Highlights Today’s equity risk premium of 1.6 percent makes equities the preferred long-term asset-class versus bonds at the current level of bond yields. The caveat is that this conclusion would quickly change if bond yields…

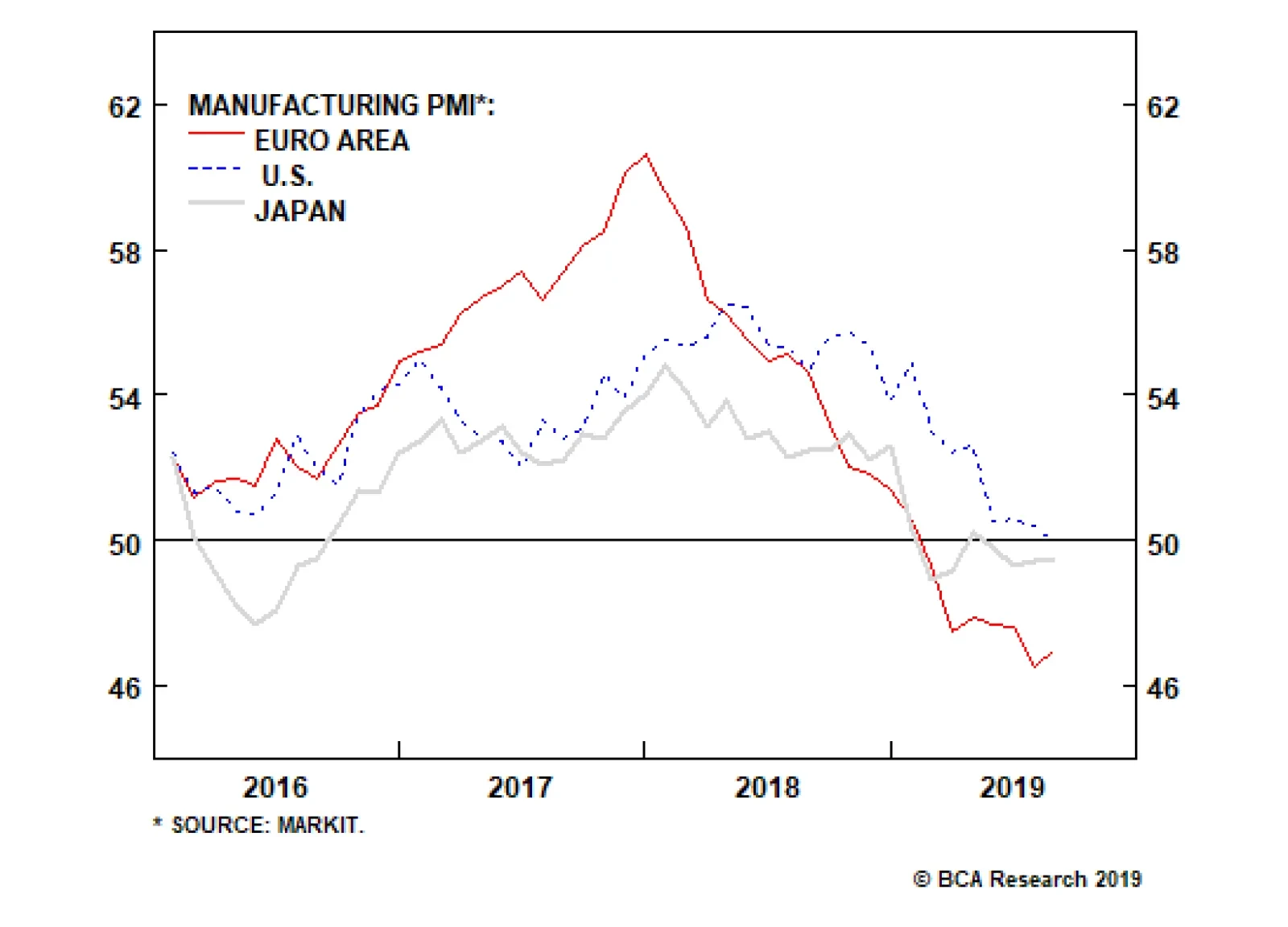

This morning, the Flash PMI saw a stabilization in the European manufacturing sector. Euro area manufacturing PMI moved up to 47 from 46.5, and in Germany, it rose to 43.6 from 43.2. In Japan, the manufacturing PMI also…

