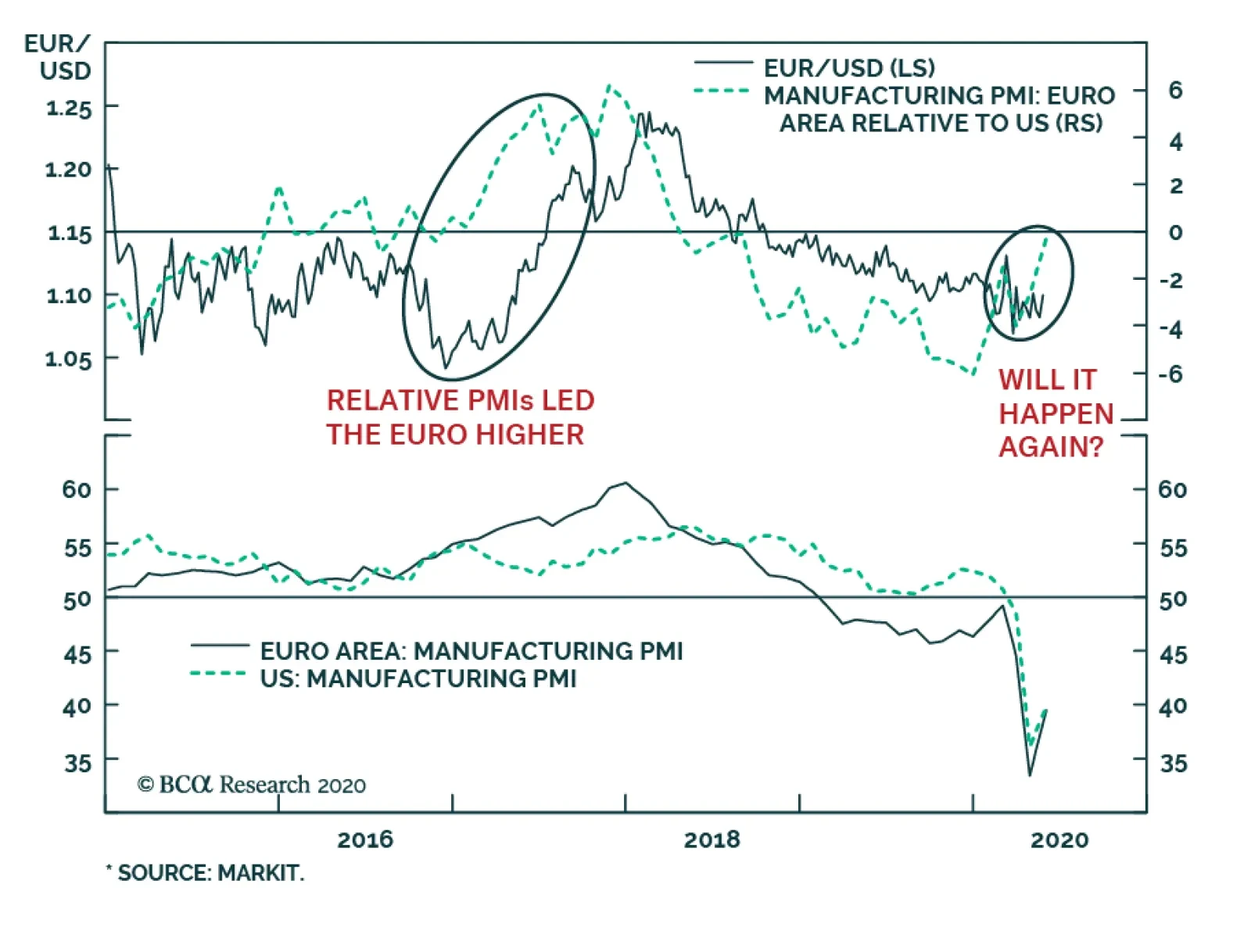

Yesterday, the Eurozone Manufacturing PMI flash estimate for May rose from 33.4 to 39.5, beating expectations of 38. The European indicator rebounded more than the US one, which increased from 36.1 to 39.8, narrowly missing…

