Highlights Global Investment Strategy View Matrix Receding trade tensions; diminished risks of a hard Brexit; reduced odds of a victory for Elizabeth Warren in the US presidential elections; liquidity injections by most…

Highlights Stock markets begin 2020 with fragile short-term fractal structures, which means there is a two in three chance of a tactical reversal. The bond yield impulse is now a strong headwind, which reliably predicts that bond…

Highlights 2020 Model Bond Portfolio Positioning: Translating our 2020 global fixed income Key Views into recommended positioning within our model bond portfolio comes up with the following conclusions: target a moderately aggressive…

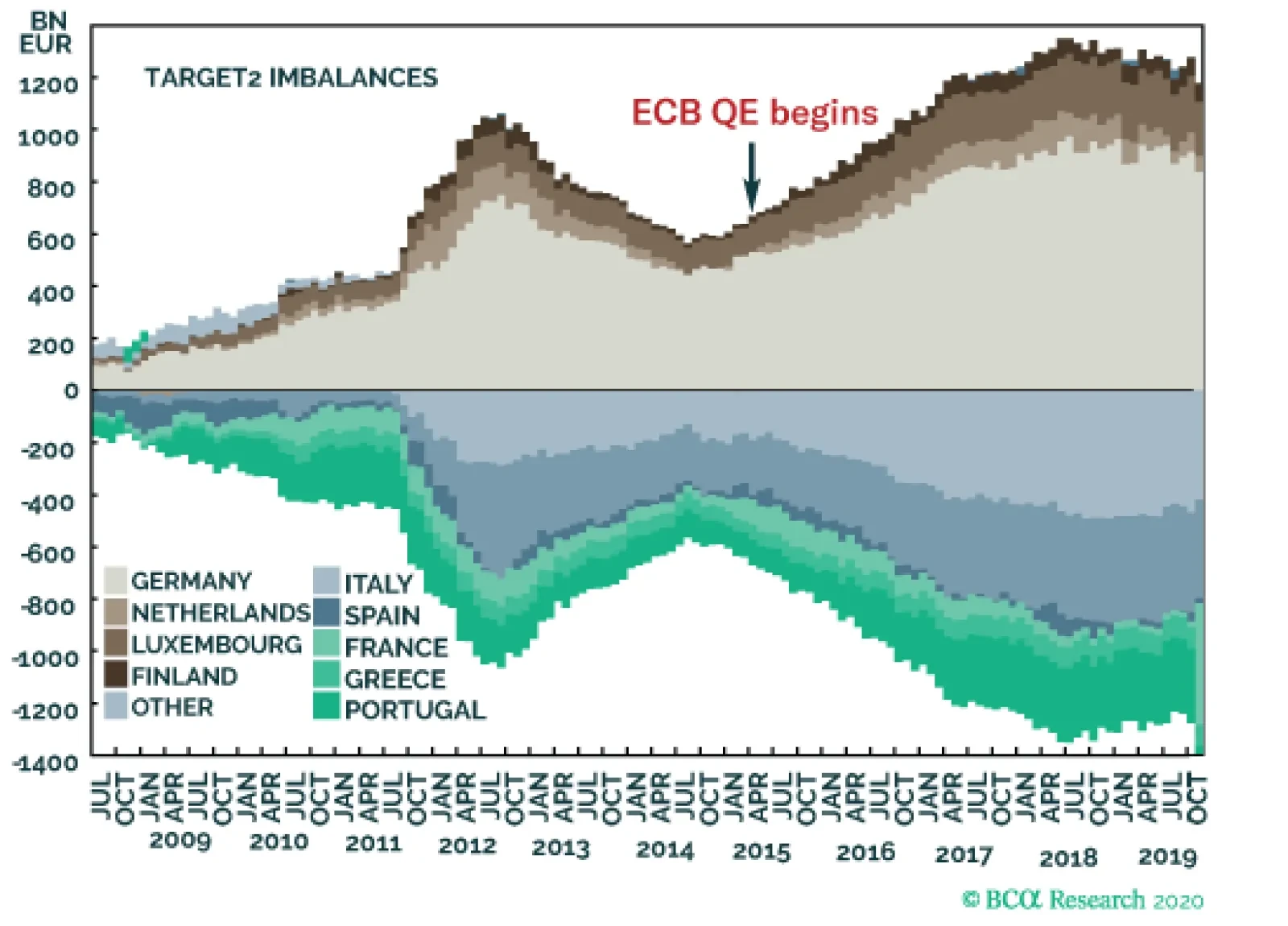

A force holding the European nucleus together has strengthened. In 2010, the Target2 banking imbalance stood at €0.3 trillion; in 2020, it stands close to €1.5 trillion. In simple terms, this means Germany’s…

