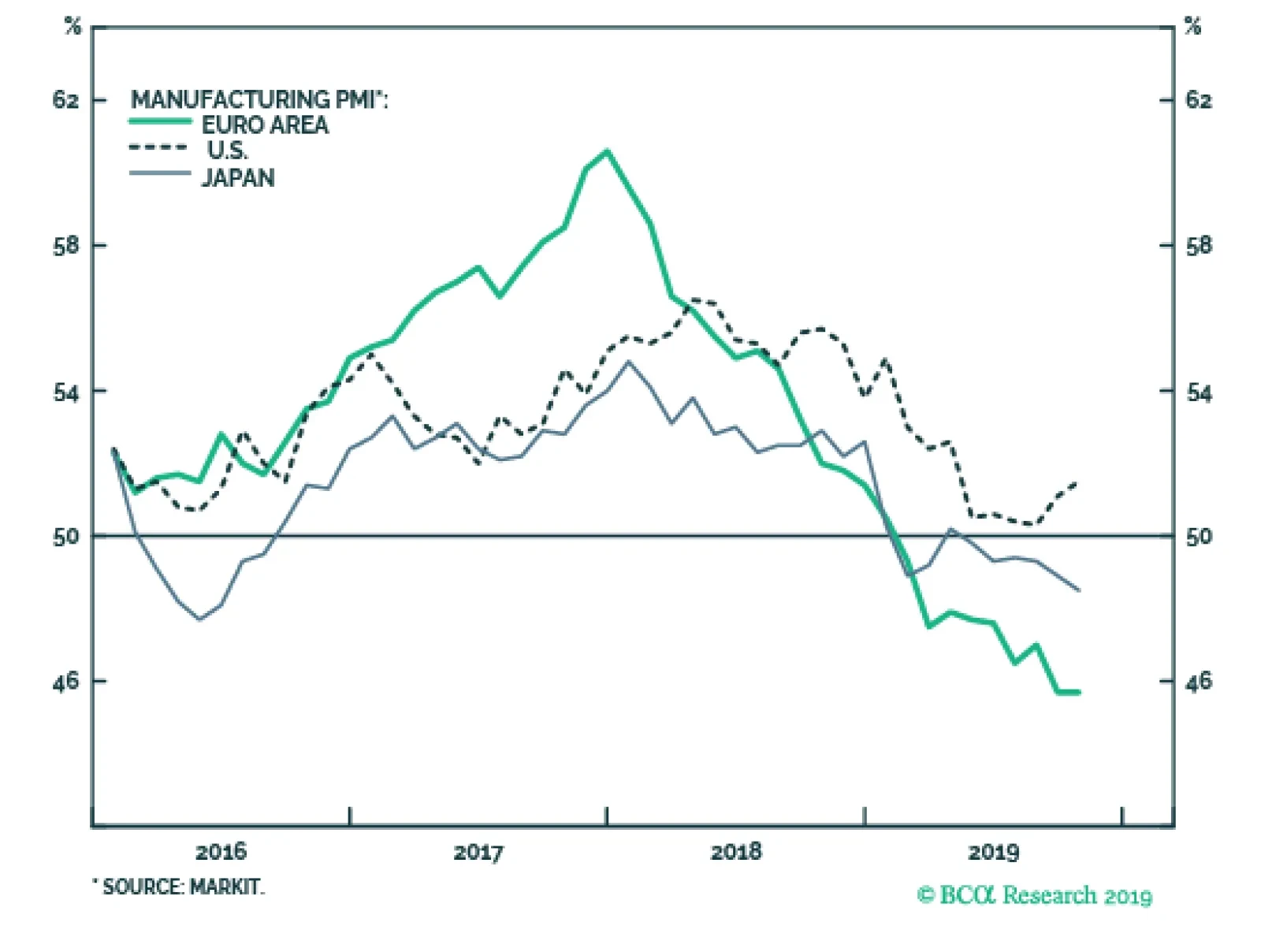

The October flash PMIs released this morning show a very modest stabilization. The Eurozone manufacturing gauge was stable at 45.7, as was Germany’s which increased slightly from 41.7 to 41.9. France’s manufacturing…

Highlights On a tactical horizon, underweight bonds versus cash, especially those bonds with deeply negative yields… …and underweight bonds versus equities. On a strategic horizon, remain overweight a 50:50 combination…

