Highlights The trade war escalation is just the catalyst and not the cause of the market correction. This year’s absolute double-digit returns have most likely already been made during the early-2019 star alignment of near-…

Highlights U.S. Bond Strategy: U.S. Treasury yields are already priced for rate cuts and lower inflation, even as U.S. (and global) growth indicators are improving and U.S. realized inflation has ticked up. Maintain a below-benchmark…

This concept is simple to understand, but difficult to implement. It is far easier to get lost in rumor intelligence-driven analysis of political consultants and journalists who pass on the cocktail party chatter insights…

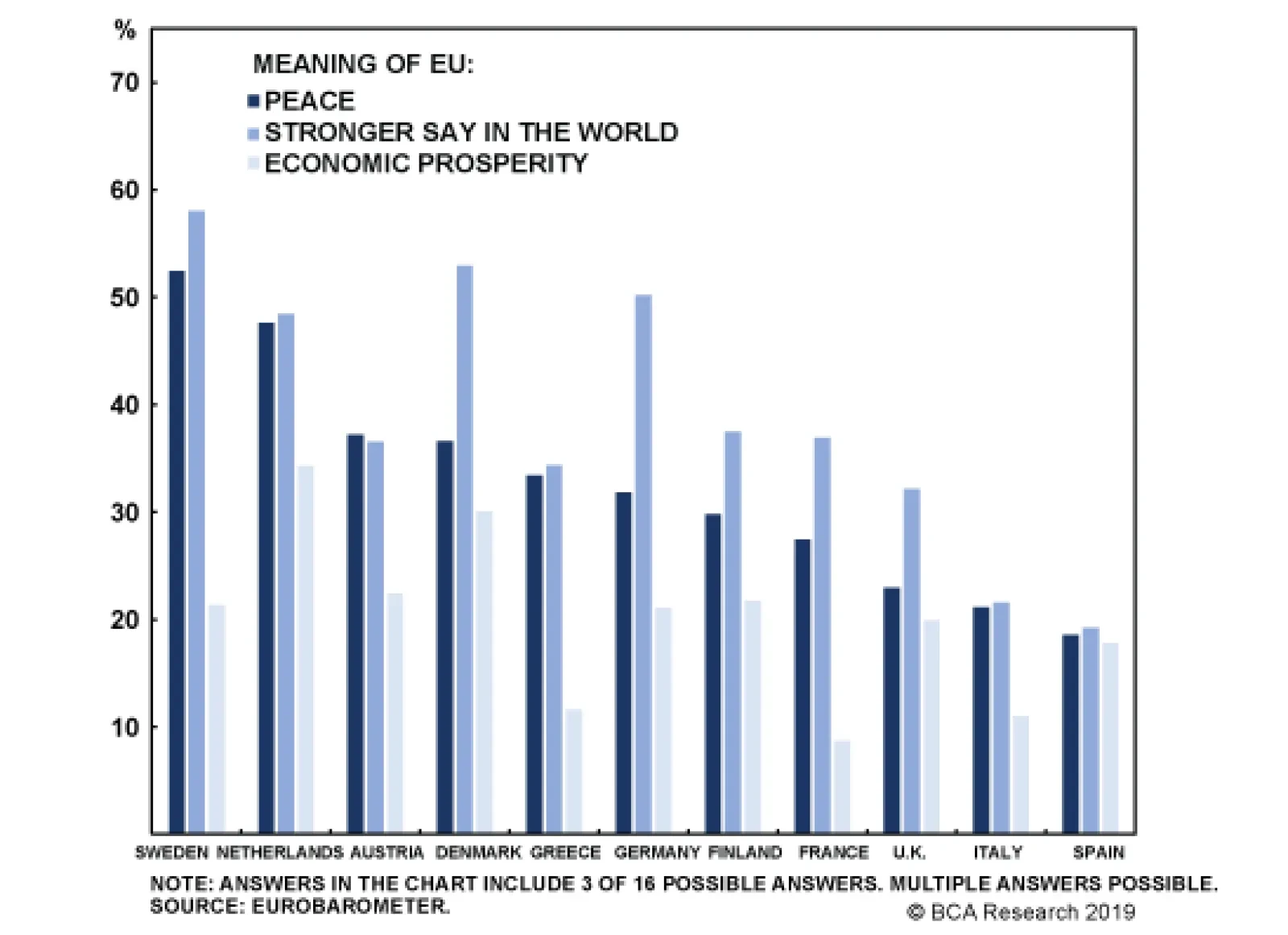

Why has the median voter remained supportive of European institutions despite mixed economic performance? For one, investors – particularly outside continental Europe – continue to overstate how much emphasis…

