Highlights Stock markets are set to produce low single digit returns in 2020. Favour stocks over bonds and cash, especially where bond yields are zero or negative – specifically, Germany, Switzerland, and Sweden. Underweight…

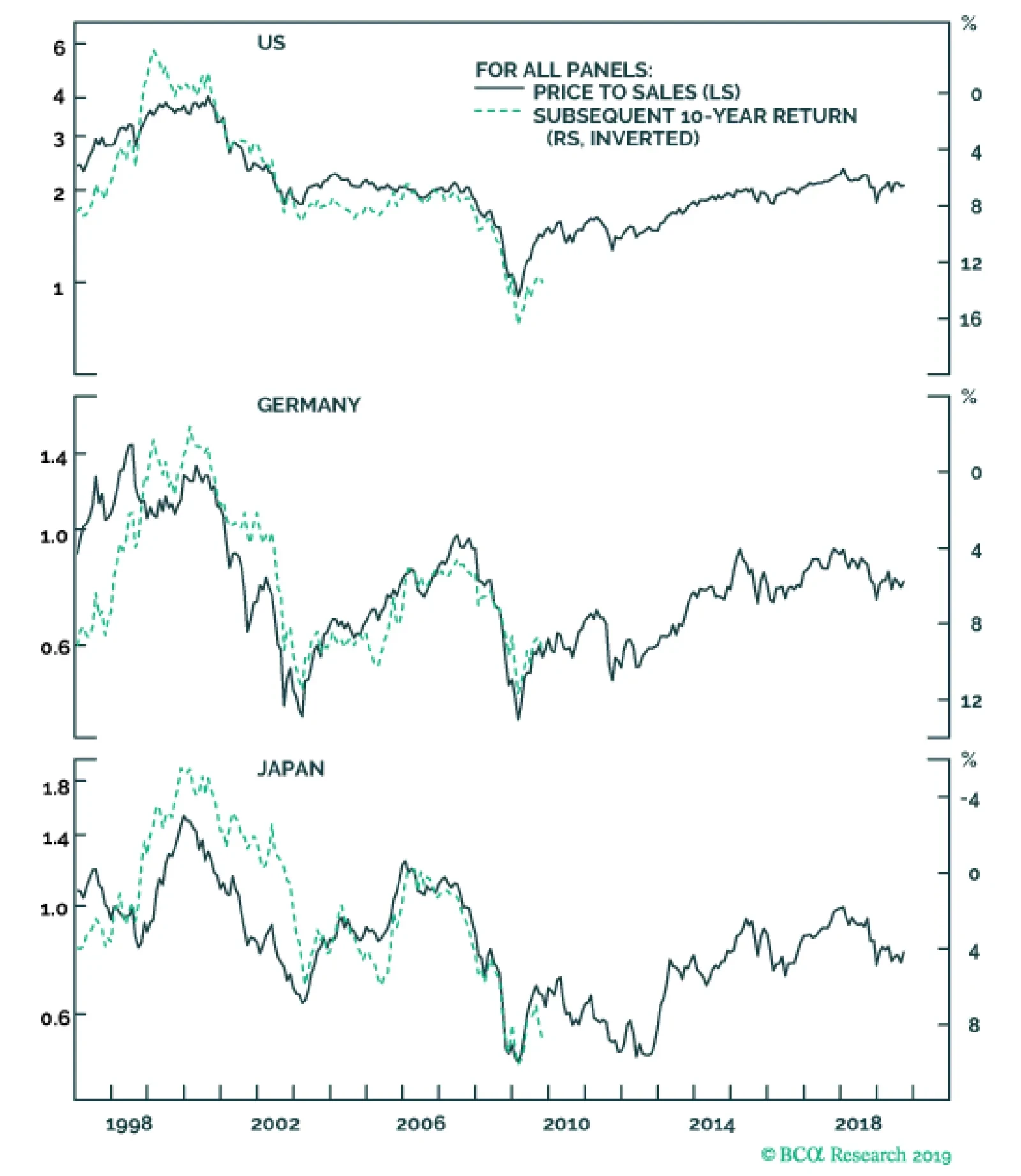

Allowing for the distortions from sector skews and currency adjustments, the best way to assess an equity region’s attractiveness is to quantify the prospective return implied by its valuation versus its own history. The…