Feature Recommended Allocation Since BCA published its 2020 Outlook,1 and the December GAA Monthly Portfolio Update,2 nothing has happened to make us fundamentally change our views. We see the global manufacturing cycle…

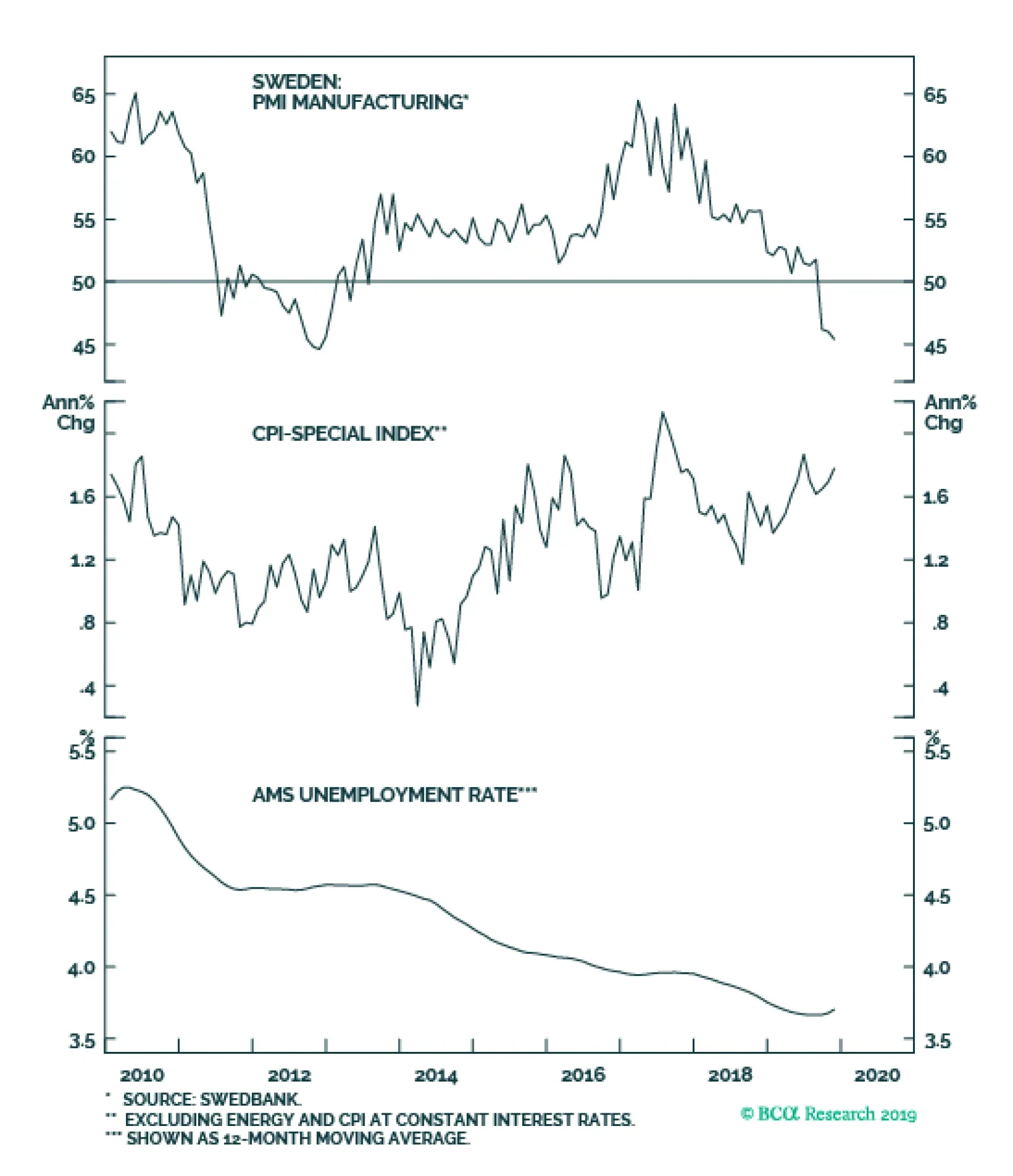

The Riskbank finally did it. In an environment where major central banks are cutting interest rates, the Swedish central bank went against the flow and lifted the repo rate by 25bps to zero. At first glance, this seems…

