Highlights US Dollar: The overvalued US dollar is finally cracking under the weight of aggressive Fed policy reflation and non-US growth outperformance coming out of the COVID-19 recession. The US dollar weakness has more room to run,…

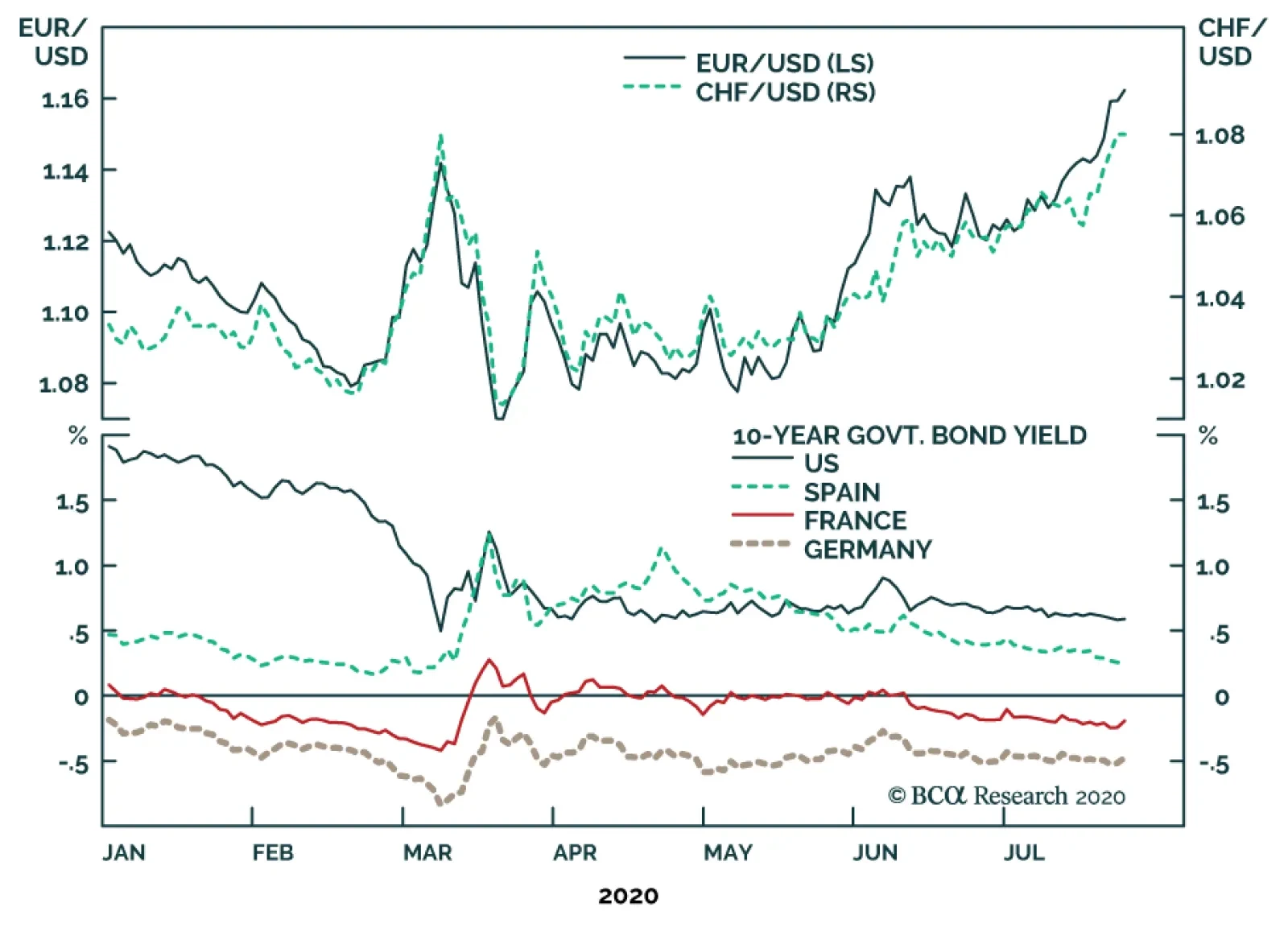

BCA Research's European Investment Strategy service recommends that investors play good news in Europe by remaining long EUR, CHF, and SEK versus USD, and long US T-bonds and Spanish Bonos versus German Bunds and French OATs…

