Highlights The elevated uncertainty about global growth stemming from the COVID-19 virus in China has not only made investors more anxious, but central bankers as well. This means that, only six weeks into the year, policymakers may…

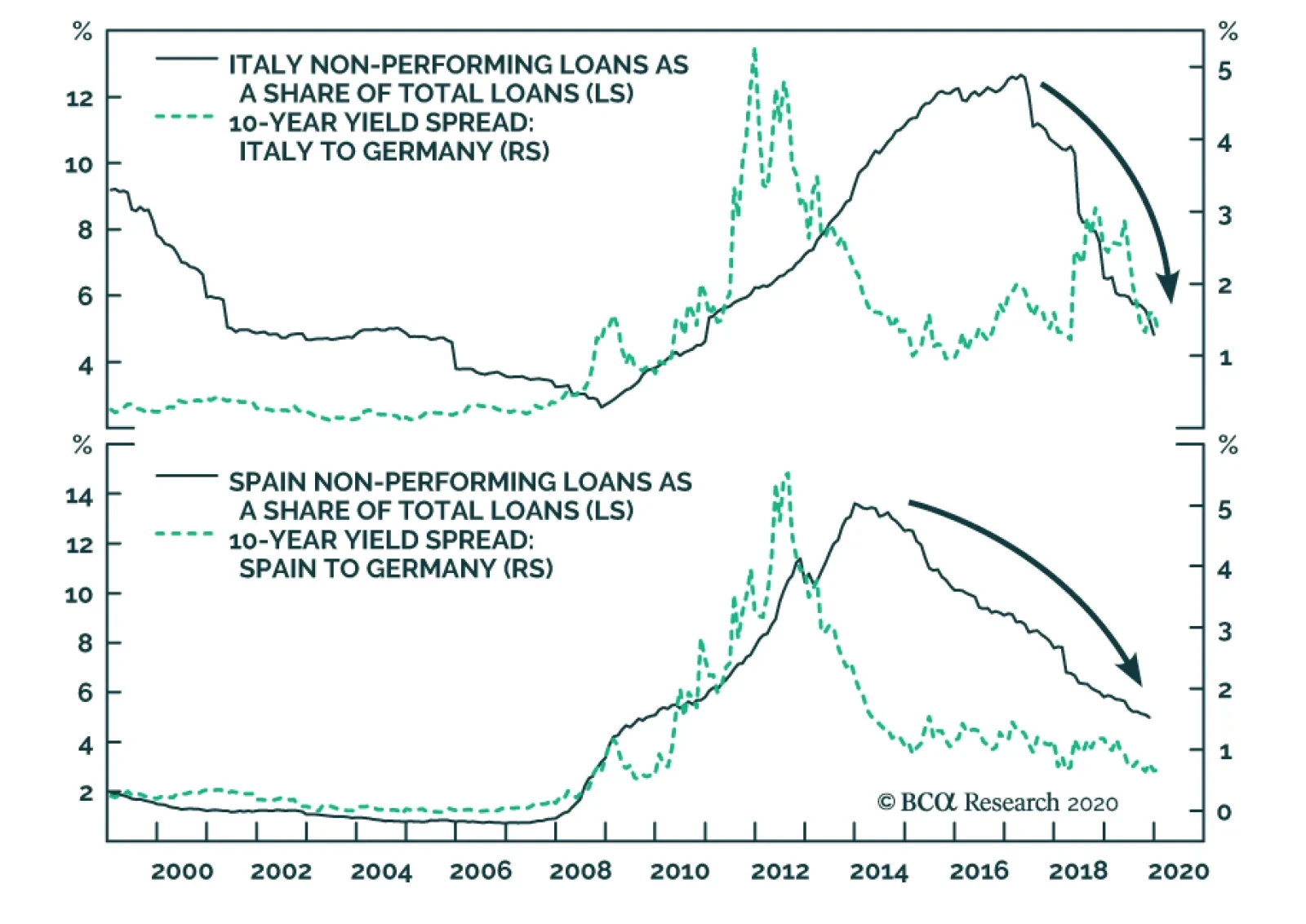

It is easy to take a dim view of Europe. Demographics are poor, the region is highly dependent on foreign economic activity, especially in emerging economies, and structural rigidities abound. However, one important domestic…

