Global risk assets are engulfed in a wave of euphoria, which is pulling Europe higher along the way. However, risks still abound. How should investors adjust their allocation to Europe under these highly uncertain conditions?

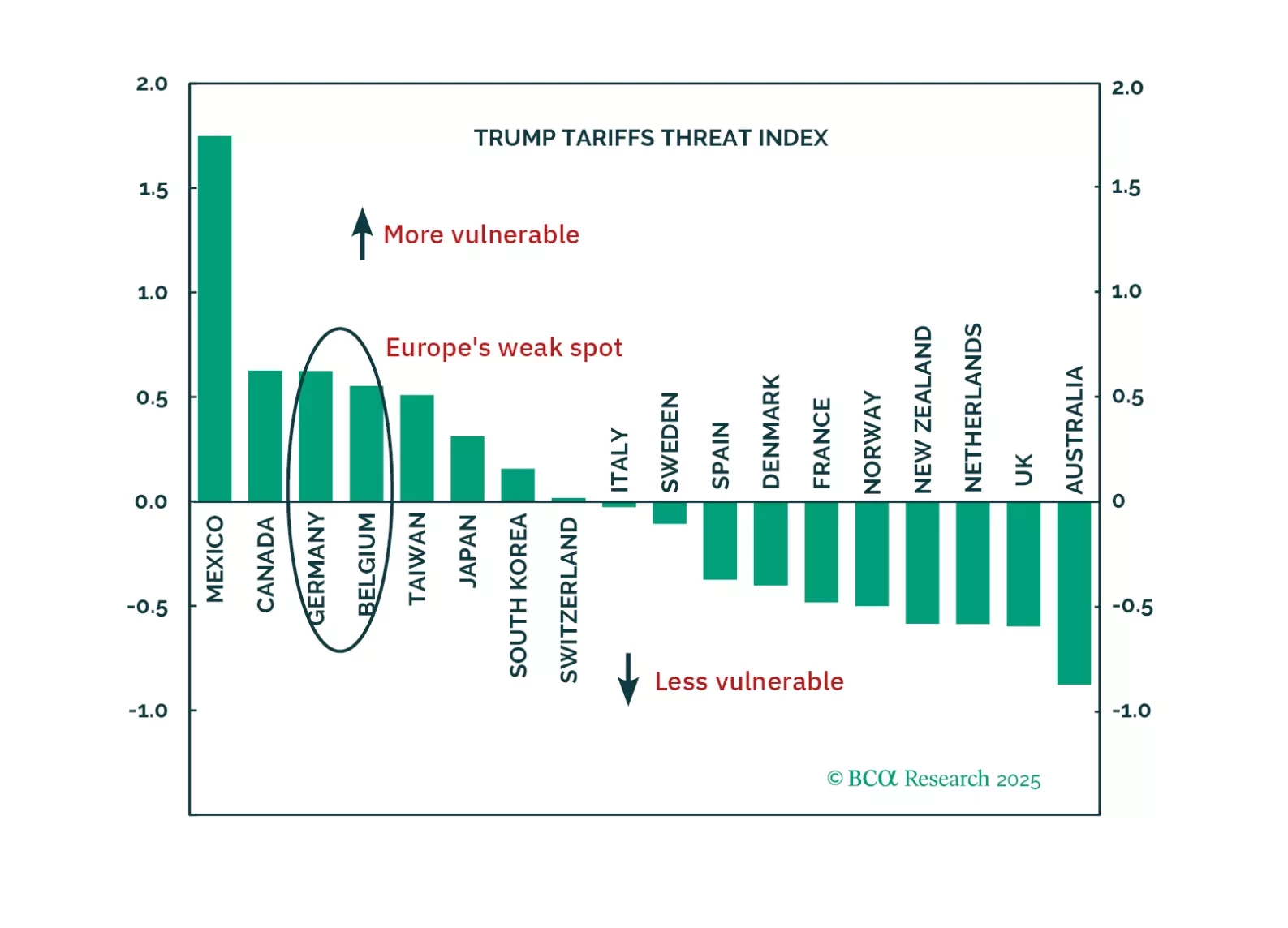

Our Chart Of The Week comes from Mathieu Savary, Chief Strategist of our European Investment Strategy service. Mathieu investigates why President Trump started his global trade offensive with an attack on Canada and Mexico, the US’…

