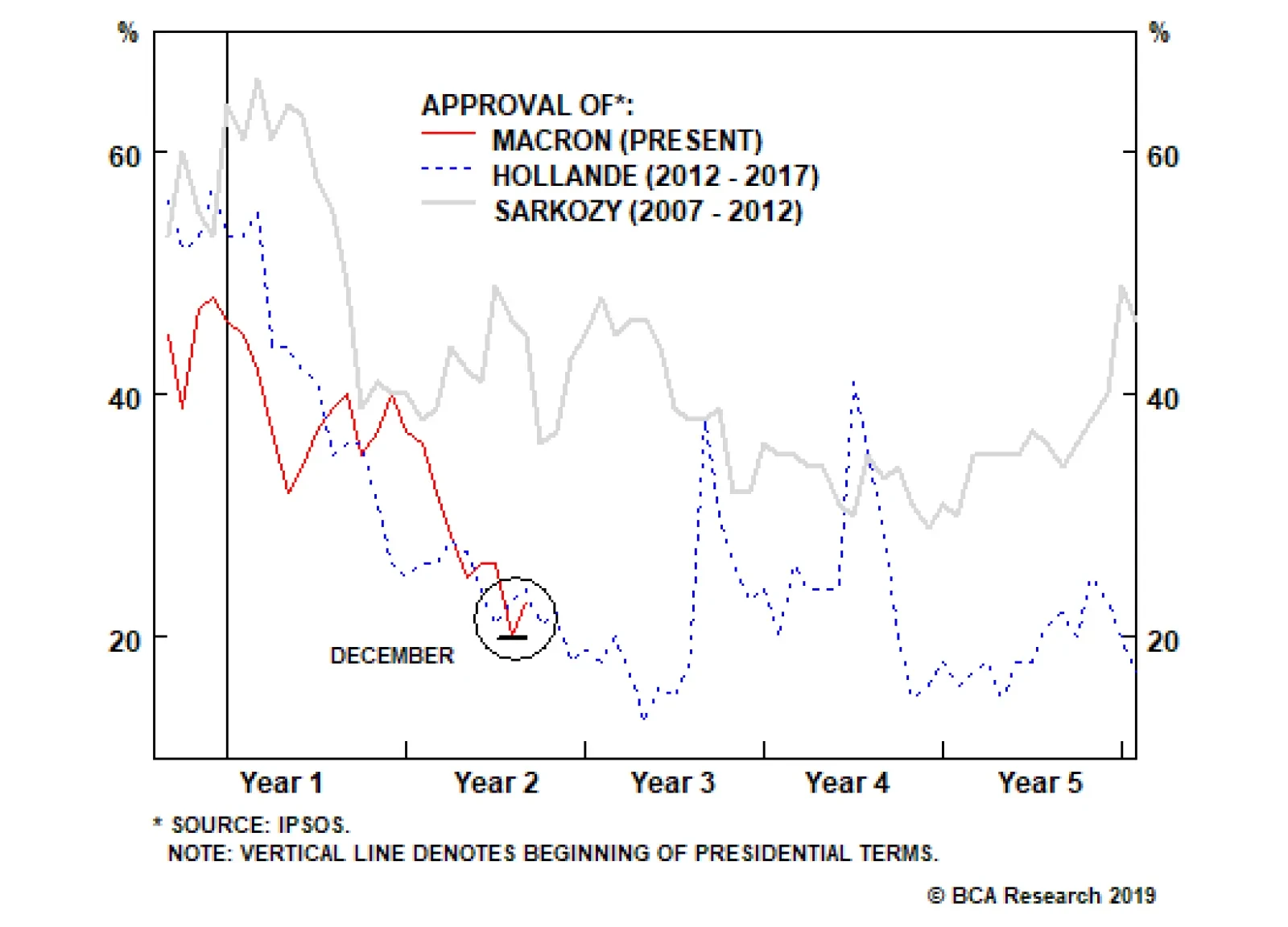

The yellow vest movement is not a coherent force led by a clear leadership. The demands of the group are many: lower taxes, better services, less of the current reforms (specifically in education), and more of other reforms.…