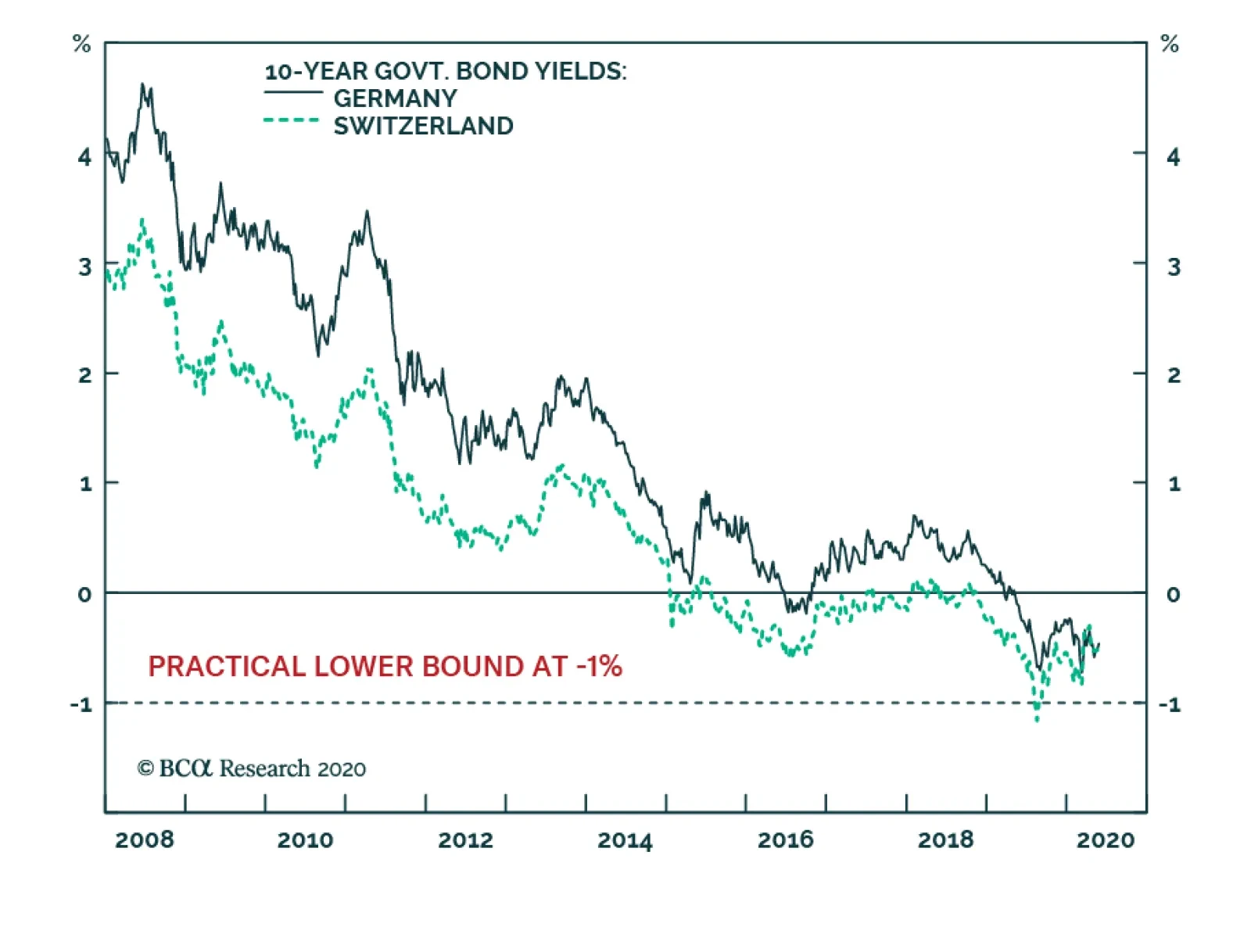

BCA Research's European Investment Strategy service argues that German Bunds and Swiss Bonds are no longer safe-haven assets. German and Swiss bond yields are close to the practical lower limit to yields, which we believe…

Highlights German bunds and Swiss bonds are no longer haven assets. The haven assets are the Swiss franc, Japanese yen, and US T-bonds. Gold is less effective as a haven asset. During this year’s coronavirus crash, the gold…

