Feature For a decade, mainstream economics has prescribed remedies for sluggish growth in the euro area on the basis of three articles of blind faith. First, that the ailment arises from structural impediments to growth; second, that in…

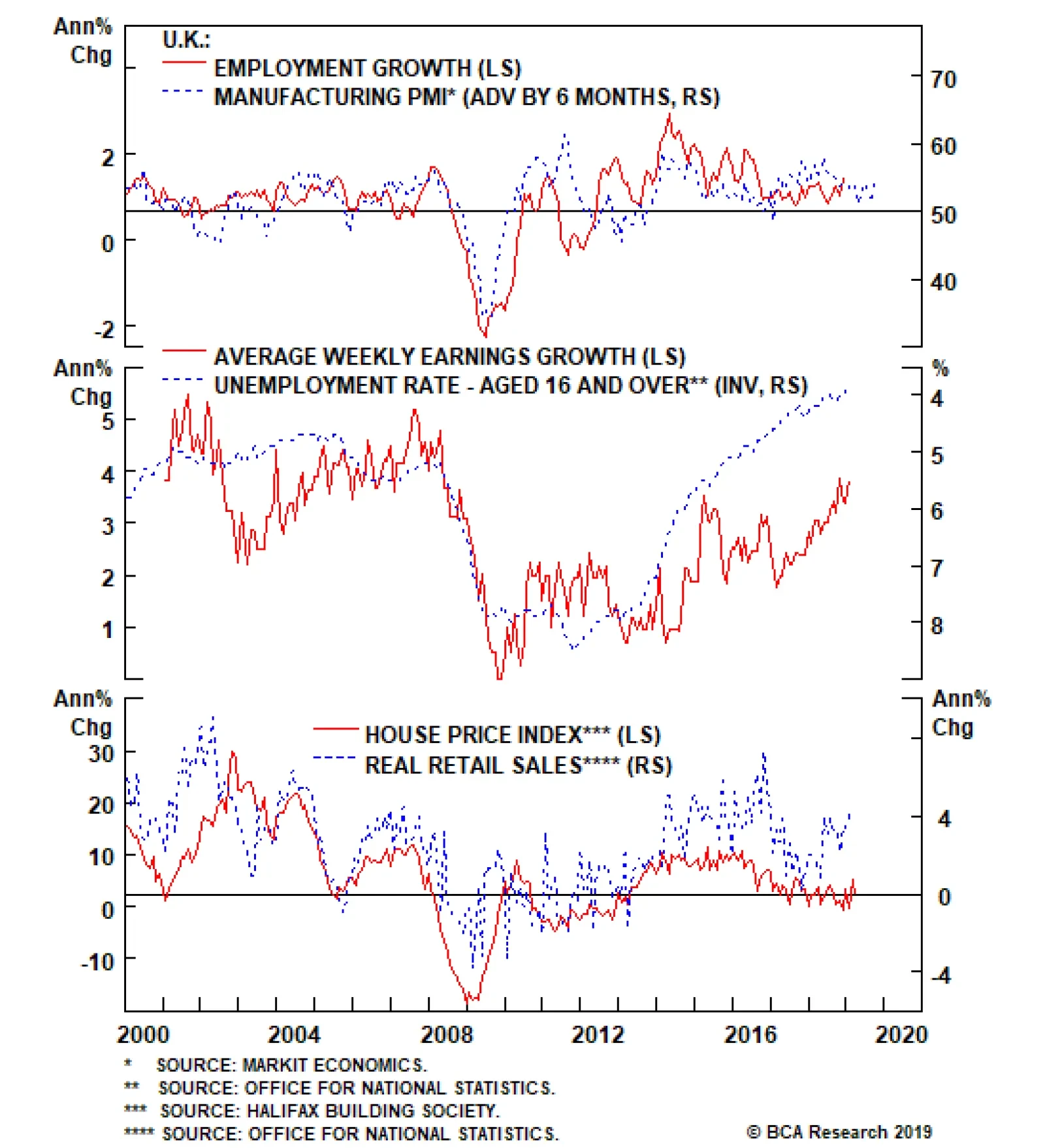

Our Foreign Exchange Strategy team’s simple observation is that while the pound is sitting exactly where it was after the 2016 referendum results, the odds of a hard Brexit have significantly fallen since then. We are…