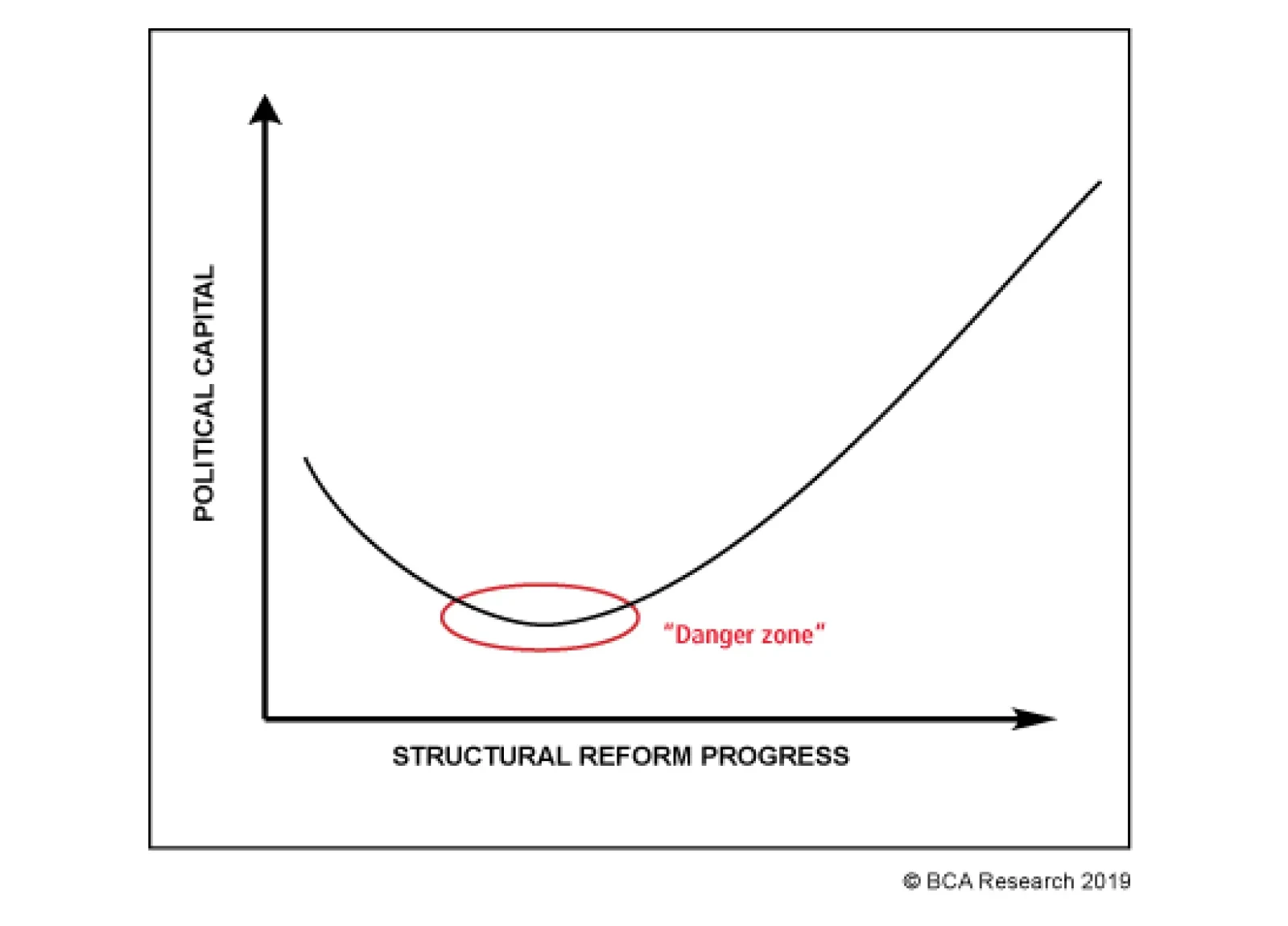

Cutting the size of the state might be what Macron needs to get out of that zone over the course of his term. Unlike the last two presidents, Macron’s term has begun with a whirlwind. If he stops now, it is highly…

Highlights Global growth is still slowing. Having rallied since the start of the year, global stocks will likely enter a “dead zone” over the next six-to-eight weeks as investors nervously await the proverbial green shoots…

Highlights Global growth is still slowing. Having rallied since the start of the year, global stocks will likely enter a “dead zone” over the next six-to-eight weeks as investors nervously await the proverbial…

