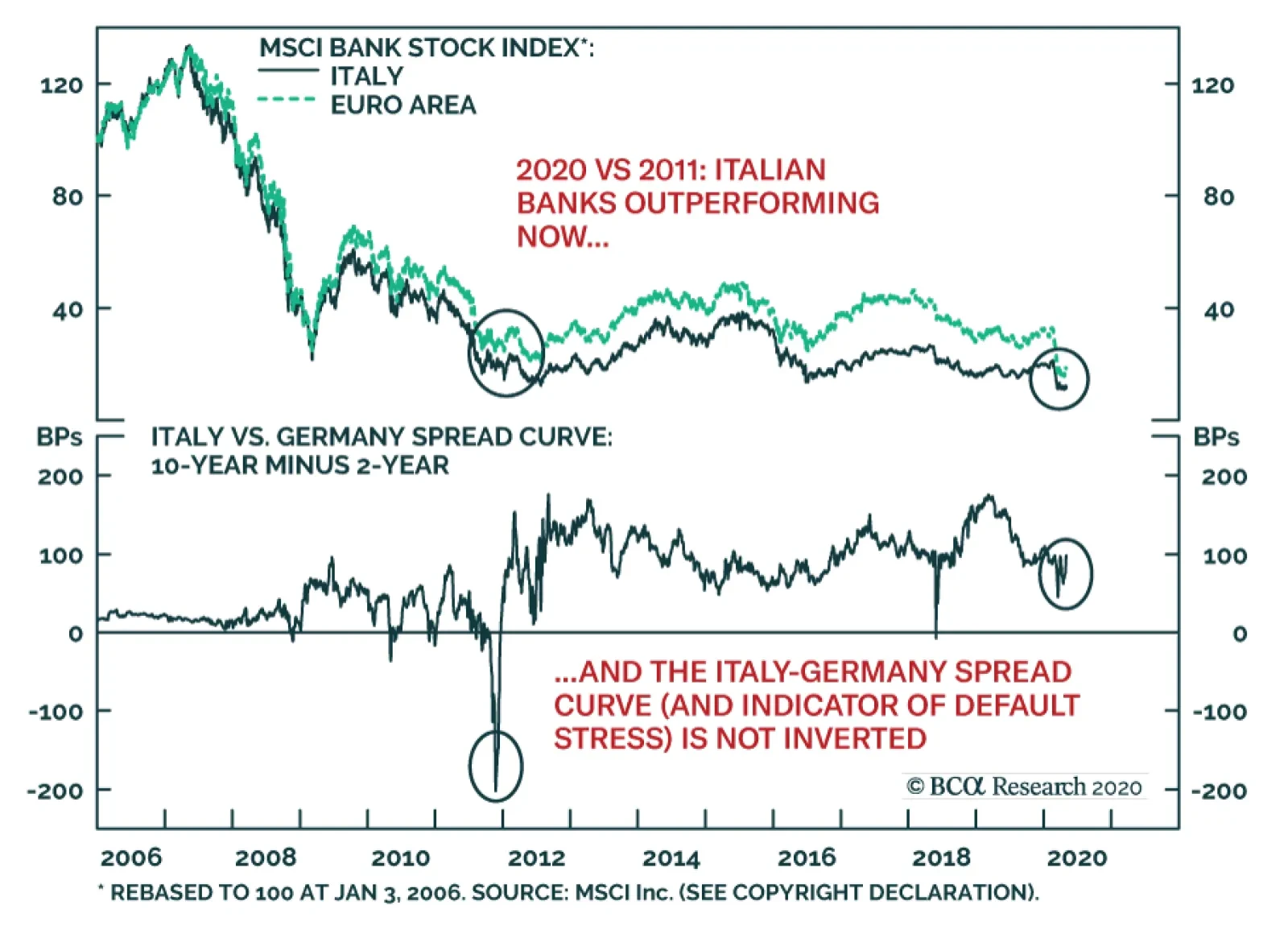

Yesterday, BCA Research's Global Fixed Income Strategy service concluded that internal divisions over Italy were a crucial determinant of why the ECB chose the LTROs over ramping up asset purchases. The unique nature of the COVID-19…

Highlights ECB: The ECB disappointed markets last week who expected an increase in the size of its asset purchase schemes given the recent increase of Italian bond yields. For now, the central bank remains focused on preventing a…