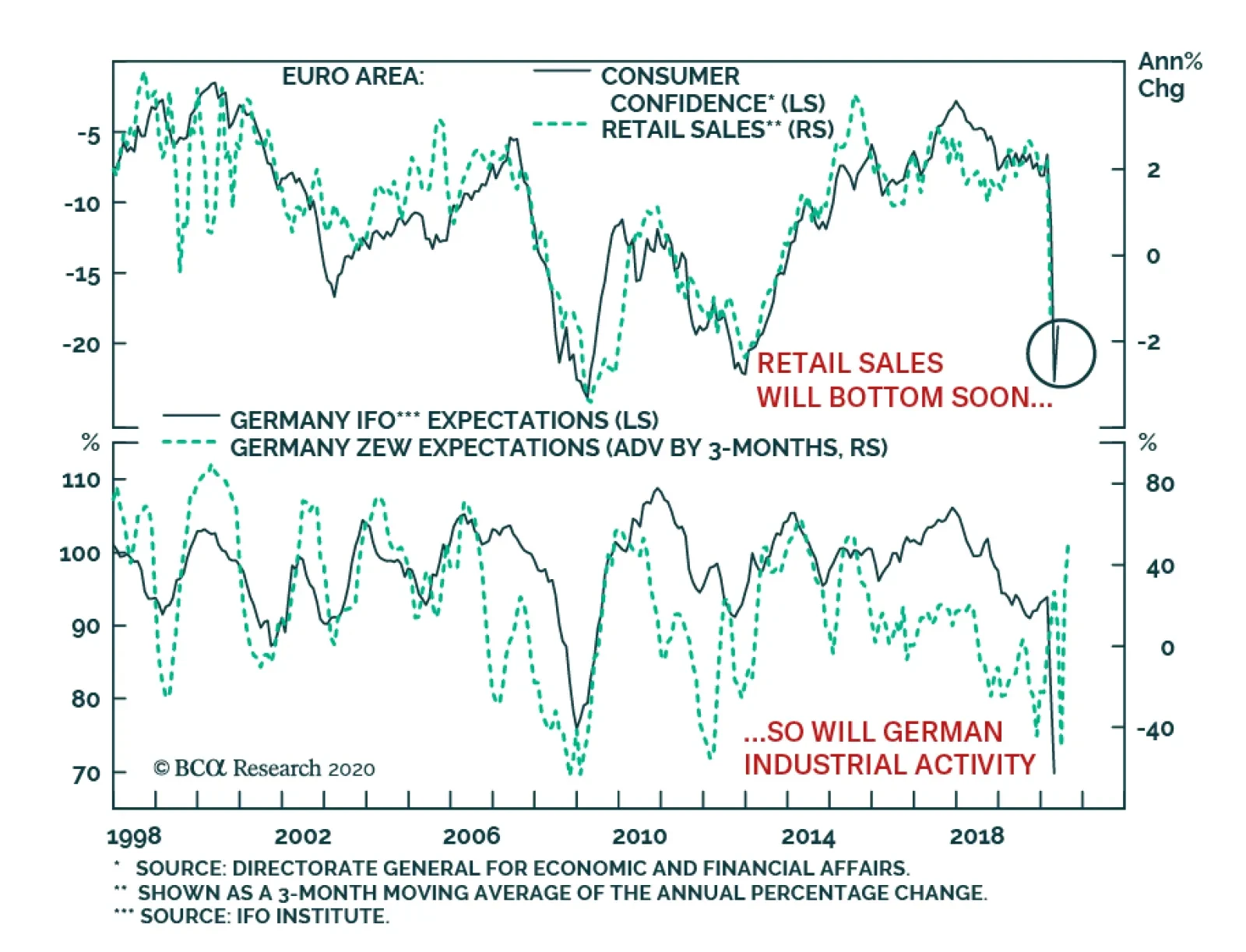

The decline in infection and death rates is having a positive impact on the European economy, which is compounded by the effect of fiscal and monetary policy support. As a result, European consumer confidence rebounded to -18.8…