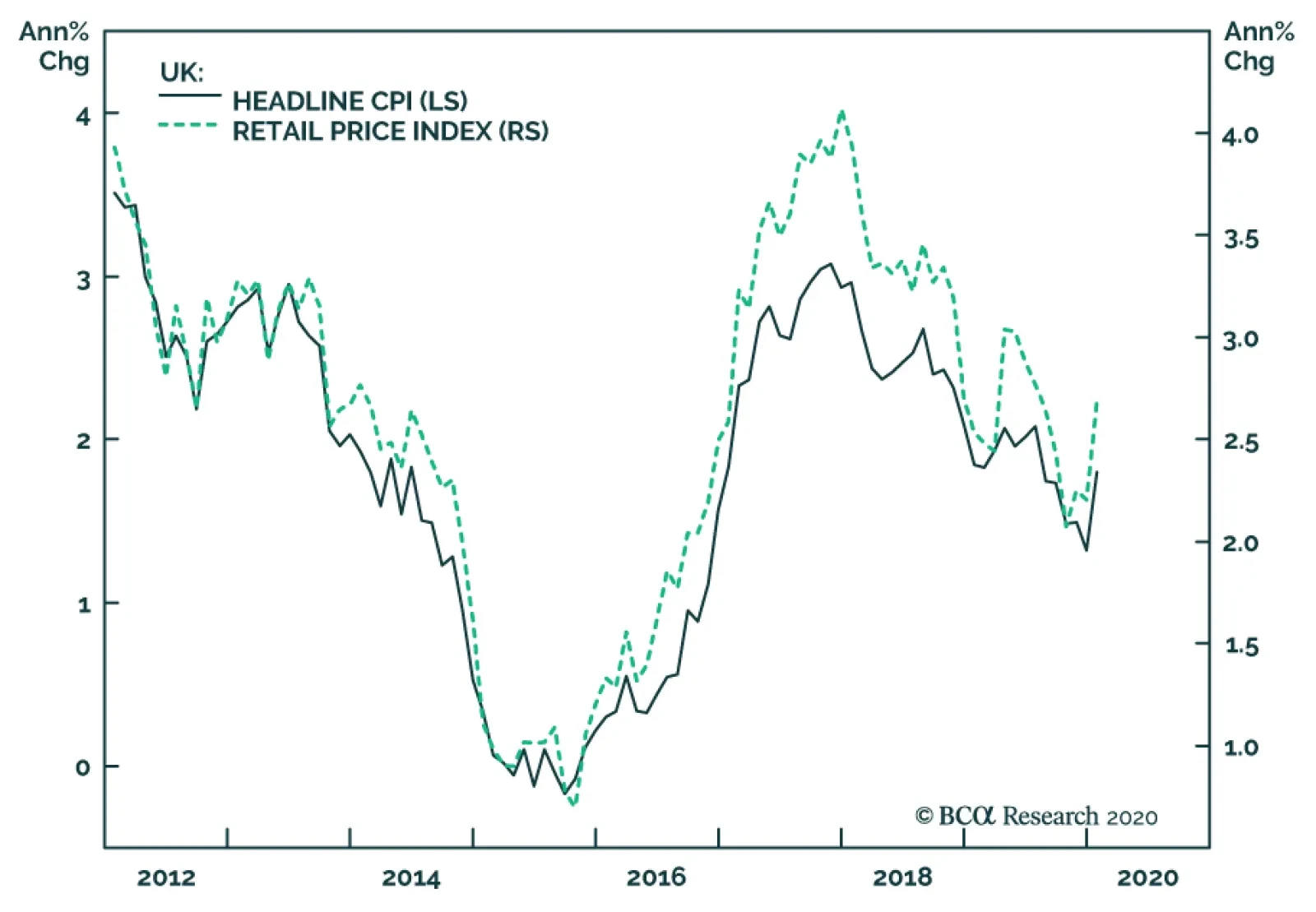

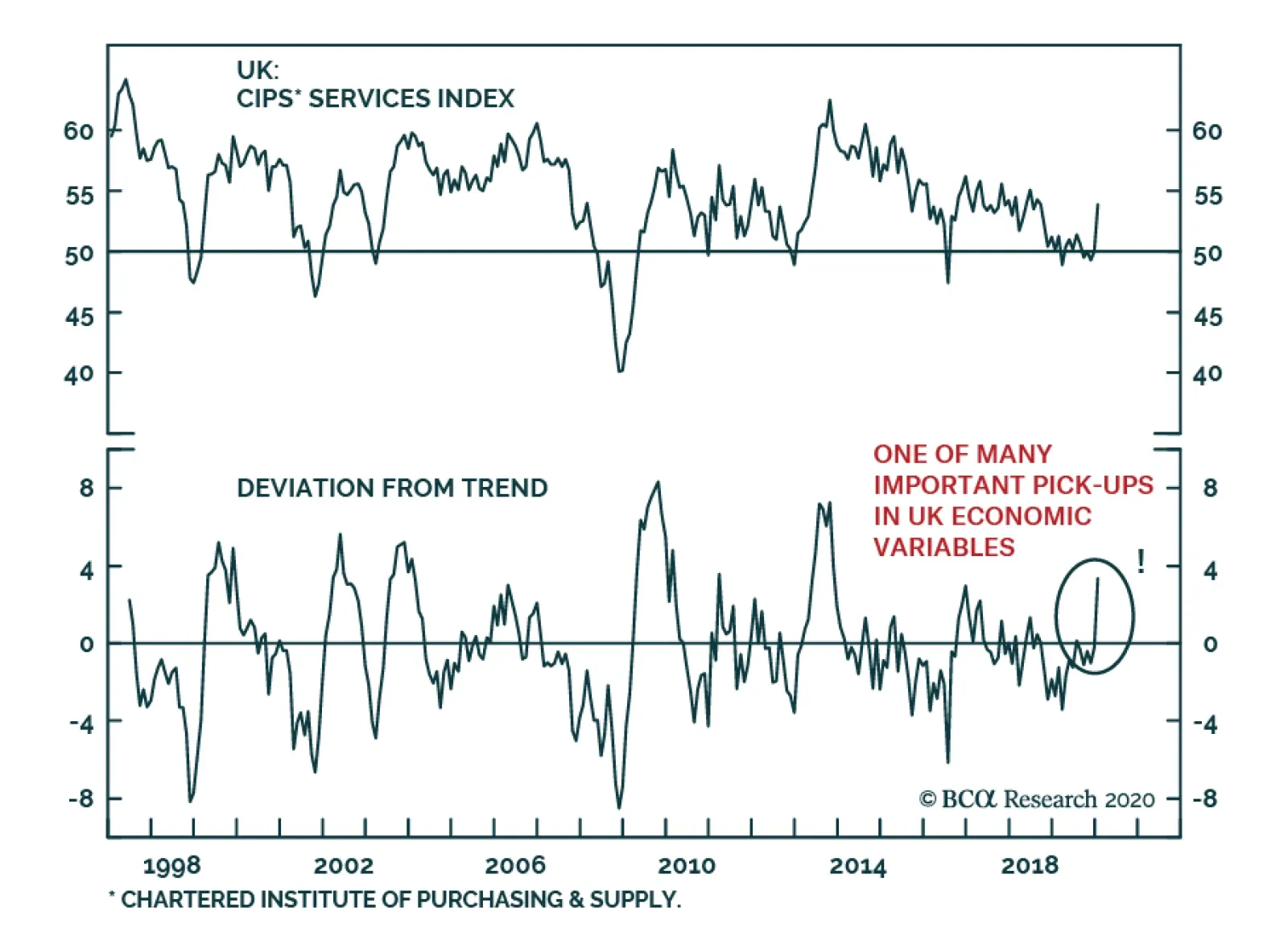

Inflation is perking up in the UK. Headline CPI jumped from 1.3% to 1.8% in January, while the more volatile retail price index surged from 2.2% to 2.7%. This follows a relatively robust labor market report for December that saw…

