Highlights The unifying chorus among global central banks is currently for more monetary stimulus. In the race towards lower interest rates, the ultimate winners will be pro-cyclical currencies. Italian 10-year real government bond…

Highlights So What? Geopolitical risks are not about to ease. Why? Fiscal policy becomes less accommodative next year unless politicians act. Financial conditions give President Trump room to expand his tariff onslaught. Our…

Highlights As long as the global long bond yield stays near 2 percent or below, European equities will end the year at broadly the same level as now… …but they will experience a dip of at least 4-5 percent along the way.…

The difficulty arises because most indicators of either full employment or inflation tend to be a lagging variable. As such, steering interest rates toward the neutral level becomes a very difficult task for any one country and/…

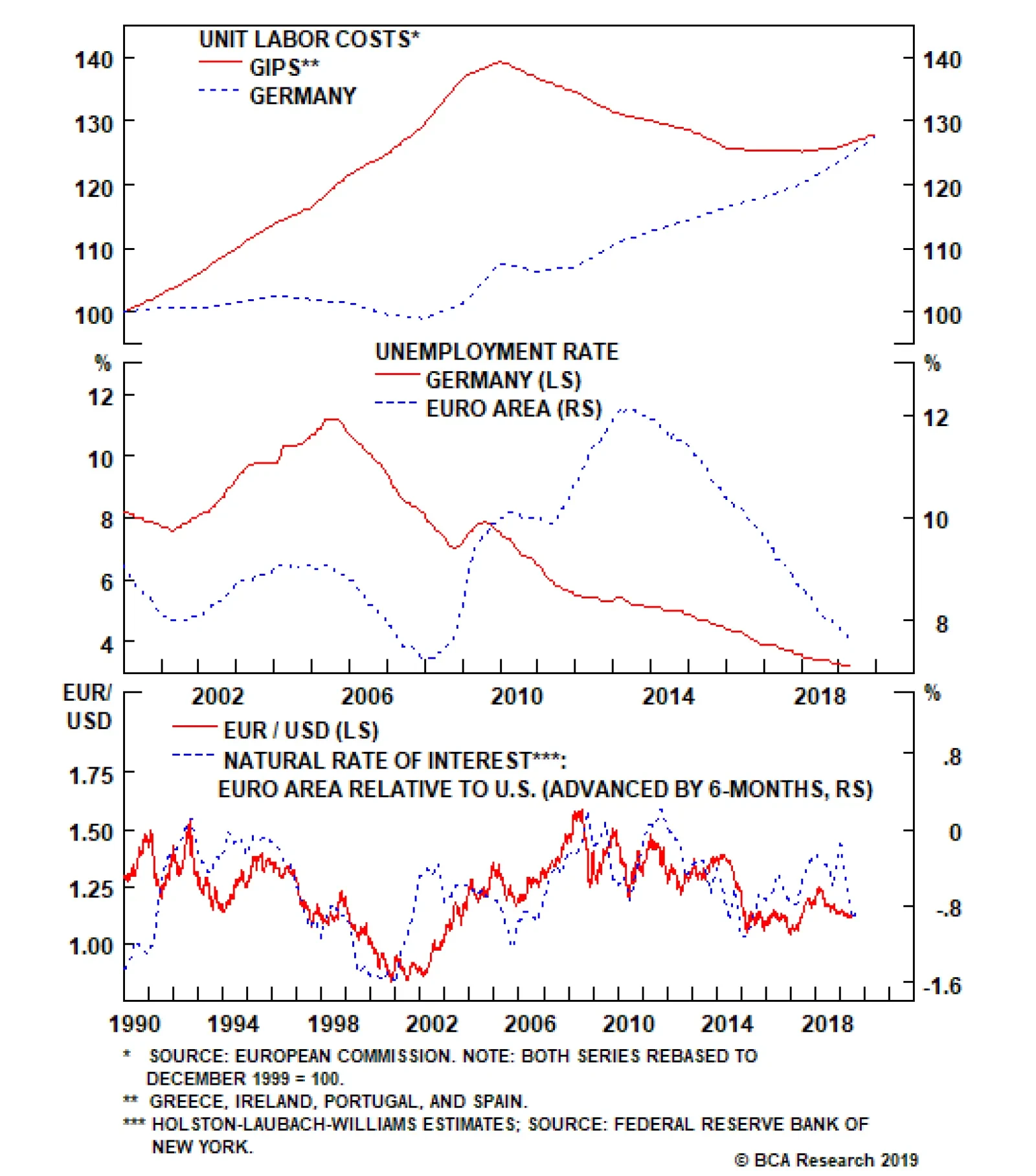

The same script has been replayed over the last decade with the European periphery. Labor market reforms in Mediterranean Europe have seen unit labor costs in Greece, Ireland, Portugal and Spain collectively contract by almost 10…

