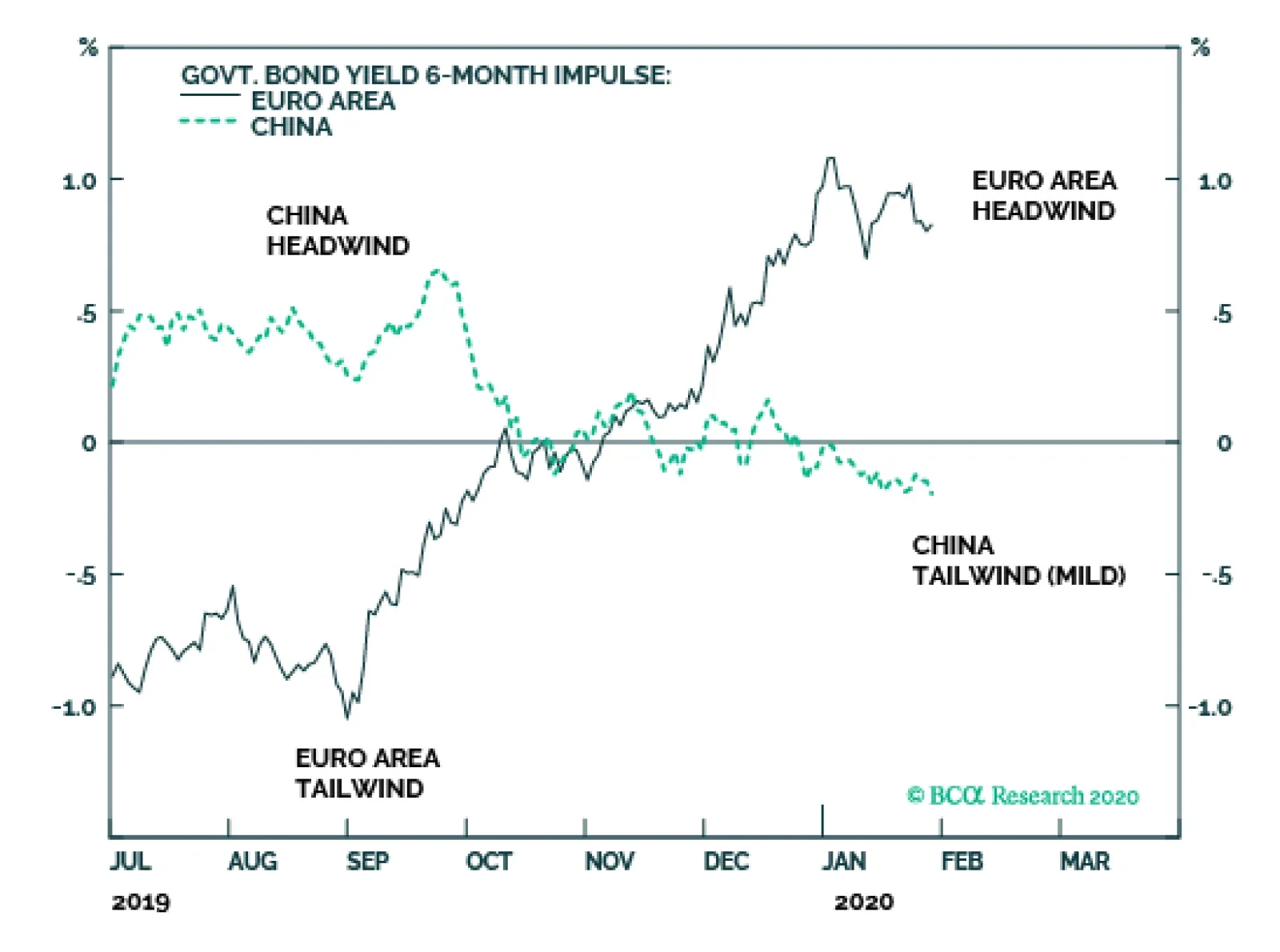

The euro area 6-month bond yield impulse stands near +100 bps, posing the strongest headwind to growth in three years. To make matters worse, the impulse has flipped from a strong -100 bps tailwind last summer into the current…