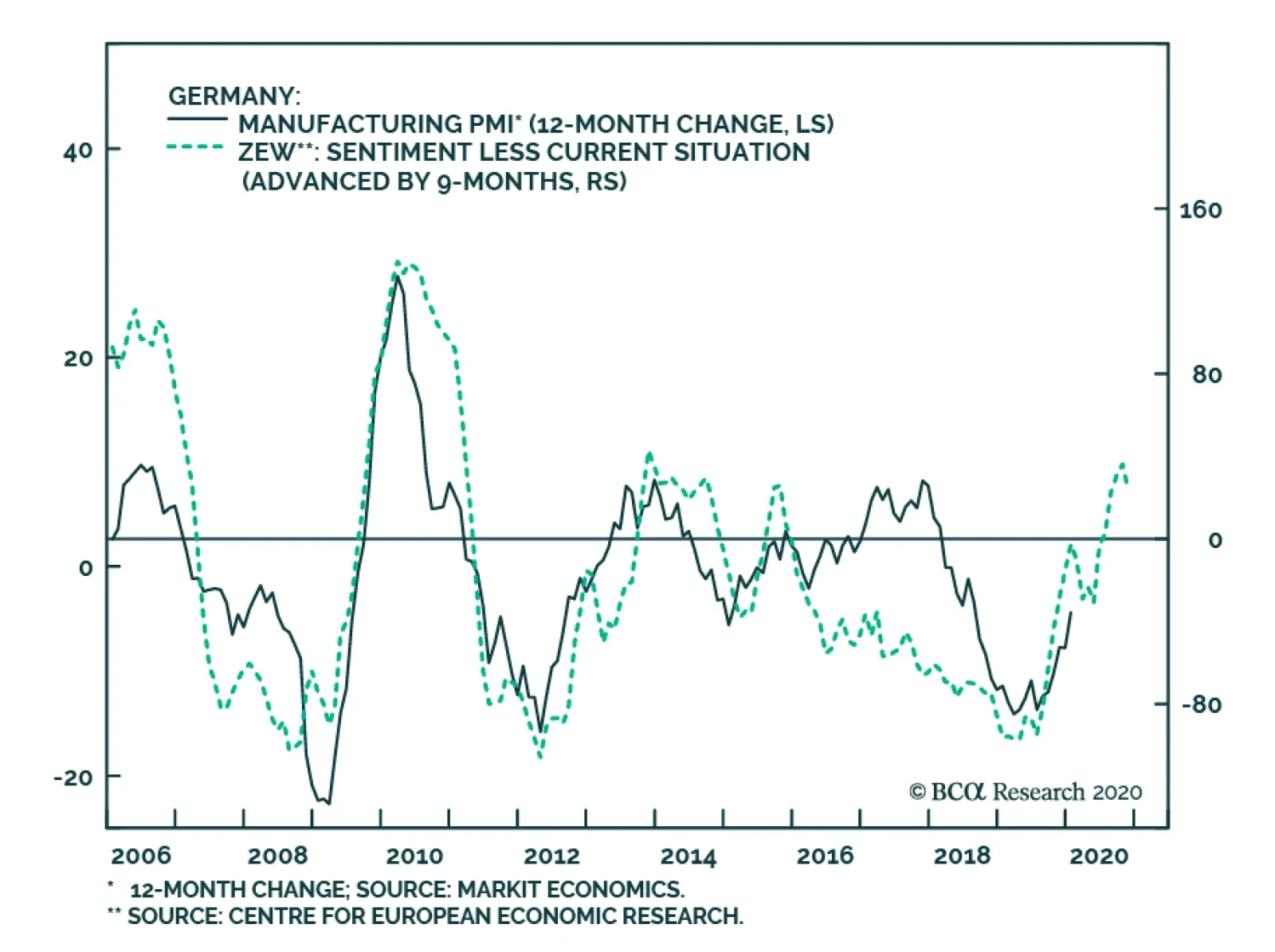

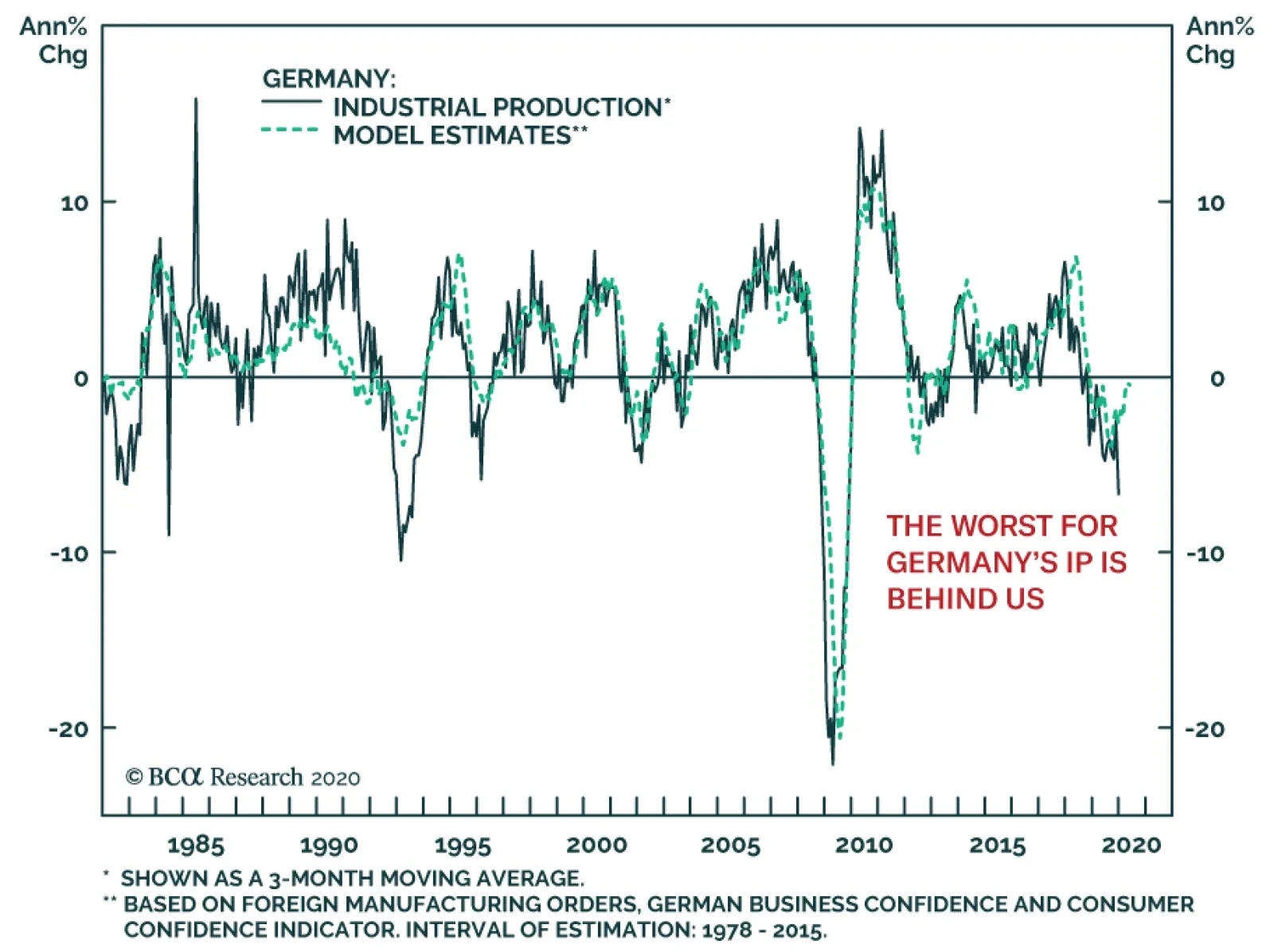

Tuesday’s release of the German ZEW survey showed that the nascent recovery in the economy is at risk from the COVID-19 shock. The current situation component of the index deteriorated from -9.5 to -15.7, while the…

Following last week’s disastrous industrial production numbers, Germany’s Q4 GDP number was weak, coming in 0% on a quarter-over-quarter basis. As BCA Research’s European Investment Strategy service often…

