Highlights Central banks globally have turned dovish, with the Fed virtually promising to cut rates in July. But this will be an “insurance” cut, like 1995 and 1998, not the beginning of a pre-recessionary easing cycle.…

Highlights Fed policy is likely to proceed in two stages: An initial stage characterized by a highly accommodative monetary policy, followed by a second stage where the Fed is raising rates aggressively in response to…

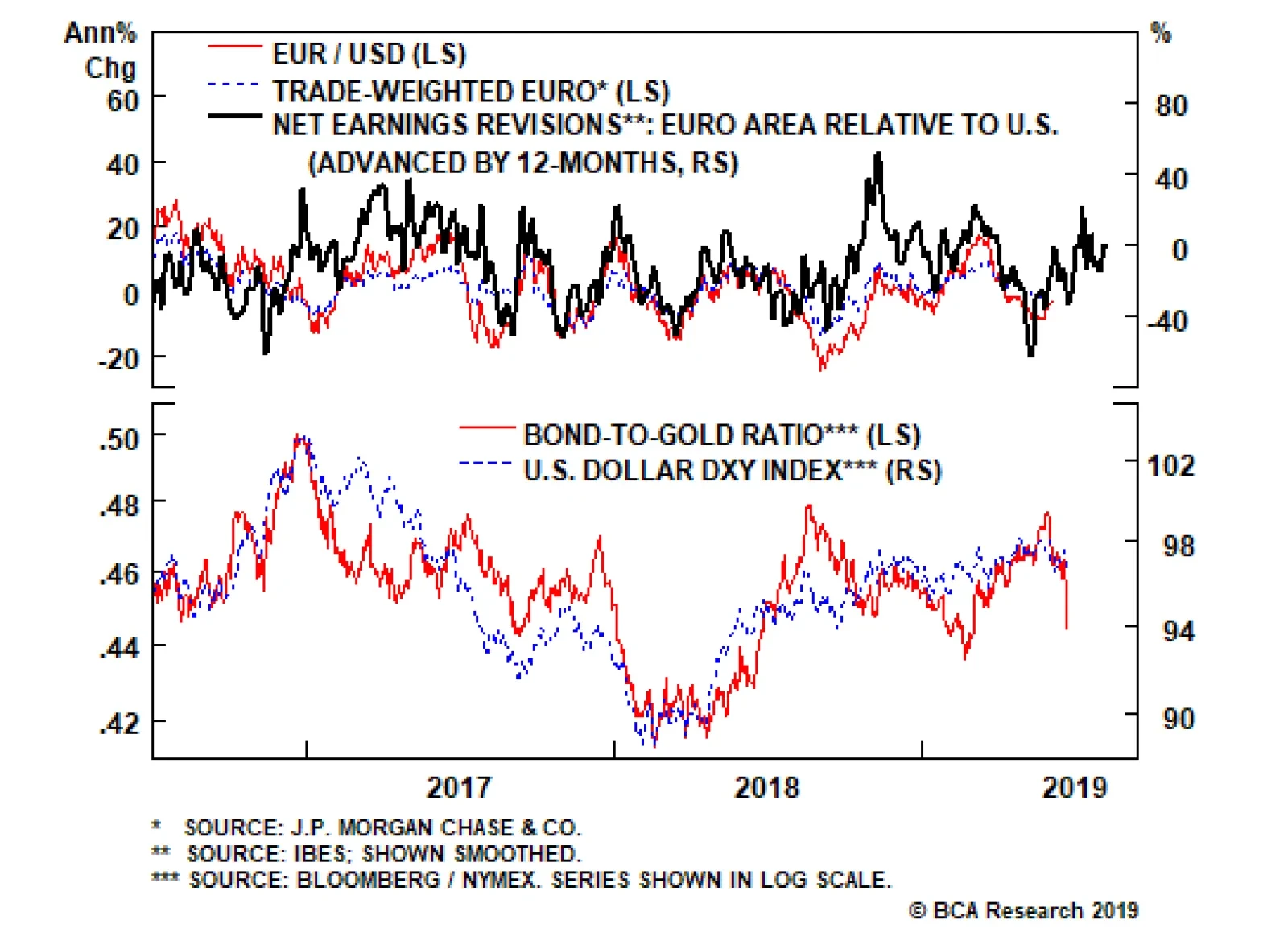

Highlights The sharp fall in the bond-to-gold ratio is an important signal to pay heed to. It might suggest that confidence in the U.S. dollar is finally waning. If correct, the sharp rally in crypto currencies over the past few…

