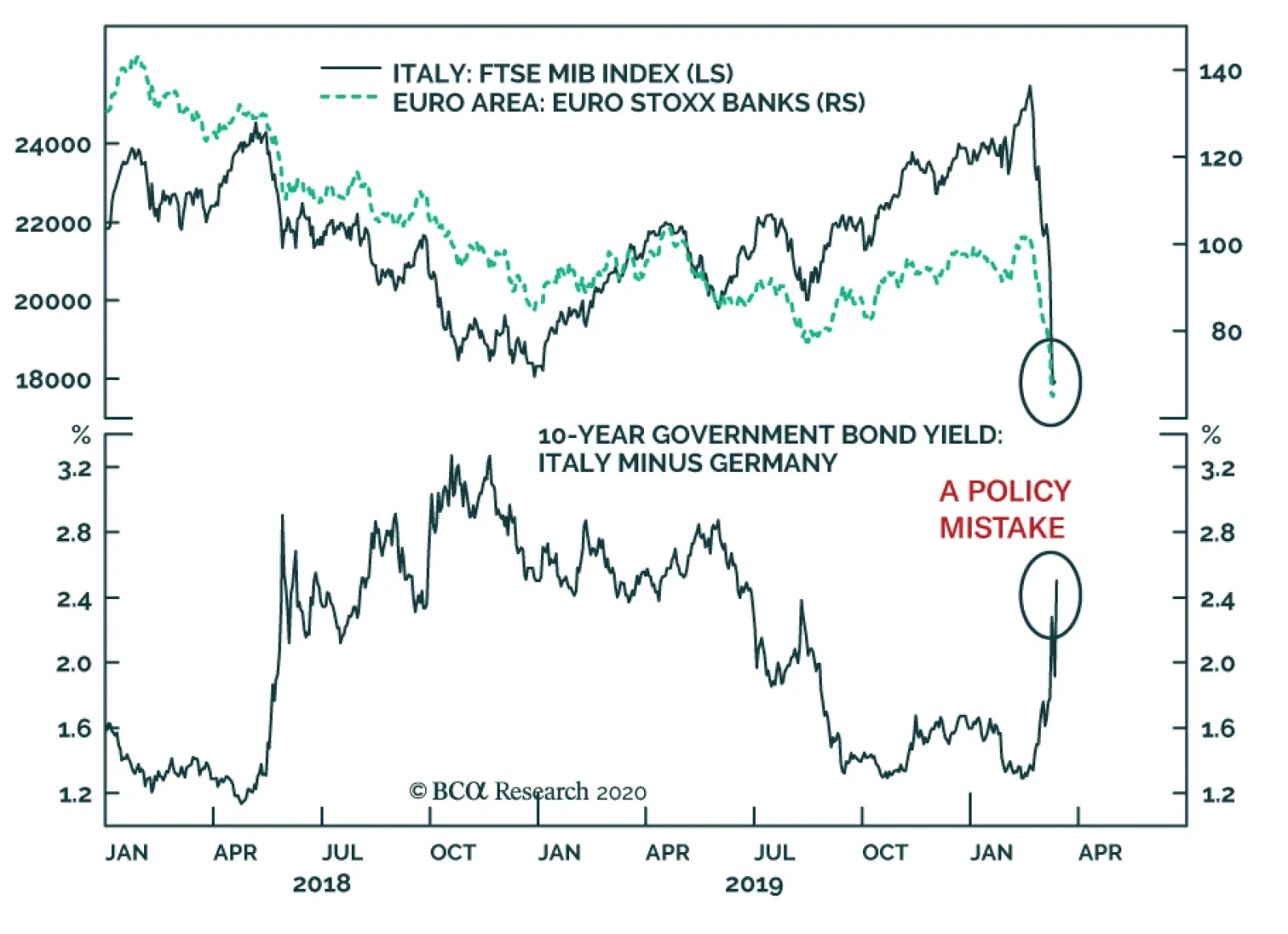

Yesterday, the ECB did not cut rates. This can be forgiven, pushing rates further into negative territory will only hurt banks and barely help economic activity. The ECB also eased the terms of the TLTRO-III programs, both in…

On a happy personal note, I will be away on paternity leave for a short time, reacquainting myself with nappies. As such, there will be no Weekly Reports for the next two weeks, but you will receive two excellent Special Reports penned…

