Highlights The deceleration in global growth that began in 2018 is entering a transition phase. The bottoming out process could prove to be volatile, warning against betting the farm too early on pro-cyclical currencies. Tactical…

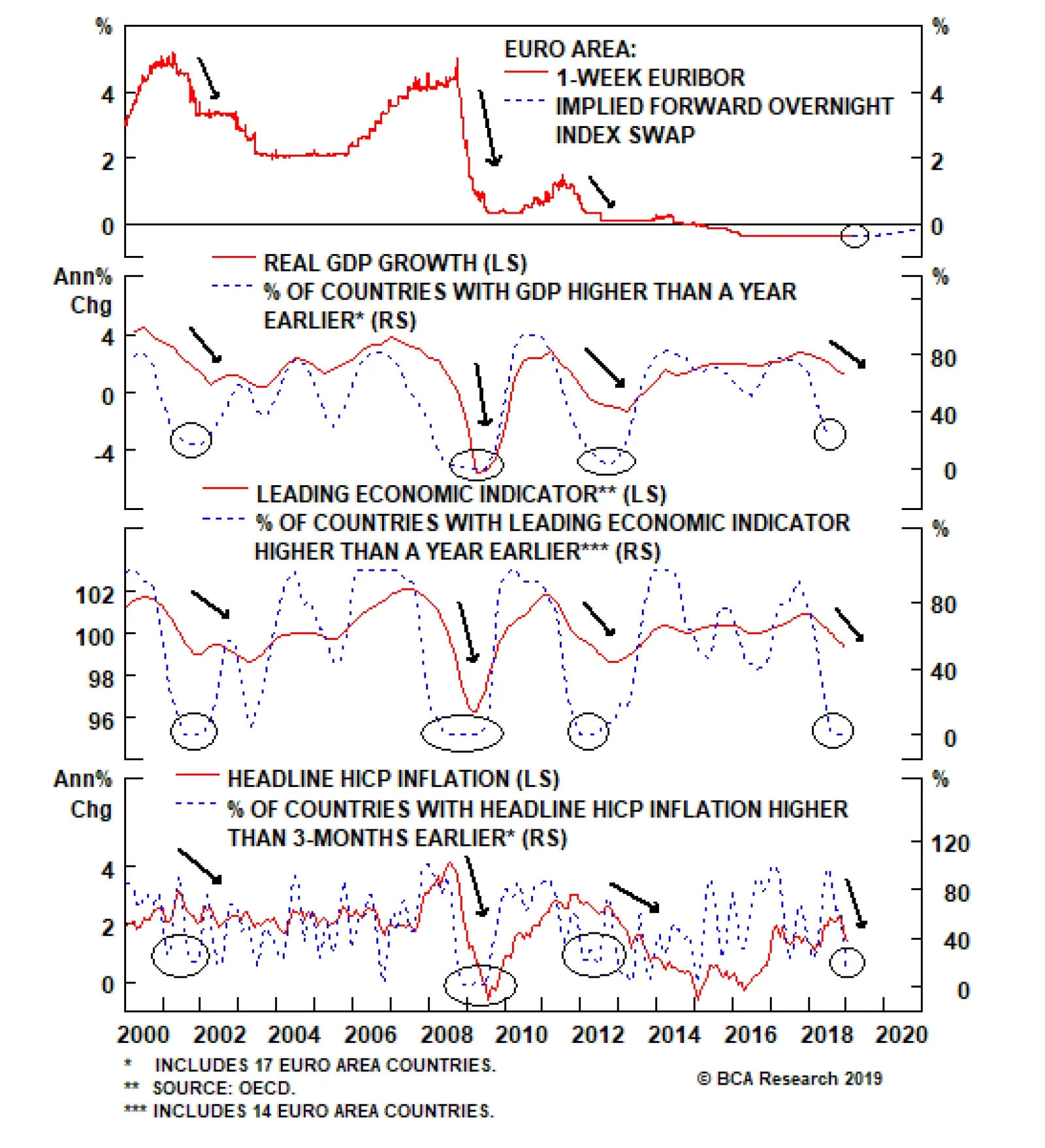

This morning, the ECB greatly curtailed its growth and inflation forecasts. Expected GDP growth in 2019 and 2020 was downgraded to 1.1% and 1.6% from 1.7% and 1.7%, respectively. While anticipated inflation was also revised down…

