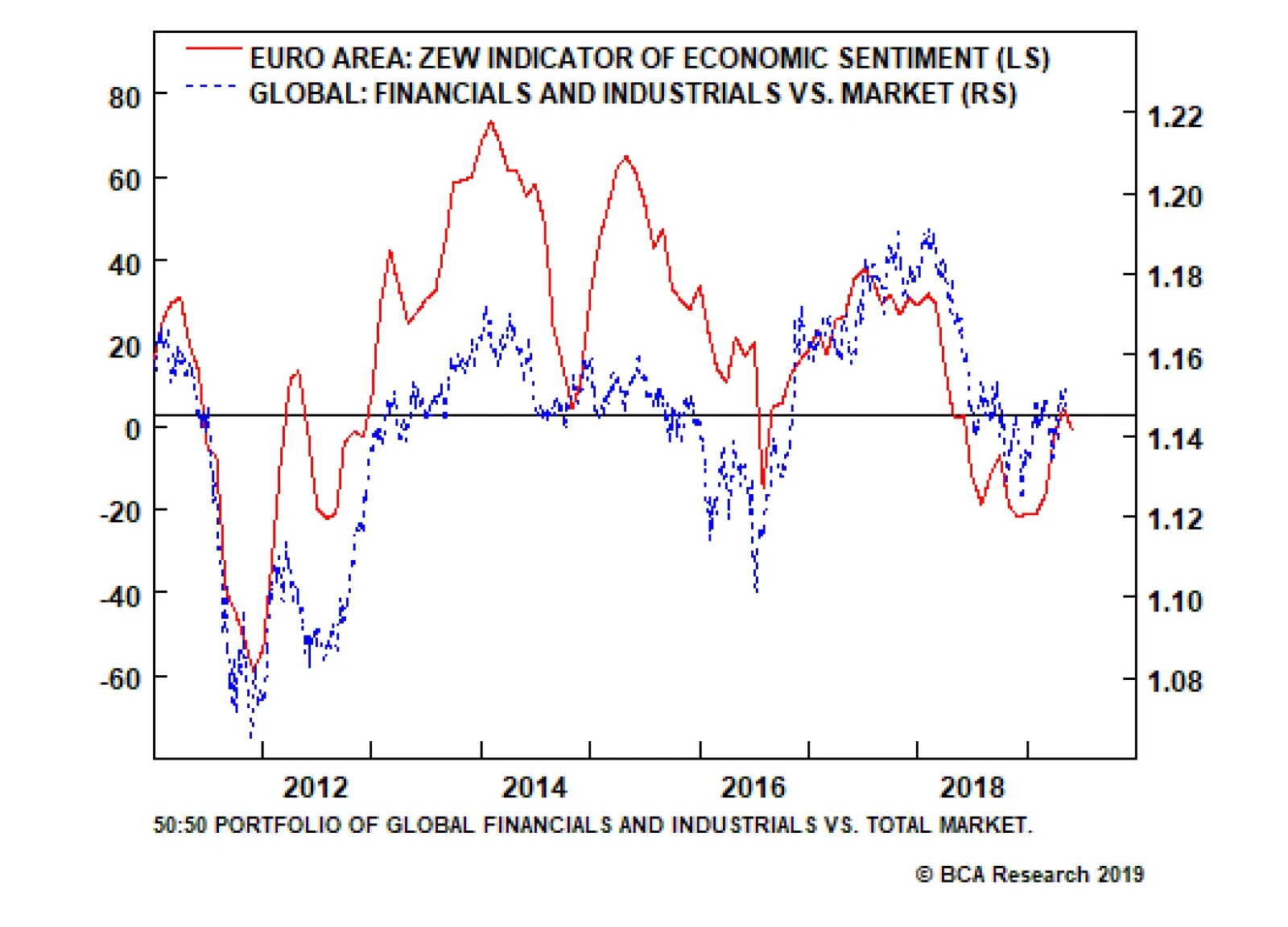

Highlights Huge imbalance #1 is the euro area’s $150 billion trade surplus with the United States. Huge imbalance #1 has resulted from the ECB holding interest rates at the lower bound while the Fed tightened policy. The upshot…