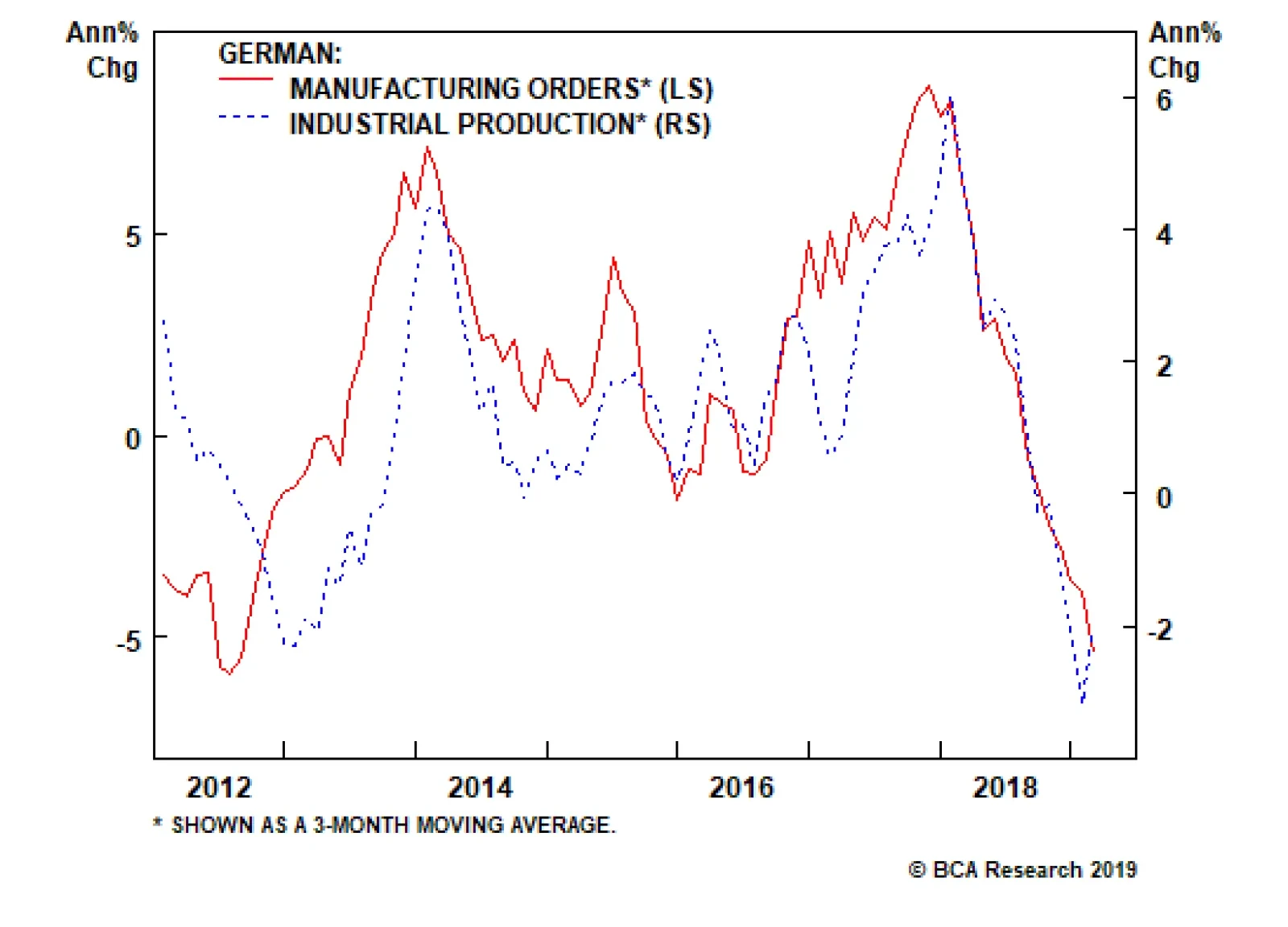

Understand that the all-important impulses to an economy do not come from the level of the bond yield, oil price, net exports, inventories, and so on. The impulse always comes from the change in these metrics. And as the metrics…

Yesterday, the German factory orders sent a chill down the spine of anyone with a positive disposition toward European growth, as they fell 8.4% on an annual basis in February. However, foreign orders drove this meltdown,…