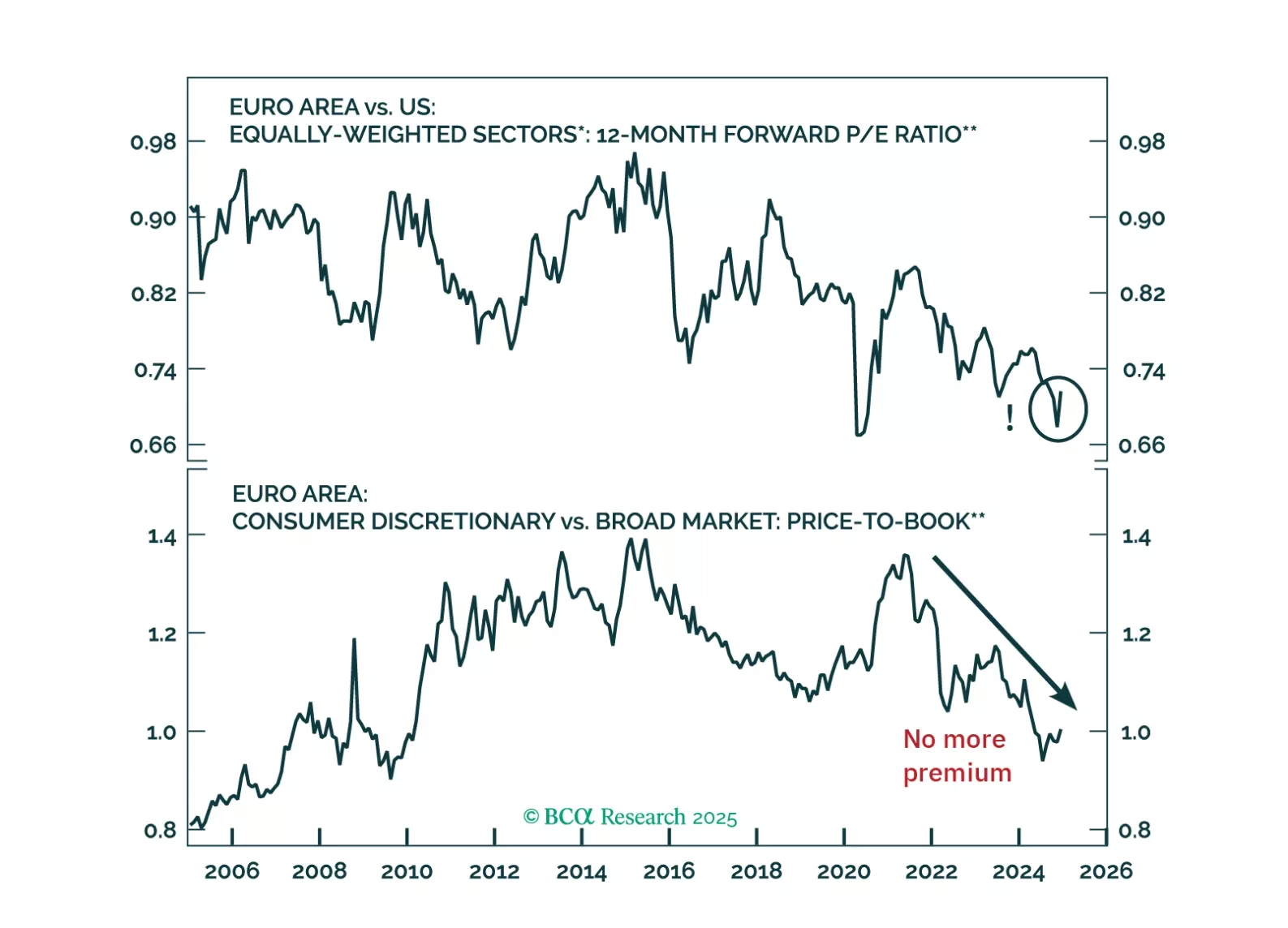

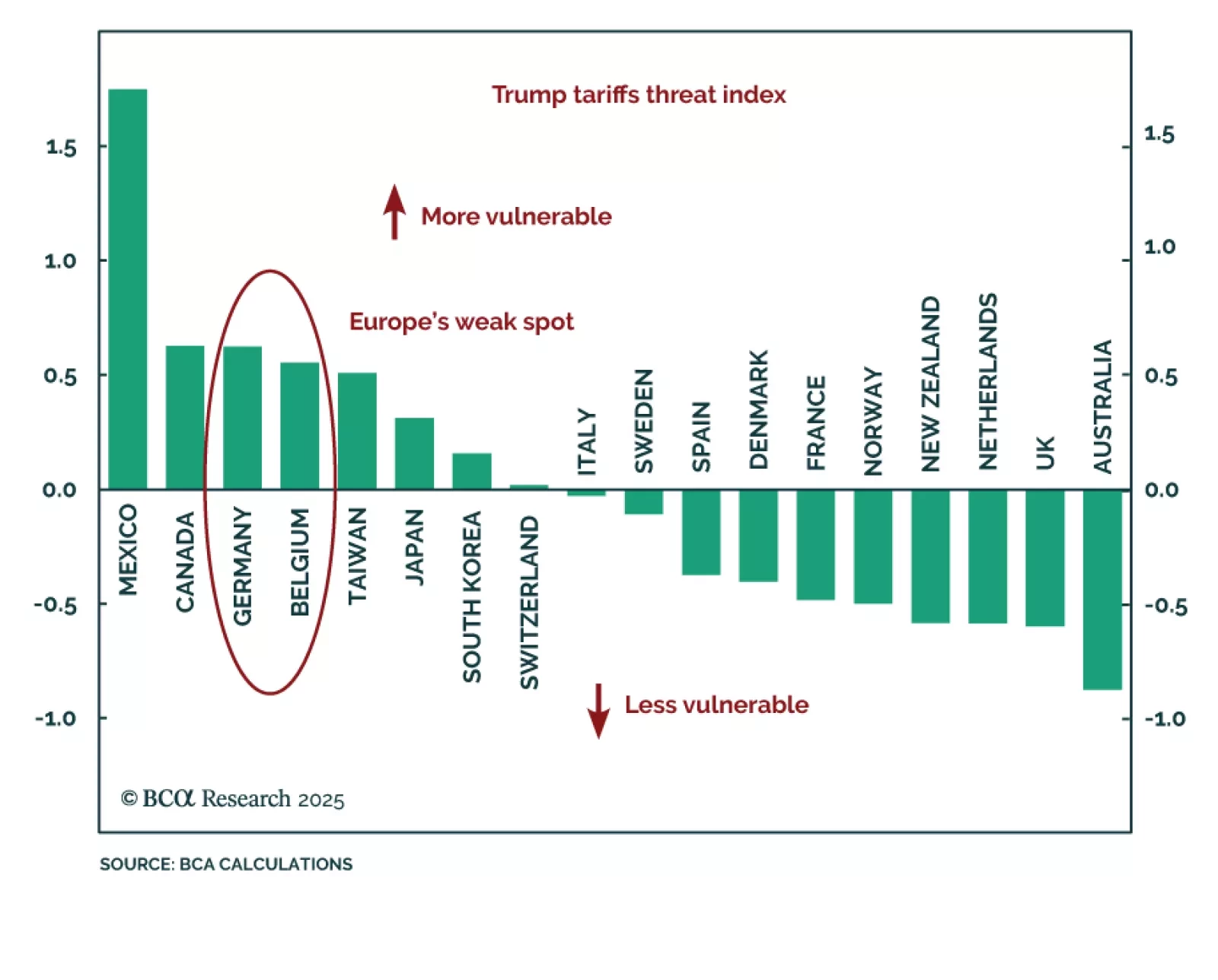

President Trump is about to be inaugurated. Investors often assume all his policies will hurt Europe, but the reality is more nuanced.

UK inflation surprised to the downside in December. Headline inflation retreated below estimates to 2.5% y/y from an eight-month high of 2.6% in November. Core inflation also decreased below estimates, printing 3.2% vs. 3.5% in…

This month, our Here, There, And Everywhere chartpack reiterates our main thesis for 2025: the three main narratives driving markets today – fiscal profligacy, trade war, and geopolitical conflict – will peak at some point in 2025.…