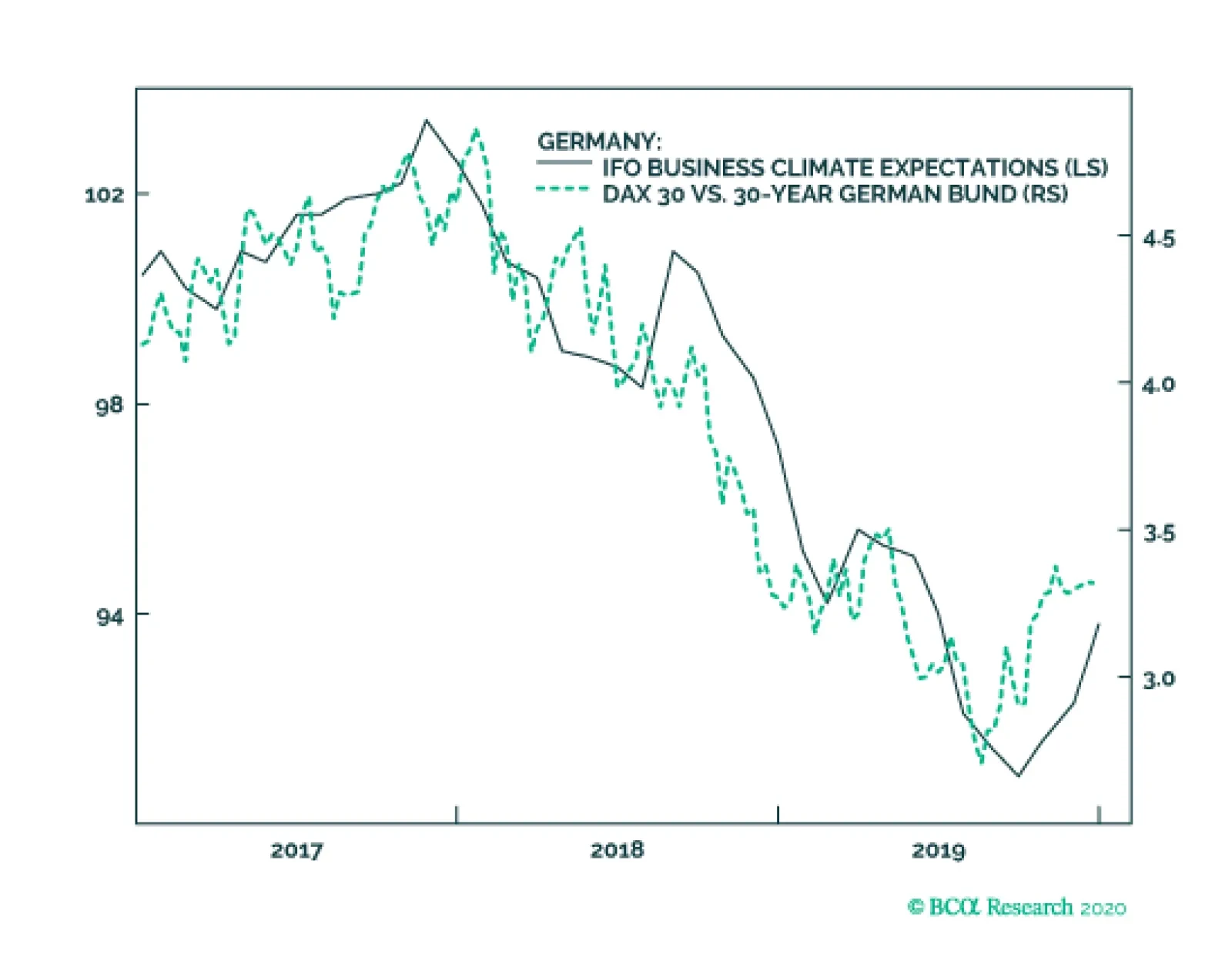

The December German Ifo not only rebounded, but also beat expectations. Business climate increased from 95.1 to 96.3 and the expectations component climbed to 93.8 from 92.3. The German Ifo tends to provide a lead on the PMI…

