Martin Barnes and I spent last week visiting clients in Hong Kong and Singapore in celebration of BCA’s 70th anniversary. Martin has been with BCA Research for 32 years and has been a keen observer of market trends for much longer…

In lieu of the next weekly report I will be presenting the quarterly webcast ‘The Japanification Of Europe: Should We Fear It, Or Celebrate It?’ on Monday 4 November at 10.00AM EST, 3.00PM GMT, 4.00PM CET, 11.00PM HKT. As…

Highlights Declining uncertainty over policy, stabilizing growth in China and improvements in international liquidity, all will allow global economic activity to pick up in the months ahead. A weak dollar will reinforce this positive…

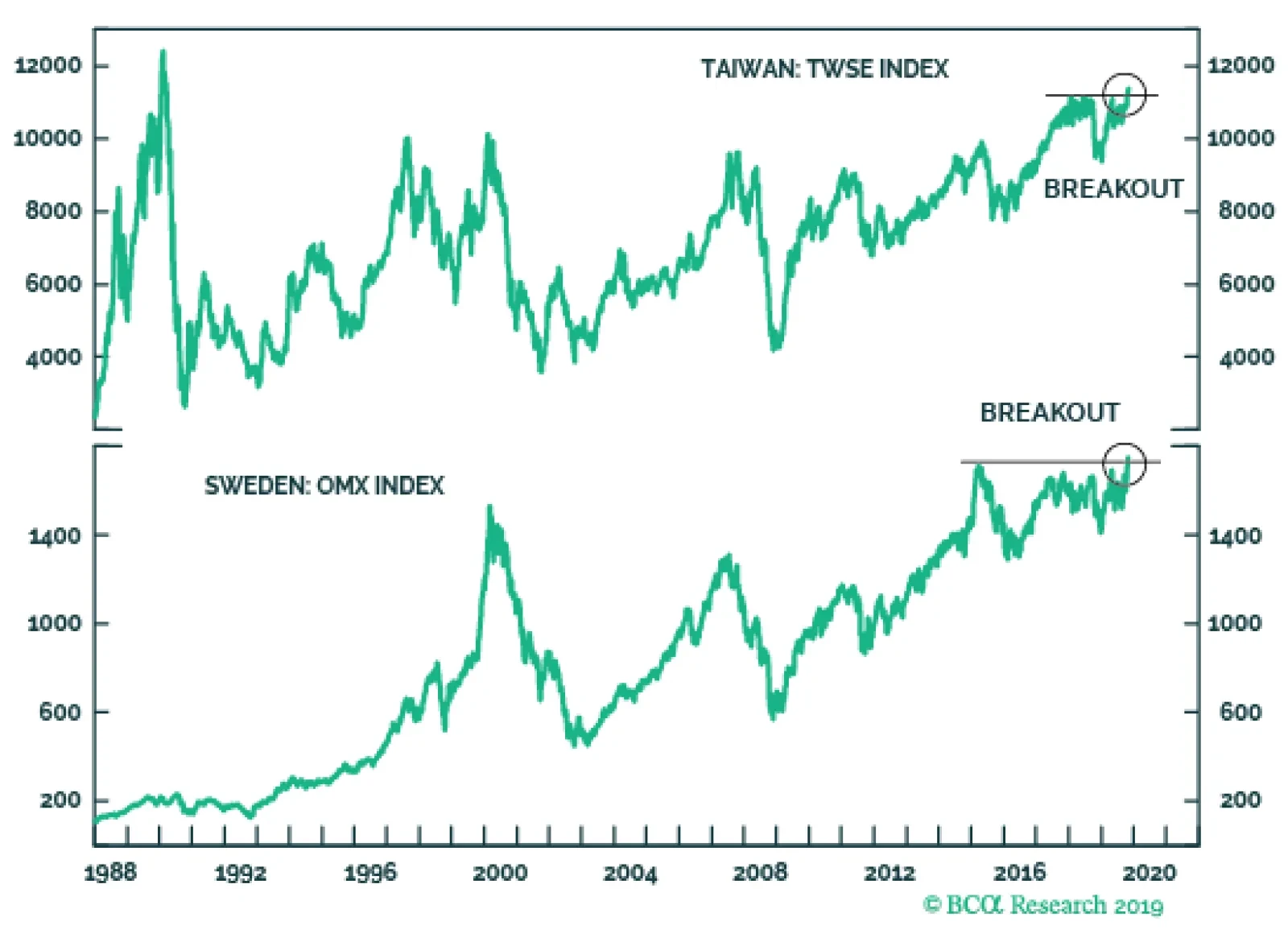

A variety of pro-cyclical financial variables are pointing toward an improving global growth outlook. The AUD/JPY has clearly bottomed, the USD/KRW is weakening, and the silver to gold ratio has been strengthening. The most…