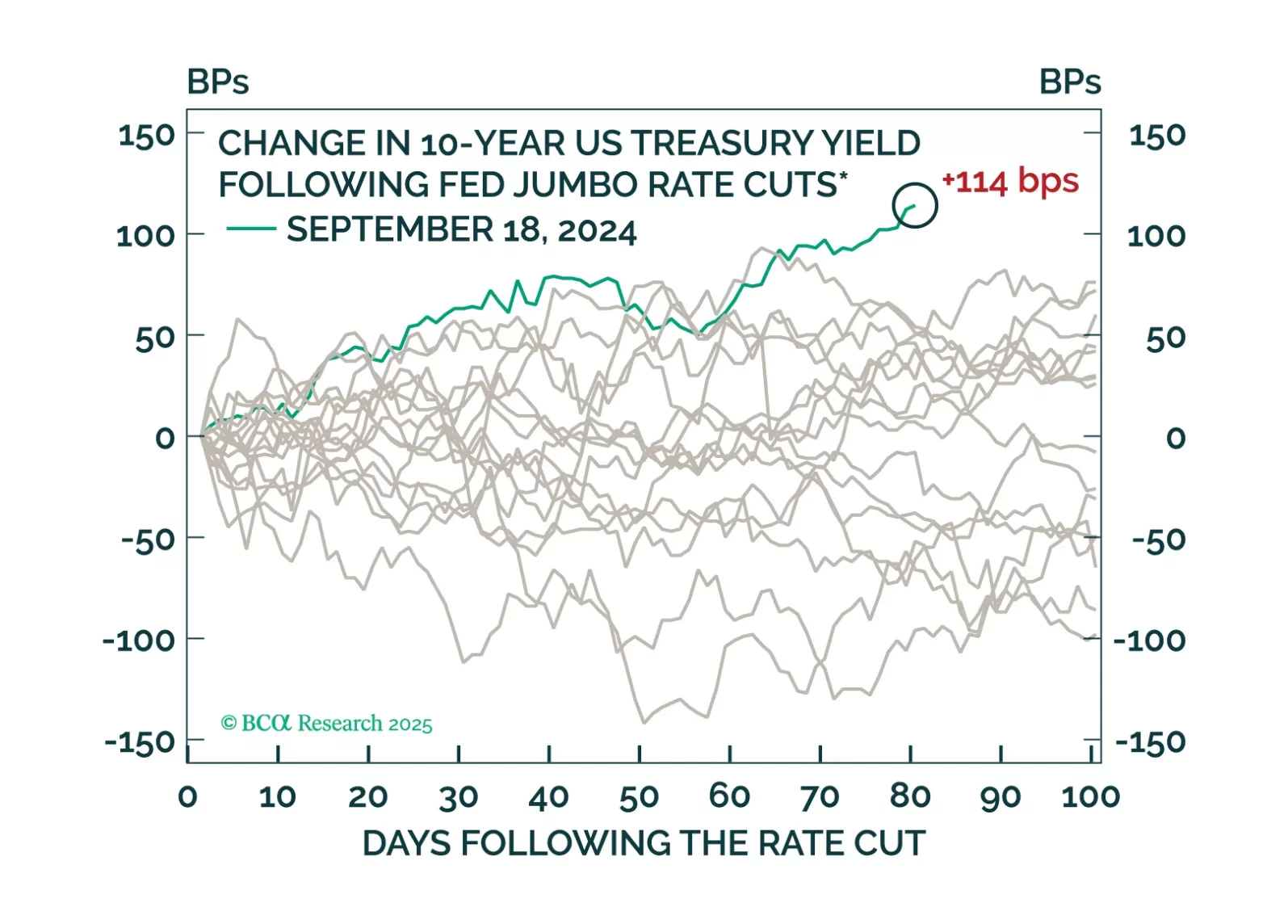

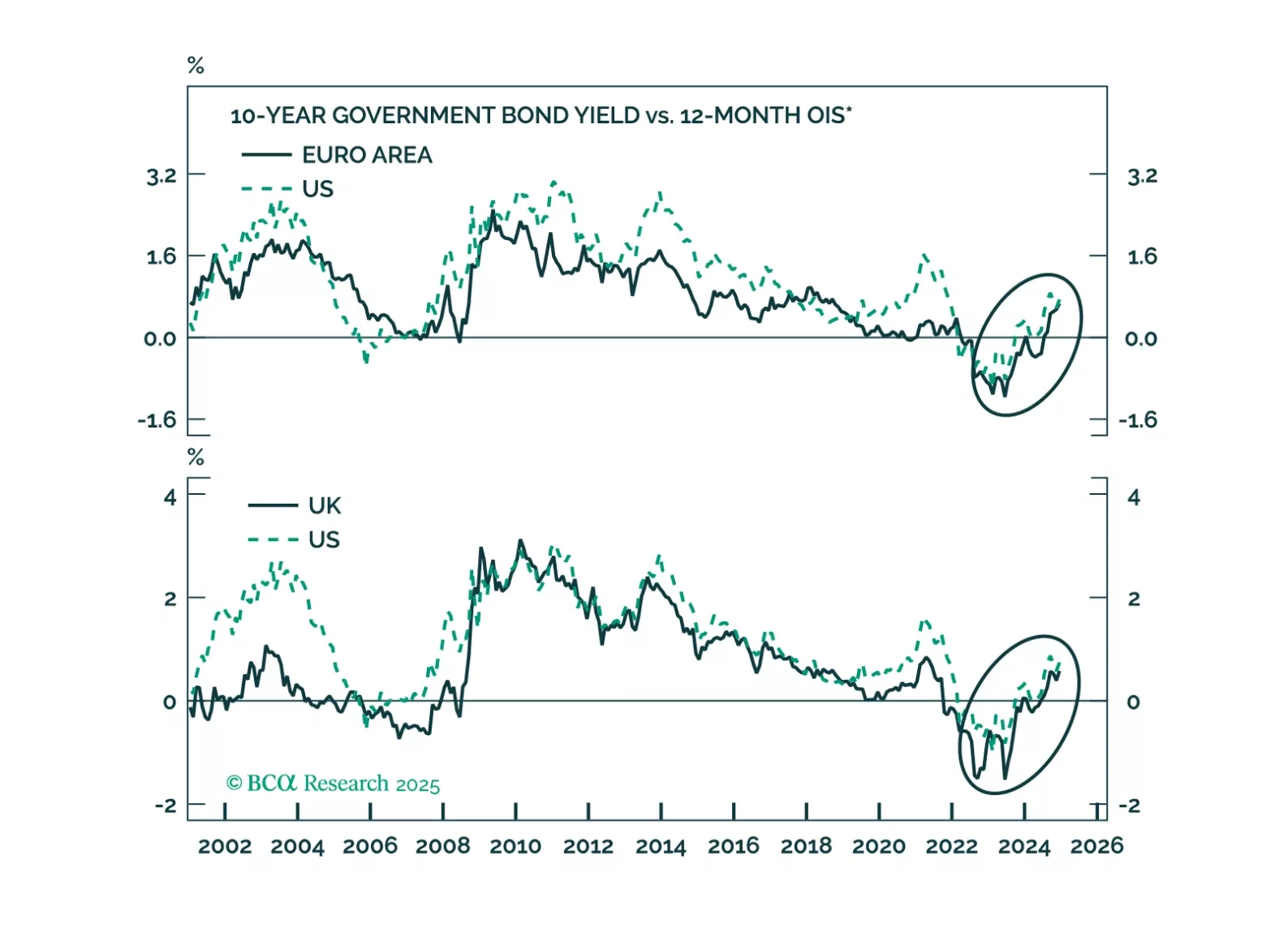

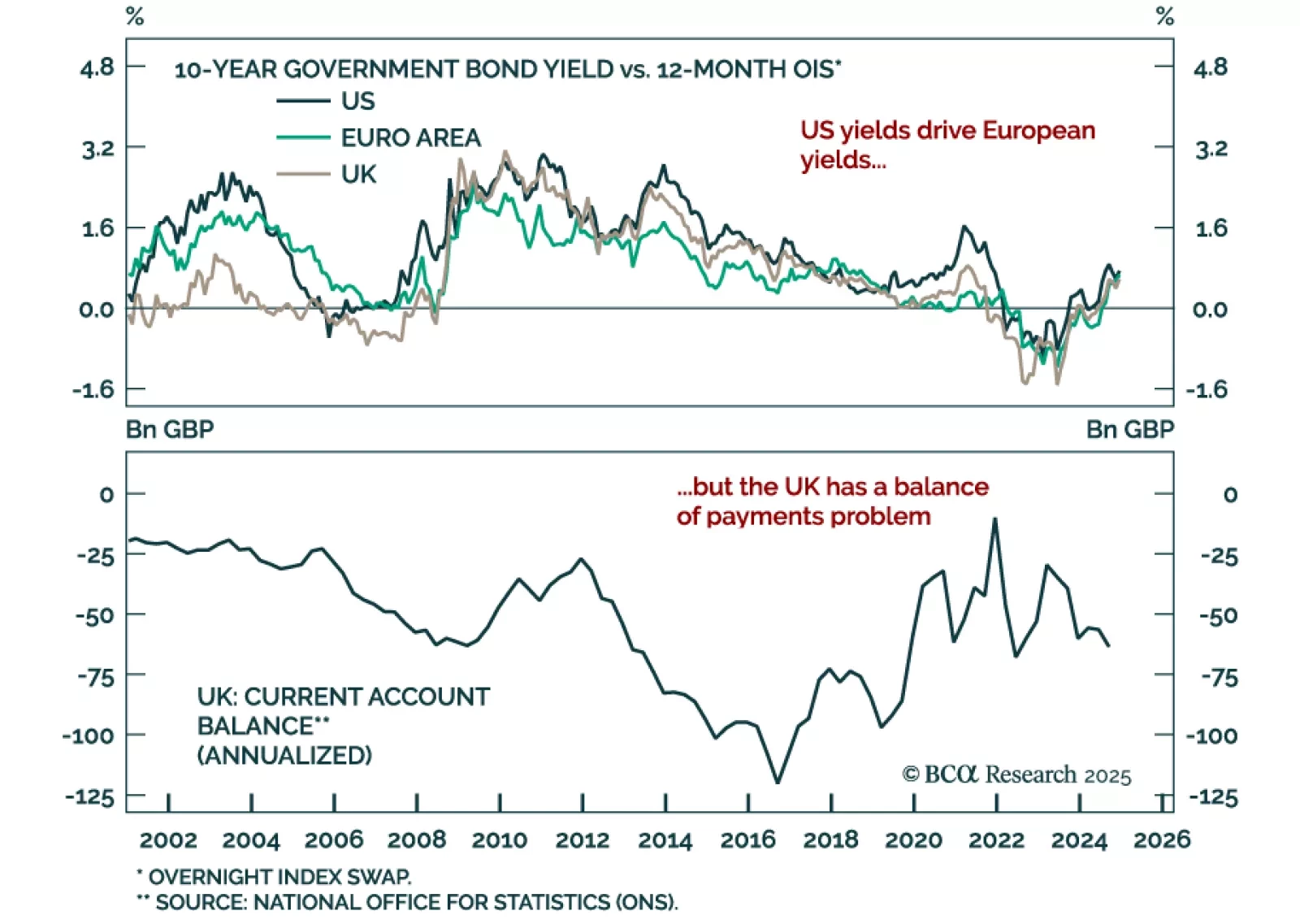

Our European Investment strategists looked at the developed markets bond selloff from a European perspective, focusing on Euro area and UK government bonds and currencies. The recent selloff in European bonds is driven primarily…

UK and German bonds are victims of the global bond market riots. Will European yields continue to move higher and will the euro and the pound find a floor anytime soon?

