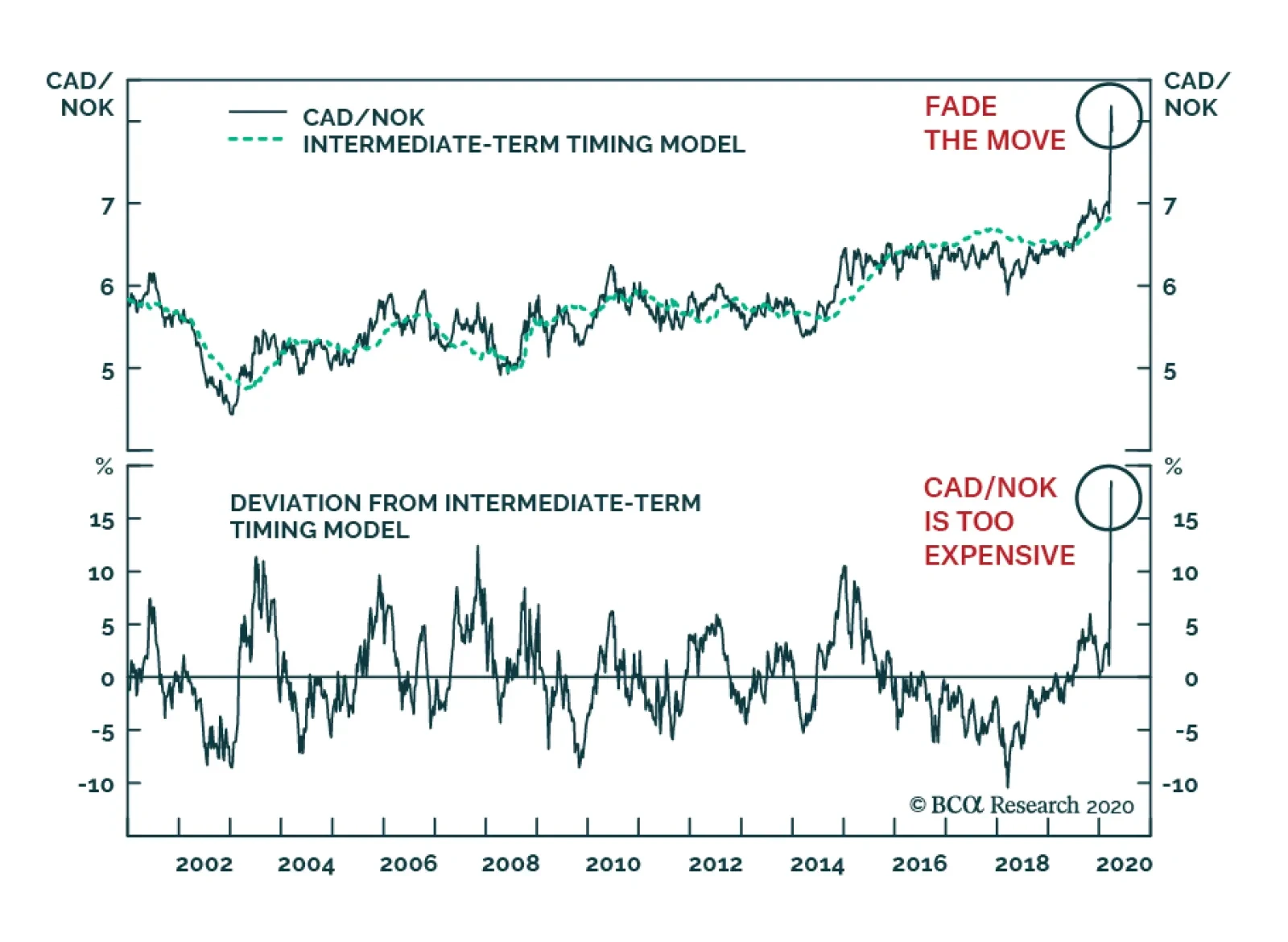

The Norwegian Krone was one of the great victims of the combined catastrophe created by both COVID-19 and the oil price collapse. Oddly, the Canadian dollar has been weak, but not nearly as much as the NOK. As a result, CAD/NOK…