Highlights Equities & Bonds: The accelerating upward momentum of global equities – the ultimate “leading economic indicator” – suggests that the current rise in global bond yields can continue. Maintain…

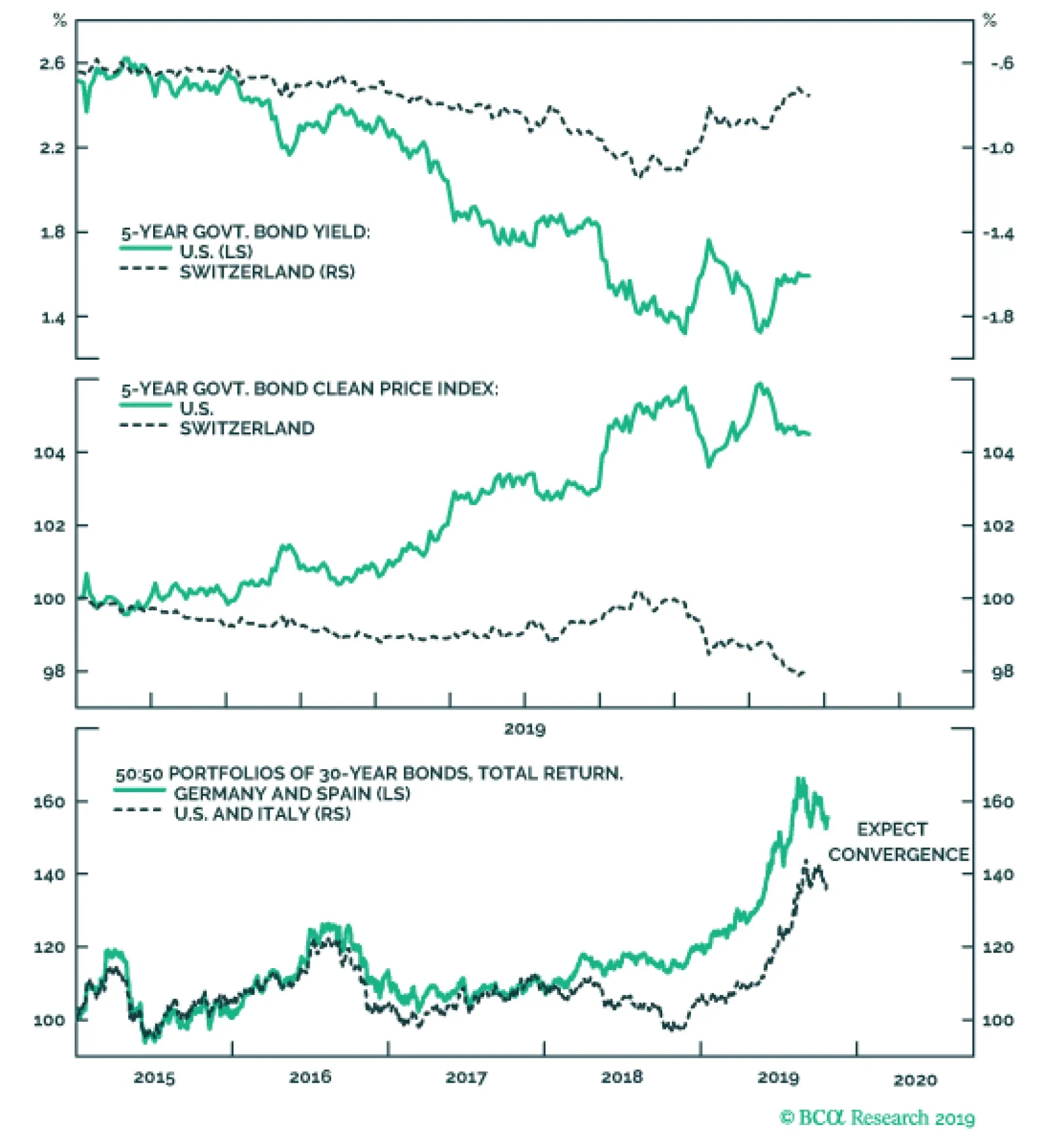

The closer a bond yield gets to the -1 percent lower bound, the more limited becomes the possibility for a further yield decline (capital gain), while the possibility for a yield increase (capital loss) stays unlimited. This…