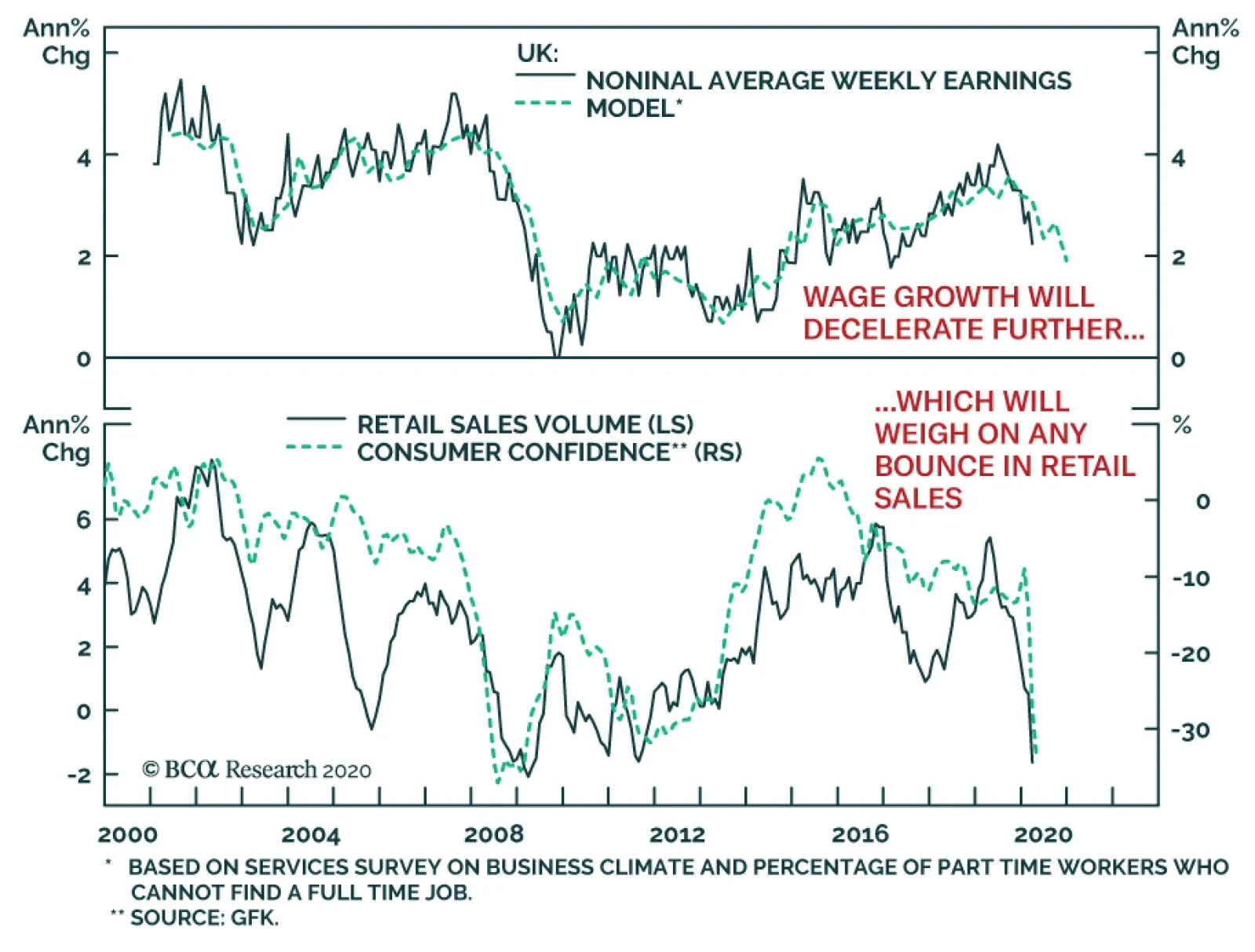

The UK labor market has been hit by a 2% contraction in the GDP in Q1. The claimant count rose by 856 thousand individuals and the claimant count rate rose to 5.8%. Moreover, weekly wage growth continues to weaken, which is a…

Highlights Global stimulus efforts are sufficient thus far, but more will need to be done, especially by Europe and emerging markets. Hiccups will not be well-received by financial markets. The net public wealth of countries helps put…

Highlights Our baseline view foresees a U-shaped recovery, as economies slowly relax lockdown measures. There are significant risks to this forecast, however. On the upside, a vaccine or effective treatment could hasten the reopening…

In lieu of the next weekly report I will be presenting the quarterly webcast ‘Leaving The Euro Would Be MAD, But Mad Things Can Happen’ on Thursday 14 May at 10.00AM EDT (3.00PM BST, 4.00PM CEST, 10.00PM HKT). As usual, the…