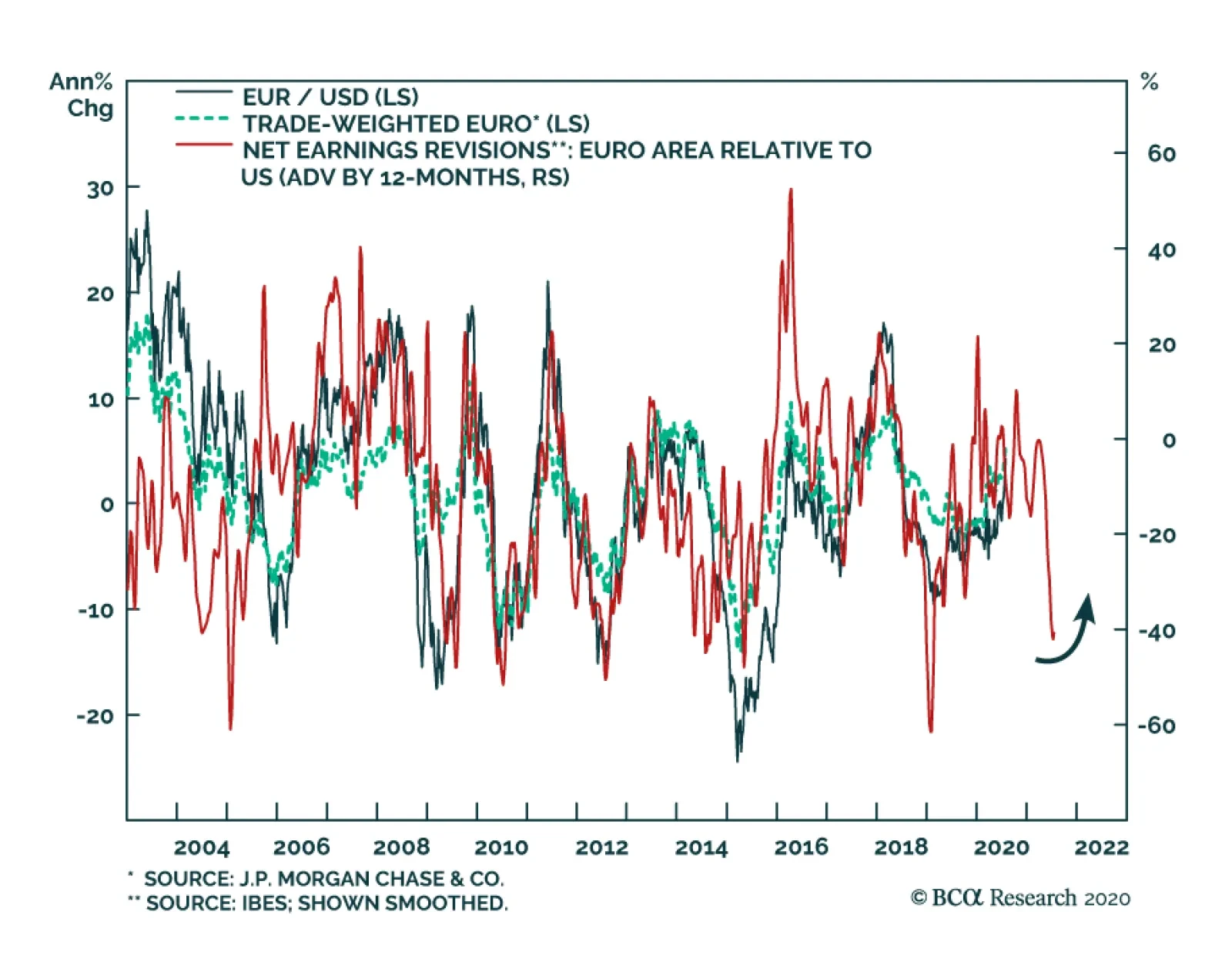

BCA Research's Foreign Exchange Strategy service concludes that the euro has more upside on a cyclical basis. As a relatively closed economy, the US has tended to have a higher services component to GDP. However, the…