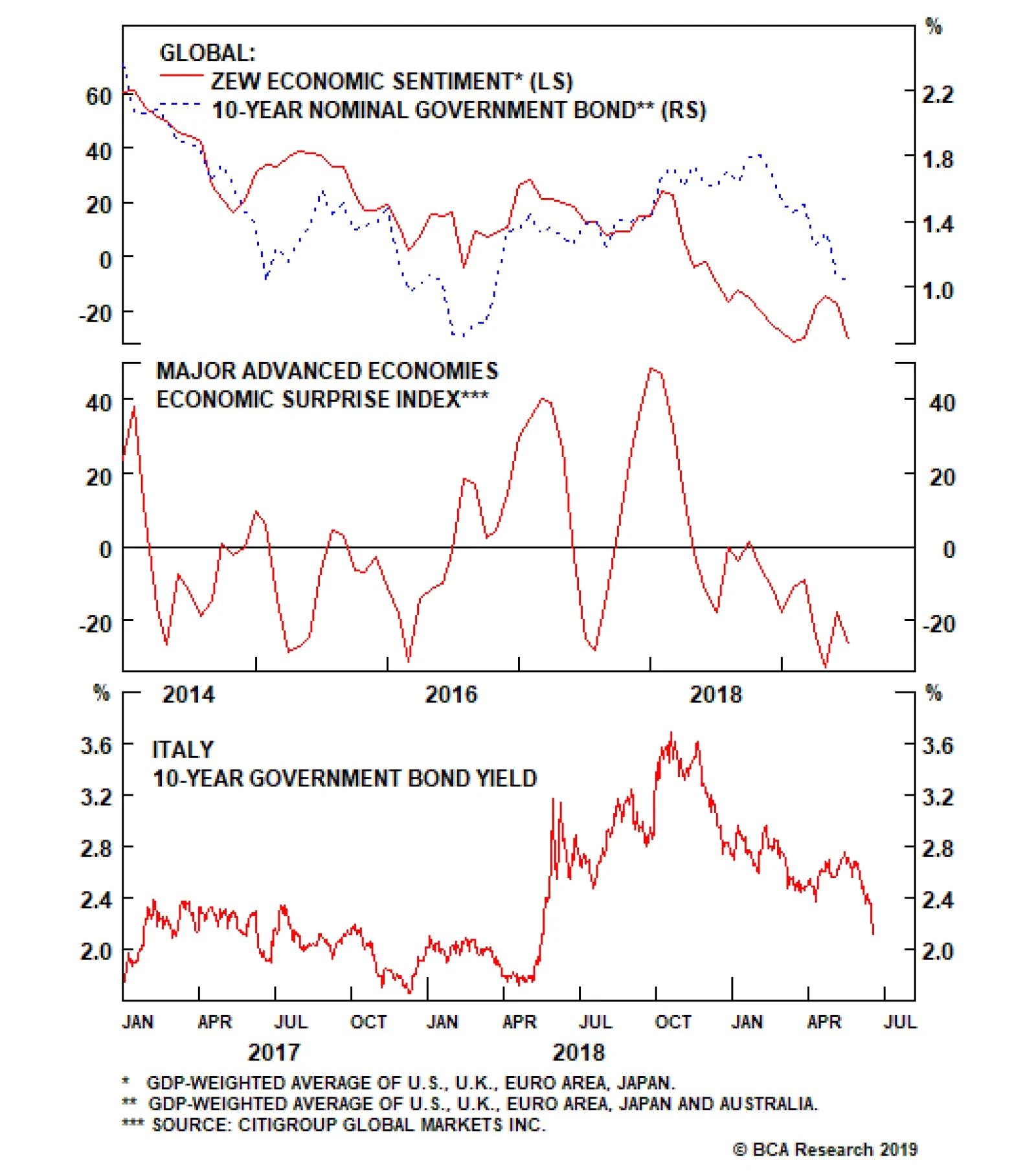

This morning's ZEW survey only confirmed what we already knew: global activity has weakened anew. In June, the expectations component of the ZEW survey fell to -21.1 from -2.1 in Germany, to -20.2 from -1.6 in the Eurozone,…