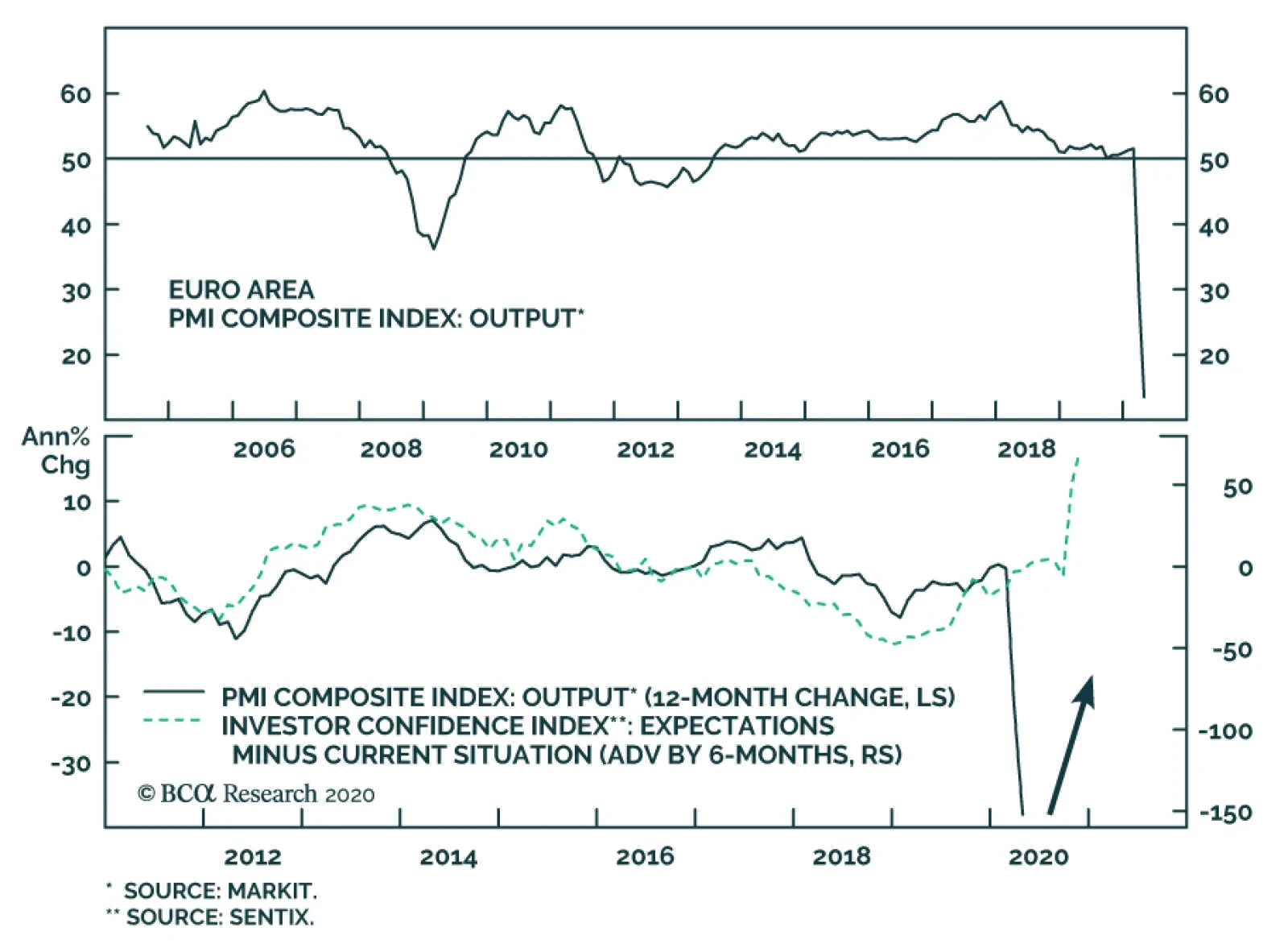

The final estimate of the Eurozone Manufacturing PMI was revised down to 33.4 from 33.6, which only highlights that the economic situation in Europe remains dismal, especially as the output index has plunged well below the…

Spanish stocks stand at their lowest level relative to the overall Eurozone since late 1996. Additionally, a composite valuation indicator currently shows that Spanish equities trade at their cheapest relative to European stocks…

Highlights Competitive devaluation will remain the dominant policy landscape in the near term. This means that paradoxically, currencies with high and/or positive long-term interest rates remain at risk. The CAD may be the next shoe…

