Highlights The ECB loaded a bazooka, and core Eurozone yields rose: The ECB surprised dovishly last Thursday, and European bond yields duly fell … for an hour. Then they began to back up as fast as they fell, and when Friday…

Highlights The lack of dollar liquidity has been a tailwind behind the dollar bull market. Going forward, an end to a contraction in the Federal Reserve’s balance sheet should help stem the global shortage of dollars. Outside…

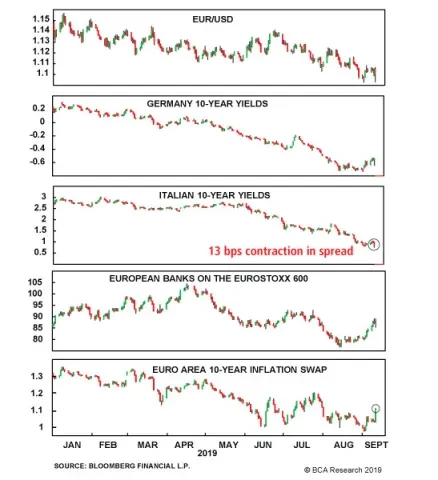

ECB President Mario Draghi managed to achieve his last “whatever it may take” moment. Interest rates on the ECB Deposit Facility have been cut to -0.5% from -0.4%, which is slightly less than traders anticipated.…

Highlights The structural message for equities: prefer equities over bonds. As long as the global 10-year bond yield remains below 2 percent, the equity market’s rich valuation is underpinned, albeit the long-term return from…

