Stronger growth in China will help European exporters. Euro area domestic demand will also benefit from a rebound in German automobile production, the winding down of the “yellow vest” protests in France, and…

Highlights Global equities will remain rangebound for the next month or so, but should move decisively higher as economic green shoots emerge in the spring. A revival in global growth will cause the recent rally in the U.S. dollar to…

Highlights Every diversified currency portfolio should hold the yen as insurance against rising market volatility. However, for tactical investors, the latest dovish shift by global central banks almost guarantees the Bank of Japan…

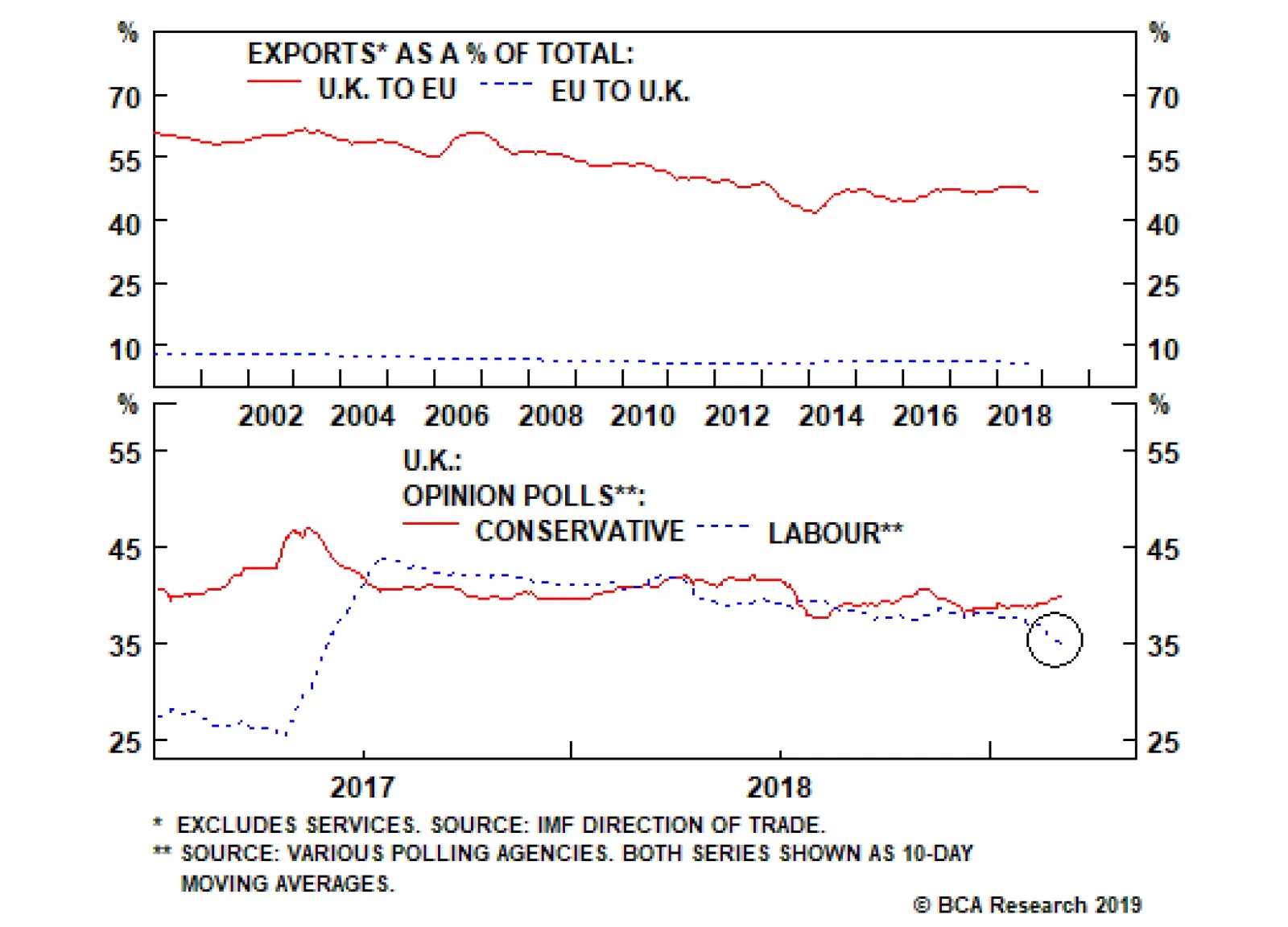

From the moment almost three years ago that the U.K. voted to leave the EU, it was clear that a rational and measured Brexit would require the U.K. to remain in a customs union with the EU. Rational and measured because a…