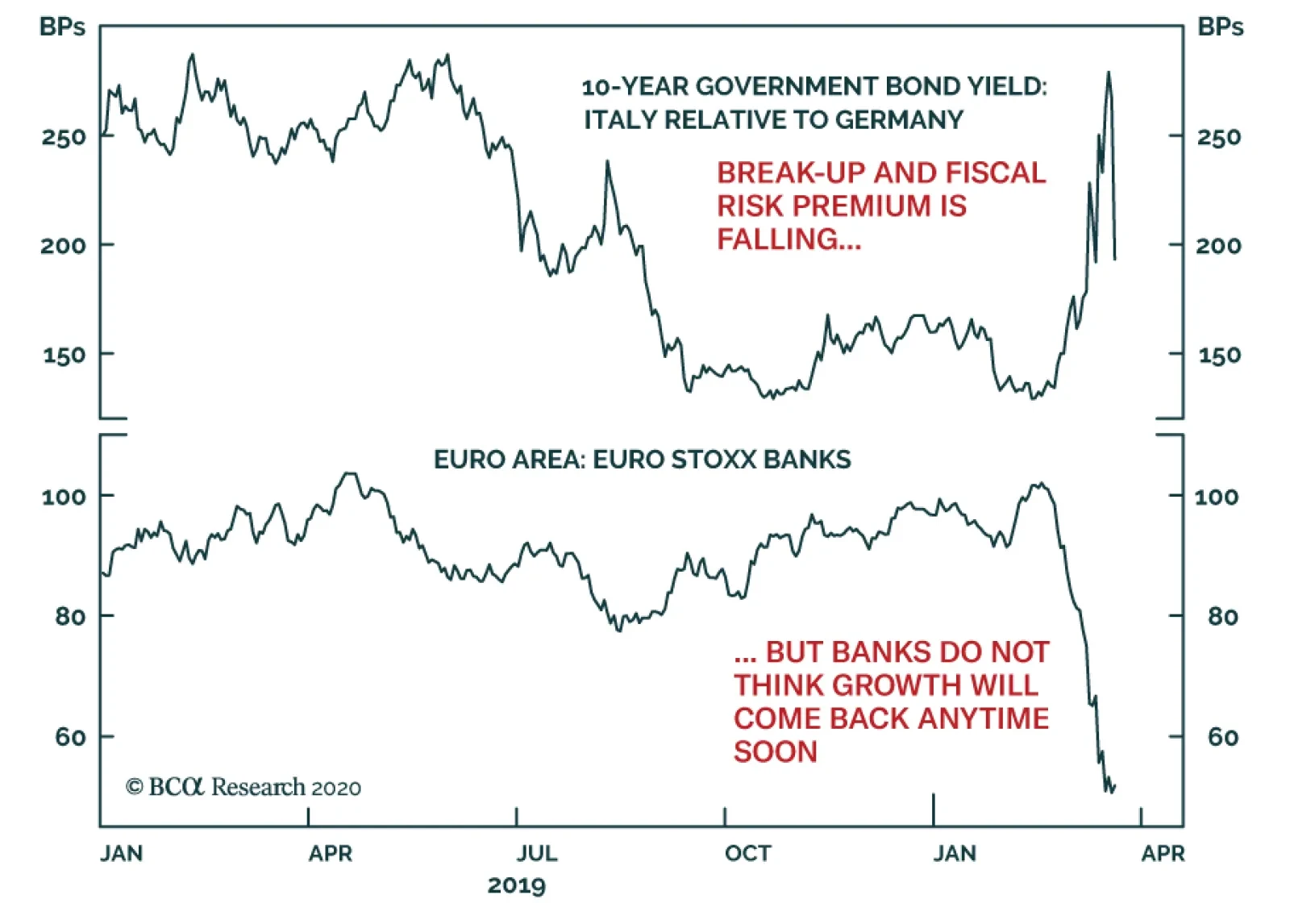

The ECB announced that it would implement EUR750 billion of government bonds purchases this year and that the program would remain open beyond December if need be. Moreover, the ECB seems to be ignoring its capital keys as self-…