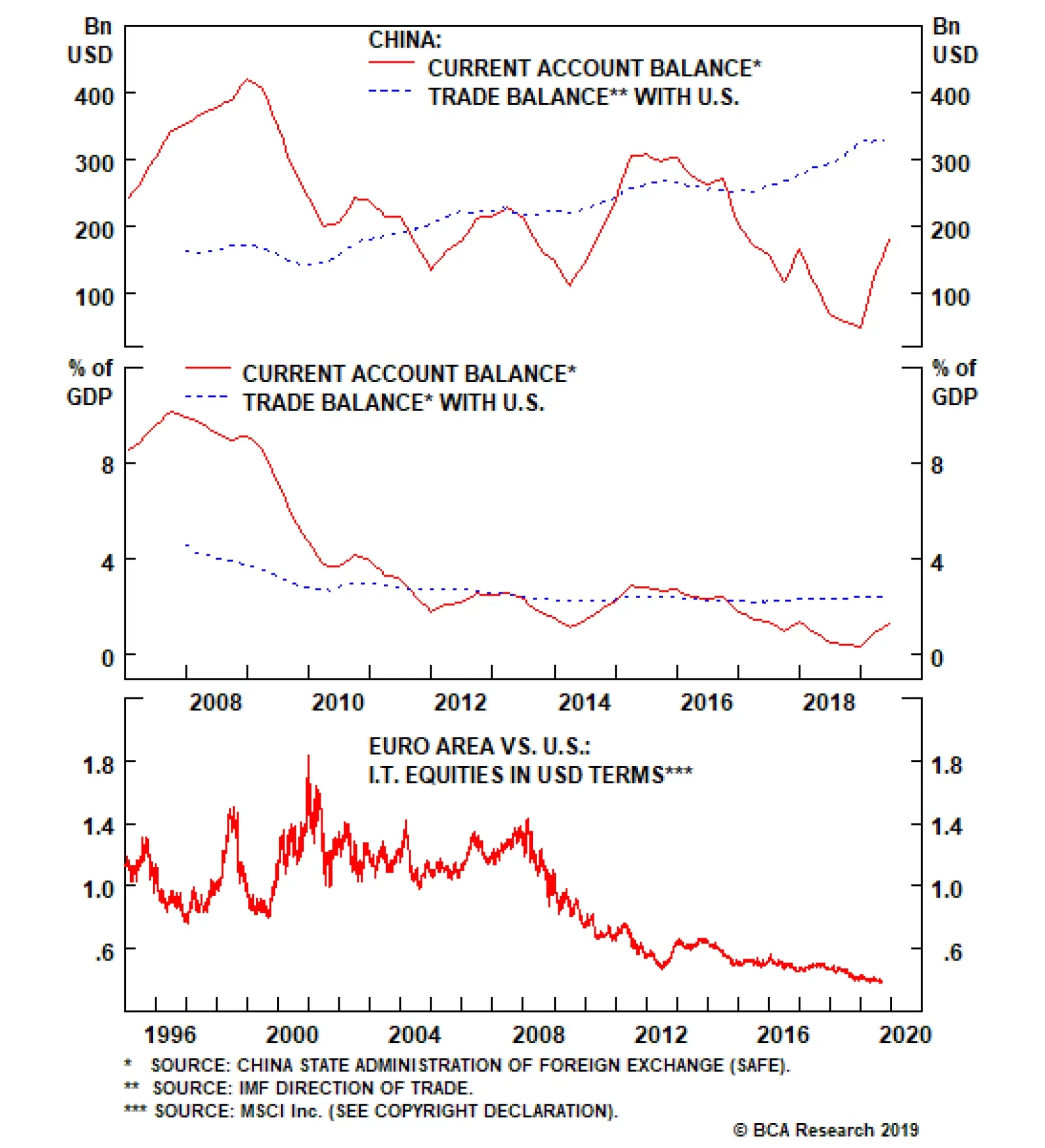

Europe will remain a high-beta play on global growth that is unlikely to collapse. As such, investors should deploy funds in Europe once the global economy turns up the confidence that the continent will not descend into…

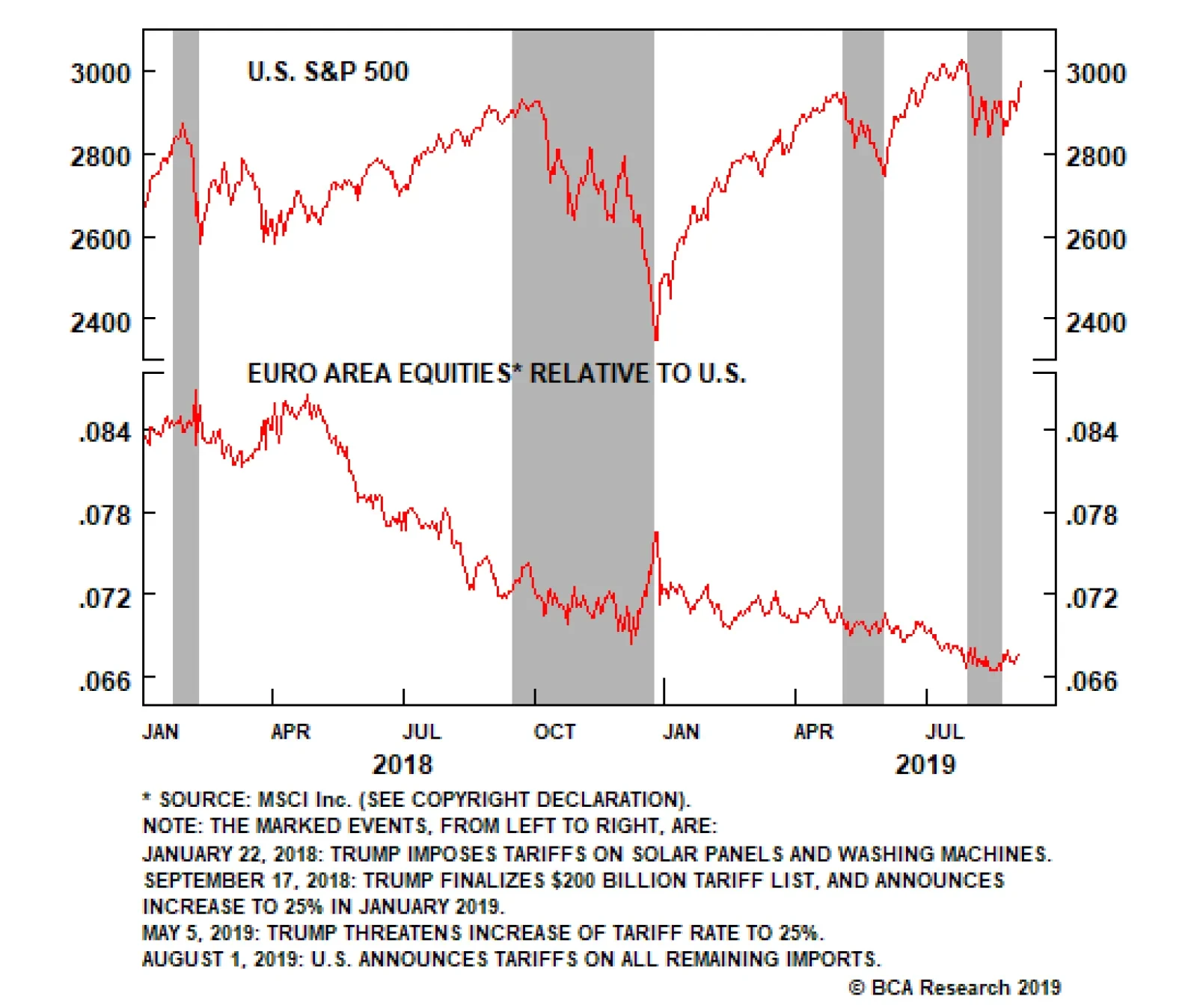

The “substitution effect” thesis is a double-edged sword for Europe. A resolution of the trade war between the U.S. and China would likely include a massive purchase of U.S. agricultural, commodity, and manufacturing…