Highlights A no-deal Brexit which did not cause pain pour encourager les autres would be the much graver existential threat for the EU. A U.K. parliamentary vote to extend Article 50 by a few months would not be a game changer in…

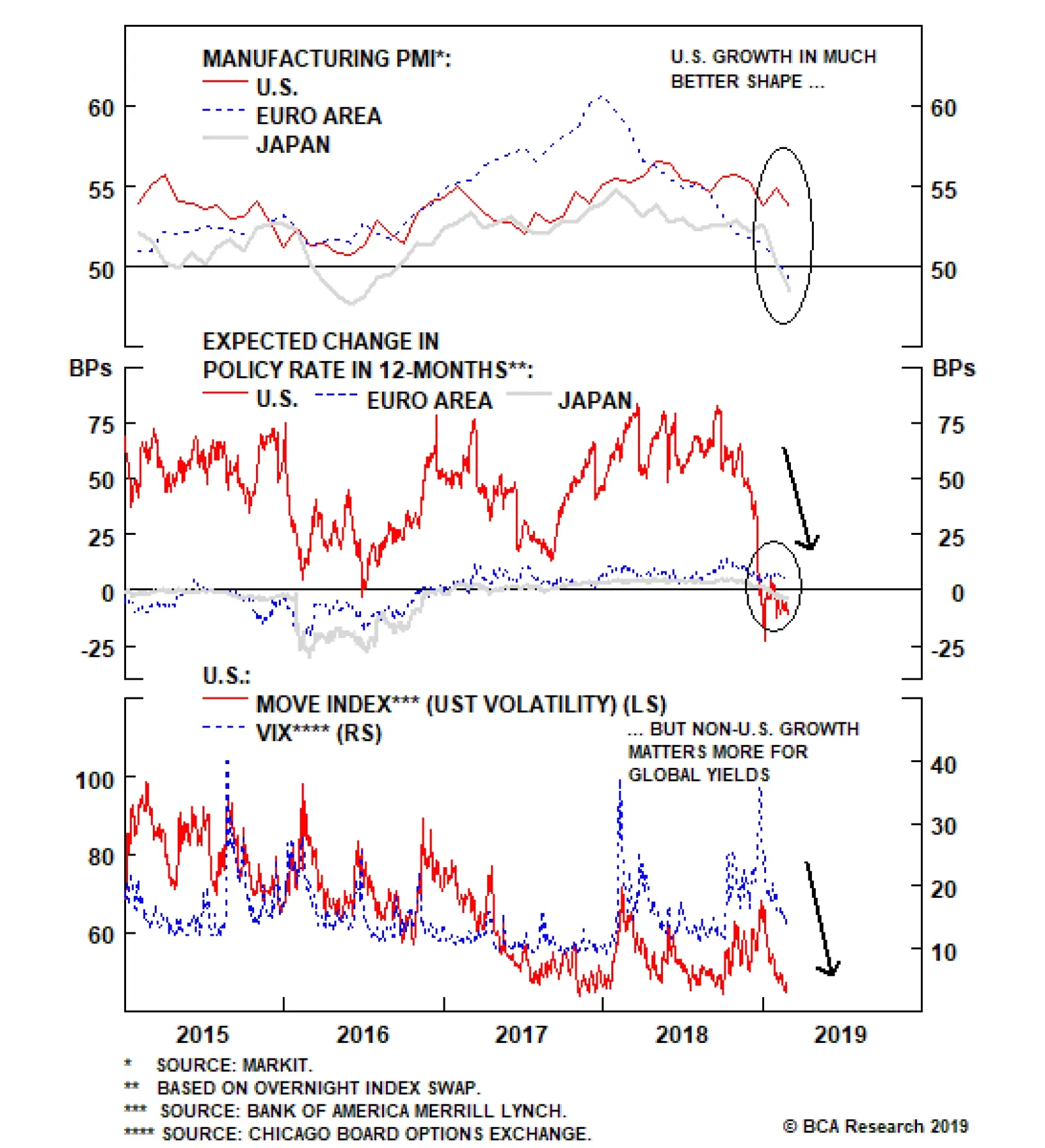

Investors have priced out any possibility of a Fed rate hike over the next year, and now even discount a modest rate cut, according to the U.S. Overnight Index Swap (OIS) curve. Yet, while most of the attention of bond investors…