The Bank of England followed on the path of the Fed and executed a 50bps inter-meeting interest rate cut. Markets did not feel relieved. Instead, they sold off, a move that continued after the WHO declared COVID-19 a pandemic…

Highlights Uncertainty & Yields: Global bond yields, driven to all-time lows as investors seek safety amid rioting markets, now discount a multi-year period of very weak global growth and inflation. Bond Portfolio Strategy:…

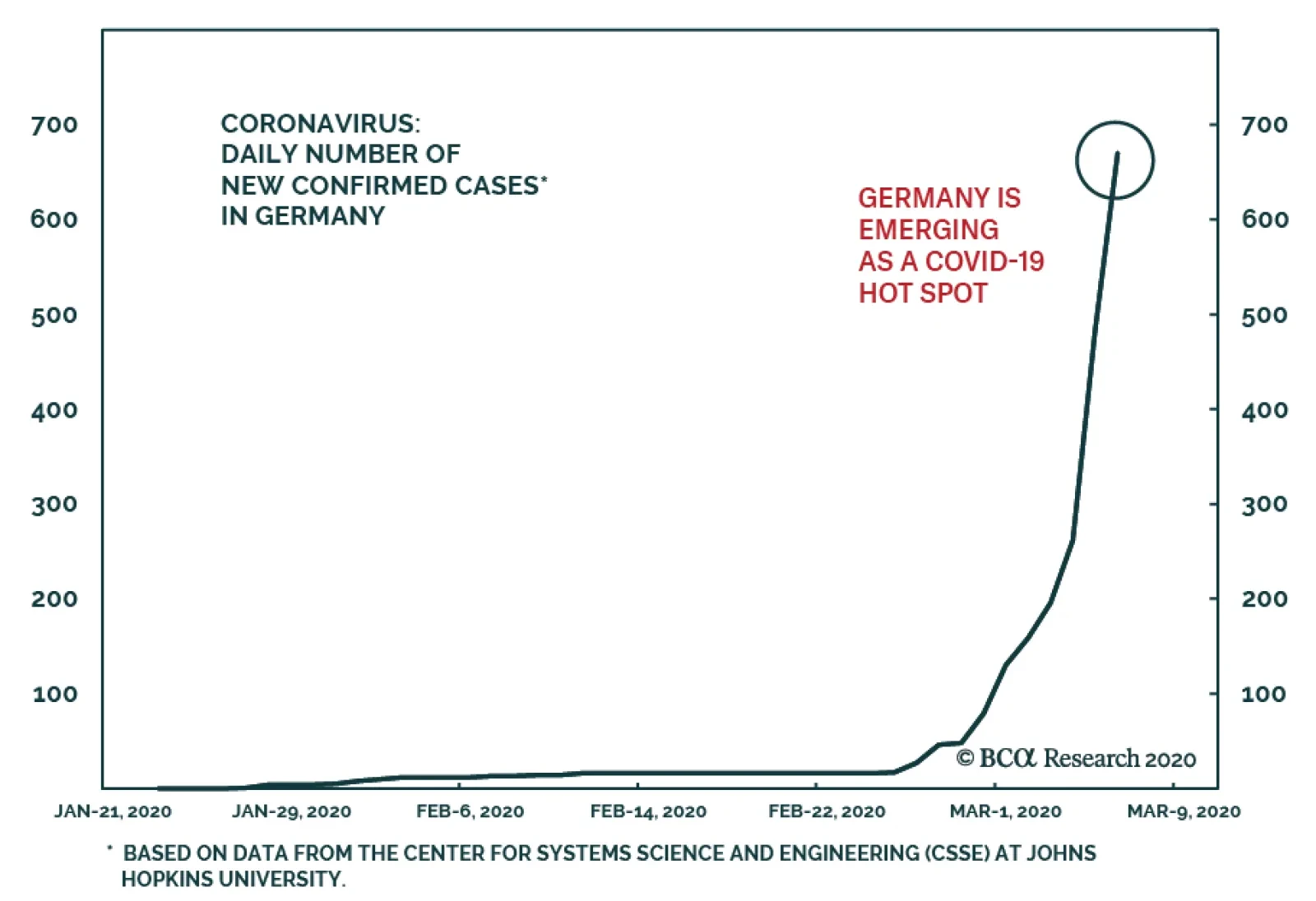

The German economy has suffered its set of woes in 2019, and 2020 is starting poorly. True, factory orders in January improved significantly, but Germany could suffer greatly from COVID-19. First, its industrial economy is very…

