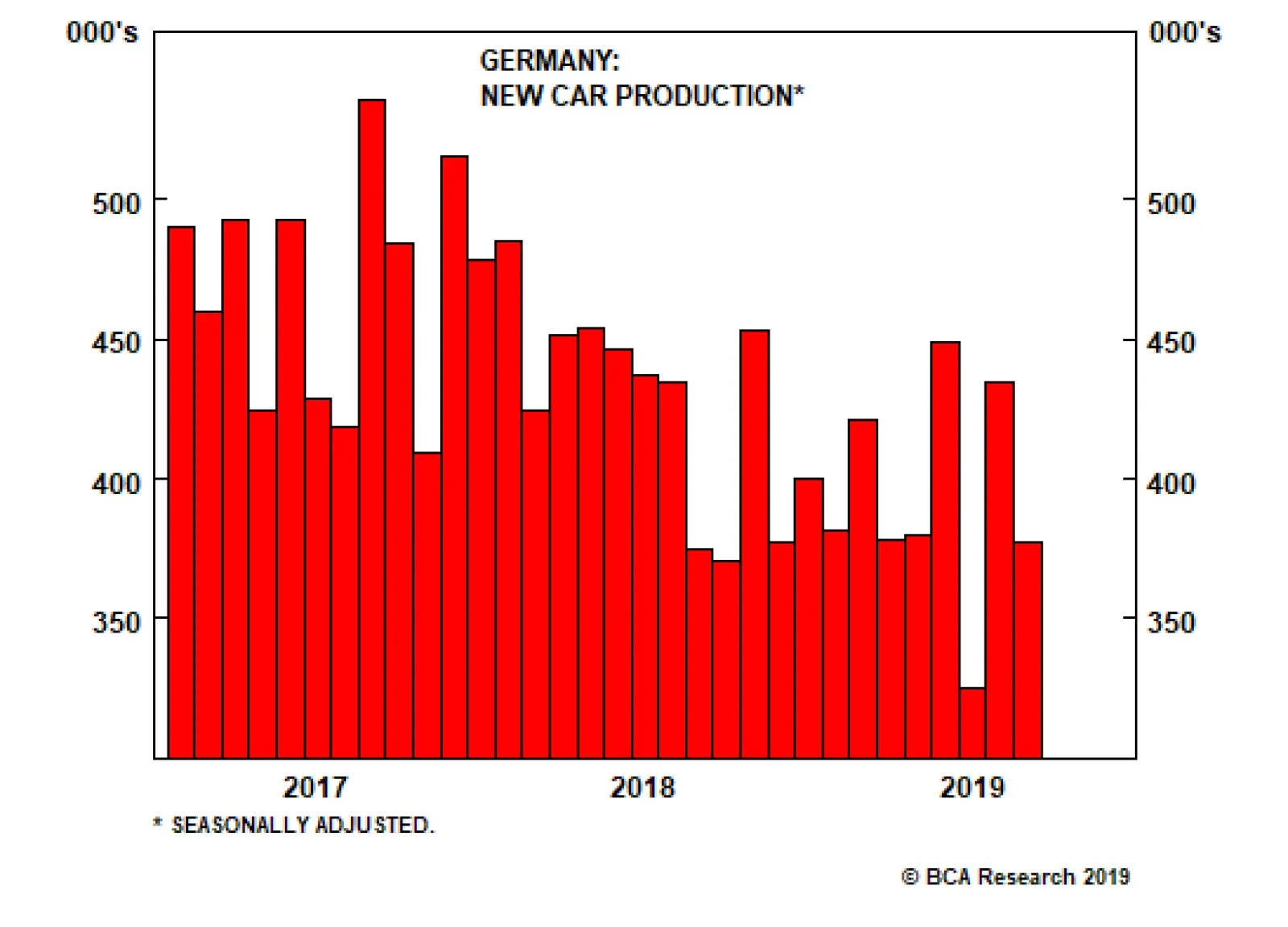

If the German economy contracts in the third quarter and thereby enters a technical recession, the knee-jerk response will be to blame the troubles in the auto industry. But the evidence does not support this story. German new…

