Highlights In this Weekly Report, we present our semi-annual chartbook of the BCA Central Bank Monitors. All of the Monitors are now below the zero line, indicating the need for continued easy global monetary policy to help mitigate the…

Highlights China is taking advantage of global chaos to solidify its sphere of influence – beginning with Hong Kong. The crisis is also motivating the European Union to link arms more tightly through a symbolic step toward…

Highlights Risk assets continue to ignore the dire state of the economy. “Don’t fight the Fed” will dictate investment policy for the coming months. Populism and supply-chain diversification will…

Highlights Investment Grade Sector Valuation: Our investment grade corporate bond sector valuation models for the US, euro area, UK, Canada and Australia show some common messages, as markets have adjusted to a virus-stricken world.…

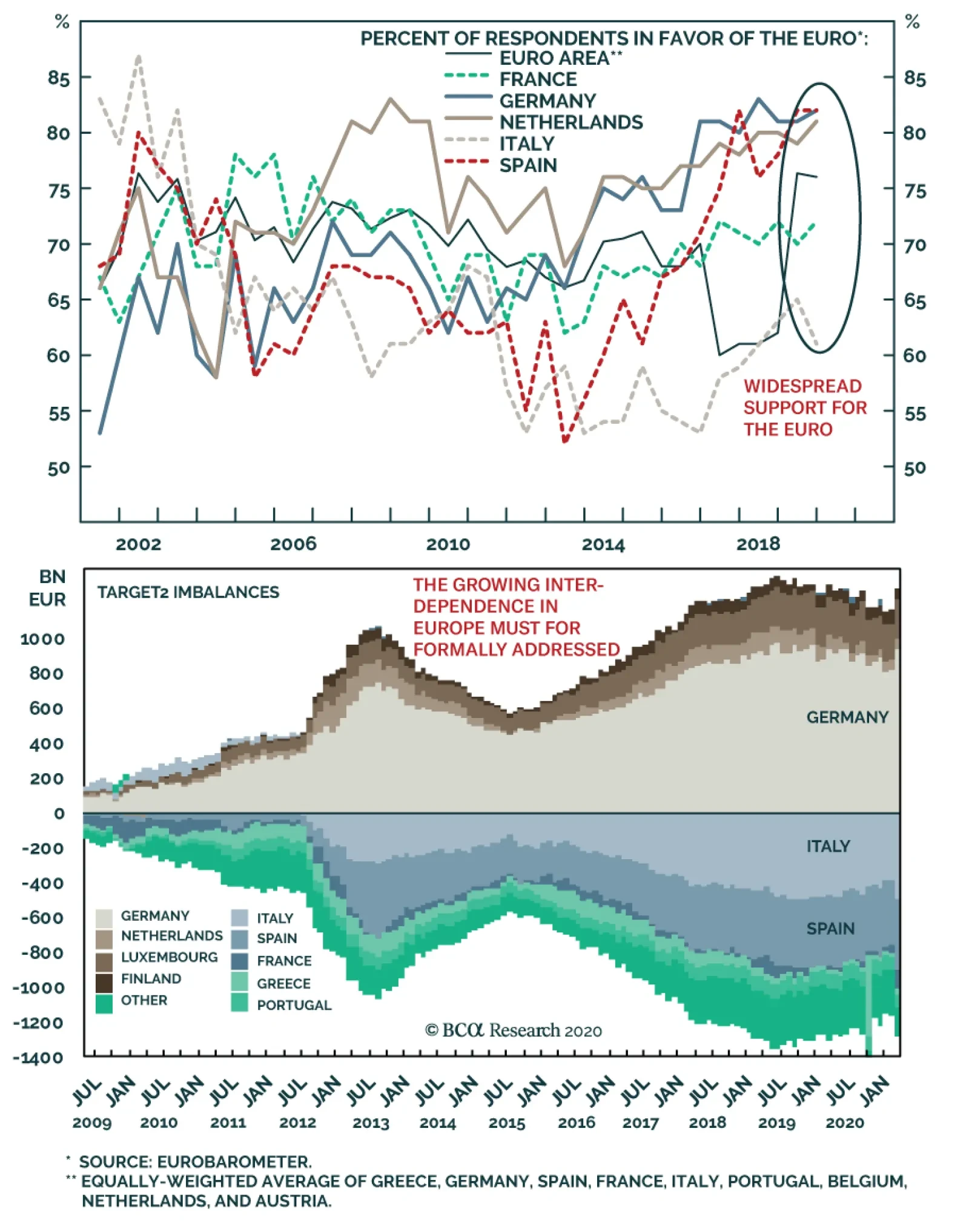

Europe is moving in the right direction. COVID-19 has broken the taboo of common bond issuance in Europe. Last week, Chancellor Merkel, President Macron and EC President von der Leyen hatched a plan to issue common bonds that will…

