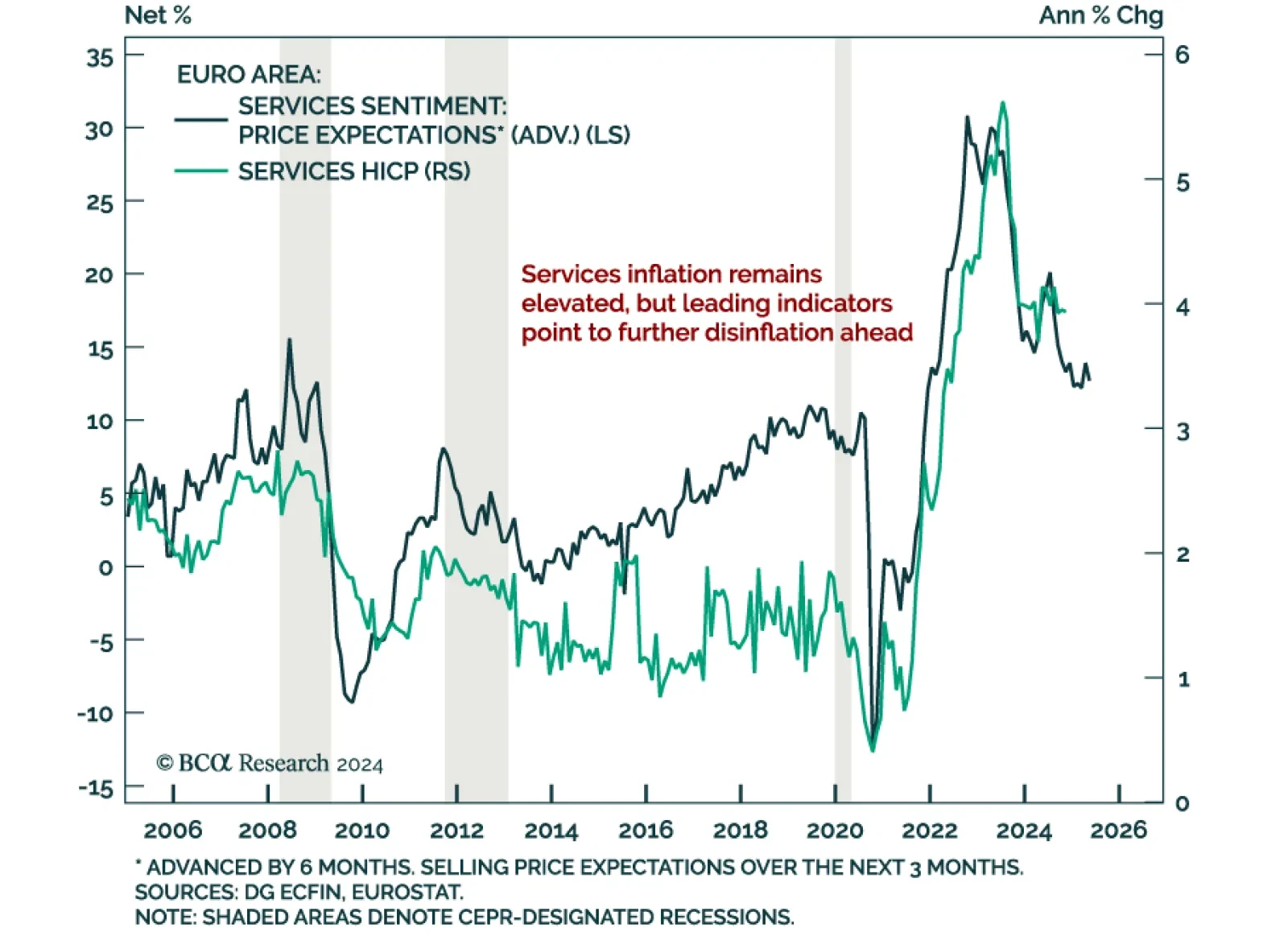

The November flash Eurozone inflation estimate met expectations, with headline HICP accelerating to 2.3% y/y from 2.0% in October, above the ECB’s target. Core inflation remained constant at 2.7%. At 3.9%, services…