Highlights Shifting Trends: The factors that have driven bond yields lower throughout 2019 – slowing growth, rising uncertainty, demand for safe assets and dovish monetary policy expectations – have all started to turn in a…

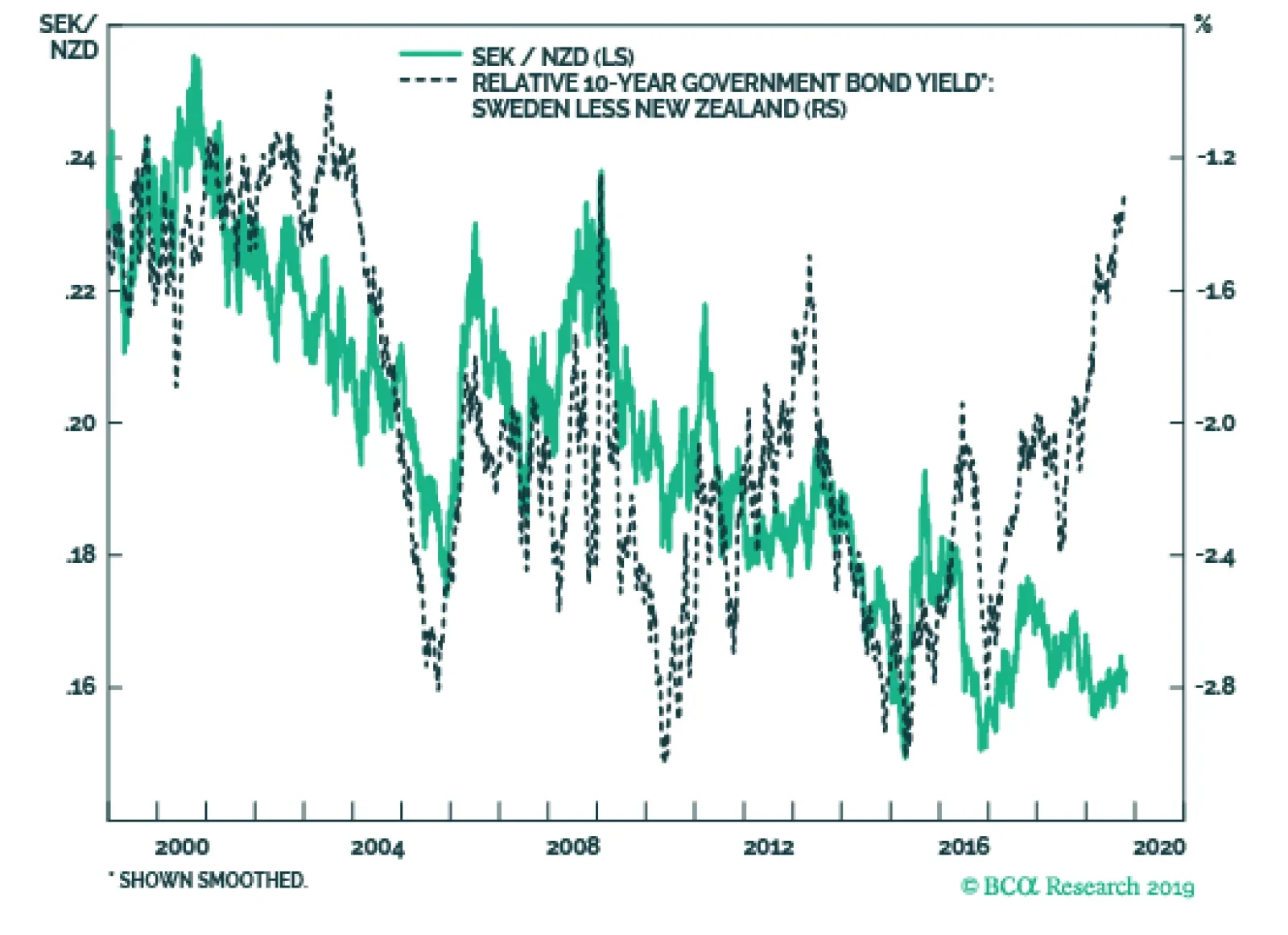

Selling NZD/SEK is the optimal vehicle to play any Swedish krona rebound. USD/SEK and NZD/SEK are often highly correlated; since the SEK has a higher beta to global growth than the kiwi (Sweden exports 45% of its GDP versus 27%…