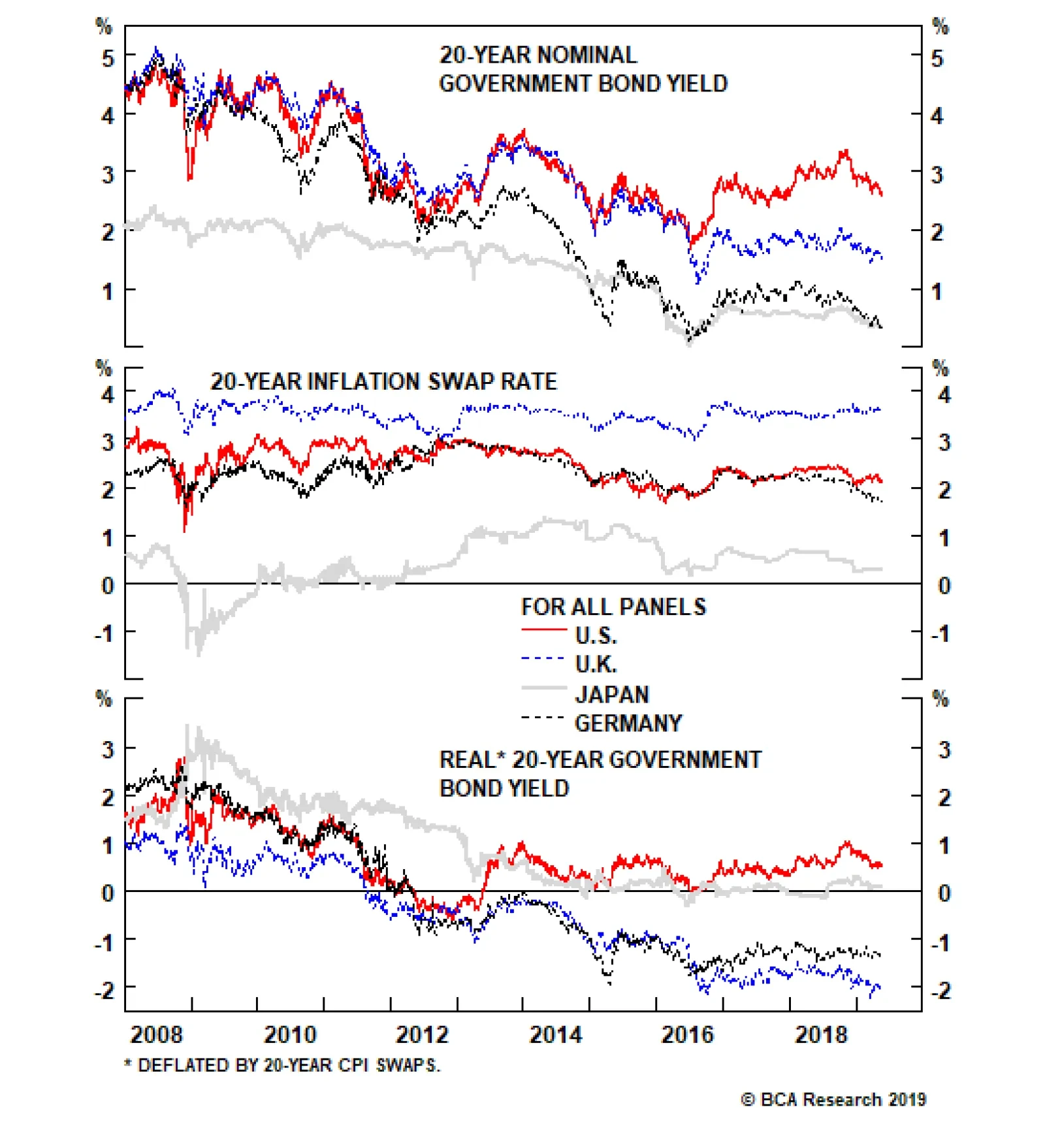

There is, however, at least one key macro difference between the two regions: While long-term inflation expectations in the euro area have declined, they are still well above Japanese levels. As a result, real yields are quite a…

Highlights The view that the world will sink into a deflationary “ice age” hinges on the assumption that policymakers will make a colossal mistake by failing to do what is in their own best interest. Contrary to popular…

The barrage of bad news in the past 24 hours is impressive. As the U.S. is extending its blacklist of Chinese companies, fears are growing that a resolution to the trade tensions is more elusive than ever. Moreover, Japanese…

