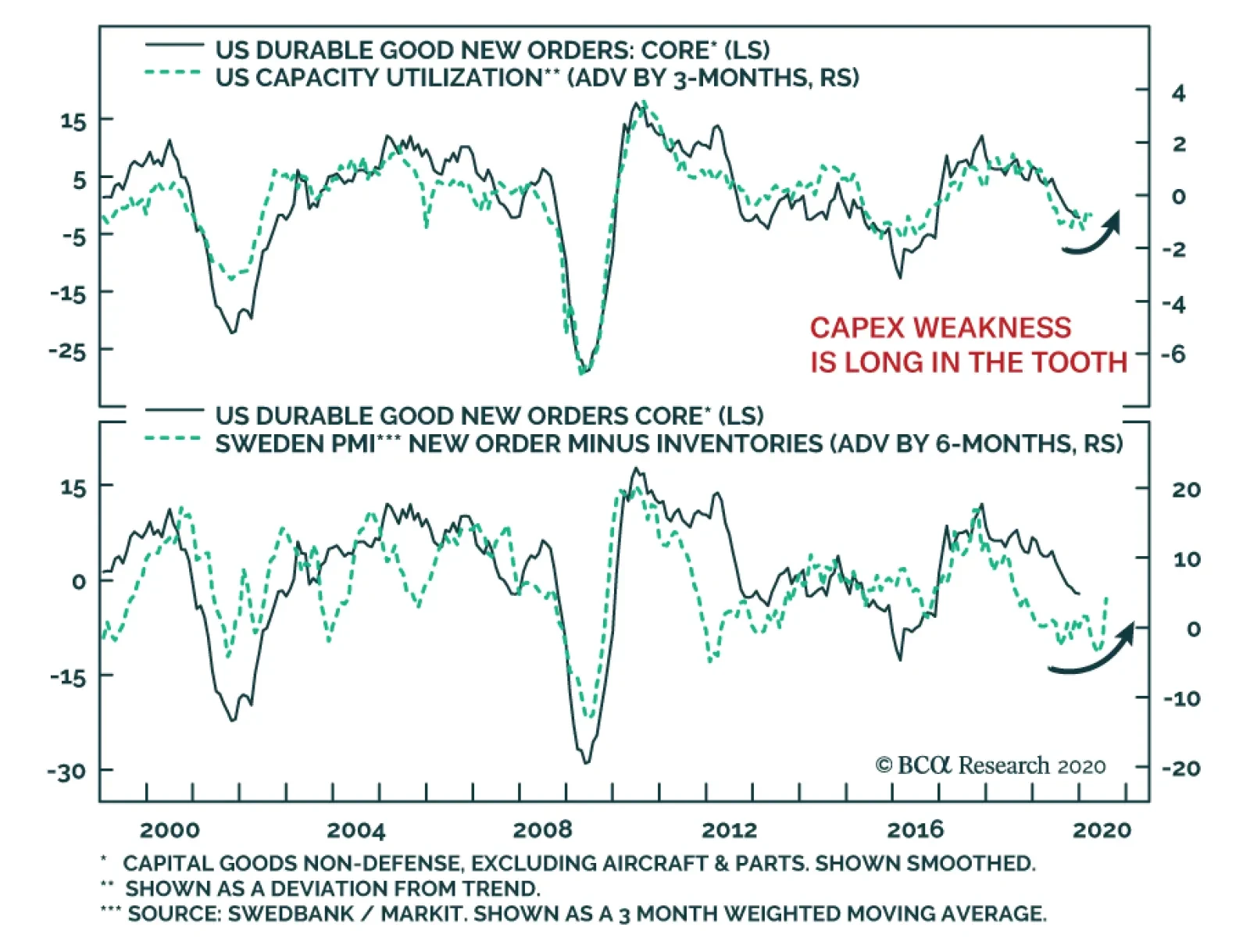

US core capital goods new orders, which excluding defense and aircraft & parts, have been weak, which suggests that the capex deterioration is intact. However, signs are accumulating that this decline is long in the tooth…