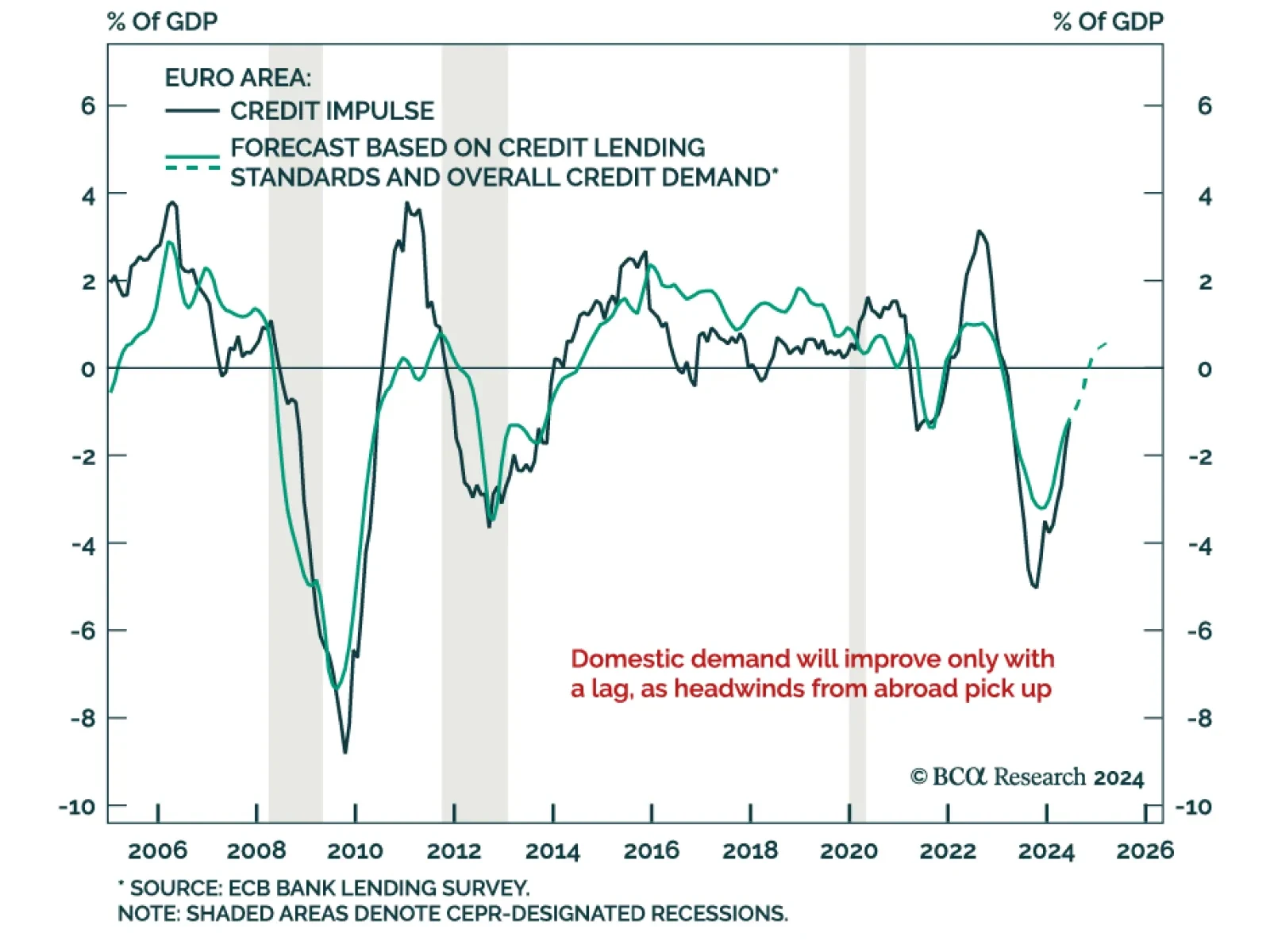

European monetary data printed in line with expectations in October, with M3 growing 3.4% y/y vs. 3.2% in September. Growth in private sector lending was unchanged at 1.2% y/y despite the recent easing in lending standards. We…