Dear Client, I am travelling this week so this report is a joint effort juxtaposing two contrasting observations about France. The ‘opulence’ part highlights France as the world’s dominant producer of luxury goods, and…

The ECB has categorized the current downturn, which has pushed real GDP growth in the Eurozone to a below-trend pace of 1.7% and triggered a technical recession in Italy, as simply the product of a bunch of idiosyncratic country-…

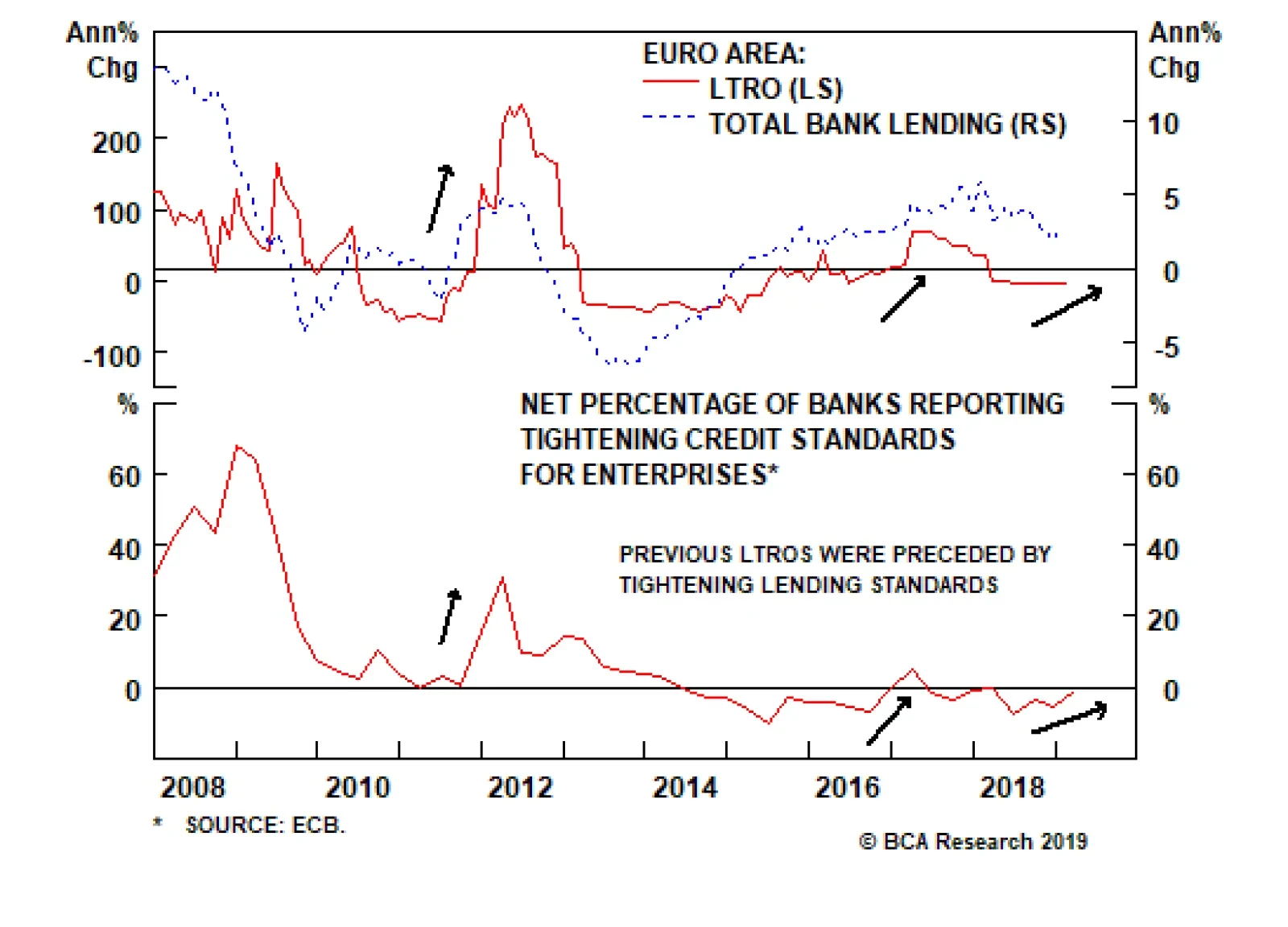

ECB President Mario Draghi has already noted that the growth risks in the euro zone are now tilted to the downside. We expect the ECB to follow a dovish script at the March ECB meeting, along these lines: Downgrade the ECB…