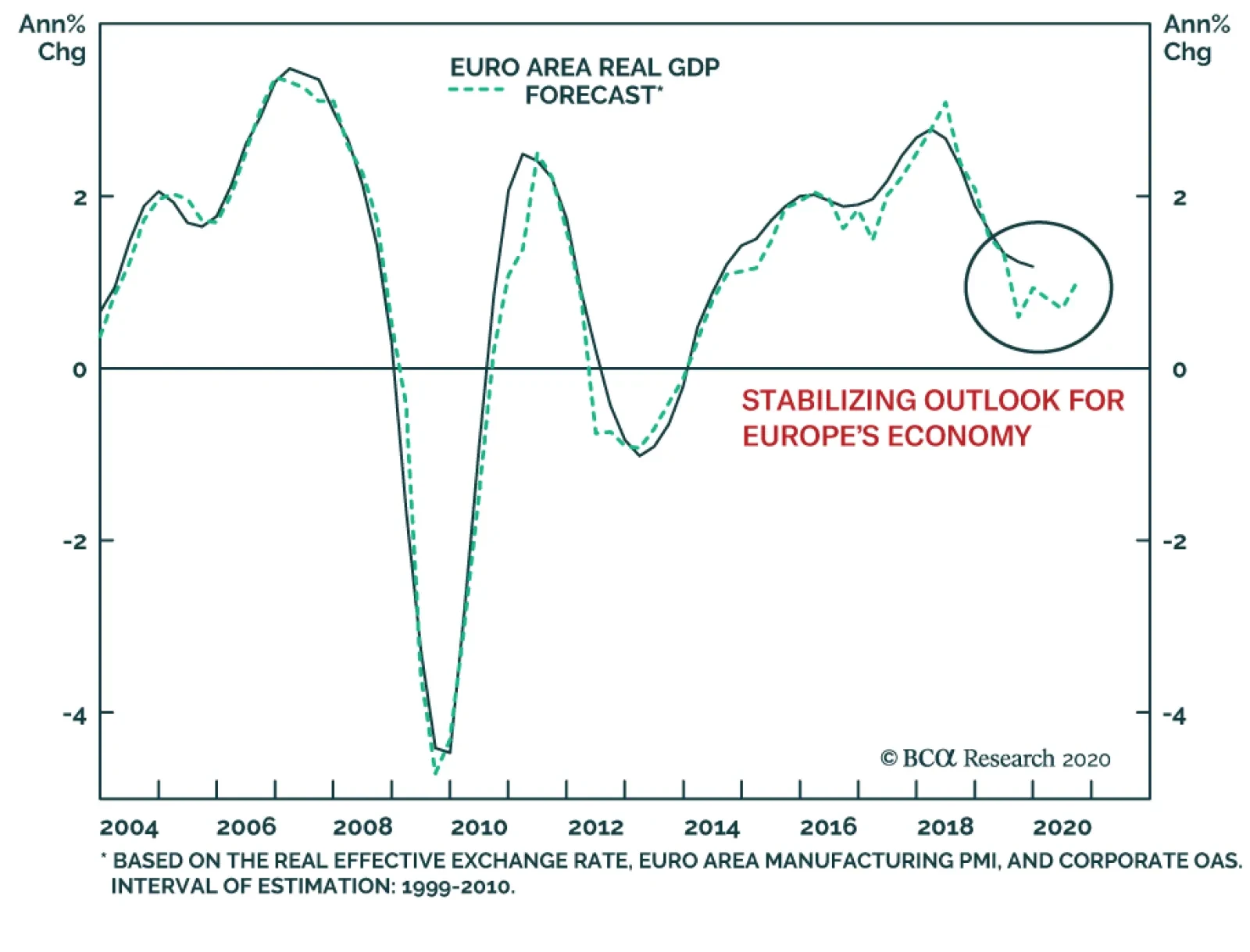

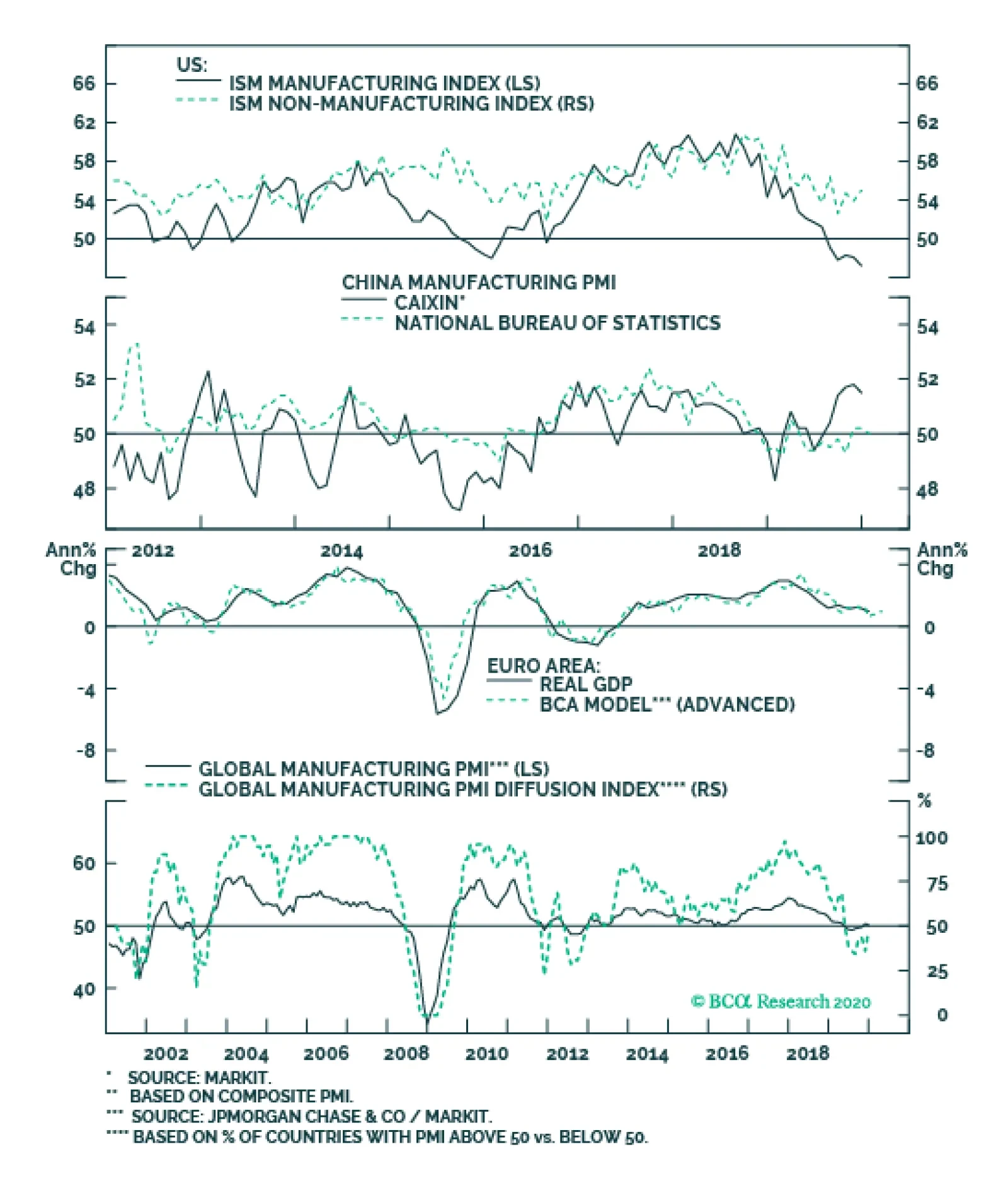

Our Euro Area GDP Model is trying to form a bottom. In effect, the variance in European GDP growth is governed by fluctuations in global economic activity. This dependence on global growth is a consequence of the lack of vigor of…

