Highlights The recent dovish shift in tone from central banks around the world is here to stay this year, providing support for global growth. As a result, stock prices will benefit from a combination of easy policy and rebounding…

Highlights The short-term trade is to overweight the DAX or Euro Stoxx 50… …versus German bunds or the S&P 500. These trades have outperformed since late last year and can continue to do so for a while longer. But…

Highlights So what? Quantifying geopolitical risk just got easier. Why? In this report we introduce 10 proprietary, market-based indicators of country-level political and geopolitical risk. Featured countries include…

Highlights Chinese credit origination surpassed expectations in March. Credit growth is now clearly trending higher, and the latest data suggest that economic activity is rebounding. This bodes well for global growth. The conventional…

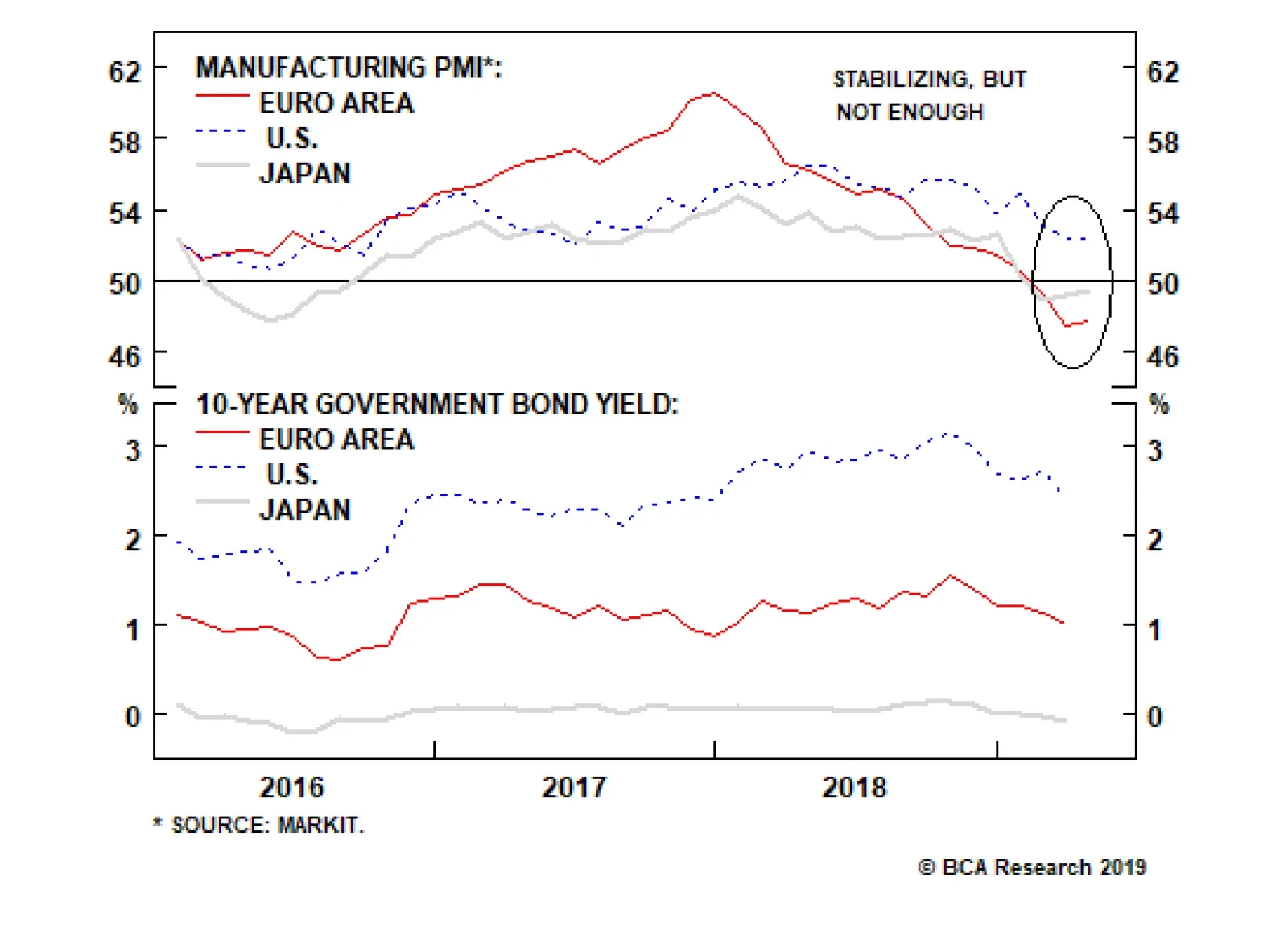

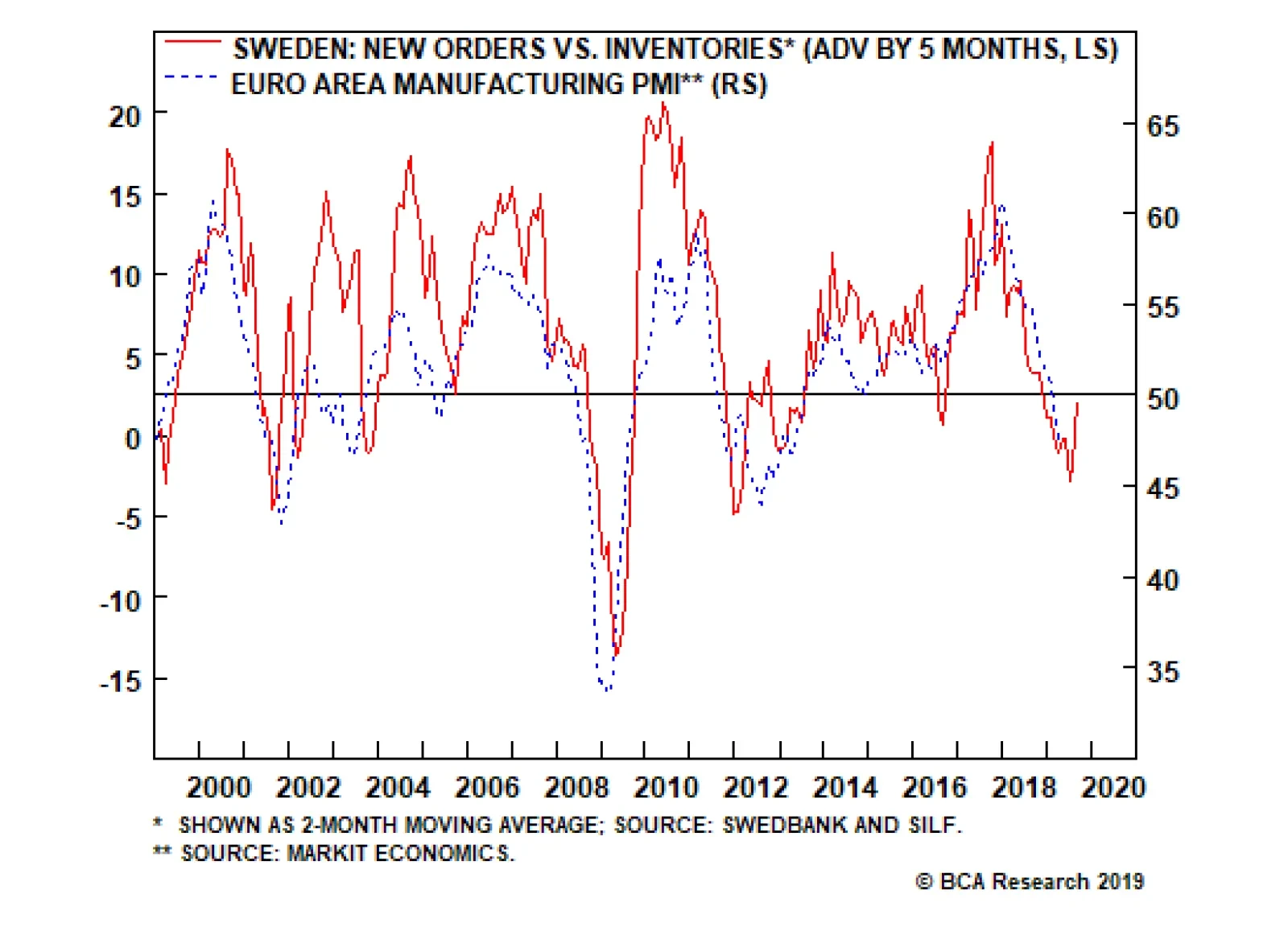

The flash estimates for the Eurozone manufacturing PMI moved up in April to 47.8 from 47.5. In Japan, they rose to 49.5 from 49.2. In the U.S, they were stable at 52.4. Despite this stabilization, bond yields weakened and the…

