First, up until the last decade, Japan benefited from a robust global economy where trade grew strongly. Europe is entering its second decade of low growth in an environment of much weaker global economic activity. Second,…

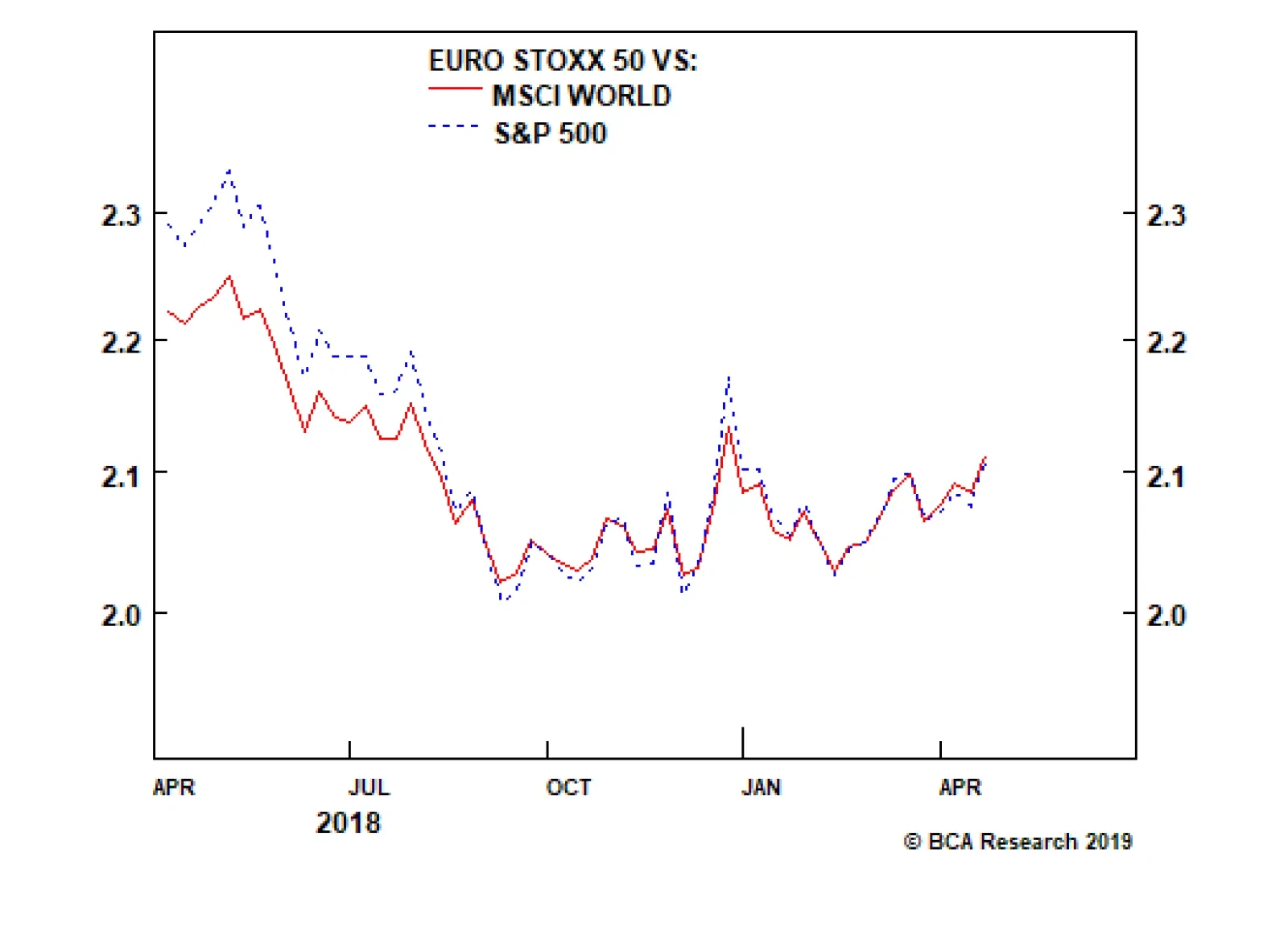

Highlights Open an equity market relative overweight to Europe versus China. Upgrade Denmark to neutral. Downgrade the Netherlands to underweight. Maintain Switzerland at overweight. With the Euro Stoxx 50 now up almost 20 percent…