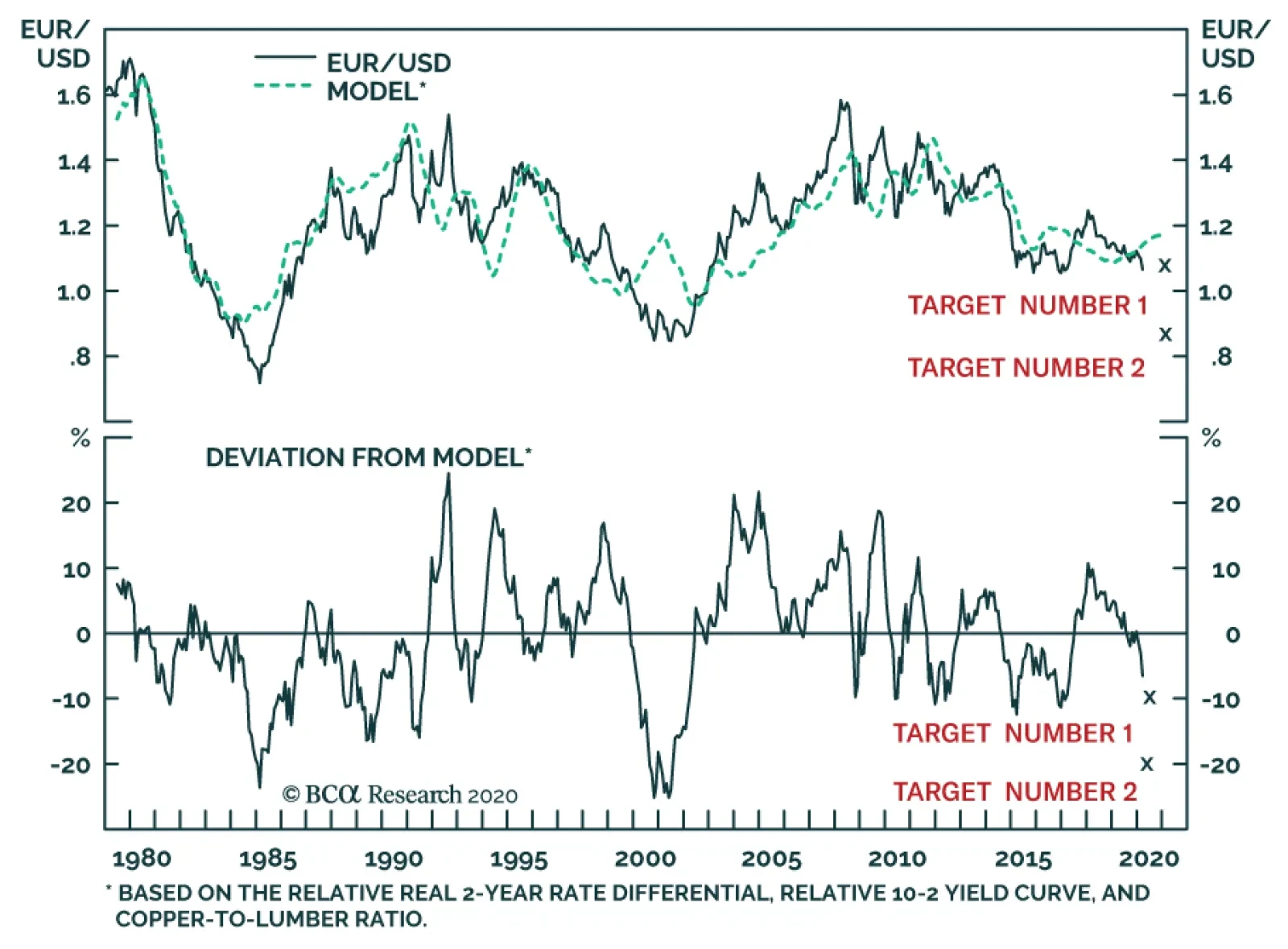

The demand for the dollar to meet dollar-funding needs is so elevated right now that the dollar is rising unstoppably, no matter what policy the Fed announces. For example, the Fed expanded its swap line program yesterday with…