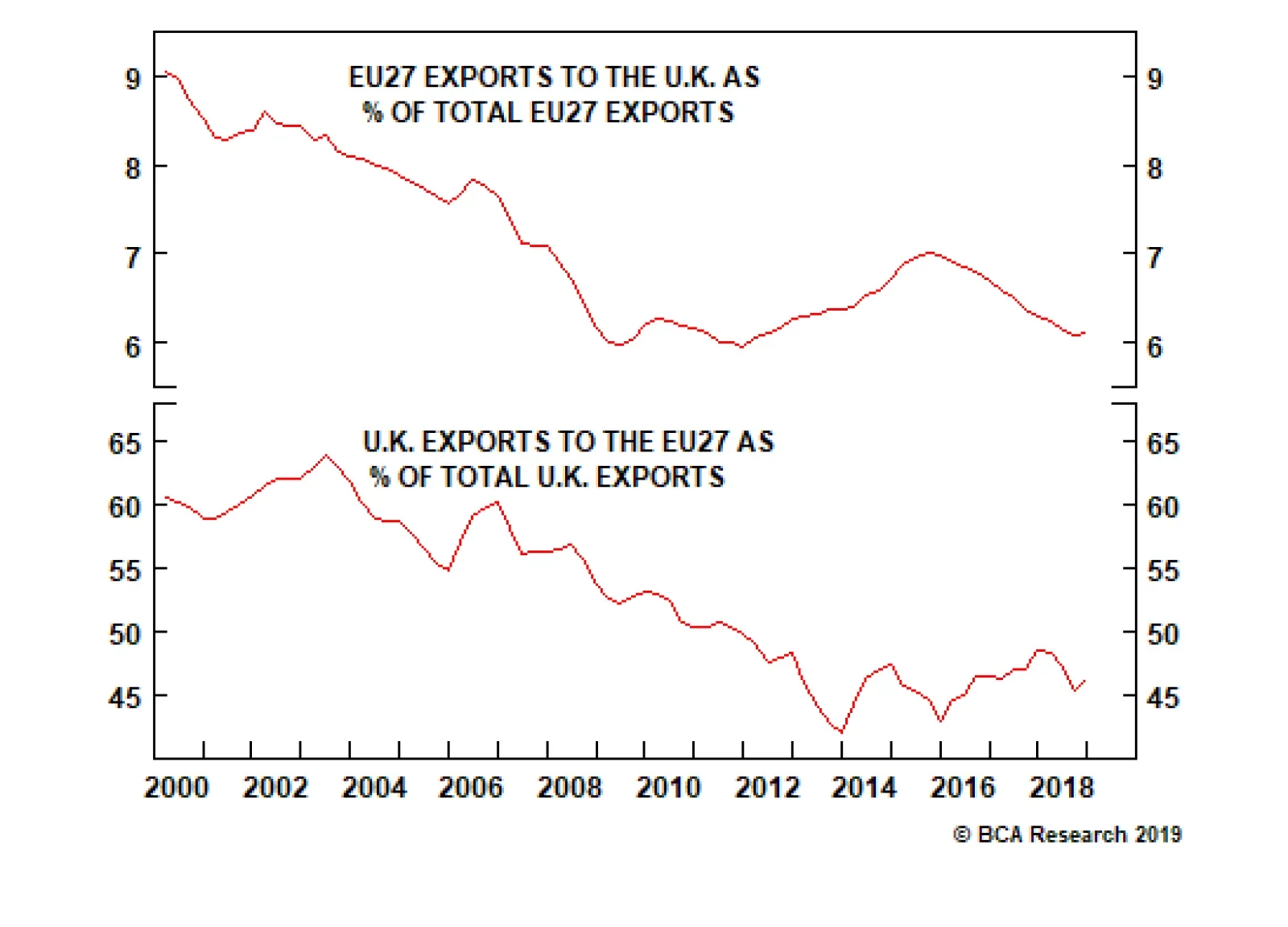

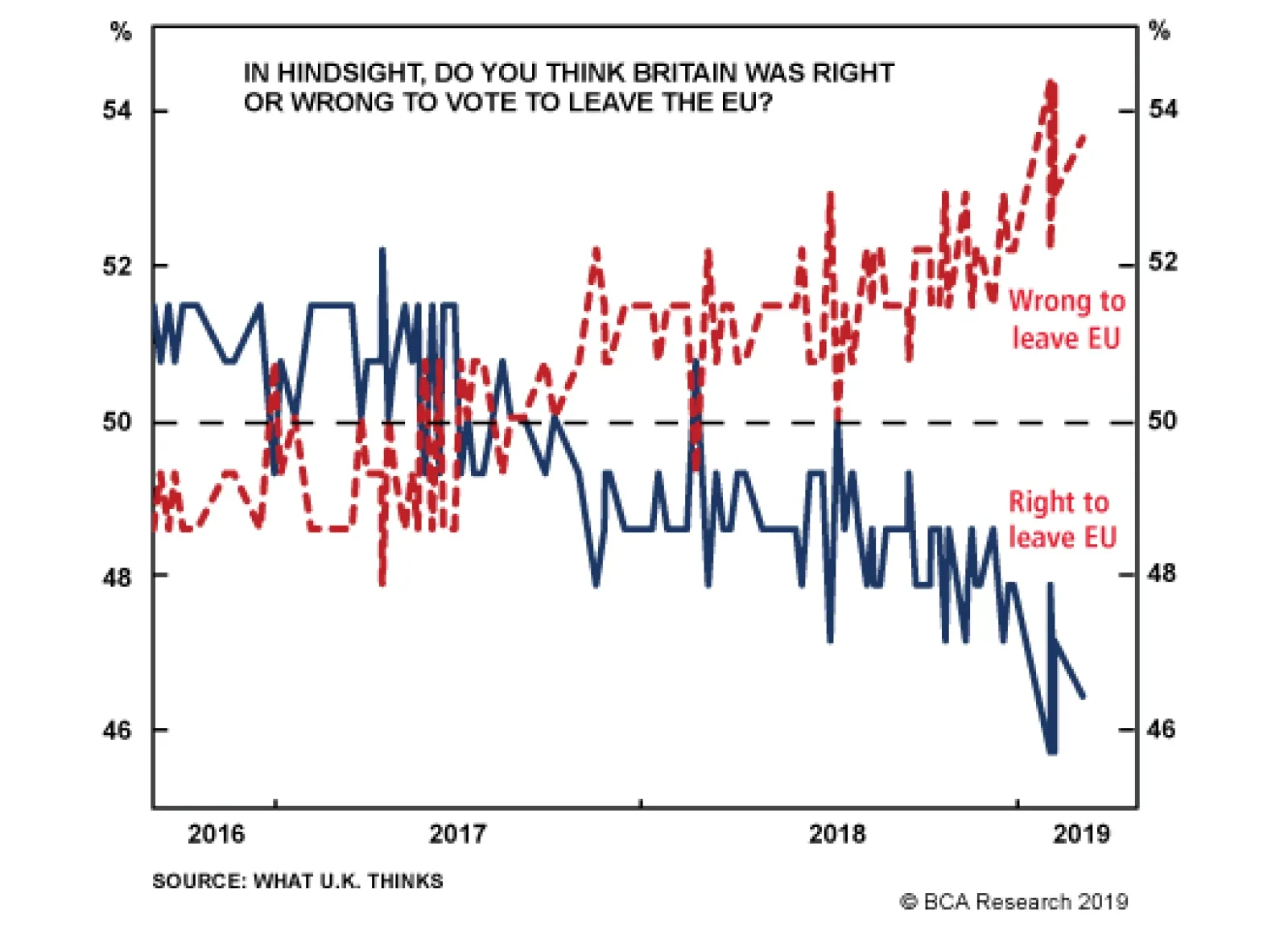

The two-year time limit in Article 50 was designed to disadvantage the exiting country relative to the EU, and this disadvantage has now become abundantly clear. After the two years have run down, a no-deal or ‘cliff edge…

