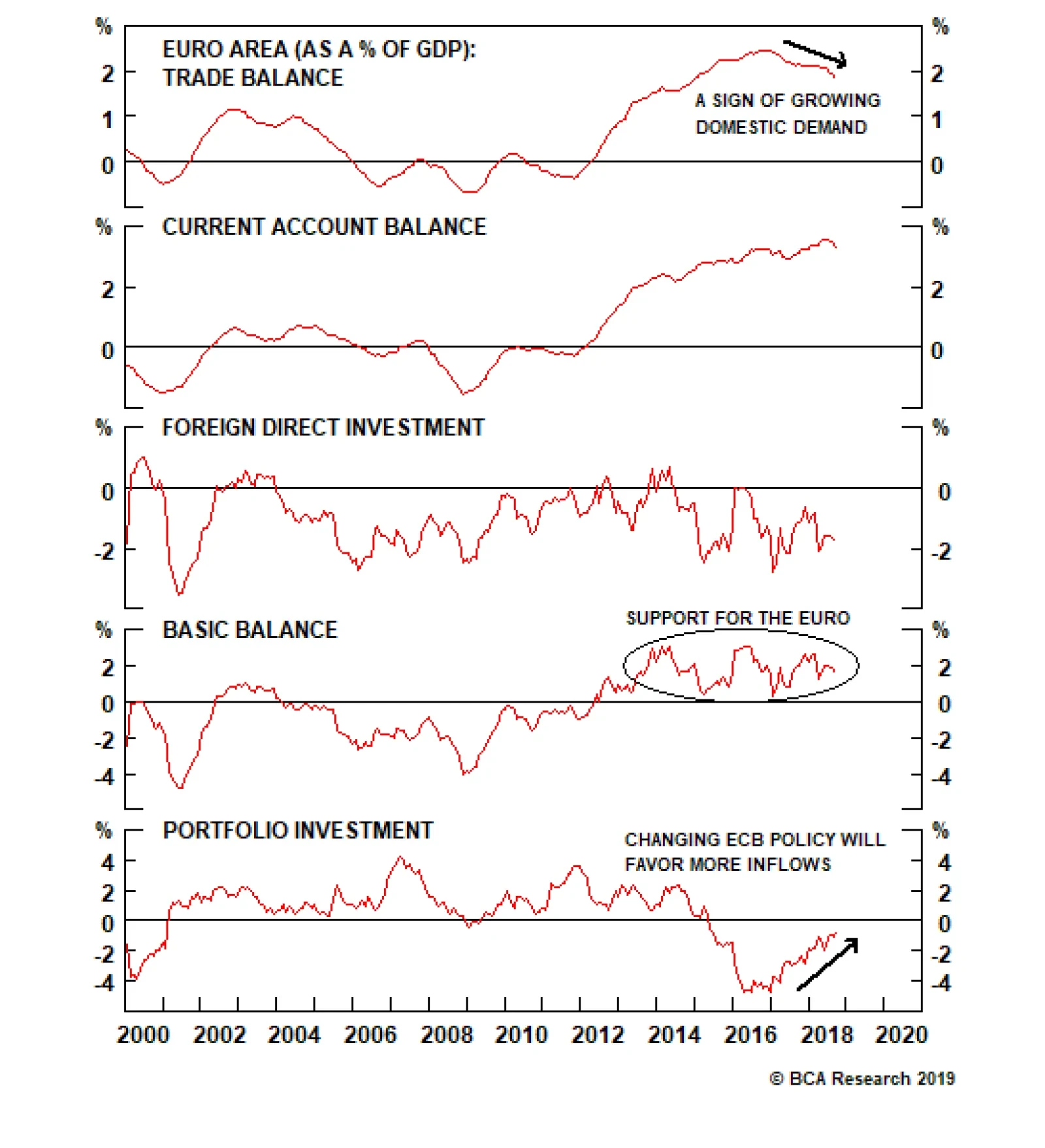

After peaking at 2.4% of GDP, the euro area trade balance has softened to 1.8% of GDP. Rebounding economic activity in the European periphery explains this small deterioration as rising domestic demand tends to lift imports…