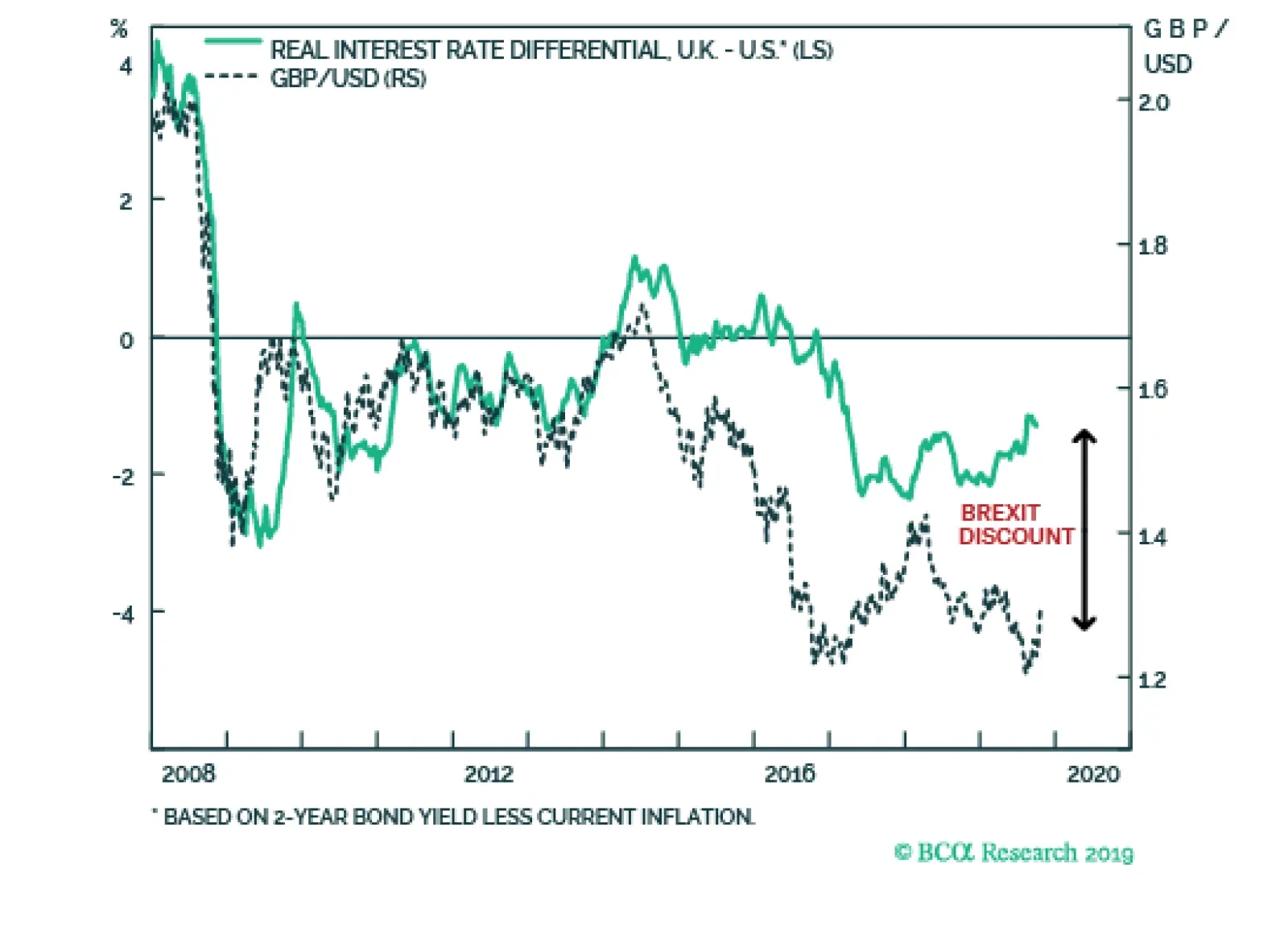

Based on the pre-Brexit relationship between relative real interest rates and the pound’s exchange rate, we can quantify the ‘Brexit discount’. Absent this discount, the pound would now be trading close to…

Highlights The currency market is bifurcated in terms of shorter-term expectations versus longer-term factors. The Swedish krona, Norwegian krone, and British pound are solid long-term buys, but could remain very volatile in the short…

Highlights The interim “phase 1” trade agreement reached last week represents a significant step forward towards reaching a détente in the China-U.S. trade war. Regardless of what happens next in the Brexit…