A catastrophic no-deal Brexit would undoubtedly hurt the EU27, and be particularly painful for the member states most exposed to U.K. trade, notably Ireland and the Netherlands. But here’s the paradox: a no-deal Brexit which…

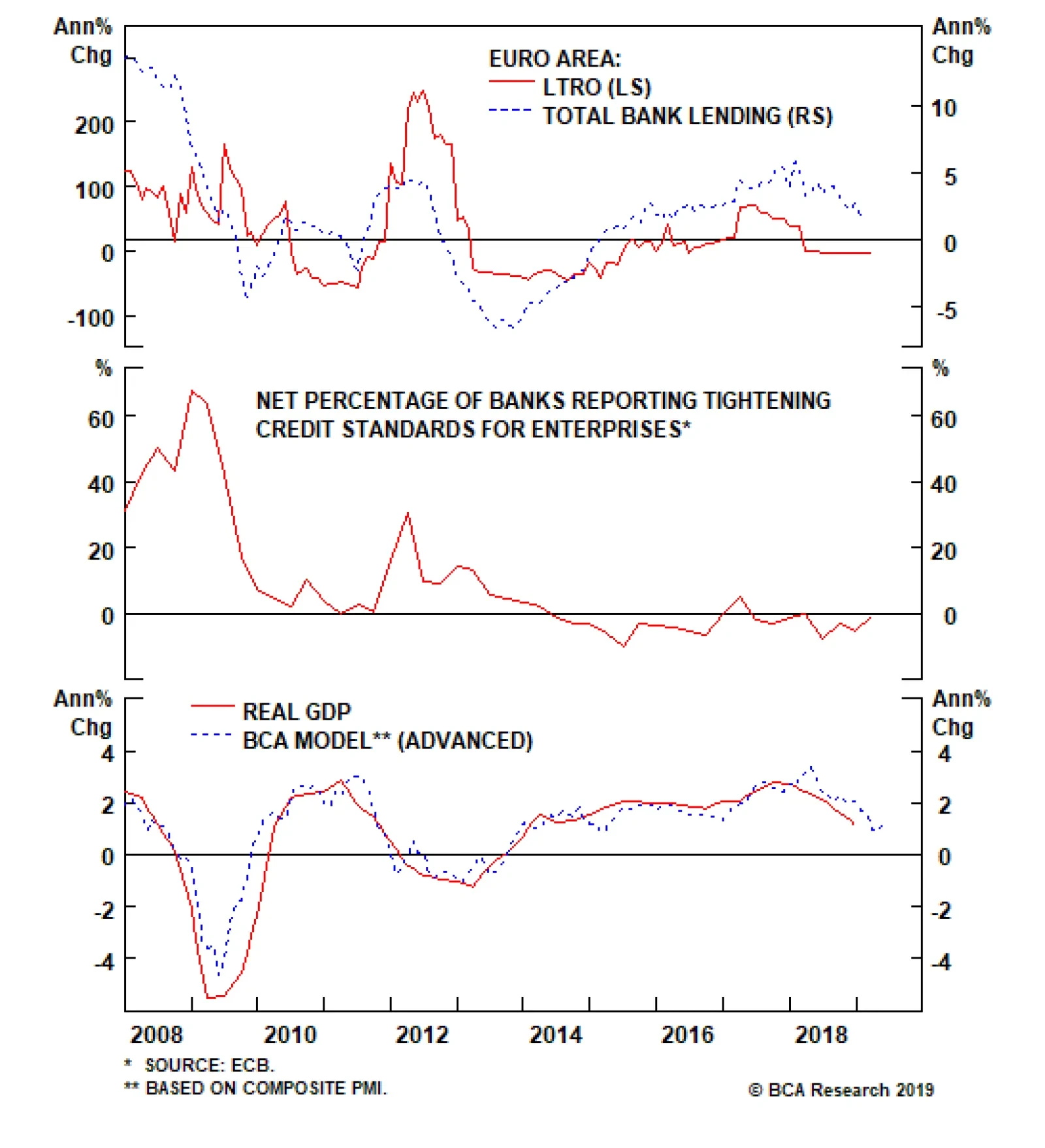

