Highlights The European barometer that best gauges global growth is euro area growth excluding inventory adjustments. Euro area growth excluding inventory adjustments is now running at a blistering 4.2 percent nominal pace –…

Highlights Fed: A Fed rate cut in June or July is not a done deal, but is looking increasingly likely purely from a risk management perspective, as it would both calm financial markets and potentially boost the inflation expectations…

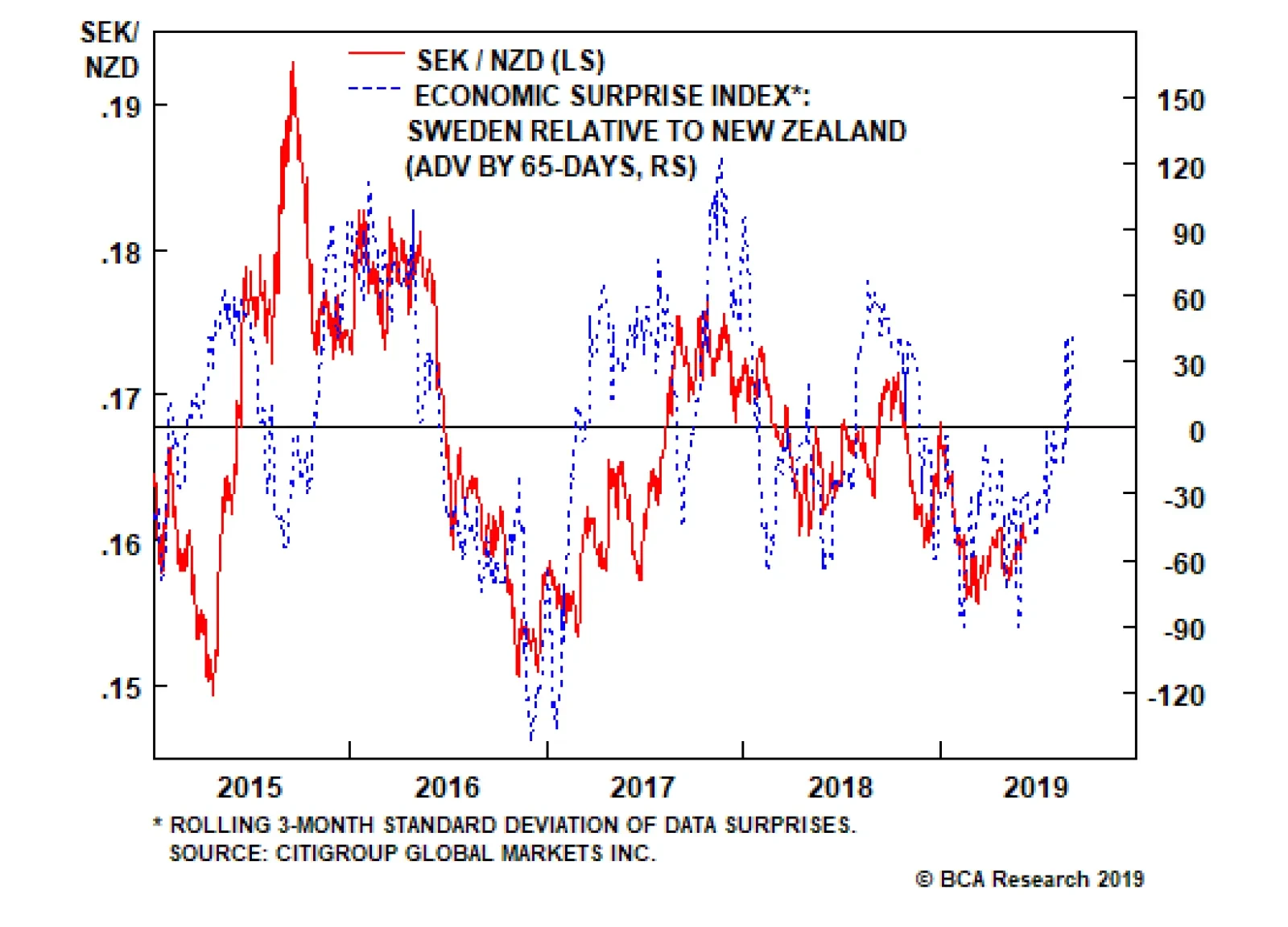

Since 2015, the cross has been trading into the apex of a tight wedge formation, defined by higher lows and lower highs. From a technical standpoint, the break above the 50-day moving average is bullish, suggesting the cross…