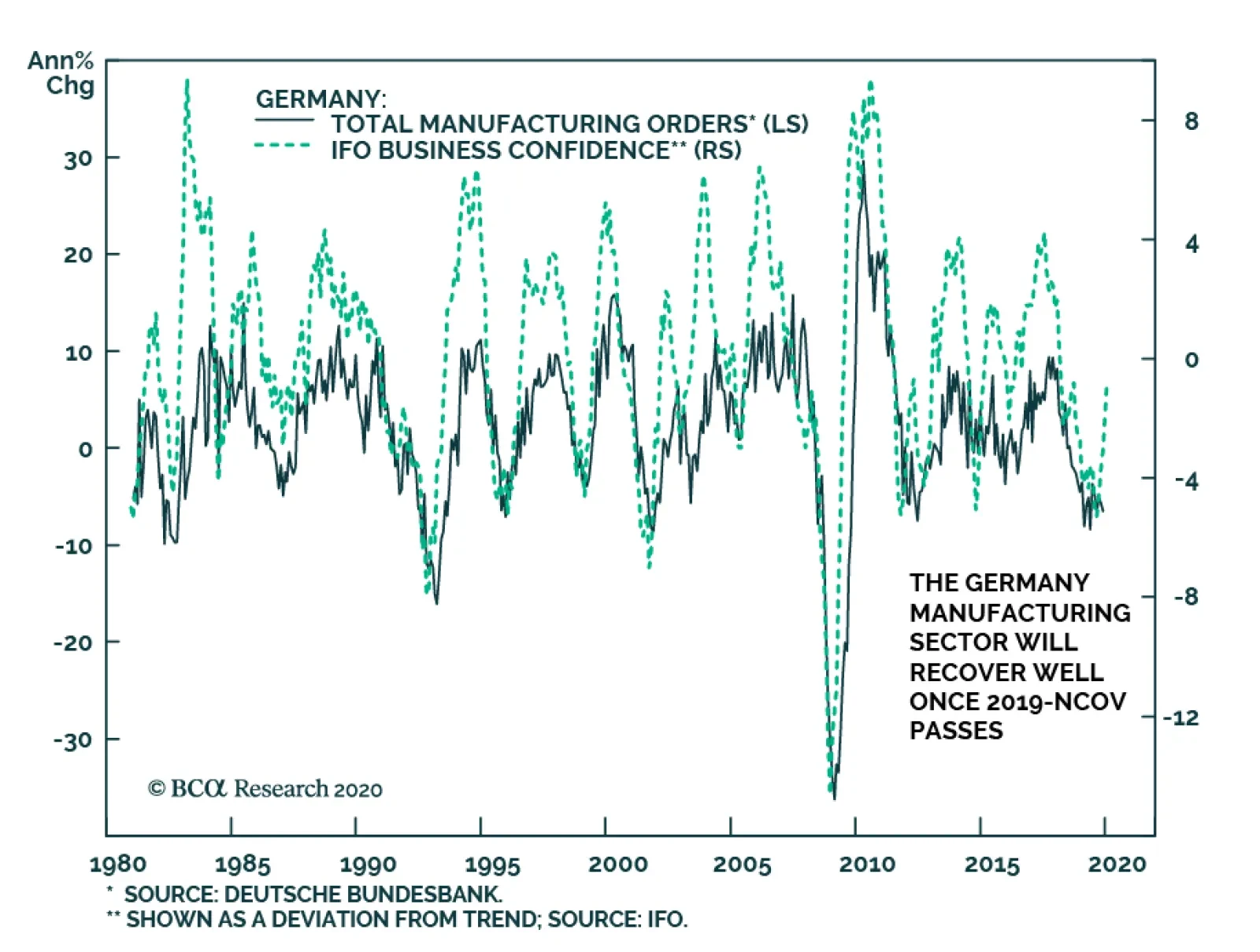

The German economy has been the main European victim of the global manufacturing slowdown. However, there are early signs that Germany should soon mend. In particular, the momentum in the IFO Survey points to an upcoming rebound…

Feature Everyone’s asset-allocation plans for the year have been disrupted by the novel coronavirus (2019-nCoV). Our view is that, while the virus is serious and will hurt the Chinese and global economy in the short term,…

The coronavirus scare is the catalyst for the recent correction. The true cause is that the stock market had reached a point of groupthink-triggered instability and therefore needed the slightest catalyst to correct. The bond…

Next week, we will focus on the following key items: The spread of nCoV-2019: We will continue to monitor how the coronavirus is spreading, especially as a case of human-to-human transmission has been reported in the US. In…

Highlights China’s economic rebound in Q1 will be delayed due to the coronavirus, which will have a larger negative hit than SARS. New stimulus measures will assist a rebound in demand later this year. Europe remains a…

Highlights The liquidity-driven rally will soon be followed by an acceleration in global growth. The economic recovery will bump up expectations of long-term profit growth. The dollar has downside, but the euro will not benefit much…

Highlights The coronavirus scare is the catalyst for the recent correction, not the cause. The true cause is that the stock market had reached a point of groupthink-triggered instability and therefore needed the slightest catalyst to…