Highlights So What? Economic stimulus will encourage key nations to pursue their self-interest – keeping geopolitical risk high. Why? The U.S. is still experiencing extraordinary strategic tensions with China and Iran…

Highlights U.S. consumption remains robust despite the recent intensification of global growth headwinds. The G-20 meeting will not result in an escalation nor a major resolution of Sino-U.S. tensions. Kicking the can down the road is…

Highlights When it comes to policy easing, the euro area 5-year yield at -0.15 percent is running out of road, while the U.S. 5-year yield is still at the dizzying heights of 1.8 percent. Hence, the ECB is likely to come out the loser…

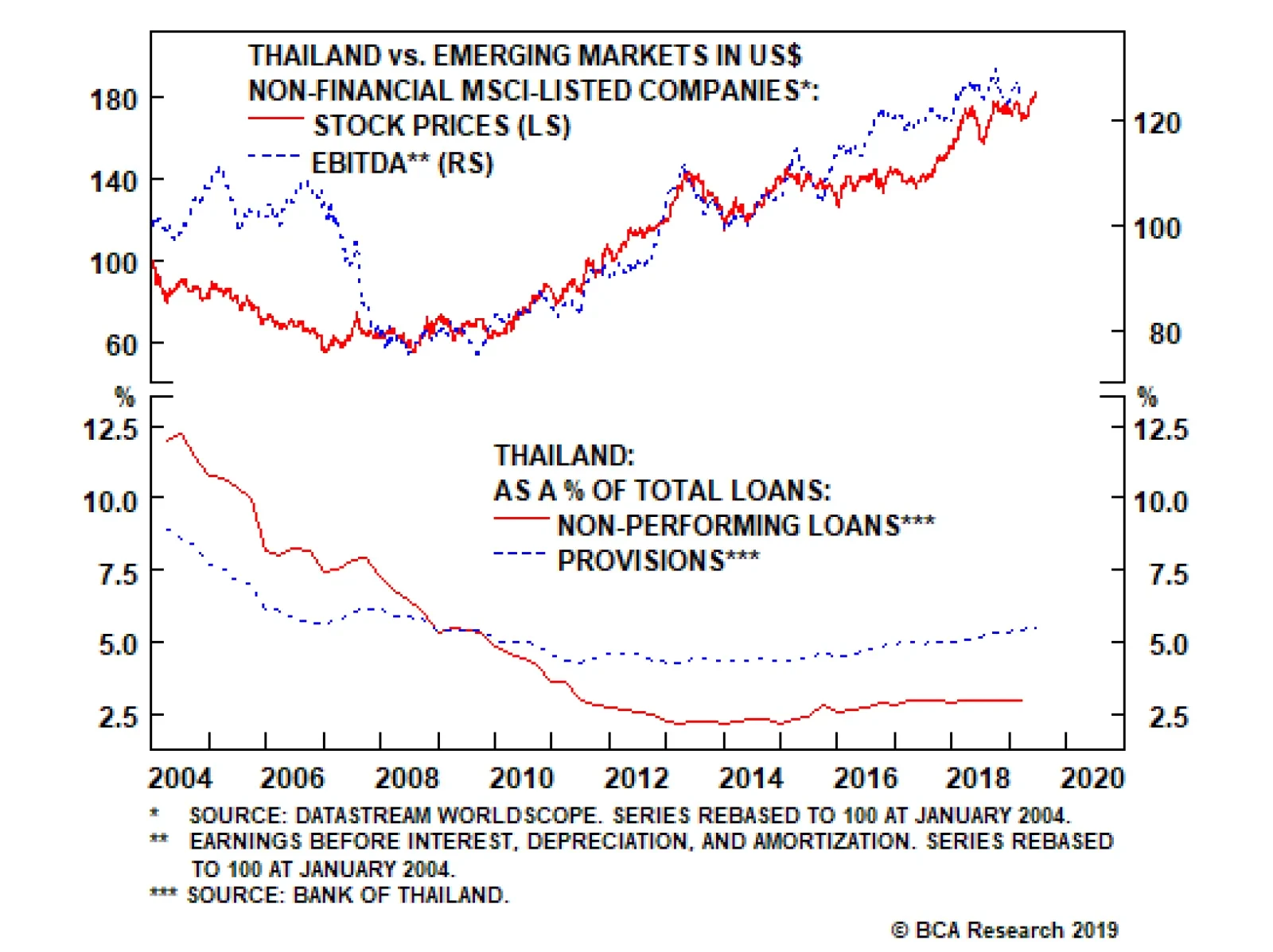

In absolute terms, Thai financial markets are leveraged to global trade and will sell off if global growth deteriorates further. But Thai equities, credit, currency and domestic bonds will continue outperforming their EM peers…

