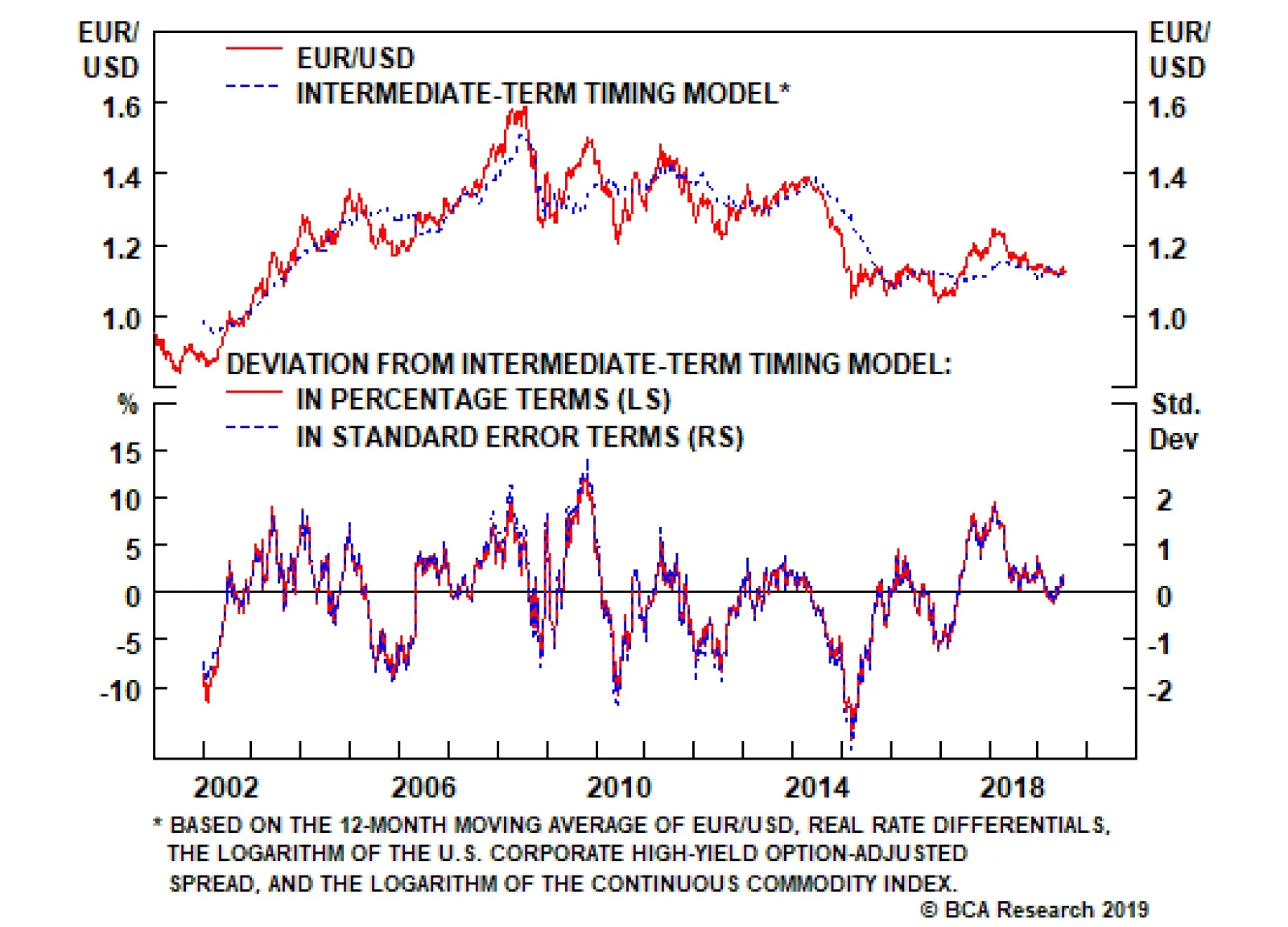

The model results for the euro are the mirror image of the dollar, with no evidence of mispricing. What is interesting about the euro, however, is that the biggest buy signal was generated in 2015, and since then the fair value…

The reason being that “both the interest rate impulse and short-term credit impulses are now on the cusp of down-oscillations, which will bear on economies and financial markets in the second half of the year.” This…