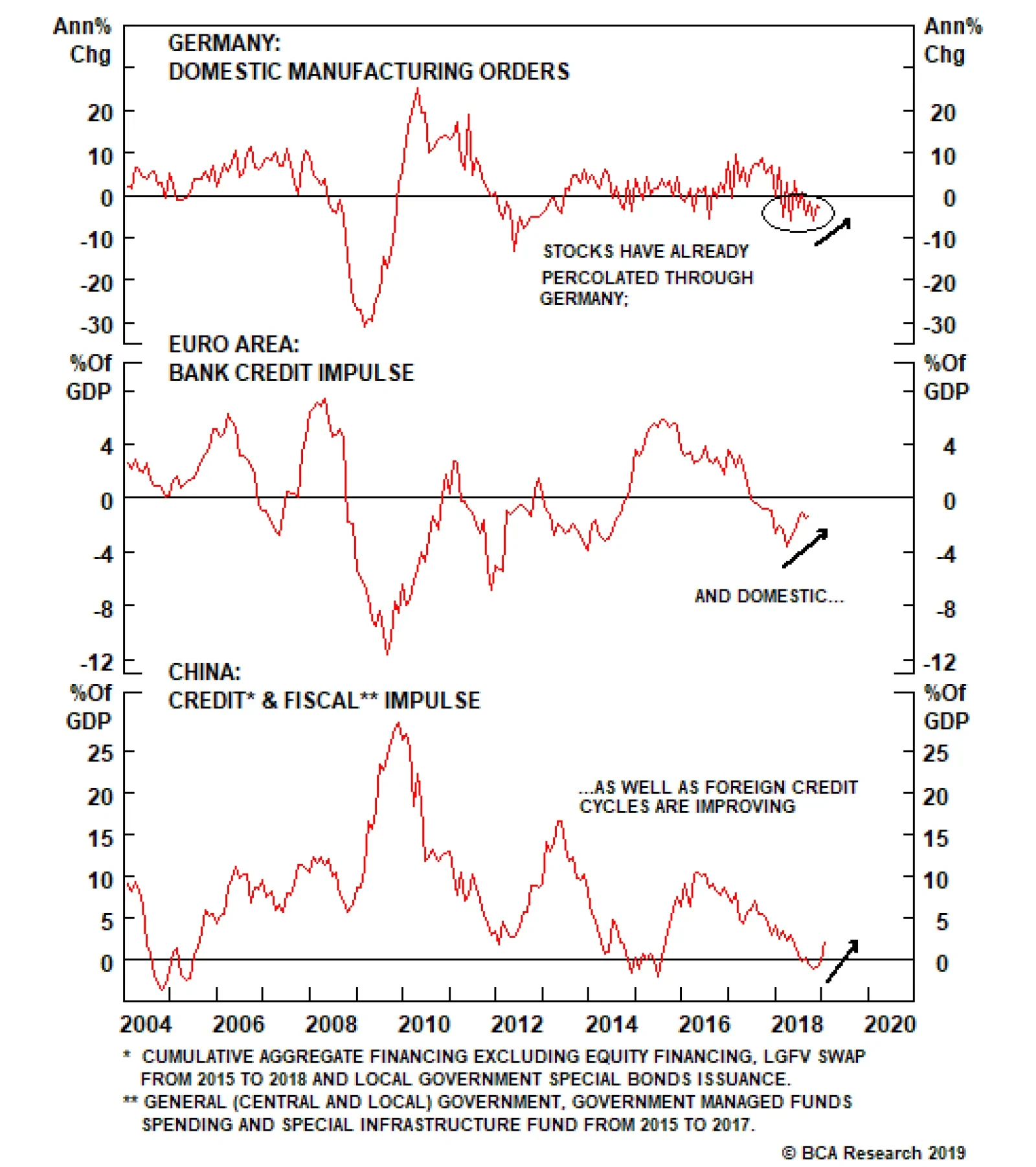

It is safe to say that the euro area is in a funk today: European real GDP growth dipped to a 1.1% annual rate in the fourth quarter of 2018, while industrial production has plunged by 3.9% on a year-on-year basis. But the…