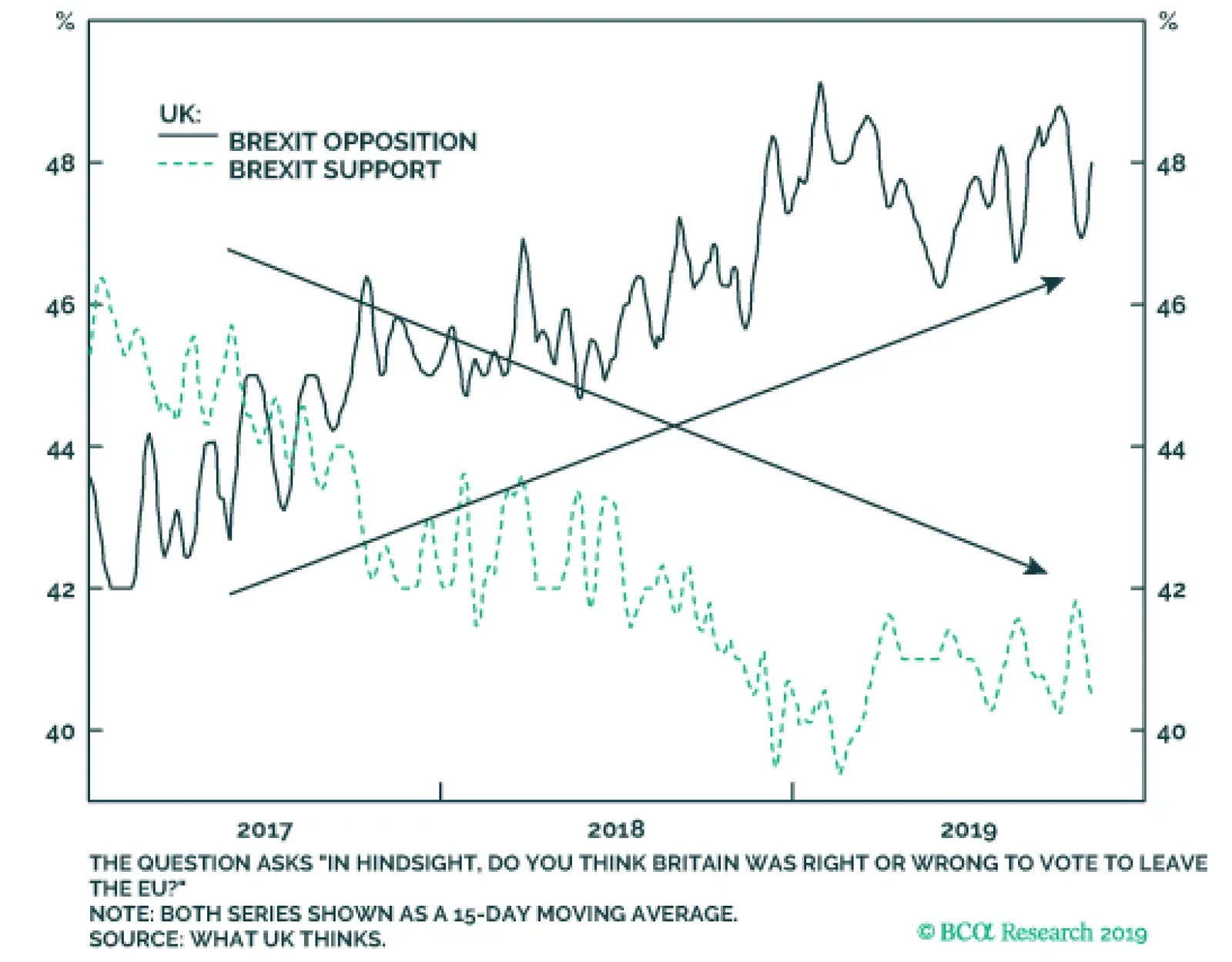

Westminster and Britain’s Supreme Court have rebuked UK Prime Minister Boris Johnson’s threat of a “No-Deal” Brexit. Moreover, parliamentary support for his latest plan, which essentially keeps Northern…

Highlights The attractiveness of European stocks is relative to European bonds rather than relative to non-European stocks. Despite vastly different stock market valuations in Germany, Japan, and the US, the implied prospective 10-year…

Our bottom-up euro area Corporate Health Monitors are sending different messages for lower-rated and higher-quality issuers. For euro area investment grade, the gap between domestic and foreign issuers has been widening, with…