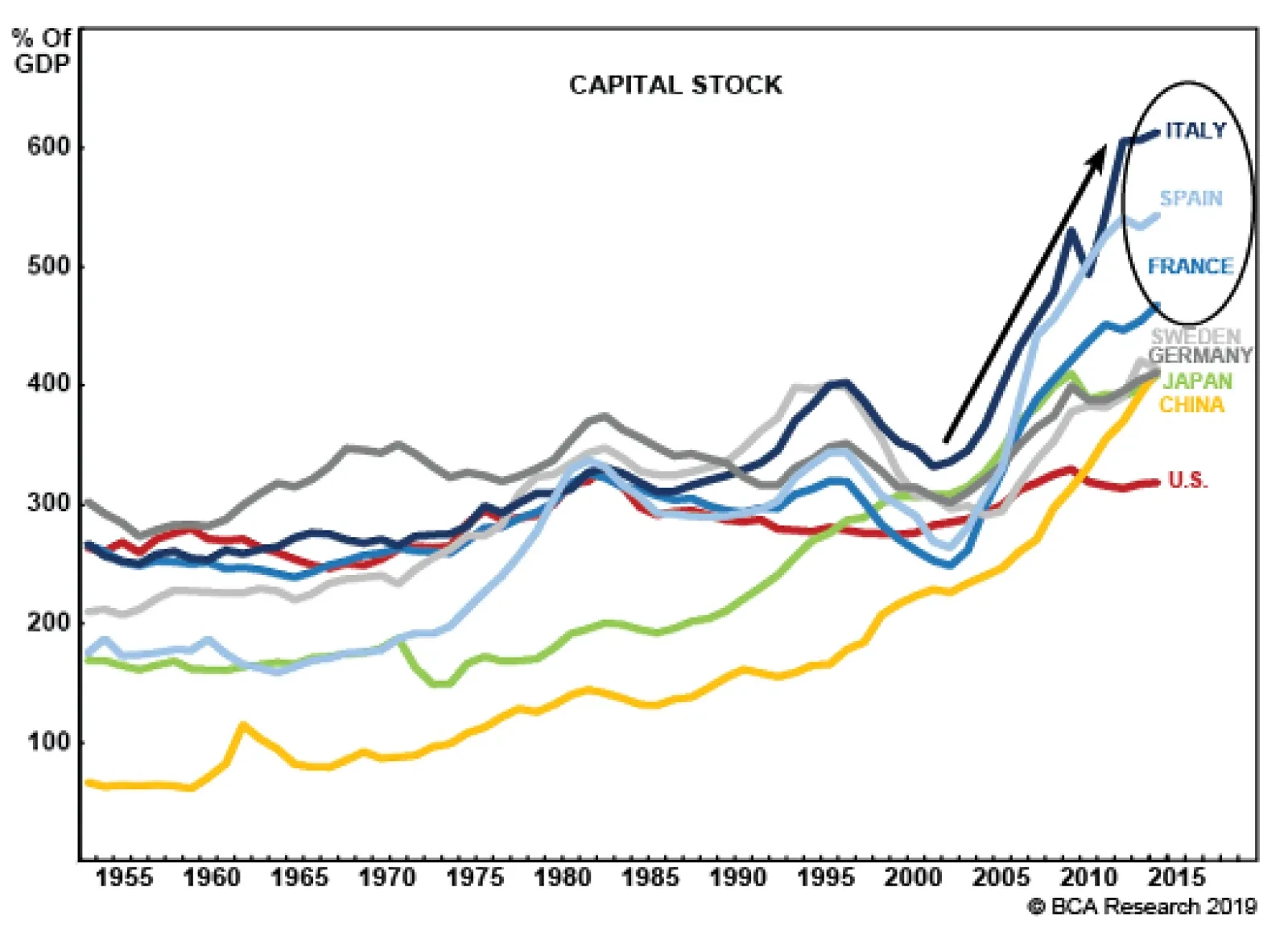

Like Japanese businesses 30 years ago, European firms have large debt loads. Another problem is the lack of capex opportunities in Europe. Why does our Bank Credit Analyst service make this assertion? The return on assets in…