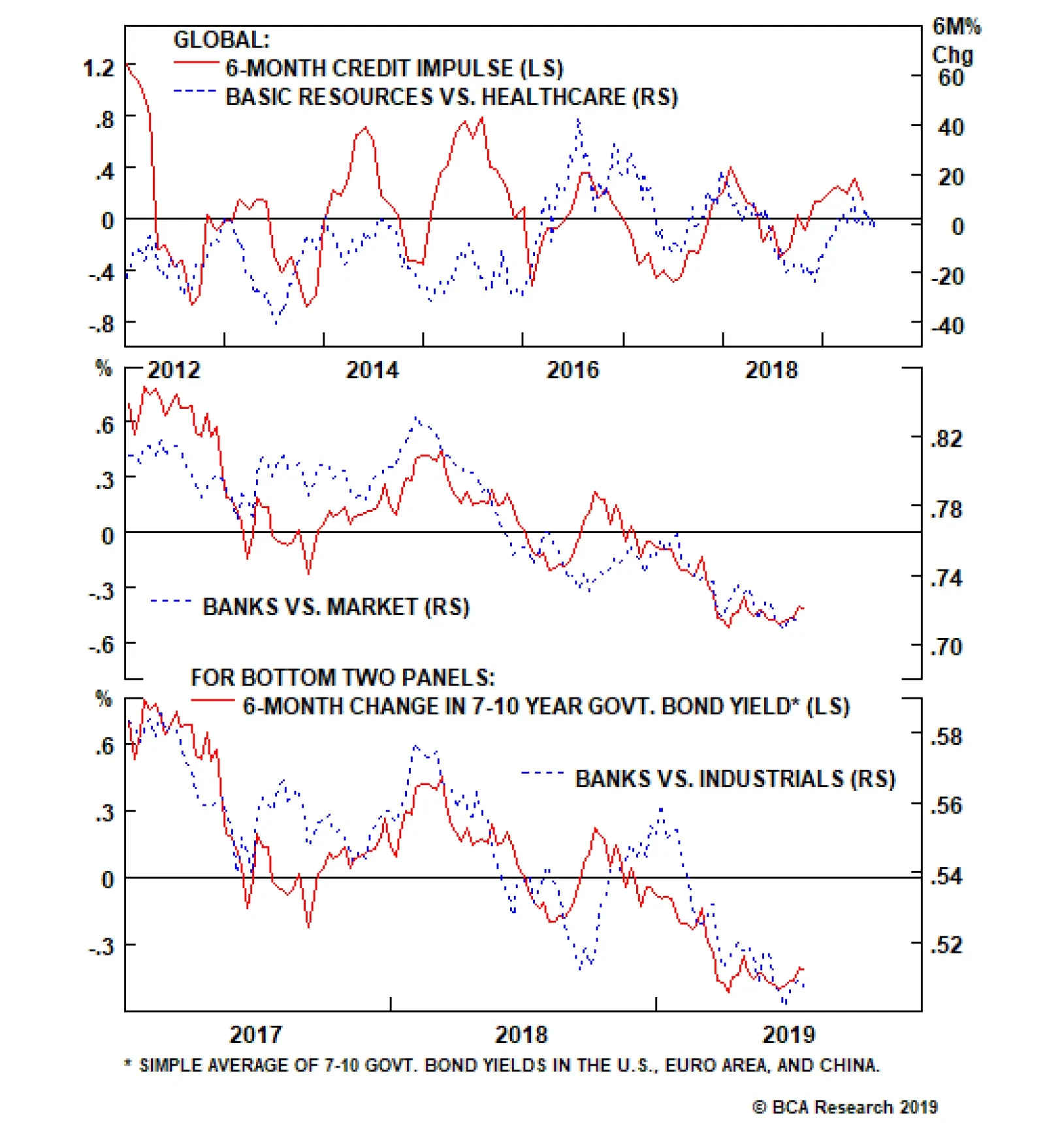

Highlights The onset of a down-oscillation in growth strongly suggests a rotation out of the growth-sensitive Industrials and Materials into the relatively defensive Healthcare sector. But if the sharpest move in bond yields has…

Highlights The breakout in financial asset prices stands at odds with a deteriorating profit outlook. This suggests a high probability of a coiled-spring reversal in one of the two variables as we enter the thin summer trading months.…