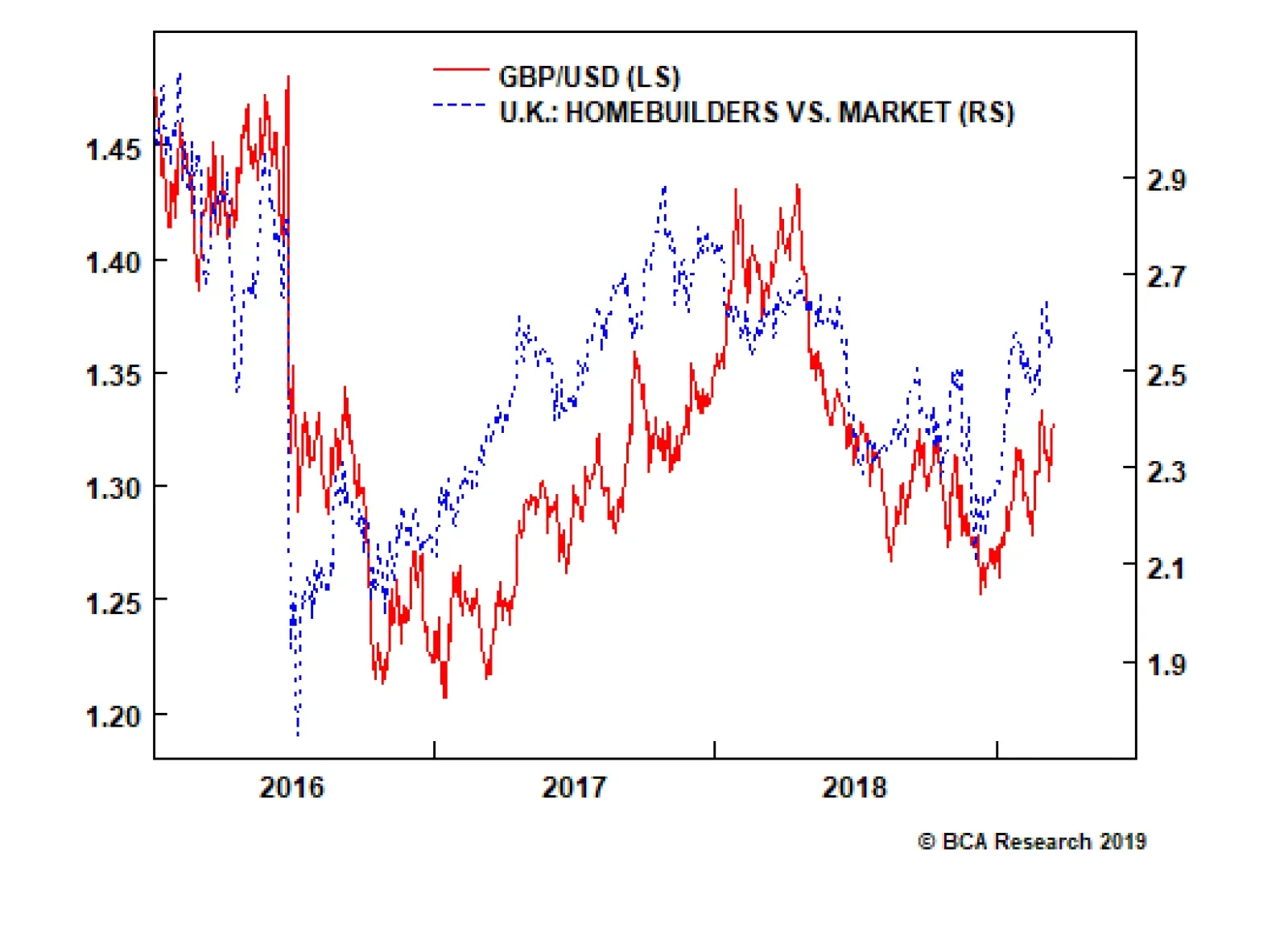

Highlights Await the U.K. parliament to coalesce a majority on a on a credible strategy for Brexit that is also acceptable to the EU27. At that point, buy the pound, the FTSE250, and U.K. homebuilder shares. An eerie calm has…