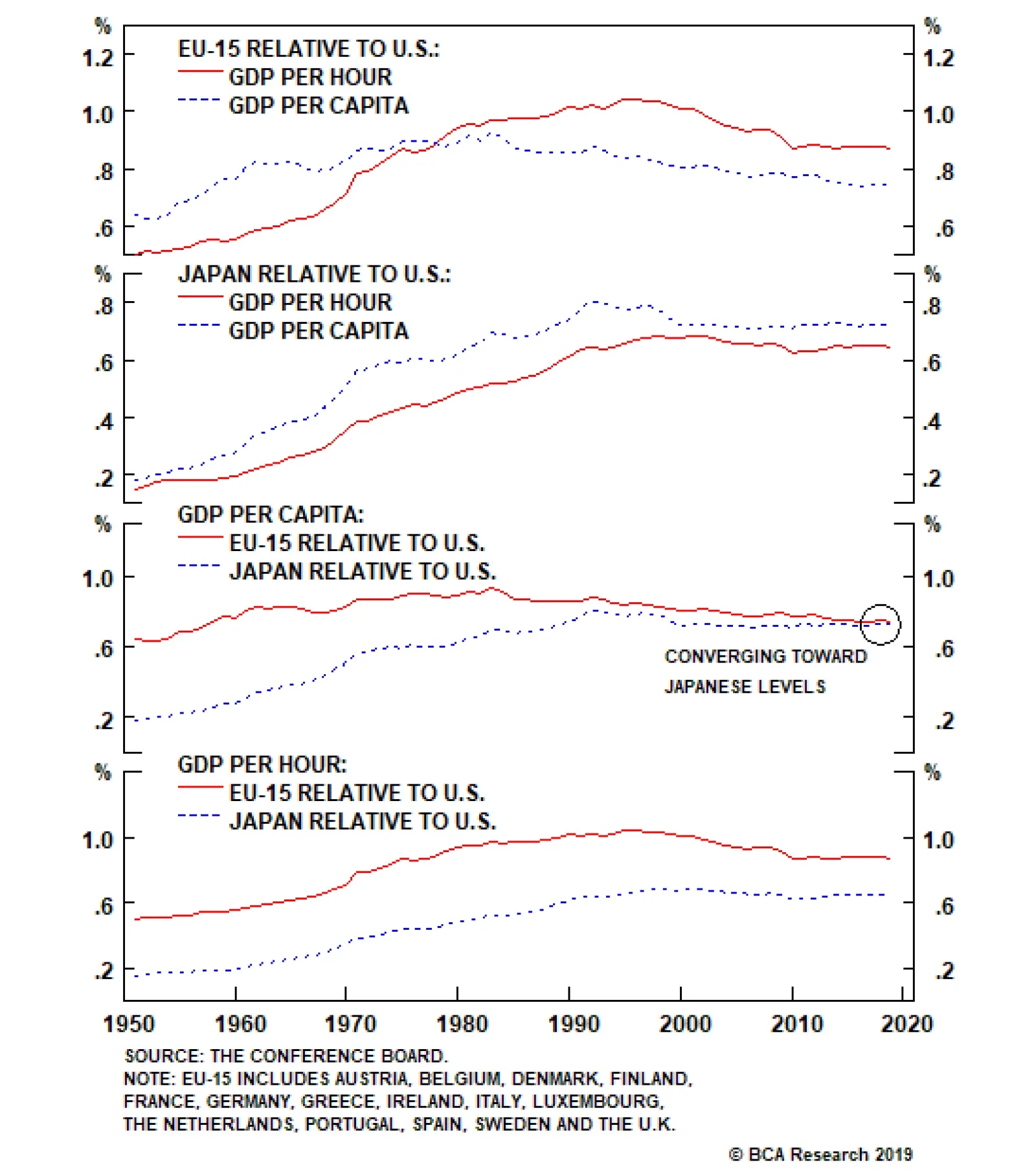

The second factor weighing on European asset utilization and returns is the poorer level of labor productivity. From the 1950s to the early 1980s, European GDP per worker rose relative to the U.S., albeit peaking at 92% of the…

It’s official, the Italian technical recession is over. Italian GDP growth moved back into positive territory in the first quarter. Additionally, Spanish GDP growth rebounded to 0.7% on a quarterly basis, or 2.4% year-on-…