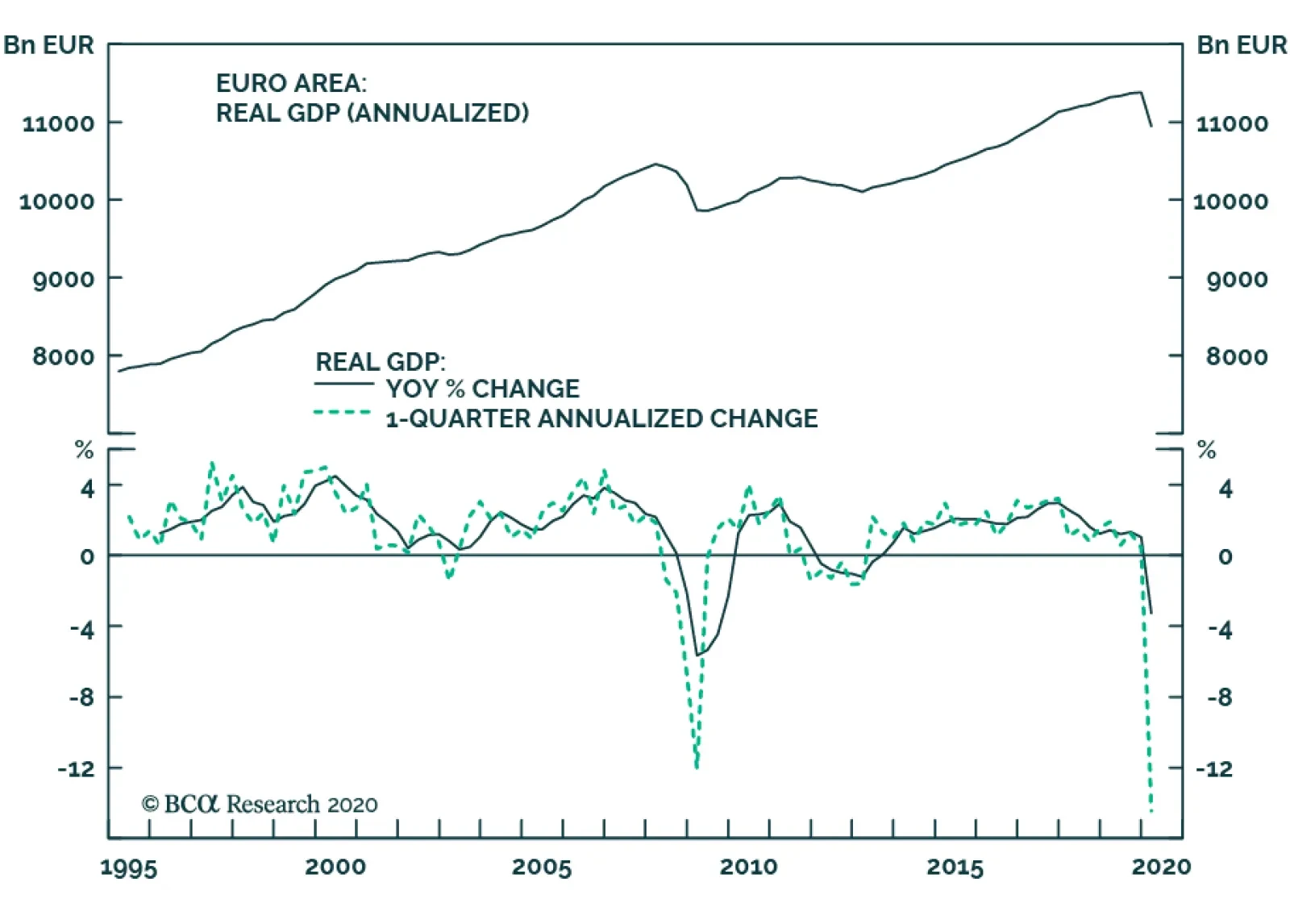

Yesterday’s euro area GDP release highlighted that output fell close to 4% in Q1, or 14.4% on an annualized basis (please see the chart above). The euro area data followed the advanced Q1 US GDP release on Wednesday, which…

Highlights The global economy will contract at its fastest pace since the early 1930s, but will not slump into a depression. Easy monetary conditions, an extremely expansive fiscal policy, and solid bank and household balance sheets…

Highlights The six-month increase in European bank credit flows amounts to an underwhelming $70 billion, compared to a record high $660 billion in the US and $550 billion in China. Underweight European domestic cyclicals versus their…