Highlights So What? The late-cycle rally still faces non-trivial political hurdles. Why? U.S.-China trade talks, the U.S. threat of tariffs on auto imports, and Brexit continue to pose risks. A shocking revelation from the…

The first vote, as we go to press on Tuesday, has resulted in a rejection of Prime Minister Theresa May’s exit plan by 149 votes – the second rejection after her colossal defeat in January by 230 votes. However,…

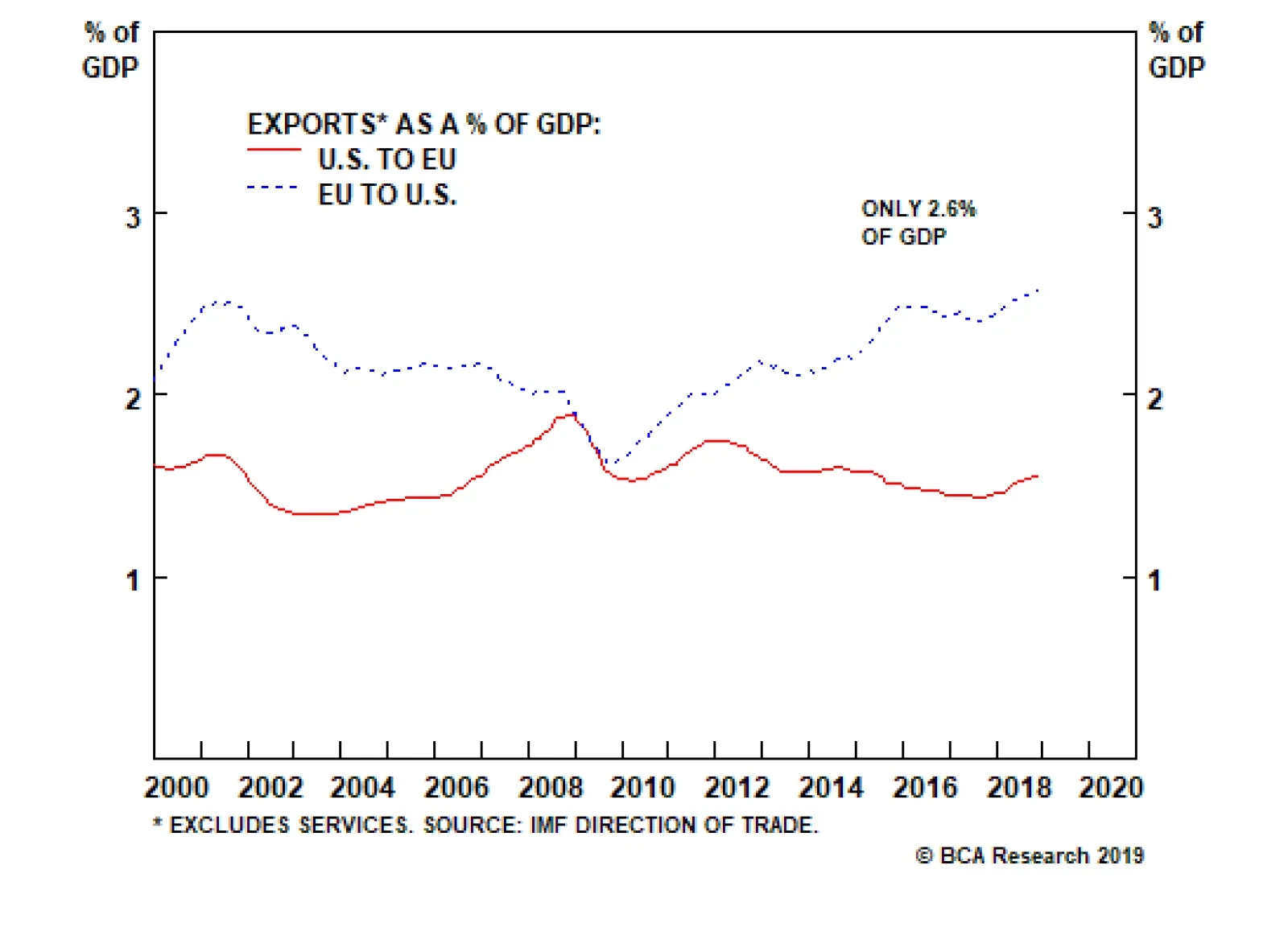

If Trump concludes a deal with China, the next question for investors is whether he will impose Section 232 tariffs on auto and auto imports on the EU and other partners. A rotation of Trump trade policy to focus on Europe is…