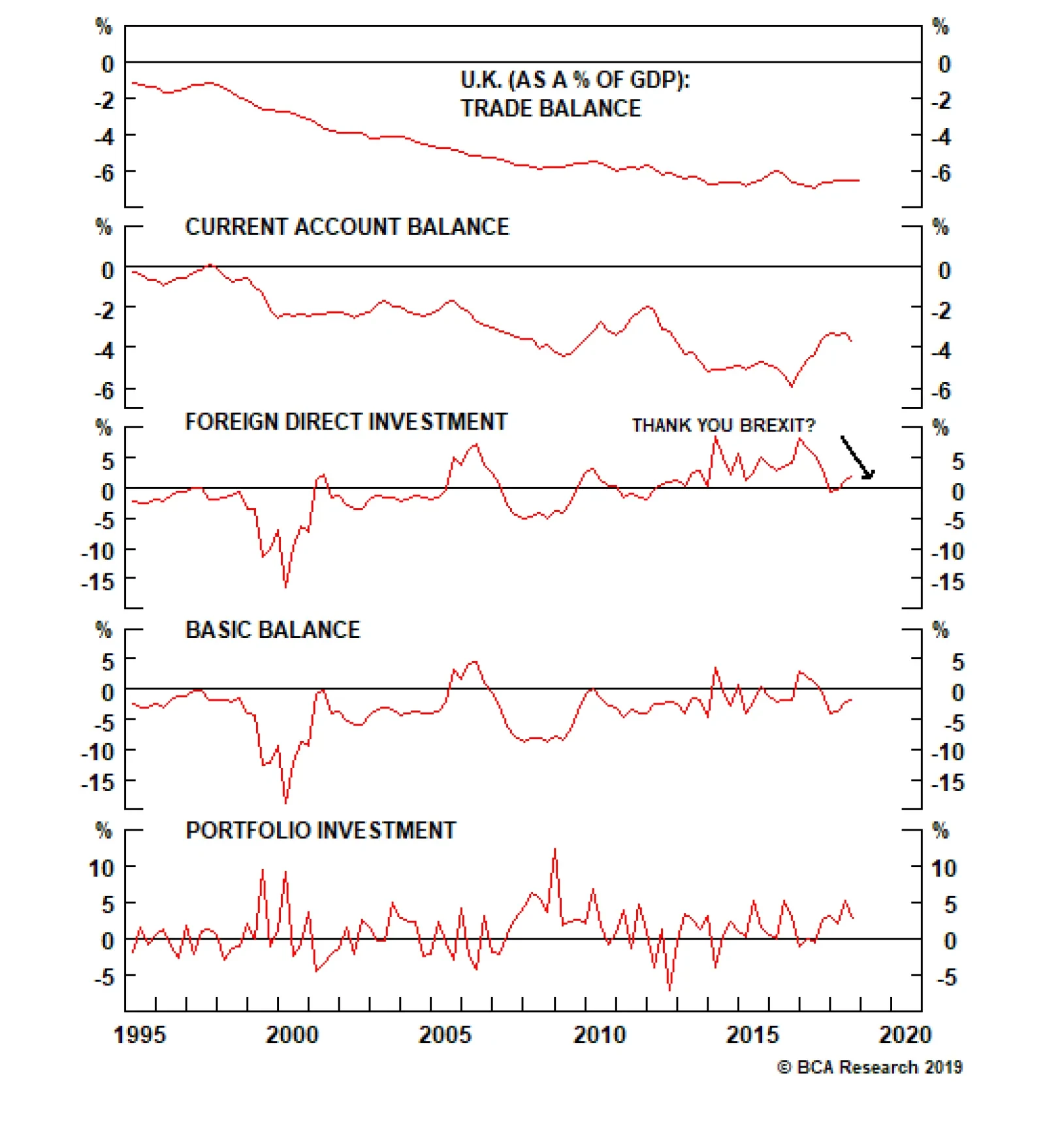

The current account looks a bit better but remains at a large deficit of 3.9% of GDP. A current account deficit is not a problem for a currency so long as it can be financed cheaply. Historically, the U.K. has been attractive to…

Highlights Global Growth: Early leading indicators (credit impulses, our global LEI diffusion index) are signaling that the worst of the global economic downturn should soon end. Okun’s Law: In the developed economies, the…

The next global economic downturn would probably be sparked by a surge in inflation which forces central banks to raise interest rates more aggressively than they would like. Given the absence of inflationary pressures today, and…