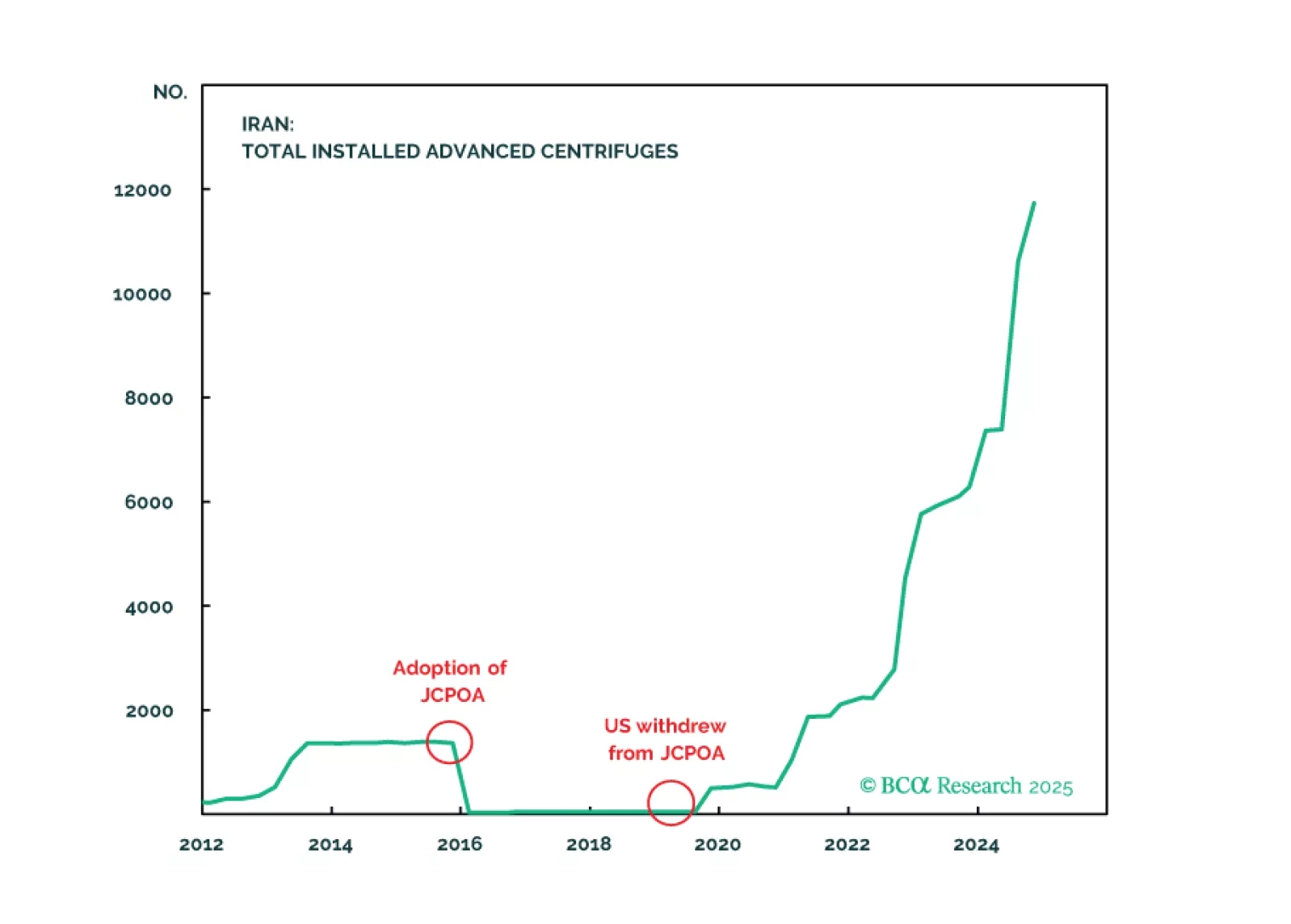

Every year we highlight five low-odds scenarios that would have a major impact on global financial markets if they happened. This year we contemplate a total reversal of Chinese policy, a US-Iran nuclear deal, a breakdown of NATO, US…

