Highlights The economic shutdown needed to exhaust the coronavirus pandemic must last much longer than is anticipated. For example, in Italy it must last 24 weeks. If the economy is reopened too soon, the pandemic will reignite in a…

Highlights Recommended Allocation The outlook for markets over the next few months is highly uncertain. On the optimistic side, new COVID-19 cases are probably close to peaking (for now), and so equities could continue to…

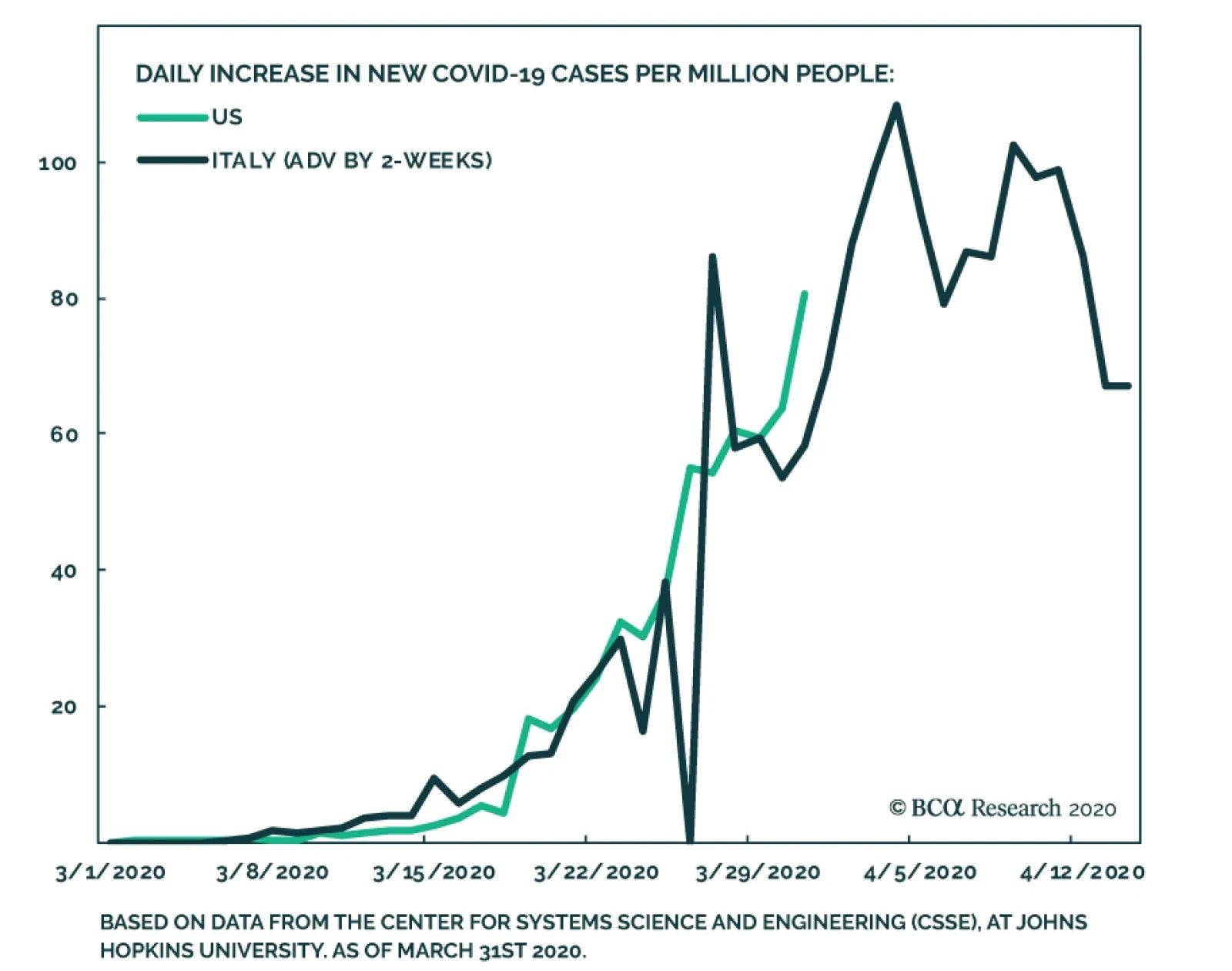

We noted in an Insight earlier this week that the US appears to be following Italy’s COVID-19 experience by roughly two weeks. The chart above makes this point more directly by comparing the US and Italian COVID-…