Unsurprisingly, incoming data has been weak of late, which the ECB (like other central banks) blamed on the external environment. It did fall short of speculation that it will introduce a tiered system for its marginal deposit…

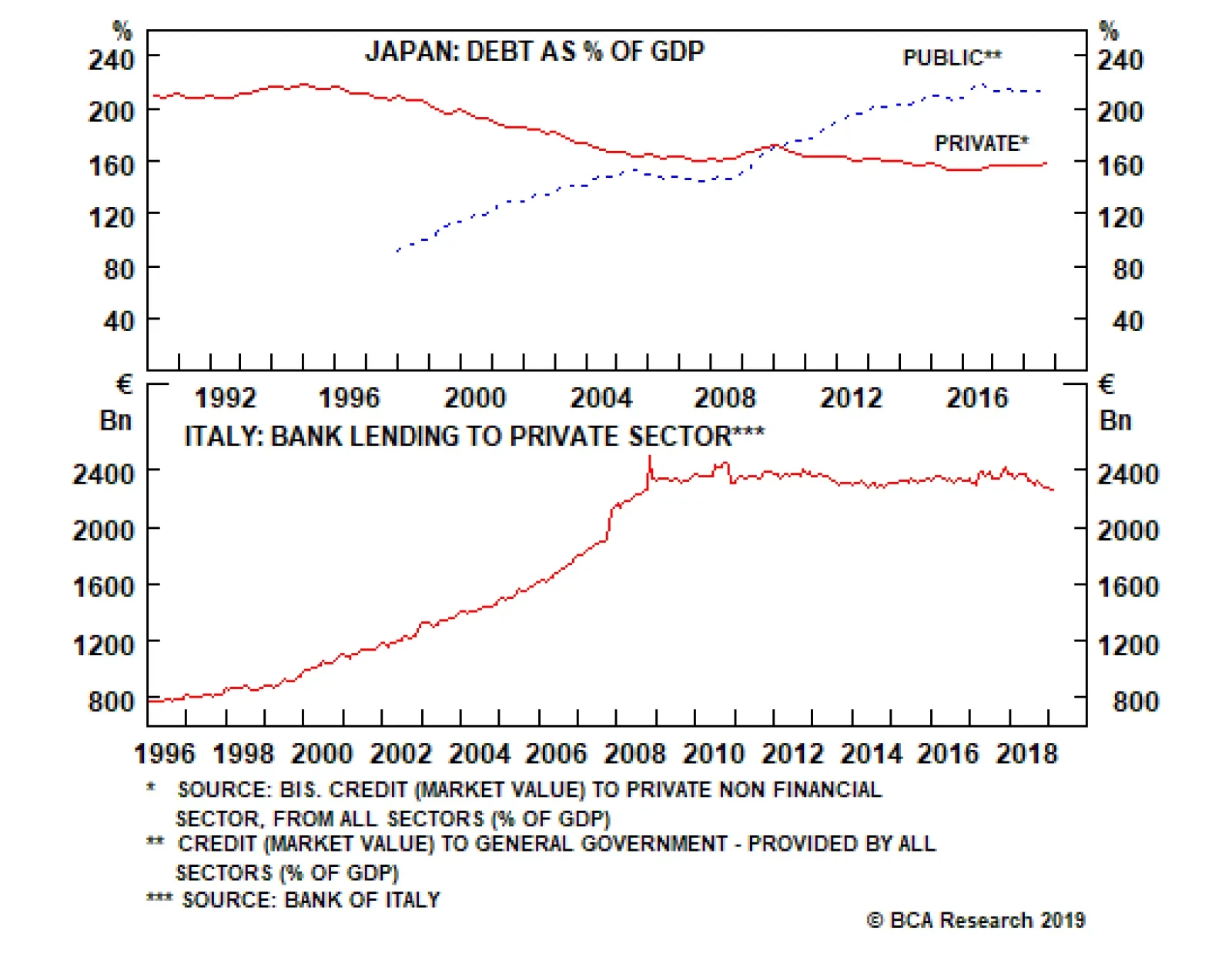

Welcome to Italy! After the 2008 global financial crisis, Italian banks’ balance sheets were left unrepaired and undercapitalized. For an individual bank whose solvency is impaired, the right thing to do is shrink its…

Highlights Evidence continues to mount that the Chinese economy is in a bottoming process. This suggests the path of least resistance for the RMB is up. Meanwhile, as the U.S. and China move closer to a trade deal, any geopolitical…