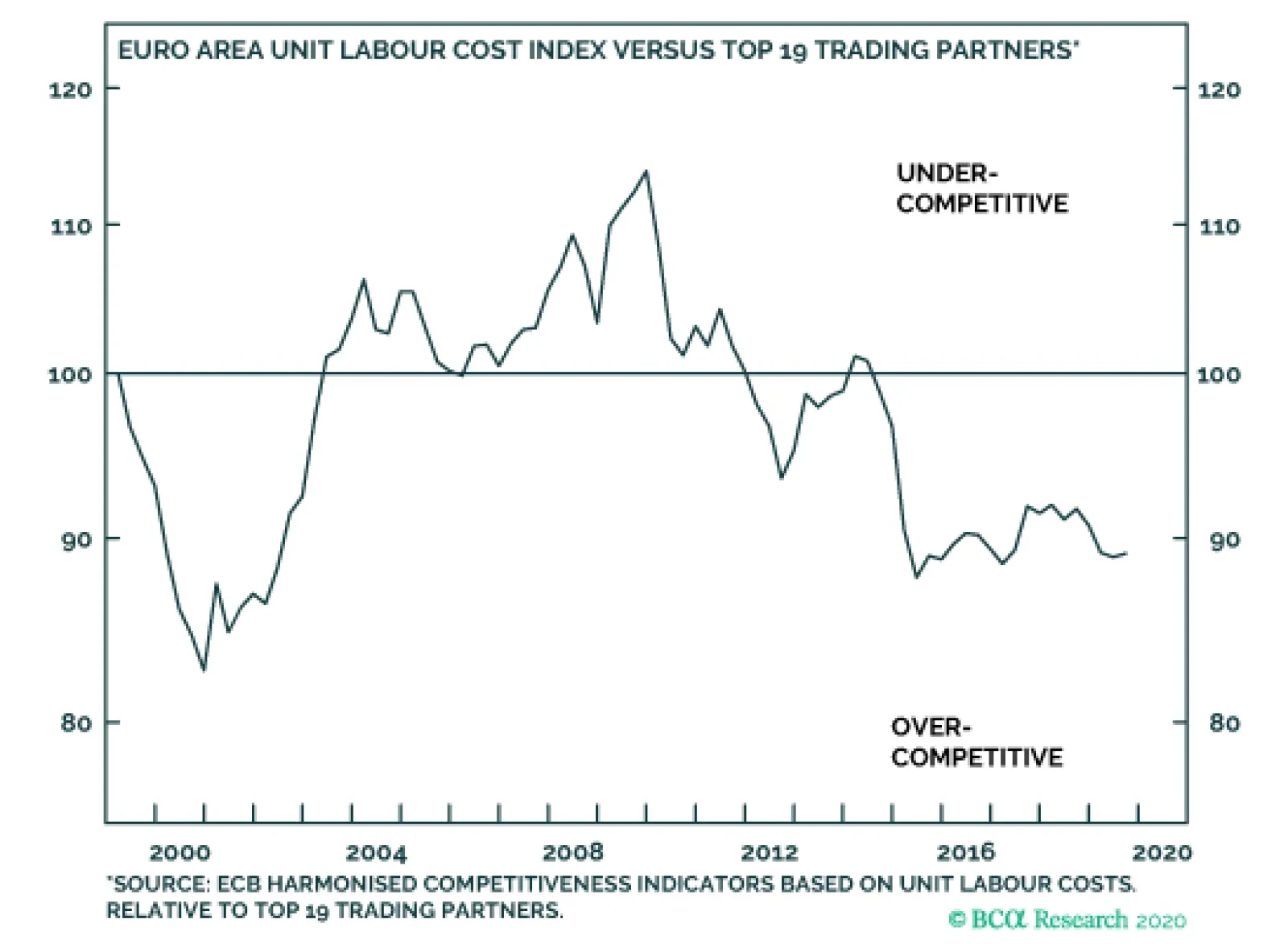

European equities are not cheap; European currencies are. The central bank's own currency valuation indicator admits that the trade-weighted euro is 10 percent undervalued. Hence, investors seeking alpha should focus on…