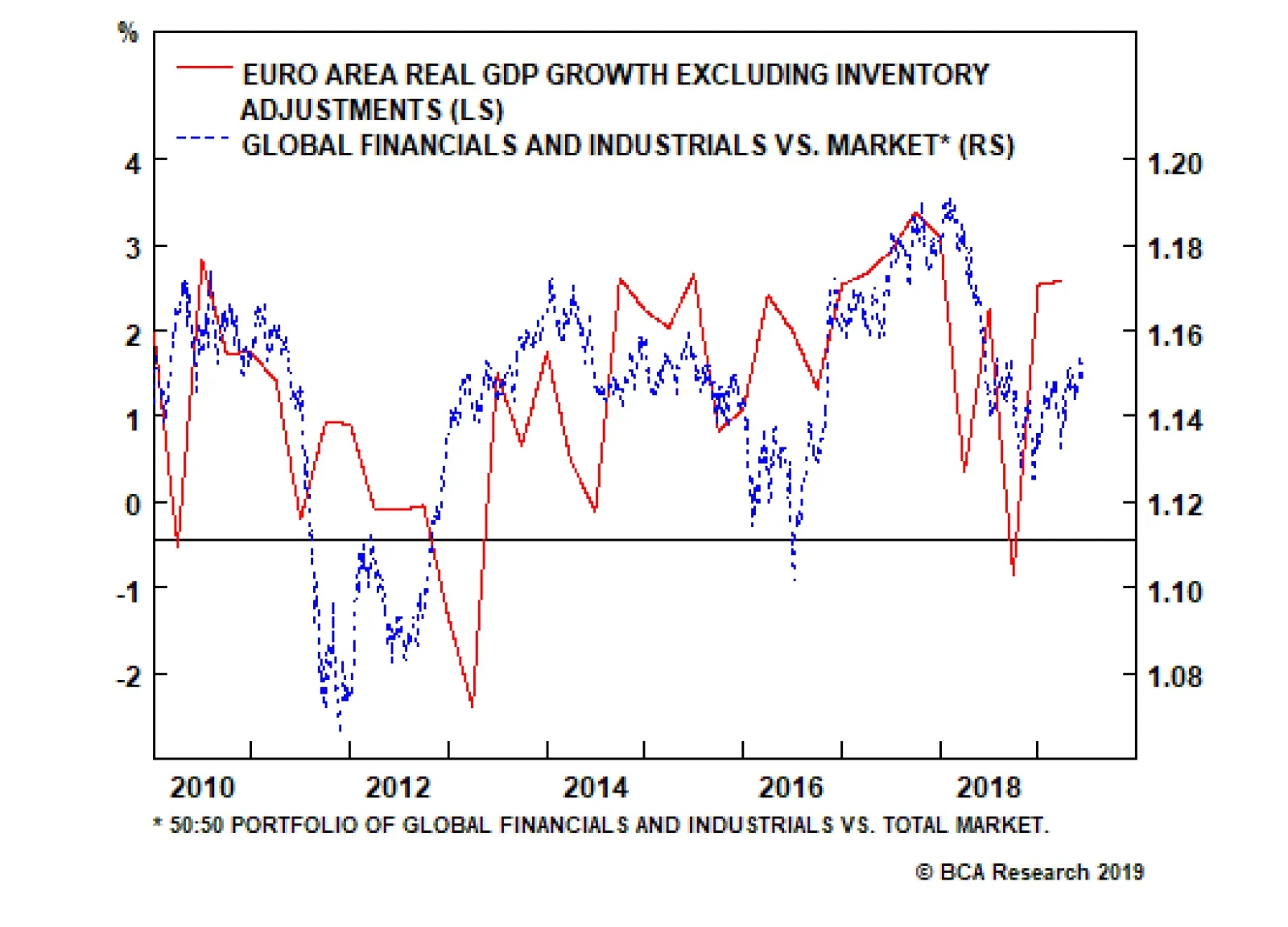

Global activity suffered its sharpest setbacks this millennium in 2002, 2008, 2012, and again briefly last year. But in the first quarter of this year, euro area real growth excluding inventory adjustments bounced back to a…