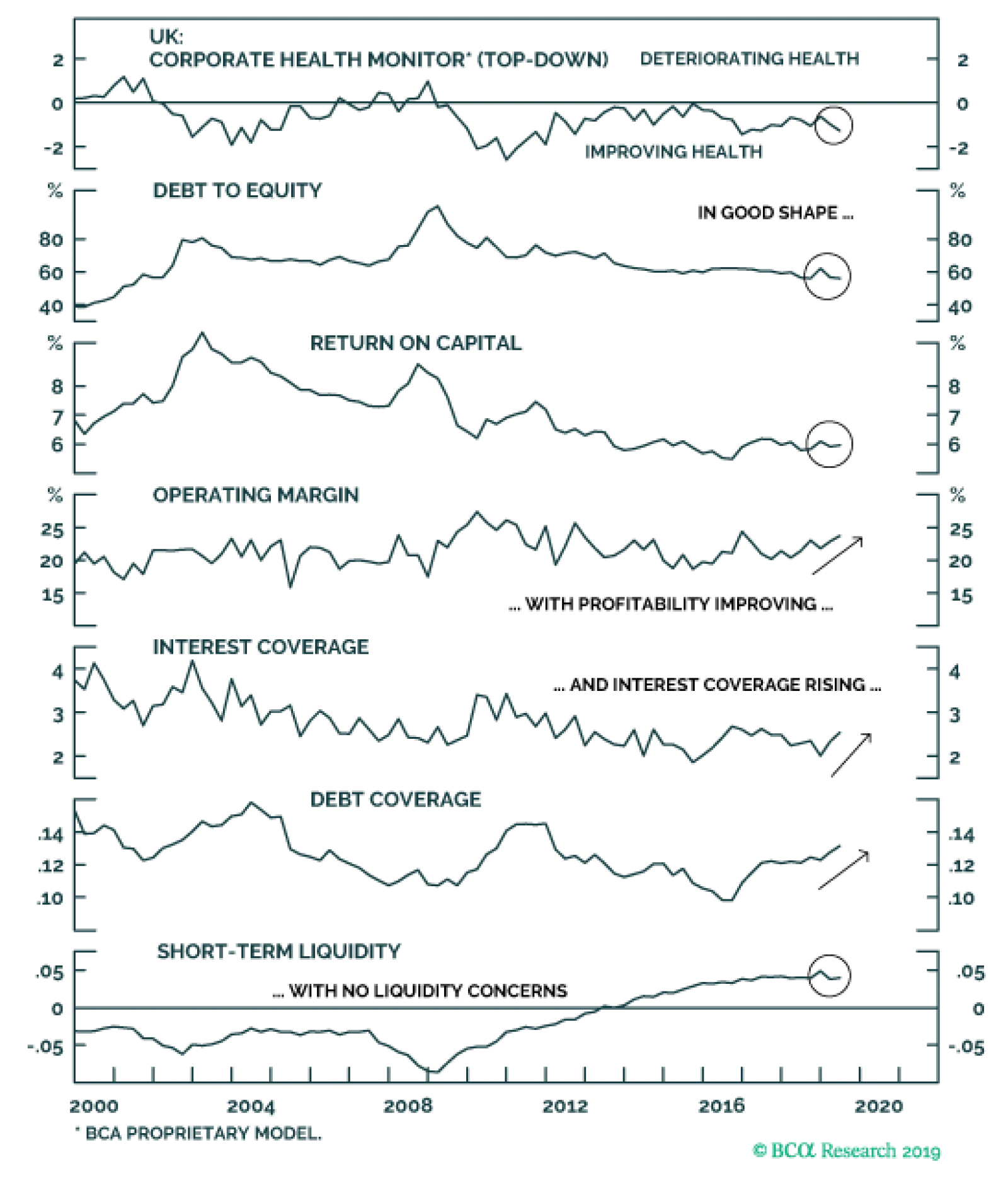

Despite the persistent uncertainty over the UK-EU Brexit negotiations that has weighed on UK economic confidence, our top-down UK corporate health monitor remains in the "improving health" zone. All of the…

Highlights The mood among investors is shifting from the recessionary gloom of this past summer. Equities worldwide are rallying, buoyed by a combination of dovish monetary policies, tentative signs of bottoming global growth and…