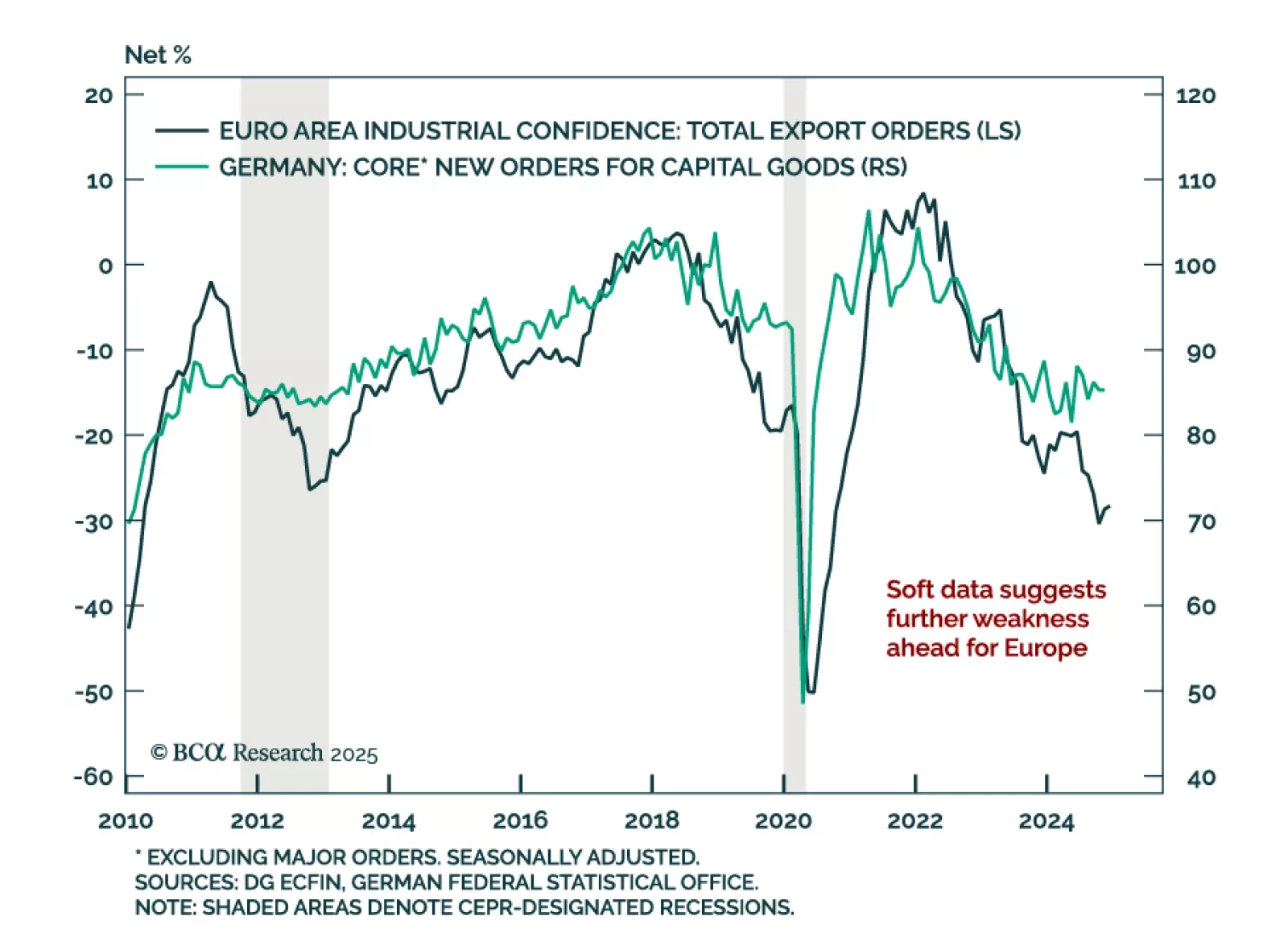

November factory orders in Germany widely missed estimates, falling by 5.4% m/m, worsening the 1.5% October decline. Excluding major orders, which often distort the overall picture, core new orders fell 1.7% y/y after growing 5.7% in…