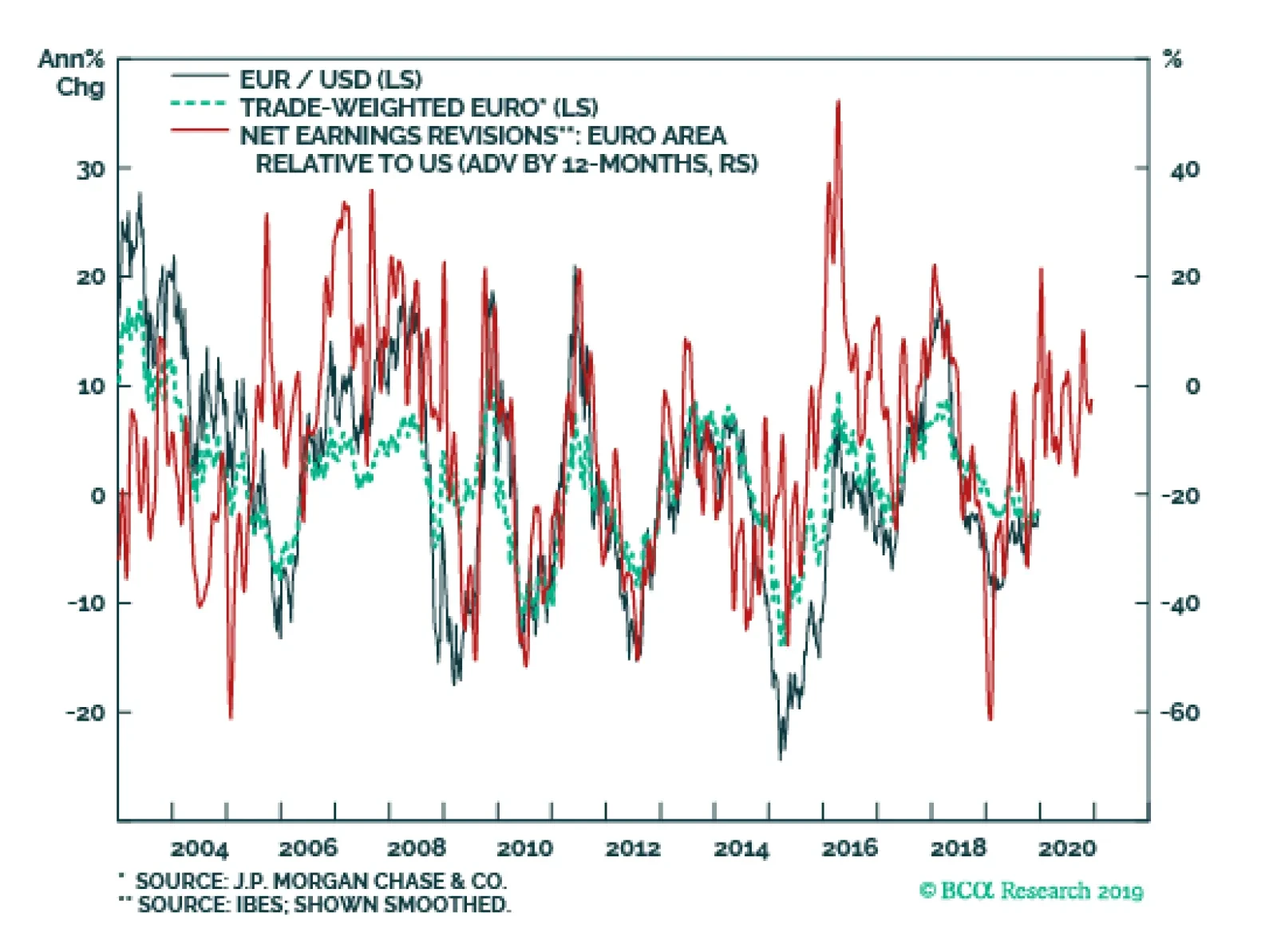

Our near-term target for EUR/USD is 1.18. This level will retest the downward sloping trendline in place since the Great Financial Crisis. The collapse in the euro since the financial crisis has been driven by falling growth…