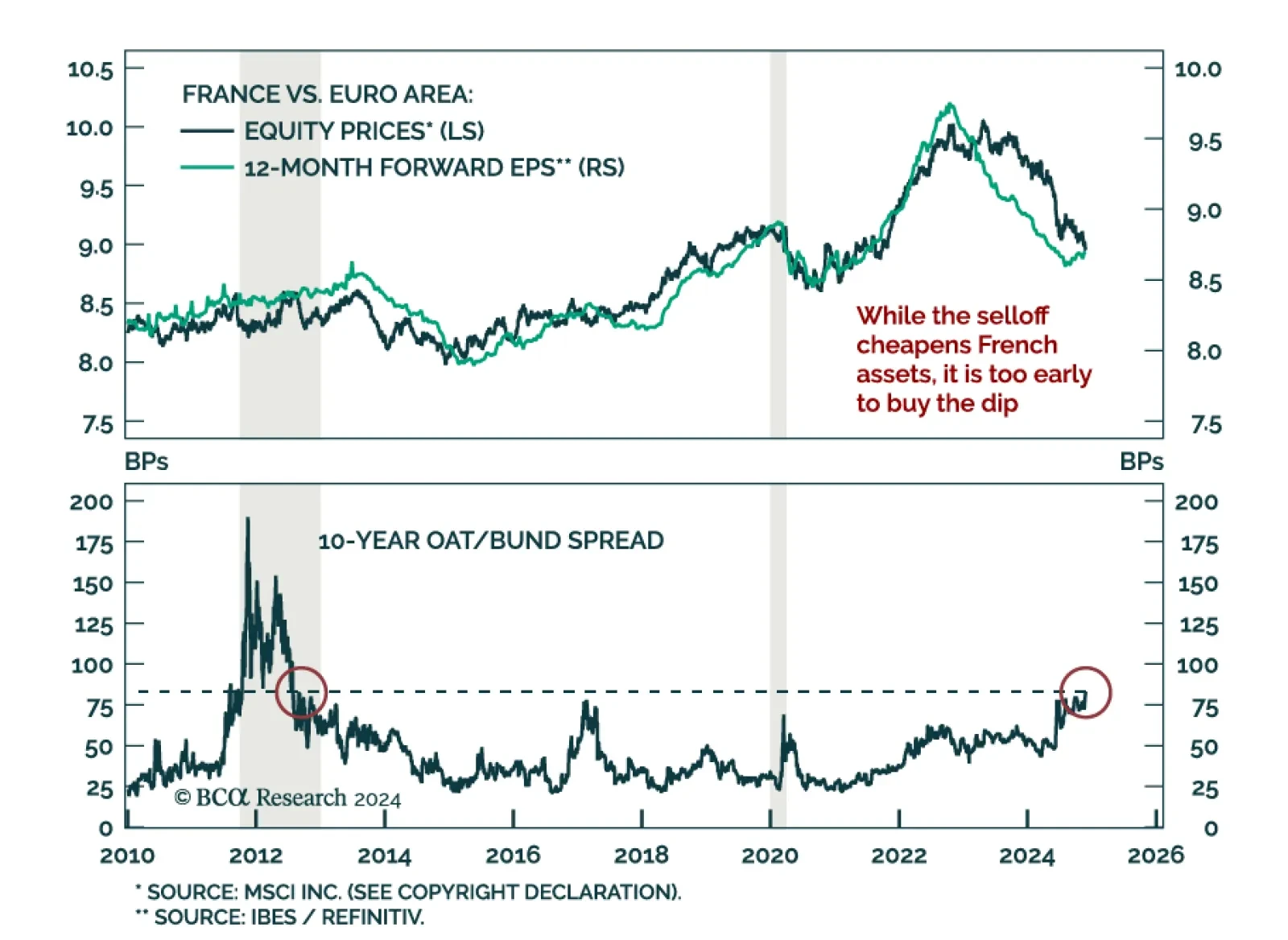

Investors focused on the flurry of cabinet nominations in the aftermath of the US election, but the US does not have a monopoly on political drama. France is going through turmoil of its own. This summer’s snap election…