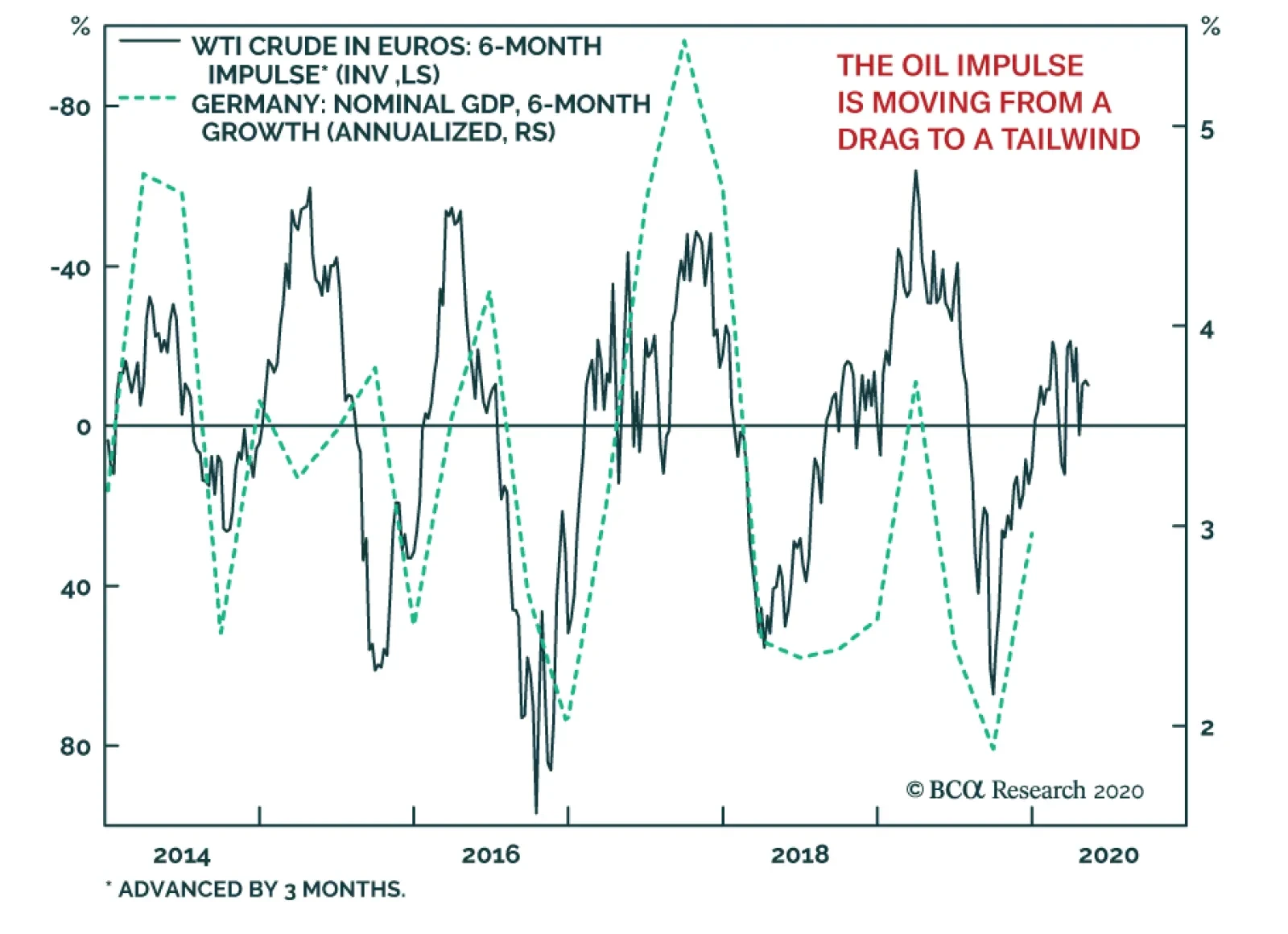

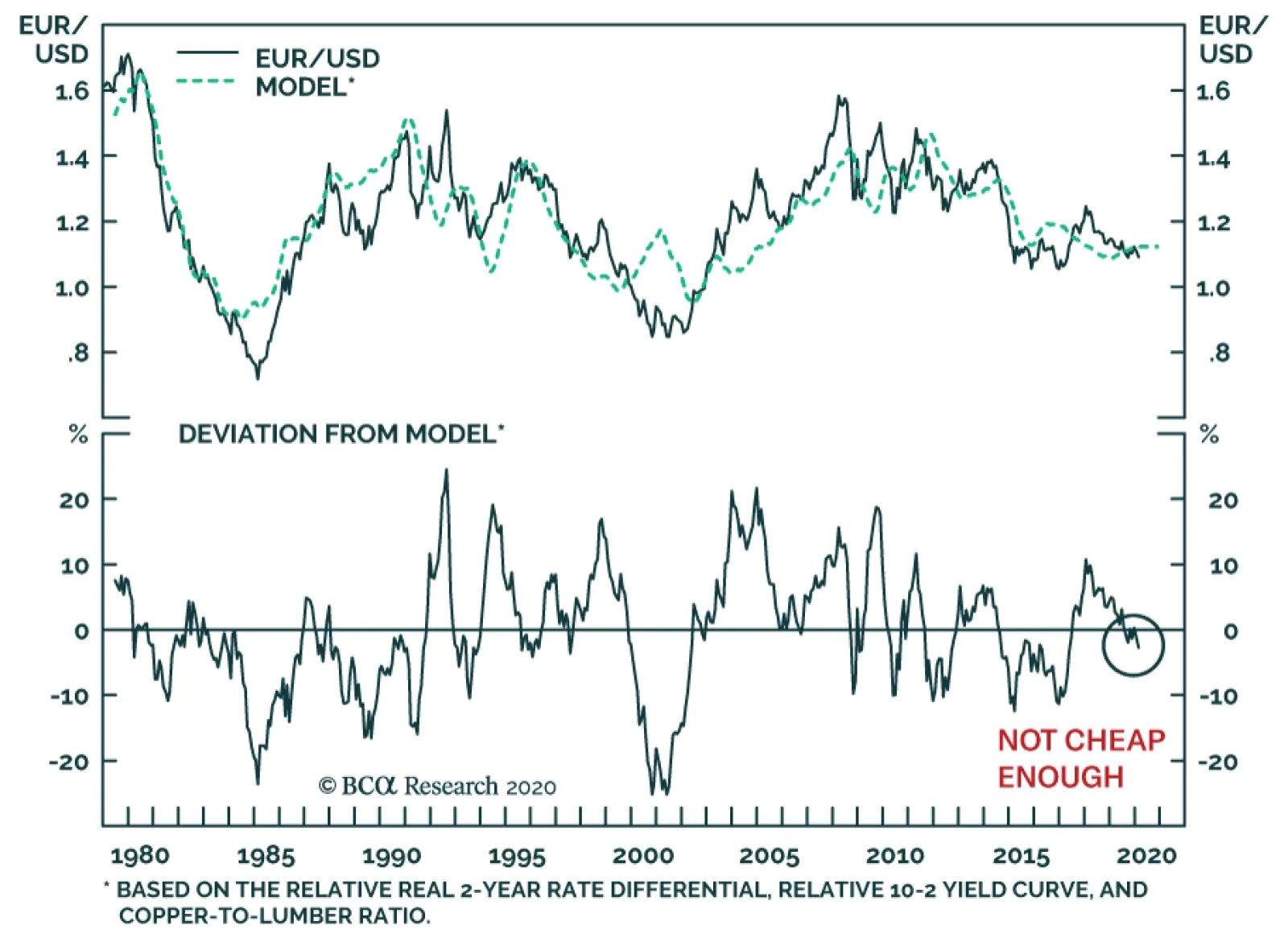

The euro is in a tricky spot. On the one hand, the euro benefits when global growth recovers. This pro-cyclical behavior reflects the heightened sensitivity of Europe to the global manufacturing cycle and to the Chinese economy…

Germany’s December industrial production was a truly dismal number, contracting at a 6.8% annual pace, or the worse result since the GFC. Unsurprisingly, the potential for a German or European recession now concerns …

Highlights A currency portfolio comprised of the US dollar, the Japanese yen and the Norwegian krone is likely to outperform a more diversified basket over multiple macroeconomic scenarios. Our work suggests that valuation matters for…

The UK’s service sector is showing signs of revival as the services PMI is rebounding significantly. This improvement is not an isolated phenomenon. Since the December election, consumer confidence, business optimism and…