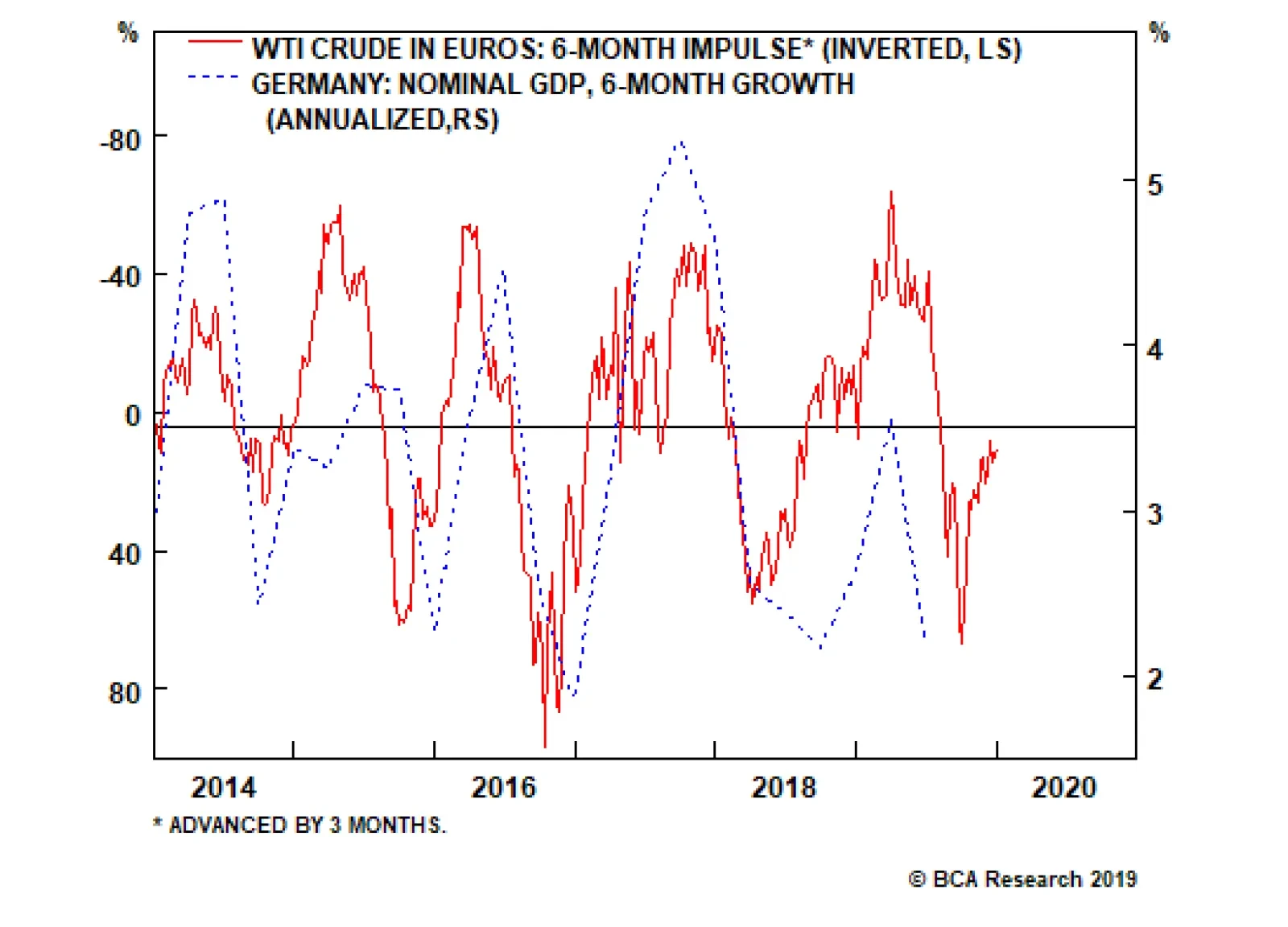

The oil price impulse has a major bearing on Germany’s short term growth accelerations and decelerations. The six months ending in June 2019 constituted a severe headwind impulse. A 30% increase in oil prices in that period…

Highlights European and global growth will rebound in the fourth quarter but the rebound will lack longevity. Bonds: Expect bond yields to edge modestly higher, especially for those yields that are deeply in negative territory.…