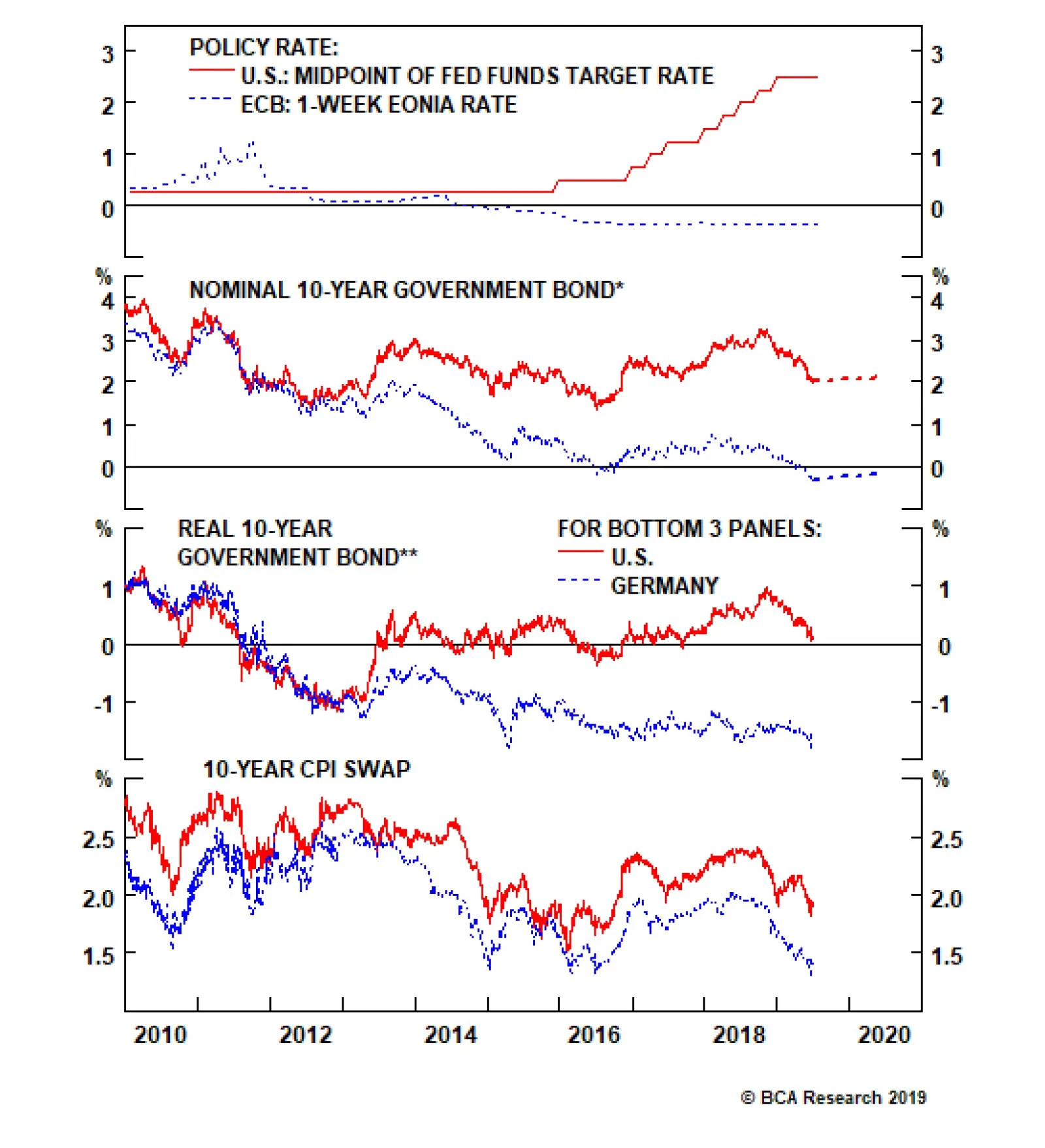

Because the yield move in the U.S. was larger, the UST-Bund spread has narrowed from a 2019 peak of 253bps to the current level of 233bps. Breaking down nominal 10-year yields into their real and inflation expectations…