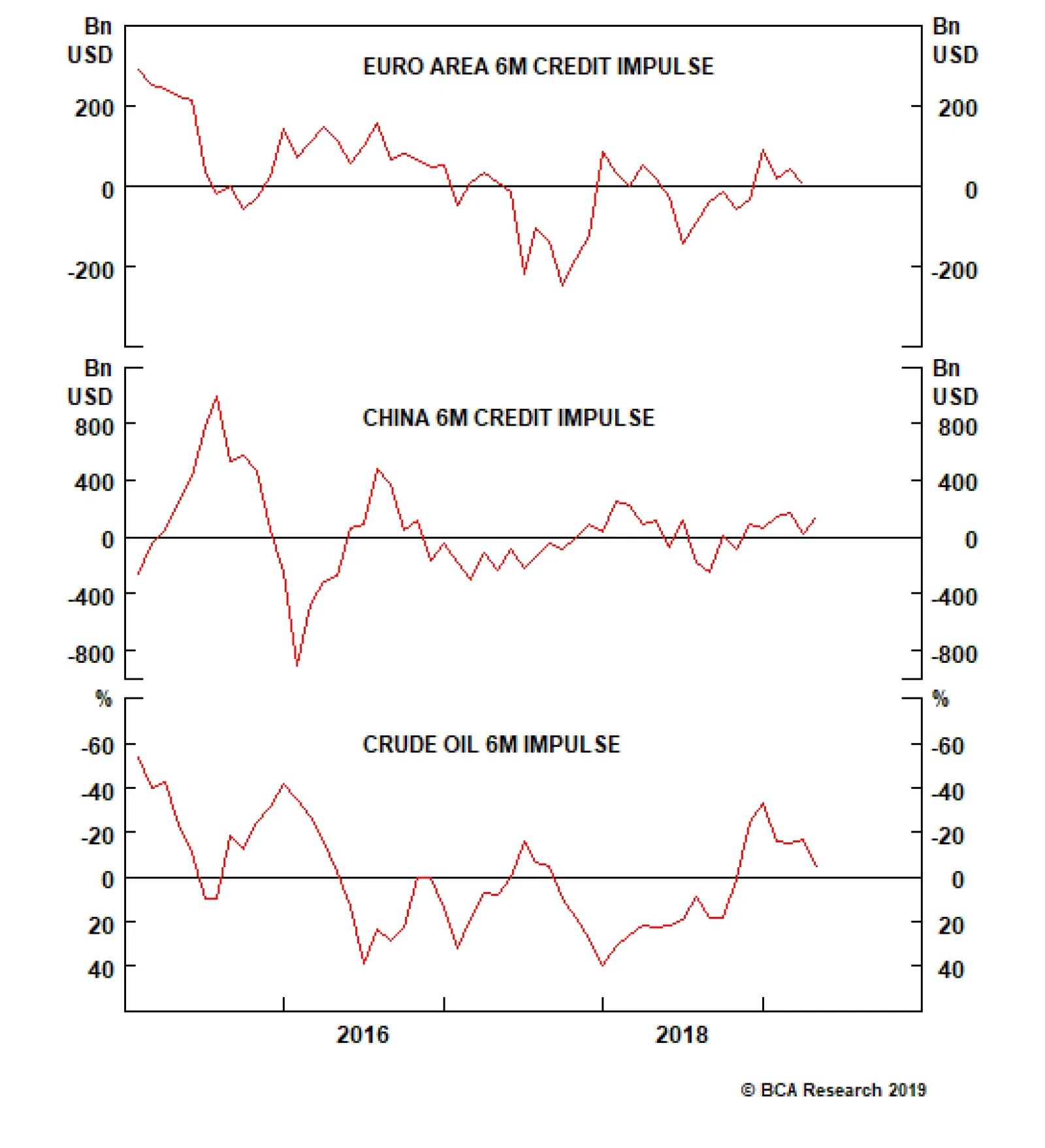

Highlights In the second half of 2019, economic growth will stop accelerating… …but an underpinning of equity valuations will limit sell-off magnitudes to around 10 percent or so, rather than deeper sustained plunges.…

Highlights Global financial markets are currently dealing with a fresh round of uncertainty related to U.S.-China trade tensions. Yet while equities and government bond yields have fallen in response to the U.S. imposition of tariffs and…