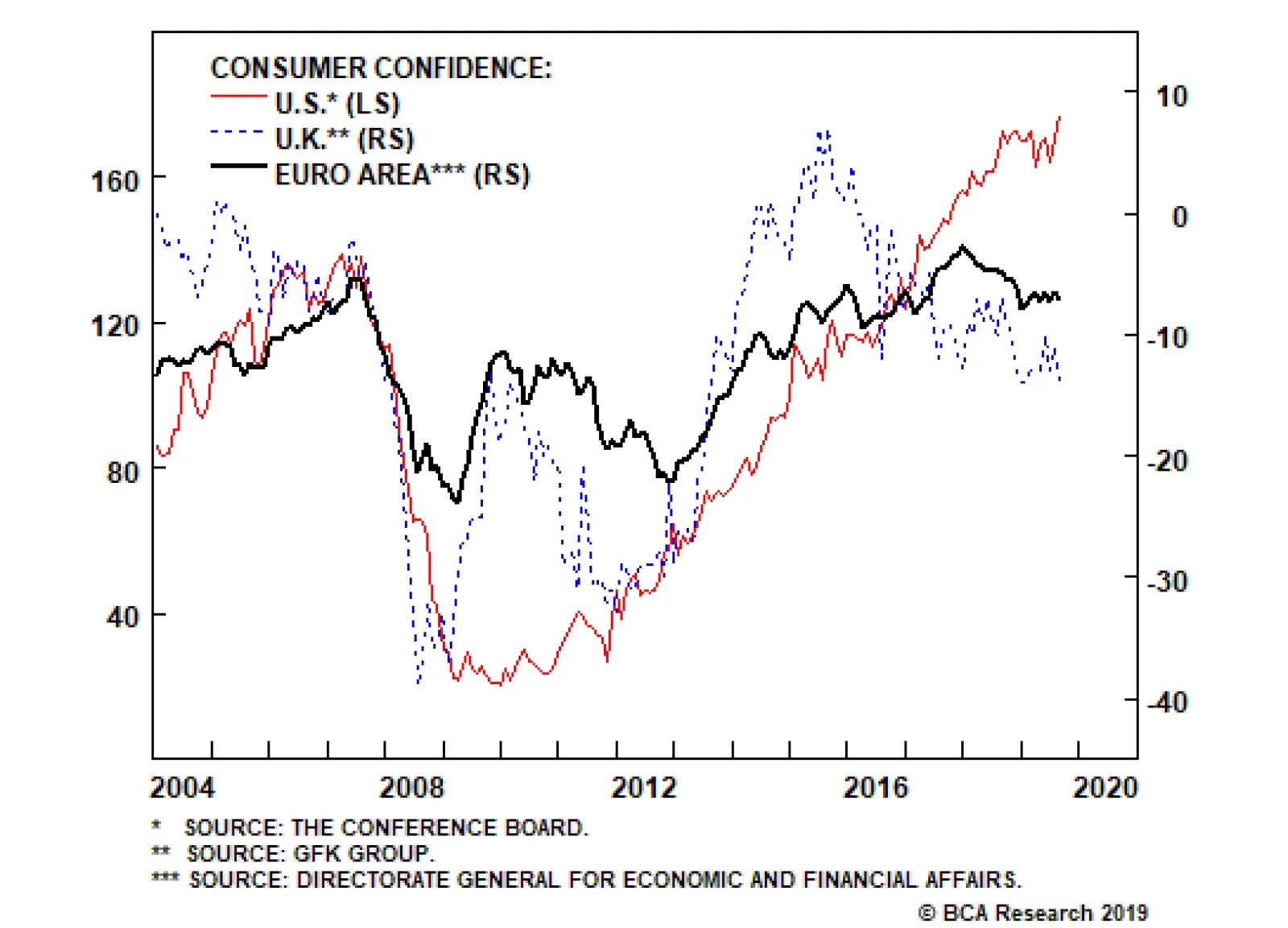

Highlights The global manufacturing cycle is likely to bottom soon, and consumption and services remain robust. The risk of recession over the next 12 months is low. This suggests that equities will continue to outperform bonds. But…