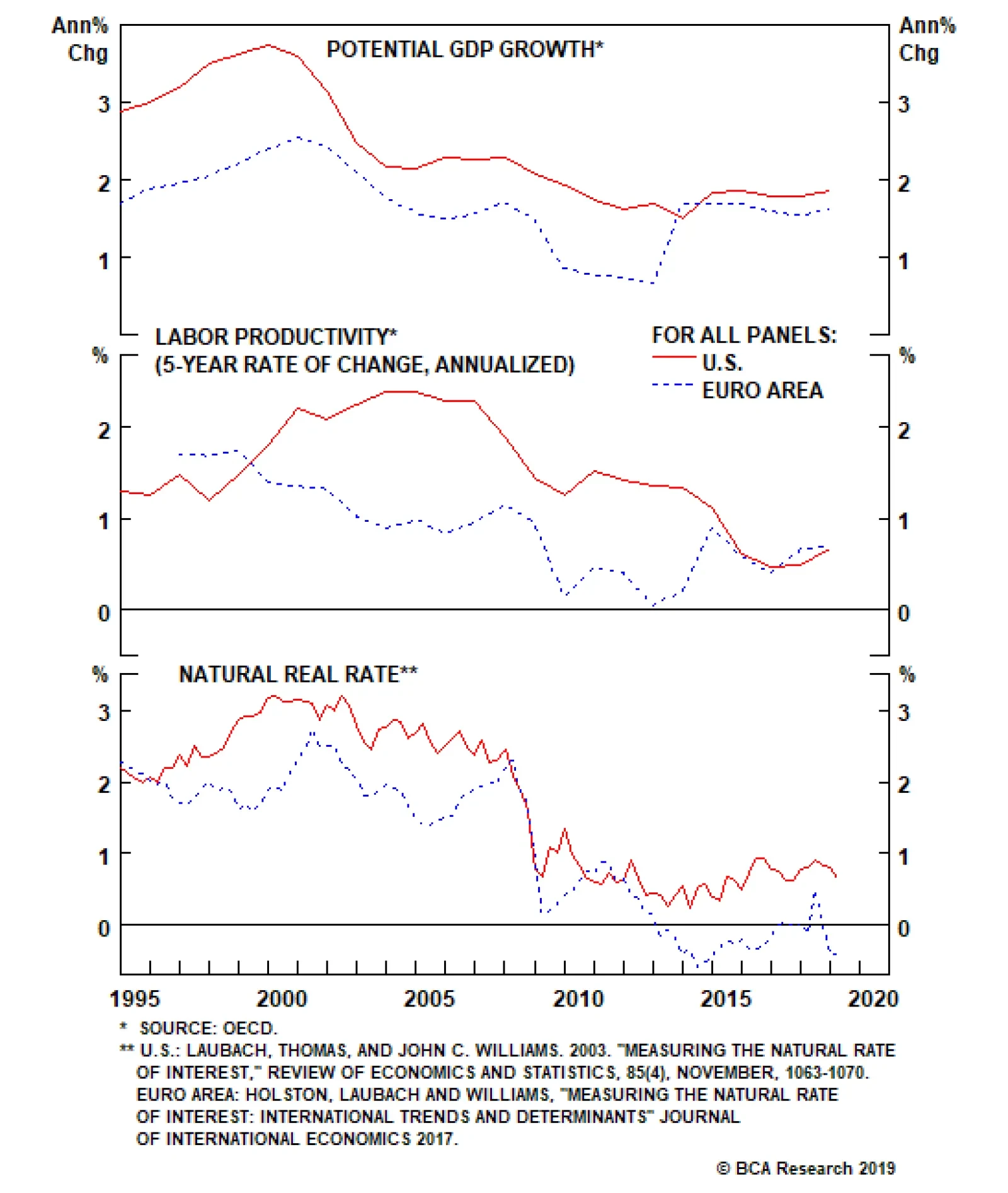

The European and U.S. labor markets are not as different as a quick glance suggests. Unemployment rates are well below the OECD’s estimates of the full employment NAIRU level. Wages are starting to gain some upward momentum…

Highlights Current activity indicators are now losing momentum, or outright rolling over. This confirms that European (and global) growth is now entering a down-oscillation. Why? It is the rate of decline in the bond yield that has…

Highlights Relative Growth & Inflation: Underlying U.S. and European economic growth momentum remains surprisingly similar, with weakness concentrated in manufacturing industries most exposed to trade uncertainty. Realized inflation…