Highlights U.S.: The Fed remains decidedly neutral, despite market expectations (and White House pressure) for lower U.S. interest rates. Treasury yields are mispriced and should grind higher over the next 6-12 months, led first by…

The lack of more pronounced strength in pro-cyclical currencies such as the Australian, New Zealand, and Canadian dollars suggests that caution prevails. Our Foreign Exchange Services team’s bias is that currency markets…

Highlights Recent data suggest central bankers remain behind the curve in boosting inflation expectations. Ergo, expect a dovish bias to persist over the next few months. Our thesis remains that global growth is in a volatile…

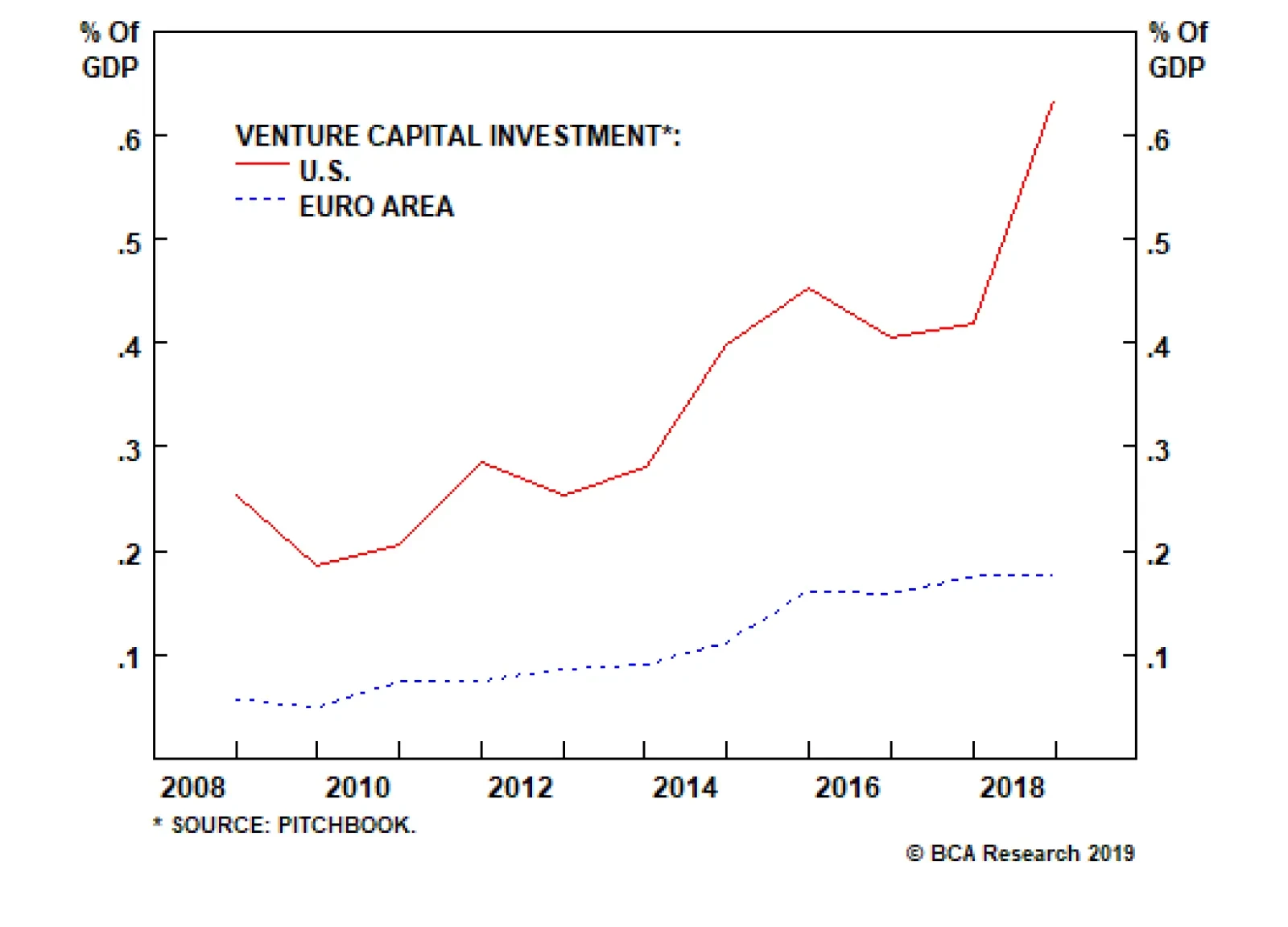

First, the level of product and service market regulation in Europe is highly punitive. Like Japan, most euro area countries fare poorly in the World Bank’s Ease of Doing Business survey. In fact, Italy scores even lower…