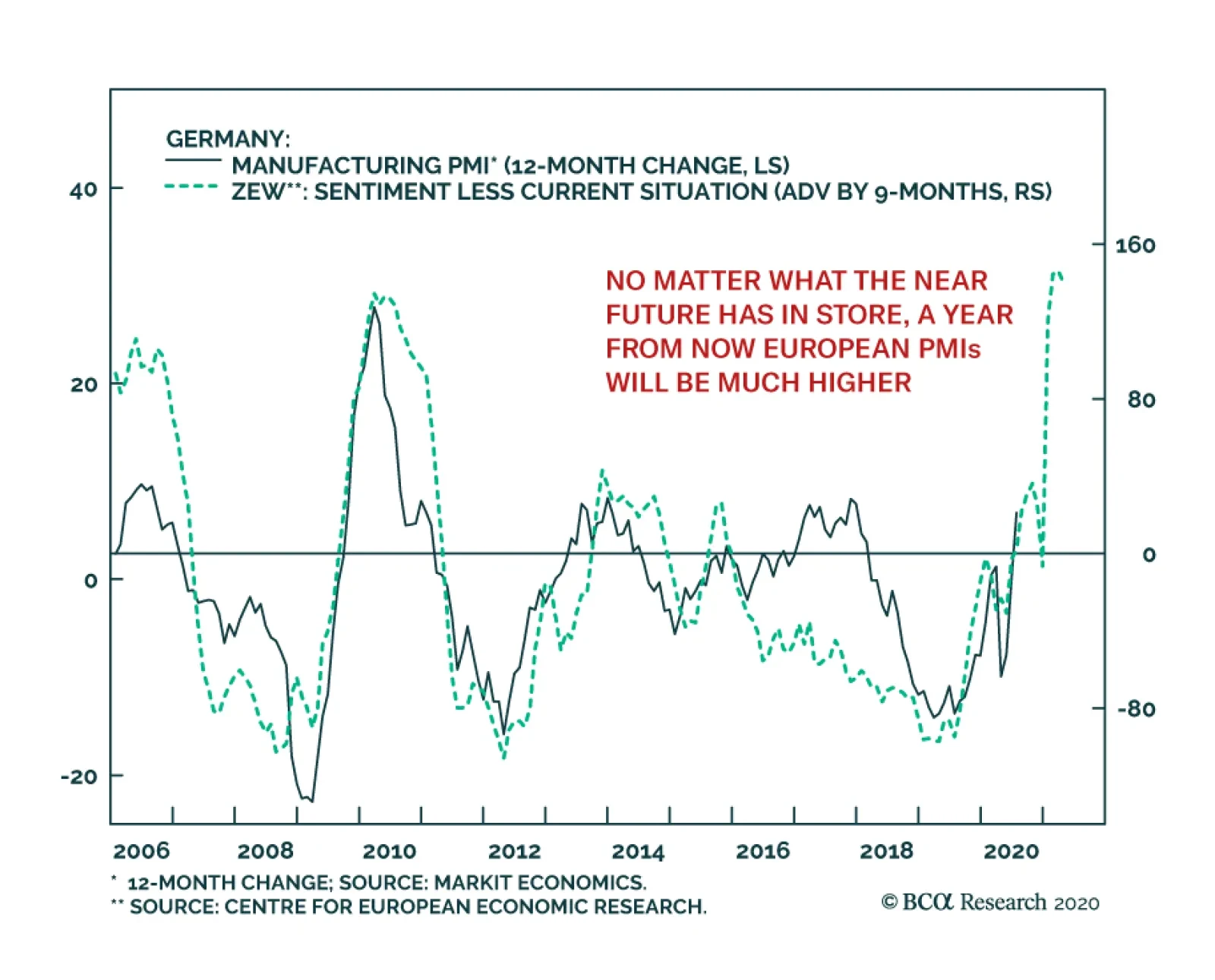

Last Friday, the European PMIs delivered a nice surprise for July. For the Eurozone, the Manufacturing index rebounded to 51.1 from 47.3, beating expectations of 50.1. The Services index bounced back to 55.1 from 48.3, handily…

Highlights The dollar is on the verge of a significant breakdown. If the DXY punches through 94, it will likely mark the beginning of a structural bear market. The most recent catalyst – fiscal support in the euro zone –…

Highlights For financials and energy to produce a sustained rally, there must be no relapse in global growth during the autumn and winter of 2020/21. However, with the coronavirus still in play and the usual flu and virus season yet…