Highlights New structural recommendation: long GBP/USD. The substantial Brexit discount in the pound makes it a long-term buy for investors who can tolerate near-term volatility. The most powerful equity play on a fading Brexit…

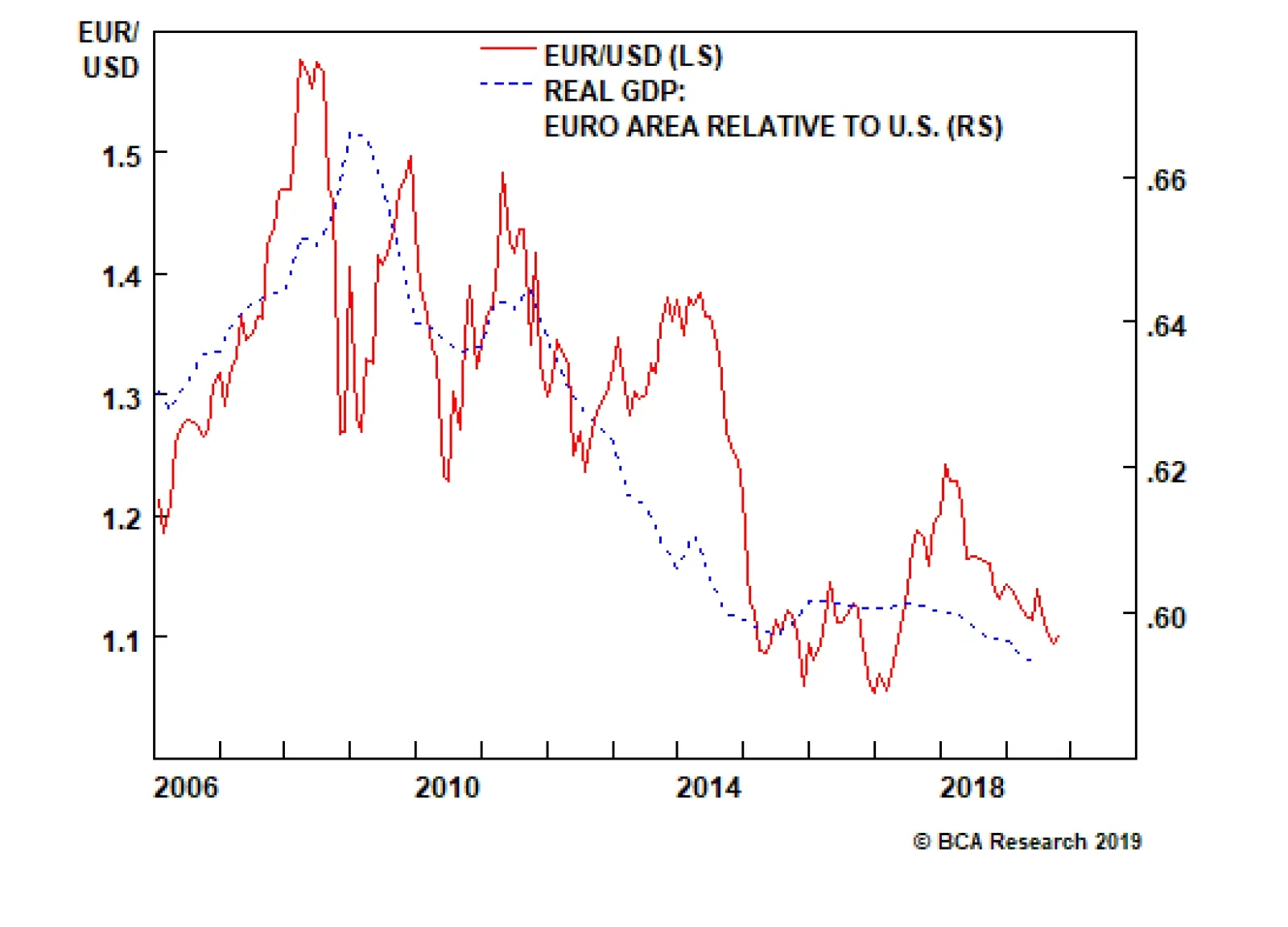

Ever since the European debt crisis, the velocity of money in the euro area has collapsed relative to that in the U.S. Relative long bond yields have followed suit in tight correlation. In a nutshell, precautionary demand for…

Highlights In this Weekly Report, we present our semi-annual chartbook of the BCA Central Bank Monitors. All of the Monitors are now below the zero line, indicating a growing need to ease global monetary policy (Chart of the Week).…