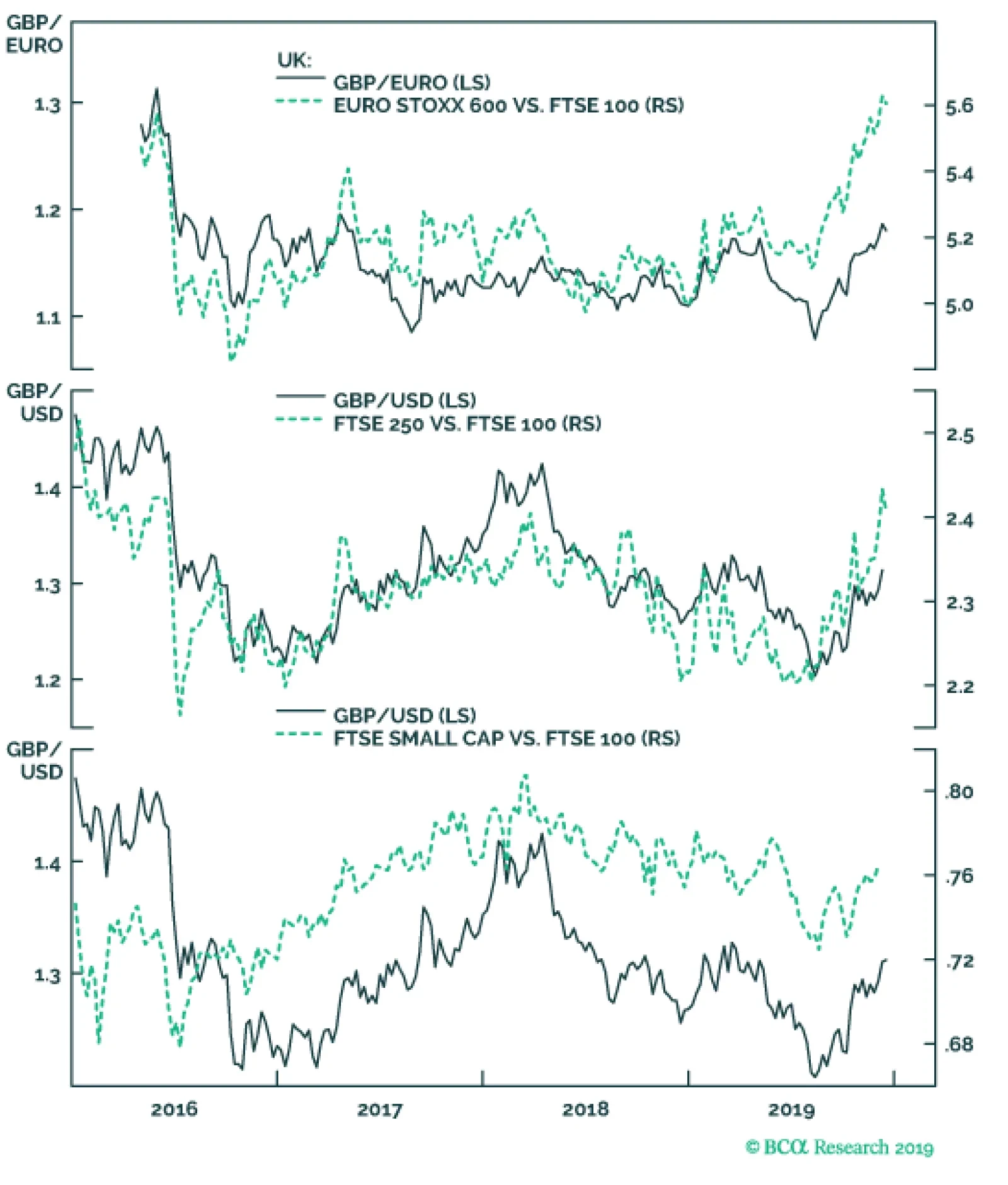

Conservatives won 364 seats last night. This comfortable majority for the Conservatives is a medium-term positive for UK exposed investments, as Prime Minister Boris Johnson is not dependent on the 20 or so hard Brexit…