Highlights Duration: Global manufacturing growth will rebound near the end of this year. Much like in 2016, this will result in higher global bond yields on a 12-month horizon. Investors should keep portfolio duration close to…

Highlights Negative Interest Rates: Time will tell if negative bond yields are indeed the “new normal”. We need to see negative yields maintained outside of a growth slowdown to prove that thesis. USTs & Bunds: U.S.…

Dear Client, In case you missed it in real time, please listen to a replay of this quarter’s webcast ‘The Investment World in 5 Charts and 18 Minutes’ available at eis.bcaresearch.com. Also please note that we will be…

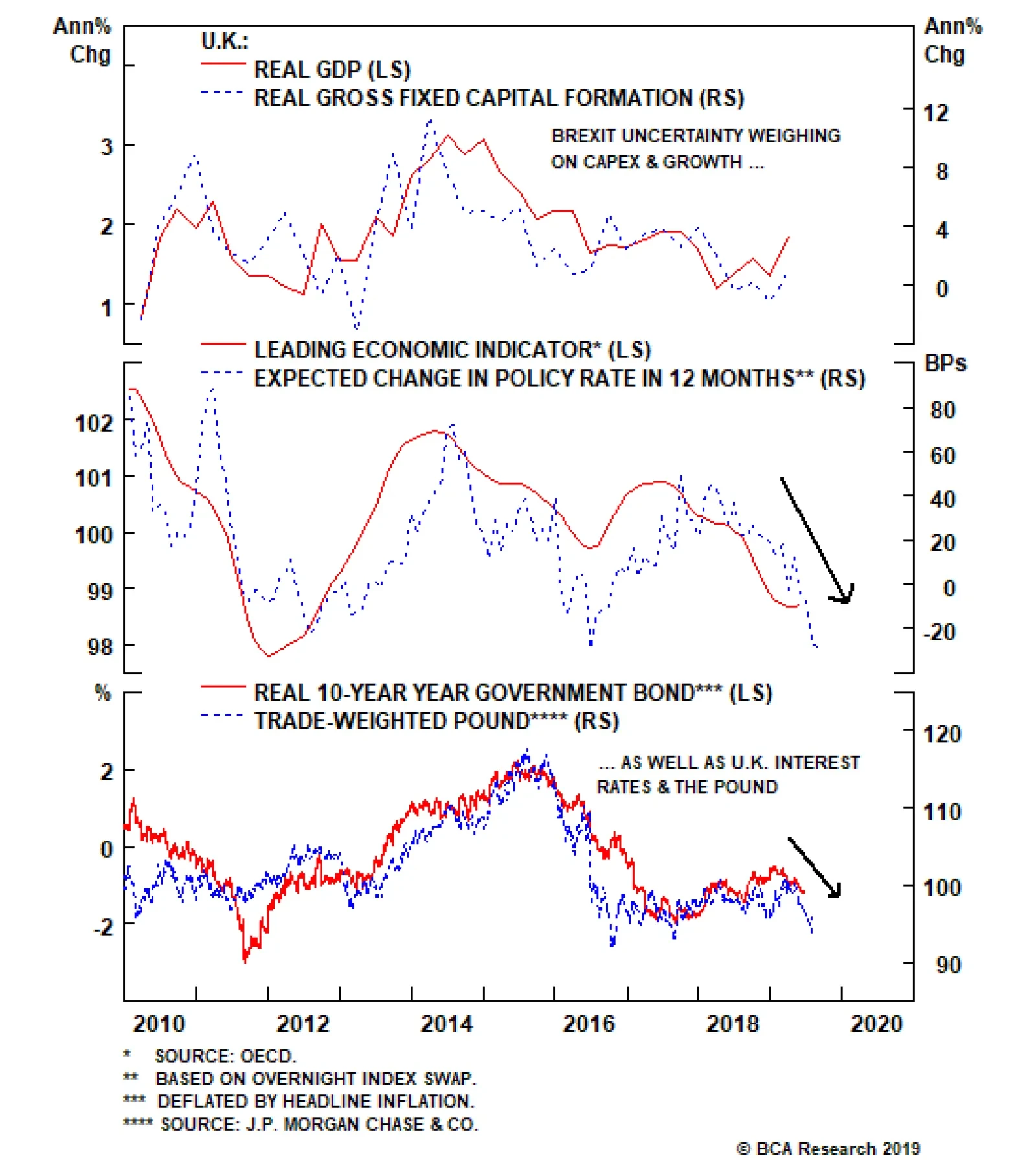

The Bank of England (BoE) held rates steady at last week’s Monetary Policy Committee (MPC) meeting, keeping the Bank Rate at 0.75%. The MPC modestly lowered its growth forecasts for 2019 and 2020 due to the dual…