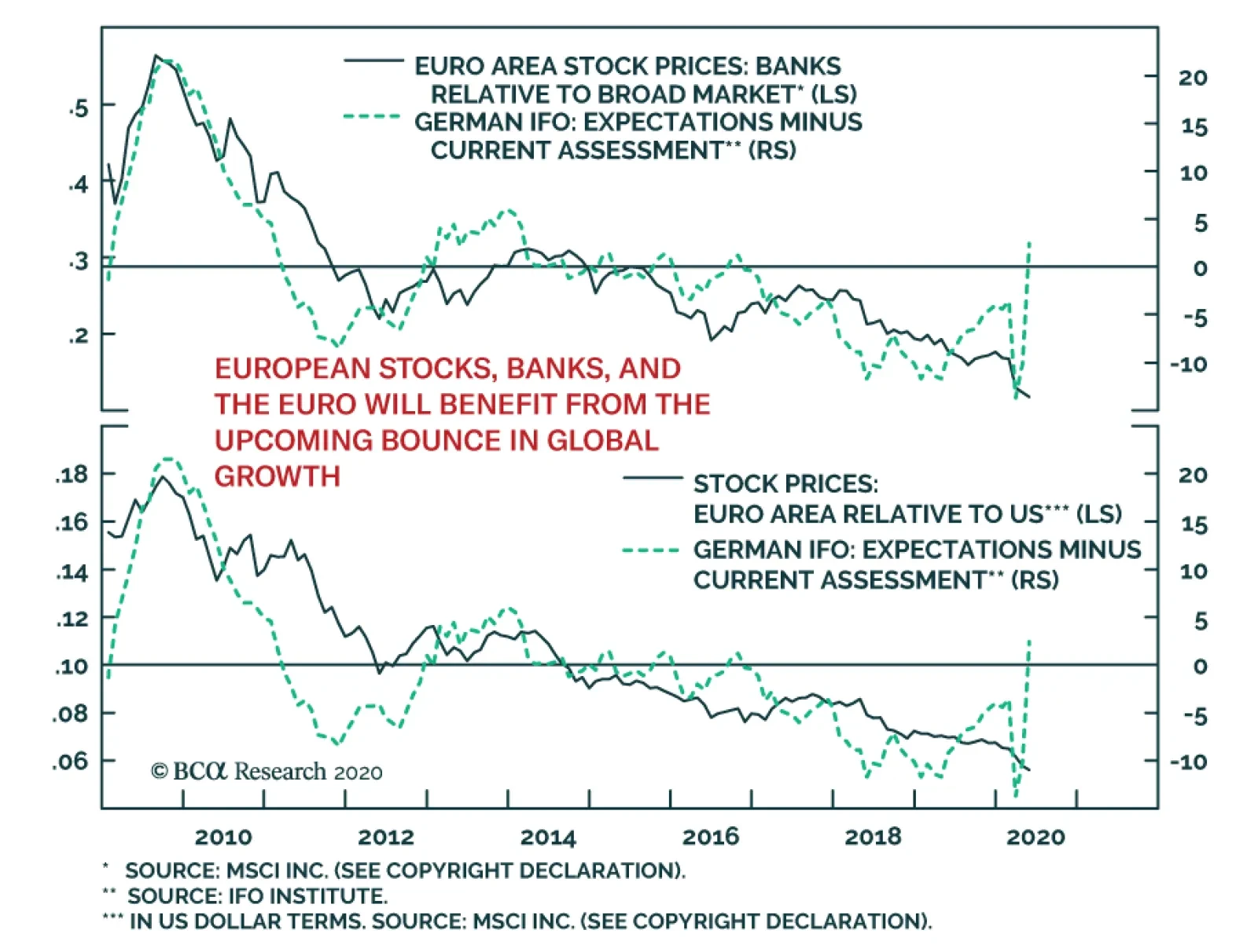

As the ZEW survey suggested last week, the German IFO rebounded in May, led by its more forward-looking components. The headline Business Climate series rose from 74.2 to 79.5, above expectations of 78.5. While the Current…