Highlights Most currency pairs continue to trade toward the apex of tight wedge formations. History suggests major breakouts could be imminent. While the trade-weighted dollar has historically tended to be the best performing…

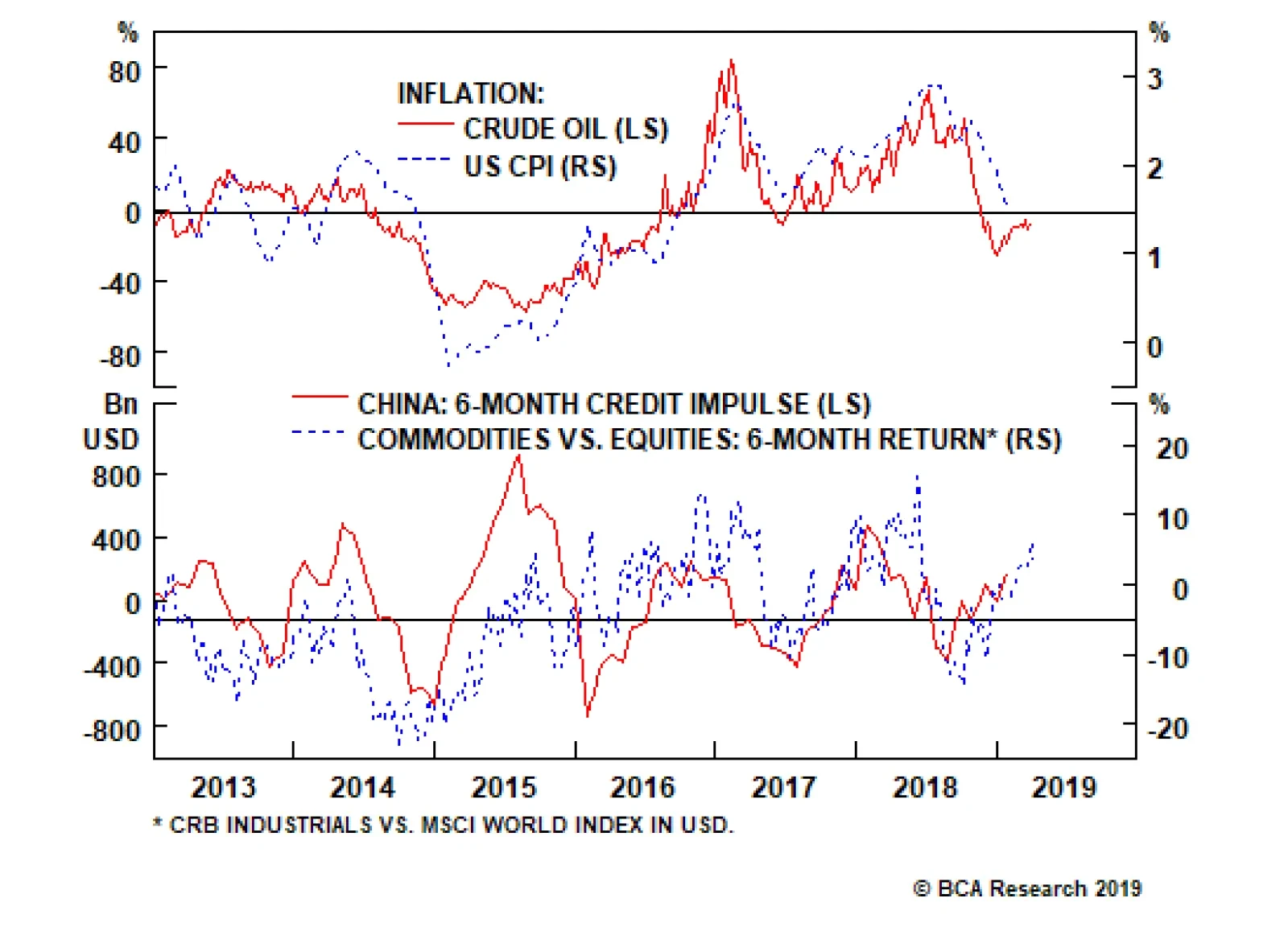

Highlights Maintain a pro-cyclical stance for the time being – overweight equities versus bonds, long commodities, overweight industrial equities, and underweight healthcare equities. But be warned, absent a continued decline in…