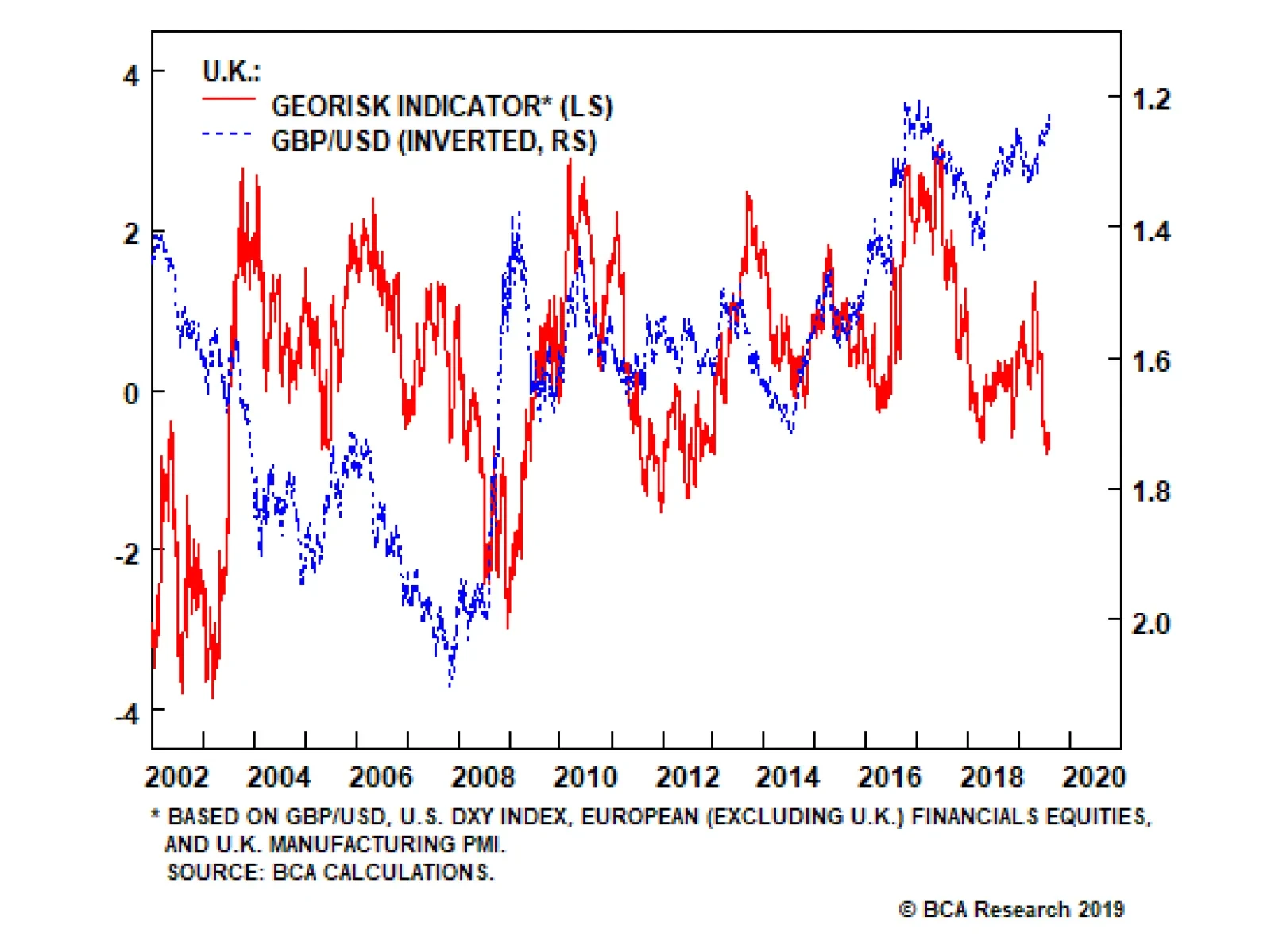

All of Boris Johnson's moves, since he took over, were anticipated – hence the decline in our Geopolitical Strategy Service's GeoRisk indicator – but the pound sterling is falling now that the confrontation is…