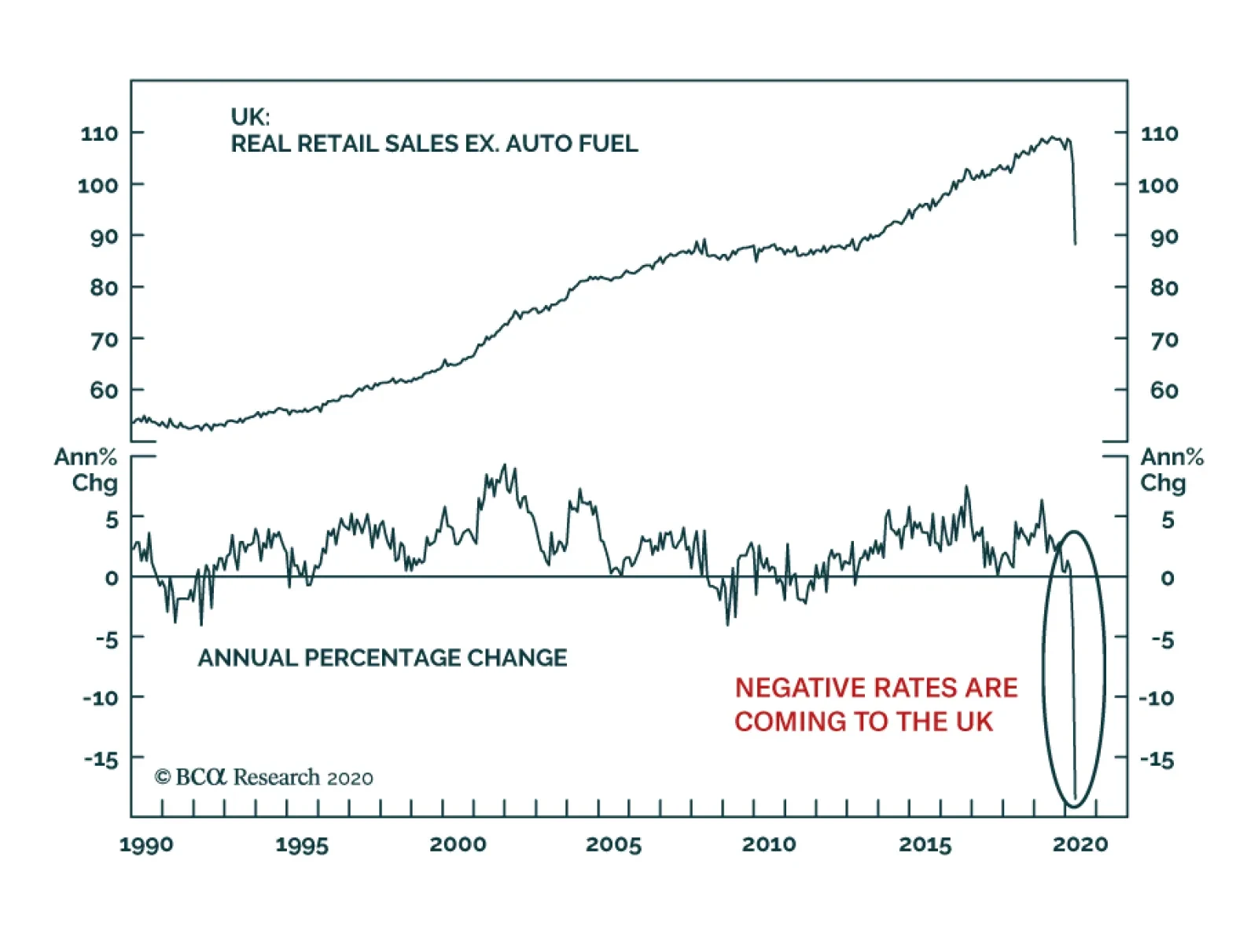

British retail sales excluding auto fuel collapsed 18.4% in April compared to last year, resulting in the worst contraction on record. This poor number comes on the heels of dismal consumer confidence, inflation, and employment…

It is easy to focus on the negatives afflicting the Spanish economy. Tourism accounts for 15% of GDP and will greatly atrophy over the coming years. NPLs will surge as 10% of businesses have already gone bankrupt and more will do…