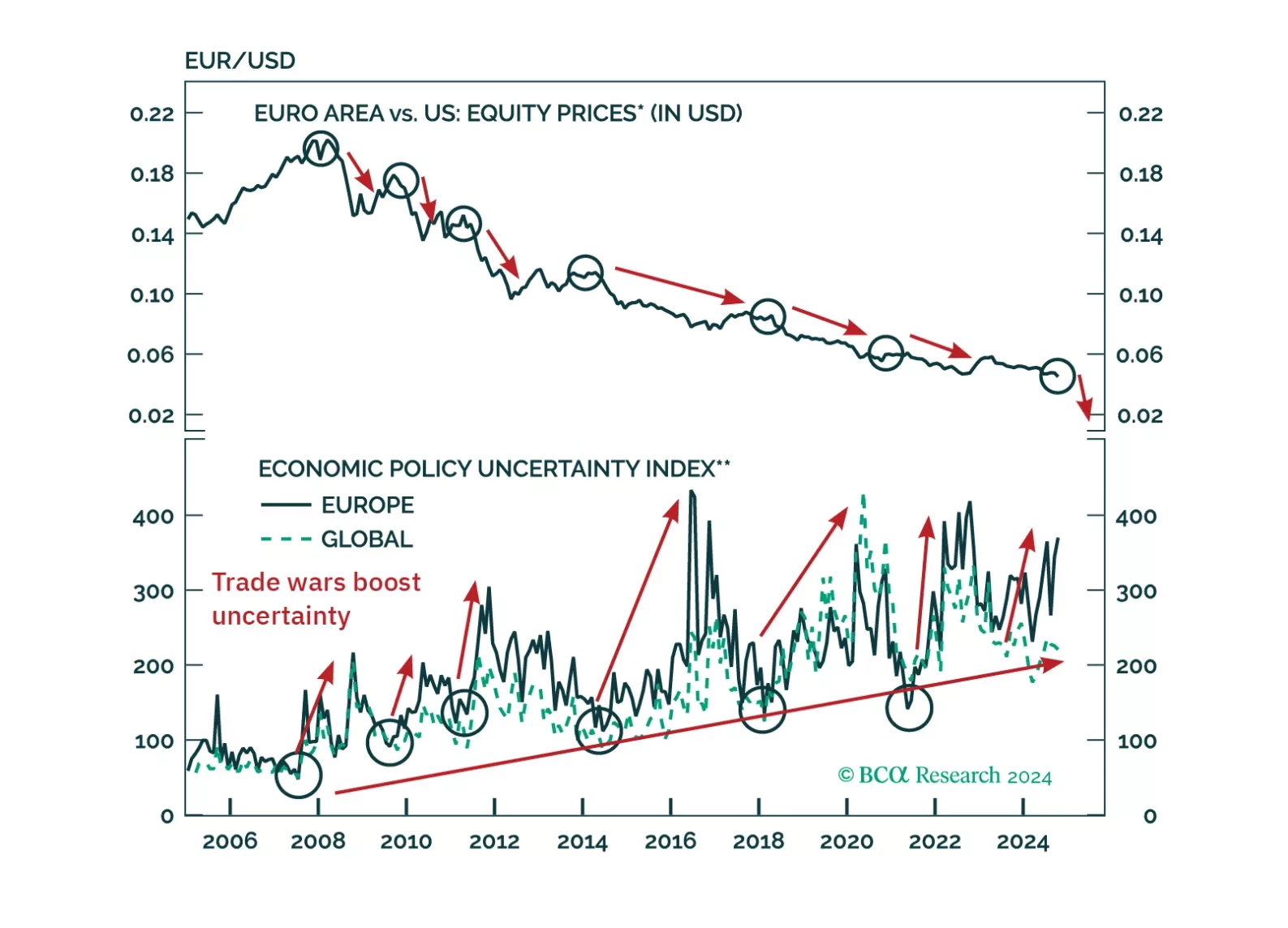

European assets and the euro have become oversold and are likely to rebound. Will this move be nothing more than a dead cat bounce leading to more weakness?

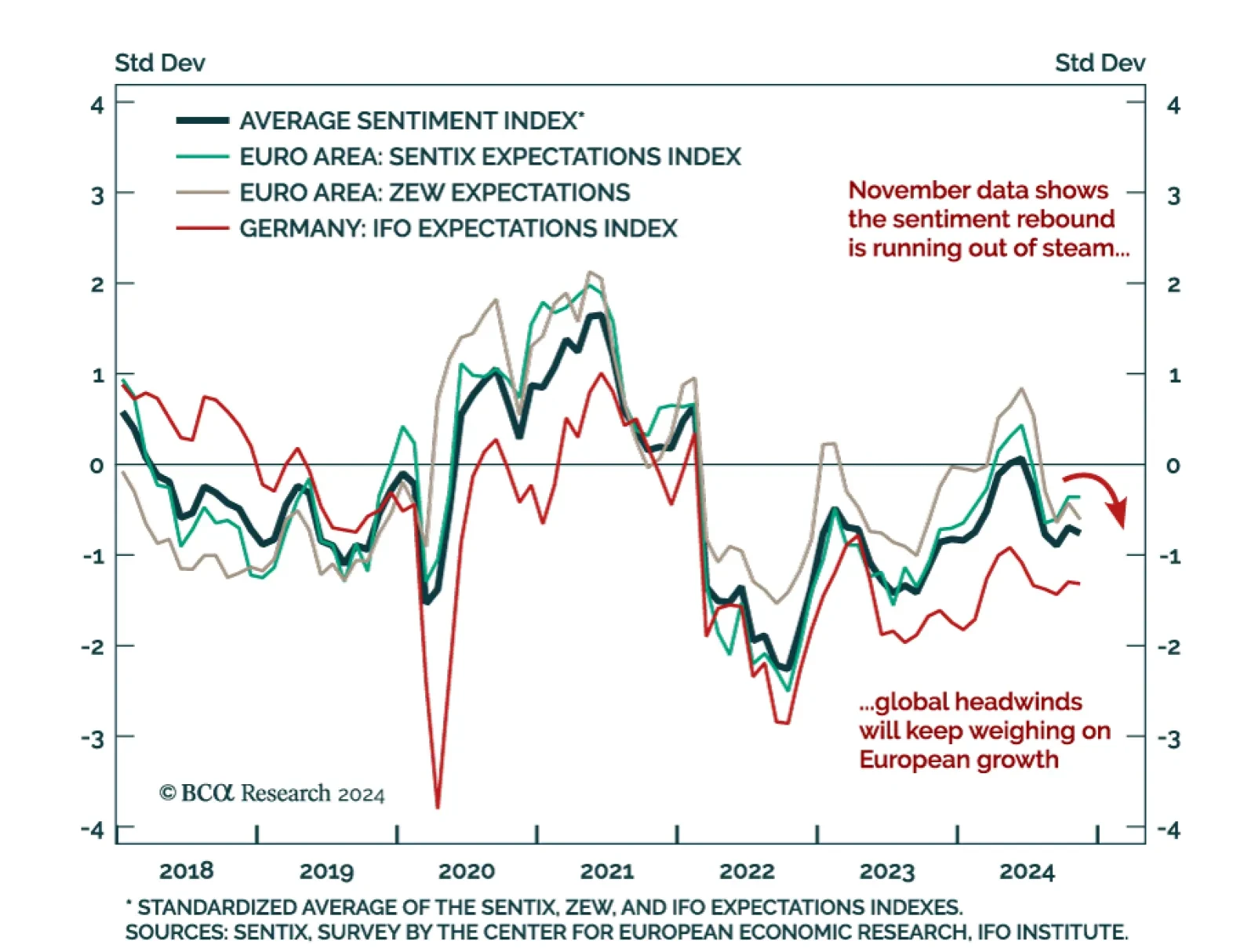

The November Ifo Business Climate index for Germany missed expectations, falling to 85.7 from 86.5 in October. Both subcomponents decreased, with the Current Assessment sliding 1.4 points to 84.3 and Expectations essentially flat…