Dear Client, I will be discussing the economic and financial implications of the pandemic with my colleague Caroline Miller this Friday, March 27 at 8:00 AM EDT (12:00 PM GMT, 1:00 PM CET, 8:00 PM HKT). I hope you will be able to join…

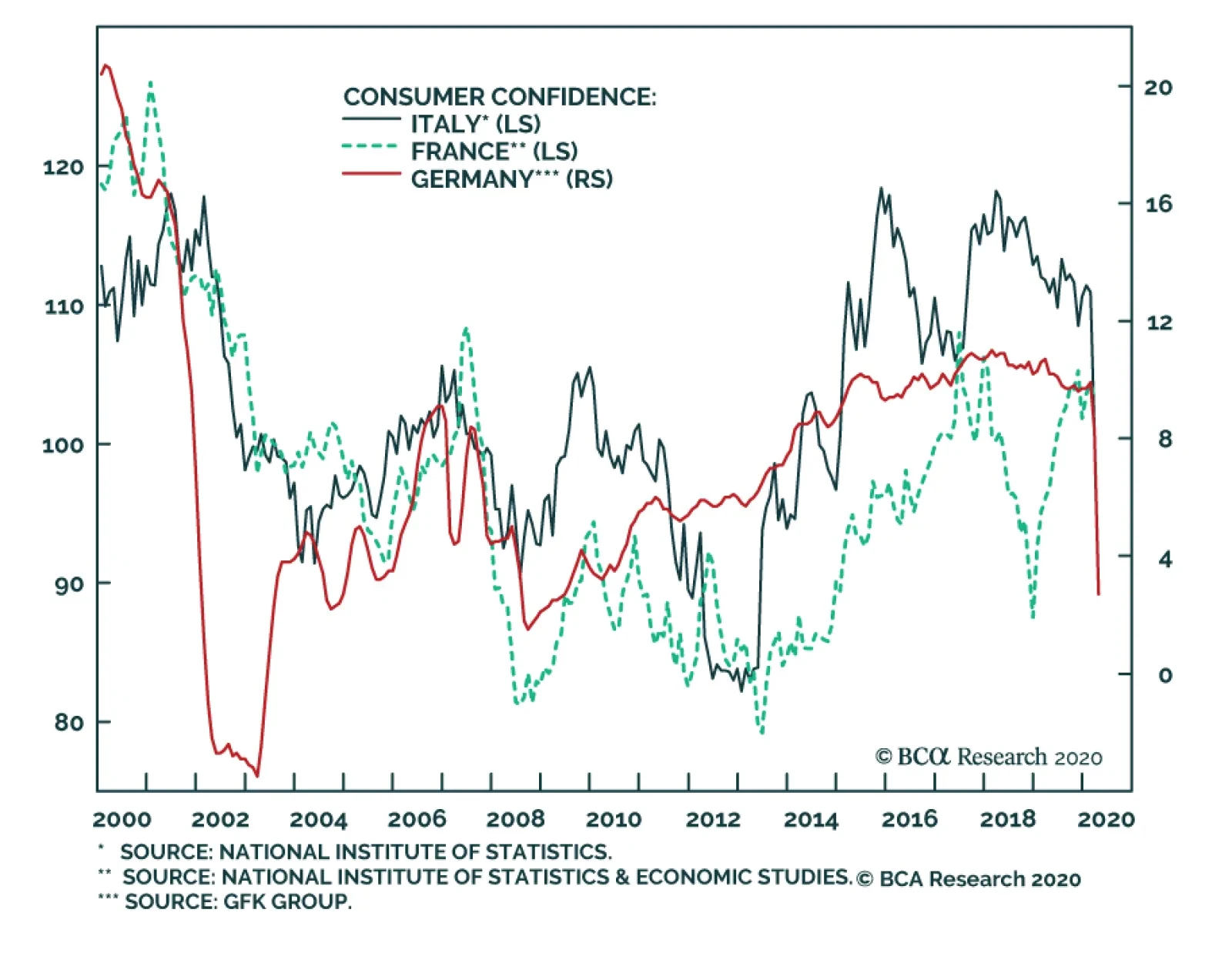

Unsurprisingly, European consumer confidence has declined sharply as a result of lockdown measures required to contain the spread of COVID-19. The GfK survey in Germany fell from 8.3 to 2.7, much worse than the consensus…

Highlights The pillars of dollar support continue to fall, but the missing catalyst is visibility on the trajectory of global growth. For now, we remain constructive on the DXY short term, but bearish longer term. Market internals…