Highlights Global bond yields have closely tracked the trajectory of global growth. While the global economy remains fragile, some positive signs are emerging: Our global leading economic indicator has moved off its lows; global…

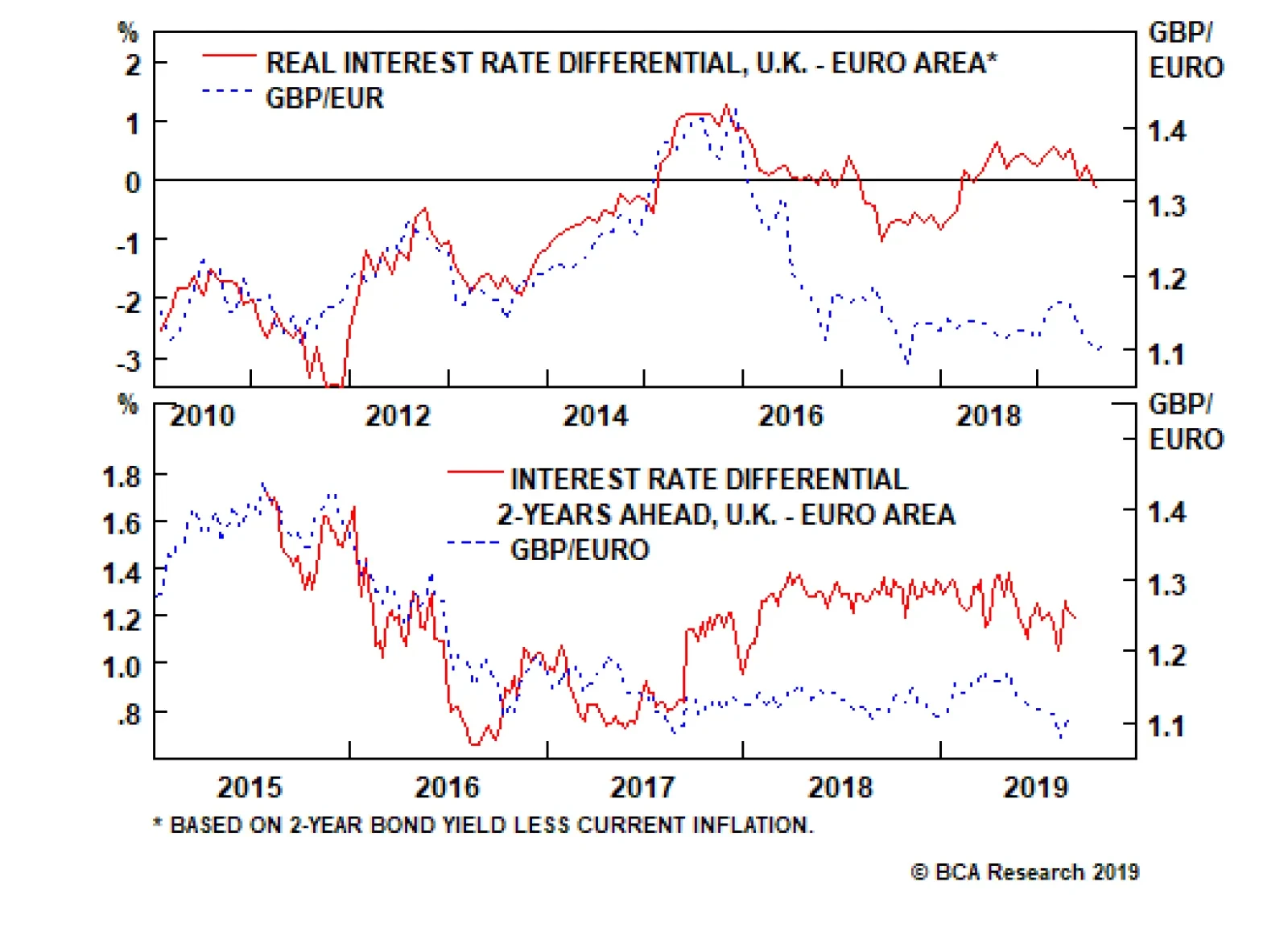

The only way out of the impasse is to change the parliamentary arithmetic via a snap general election. The trouble is that the outcome of such an election is near impossible to predict. This is because the U.K.’s first past…