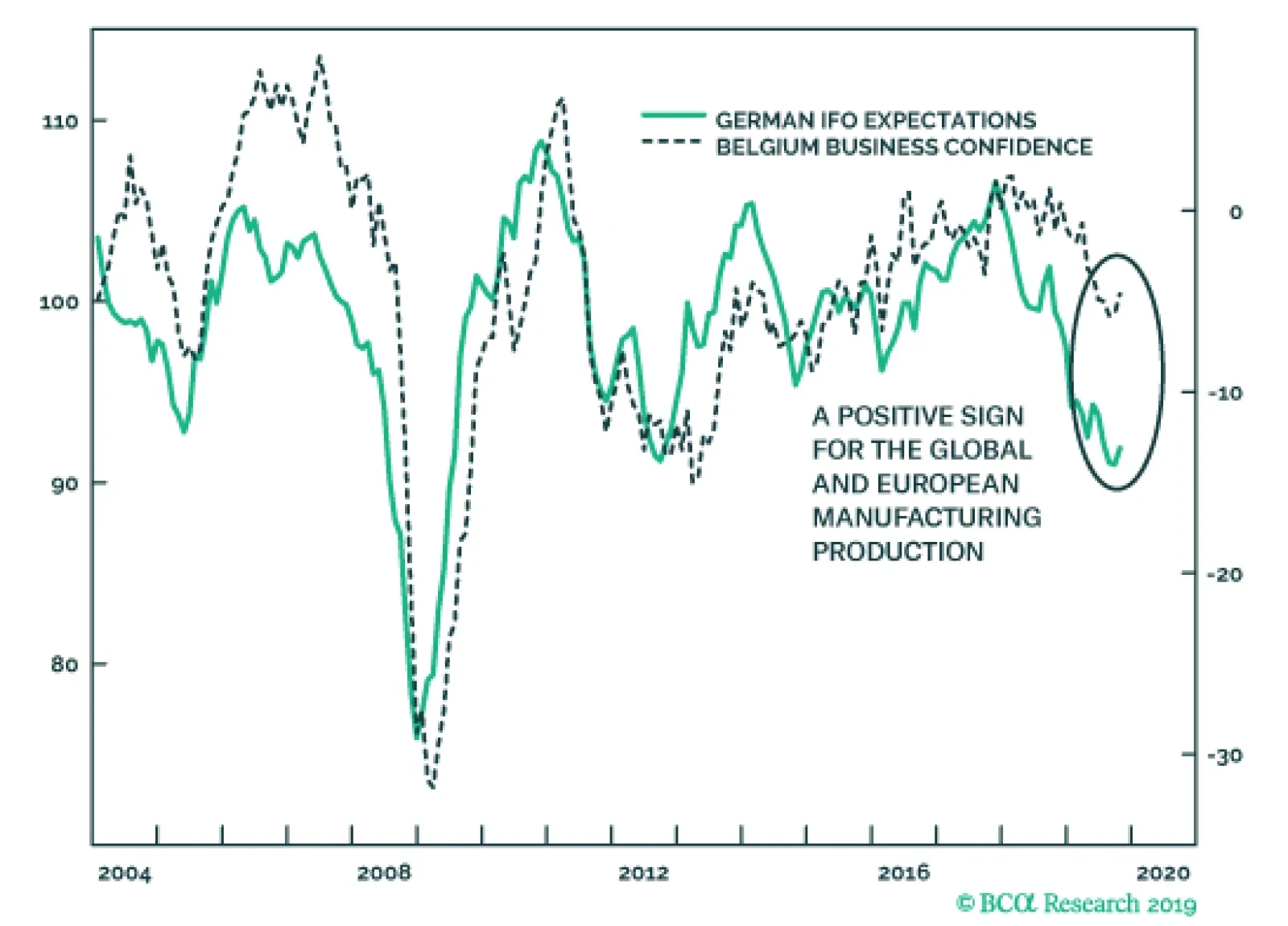

On the heels of yesterday’s disappointing German PMIs, the October Belgian Business Confidence and German IFO surveys will help alleviate fears towards the European economy. While the current assessment component of the IFO…

Highlights The U.S. and China are moving toward formalizing a trade ceasefire that reduces geopolitical risk in the near term. The risk of a no-deal Brexit is finished – removing a major downside to European assets. Spanish…