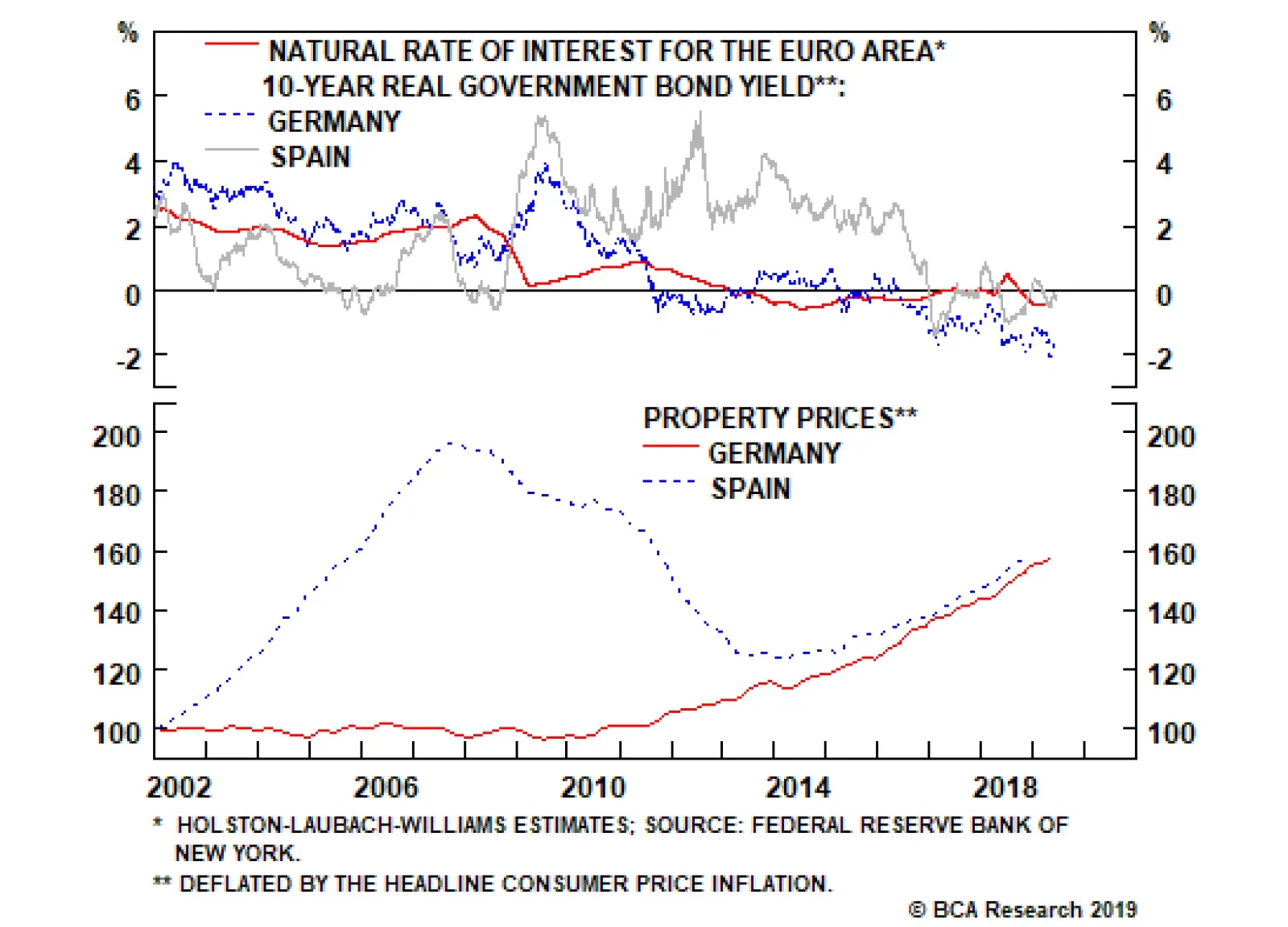

Highlights 10-year real Spanish and Portuguese bond yields have already fallen below the neutral rate of interest for the entire euro zone. This suggests monetary conditions could now be favorable for all euro zone countries. Should…