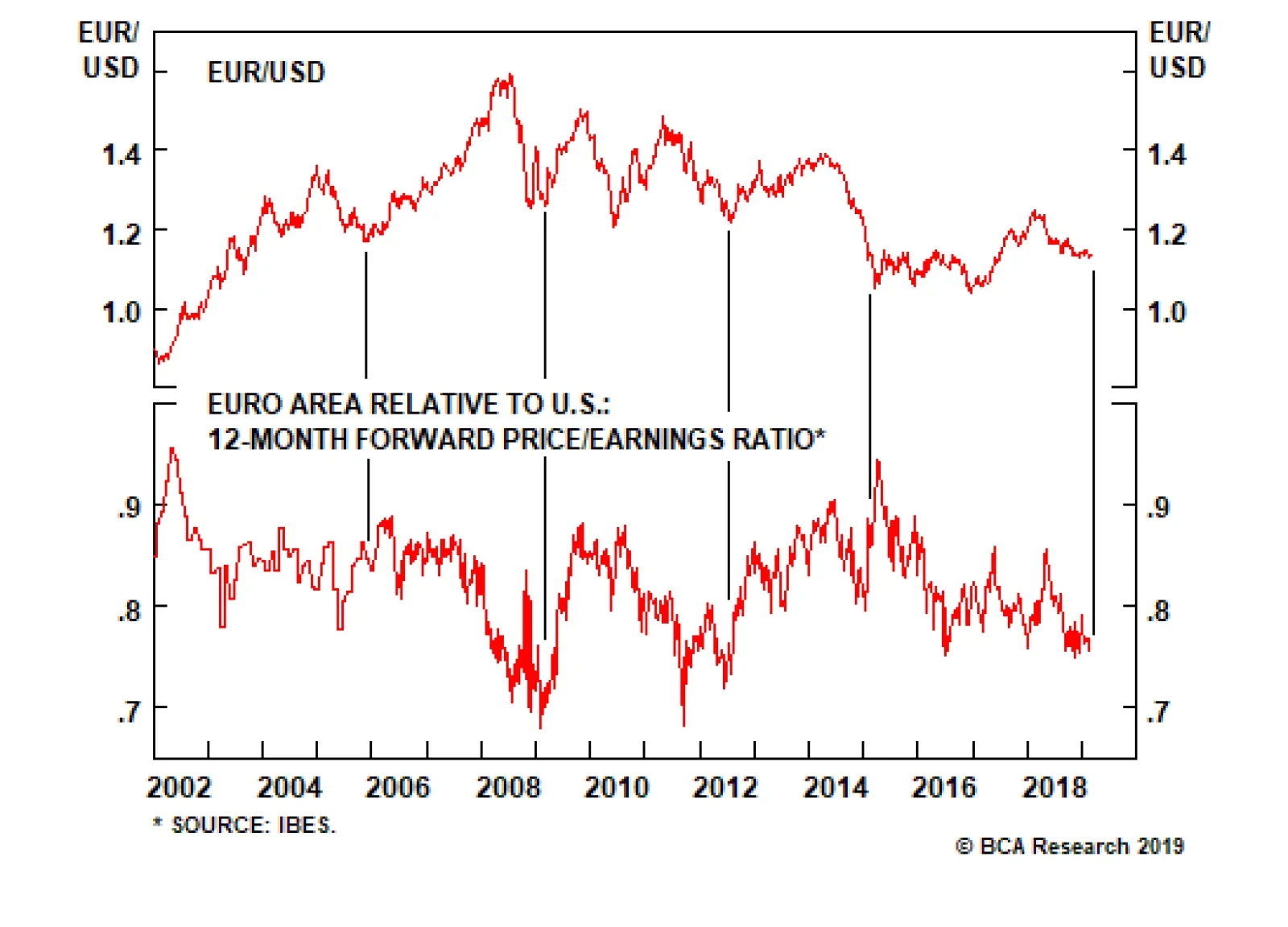

First, on a 12-month forward P/E ratio basis, euro area equities are trading at the kind of deep discount to U.S. stocks normally symptomatic of a trough in relative sentiment toward Europe. Such a discount is often followed by a…