Highlights The world remains mired in a manufacturing recession. This has historically not been bullish for pro-cyclical currencies. The velocity of money in the euro area will need to rise vis-à-vis the U.S. to confirm a…

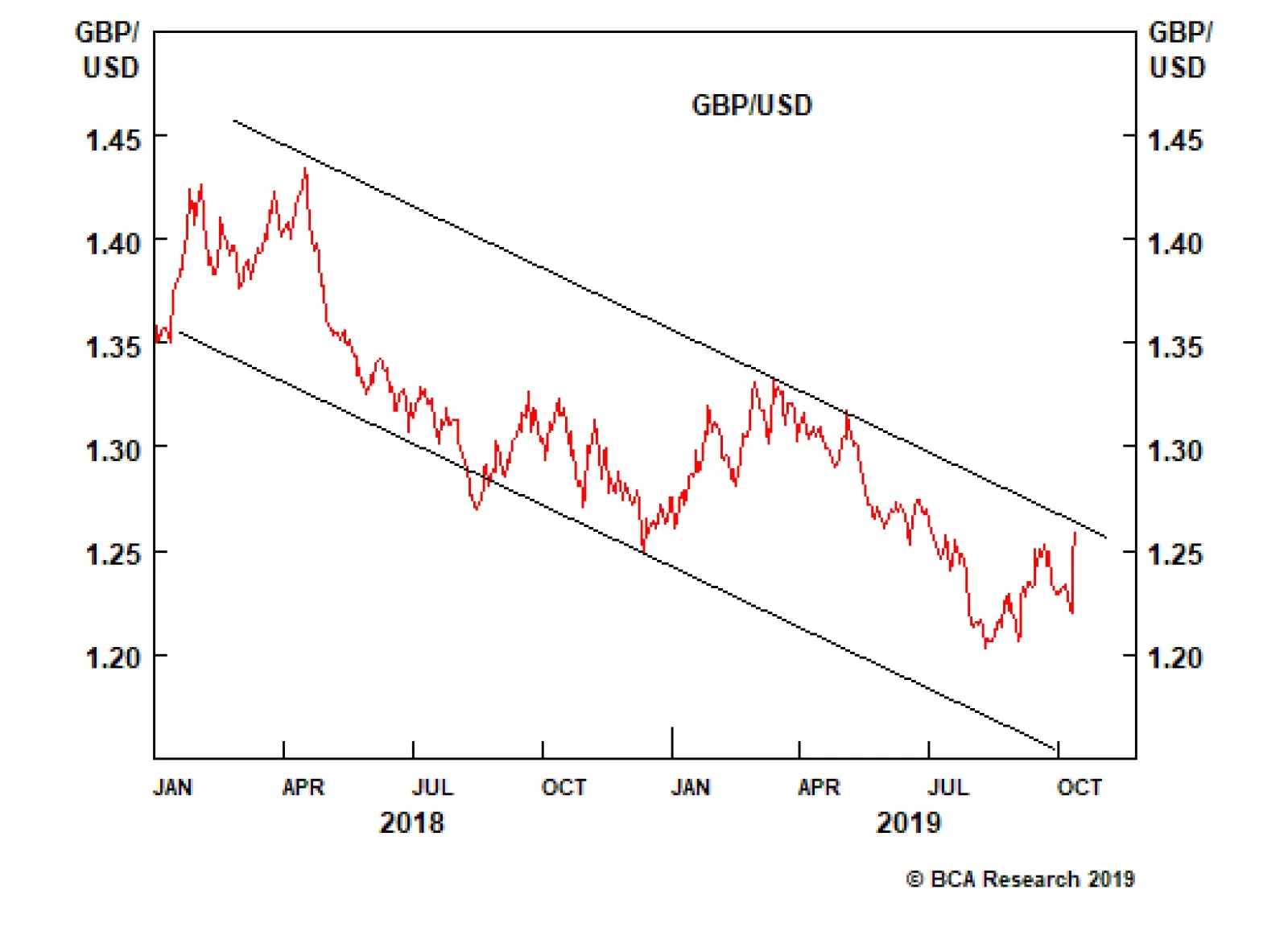

The U.K. and EU negotiators meet next Friday to try to hammer a deal. There have been hopeful signs in recent days that both sides are getting closer to an agreement. As a result, the pound has rallied nearly 4% in the past two…