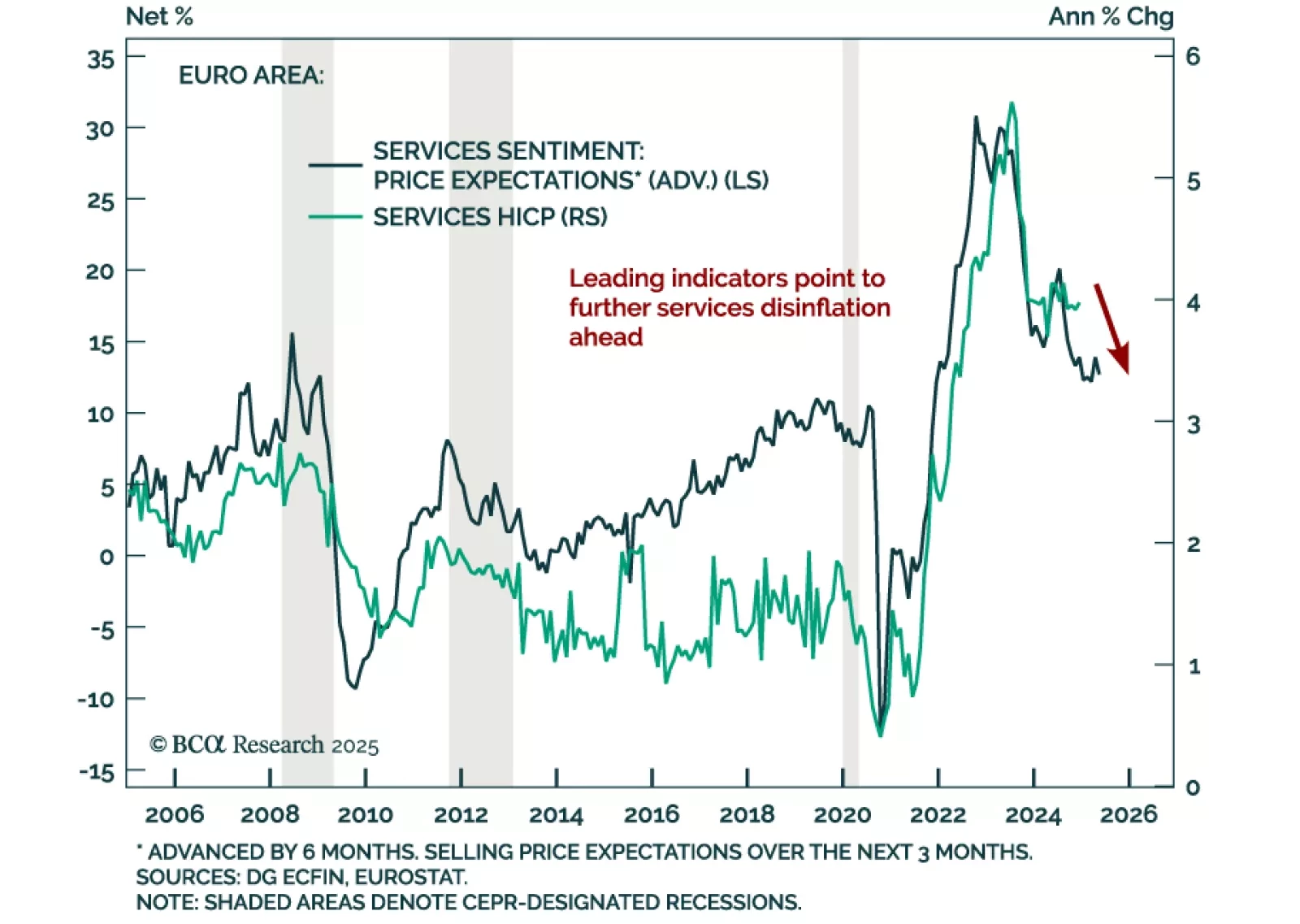

December euro area inflation met expectations, with headline HICP printing at 2.4% y/y from 2.2% in November, and core steady at 2.7%, above the ECB’s target. Services inflation remains elevated at 4.0% y/y, up from 3.9% a month…