Highlights It remains too early to put on fresh pro-cyclical trades, but the Federal Reserve’s dovish shift is a positive development at the margin. As the market fights a tug of war between weak fundamentals and easier monetary…

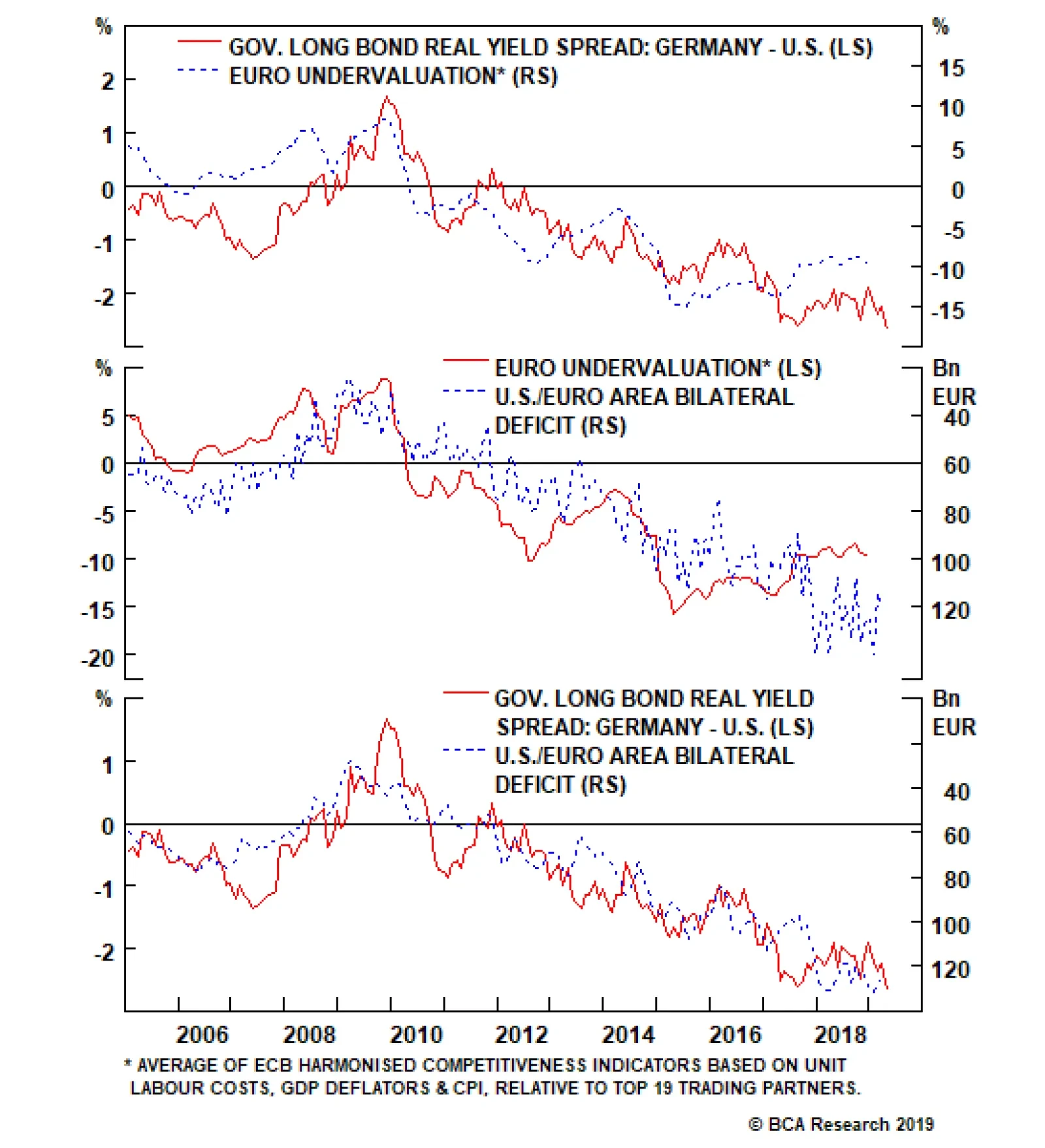

The euro area trade surplus with the U.S. – standing near an all-time high of $150 billion – is extreme; and it is extreme because the undervaluation of the euro has made the euro area grossly over-competitive vis-…