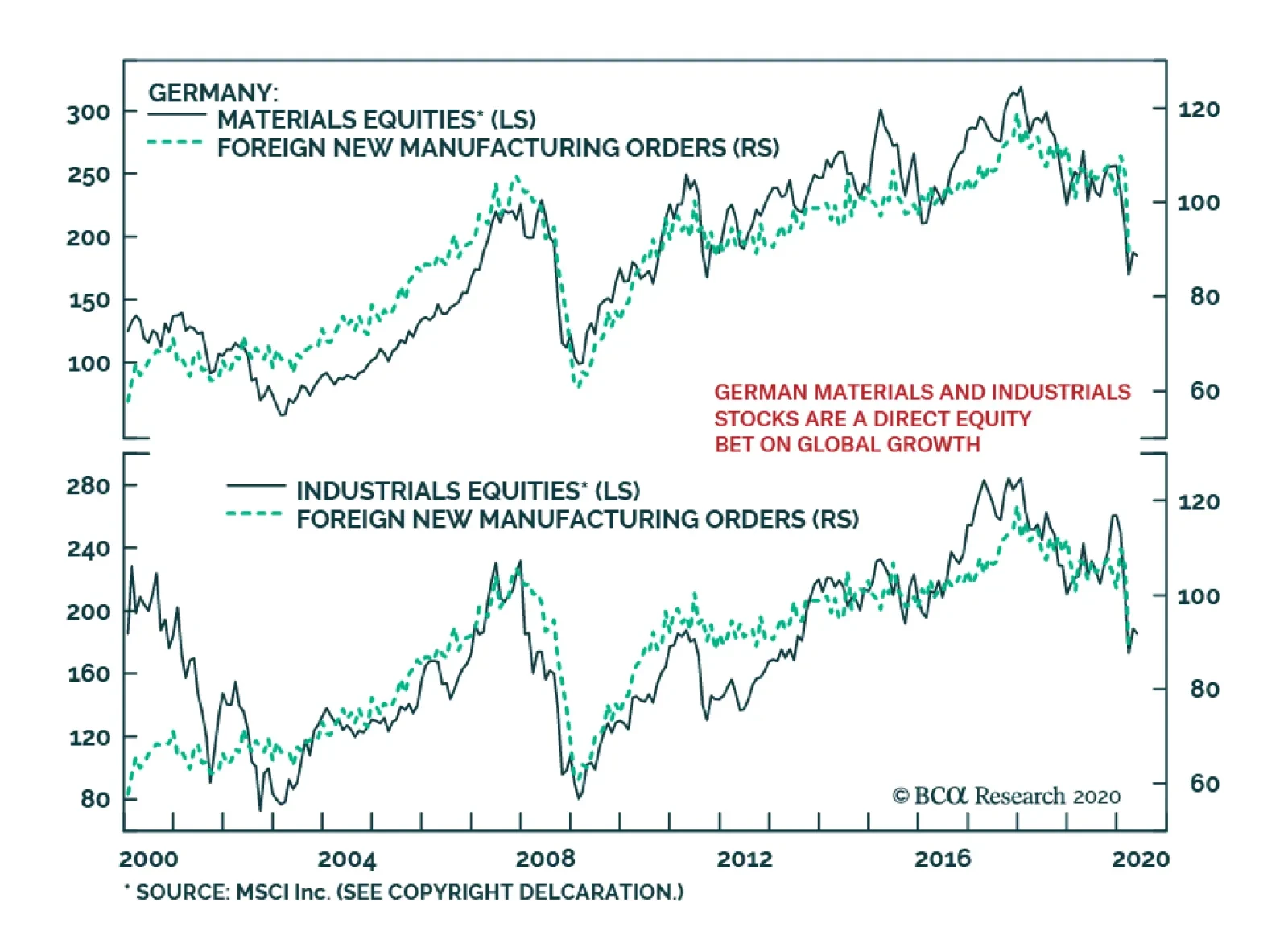

Germany’s factory orders have begun a violent freefall in March, contracting 16% on an annual basis. Capital goods were particularly hard hit, contracting nearly 25% on an annual basis. Germany’s economy depends on…