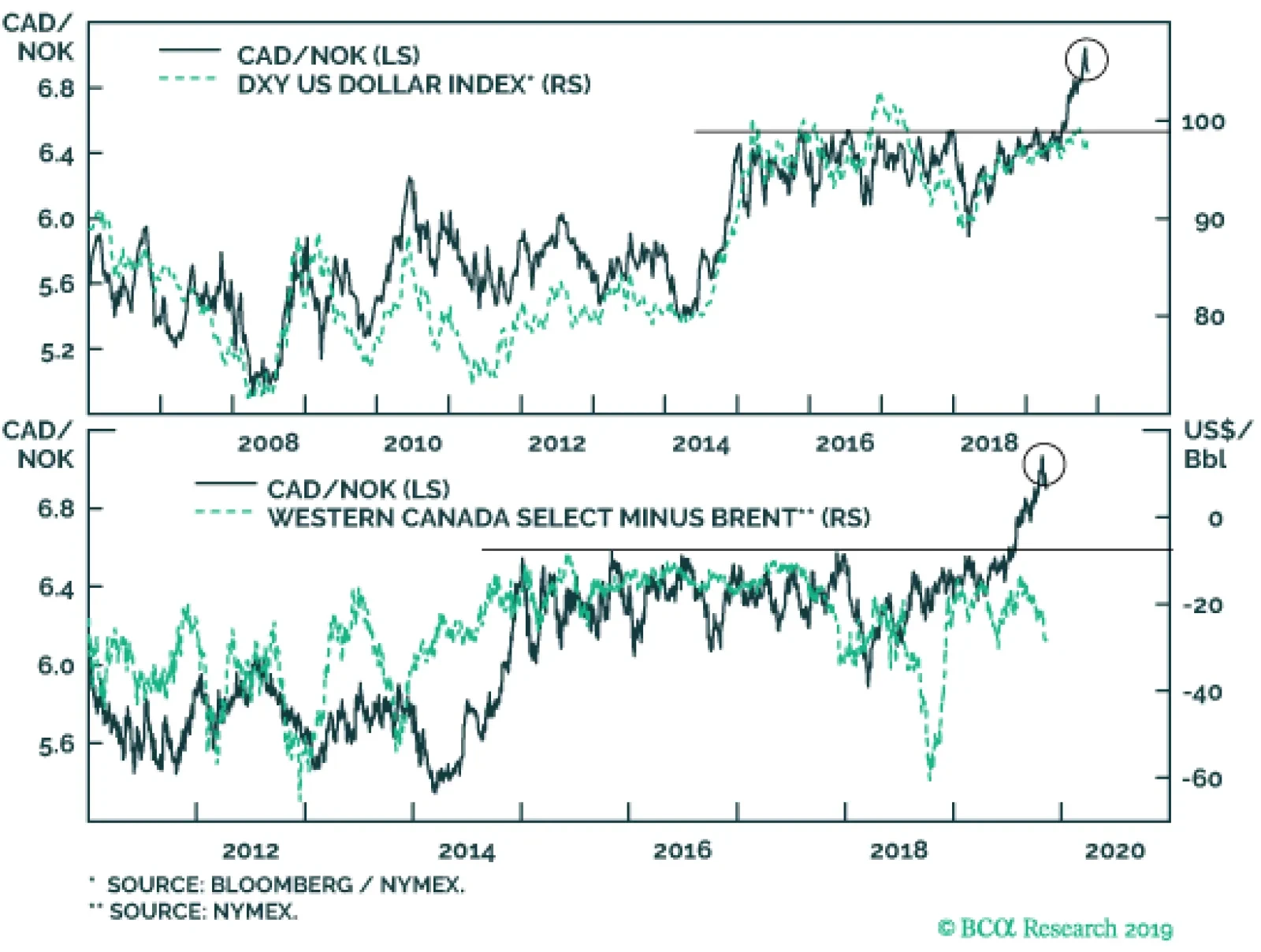

The Norges Bank has been hawkish in spite of the dovish tilt by most other central banks. As such, the underperformance of the Norwegian krone, especially versus the euro, has been quite perplexing in the face of diverging…

Highlights The correlation between oil and petrocurrencies has shifted in recent years. It no longer makes sense going long petrocurrencies versus the US dollar blindly. One of the reasons has been the impressive and prominent output…

The key question for asset allocators over coming months will be when (or, perhaps, whether) the global manufacturing cycle will turn up. This would trigger a move into more cyclically sensitive markets, for example euro zone…