Highlights The latest interest rate cuts by central banks confirms the narrative that the authorities view economic risks as asymmetrical to the downside. This all but assures that competitive devaluation will become the dominant…

Highlights Financial markets are now fully priced for an economic downturn lasting one quarter… …but they are not fully priced for a recession. To go tactically long equities versus bonds requires a high conviction that…

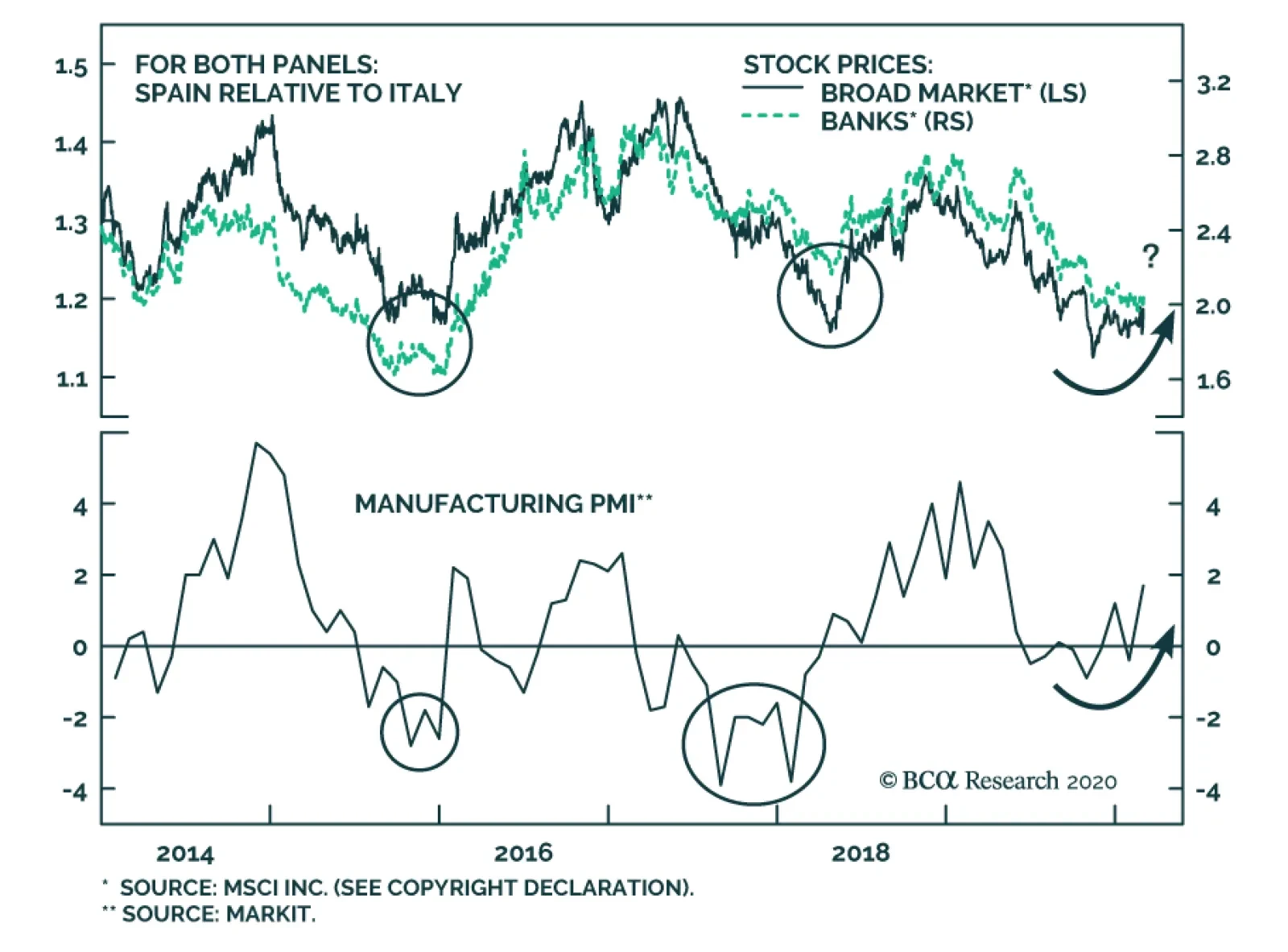

After underperforming through 2019, Spanish equities have become attractive relative to their Italian counterparts for the following reasons: Italy, with 2036 confirmed cases at the time of writing, has become the European…