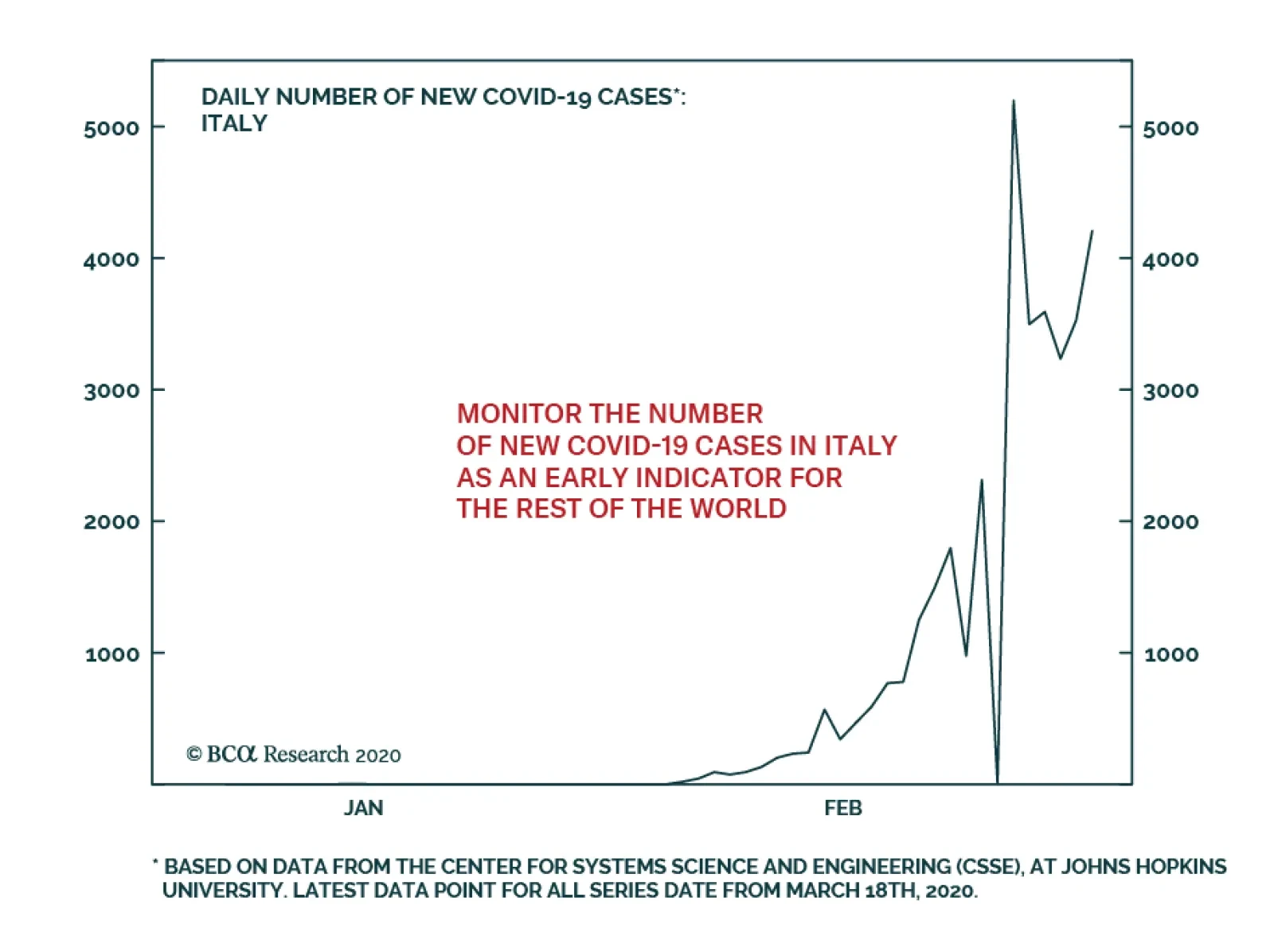

We recommend investors closely follow the number of new COVID-19 cases in Italy. At 4,207, as of March 18th, this number remains lower than it was on March 13th. However, new cases have nonetheless trended up over that past…