Highlights Geopolitical risks are starting to abate as a result of material constraints influencing policymakers. China needs to ensure its economy bottoms and a debt-deflationary tendency does not take hold. President Trump needs to…

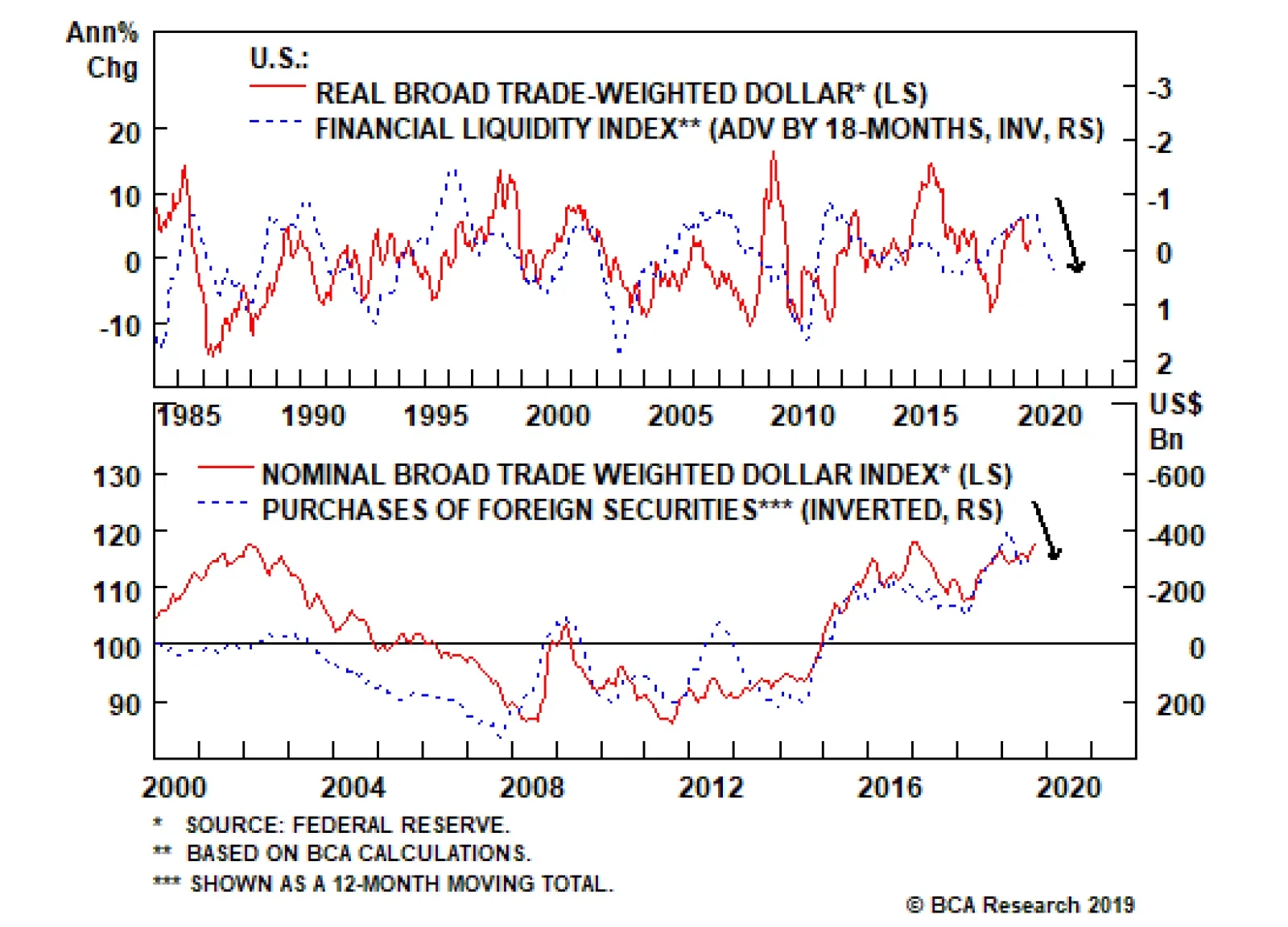

The dollar has significant downside. The greenback is very expensive and will decline as global liquidity conditions improve. These dynamics reflect the countercyclical nature of the dollar and also lead to strong greenback…