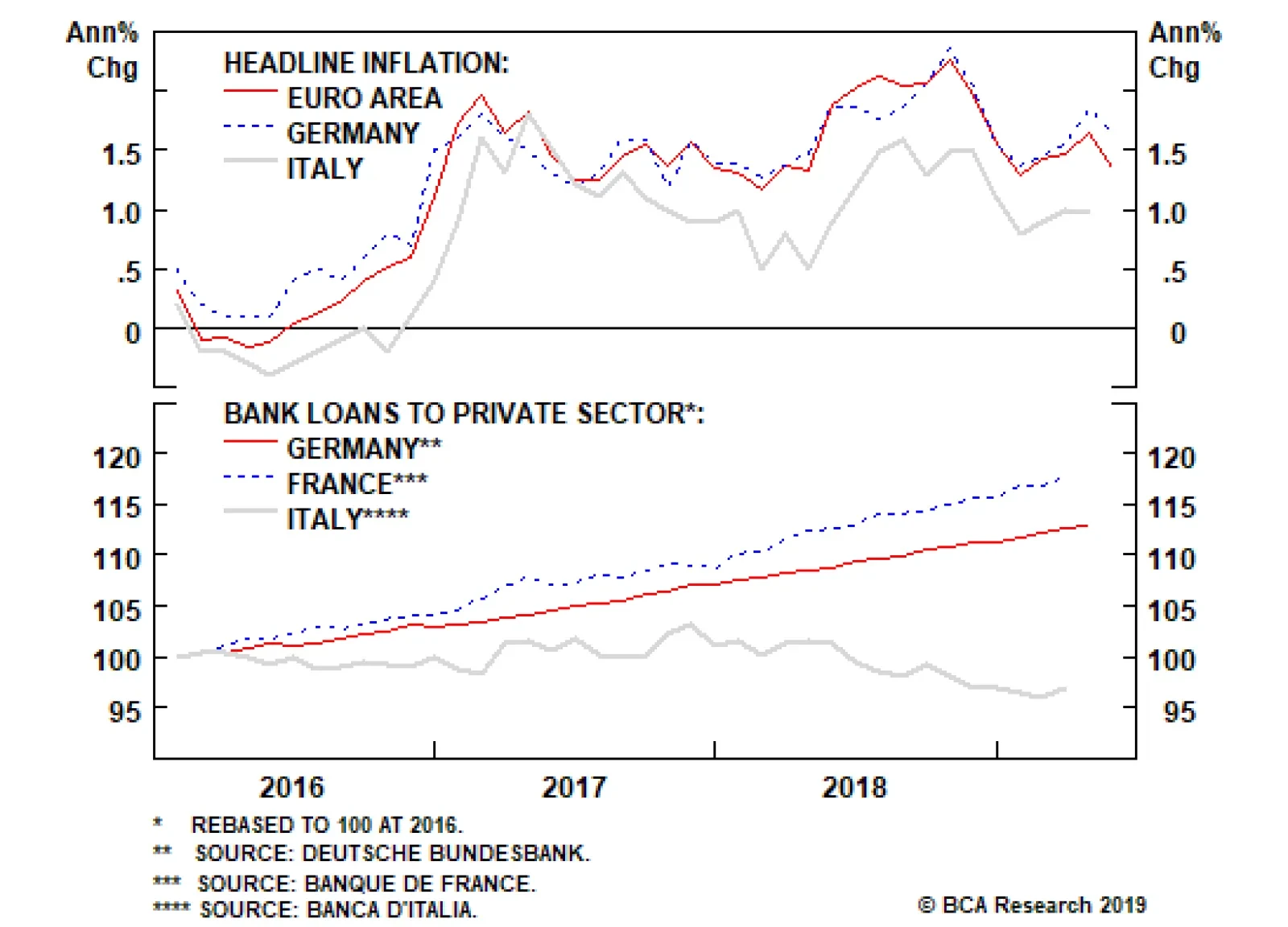

The ECB’s definition of price stability omits owner-occupied housing (OOH) inflation, and thereby understates true euro area inflation by 0.5 percent. To the extent that the ECB thinks in terms of real interest rates based…