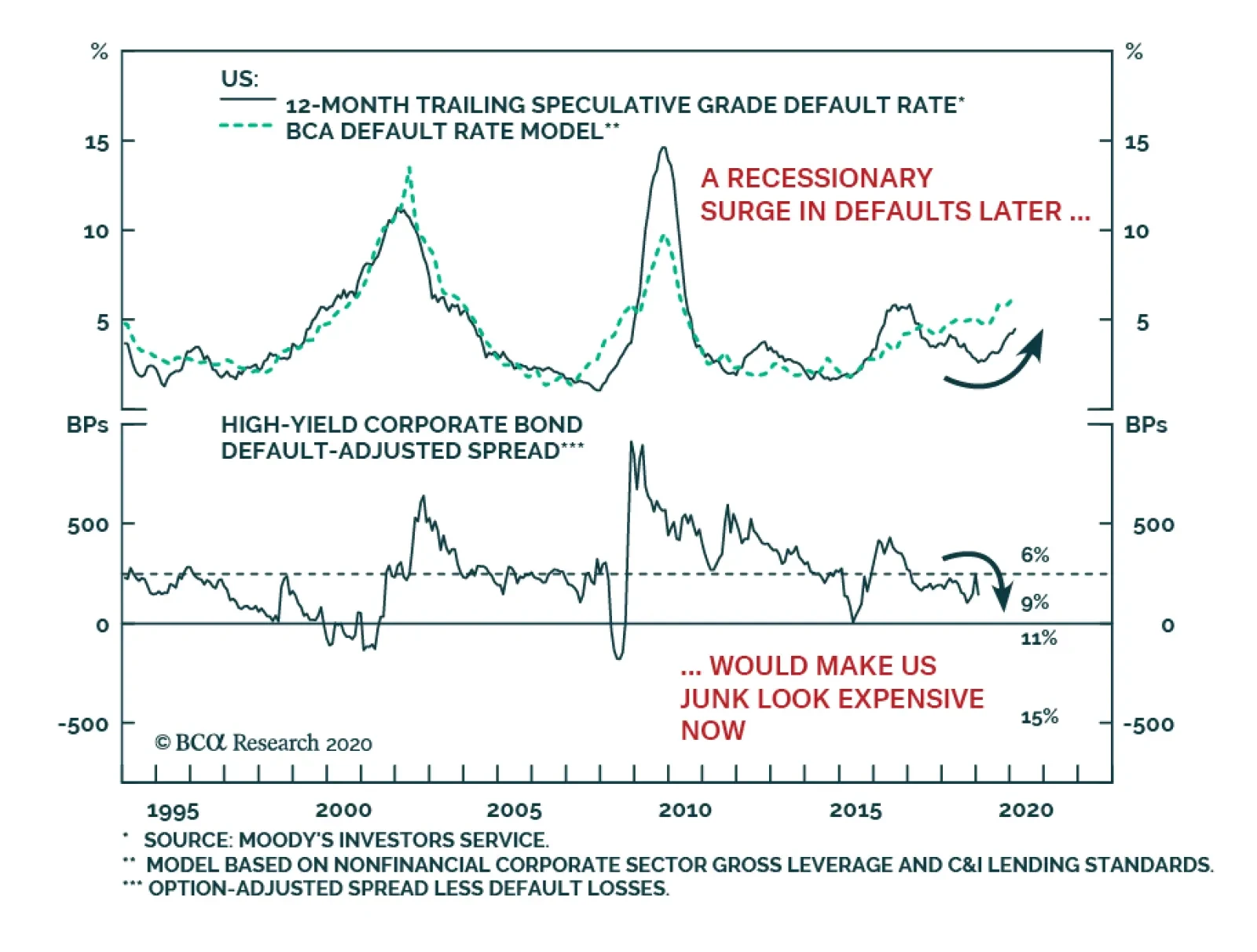

Yesterday, BCA Research's Global Fixed Income Strategy service urged investors to stay tactically defensive on corporate credit. The COVID-19 global market rout has generated levels of market volatility not seen since the 2008…

Highlights Policy Responses: The COVID-19 pandemic has become a full-blown global crisis and recession. Governments and central bankers worldwide are now responding with aggressive monetary easing and fiscal stimulus. Markets will not…

Highlights The path of least resistance for the DXY remains up. The internal dynamics of financial markets remain constructive for the DXY. We explore more key indicators to complement the analysis in our February 28 report. Our…

Highlights China is moving from virus containment to normalization and economic stimulus. The full weight of the virus panic is only now hitting the US public and has not yet peaked. The US – and western democracies in general…