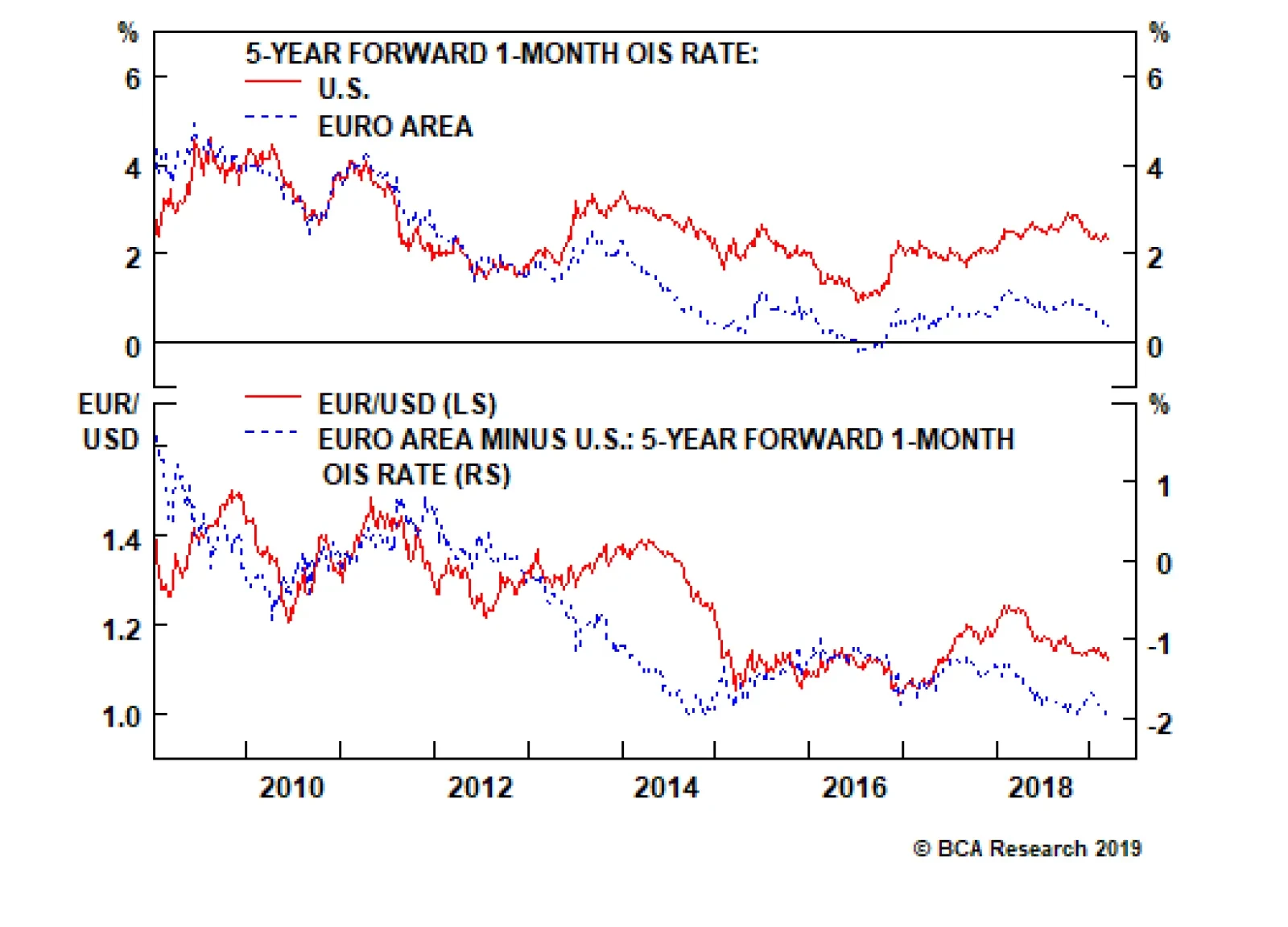

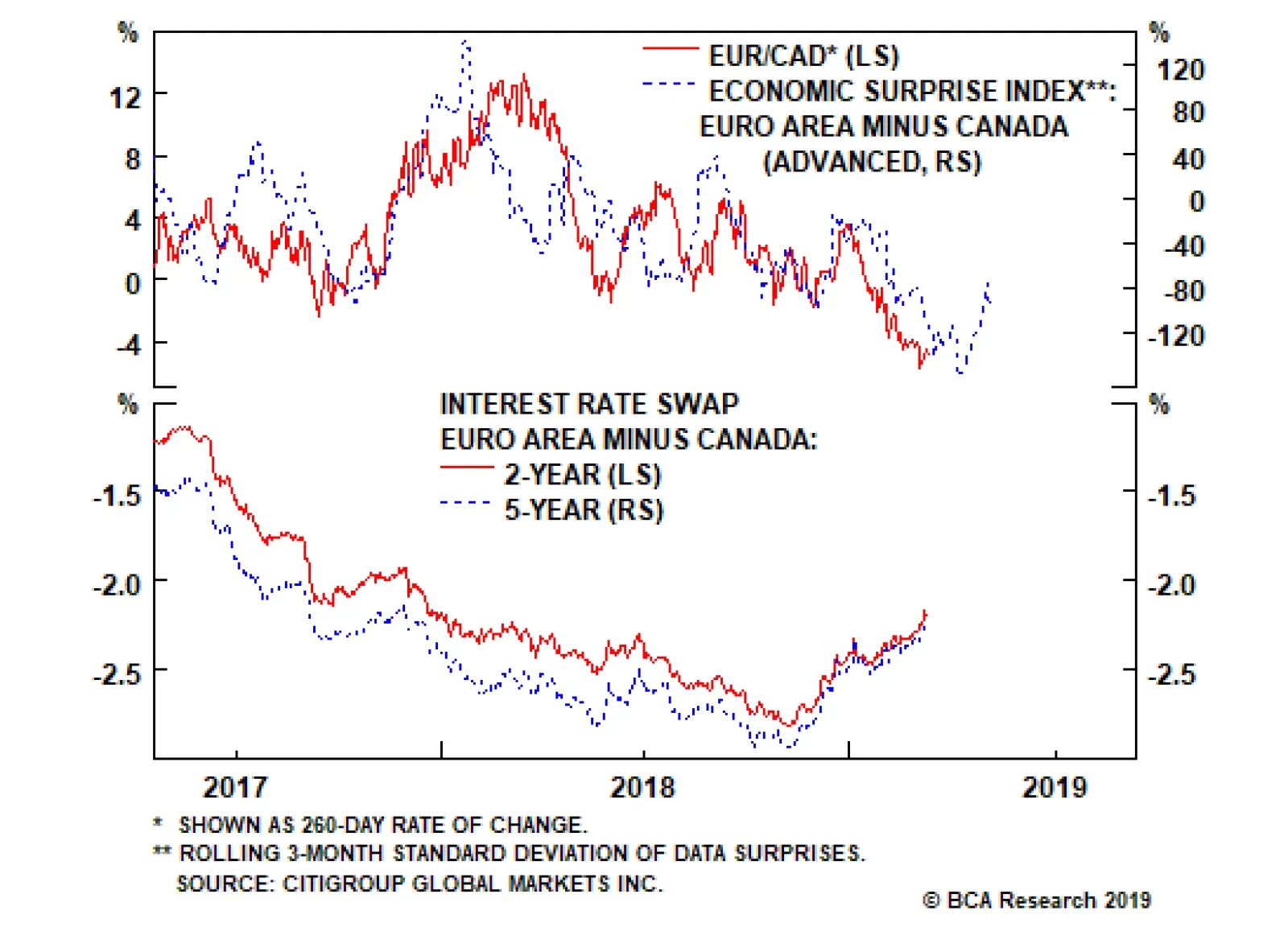

First, valuations and balance-of-payment dynamics favor the euro versus the CAD on a long-term basis. Second, we estimate there is more scope for long-term interest-rate expectations to rise in the euro area than in Canada.…

The European Central Bank left rates unchanged at Thursday’s policy meeting but the decision to launch a new Targeted Long Term Refinancing Operation (TLTRO III – or, in other words, cheap loans), could be paradoxically…