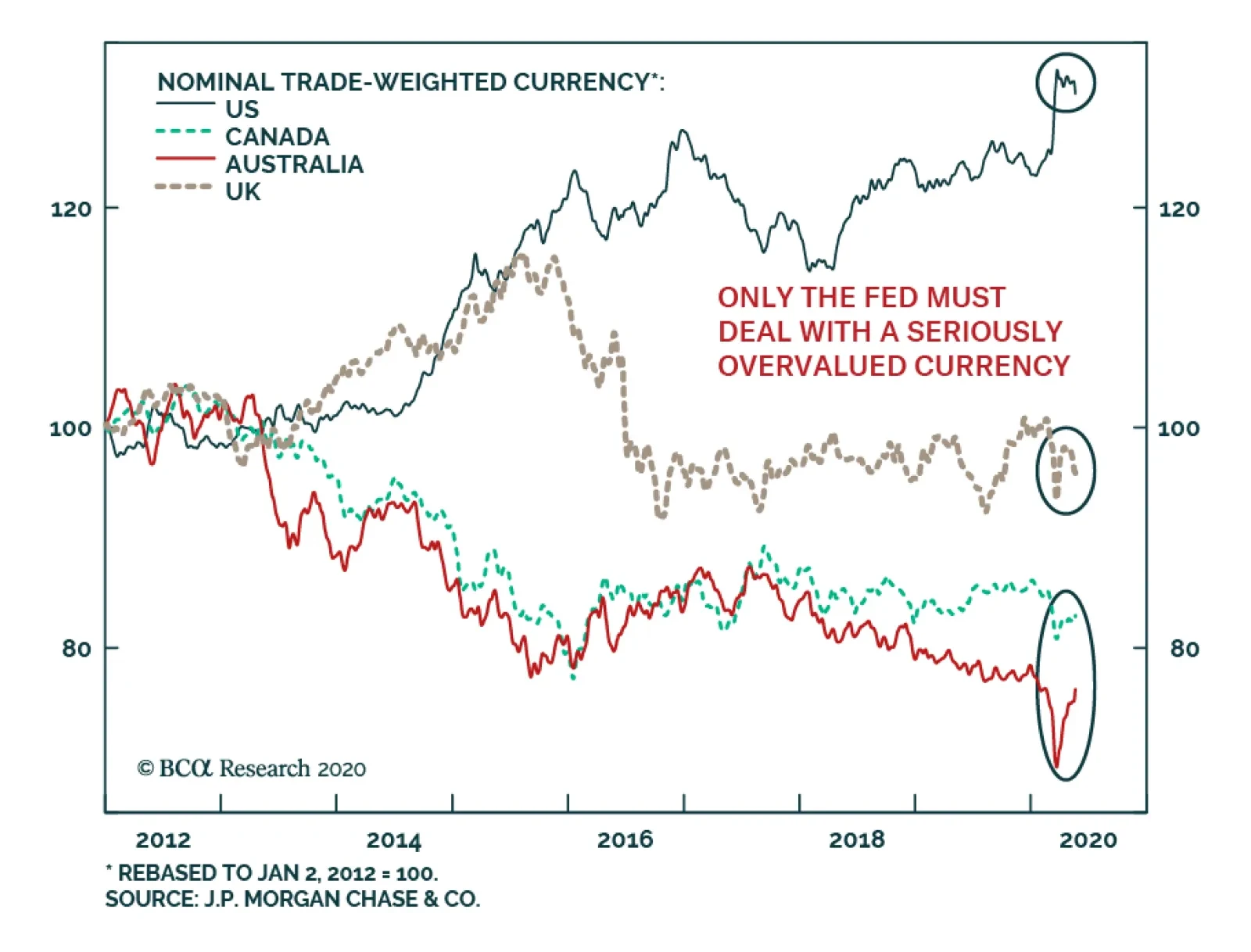

Dear client, In lieu of our regular weekly report next week, we will hold a webcast on Thursday at 10:00 am ET discussing both tactical and strategic currency considerations. The format will be a short presentation, followed by a Q&…

Yesterday, BCA Research's Global Fixed Income Strategy service concluded that among the major countries without negative interest rates (the US, UK, Canada, and Australia), longer-term borrowing rates do not need to fall…