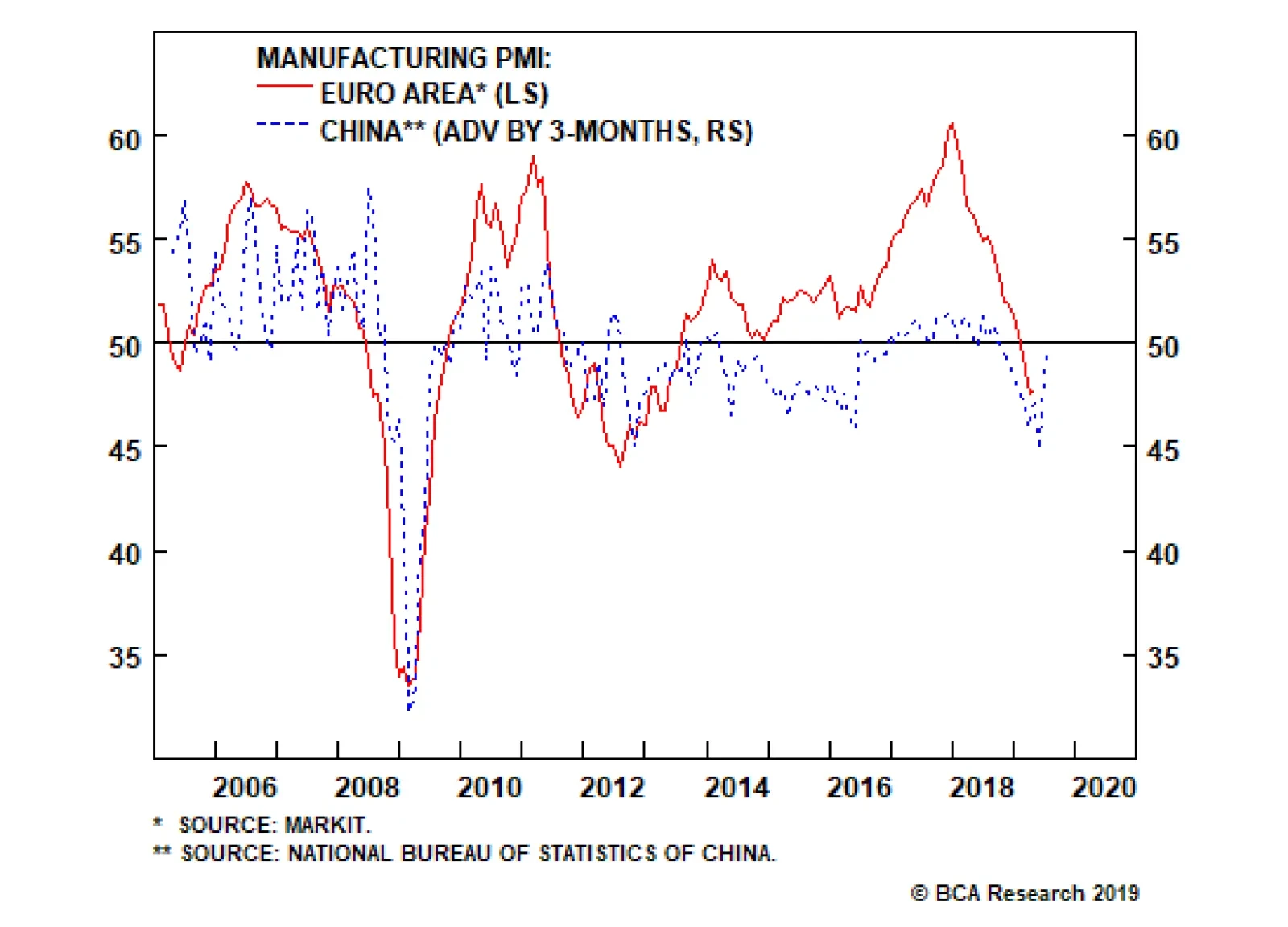

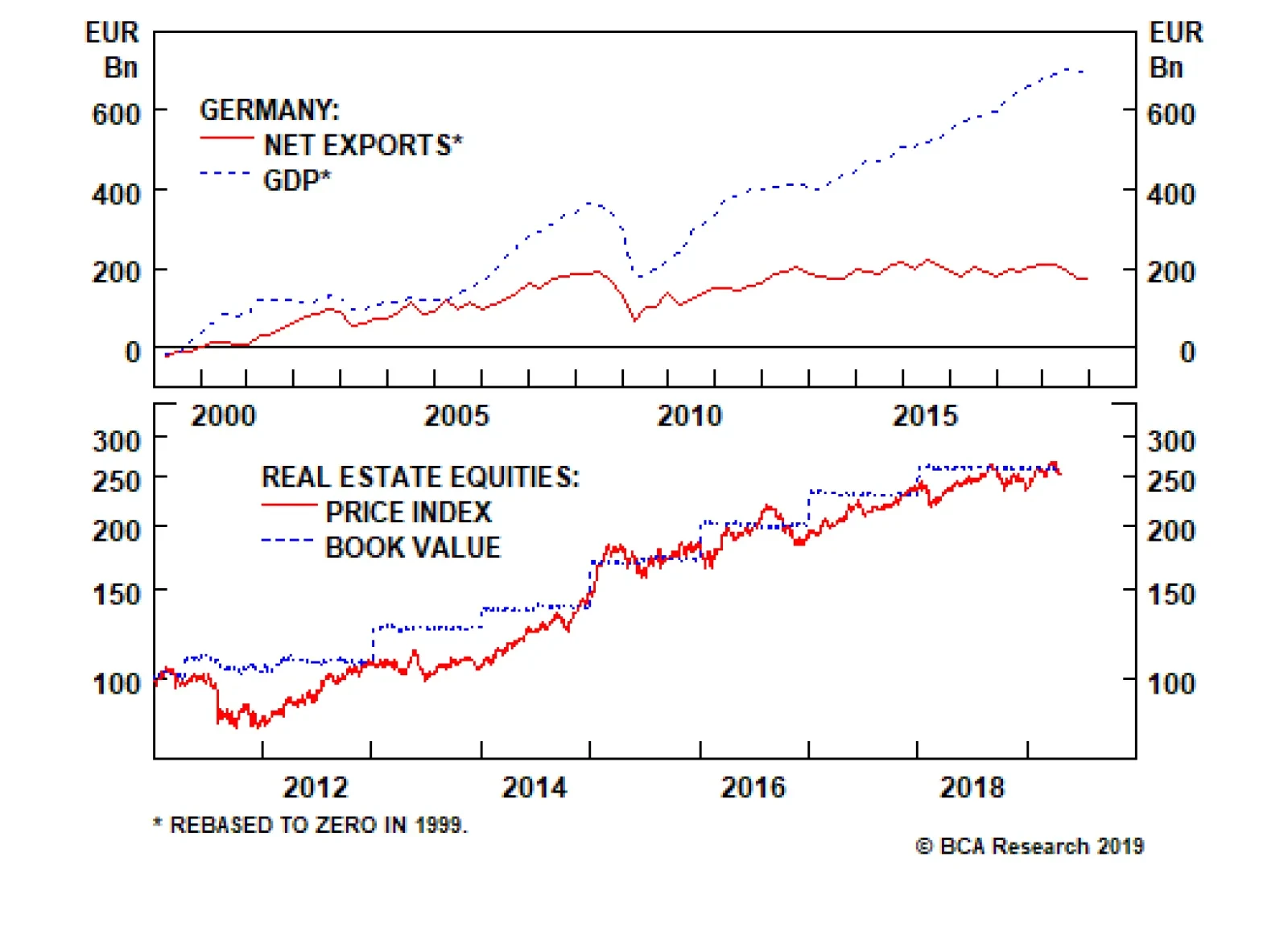

Here’s the paradox: while the level of German exports is very high, it has been flat-lining at this elevated level since 2012. Hence Germany is no longer deriving any structural growth from its export sector. Germany…

Interestingly, emerging markets (EM) versus developed markets (DM) has followed a near carbon copy profile, albeit the outperformance was front-end loaded. Can this continue? Recent history is not very encouraging. Since the…