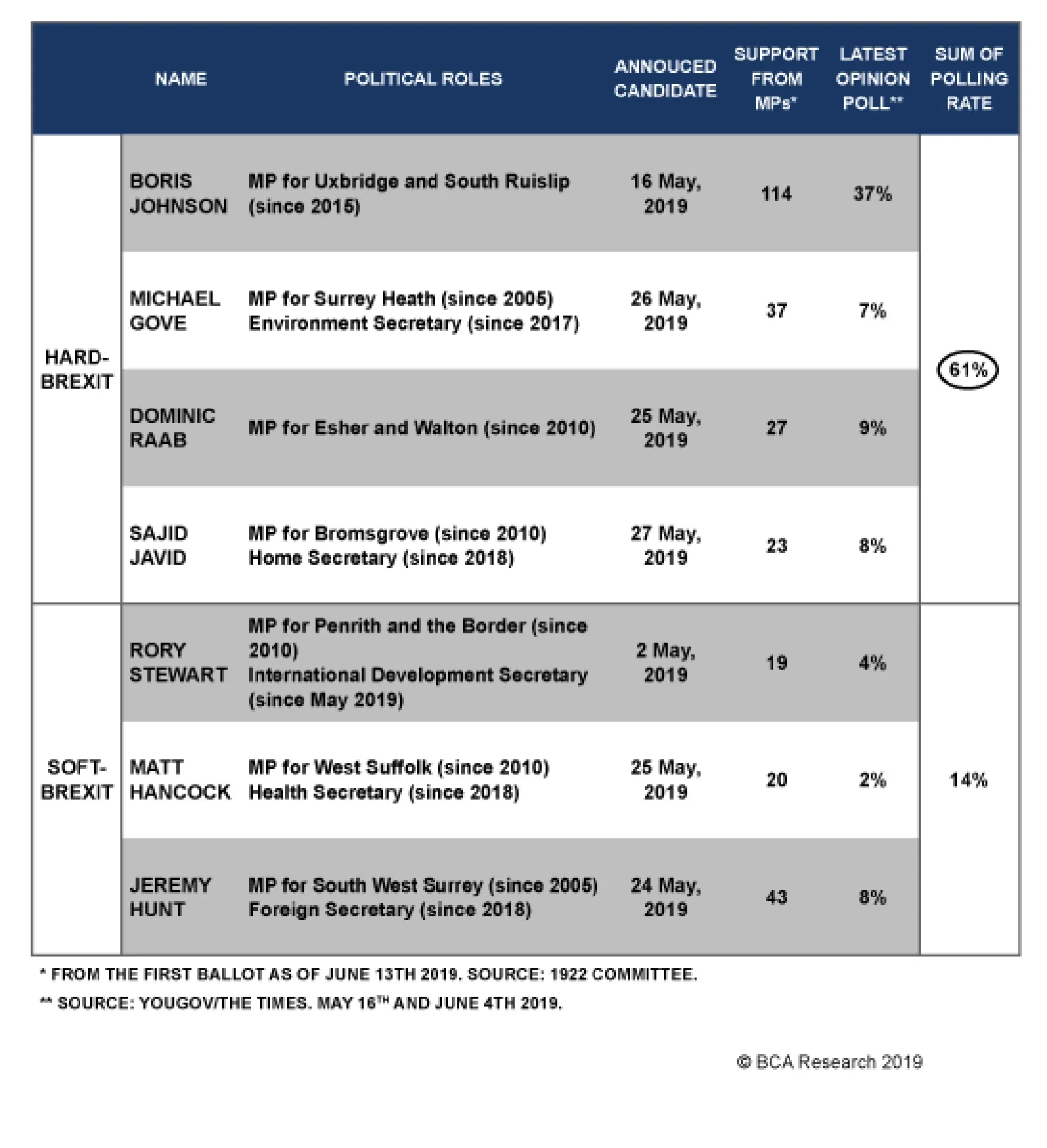

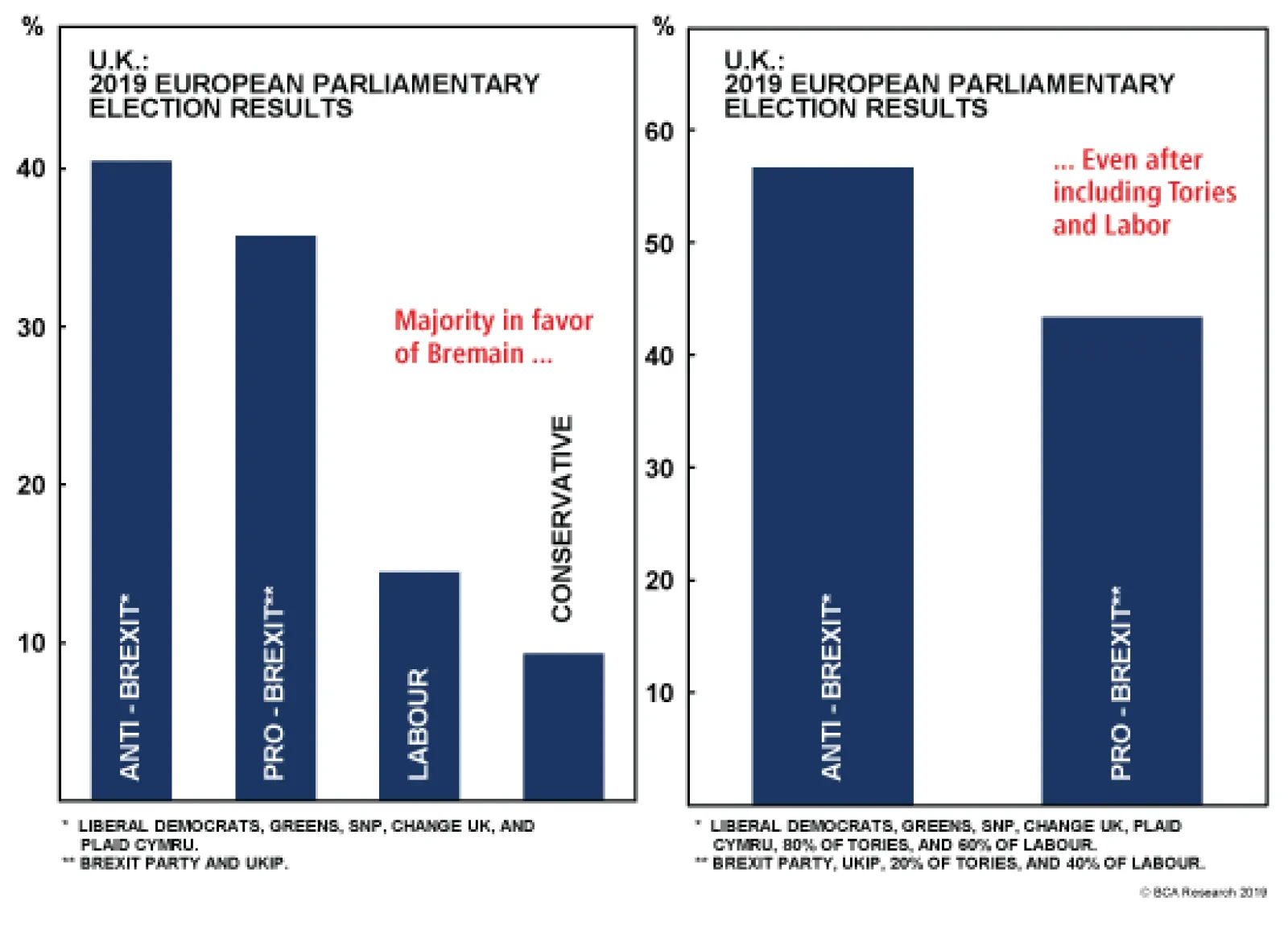

While the timeline for this process is straightforward, the impact on the Brexit process is not. The odds of a “no-deal Brexit” have increased but so has the prospect of parliament passing a soft Brexit prior to any…

The no-deal option is the default scenario if an agreement is not finalized by the Halloween deadline and no further extension is granted. However, Speaker of the House of Commons John Bercow recently stated that the prime…