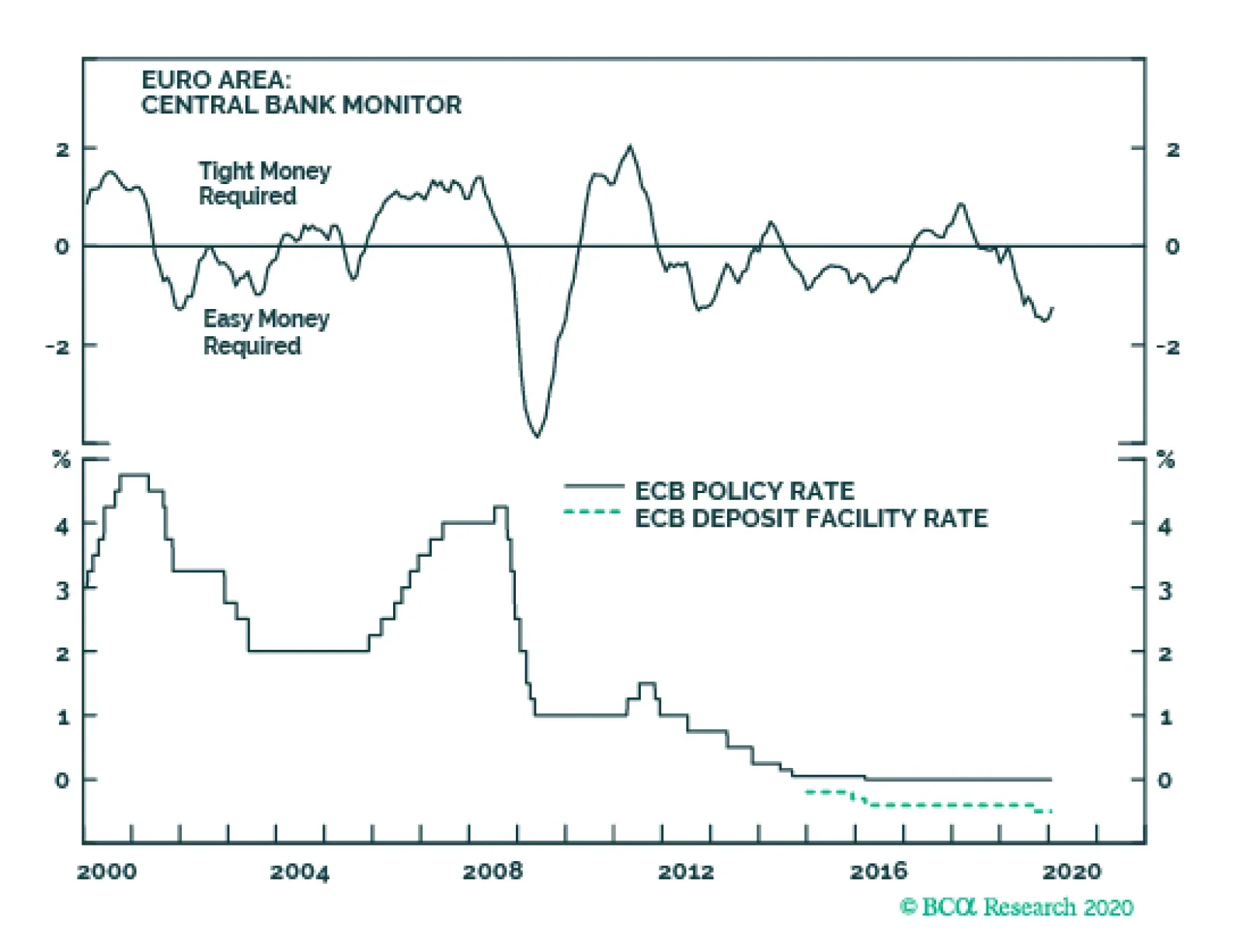

Highlights Most central banks still consider economic risks asymmetrical to the downside. This means that even if global growth rebounds in earnest, policy is likely to stay pat over the next three to six months. The conclusion is…

Today, the major development of the ECB’s policy meeting was the announcement of the new monetary strategy policy review. Following the press conference where the program was announced, the euro fell 0.6% and bunds…

Highlights The bank credit 6-month impulse is likely to drop sharply in Europe, drop modestly in the US, but remain positive in China. Hence, the momentum of first-half economic data is likely to be worse in Europe than in China…

Highlights Our top five geopolitical “Black Swans” are risks that the market is seriously underpricing. With the “phase one” trade deal signed, Chinese policy could become less accommodative, resulting in a…

Highlights The euro area bond yield 6-month impulse recently hit 100 bps, constituting the strongest headwind to growth for three years. Nine times out of ten, the strong headwind to nominal growth pushes the bond yield to a lower…