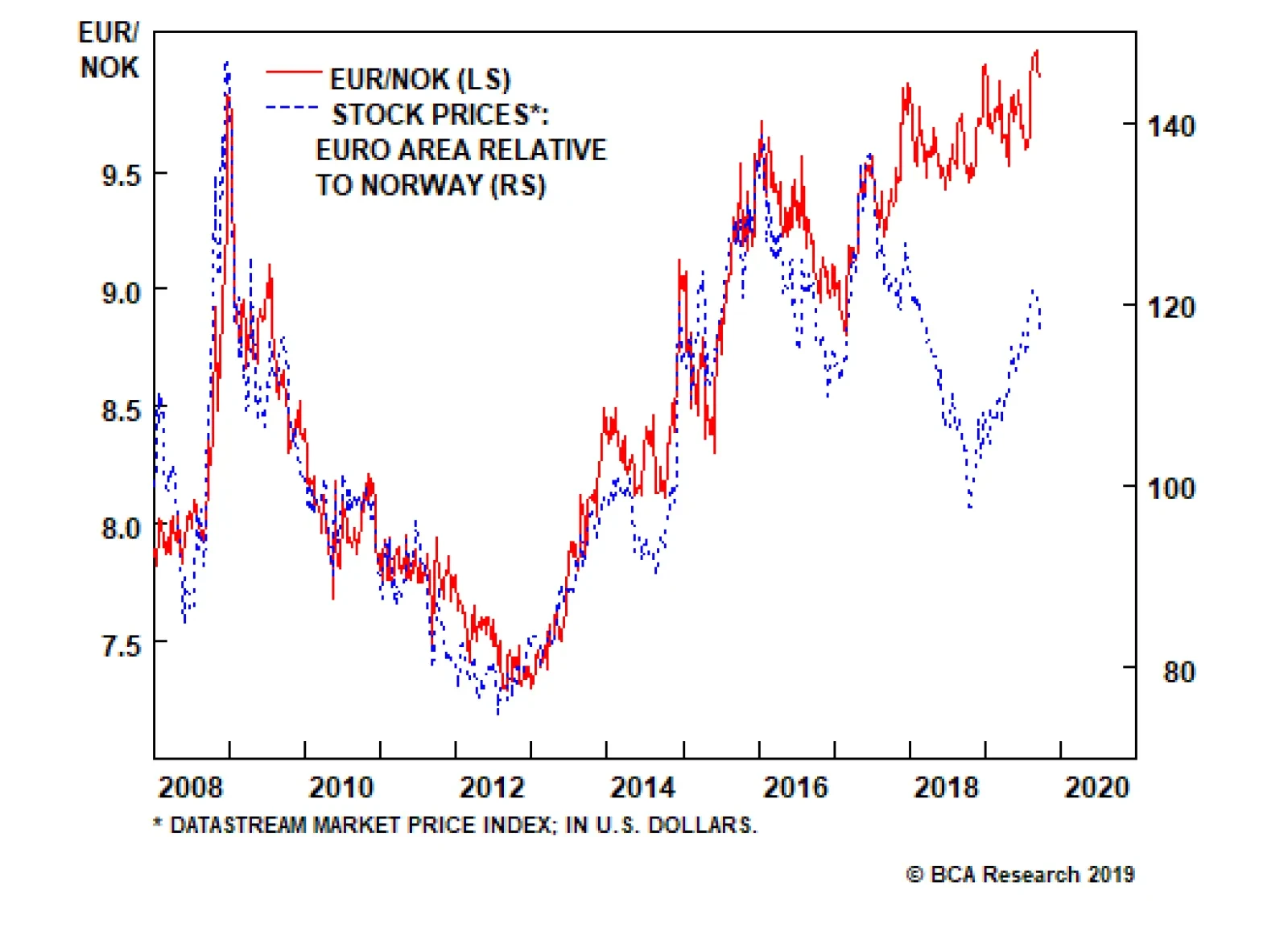

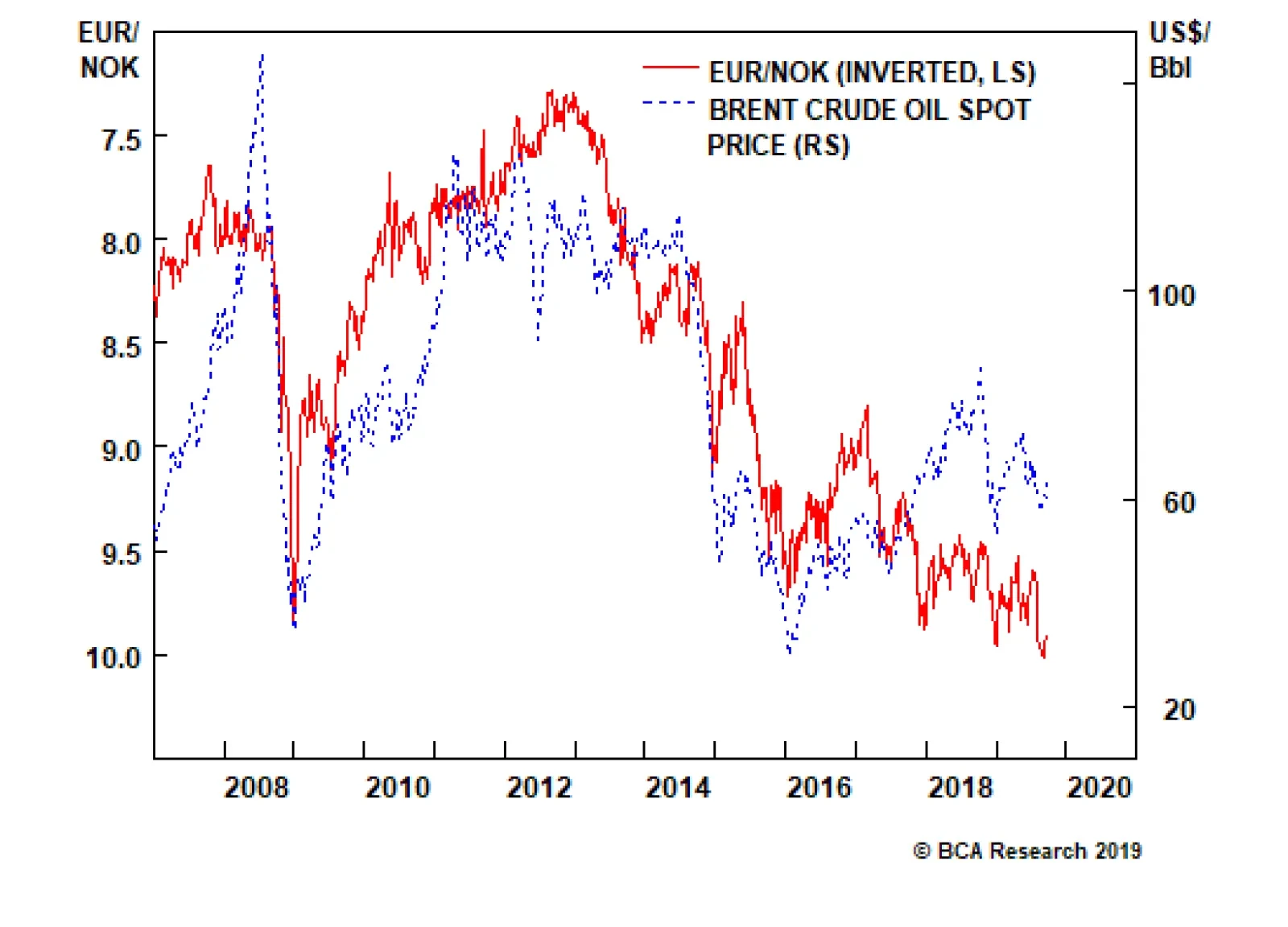

Sometimes, the best ideas are the simplest ones. The Norges bank is the most hawkish G-10 central bank, while the European Central Bank restarted QE at its latest meeting. This is a powerful catalyst for a short EUR/NOK trade. The…

The ECB’s tiering of reserves might prevent euro zone banks from teetering over the edge, but unless the manufacturing recession ends soon and firms start to borrow to invest, banks will continue to have a demand problem.…

Highlights The world remains mired in a manufacturing recession. As such, it is still too early to put on fresh pro-cyclical trades. Focus on the crosses rather than outright U.S. dollar bets. Two new trade ideas: sell EUR/NOK and…

Highlights President Trump’s support among Republicans and lack of smoking gun evidence will prevent his removal from office. Trade risk will increase if Trump’s approval benefits from impeachment proceedings and the U.S.…

Highlights U.S. growth will soon rebound thanks to robust drivers of domestic activity, and strengthening money and credit trends. The U.S. Federal Reserve will maintain an easing bias and will expand its balance sheet again. A…

A big driver for retail sales in the U.K. are tourist arrivals and the weaker pound is likely to keep attracting an influx of visitors. The U.K. commands many of the world’s leading brands that will benefit from a…