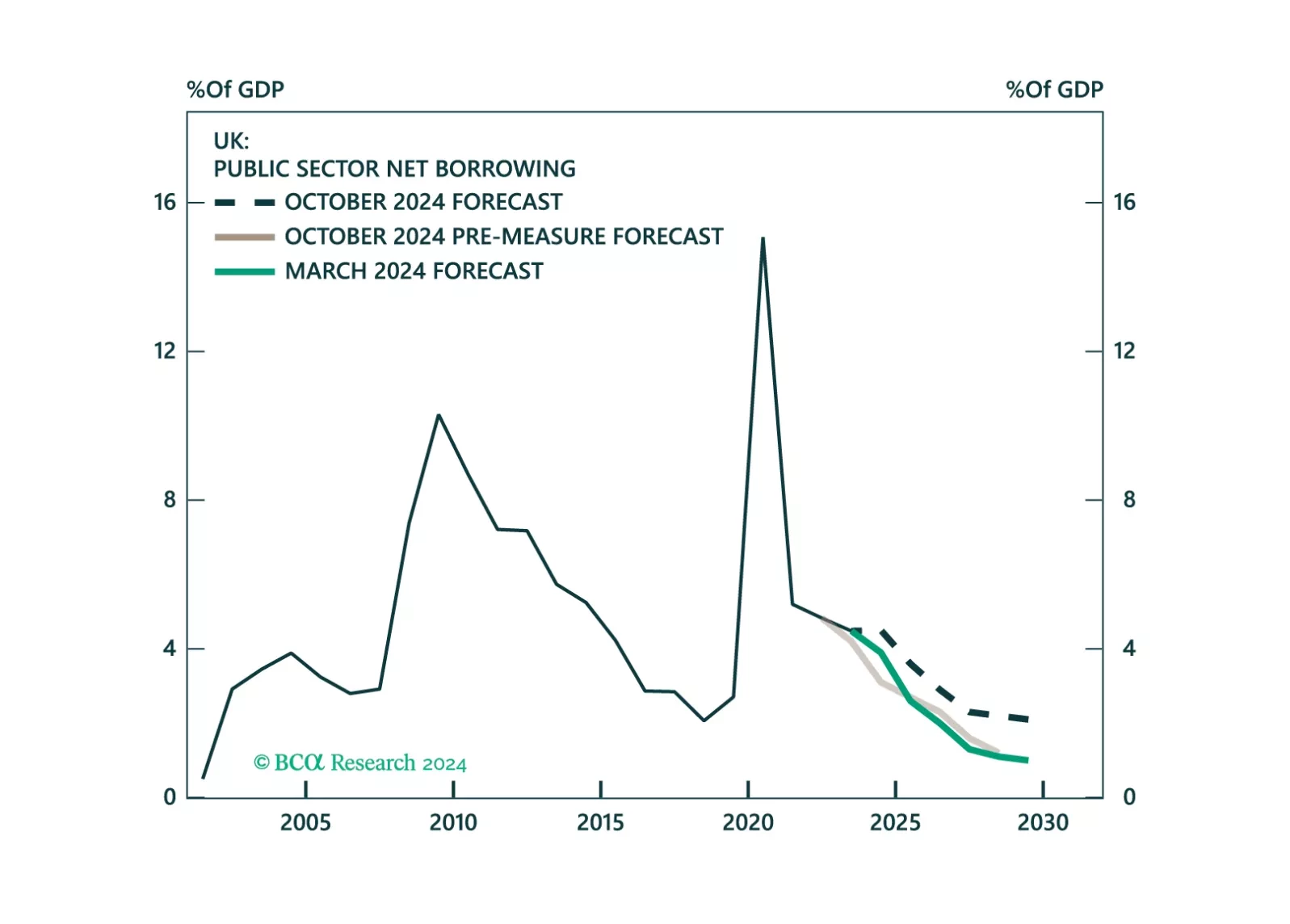

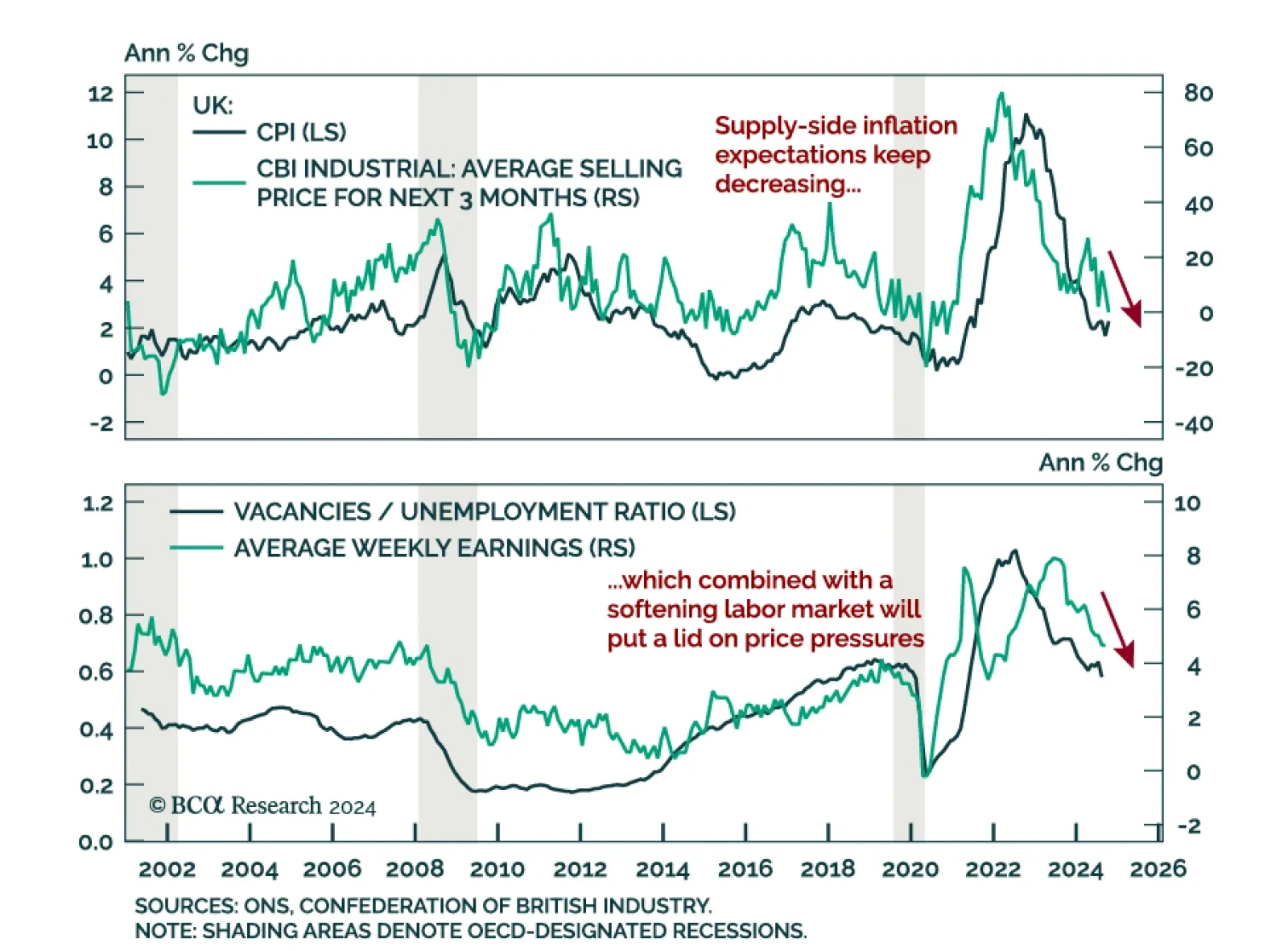

UK inflation was hotter than expected in October, rising to 0.6% m/m from being flat in September. Core inflation also ticked up, printing at 3.3% y/y vs. 3.2% a month prior. Services inflation remains elevated at 5.0% y/y.…