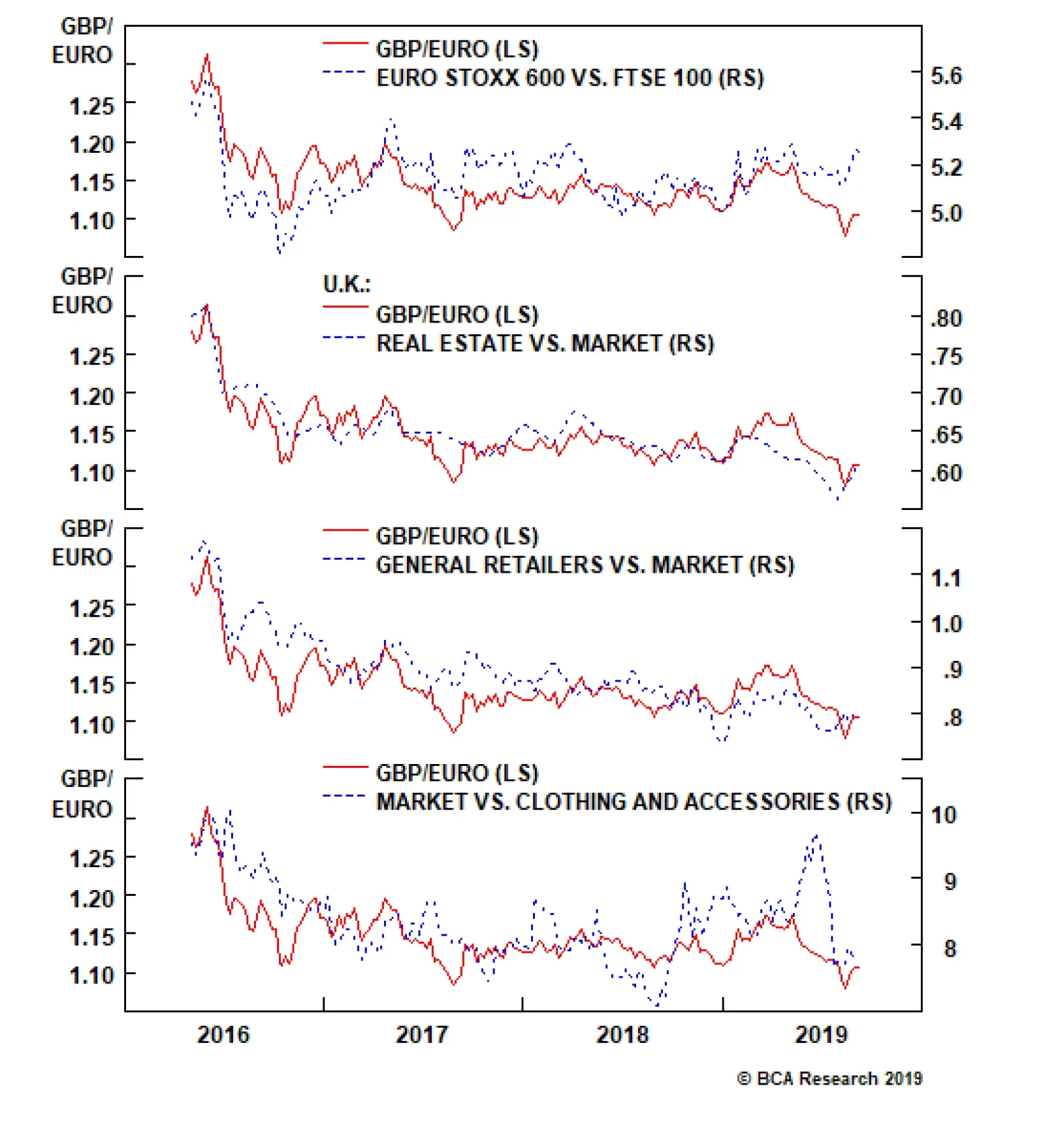

The non-linearity of any potential U.K. election is what makes it difficult to take a high-conviction view on sterling’s direction. Instead, as soon as an election is announced, a good strategy is to buy sterling volatility…

Highlights Currency markets continue to fight a tug-of-war between deteriorating global growth and easing global financial conditions. Such an environment is typically fertile ground for a dollar bull market, yet the trade-weighted…