If those expectations continue to rise, likely in the context of stickier realized U.S. inflation alongside solid U.S. growth, then the Fed will return to a hawkish bias. That ultimately means higher U.S. real yields and, most…

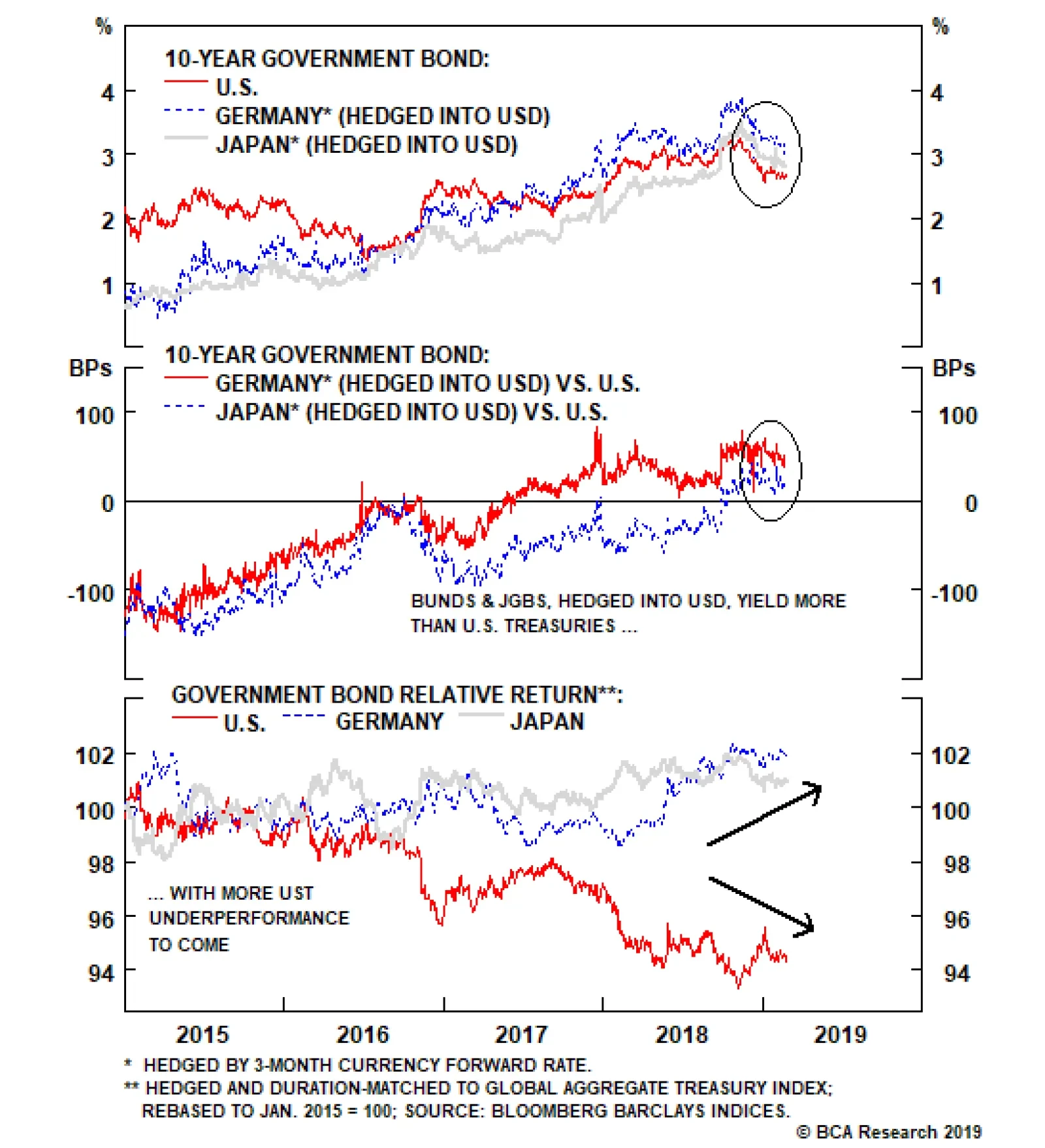

Highlights Low Bond Volatility: Weakening non-U.S. growth and a more dovish Fed have crushed global government bond volatility, especially in Europe and Japan where yields are struggling to stay above 0%. Treasury-Bund and Treasury-JGB…