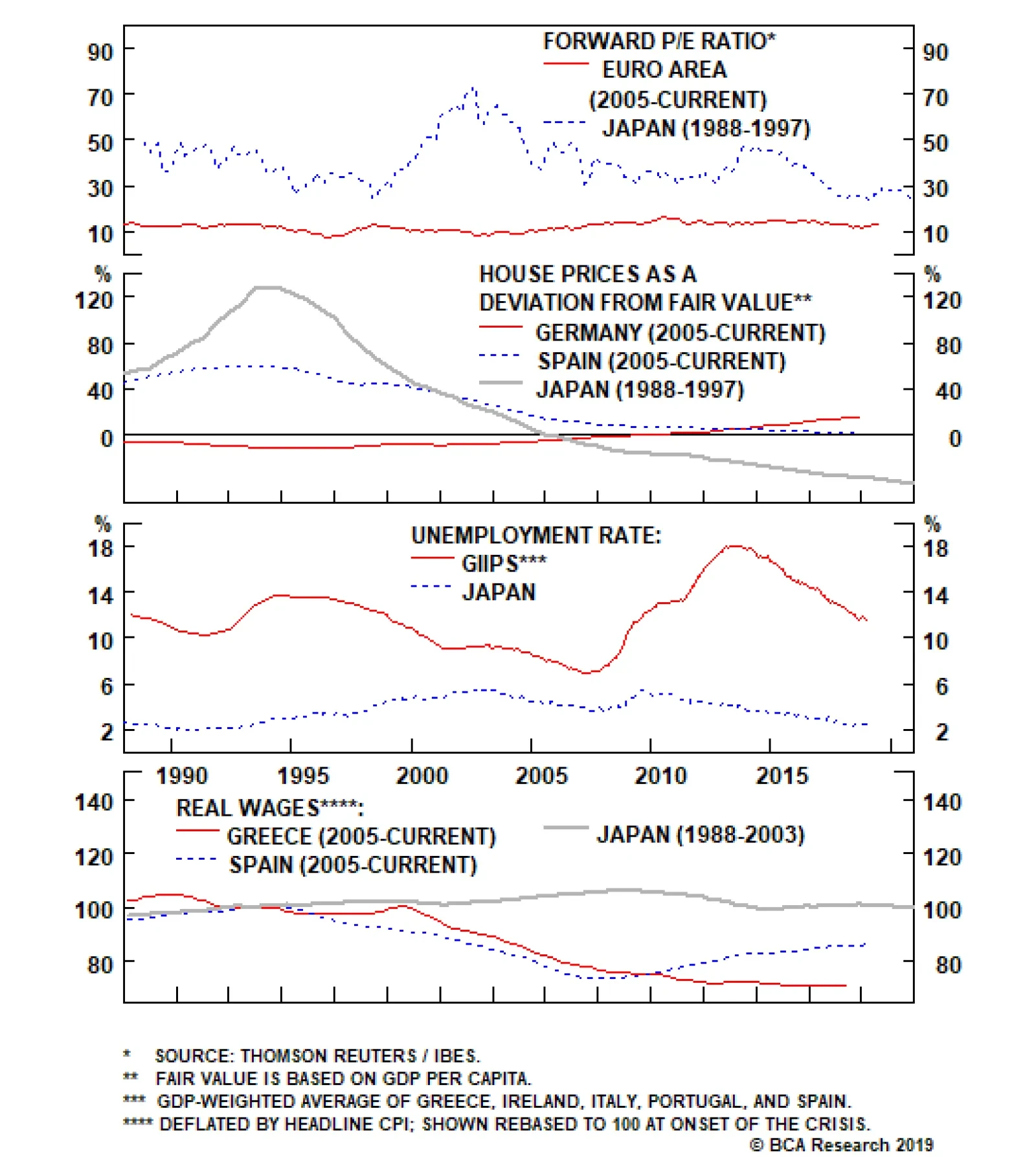

Europe has a more dire demographic profile than the U.S. It needs to purge capital stock and invigorate its economy through reforms, a smaller public sector, and more diversified financing channels. But can the euro area fare…