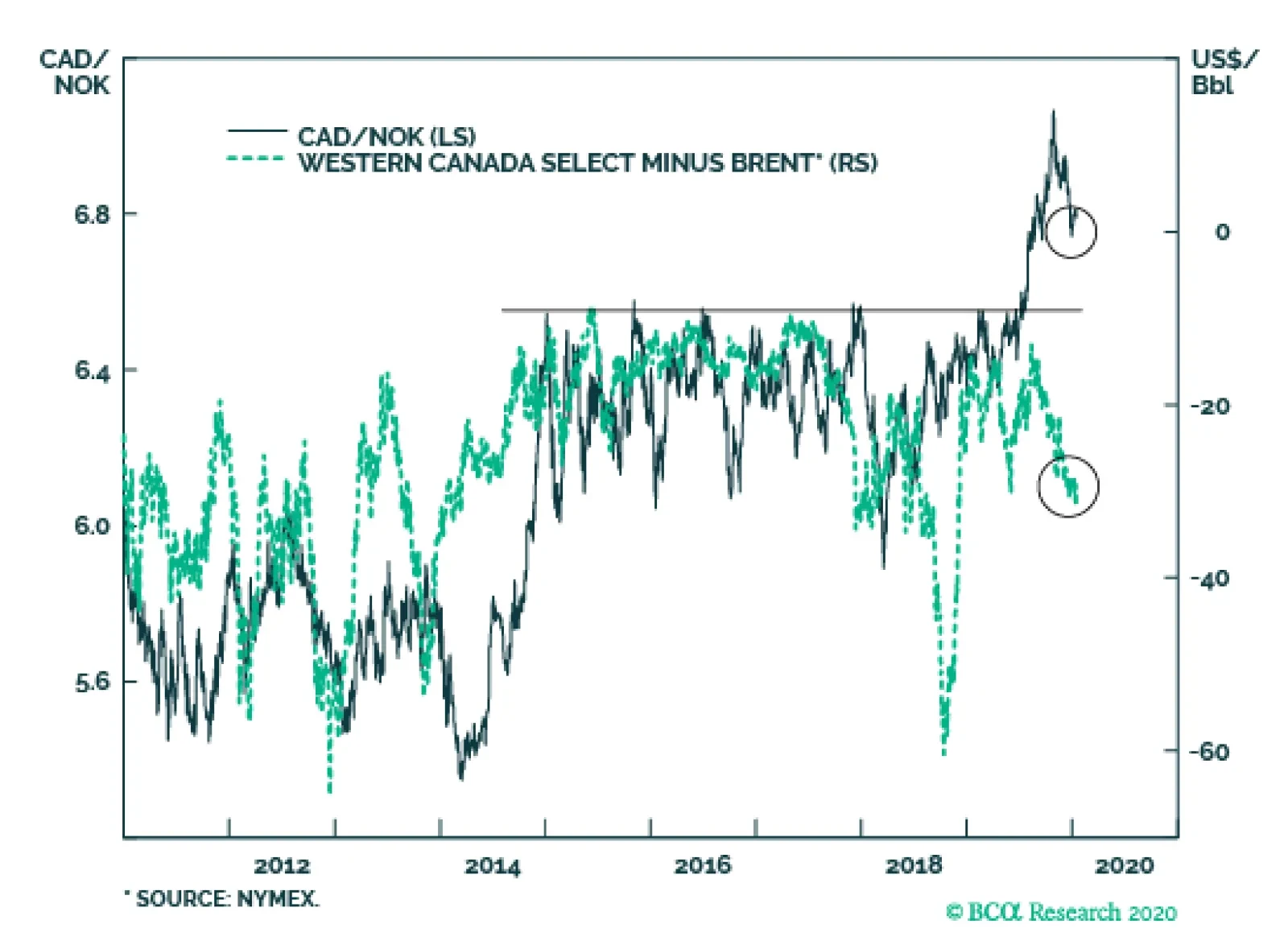

Rising oil prices will go a long way towards improving Canada’s and Norway’s trade balances. In the case of Norway, net trade fell in 2019 due to lower exports of oil and natural gas, but still stands at 5.1% of GDP.…

Highlights Remain short the DXY index. The key risk to this view is a US-led rebound in global growth, or a pickup in US inflation that tilts the Federal Reserve to a relatively more hawkish bias. Stay long a petrocurrency basket. The…