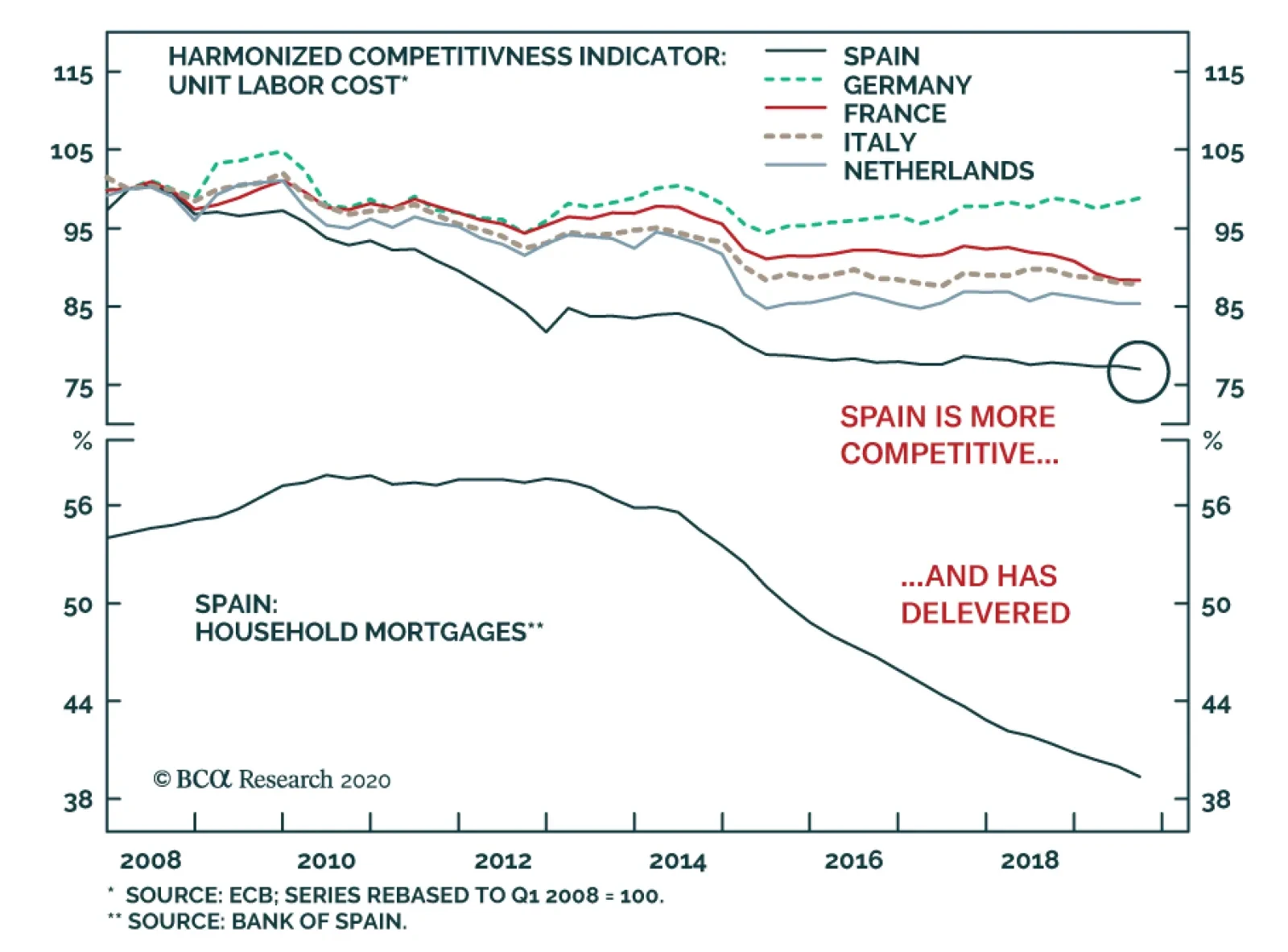

Two key structural factors support the Spanish economy. First, following the collapse in real wages and the productivity-boosting draconian labor market reforms that ensued from the debt crisis, Spanish competitiveness continues…