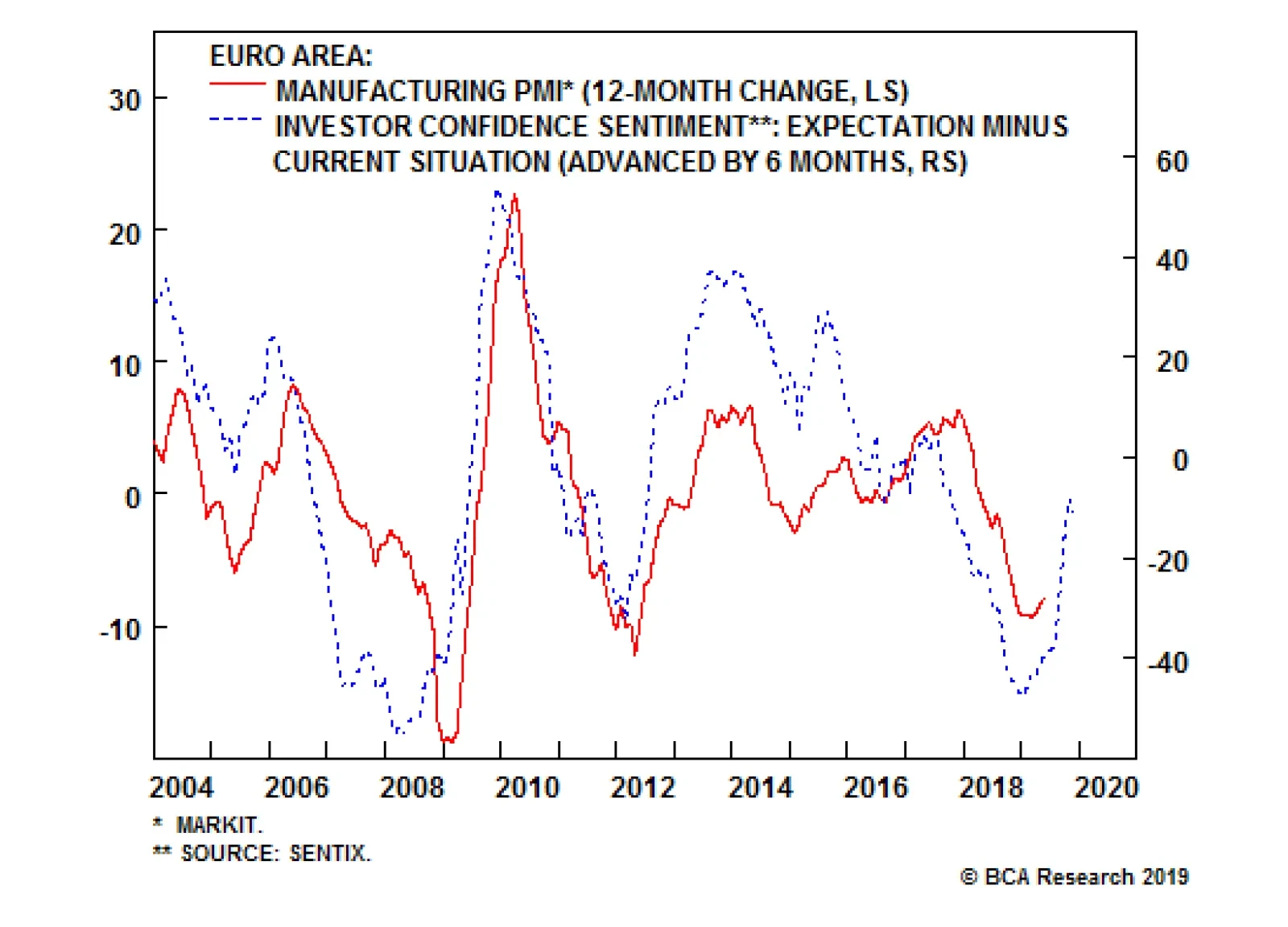

Feature Markets have turned jittery in the past month. Global growth data have deteriorated further (Chart 1), with Korean exports, the German manufacturing PMI, and even U.S. industrial production weak. Moreover, trade negotiations…

Seventeen months since global trade peaked in January 2018, evidence continues to accumulate that there is little recovery in sight: The euro zone manufacturing PMI remained very weak in May. The print came in at 47.7…

Highlights So What? U.S.-China relations are still in free fall as we go to press. Why? The trade war will elicit Chinese stimulus but downside risks to markets are front-loaded. The oil risk premium will remain elevated as Iran…