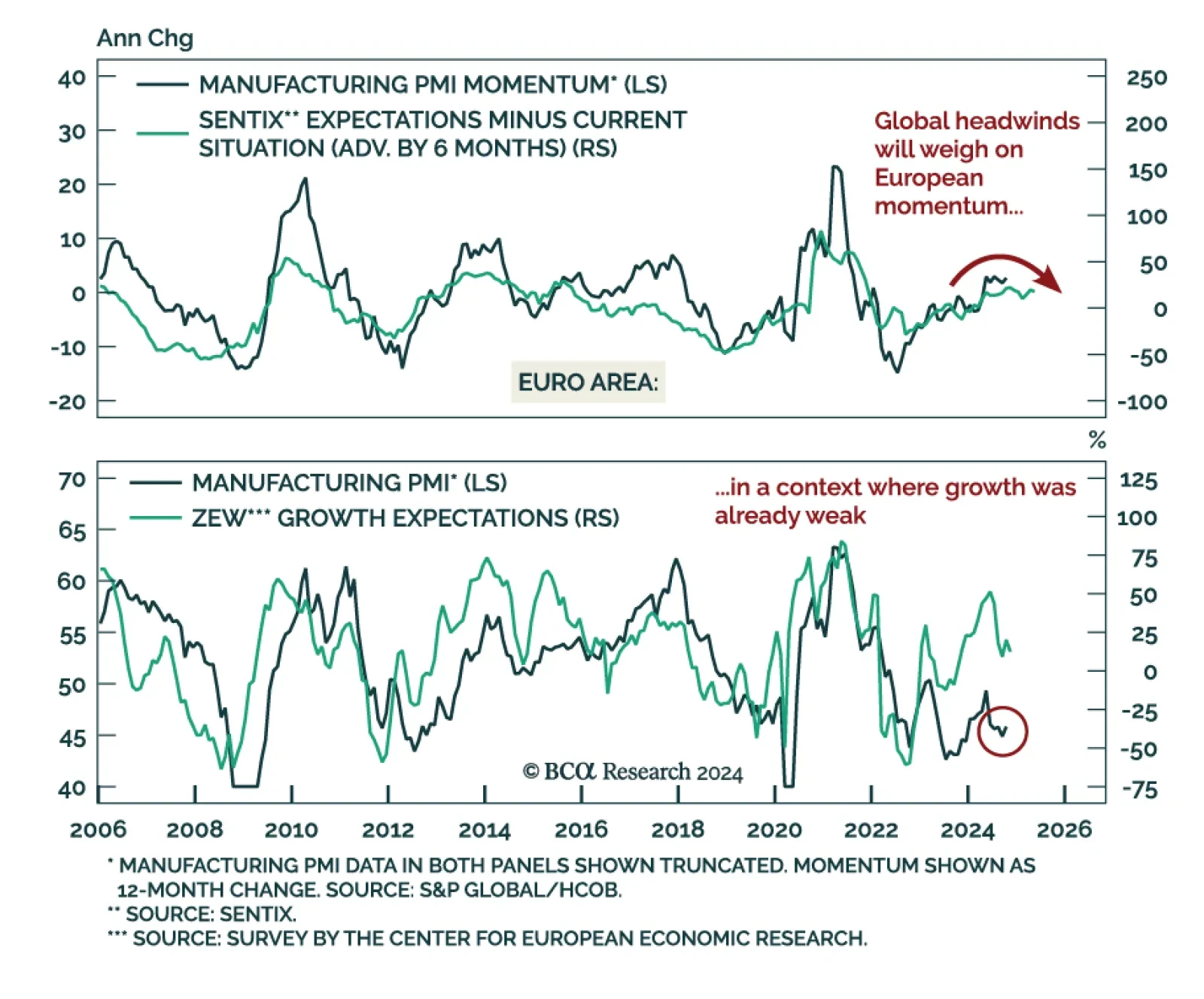

Economic expectations for Germany and the Eurozone disappointed, with the November ZEW decreasing to 12.5 from 20.1. The assessment of current conditions also worsened, implying the sentiment rebound from September will not be…