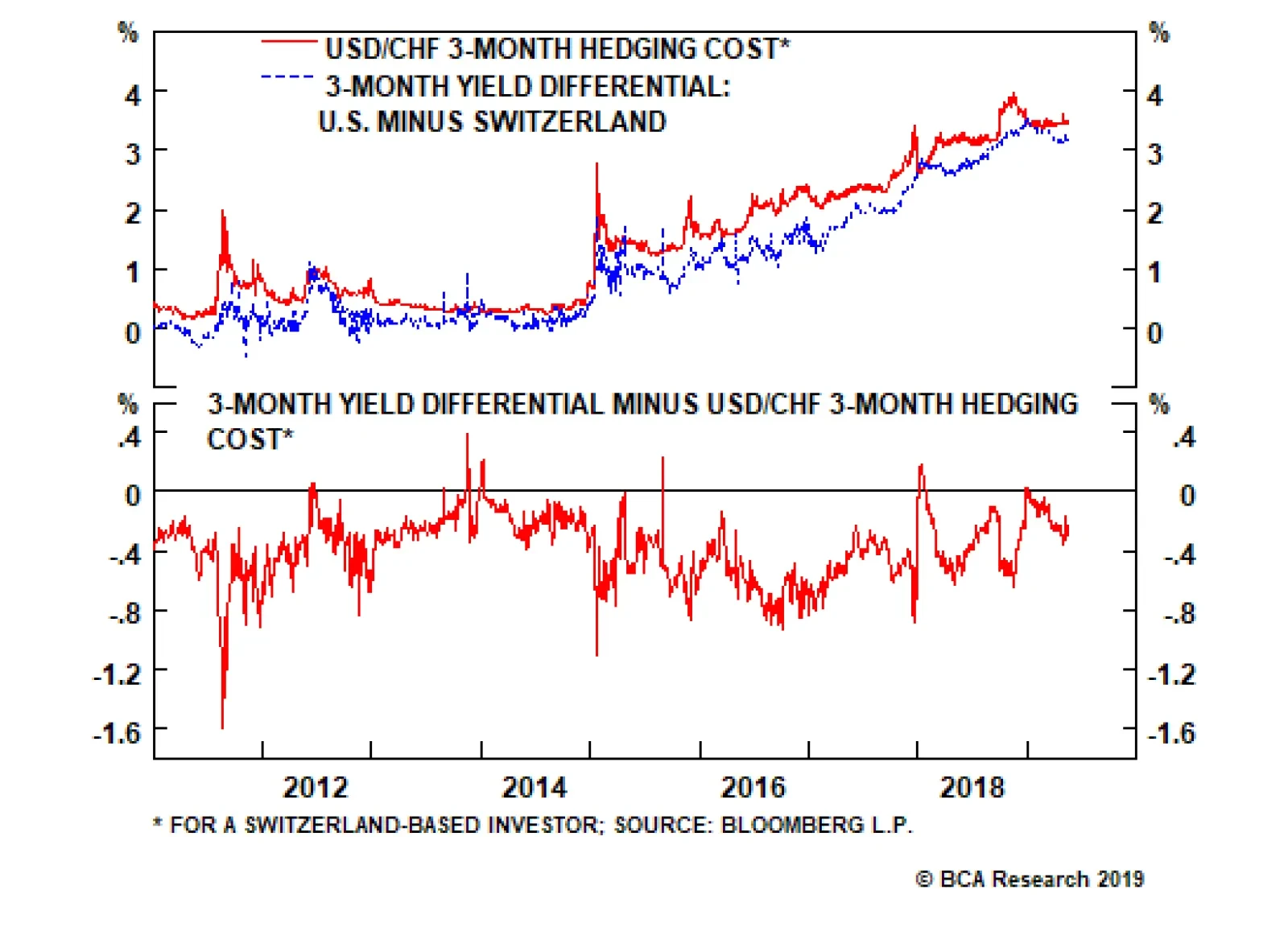

Switzerland ticks off all the characteristics of a safe-haven currency. Its large net international investment position of 125% of GDP generates huge income inflows. Meanwhile, rising productivity over the years has led to a…

Highlights The rising spectre of global market volatility has reignited interest in the Swiss franc. In the current geopolitical game of brinksmanship between the U.S. and China, the risk of miscalculation is high, suggesting it pays…