Interest rate differentials are moving against the dollar, but our important takeaway – that gold continues to outperform Treasurys – is an ominous sign. Gold has stood as a viable threat to dollar liabilities, any sign…

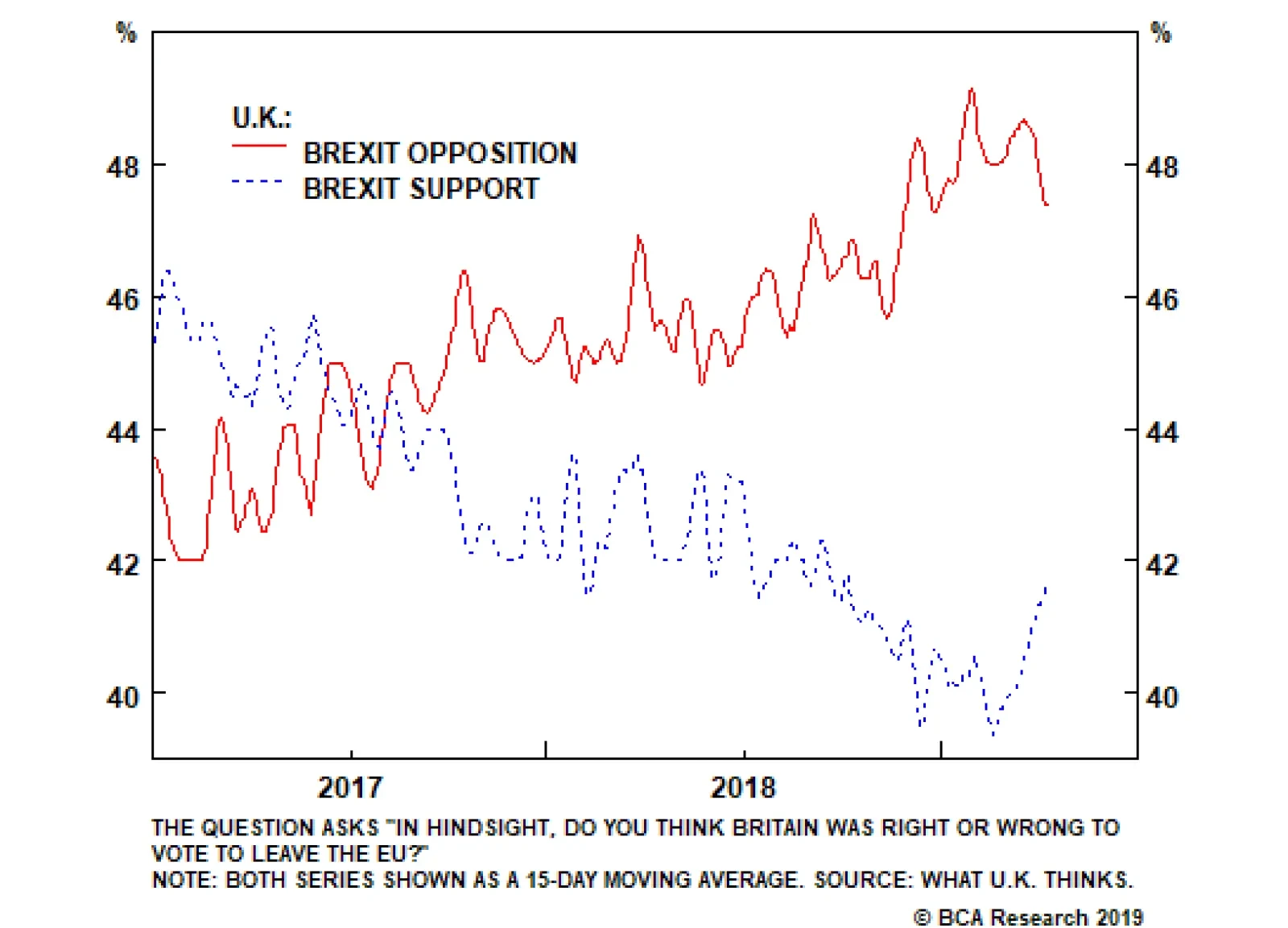

It is not yet a done deal, but the shift within the party in favor of accepting a “no deal” exit is clear. None of the remaining candidates is willing to forgo that option. The newest development advances us along…