Highlights Q3/2019 Performance Breakdown: Our recommended model bond portfolio underperformed the custom benchmark by -30bps during the third quarter of the year. Winners & Losers: The biggest underperformance came from…

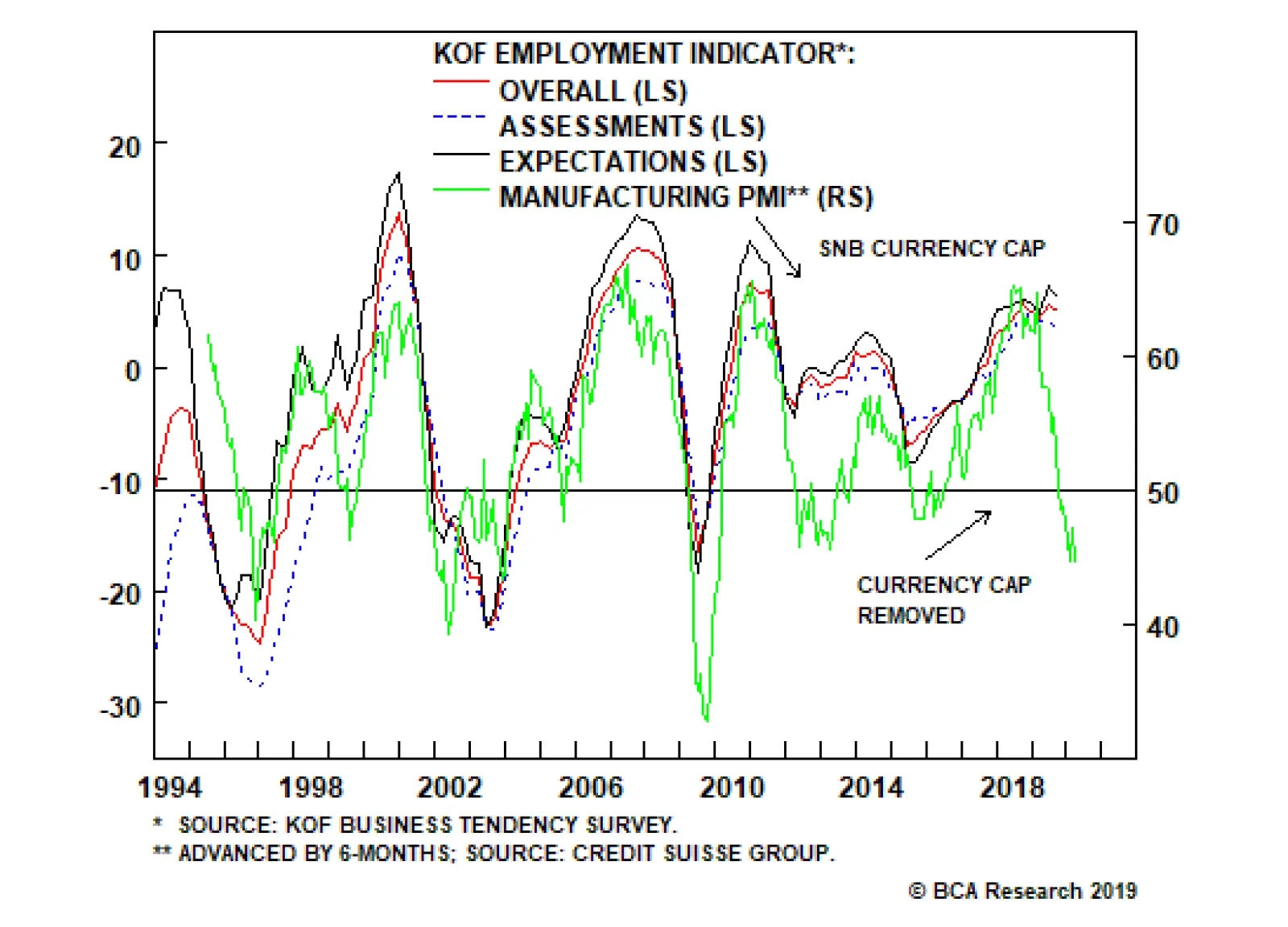

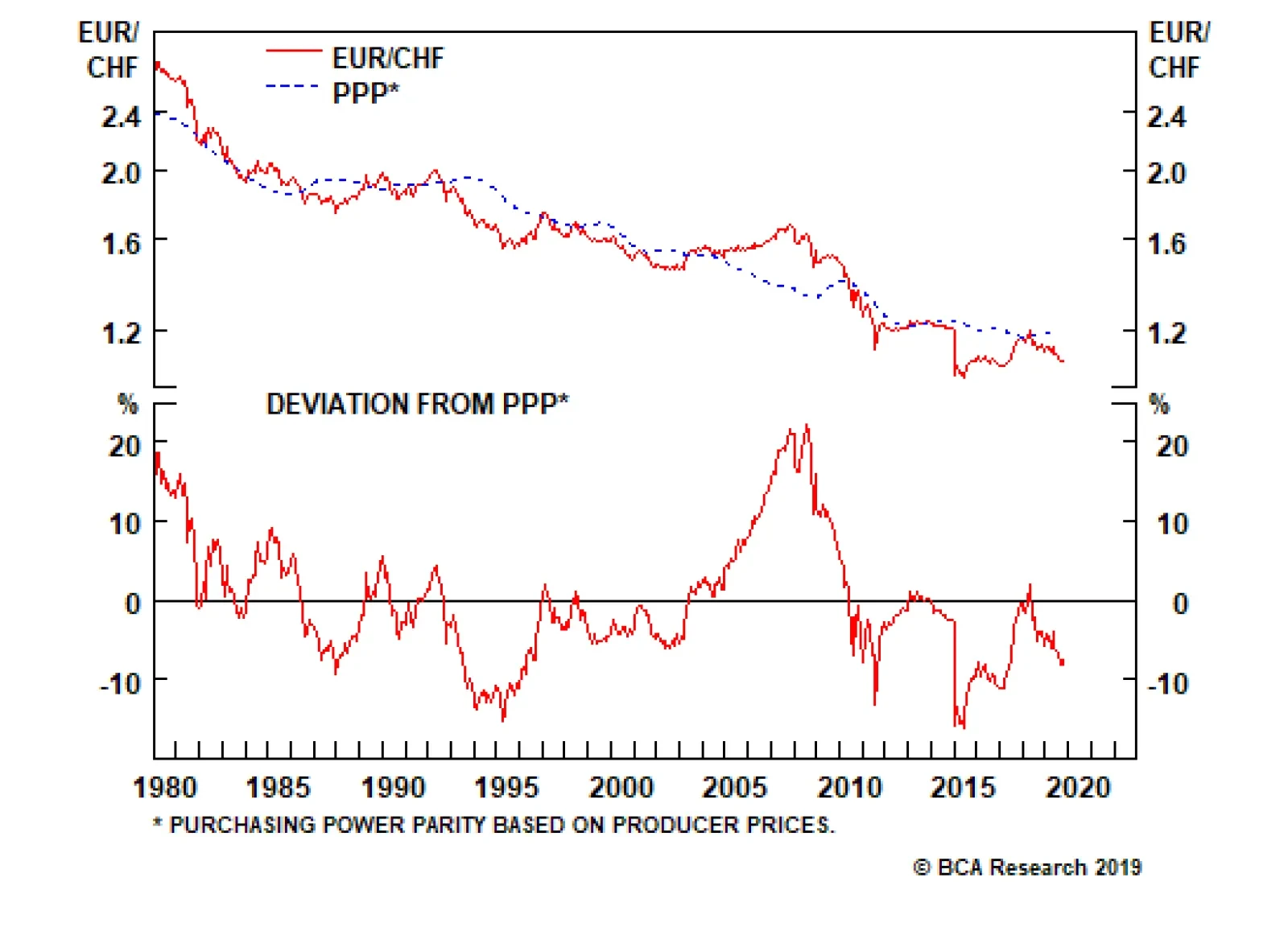

Domestically, the Swiss economy is holding up well, but how much longer will it defy a slowing external sector. The KOF employment indicator is at its highest level since 2010, and the expectations component continues to exceed…

The four key factors that suggest the Swiss economy needs a weaker currency, especially versus the euro are: The Swiss trade balance has held up well in the face of the global slowdown, but this has been largely driven by…

Highlights The slowdown in the U.S. manufacturing sector is at risk of becoming deeper than elsewhere. This is not bearish for the U.S. dollar, given that it is a countercyclical currency, but it is not a constructive development,…

Highlights MARKET FORECASTS Investment Strategy: Markets have entered a “show me” phase. Better economic data and meaningful progress on the trade negotiations will be necessary for stocks to move sustainably…