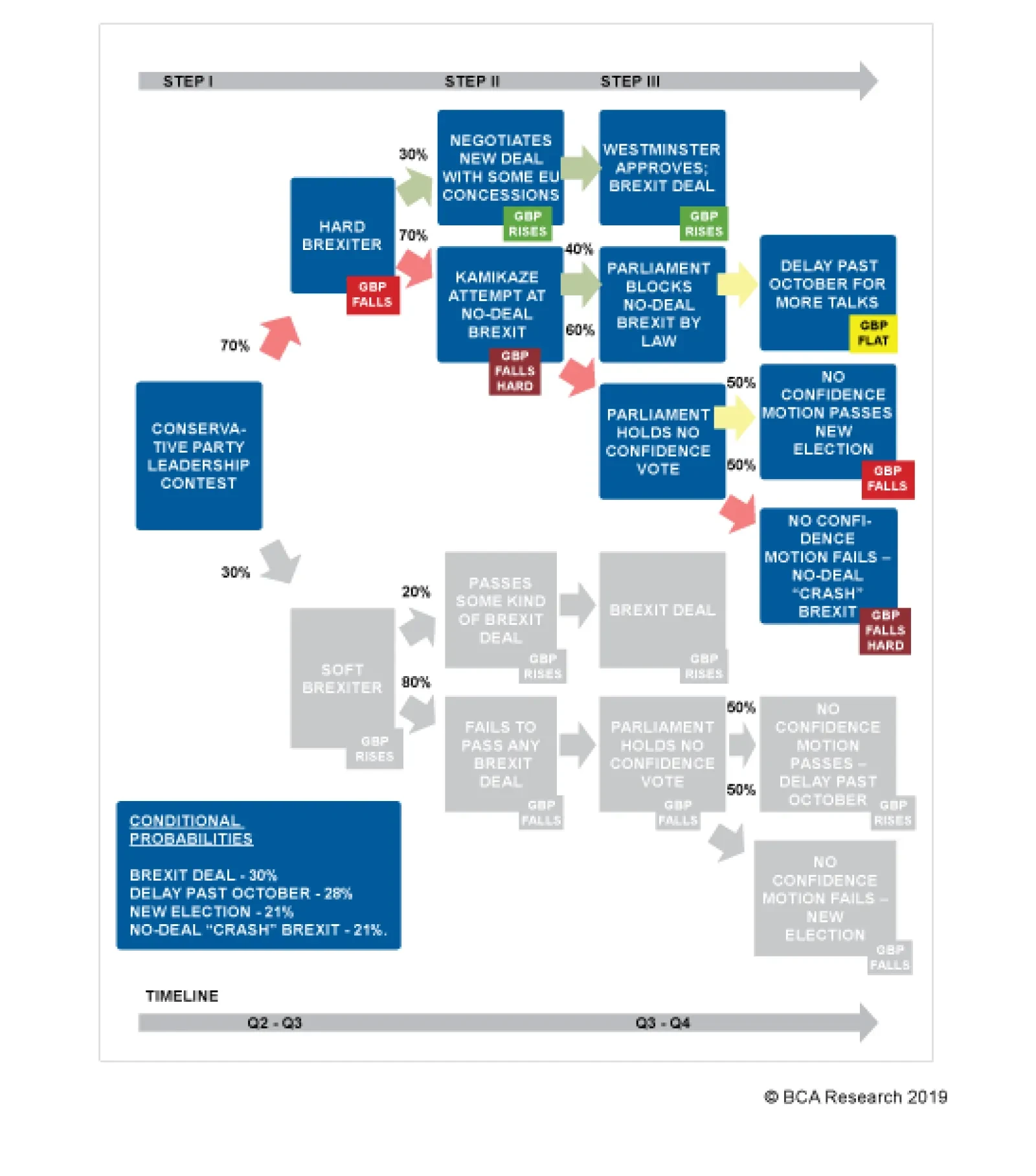

Politicians have to pay attention to the opinion polls as well as the referendum result, since opinion polls impact the next election. These show a plurality in favor of remaining in the EU and a strong trend against Brexit since…

Highlights So What? Prime Minister Boris Johnson’s threat to take the U.K. out of the EU without a withdrawal deal in place is a substantial 21% risk. Why? The odds of a no-deal exit could range from today’s 21% to around…

Dear Client, Next week I am sending you a Special Report on Japan written by Amr Hanafy, Research Associate of BCA’s Global Asset Allocation service. Amr answers some key questions that clients have been asking about Japan recently…