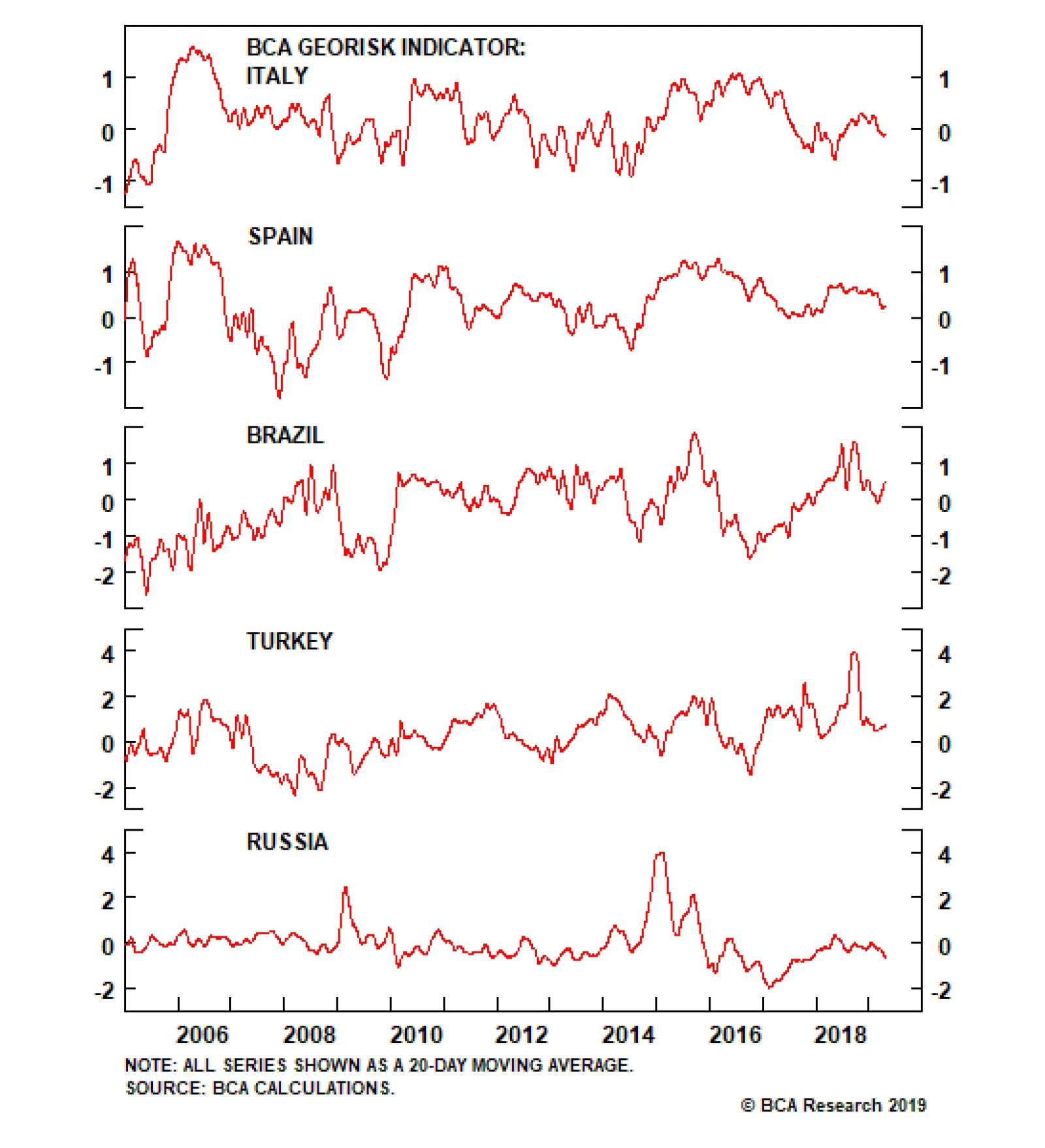

Investor surveys show that the majority of investors’ top concerns are political or geopolitical in nature. Yet there is limited research devoted to quantifying these risks. The most prominent techniques involve tallying…

Highlights Central bankers appear to be in a rush to boost inflation expectations before the next economic downturn. This in practice should be stimulative for the global economy. Historically, currencies of small, open economies are…

Highlights The U.S. dollar will ultimately reach fresh cycle highs, but not before going through a weak phase starting this summer that could last 12 months. We closed our long DXY trade for a carry-adjusted return of 16.4% last week…