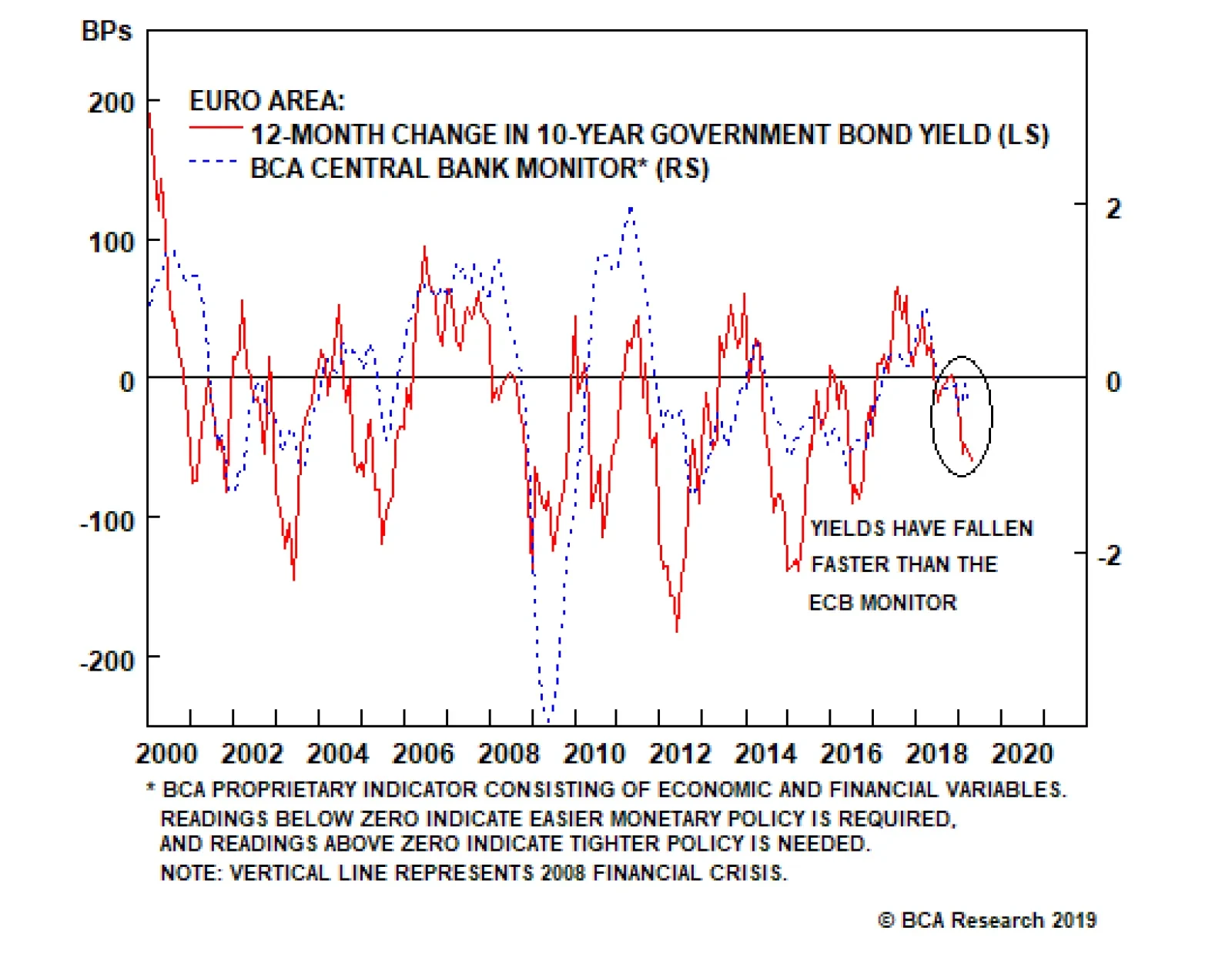

Our Global Fixed Income Strategy team’s European Central Bank (ECB) Monitor is slightly below the zero line, signaling no real need for any change to euro area monetary policy. The sharp slowing of economic growth last year…