Highlights The pandemic has a negative impact on households and has not peaked in the US. But a depression is likely to be averted. Our market-based geopolitical risk indicators point toward a period of rising political turbulence…

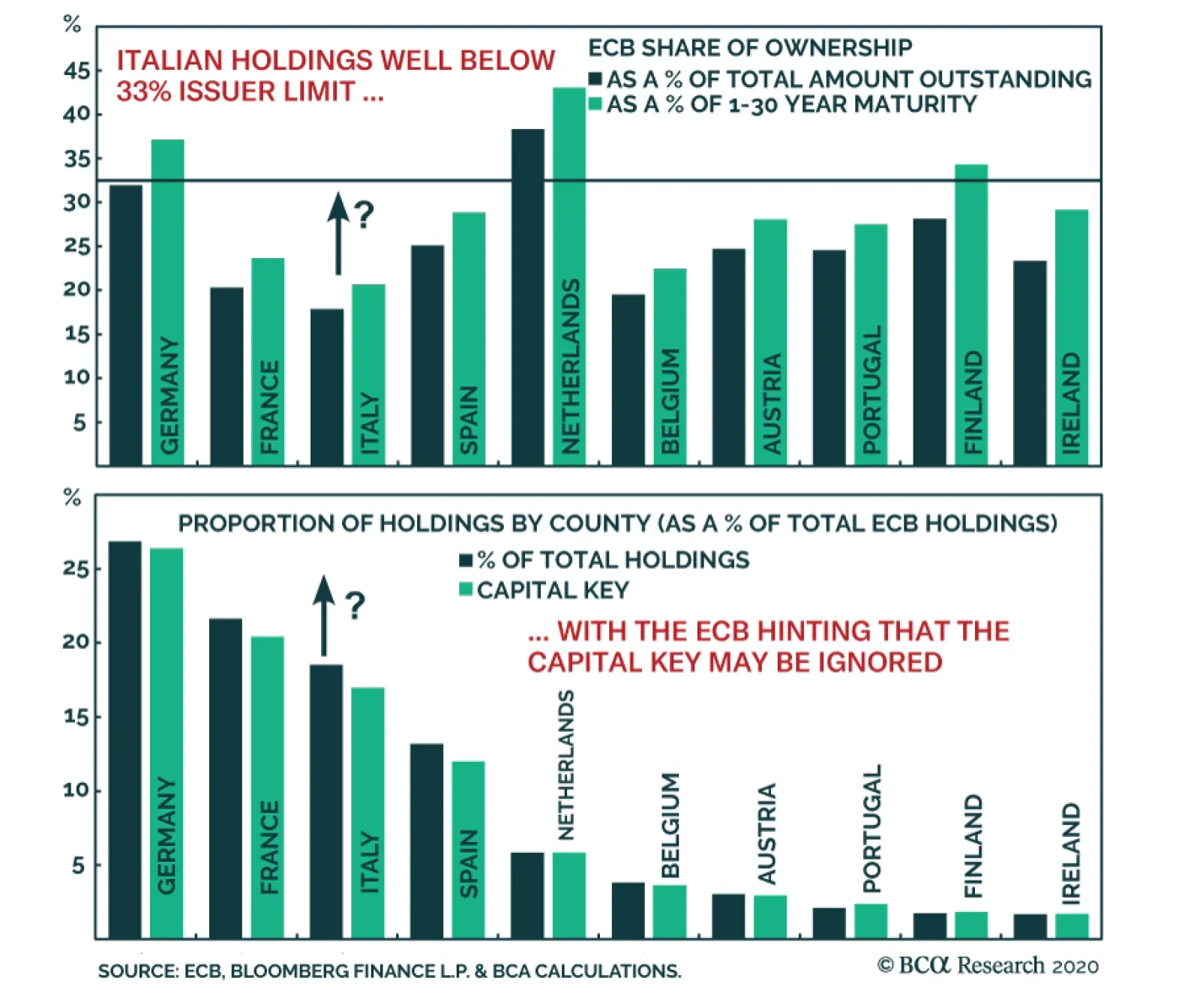

The ECB unloaded its latest “bazooka” last week to fight the negative financial and economic effects of COVID-19. The central bank announced a new €750bn Pandemic Emergency Purchase Program (PEPP) that will…

Highlights Market Turmoil: The combination of accelerating global cases of COVID-19, a surging US dollar and elevated market volatility has wreaked havoc on financial markets. A sustainable bottom in global risk assets (and,…