The drubbing in the US/EMU sovereign bond spread is cause for concern for the SPX’s slingshot recovery off the March 23 lows, especially given the tight positive correlation of these two series over the past three…

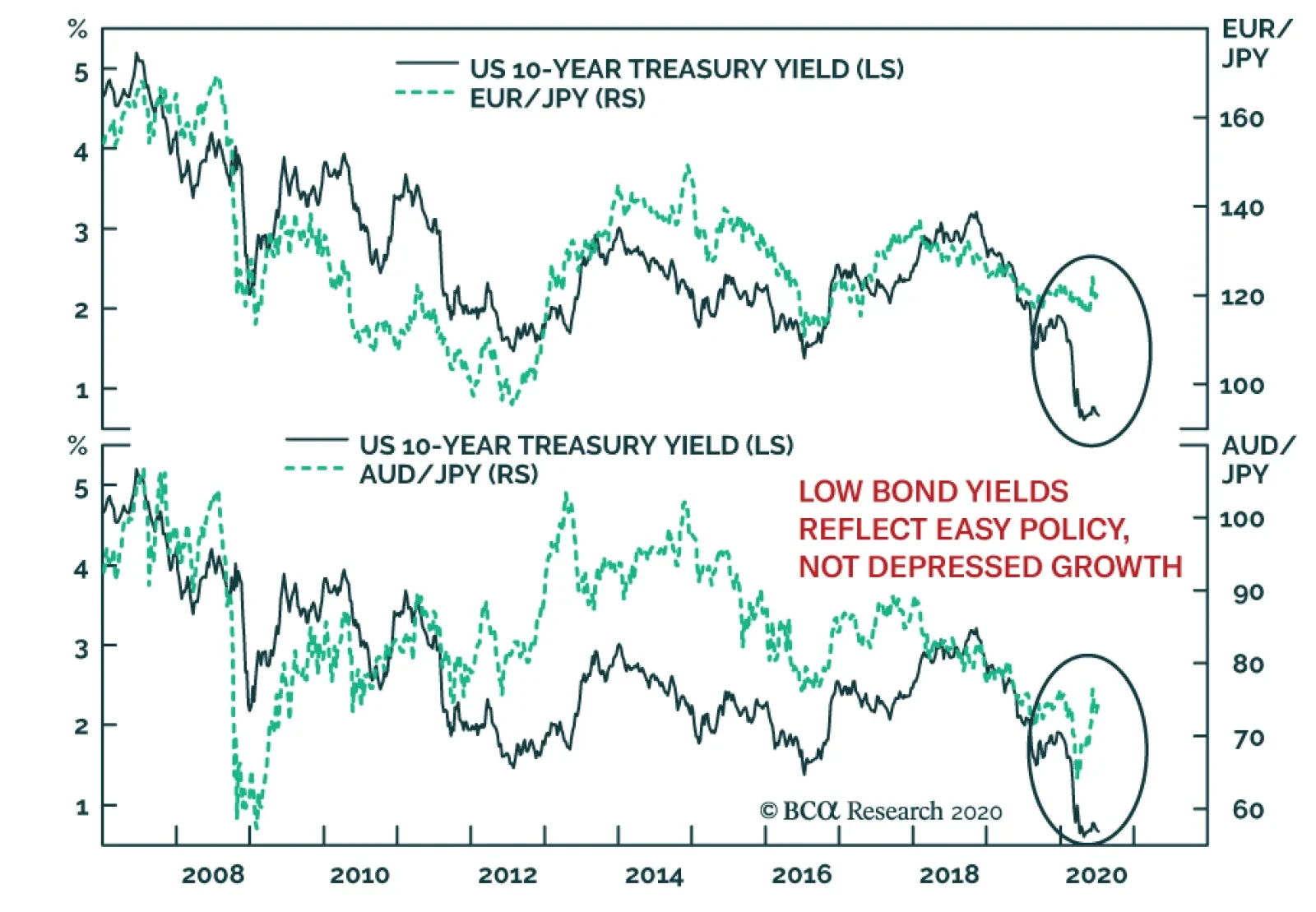

Among many investors, low bond yields arouse worries that equities will make new lows in the coming months. The idea is that low bond yields, especially their extremely depressed real components, point to weaker growth ahead.…