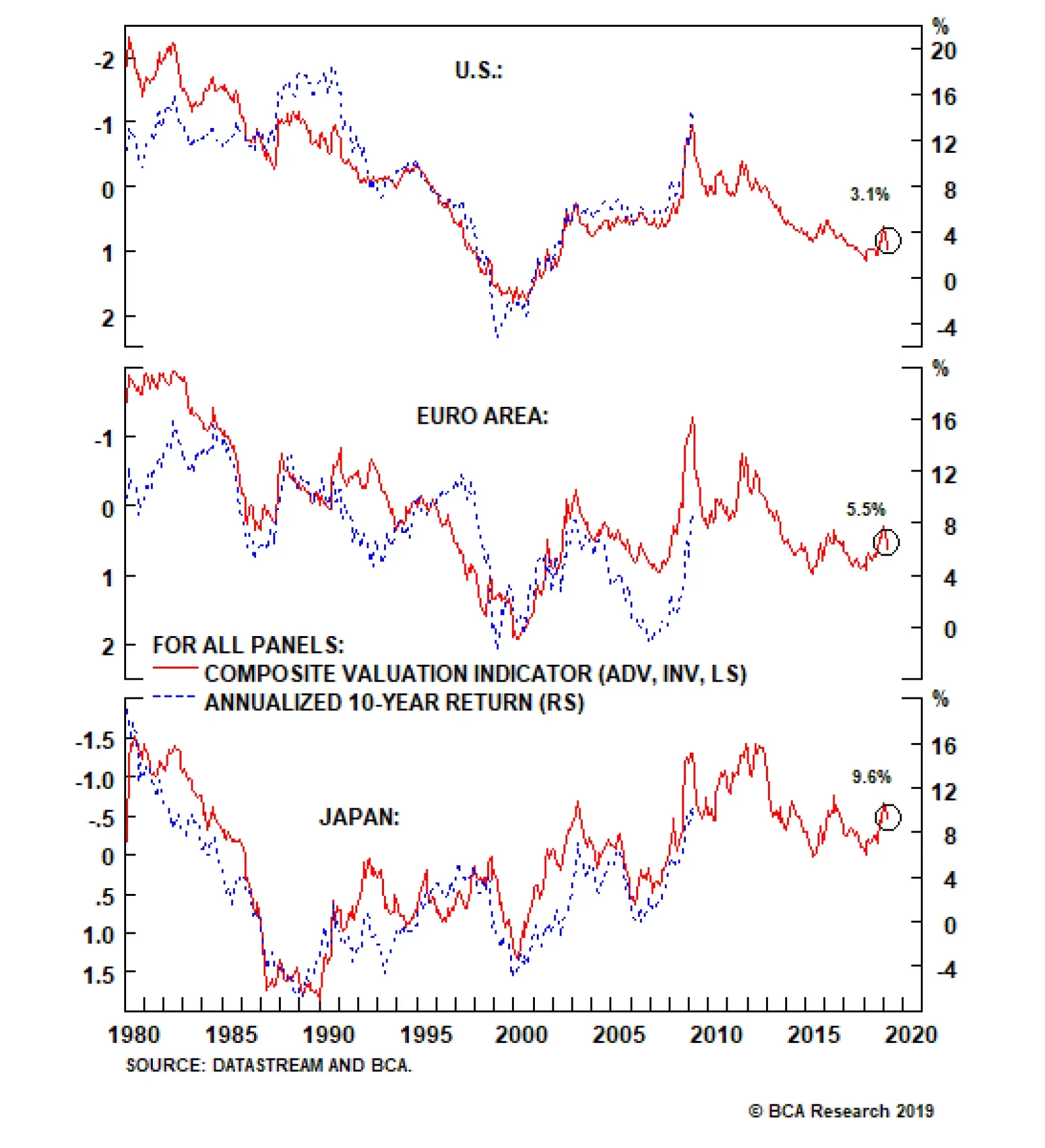

Private capital will begin stampeding toward the exits when the return on invested capital (ROIC) for U.S. assets falls below their cost of capital. For investors with a long horizon, this may already be happening. During bull…

Highlights In this Weekly Report, we present our semi-annual chartbook of the BCA Central Bank Monitors. All of our country Monitors are now forecasting monetary policy on hold, apart from Australia and New Zealand where looser policy is…

Highlights U.S. growth remains robust, despite some temporary softness in recent months. Ex U.S., growth continues to fall but, with China probably now ramping up monetary stimulus, should bottom in the second half. Central banks…