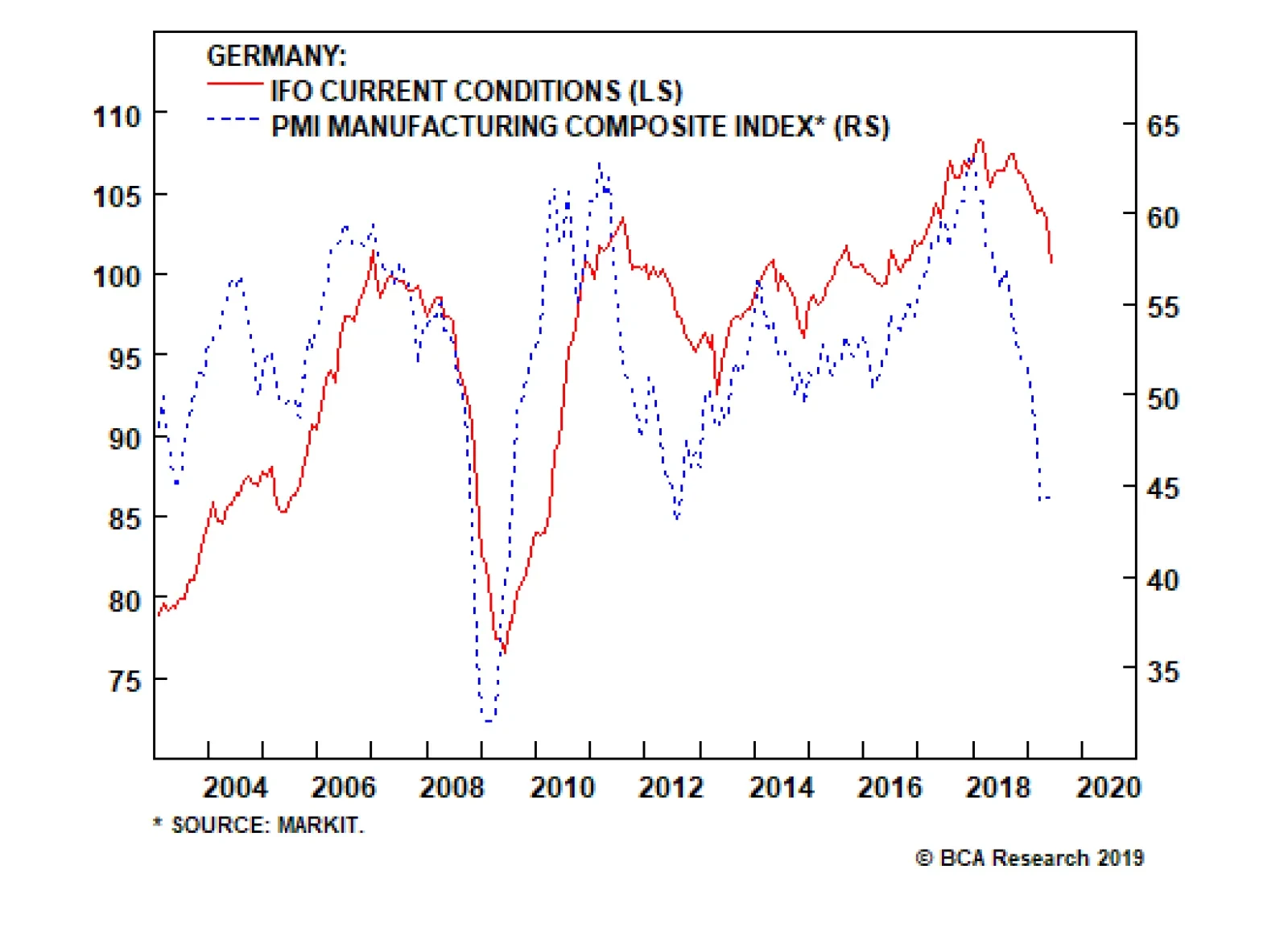

This acceleration is beyond doubt: euro area GDP growth picked up to 1.6 percent in the first quarter of 2019 from a low of 0.6 percent in the third quarter of 2018. Given the openness of the euro area economy, it is inconceivable…

The simple reason is that profits growth is highly leveraged to economic growth. For many years, the big moves in the Euro Stoxx 50 have reflected changes in euro area GDP growth. It follows that what investors really need…