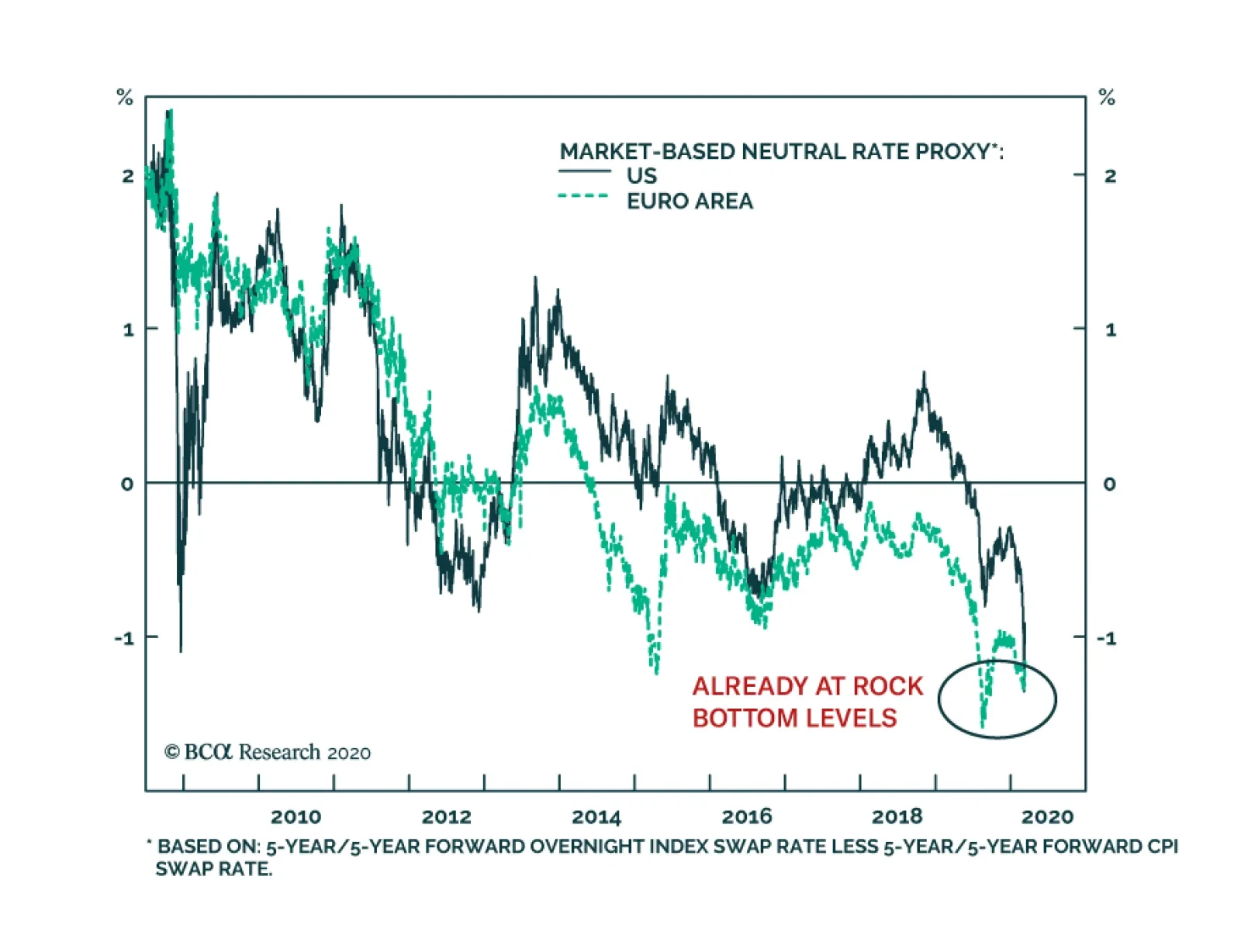

Highlights Policy Responses To The Virus: Markets are now pricing in significant monetary policy easing in response to the growth shock from the COVID-19 outbreak and related financial market instability. It is not yet clear, however,…