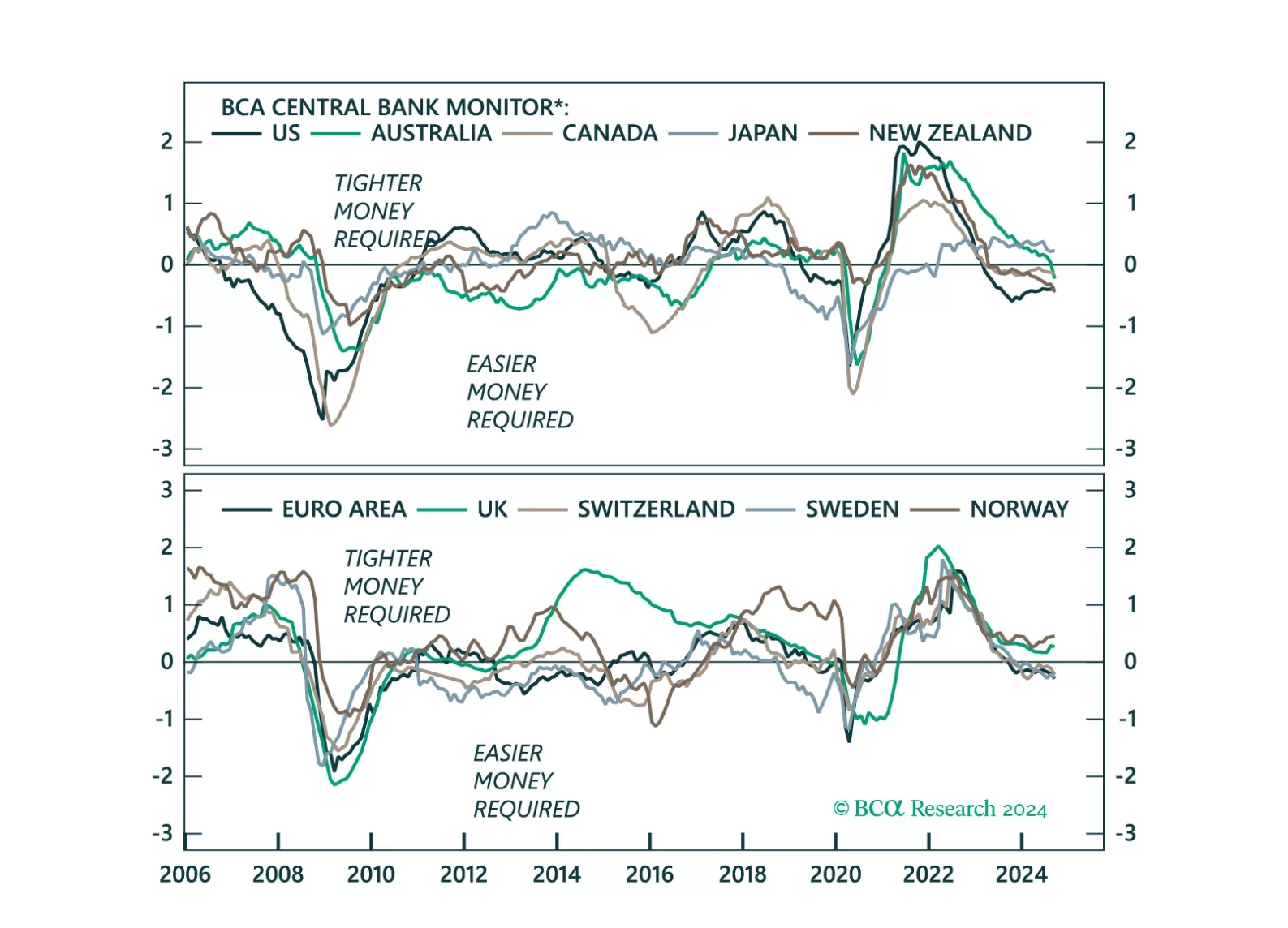

This week, we update our Central Bank Monitors (CBMs), that help us calibrate how monetary policy should be adjusted in developed-market economies. Our conclusion is that while overall, easier monetary settings are required, there a…

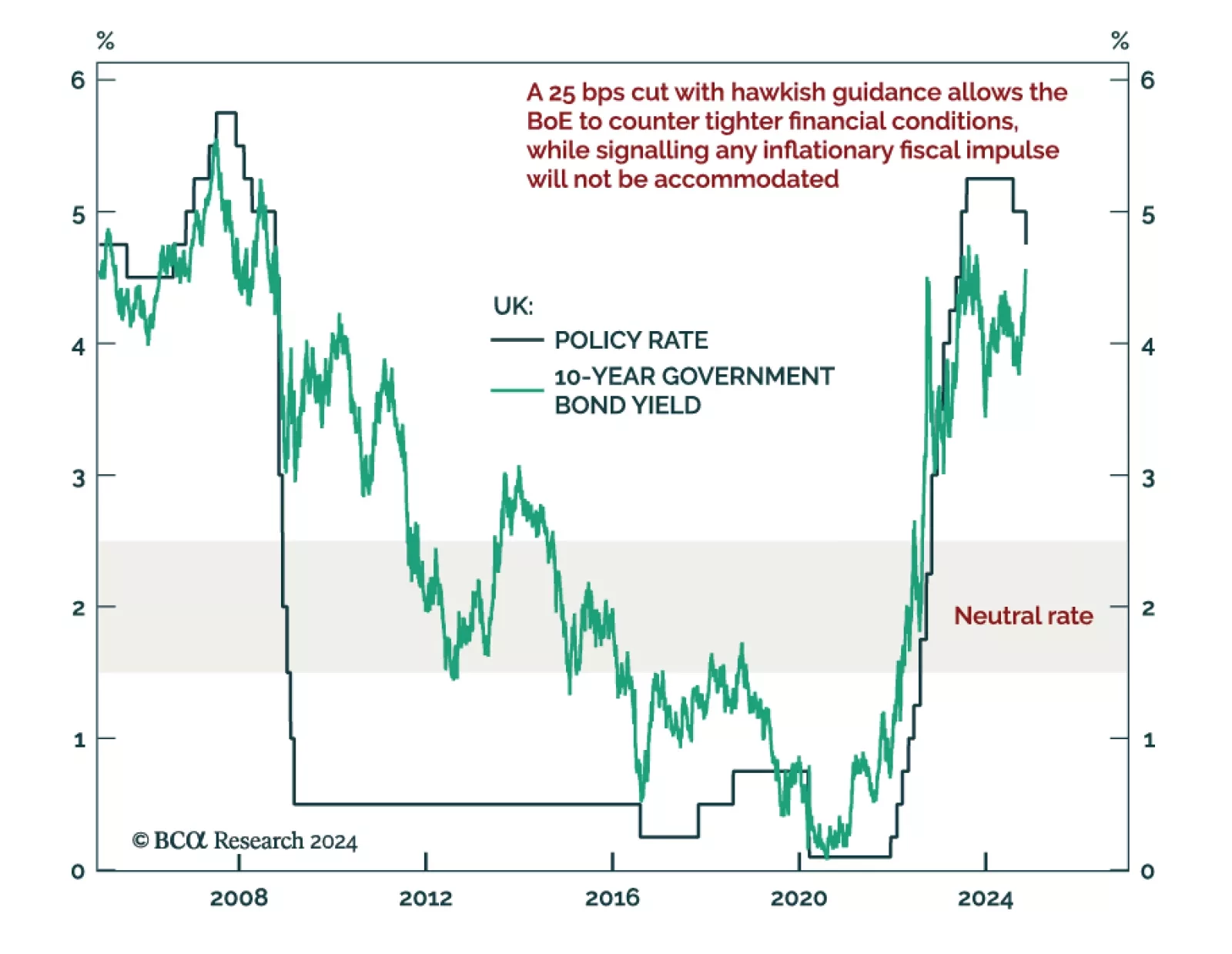

This Strategy Insight presents our view on today’s rate cut by the Bank of England as well as the budget announced by the UK government last week.

The Bank of England cut its policy rate in line with expectations to 4.75%, but it signaled a more gradual pace of cuts as it increased its inflation forecast following last week’s budget. A 25 bps cut with hawkish…