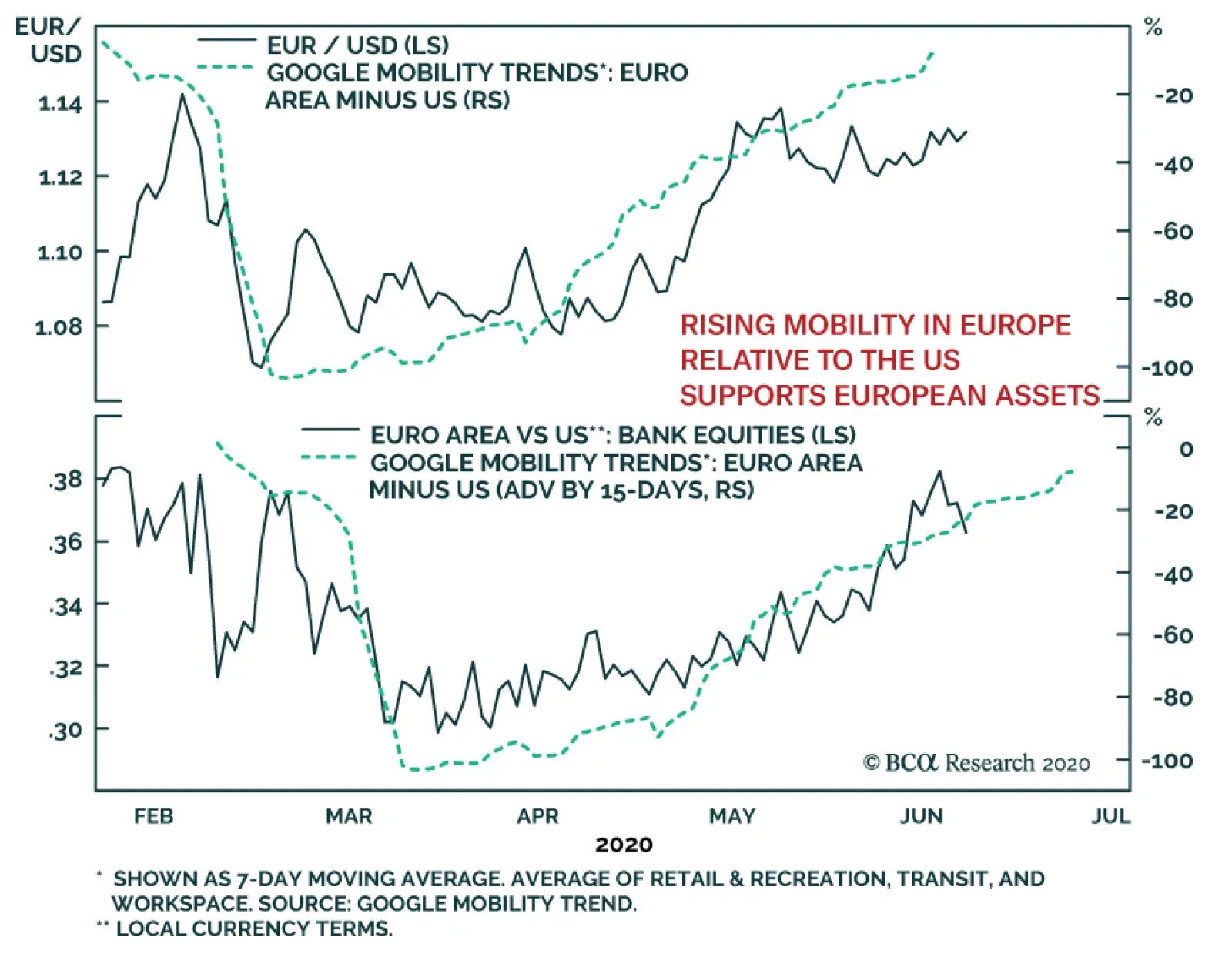

Europe implemented particularly draconian lockdowns in the spring, which resulted in violent declines in mobility and, as a corollary, in economic activity. However, Europe is re-opening and its second wave remains marginal.…

Highlights In this report, we initiate coverage of the EU Emission Trading System’s (ETS) CO2 allowances. We expect this policy-driven cap-and-trade market to become central to the market-driven pricing mechanism for CO2…